Key Insights

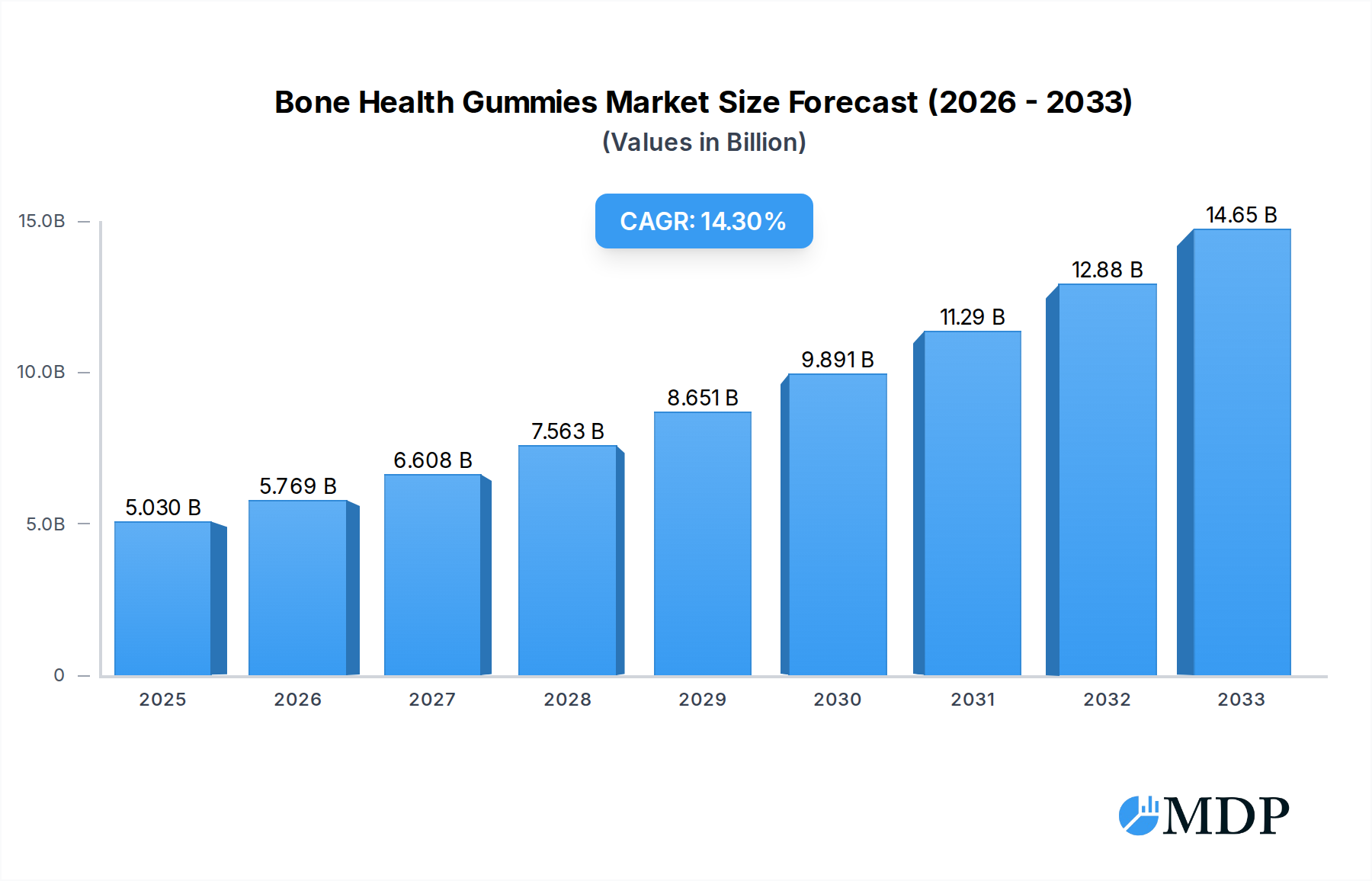

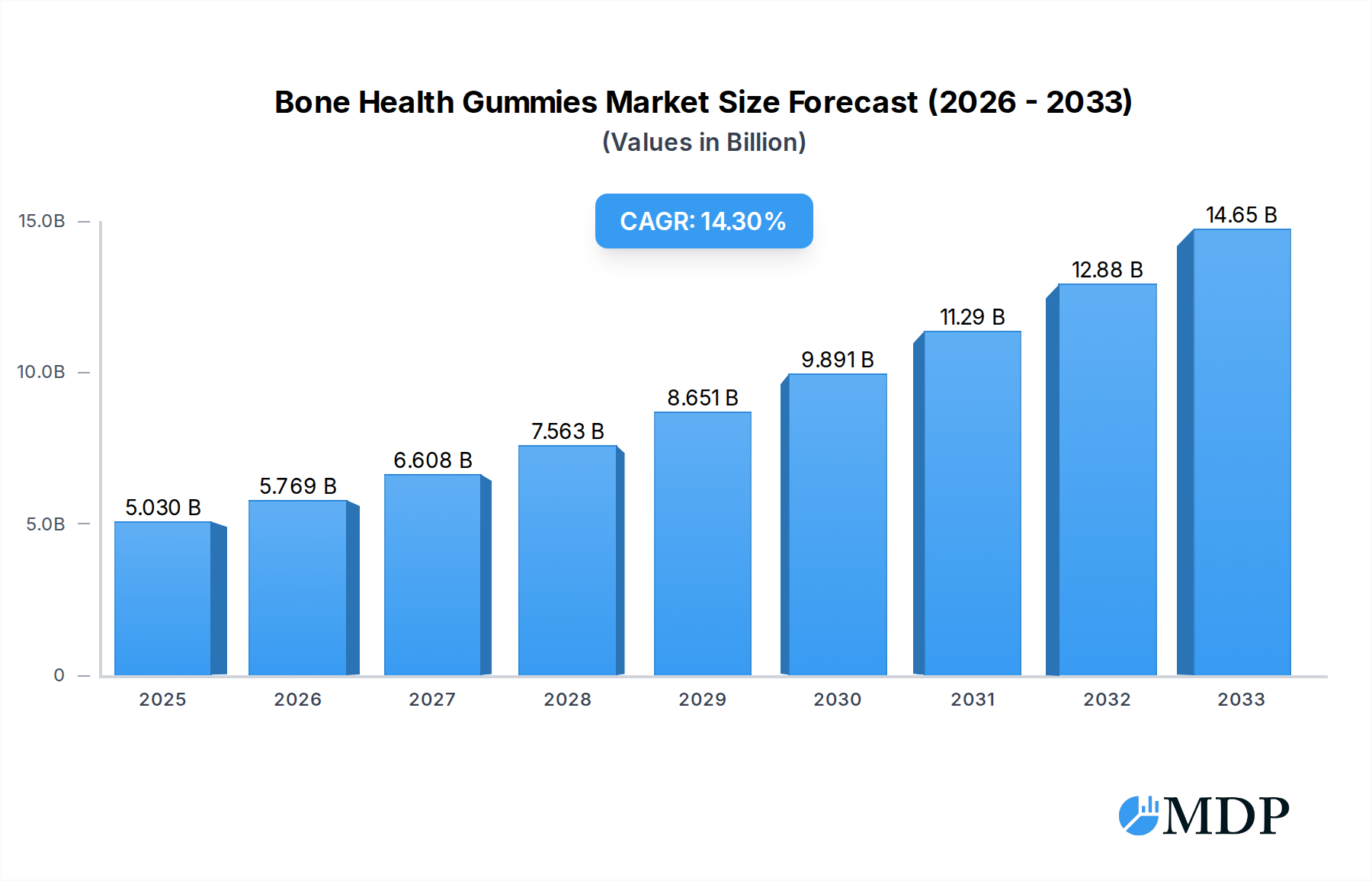

The global Bone Health Gummies market is poised for substantial growth, projected to reach an estimated USD 5,030 million in 2025. This upward trajectory is fueled by a robust CAGR of 14.5% anticipated to persist throughout the forecast period. The increasing consumer awareness regarding the importance of bone health, particularly among aging populations and health-conscious individuals, is a primary driver. The convenience and palatable nature of gummies, offering an appealing alternative to traditional supplements, further contribute to their rising popularity. This segment is experiencing significant innovation, with manufacturers introducing novel formulations catering to specific demographic needs, such as enhanced calcium and vitamin D absorption for seniors, and convenient, tasty options for children. The growing prevalence of osteoporosis and other bone-related ailments worldwide underscores the escalating demand for effective bone health solutions.

Bone Health Gummies Market Size (In Billion)

The market's expansion is further propelled by the expanding retail landscape, including an increasing presence in pharmacies, supermarkets, and online channels, making bone health gummies more accessible to consumers globally. Emerging economies, particularly in the Asia Pacific region, represent a significant untapped potential due to rising disposable incomes and growing health consciousness. While the market is characterized by a competitive landscape with established players like GSK (Caltrate) and Otsuka (Nature Made) alongside emerging brands, the consistent demand for effective bone health management solutions ensures sustained market vitality. The segment's ability to adapt to evolving consumer preferences for natural and fortified ingredients will be crucial for continued dominance.

Bone Health Gummies Company Market Share

Bone Health Gummies Market Dynamics & Concentration

The global Bone Health Gummies market is characterized by a moderately concentrated landscape, with key players like GSK (Caltrate), Otsuka (Nature Made), and Bayer (One A Day) holding significant market share, estimated to be 3.5 billion USD. Innovation is a primary driver, fueled by advancements in gummy delivery systems and the incorporation of enhanced nutrient bioavailability. Regulatory frameworks, particularly concerning dietary supplement approvals and labeling standards in major markets like North America and Europe, exert a considerable influence on product development and market entry. While direct product substitutes are limited, the broader health and wellness sector, encompassing traditional supplements and fortified foods, presents indirect competition. End-user trends are increasingly favoring convenient and palatable supplement formats, especially among children and adults seeking to maintain bone density. Mergers and Acquisitions (M&A) activity, while not rampant, plays a role in market consolidation and expansion. For instance, recent M&A deals are estimated to be around 25 deals, with a combined value of 5.8 billion USD, indicating strategic moves by larger entities to acquire niche players or expand their product portfolios. The competitive environment is intensifying as new entrants leverage unique formulations and targeted marketing strategies.

Bone Health Gummies Industry Trends & Analysis

The Bone Health Gummies industry is experiencing robust growth, projected to reach a market size of 12.7 billion USD by 2033, driven by a confluence of factors that underscore the increasing consumer focus on proactive health management. A significant growth driver is the rising global prevalence of osteoporosis and other bone-related conditions, prompting individuals of all age groups to seek accessible and enjoyable methods for calcium and Vitamin D supplementation. The market penetration of bone health supplements, particularly in the gummy format, has surged due to their superior palatability and ease of consumption compared to traditional pills, especially for children and the elderly. This shift in consumer preference is a pivotal trend, with the gummy segment alone estimated to hold a 45% market share of the overall bone health supplement market. Technological disruptions are continuously enhancing the efficacy and appeal of bone health gummies. Innovations in encapsulation techniques are improving nutrient absorption, while advancements in flavor profiles and textures are making these supplements more appealing to a wider demographic. The CAGR for the bone health gummies market is projected to be 7.8% during the forecast period. Competitive dynamics are characterized by a blend of established pharmaceutical giants and agile dietary supplement companies vying for market dominance. Companies are investing heavily in research and development to introduce novel formulations, such as gummies fortified with additional bone-supporting nutrients like Vitamin K2, magnesium, and collagen. The increasing awareness among healthcare professionals about the benefits of early intervention for bone health also contributes to market expansion. Furthermore, the growing influence of e-commerce platforms has democratized access to bone health gummies, enabling companies to reach a global customer base more effectively and contributing to the overall market growth. The shift towards natural and organic ingredients also presents a significant trend, with consumers actively seeking products free from artificial colors, flavors, and sweeteners, pushing manufacturers to adapt their product lines. The market is poised for continued expansion as these trends converge, solidifying the importance of bone health gummies in the global wellness landscape, with an estimated market value of 8.9 billion USD in the base year 2025.

Leading Markets & Segments in Bone Health Gummies

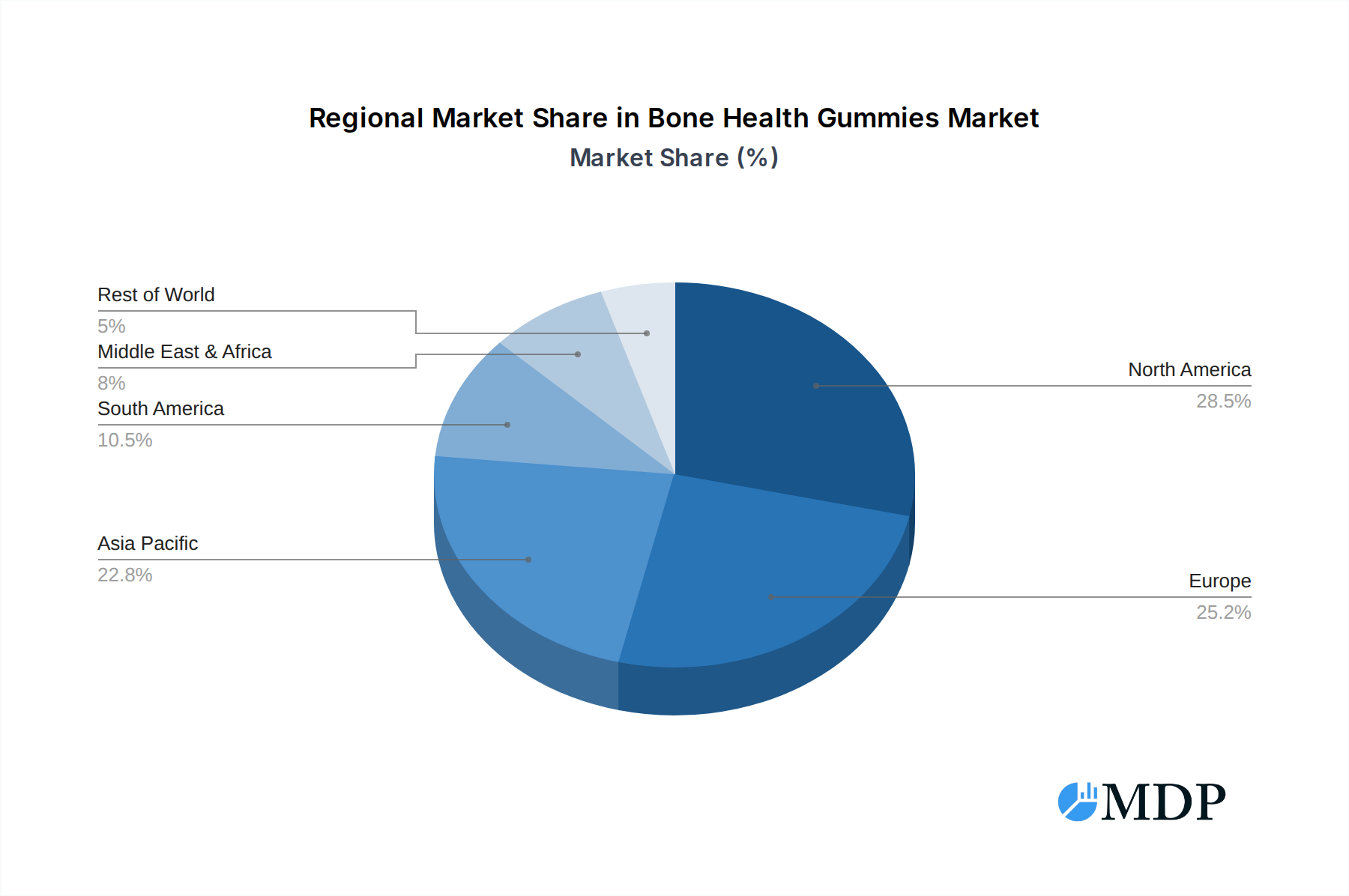

The North America region stands as the dominant market for Bone Health Gummies, driven by a high per capita disposable income, a strong emphasis on preventative healthcare, and a well-established dietary supplement industry. Within North America, the United States accounts for a substantial portion of the market share, estimated at 60%. This dominance is further amplified by robust consumer awareness regarding bone health, particularly among aging populations concerned about age-related bone density loss.

Key Drivers for Dominance:

- Economic Policies and Healthcare Expenditure: Favorable government policies supporting the dietary supplement market and high healthcare expenditure enable consumers to invest in proactive health solutions.

- Infrastructure and Distribution Networks: Well-developed retail and e-commerce infrastructure ensures widespread accessibility of bone health gummies across the country.

- Consumer Awareness and Education: Extensive public health campaigns and readily available information about bone health contribute to high consumer demand.

Analyzing by Application, the Adults segment is currently the largest, holding an estimated 55% market share. This is attributed to the growing awareness of bone health maintenance throughout adulthood to prevent future complications. However, the Seniors segment is exhibiting the fastest growth rate, projected to expand significantly due to the higher incidence of osteoporosis and fractures in this demographic. The Kids segment, while smaller, is also witnessing consistent growth, driven by parental concerns for their children's skeletal development and the appeal of gummy formats.

Dominance Analysis by Type:

- Calcium Gummies: This segment is the most established and commands a significant market share, estimated at 48%. Calcium is widely recognized as the cornerstone of bone health, making these gummies a popular choice. The market is driven by widespread recommendations from healthcare professionals and easy accessibility.

- Vitamin D Gummies: Holding an estimated 35% market share, Vitamin D gummies are gaining prominence due to their crucial role in calcium absorption. The increasing understanding of Vitamin D deficiency and its impact on bone health has propelled this segment's growth.

- Others: This segment, encompassing gummies with added nutrients like Vitamin K2, magnesium, and collagen, represents a growing market share of approximately 17%. These "complete bone support" formulations cater to consumers seeking comprehensive solutions and are a key area of innovation. The demand for synergistic nutrient combinations is a significant driver in this segment.

The Asia-Pacific region, particularly China and India, is emerging as a significant growth frontier, fueled by a rapidly expanding middle class and increasing health consciousness. Regulatory shifts and a growing preference for convenient health supplements are also contributing to this regional expansion.

Bone Health Gummies Product Developments

Product development in the Bone Health Gummies sector is focused on enhancing efficacy and consumer appeal. Innovations include the development of gummies with improved bioavailability of calcium and Vitamin D through advanced formulation techniques. Companies are also expanding product lines to include multi-nutrient gummies that combine calcium, Vitamin D, Vitamin K2, and magnesium for a more holistic approach to bone health. The introduction of gummies with novel flavors, textures, and natural sweeteners caters to a broader consumer base, including children and adults with specific dietary preferences or sensitivities. Competitive advantages are being built on transparent sourcing of ingredients, clinically supported formulations, and appealing branding that emphasizes convenience and health benefits.

Key Drivers of Bone Health Gummies Growth

The sustained growth of the Bone Health Gummies market is propelled by several key drivers. The escalating global awareness of the importance of bone health, especially concerning age-related conditions like osteoporosis, is a primary catalyst. The inherent convenience and palatability of gummy supplements, making them an attractive alternative to traditional pills, are significantly boosting adoption rates across all age demographics, particularly for children and seniors. Furthermore, ongoing advancements in nutritional science are leading to the development of more efficacious gummy formulations, incorporating synergistic nutrients that enhance calcium absorption and overall bone strength. Regulatory support for dietary supplements and increasing disposable incomes in emerging economies also contribute to market expansion.

Challenges in the Bone Health Gummies Market

Despite its promising growth, the Bone Health Gummies market faces several challenges. Stringent regulatory frameworks governing the approval, labeling, and marketing of dietary supplements in different regions can create hurdles for new product launches and market penetration, with compliance costs estimated to impact profitability by 5-10%. The competitive intensity among numerous brands, both established and emerging, puts pressure on pricing and necessitates continuous innovation to maintain market share. Supply chain disruptions, particularly for key raw materials like calcium carbonate and Vitamin D, can affect production capacity and product availability, potentially leading to price volatility. Furthermore, consumer skepticism regarding the efficacy of supplements and the prevalence of misleading health claims can pose a barrier to widespread adoption.

Emerging Opportunities in Bone Health Gummies

Emerging opportunities in the Bone Health Gummies market are abundant, driven by continued innovation and evolving consumer needs. The development of specialized gummies targeting specific bone health concerns, such as prenatal bone support or post-menopausal bone density maintenance, presents a significant avenue for growth. Strategic partnerships between supplement manufacturers and healthcare providers, as well as collaborations with fitness and wellness influencers, can enhance product credibility and reach wider audiences. The expansion of e-commerce platforms globally provides an accessible channel for companies to reach underserved markets and offer personalized product recommendations. Furthermore, incorporating advanced delivery systems that improve nutrient absorption and exploring the potential of novel bioactive ingredients for bone health are key areas that will unlock future growth potential, with an estimated 3.1 billion USD in untapped market potential.

Leading Players in the Bone Health Gummies Sector

- GSK (Caltrate)

- Otsuka (Nature Made)

- Bayer (One A Day)

- Swisse

- Nature's Way Products

- F. Hunziker + (Health-iX)

- The Boots Company

- Nature’s Bounty

- GNC Holdings

- Lifeable

Key Milestones in Bone Health Gummies Industry

- 2019: Increased consumer focus on preventative health and immunity drives demand for fortified supplements.

- 2020: Surge in e-commerce adoption leads to wider accessibility of bone health gummies globally.

- 2021: Introduction of gummies with enhanced bioavailability and novel nutrient combinations.

- 2022: Growing consumer preference for natural and organic ingredients influences product formulations.

- 2023: Regulatory bodies begin implementing stricter guidelines for supplement claims and labeling.

- 2024: Significant investment in research and development for personalized bone health solutions.

Strategic Outlook for Bone Health Gummies Market

The strategic outlook for the Bone Health Gummies market remains exceptionally positive, with a projected market expansion fueled by an intensifying focus on preventative healthcare and the increasing preference for convenient, enjoyable supplement formats. Key growth accelerators include the continuous innovation in product formulations, such as the integration of complementary nutrients like Vitamin K2 and magnesium to enhance efficacy. Companies that can successfully tap into the burgeoning demand in emerging markets and leverage digital channels for direct-to-consumer engagement will experience substantial growth. Furthermore, strategic collaborations with healthcare professionals and a commitment to transparent, scientifically backed product claims will solidify market leadership and build consumer trust, paving the way for sustained market expansion valued at 12.7 billion USD by 2033.

Bone Health Gummies Segmentation

-

1. Application

- 1.1. Kids

- 1.2. Adults

- 1.3. Seniors

-

2. Types

- 2.1. Calcium Gummies

- 2.2. Vitamin D Gummies

- 2.3. Others

Bone Health Gummies Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Bone Health Gummies Regional Market Share

Geographic Coverage of Bone Health Gummies

Bone Health Gummies REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Kids

- 5.1.2. Adults

- 5.1.3. Seniors

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Calcium Gummies

- 5.2.2. Vitamin D Gummies

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Kids

- 6.1.2. Adults

- 6.1.3. Seniors

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Calcium Gummies

- 6.2.2. Vitamin D Gummies

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Kids

- 7.1.2. Adults

- 7.1.3. Seniors

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Calcium Gummies

- 7.2.2. Vitamin D Gummies

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Kids

- 8.1.2. Adults

- 8.1.3. Seniors

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Calcium Gummies

- 8.2.2. Vitamin D Gummies

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Kids

- 9.1.2. Adults

- 9.1.3. Seniors

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Calcium Gummies

- 9.2.2. Vitamin D Gummies

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Bone Health Gummies Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Kids

- 10.1.2. Adults

- 10.1.3. Seniors

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Calcium Gummies

- 10.2.2. Vitamin D Gummies

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GSK (Caltrate)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Otsuka (Nature Made)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer (One A Day)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Swisse

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nature's Way Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F. Hunziker + (Health-iX)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 The Boots Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nature’s Bounty

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GNC Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lifeable

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 GSK (Caltrate)

List of Figures

- Figure 1: Global Bone Health Gummies Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Bone Health Gummies Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Bone Health Gummies Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Bone Health Gummies Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Bone Health Gummies Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Bone Health Gummies Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Bone Health Gummies Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Bone Health Gummies Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Bone Health Gummies Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Bone Health Gummies Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Bone Health Gummies Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Bone Health Gummies Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Bone Health Gummies Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Bone Health Gummies Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Bone Health Gummies Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Bone Health Gummies Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Bone Health Gummies Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Bone Health Gummies Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Bone Health Gummies Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Bone Health Gummies Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Bone Health Gummies Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Bone Health Gummies Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Bone Health Gummies Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Bone Health Gummies Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Bone Health Gummies Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Bone Health Gummies Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Bone Health Gummies Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Bone Health Gummies Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Bone Health Gummies Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Bone Health Gummies Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Bone Health Gummies Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Bone Health Gummies Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Bone Health Gummies Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Bone Health Gummies Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Bone Health Gummies Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Bone Health Gummies Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Bone Health Gummies Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Bone Health Gummies Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Bone Health Gummies Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Bone Health Gummies Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bone Health Gummies?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Bone Health Gummies?

Key companies in the market include GSK (Caltrate), Otsuka (Nature Made), Bayer (One A Day), Swisse, Nature's Way Products, F. Hunziker + (Health-iX), The Boots Company, Nature’s Bounty, GNC Holdings, Lifeable.

3. What are the main segments of the Bone Health Gummies?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bone Health Gummies," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bone Health Gummies report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bone Health Gummies?

To stay informed about further developments, trends, and reports in the Bone Health Gummies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence