Key Insights

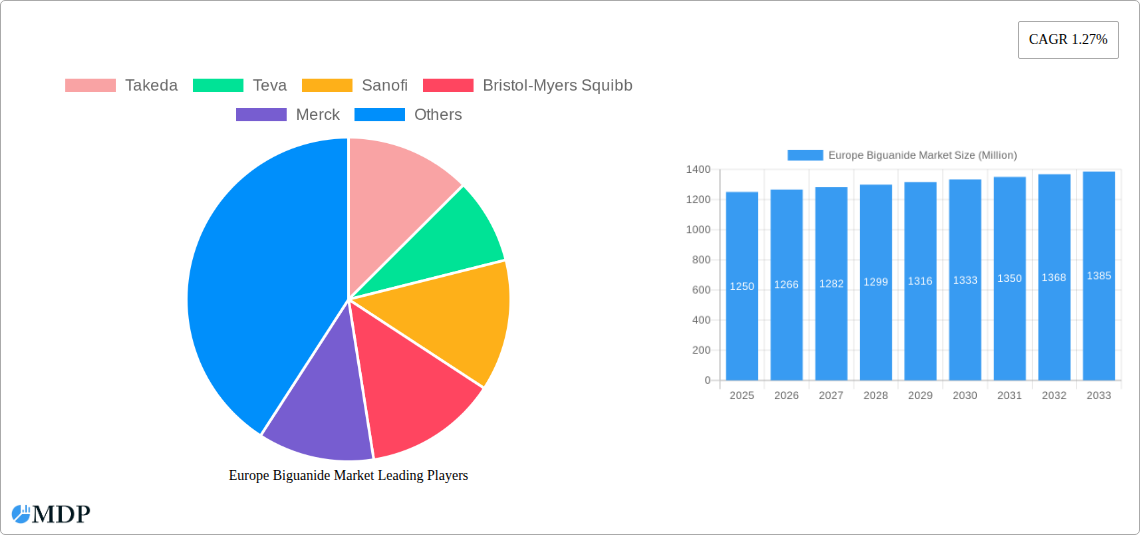

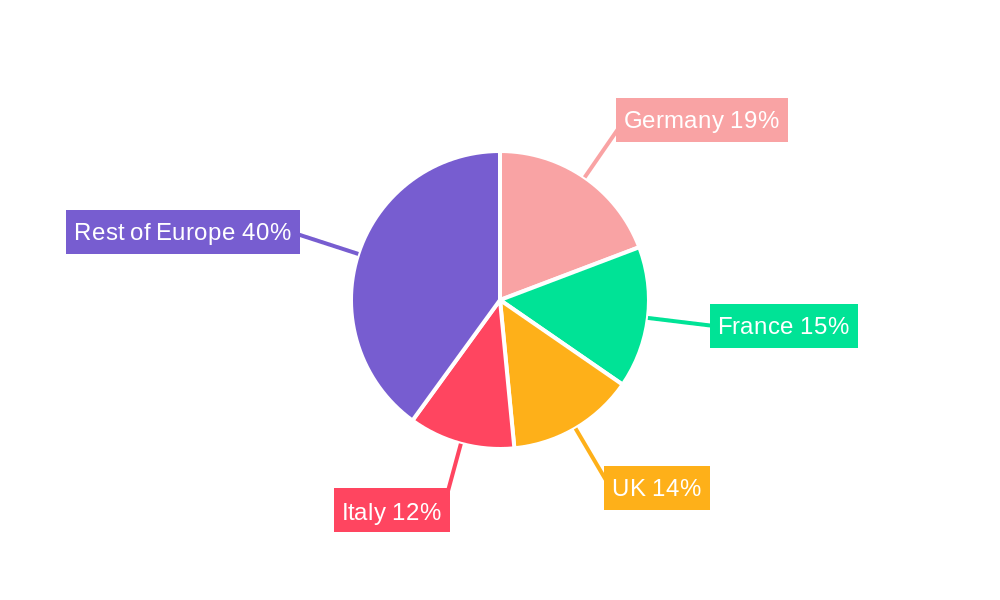

The European biguanide market, valued at approximately €1.25 billion in 2025, is projected to experience steady growth, driven primarily by the increasing prevalence of type 2 diabetes across the region. This growth, although moderate with a Compound Annual Growth Rate (CAGR) of 1.27%, reflects a consistent demand for biguanides, particularly metformin, as a first-line treatment for type 2 diabetes. The market is segmented by product type (immediate-release and extended-release biguanides) and application type (type 1 and type 2 diabetes), with type 2 diabetes significantly dominating the market share. The extended-release formulations are expected to witness faster growth compared to immediate-release due to their improved tolerability and efficacy profiles. Key players such as Takeda, Sanofi, and Merck, among others, are actively engaged in research and development to enhance their product portfolios and maintain a competitive edge. Factors such as growing geriatric population, improved healthcare infrastructure, and increased awareness about diabetes management contribute positively to market growth. However, the emergence of newer antidiabetic drugs and potential side effects associated with biguanide use pose certain restraints on market expansion. The German, French, UK, and Italian markets are expected to lead regional growth within Europe, driven by higher diabetes prevalence and robust healthcare systems.

Europe Biguanide Market Market Size (In Billion)

The consistent growth trajectory of the European biguanide market is further supported by the strategic initiatives undertaken by major pharmaceutical companies. These initiatives include investments in clinical trials focusing on the efficacy and safety of biguanide-based therapies. Moreover, continuous advancements in drug delivery technologies, such as the development of improved extended-release formulations, promise to enhance patient compliance and therapeutic outcomes. Competition amongst leading players is expected to remain intense, focusing on brand positioning, pricing strategies, and market penetration. Regulatory changes and pricing pressures may pose challenges in the future, but the fundamental need for effective and affordable diabetes management suggests the market will continue its steady, albeit moderate, expansion throughout the forecast period (2025-2033).

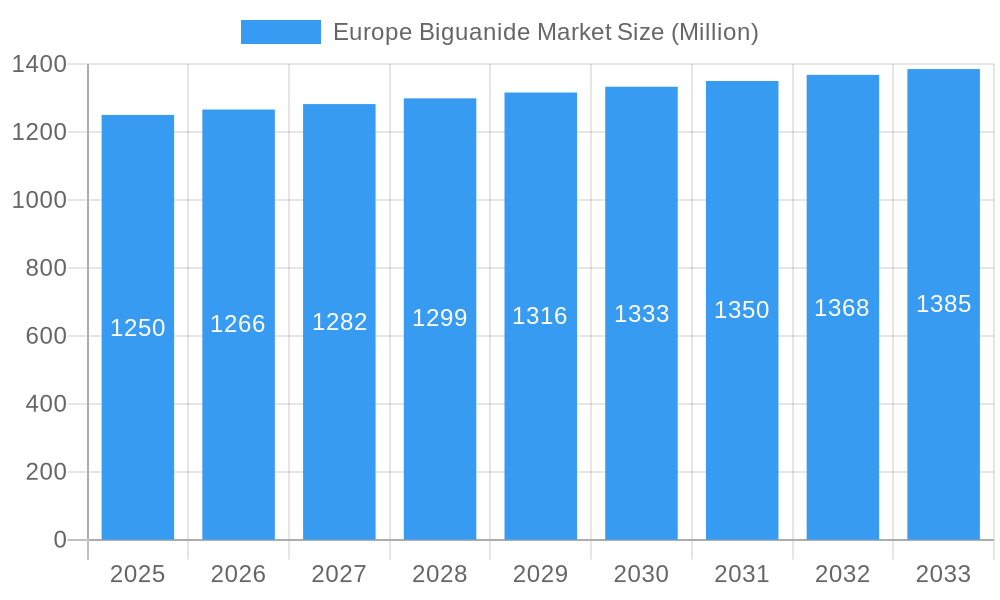

Europe Biguanide Market Company Market Share

Europe Biguanide Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Biguanide market, covering the period 2019-2033. With a focus on market dynamics, leading players, and future trends, this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating historical data (2019-2024), base year (2025), and a detailed forecast (2025-2033) to deliver actionable insights. Key segments analyzed include Product Type (Immediate-Release Biguanides, Extended-Release Biguanides) and Application Type (Type 1 Diabetes, Type 2 Diabetes). Leading companies like Takeda, Teva, Sanofi, Bristol-Myers Squibb, Merck, AstraZeneca, Glenmark, GlaxoSmithKline, and Boehringer Ingelheim are profiled, providing a competitive landscape overview. The report's value is in its detailed analysis of market size (in Millions), CAGR, market share, and key industry developments.

Europe Biguanide Market Market Dynamics & Concentration

The Europe Biguanide market, valued at xx Million in 2024, is characterized by moderate concentration with a few major players holding significant market share. Market dynamics are shaped by several factors:

- Innovation Drivers: Ongoing research into novel formulations and delivery systems for biguanides, focusing on improved efficacy and reduced side effects, is a key driver. The development of extended-release formulations, for instance, enhances patient compliance.

- Regulatory Frameworks: Stringent regulatory approvals and post-market surveillance influence market entry and product lifecycle management. Recent updates to the Classification, Labelling and Packaging Regulation (April 2023) will necessitate adjustments to labeling and packaging for biguanide products.

- Product Substitutes: Competition from other antidiabetic drugs, such as GLP-1 receptor agonists and SGLT2 inhibitors, impacts market growth. However, biguanides maintain their relevance due to their cost-effectiveness and established efficacy in certain patient populations.

- End-User Trends: Growing prevalence of diabetes, particularly Type 2 Diabetes, fuels demand for biguanides. However, changing treatment preferences and the emergence of newer therapies present challenges.

- M&A Activities: The number of M&A deals in the biguanide market has been relatively low in recent years (xx deals in the past 5 years), primarily driven by strategic acquisitions to enhance product portfolios or expand market reach. Market share distribution among the top 5 players is approximately xx%.

Europe Biguanide Market Industry Trends & Analysis

The Europe Biguanide market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by several factors:

The increasing prevalence of diabetes, particularly Type 2 Diabetes, across Europe, is a major growth driver. The aging population, coupled with lifestyle changes contributing to higher rates of obesity and metabolic syndrome, further fuels market expansion. Technological advancements in biguanide formulations, such as improved extended-release products with enhanced tolerability, contribute to increased market penetration. However, the competitive landscape, with the introduction of newer antidiabetic agents, poses a challenge. Market penetration of biguanides is estimated at xx% in 2025, projected to reach xx% by 2033, driven primarily by type 2 diabetes treatment and cost-effectiveness. Consumer preference continues to favor convenient, once-daily extended-release formulations. Competitive dynamics are primarily centered around pricing strategies, efficacy claims, and the expansion of product portfolios.

Leading Markets & Segments in Europe Biguanide Market

Within the Europe Biguanide market, Type 2 Diabetes represents the dominant application segment, accounting for approximately xx% of the total market in 2025. This is primarily driven by its high prevalence compared to Type 1 Diabetes. Germany, followed by France and the UK, represent the leading national markets, attributed to high diabetes prevalence, strong healthcare infrastructure, and robust reimbursement policies.

Key Drivers for Type 2 Diabetes Segment Dominance:

- High prevalence of Type 2 Diabetes in Europe.

- Cost-effectiveness of biguanides compared to newer antidiabetic drugs.

- Established efficacy and safety profile in Type 2 Diabetes management.

Key Drivers for Leading National Markets:

- High prevalence of diabetes.

- Well-developed healthcare infrastructure.

- Favorable reimbursement policies.

- Strong presence of pharmaceutical companies.

Extended-Release Biguanides dominate the product type segment, owing to improved patient compliance and reduced side effects. This segment is projected to show higher CAGR than immediate-release biguanides in the forecast period.

Europe Biguanide Market Product Developments

Recent innovations in biguanide formulations have focused on enhancing bioavailability, reducing gastrointestinal side effects, and improving patient compliance. Extended-release formulations, designed for once-daily administration, are gaining significant traction. Technological trends suggest a focus on developing combination therapies with other antidiabetic agents to improve treatment outcomes. These developments offer competitive advantages through enhanced efficacy and better patient experience, leading to increased market share and improved patient outcomes.

Key Drivers of Europe Biguanide Market Growth

Several factors contribute to the projected growth of the Europe Biguanide market. The increasing prevalence of diabetes, particularly Type 2 Diabetes, across Europe is a key driver. The aging population and rising incidence of obesity and metabolic syndrome further exacerbate this trend. Cost-effectiveness compared to newer antidiabetic medications ensures continued market demand. Furthermore, regulatory support and ongoing research into improved formulations (like extended release) propel growth.

Challenges in the Europe Biguanide Market Market

The Europe Biguanide market faces several challenges. Intense competition from newer antidiabetic drugs with improved efficacy profiles and patient tolerability poses a significant threat. Regulatory hurdles related to product approvals and labeling updates can create delays in market entry and expansion. Moreover, fluctuations in raw material costs can impact pricing and profitability. Supply chain disruptions can also limit production capacity, affecting product availability.

Emerging Opportunities in Europe Biguanide Market

Emerging opportunities in the Europe Biguanide market include strategic partnerships and collaborations among pharmaceutical companies to develop combination therapies with improved efficacy and reduced side effects. Market expansion into underpenetrated regions of Europe, combined with ongoing research and development efforts to address current formulation limitations, offer significant growth potential. Furthermore, focusing on patient education and improved access to biguanide medications can stimulate market growth.

Leading Players in the Europe Biguanide Market Sector

- Takeda

- Teva

- Sanofi

- Bristol-Myers Squibb

- Merck

- AstraZeneca

- Glenmark

- GlaxoSmithKline

- Boehringer Ingelheim

Key Milestones in Europe Biguanide Market Industry

- April 2023: The European Commission updated the Classification, Labelling and Packaging Regulation, impacting hazard class classifications for biguanide products like Sitagliptin/Metformin Hydrochloride. This necessitates changes to product labeling and packaging, potentially impacting market dynamics and requiring increased investment.

- February 2022: Merck secured an extended label for its metformin products (Glucophage, Glucophage XR, Stagid) in the EU to include use throughout pregnancy, based on the CLUE safety cohort study. This expanded indication significantly increases the market potential for Merck's metformin products.

Strategic Outlook for Europe Biguanide Market Market

The Europe Biguanide market presents significant long-term growth potential driven by the persistent increase in diabetes prevalence, particularly Type 2 Diabetes. Strategic opportunities lie in developing innovative formulations with improved efficacy and tolerability, exploring combination therapies, and focusing on patient education and adherence programs. Companies that invest in research and development, focus on differentiated product offerings, and build strong distribution networks are well-positioned to capture a significant market share in the years to come.

Europe Biguanide Market Segmentation

-

1. Product Type

- 1.1. Immediate-Release Biguanides

- 1.2. Extended-Release Biguanides

-

2. Application

- 2.1. Type 1 Diabetes

- 2.2. Type 2 Diabetes

Europe Biguanide Market Segmentation By Geography

- 1. France

- 2. Germany

- 3. Italy

- 4. Russia

- 5. Spain

- 6. United Kingdom

- 7. Rest of Europe

Europe Biguanide Market Regional Market Share

Geographic Coverage of Europe Biguanide Market

Europe Biguanide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Prevalence of Respiratory Diseases; Technological Advancements Owing to Telehealth and Remote Patient Monitoring; Improved Medication Adherence

- 3.3. Market Restrains

- 3.3.1. Availability of Traditional Inhalers as a Substitute; High Cost Associated with These Advanced Devices

- 3.4. Market Trends

- 3.4.1. Increasing diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Immediate-Release Biguanides

- 5.1.2. Extended-Release Biguanides

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Type 1 Diabetes

- 5.2.2. Type 2 Diabetes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.3.2. Germany

- 5.3.3. Italy

- 5.3.4. Russia

- 5.3.5. Spain

- 5.3.6. United Kingdom

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. France Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Immediate-Release Biguanides

- 6.1.2. Extended-Release Biguanides

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Type 1 Diabetes

- 6.2.2. Type 2 Diabetes

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Germany Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Immediate-Release Biguanides

- 7.1.2. Extended-Release Biguanides

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Type 1 Diabetes

- 7.2.2. Type 2 Diabetes

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Immediate-Release Biguanides

- 8.1.2. Extended-Release Biguanides

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Type 1 Diabetes

- 8.2.2. Type 2 Diabetes

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Russia Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Immediate-Release Biguanides

- 9.1.2. Extended-Release Biguanides

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Type 1 Diabetes

- 9.2.2. Type 2 Diabetes

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Spain Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Immediate-Release Biguanides

- 10.1.2. Extended-Release Biguanides

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Type 1 Diabetes

- 10.2.2. Type 2 Diabetes

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. United Kingdom Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Immediate-Release Biguanides

- 11.1.2. Extended-Release Biguanides

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Type 1 Diabetes

- 11.2.2. Type 2 Diabetes

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Biguanide Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Immediate-Release Biguanides

- 12.1.2. Extended-Release Biguanides

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Type 1 Diabetes

- 12.2.2. Type 2 Diabetes

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Takeda

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Teva

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sanofi

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bristol-Myers Squibb

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Merck

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 AstraZeneca

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Glenmark

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 GlaxoSmithKline

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Boehringer Ingelheim

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Takeda

List of Figures

- Figure 1: Europe Biguanide Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Biguanide Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Biguanide Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Biguanide Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 15: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 40: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 41: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Europe Biguanide Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Europe Biguanide Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 45: Europe Biguanide Market Revenue Million Forecast, by Application 2020 & 2033

- Table 46: Europe Biguanide Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Europe Biguanide Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Biguanide Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biguanide Market?

The projected CAGR is approximately 1.27%.

2. Which companies are prominent players in the Europe Biguanide Market?

Key companies in the market include Takeda, Teva, Sanofi, Bristol-Myers Squibb, Merck, AstraZeneca, Glenmark, GlaxoSmithKline, Boehringer Ingelheim.

3. What are the main segments of the Europe Biguanide Market?

The market segments include Product Type , Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Prevalence of Respiratory Diseases; Technological Advancements Owing to Telehealth and Remote Patient Monitoring; Improved Medication Adherence.

6. What are the notable trends driving market growth?

Increasing diabetes prevalence.

7. Are there any restraints impacting market growth?

Availability of Traditional Inhalers as a Substitute; High Cost Associated with These Advanced Devices.

8. Can you provide examples of recent developments in the market?

April 2023: The European Commission has updated the Classification, Labelling and Packaging Regulation with the following hazard classes which includes, for "Sitagliptin/Metformin Hydrochloride.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biguanide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biguanide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biguanide Market?

To stay informed about further developments, trends, and reports in the Europe Biguanide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence