Key Insights

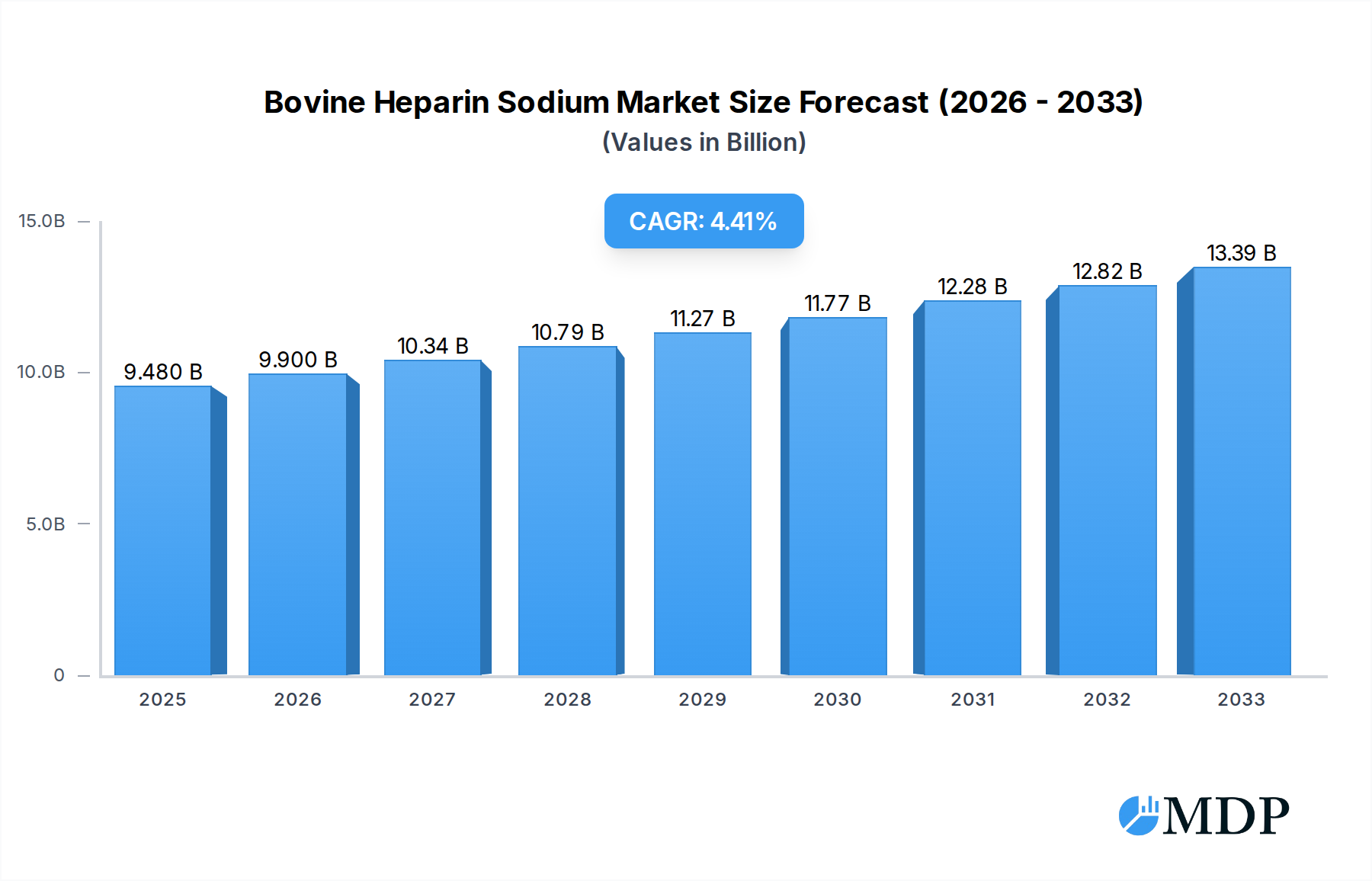

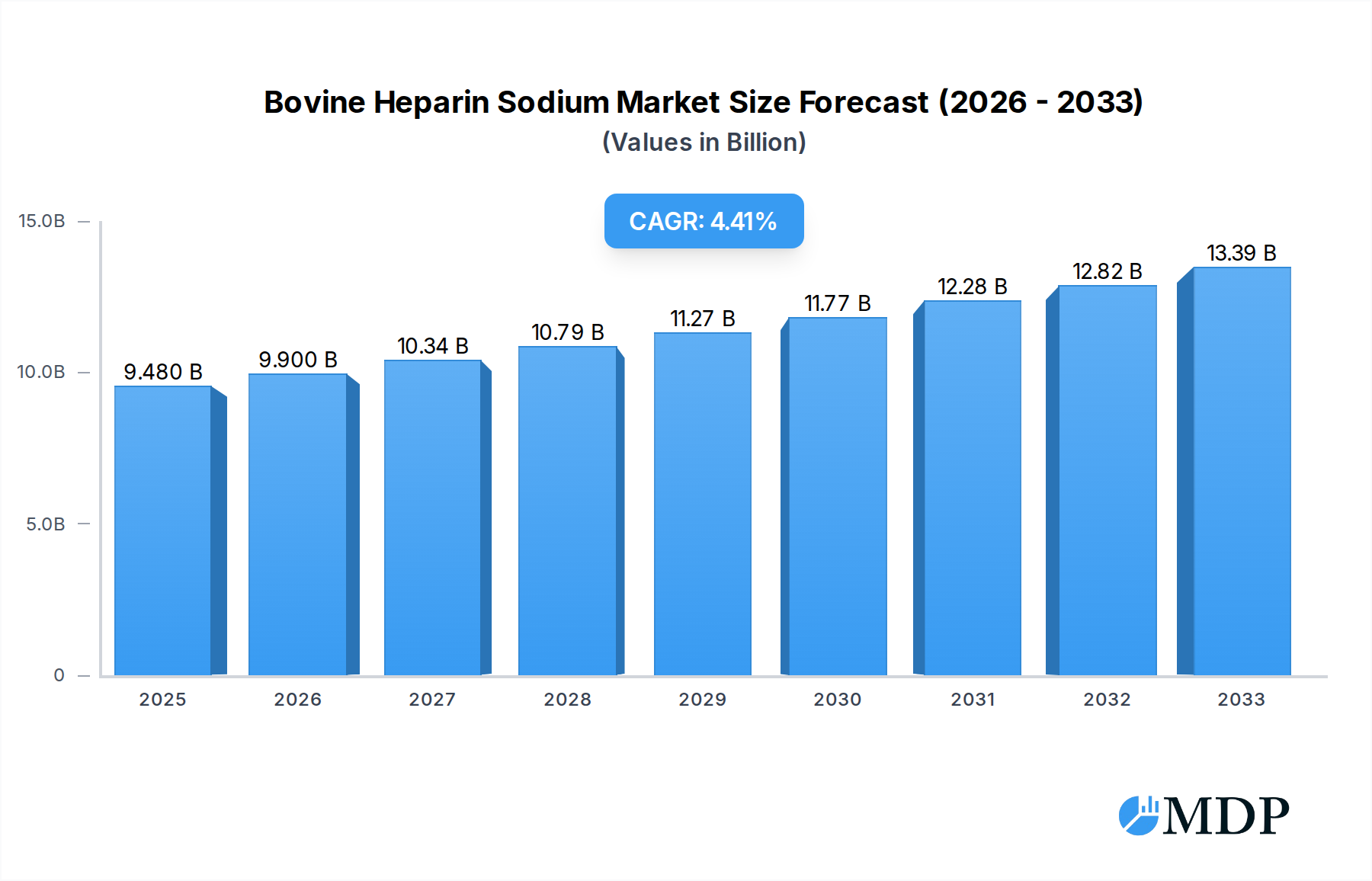

The global Bovine Heparin Sodium market is projected to reach USD 9.48 billion in 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.4% through the forecast period of 2025-2033. This expansion is primarily fueled by the increasing prevalence of cardiovascular diseases, a significant driver for heparin's use in anticoagulation therapies. The rising incidence of Venous Thromboembolism (VTE) and Atrial Fibrillation/Flutter further propels market demand, as bovine heparin sodium remains a cornerstone in managing these critical conditions. Advances in pharmaceutical manufacturing and a growing focus on animal-derived biopharmaceuticals also contribute to market stability and growth. The market is segmented by application, with Treatment of Venous Thromboembolism and Cardioversion of Atrial Fibrillation/Flutter dominating as key revenue streams. The "Others" category, likely encompassing applications in complications of pregnancy and other less common uses, is also expected to see steady growth.

Bovine Heparin Sodium Market Size (In Billion)

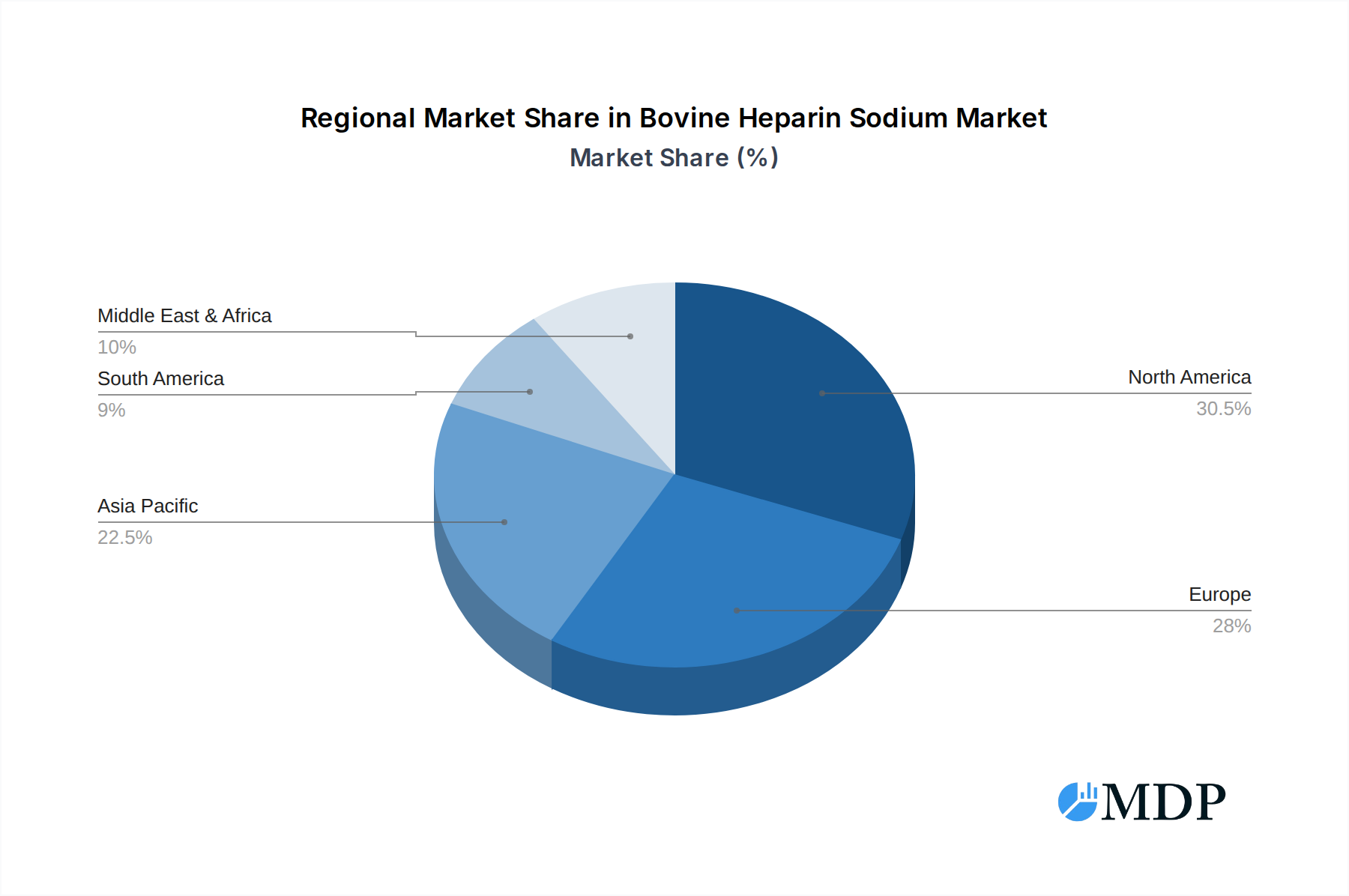

The market's growth trajectory is influenced by several key trends, including the development of more refined extraction and purification techniques for bovine heparin sodium, enhancing its safety and efficacy profile. Furthermore, there's a continuous effort to ensure a stable and reliable supply chain amidst evolving regulatory landscapes. While the market is robust, potential restraints include the growing adoption of alternative anticoagulants and the increasing scrutiny surrounding the sourcing of animal-derived products. However, the established efficacy and cost-effectiveness of bovine heparin sodium in numerous clinical scenarios are expected to counterbalance these challenges. Geographically, North America and Europe are anticipated to lead the market, driven by advanced healthcare infrastructure and high disease burden. The Asia Pacific region, with its expanding healthcare access and increasing awareness, presents a significant growth opportunity. Key players are actively engaged in strategic collaborations and product development to maintain a competitive edge.

Bovine Heparin Sodium Company Market Share

Bovine Heparin Sodium Market Analysis: Comprehensive Report 2019-2033

This in-depth report offers a comprehensive analysis of the global Bovine Heparin Sodium market, providing critical insights for industry stakeholders. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study delves into market dynamics, trends, leading segments, product developments, growth drivers, challenges, opportunities, and key players. With an estimated market value of over Billion in 2025, this report is an indispensable resource for understanding the current and future landscape of this vital pharmaceutical ingredient.

Bovine Heparin Sodium Market Dynamics & Concentration

The Bovine Heparin Sodium market exhibits a moderate to high concentration, with a few key global players dominating a significant portion of the market share, estimated to be over Billion in 2025. Innovation is primarily driven by advancements in purification techniques and the development of more consistent product quality, crucial for its application in critical medical treatments. Regulatory frameworks, particularly those from agencies like the FDA and EMA, play a pivotal role, influencing manufacturing standards, product approvals, and market access. The specter of product substitutes, such as synthetic heparins and other anticoagulants, presents a continuous challenge, although the established efficacy and cost-effectiveness of bovine heparin sodium maintain its strong market position. End-user trends are heavily influenced by the increasing prevalence of cardiovascular diseases and thromboembolic disorders globally. Mergers and acquisitions (M&A) activities are moderate, with an estimated Billion in deal value and approximately X deals observed during the historical period, indicating strategic consolidation and market expansion efforts by leading companies.

Bovine Heparin Sodium Industry Trends & Analysis

The Bovine Heparin Sodium industry is poised for sustained growth, driven by escalating demand for anticoagulant therapies worldwide. The market is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033, reaching a market value exceeding Billion. This growth is underpinned by several key factors, including the rising incidence of deep vein thrombosis (DVT) and pulmonary embolism (PE), particularly among aging populations and individuals with chronic medical conditions. Technological disruptions, while not revolutionary, focus on enhancing extraction efficiency, reducing impurities, and ensuring lot-to-lot consistency, thereby improving product safety and efficacy. Consumer preferences, primarily dictated by healthcare providers and regulatory bodies, prioritize proven therapeutic outcomes and stringent quality control. The competitive landscape is characterized by a mix of established global manufacturers and emerging regional players, all vying for market share through product differentiation, strategic partnerships, and supply chain optimization. Market penetration of bovine heparin sodium remains high in its established therapeutic areas, with ongoing efforts to explore novel applications. The increasing global healthcare expenditure, coupled with expanding access to advanced medical treatments in developing economies, further fuels market expansion. The continuous research into the therapeutic benefits of heparin, beyond its anticoagulant properties, also presents opportunities for market diversification.

Leading Markets & Segments in Bovine Heparin Sodium

The global Bovine Heparin Sodium market is segmented by application and type, with each segment demonstrating unique growth trajectories.

Dominant Application Segment: Treatment of Venous Thromboembolism

Key Drivers:

- Increasing global prevalence of DVT and PE, linked to sedentary lifestyles, surgery, and prolonged immobility.

- Aging global population, a demographic highly susceptible to thromboembolic events.

- Advancements in diagnostic tools leading to earlier and more accurate identification of VTE.

- Established efficacy and cost-effectiveness of bovine heparin sodium in preventing and treating VTE.

- Robust clinical guidelines recommending heparin therapy for VTE management.

Detailed Dominance Analysis: The "Treatment of Venous Thromboembolism" segment represents the largest and most dominant application for Bovine Heparin Sodium. This is directly attributable to the pervasive and growing threat of VTE across diverse patient populations. Economic policies that prioritize accessible healthcare and robust insurance coverage for critical care further bolster demand. Infrastructure development in healthcare facilities, including specialized cardiac and vascular units, facilitates the administration of heparin therapies. The regulatory landscape actively supports the use of approved anticoagulants for VTE, solidifying this segment's leading position.

Prominent Application Segment: Cardioversion of Atrial Fibrillation/Flutter

- Key Drivers:

- Rising rates of atrial fibrillation and flutter globally.

- Heparin's role in preventing stroke during cardioversion procedures.

- Clinical recommendations for anticoagulation prior to electrical cardioversion.

Significant Application Segment: Complications of Pregnancy

- Key Drivers:

- Increasing awareness and diagnosis of thrombotic disorders during pregnancy.

- Heparin's established safety profile for pregnant women experiencing or at risk of thromboembolism.

- Personalized medicine approaches to manage pregnancy-related complications.

Emerging Application Segment: Others

- Key Drivers:

- Ongoing research into novel applications of heparin, including its anti-inflammatory and immunomodulatory properties.

- Potential use in wound healing and other non-thrombotic medical interventions.

- Expansion into veterinary medicine applications.

Dominant Type Segment: Type A Heparin

- Key Drivers:

- Type A heparin, typically unfractionated heparin (UFH), remains the most widely used form due to its historical efficacy and established manufacturing processes.

- Cost-effectiveness and broad therapeutic indications for UFH.

- Regulatory familiarity and widespread clinical acceptance of Type A.

Emerging Type Segment: Type B Heparin

- Key Drivers:

- Development and increasing adoption of low molecular weight heparins (LMWHs) which fall under Type B, offering improved pharmacokinetic profiles and reduced monitoring requirements in certain cases.

- Growing preference for LMWHs in specific clinical scenarios due to convenience and reduced risk of certain complications.

Bovine Heparin Sodium Product Developments

Product developments in the Bovine Heparin Sodium sector primarily focus on enhancing purity, consistency, and developing specialized formulations. Manufacturers are investing in advanced chromatographic techniques and rigorous quality control measures to minimize impurities and ensure lot-to-lot variability, directly addressing pharmacopeial standards and end-user demands for safety and reliability. Innovations also explore optimized extraction and purification processes that can improve yield and reduce manufacturing costs. While groundbreaking new types of bovine heparin sodium are infrequent, the emphasis remains on refining the existing product to meet evolving clinical needs and regulatory expectations, thereby strengthening its competitive advantage in a market increasingly prioritizing quality and safety.

Key Drivers of Bovine Heparin Sodium Growth

The growth of the Bovine Heparin Sodium market is propelled by several interconnected factors. Technologically, advancements in purification and analytical methods ensure higher quality and more consistent product, crucial for therapeutic efficacy and patient safety. Economically, the rising global healthcare expenditure and the increasing prevalence of cardiovascular and thromboembolic diseases in aging populations drive demand. Furthermore, government initiatives promoting accessible healthcare and the growing emphasis on preventative medicine contribute to a sustained need for effective anticoagulant therapies. Regulatory bodies' continued approval and guidelines supporting the use of bovine heparin sodium in established indications solidify its market position.

Challenges in the Bovine Heparin Sodium Market

Despite its significant market presence, the Bovine Heparin Sodium market faces notable challenges. Stringent and evolving regulatory requirements for pharmaceutical ingredients necessitate continuous investment in compliance and quality assurance, acting as a barrier for smaller players. Supply chain vulnerabilities, including potential disruptions in raw material sourcing and geopolitical uncertainties, can impact production and availability. Furthermore, the competitive pressure from synthetic heparin alternatives and other anticoagulant drugs, which offer distinct advantages in certain applications, requires continuous innovation and cost optimization to maintain market share. The potential for viral contamination in animal-derived products also necessitates robust safety protocols, adding to manufacturing complexity.

Emerging Opportunities in Bovine Heparin Sodium

Emerging opportunities in the Bovine Heparin Sodium market lie in the ongoing exploration of its multifaceted pharmacological properties beyond anticoagulation. Research into its potential anti-inflammatory, anti-cancer, and antiviral effects could unlock novel therapeutic applications, diversifying its market relevance. Strategic partnerships between heparin manufacturers and pharmaceutical companies developing these new indications can accelerate product development and market penetration. Furthermore, the expanding healthcare infrastructure and increasing medical treatment access in emerging economies present significant untapped market potential for established and high-quality bovine heparin sodium products.

Leading Players in the Bovine Heparin Sodium Sector

- Kin Master Produtos Químicos Ltda

- Syntex

- Bacto Chem

- Wegmed - Caminhos Medicinais Ltda

- Alliance Brasil

- Ralington Pharma

- Hebei Changshan Biochemical Pharmaceutical

- Suzhou Ronnsi Pharma

Key Milestones in Bovine Heparin Sodium Industry

- 2019: Increased regulatory scrutiny and enhanced quality control standards introduced by major pharmacopeias.

- 2020: Global pandemic highlights the critical role of anticoagulants in managing critically ill patients.

- 2021: Continued investment in advanced purification technologies by leading manufacturers to ensure product purity.

- 2022: Growing research interest in non-anticoagulant properties of heparin, such as anti-inflammatory effects.

- 2023: Strategic partnerships and potential M&A activities signaling market consolidation and expansion efforts.

- 2024: Focus on supply chain resilience and diversification of raw material sourcing.

Strategic Outlook for Bovine Heparin Sodium Market

The strategic outlook for the Bovine Heparin Sodium market is one of continued stability and moderate growth, underpinned by its indispensable role in established therapeutic areas. Key growth accelerators include the increasing global demand for anticoagulants driven by an aging population and the rising incidence of cardiovascular diseases. Continuous investment in R&D for enhanced product quality and exploration of novel applications will be crucial for maintaining competitive advantage. Strategic collaborations and a focus on supply chain robustness will further solidify market positions. The market is expected to benefit from a growing emphasis on accessible and cost-effective healthcare solutions globally.

Bovine Heparin Sodium Segmentation

-

1. Application

- 1.1. Treatment of Venous Thromboembolism

- 1.2. Cardioversion of Atrial Fibrillation/Flutter

- 1.3. Complications of Pregnancy

- 1.4. Others

-

2. Types

- 2.1. Type A

- 2.2. Type B

Bovine Heparin Sodium Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bovine Heparin Sodium Regional Market Share

Geographic Coverage of Bovine Heparin Sodium

Bovine Heparin Sodium REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Treatment of Venous Thromboembolism

- 5.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 5.1.3. Complications of Pregnancy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Type A

- 5.2.2. Type B

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Treatment of Venous Thromboembolism

- 6.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 6.1.3. Complications of Pregnancy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Type A

- 6.2.2. Type B

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Treatment of Venous Thromboembolism

- 7.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 7.1.3. Complications of Pregnancy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Type A

- 7.2.2. Type B

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Treatment of Venous Thromboembolism

- 8.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 8.1.3. Complications of Pregnancy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Type A

- 8.2.2. Type B

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Treatment of Venous Thromboembolism

- 9.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 9.1.3. Complications of Pregnancy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Type A

- 9.2.2. Type B

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bovine Heparin Sodium Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Treatment of Venous Thromboembolism

- 10.1.2. Cardioversion of Atrial Fibrillation/Flutter

- 10.1.3. Complications of Pregnancy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Type A

- 10.2.2. Type B

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kin Master Produtos Químicos Ltda

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Syntex

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bacto Chem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wegmed - Caminhos Medicinais Ltda

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alliance Brasil

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ralington Pharma

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hebei Changshan Biochemical Pharmaceutical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suzhou Ronnsi Pharma

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Kin Master Produtos Químicos Ltda

List of Figures

- Figure 1: Global Bovine Heparin Sodium Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bovine Heparin Sodium Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Bovine Heparin Sodium Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Bovine Heparin Sodium Revenue (billion), by Types 2025 & 2033

- Figure 5: North America Bovine Heparin Sodium Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Bovine Heparin Sodium Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Bovine Heparin Sodium Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Bovine Heparin Sodium Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Bovine Heparin Sodium Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Bovine Heparin Sodium Revenue (billion), by Types 2025 & 2033

- Figure 11: South America Bovine Heparin Sodium Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Bovine Heparin Sodium Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Bovine Heparin Sodium Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bovine Heparin Sodium Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Bovine Heparin Sodium Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Bovine Heparin Sodium Revenue (billion), by Types 2025 & 2033

- Figure 17: Europe Bovine Heparin Sodium Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Bovine Heparin Sodium Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Bovine Heparin Sodium Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Bovine Heparin Sodium Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Bovine Heparin Sodium Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Bovine Heparin Sodium Revenue (billion), by Types 2025 & 2033

- Figure 23: Middle East & Africa Bovine Heparin Sodium Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Bovine Heparin Sodium Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Bovine Heparin Sodium Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Bovine Heparin Sodium Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Bovine Heparin Sodium Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Bovine Heparin Sodium Revenue (billion), by Types 2025 & 2033

- Figure 29: Asia Pacific Bovine Heparin Sodium Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Bovine Heparin Sodium Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Bovine Heparin Sodium Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 3: Global Bovine Heparin Sodium Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Global Bovine Heparin Sodium Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 12: Global Bovine Heparin Sodium Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Global Bovine Heparin Sodium Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 30: Global Bovine Heparin Sodium Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Bovine Heparin Sodium Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Bovine Heparin Sodium Revenue billion Forecast, by Types 2020 & 2033

- Table 39: Global Bovine Heparin Sodium Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Bovine Heparin Sodium Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bovine Heparin Sodium?

The projected CAGR is approximately 4.4%.

2. Which companies are prominent players in the Bovine Heparin Sodium?

Key companies in the market include Kin Master Produtos Químicos Ltda, Syntex, Bacto Chem, Wegmed - Caminhos Medicinais Ltda, Alliance Brasil, Ralington Pharma, Hebei Changshan Biochemical Pharmaceutical, Suzhou Ronnsi Pharma.

3. What are the main segments of the Bovine Heparin Sodium?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.48 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bovine Heparin Sodium," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bovine Heparin Sodium report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bovine Heparin Sodium?

To stay informed about further developments, trends, and reports in the Bovine Heparin Sodium, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence