Key Insights

The global COVID-19 testing kits market is projected to reach $15 billion by 2025, with a robust compound annual growth rate (CAGR) of 5% from 2025 to 2033. This sustained growth is propelled by persistent concerns over new viral variants and the need for effective pandemic preparedness. Technological advancements, including improved rapid antigen and PCR assays, enhance diagnostic accuracy and accessibility. The increasing adoption of home testing kits and point-of-care solutions further expands market reach. Government investments in public health infrastructure and supportive policies are also key drivers. The market is segmented by product type (RT-PCR assay kits, immunoassay test strips/cassettes), specimen type (nasopharyngeal, nasal, oropharyngeal swabs), and end-user (hospitals, diagnostic centers). Growth is anticipated to be significant in regions with developing healthcare systems and high population densities. Intense competition among established players and emerging companies fosters continuous innovation and price optimization.

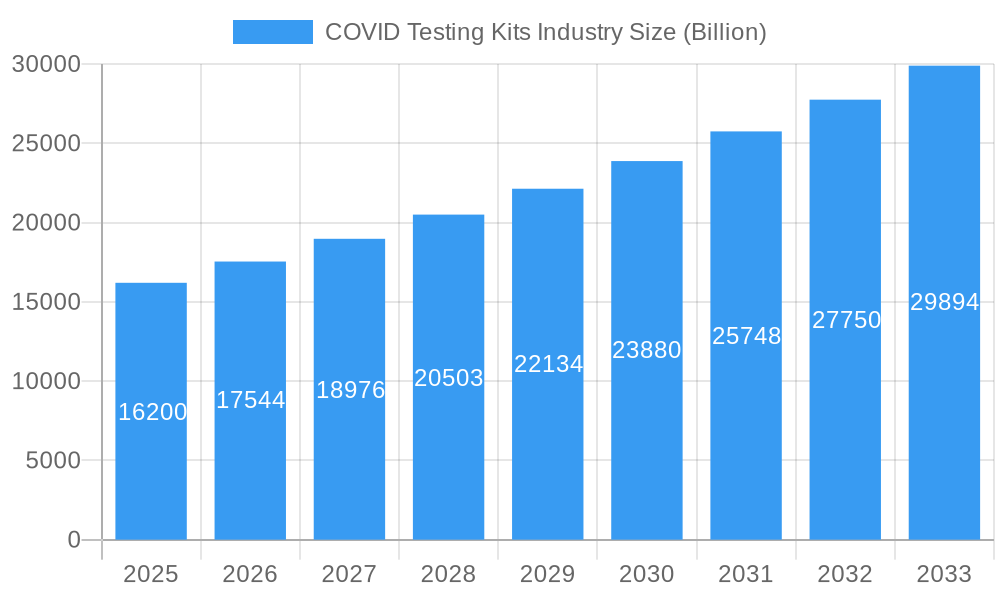

COVID Testing Kits Industry Market Size (In Billion)

Market segmentation highlights diverse testing requirements and technological progress. RT-PCR kits offer high precision, while rapid antigen tests provide speed and convenience. Specimen type preferences are influenced by regional testing protocols. Hospitals and diagnostic centers remain primary users, with home testing kits gradually altering the market dynamic. The future trajectory will be shaped by the development of more sensitive, specific, and user-friendly tests, strategic partnerships, and global distribution. While regulatory challenges and price sensitivity may pose limitations, the market is poised for enduring expansion driven by ongoing pandemic preparedness and evolving healthcare demands.

COVID Testing Kits Industry Company Market Share

COVID Testing Kits Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the COVID-19 testing kits industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market dynamics, trends, and future potential of this rapidly evolving sector. The global market size reached approximately $XX Billion in 2024 and is projected to reach $XX Billion by 2033, exhibiting a CAGR of XX%. Key players like Becton Dickinson and Company, Danaher Corporation (Cepheid), and Abbott are analyzed, along with an assessment of market segments (By Product, By Specimen, By End User).

COVID Testing Kits Industry Market Dynamics & Concentration

The COVID-19 testing kits market experienced explosive growth during the pandemic, driven by urgent global health needs. Market concentration is moderate, with several large players holding significant shares but a substantial number of smaller companies also participating. The industry is marked by rapid innovation, particularly in areas like rapid antigen tests and advanced molecular diagnostics. Stringent regulatory frameworks, varying across countries, significantly impact market access and product approvals. Product substitutes, such as antibody tests, exist but are often less sensitive or specific. End-user trends show a shift towards point-of-care testing and home-based testing solutions, driven by convenience and efficiency.

- Market Share: Top 5 players hold approximately XX% of the market share in 2024.

- M&A Activity: A total of XX M&A deals were recorded between 2019 and 2024, showcasing consolidation efforts within the sector.

- Innovation Drivers: Rapid advancements in molecular diagnostics, development of portable and user-friendly devices, and AI-driven diagnostic solutions are driving innovation.

- Regulatory Frameworks: Stringent regulatory approvals (e.g., EUA in the US, CE marking in Europe) are critical for market entry and significantly impact product lifecycles.

- Product Substitutes: Antibody tests and other serological assays provide alternative testing methods but are less sensitive for acute infection detection.

COVID Testing Kits Industry Industry Trends & Analysis

The COVID-19 testing kits market is characterized by several key trends:

- Market Growth Drivers: The pandemic initially fueled explosive growth, followed by a gradual stabilization and shift toward routine testing and surveillance. Government initiatives, public health programs, and rising awareness of infectious diseases continue to support market growth. The shift towards more convenient testing options (at-home tests, point-of-care tests) has also significantly impacted market dynamics.

- Technological Disruptions: Next-generation sequencing (NGS) technologies are being integrated into diagnostic workflows, enabling faster, more accurate, and comprehensive virus detection. Advancements in multiplex assays allow for simultaneous detection of multiple pathogens, increasing efficiency. AI and machine learning are improving diagnostic accuracy and test interpretation.

- Consumer Preferences: Convenience, speed of results, accuracy, and ease of use are key factors influencing consumer choices. The preference for at-home testing continues to rise.

- Competitive Dynamics: Intense competition exists among manufacturers, driven by technology advancements, product differentiation, and cost-optimization strategies. Strategic collaborations, partnerships, and distribution agreements are common. Market entry barriers are relatively high, driven by regulatory hurdles and manufacturing complexities.

Leading Markets & Segments in COVID Testing Kits Industry

The North American region dominated the market in 2024, followed by Europe and Asia Pacific. Within segments:

By Product: RT-PCR assay kits held the largest market share due to their high sensitivity and specificity, followed by immunoassay test strips/cassettes, which offered rapid turnaround times.

By Specimen: Nasopharyngeal swabs were the most common specimen type due to their high sensitivity in detecting viral RNA/antigen.

By End User: Hospitals and diagnostic centers constituted major end-users, owing to their infrastructure and expertise in handling infectious disease diagnostics.

Key Drivers by Region (Examples):

- North America: Strong healthcare infrastructure, high adoption of advanced diagnostic technologies, robust regulatory support, and high per capita healthcare spending are key drivers.

- Europe: Government investments in public health programs, stringent regulatory frameworks, and a large aging population contribute to market growth.

- Asia Pacific: High population density, increasing healthcare awareness, growing investments in diagnostic infrastructure, and rising prevalence of infectious diseases are major drivers.

COVID Testing Kits Industry Product Developments

Recent advancements encompass more accurate, rapid, and user-friendly test kits. Miniaturization, integration of AI for result interpretation, and multiplex capabilities are enhancing diagnostic capacity. The market is increasingly shifting towards point-of-care and home-testing solutions, emphasizing convenience and accessibility. This focus on user-friendly devices addresses evolving consumer preferences and accelerates broader testing adoption.

Key Drivers of COVID Testing Kits Industry Growth

Technological advancements (e.g., rapid antigen tests, PCR technology), economic factors (e.g., government funding, investments in healthcare infrastructure), and regulatory frameworks (e.g., expedited approvals during health crises) fuel market expansion. The continuous need for infectious disease surveillance and preparedness further fuels demand.

Challenges in the COVID Testing Kits Industry Market

Regulatory hurdles (e.g., complex approval processes), supply chain disruptions (e.g., shortages of reagents and consumables), and intense competition among manufacturers (e.g., price wars, patent disputes) present significant challenges. Maintaining quality control, ensuring equitable access, and adapting to evolving virus variants also pose significant ongoing obstacles. The market is projected to face a decline in demand post-pandemic, though the need for infectious disease surveillance and preparedness will persist.

Emerging Opportunities in COVID Testing Kits Industry

Technological breakthroughs in point-of-care testing and at-home diagnostic solutions are creating substantial opportunities. Strategic partnerships between diagnostic companies, pharmaceutical firms, and technology providers will further accelerate innovation and market penetration. Expanding into emerging markets and focusing on the detection of other respiratory viruses present additional growth avenues.

Leading Players in the COVID Testing Kits Industry Sector

- Becton Dickinson and Company

- Danaher Corporation (Cepheid)

- Perkin Elmer Inc

- Laboratory Corporation of America Holdings

- F Hoffmann-La Roche Ltd

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc

- Qiagen

- Abbott

- DiaSorin

- BGI

- bioMerieux

Key Milestones in COVID Testing Kits Industry Industry

- May 2022: Cipla launched a COVID-19 RT-PCR test kit in India in collaboration with Genes2Me, called RT-Direct multiplex COVID-19 RT PCR, expanding testing access in a key market.

- June 2022: Genes2Me launched the CoviEasy Self-Test Rapid Antigen test kit for COVID-19 in India, demonstrating a shift towards user-friendly at-home testing solutions and highlighting the growth of AI-driven diagnostics.

Strategic Outlook for COVID Testing Kits Industry Market

The COVID-19 testing kits market is expected to experience a period of consolidation and focus on innovation post-pandemic. The continued need for surveillance of respiratory viruses and preparedness for future pandemics ensures long-term market potential. Strategic investments in advanced technologies, strategic partnerships, and expansion into emerging markets will drive future growth and solidify the leading players’ market positions. Furthermore, diversification into broader infectious disease diagnostics will be key for continued success.

COVID Testing Kits Industry Segmentation

-

1. Product

- 1.1. RT-PCR Assay Kits

- 1.2. Immunoassay Test Strips/Cassettes

-

2. Specimen

- 2.1. Nasopharyngeal Swab

- 2.2. Nasal Swab

- 2.3. Oropharyngeal Swab

- 2.4. Others

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostic Centers

- 3.3. Others

COVID Testing Kits Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of World

COVID Testing Kits Industry Regional Market Share

Geographic Coverage of COVID Testing Kits Industry

COVID Testing Kits Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Incidence of COVID-19 and Emerging New Strains; Increasing Product Approvals and Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Lower Accuracy of immunoassay-based Tests

- 3.4. Market Trends

- 3.4.1. RT-PCR Assay Kits Segment Held a Major Market Share and is Estimated to do the Same Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global COVID Testing Kits Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. RT-PCR Assay Kits

- 5.1.2. Immunoassay Test Strips/Cassettes

- 5.2. Market Analysis, Insights and Forecast - by Specimen

- 5.2.1. Nasopharyngeal Swab

- 5.2.2. Nasal Swab

- 5.2.3. Oropharyngeal Swab

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostic Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America COVID Testing Kits Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. RT-PCR Assay Kits

- 6.1.2. Immunoassay Test Strips/Cassettes

- 6.2. Market Analysis, Insights and Forecast - by Specimen

- 6.2.1. Nasopharyngeal Swab

- 6.2.2. Nasal Swab

- 6.2.3. Oropharyngeal Swab

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostic Centers

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe COVID Testing Kits Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. RT-PCR Assay Kits

- 7.1.2. Immunoassay Test Strips/Cassettes

- 7.2. Market Analysis, Insights and Forecast - by Specimen

- 7.2.1. Nasopharyngeal Swab

- 7.2.2. Nasal Swab

- 7.2.3. Oropharyngeal Swab

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostic Centers

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific COVID Testing Kits Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. RT-PCR Assay Kits

- 8.1.2. Immunoassay Test Strips/Cassettes

- 8.2. Market Analysis, Insights and Forecast - by Specimen

- 8.2.1. Nasopharyngeal Swab

- 8.2.2. Nasal Swab

- 8.2.3. Oropharyngeal Swab

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostic Centers

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of World COVID Testing Kits Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. RT-PCR Assay Kits

- 9.1.2. Immunoassay Test Strips/Cassettes

- 9.2. Market Analysis, Insights and Forecast - by Specimen

- 9.2.1. Nasopharyngeal Swab

- 9.2.2. Nasal Swab

- 9.2.3. Oropharyngeal Swab

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostic Centers

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Danaher Corporation (Cepheid)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Perkin Elmer Inc *List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Laboratory Corporation of America Holdings

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 F Hoffmann-La Roche Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Randox Laboratories Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Thermo Fisher Scientific Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Qiagen

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Abbott

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 DiaSorin

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BGI

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 bioMerieux

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global COVID Testing Kits Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global COVID Testing Kits Industry Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America COVID Testing Kits Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America COVID Testing Kits Industry Volume (K Units), by Product 2025 & 2033

- Figure 5: North America COVID Testing Kits Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America COVID Testing Kits Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America COVID Testing Kits Industry Revenue (billion), by Specimen 2025 & 2033

- Figure 8: North America COVID Testing Kits Industry Volume (K Units), by Specimen 2025 & 2033

- Figure 9: North America COVID Testing Kits Industry Revenue Share (%), by Specimen 2025 & 2033

- Figure 10: North America COVID Testing Kits Industry Volume Share (%), by Specimen 2025 & 2033

- Figure 11: North America COVID Testing Kits Industry Revenue (billion), by End User 2025 & 2033

- Figure 12: North America COVID Testing Kits Industry Volume (K Units), by End User 2025 & 2033

- Figure 13: North America COVID Testing Kits Industry Revenue Share (%), by End User 2025 & 2033

- Figure 14: North America COVID Testing Kits Industry Volume Share (%), by End User 2025 & 2033

- Figure 15: North America COVID Testing Kits Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America COVID Testing Kits Industry Volume (K Units), by Country 2025 & 2033

- Figure 17: North America COVID Testing Kits Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America COVID Testing Kits Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe COVID Testing Kits Industry Revenue (billion), by Product 2025 & 2033

- Figure 20: Europe COVID Testing Kits Industry Volume (K Units), by Product 2025 & 2033

- Figure 21: Europe COVID Testing Kits Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe COVID Testing Kits Industry Volume Share (%), by Product 2025 & 2033

- Figure 23: Europe COVID Testing Kits Industry Revenue (billion), by Specimen 2025 & 2033

- Figure 24: Europe COVID Testing Kits Industry Volume (K Units), by Specimen 2025 & 2033

- Figure 25: Europe COVID Testing Kits Industry Revenue Share (%), by Specimen 2025 & 2033

- Figure 26: Europe COVID Testing Kits Industry Volume Share (%), by Specimen 2025 & 2033

- Figure 27: Europe COVID Testing Kits Industry Revenue (billion), by End User 2025 & 2033

- Figure 28: Europe COVID Testing Kits Industry Volume (K Units), by End User 2025 & 2033

- Figure 29: Europe COVID Testing Kits Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Europe COVID Testing Kits Industry Volume Share (%), by End User 2025 & 2033

- Figure 31: Europe COVID Testing Kits Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe COVID Testing Kits Industry Volume (K Units), by Country 2025 & 2033

- Figure 33: Europe COVID Testing Kits Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe COVID Testing Kits Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific COVID Testing Kits Industry Revenue (billion), by Product 2025 & 2033

- Figure 36: Asia Pacific COVID Testing Kits Industry Volume (K Units), by Product 2025 & 2033

- Figure 37: Asia Pacific COVID Testing Kits Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific COVID Testing Kits Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: Asia Pacific COVID Testing Kits Industry Revenue (billion), by Specimen 2025 & 2033

- Figure 40: Asia Pacific COVID Testing Kits Industry Volume (K Units), by Specimen 2025 & 2033

- Figure 41: Asia Pacific COVID Testing Kits Industry Revenue Share (%), by Specimen 2025 & 2033

- Figure 42: Asia Pacific COVID Testing Kits Industry Volume Share (%), by Specimen 2025 & 2033

- Figure 43: Asia Pacific COVID Testing Kits Industry Revenue (billion), by End User 2025 & 2033

- Figure 44: Asia Pacific COVID Testing Kits Industry Volume (K Units), by End User 2025 & 2033

- Figure 45: Asia Pacific COVID Testing Kits Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Asia Pacific COVID Testing Kits Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Asia Pacific COVID Testing Kits Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific COVID Testing Kits Industry Volume (K Units), by Country 2025 & 2033

- Figure 49: Asia Pacific COVID Testing Kits Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific COVID Testing Kits Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of World COVID Testing Kits Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: Rest of World COVID Testing Kits Industry Volume (K Units), by Product 2025 & 2033

- Figure 53: Rest of World COVID Testing Kits Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: Rest of World COVID Testing Kits Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: Rest of World COVID Testing Kits Industry Revenue (billion), by Specimen 2025 & 2033

- Figure 56: Rest of World COVID Testing Kits Industry Volume (K Units), by Specimen 2025 & 2033

- Figure 57: Rest of World COVID Testing Kits Industry Revenue Share (%), by Specimen 2025 & 2033

- Figure 58: Rest of World COVID Testing Kits Industry Volume Share (%), by Specimen 2025 & 2033

- Figure 59: Rest of World COVID Testing Kits Industry Revenue (billion), by End User 2025 & 2033

- Figure 60: Rest of World COVID Testing Kits Industry Volume (K Units), by End User 2025 & 2033

- Figure 61: Rest of World COVID Testing Kits Industry Revenue Share (%), by End User 2025 & 2033

- Figure 62: Rest of World COVID Testing Kits Industry Volume Share (%), by End User 2025 & 2033

- Figure 63: Rest of World COVID Testing Kits Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Rest of World COVID Testing Kits Industry Volume (K Units), by Country 2025 & 2033

- Figure 65: Rest of World COVID Testing Kits Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of World COVID Testing Kits Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global COVID Testing Kits Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global COVID Testing Kits Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Global COVID Testing Kits Industry Revenue billion Forecast, by Specimen 2020 & 2033

- Table 4: Global COVID Testing Kits Industry Volume K Units Forecast, by Specimen 2020 & 2033

- Table 5: Global COVID Testing Kits Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global COVID Testing Kits Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Global COVID Testing Kits Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global COVID Testing Kits Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Global COVID Testing Kits Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Global COVID Testing Kits Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 11: Global COVID Testing Kits Industry Revenue billion Forecast, by Specimen 2020 & 2033

- Table 12: Global COVID Testing Kits Industry Volume K Units Forecast, by Specimen 2020 & 2033

- Table 13: Global COVID Testing Kits Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Global COVID Testing Kits Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Global COVID Testing Kits Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global COVID Testing Kits Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: United States COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Canada COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: Mexico COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 23: Global COVID Testing Kits Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 24: Global COVID Testing Kits Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 25: Global COVID Testing Kits Industry Revenue billion Forecast, by Specimen 2020 & 2033

- Table 26: Global COVID Testing Kits Industry Volume K Units Forecast, by Specimen 2020 & 2033

- Table 27: Global COVID Testing Kits Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Global COVID Testing Kits Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 29: Global COVID Testing Kits Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global COVID Testing Kits Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Germany COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 35: France COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 37: Italy COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Spain COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Global COVID Testing Kits Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 44: Global COVID Testing Kits Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 45: Global COVID Testing Kits Industry Revenue billion Forecast, by Specimen 2020 & 2033

- Table 46: Global COVID Testing Kits Industry Volume K Units Forecast, by Specimen 2020 & 2033

- Table 47: Global COVID Testing Kits Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 48: Global COVID Testing Kits Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 49: Global COVID Testing Kits Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global COVID Testing Kits Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 51: China COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Japan COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: India COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 57: Australia COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 59: South Korea COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific COVID Testing Kits Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific COVID Testing Kits Industry Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Global COVID Testing Kits Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 64: Global COVID Testing Kits Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 65: Global COVID Testing Kits Industry Revenue billion Forecast, by Specimen 2020 & 2033

- Table 66: Global COVID Testing Kits Industry Volume K Units Forecast, by Specimen 2020 & 2033

- Table 67: Global COVID Testing Kits Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 68: Global COVID Testing Kits Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 69: Global COVID Testing Kits Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global COVID Testing Kits Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the COVID Testing Kits Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the COVID Testing Kits Industry?

Key companies in the market include Becton Dickinson and Company, Danaher Corporation (Cepheid), Perkin Elmer Inc *List Not Exhaustive, Laboratory Corporation of America Holdings, F Hoffmann-La Roche Ltd, Randox Laboratories Ltd, Thermo Fisher Scientific Inc, Qiagen, Abbott, DiaSorin, BGI, bioMerieux.

3. What are the main segments of the COVID Testing Kits Industry?

The market segments include Product, Specimen, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

High Incidence of COVID-19 and Emerging New Strains; Increasing Product Approvals and Government Initiatives.

6. What are the notable trends driving market growth?

RT-PCR Assay Kits Segment Held a Major Market Share and is Estimated to do the Same Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lower Accuracy of immunoassay-based Tests.

8. Can you provide examples of recent developments in the market?

May 2022: Cipla launched a COVID-19 RT-PCR test kit in India in collaboration with Genes2Me, called RT-Direct multiplex COVID-19 RT PCR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "COVID Testing Kits Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the COVID Testing Kits Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the COVID Testing Kits Industry?

To stay informed about further developments, trends, and reports in the COVID Testing Kits Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence