Key Insights

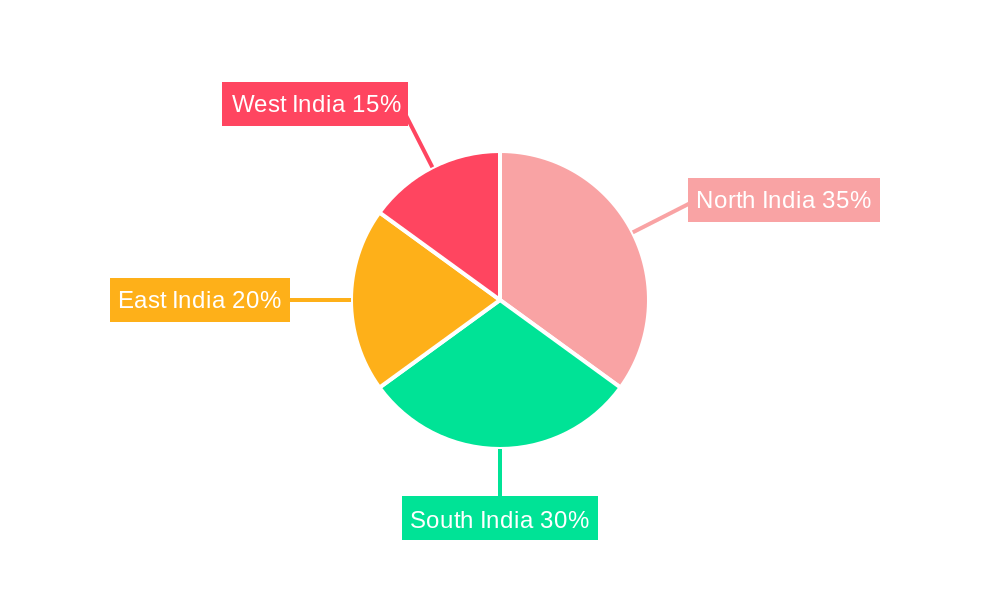

The Indian Ayush alternative medicines market, encompassing Ayurvedic medicine, herbal remedies, aromatherapy, homeopathy, and acupuncture, is poised for substantial growth. This expansion is propelled by heightened health awareness, increasing disposable incomes, and a growing demand for natural, holistic healthcare solutions. The market is projected to reach $20.42 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 19.72% from 2025 to 2033. This growth trajectory is further supported by increasing awareness of the side effects of conventional medicine and governmental promotion of Ayush practices. Ayurvedic and herbal medicines dominate the market share, reflecting deep-rooted cultural preferences. Key players include Baidyanath, Himalaya Wellness, and Dabur India, alongside dynamic emerging brands, creating a competitive landscape. Regional demand is highest in North and South India due to population density and established distribution networks. Despite regulatory hurdles and quality control challenges, the market offers significant opportunities.

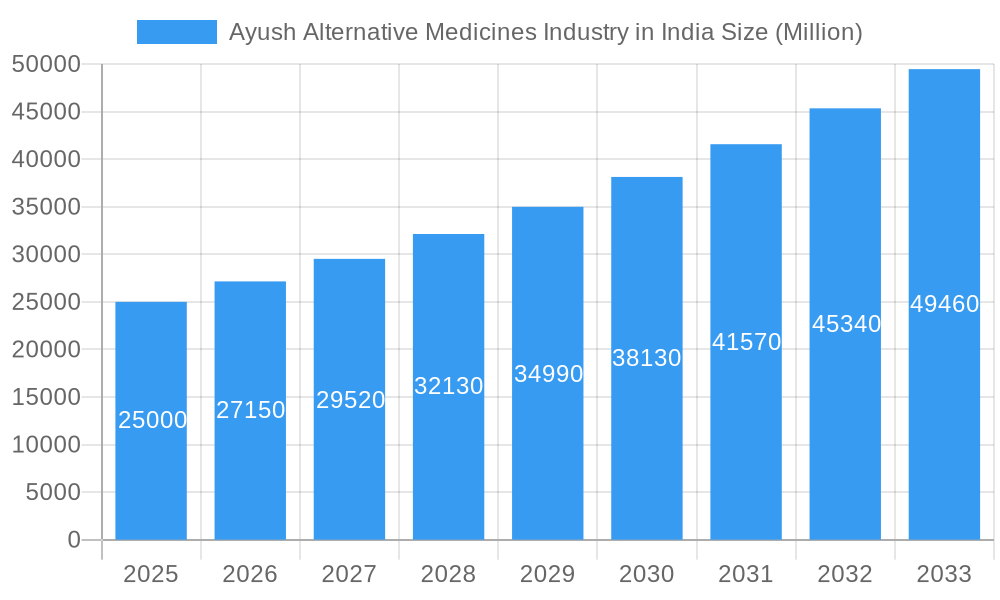

Ayush Alternative Medicines Industry in India Market Size (In Billion)

To sustain and accelerate market expansion, strategic initiatives are essential. Effective marketing campaigns emphasizing the efficacy and safety of Ayush treatments are critical. Investment in research and development will be vital to scientifically validate traditional practices and enhance product standardization. Stringent quality control measures are paramount for building consumer trust and preventing the circulation of substandard products. Furthermore, fostering collaboration between traditional practitioners and modern medical professionals can facilitate the integration of Ayush therapies into mainstream healthcare, thereby increasing market penetration and unlocking the sector's full potential.

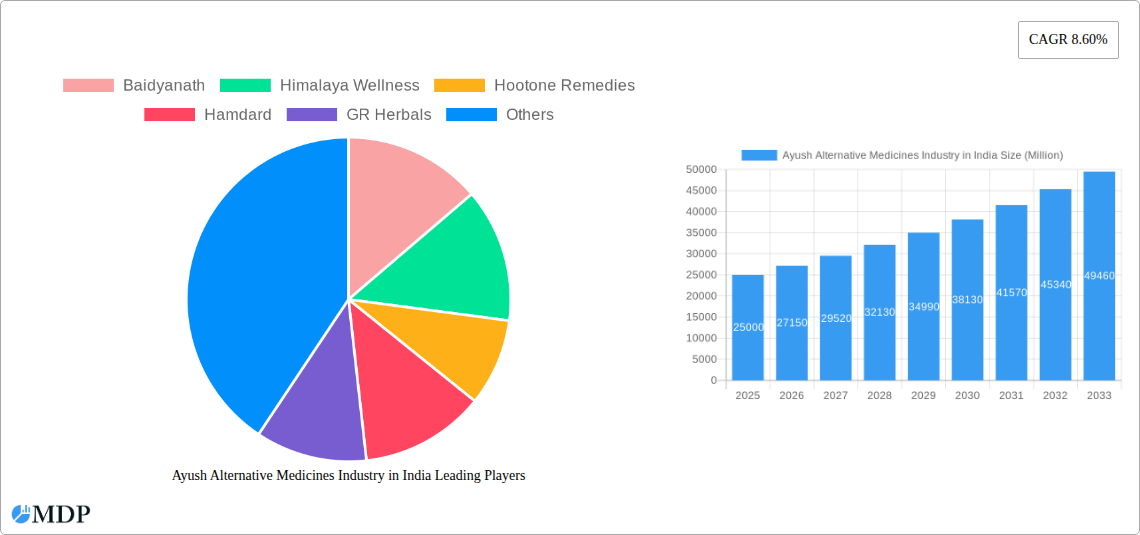

Ayush Alternative Medicines Industry in India Company Market Share

Ayush Alternative Medicines Industry in India: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming Ayush Alternative Medicines industry in India, covering market dynamics, trends, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. The report leverages extensive data analysis to provide actionable intelligence, forecasting a market valued at xx Million by 2033. High-traffic keywords like "Ayurvedic Medicine Market India," "Herbal Medicine Industry Growth," "Ayush Market Size," and "Traditional Medicine India" are strategically incorporated to maximize search engine visibility.

Ayush Alternative Medicines Industry in India Market Dynamics & Concentration

The Indian Ayush alternative medicines market exhibits a complex interplay of factors driving its growth and shaping its competitive landscape. Market concentration is relatively high, with a few dominant players commanding significant market share. However, the presence of numerous smaller players, particularly in regional markets, indicates a fragmented landscape. Innovation, particularly in product formulations and delivery mechanisms, is a key driver. The regulatory framework, though evolving, plays a crucial role in shaping industry practices and consumer trust. Product substitutes, such as conventional pharmaceuticals, pose a competitive challenge, demanding continuous innovation and differentiation. End-user trends reveal a growing preference for natural and holistic healthcare approaches, boosting market demand. M&A activity has been moderate, with a few notable deals in recent years, indicating a potential for further consolidation. Over the historical period (2019-2024), the estimated average annual M&A deal count was 5, while the market share of the top 5 players stood at approximately 60%. Future market concentration is expected to increase slightly due to ongoing mergers and acquisitions.

Ayush Alternative Medicines Industry in India Industry Trends & Analysis

The Indian Ayush alternative medicines market is experiencing robust growth, driven by several key factors. Rising consumer awareness of the benefits of natural and holistic healthcare, coupled with increasing disposable incomes, fuels market expansion. Technological advancements, such as improved extraction techniques and quality control measures, enhance product efficacy and safety. Consumer preferences increasingly favor organic, sustainably sourced products, influencing product development strategies. The competitive dynamics are characterized by both intense competition among established players and the emergence of new entrants, particularly in niche segments like aromatherapy and acupuncture. The Compound Annual Growth Rate (CAGR) for the period 2019-2024 was estimated at 12%, with a projected CAGR of 10% for 2025-2033. Market penetration remains relatively low, suggesting significant untapped potential for future growth. This growth is further fueled by government initiatives promoting traditional medicine and increasing healthcare expenditure.

Leading Markets & Segments in Ayush Alternative Medicines Industry in India

The Ayurvedic medicine segment dominates the Ayush alternative medicines market in India, driven by its deep-rooted cultural significance and widespread acceptance.

- Key Drivers of Ayurvedic Medicine Dominance:

- Strong cultural heritage and traditional usage.

- Government support and initiatives to promote Ayurveda.

- Increasing consumer awareness of its therapeutic benefits.

- Availability of a wide range of Ayurvedic products catering to various health needs.

While other segments, such as Herbal Medicine, Aroma Therapy, and Homeopathy, also show significant growth, their market share is considerably lower compared to Ayurveda. This dominance is attributable to several factors. Firstly, Ayurveda has a centuries-old history and widespread acceptance in India, creating a strong foundation for market leadership. Government initiatives, such as the AYUSH ministry's promotion of traditional medicine and the launch of the AYUSH mark, further bolster the segment's growth. The diverse range of products available, from dietary supplements to personal care items, caters to a broad consumer base. Geographic factors also play a role, with certain regions having higher acceptance rates than others.

Ayush Alternative Medicines Industry in India Product Developments

Recent product innovations focus on enhancing the efficacy, safety, and convenience of Ayush products. This includes the development of standardized extracts, innovative dosage forms, and personalized medicine approaches. Companies are increasingly leveraging technology to improve product quality control, trace-ability, and supply chain management. The market is witnessing a rise in specialized products catering to specific health conditions, such as diabetes, cardiovascular diseases, and stress management, emphasizing the market's responsiveness to unmet needs. The incorporation of modern scientific research into traditional formulations provides a competitive advantage, attracting health-conscious consumers.

Key Drivers of Ayush Alternative Medicines Industry in India Growth

Several factors drive the growth of the Ayush alternative medicines industry in India. Firstly, the rising prevalence of chronic diseases and increasing healthcare costs are pushing consumers towards cost-effective and holistic treatment options. The government's support for traditional medicine through various initiatives and funding programs significantly boosts the industry's growth. Technological advancements in extraction techniques and quality control lead to better product efficacy and safety, improving consumer trust and driving market expansion. Increased consumer awareness of the benefits of natural remedies also fuels market expansion.

Challenges in the Ayush Alternative Medicines Industry in India Market

Despite strong growth potential, the Ayush alternative medicines industry faces challenges. Regulatory hurdles, including the lack of standardized quality control protocols for some products, hinder market expansion. Supply chain inefficiencies and fluctuating raw material prices pose risks to production and pricing. Intense competition, both from established players and new entrants, creates pricing pressures and necessitates continuous innovation. Maintaining the quality and authenticity of products is crucial to overcome consumer skepticism and build long-term trust. These factors collectively impact market growth and necessitate proactive strategies to overcome these limitations.

Emerging Opportunities in Ayush Alternative Medicines Industry in India

The Ayush alternative medicines industry presents significant opportunities for long-term growth. Technological breakthroughs, such as advanced analytical techniques and nanotechnology, allow for the development of innovative products. Strategic partnerships between traditional medicine practitioners and modern healthcare providers expand market reach and improve accessibility. Market expansion into international territories taps into the growing global interest in holistic and natural health solutions, generating substantial revenue streams.

Leading Players in the Ayush Alternative Medicines Industry in India Sector

- Baidyanath

- Himalaya Wellness

- Hootone Remedies

- Hamdard

- GR Herbals

- Sydler India Pvt Ltd

- Ganga Pharmaceuticals

- Dabur India

- Lotus Herbal

- Patanjali Ayurved Limited

Key Milestones in Ayush Alternative Medicines Industry in India Industry

- April 2022: Prime Minister Narendra Modi launched the AYUSH mark to recognize traditional medicine products, enhancing consumer trust and product authenticity.

- May 2022: The Ayurveda Company (T.A.C) expanded its product portfolio with the launch of T.A.C Junior, a baby care range, signifying market diversification and product innovation.

Strategic Outlook for Ayush Alternative Medicines Industry in India Market

The future of the Ayush alternative medicines industry in India is promising. Continued government support, technological advancements, and growing consumer demand will drive market expansion. Strategic partnerships and investments in research and development will further enhance product innovation and competitiveness. Focusing on product quality, safety, and efficacy while embracing sustainable practices is essential to achieving long-term growth and building consumer confidence. Expansion into new product categories and international markets presents lucrative growth opportunities.

Ayush Alternative Medicines Industry in India Segmentation

-

1. Type

- 1.1. Ayurvedic Medicine

- 1.2. Herbal Medicine

- 1.3. Aroma Therapy

- 1.4. Homeopathy

- 1.5. Acupuncture

- 1.6. Other Types

Ayush Alternative Medicines Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ayush Alternative Medicines Industry in India Regional Market Share

Geographic Coverage of Ayush Alternative Medicines Industry in India

Ayush Alternative Medicines Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Initiatives; Growing Awareness About the Effectiveness and Efficacy of Traditional Systems of Medicine; Increase in the R&D Activities

- 3.3. Market Restrains

- 3.3.1. Lack of World-class Treatment Centers; Lack of Health Insurance Approval and Scientific Validation

- 3.4. Market Trends

- 3.4.1. Ayurveda Segment is Hold Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ayurvedic Medicine

- 5.1.2. Herbal Medicine

- 5.1.3. Aroma Therapy

- 5.1.4. Homeopathy

- 5.1.5. Acupuncture

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ayurvedic Medicine

- 6.1.2. Herbal Medicine

- 6.1.3. Aroma Therapy

- 6.1.4. Homeopathy

- 6.1.5. Acupuncture

- 6.1.6. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ayurvedic Medicine

- 7.1.2. Herbal Medicine

- 7.1.3. Aroma Therapy

- 7.1.4. Homeopathy

- 7.1.5. Acupuncture

- 7.1.6. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ayurvedic Medicine

- 8.1.2. Herbal Medicine

- 8.1.3. Aroma Therapy

- 8.1.4. Homeopathy

- 8.1.5. Acupuncture

- 8.1.6. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Ayurvedic Medicine

- 9.1.2. Herbal Medicine

- 9.1.3. Aroma Therapy

- 9.1.4. Homeopathy

- 9.1.5. Acupuncture

- 9.1.6. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Ayush Alternative Medicines Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Ayurvedic Medicine

- 10.1.2. Herbal Medicine

- 10.1.3. Aroma Therapy

- 10.1.4. Homeopathy

- 10.1.5. Acupuncture

- 10.1.6. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baidyanath

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Himalaya Wellness

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hootone Remedies

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hamdard

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GR Herbals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sydler India Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ganga Pharmaceuticals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dabur India

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lotus Herbal

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Patanjali Ayurved Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Baidyanath

List of Figures

- Figure 1: Global Ayush Alternative Medicines Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Ayush Alternative Medicines Industry in India Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Ayush Alternative Medicines Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Ayush Alternative Medicines Industry in India Revenue (billion), by Type 2025 & 2033

- Figure 7: South America Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America Ayush Alternative Medicines Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Ayush Alternative Medicines Industry in India Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Ayush Alternative Medicines Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Ayush Alternative Medicines Industry in India Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Ayush Alternative Medicines Industry in India Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Ayush Alternative Medicines Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Ayush Alternative Medicines Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 9: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Ayush Alternative Medicines Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Ayush Alternative Medicines Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ayush Alternative Medicines Industry in India?

The projected CAGR is approximately 19.72%.

2. Which companies are prominent players in the Ayush Alternative Medicines Industry in India?

Key companies in the market include Baidyanath, Himalaya Wellness, Hootone Remedies, Hamdard, GR Herbals, Sydler India Pvt Ltd*List Not Exhaustive, Ganga Pharmaceuticals, Dabur India, Lotus Herbal, Patanjali Ayurved Limited.

3. What are the main segments of the Ayush Alternative Medicines Industry in India?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.42 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Initiatives; Growing Awareness About the Effectiveness and Efficacy of Traditional Systems of Medicine; Increase in the R&D Activities.

6. What are the notable trends driving market growth?

Ayurveda Segment is Hold Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of World-class Treatment Centers; Lack of Health Insurance Approval and Scientific Validation.

8. Can you provide examples of recent developments in the market?

May 2022: The Ayurveda Company (T.A.C) expanded its product portfolio with the launch of an exclusive baby care range, T.A.C Junior, which comprises 100% Ayurvedic products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ayush Alternative Medicines Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ayush Alternative Medicines Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ayush Alternative Medicines Industry in India?

To stay informed about further developments, trends, and reports in the Ayush Alternative Medicines Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence