Key Insights

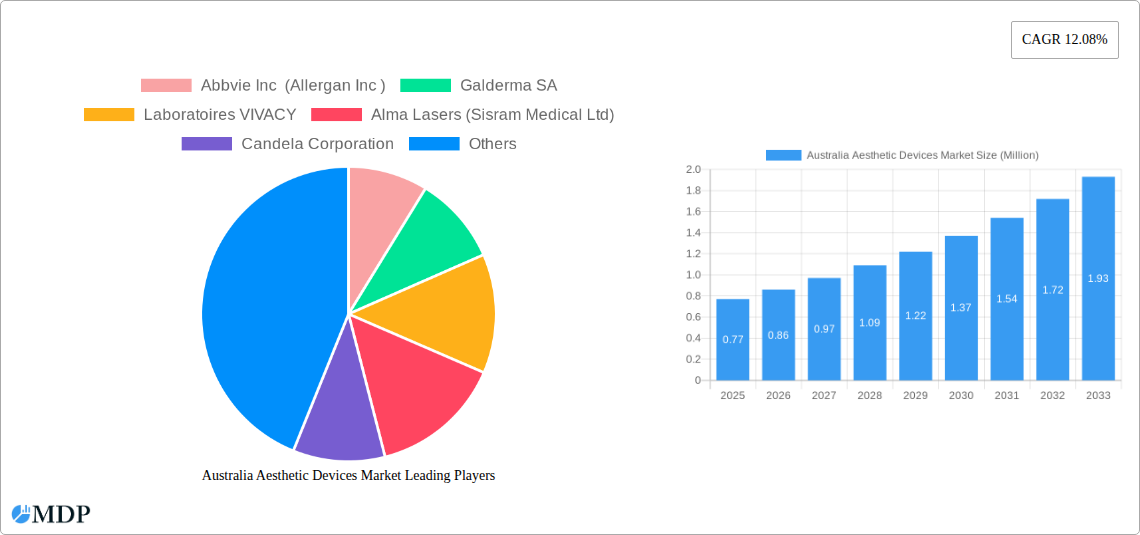

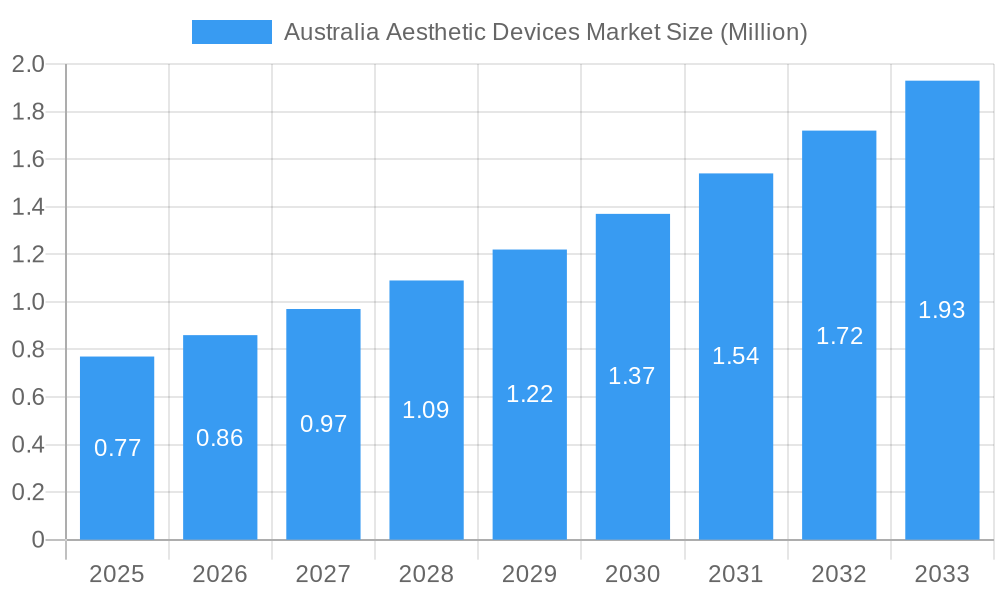

The Australian aesthetic devices market is poised for significant expansion, projected to reach an estimated value of $0.77 million in 2025 and grow at a robust Compound Annual Growth Rate (CAGR) of 12.08% throughout the forecast period of 2025-2033. This remarkable growth trajectory is fueled by a confluence of increasing consumer demand for aesthetic enhancements, a rising disposable income among the Australian population, and growing awareness and acceptance of minimally invasive and non-invasive cosmetic procedures. The market is experiencing a strong impetus from energy-based aesthetic devices, particularly laser-based and radiofrequency (RF) based technologies, driven by their efficacy in skin resurfacing, hair removal, and skin tightening. Furthermore, the surge in demand for body contouring and cellulite reduction treatments is also playing a pivotal role in market expansion.

Australia Aesthetic Devices Market Market Size (In Million)

The Australian aesthetic devices market is characterized by a dynamic segmentation across various device types, applications, and end-user settings. Non-energy-based devices, including popular treatments like Botulinum Toxin and Dermal Fillers, continue to hold a substantial share, catering to the demand for facial aesthetic procedures and wrinkle reduction. However, the segment of energy-based devices, encompassing laser, RF, light, and ultrasound technologies, is witnessing accelerated growth, driven by advancements in technology and patient preference for less downtime. Hospitals and aesthetic clinics are the primary end-users, leveraging these advanced devices to offer a comprehensive suite of aesthetic services. While home-use aesthetic devices are emerging, their market penetration is still in its nascent stages. The market is also influenced by increasing strategic collaborations and product launches by key players, aiming to capture a larger market share and cater to evolving consumer needs for innovative and effective aesthetic solutions in Australia.

Australia Aesthetic Devices Market Company Market Share

Australia Aesthetic Devices Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Australia Aesthetic Devices Market, offering critical insights into its dynamics, trends, and future trajectory. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this study is an indispensable resource for cosmetic surgery devices, medical aesthetics Australia, beauty technology market, dermal fillers Australia, laser hair removal devices, skin tightening treatments, and body contouring Australia stakeholders. We delve into market segmentation by Type of Device (including Laser-based Aesthetic Devices, Radiofrequency (RF) Based Aesthetic Devices, Light-based Aesthetic Devices, Ultrasound Aesthetic Devices, Botulinum Toxin, Dermal Fillers and Aesthetic Threads, Microdermabrasion, Implants, and Other Aesthetic Devices), Application (such as Skin Resurfacing, Body Contouring and Cellulite Reduction, Hair Removal, Facial Aesthetic Procedures, Breast Augmentation, Skin Tightening, and Other Applications), and End User (comprising Hospitals, Aesthetic Clinics, and Home Settings). Gain actionable intelligence on market concentration, innovation drivers, regulatory frameworks, competitive landscapes, and emerging opportunities. The report highlights leading players like Abbvie Inc (Allergan Inc), Galderma SA, Laboratoires VIVACY, Alma Lasers (Sisram Medical Ltd), Candela Corporation, Cryomed Aesthetics, Cutera Inc, Lumenis Inc, Venus Concept, Bausch Health Companies Inc (Solta Medical Inc), Merz Pharma GmbH & Co KGaA, Sinclair Pharma PLC, Cynosure Inc, Sciton Inc, Teoxane Laboratories, and others, providing a holistic view of this rapidly evolving market.

Australia Aesthetic Devices Market Market Dynamics & Concentration

The Australia Aesthetic Devices Market is characterized by a moderate to high level of concentration, driven by the presence of established global players and a growing number of specialized local providers. Innovation remains a primary driver, with continuous advancements in energy-based aesthetic devices and minimally invasive non-energy-based aesthetic devices fueling market growth. The regulatory framework in Australia, overseen by bodies like the Therapeutic Goods Administration (TGA), plays a crucial role in ensuring product safety and efficacy, influencing market entry and product development strategies.

- Market Concentration: Dominated by a few key players, with an increasing number of smaller, innovative companies entering the market.

- Innovation Drivers: Demand for less invasive procedures, enhanced patient outcomes, and technological advancements in energy delivery systems.

- Regulatory Framework: TGA approval is mandatory for most aesthetic devices, impacting R&D timelines and market access.

- Product Substitutes: The availability of a wide range of treatments, from surgical interventions to topical solutions, presents a degree of product substitutability, influencing pricing and market positioning.

- End-User Trends: Growing consumer awareness, increased disposable income, and a desire for aesthetic enhancements are significant demand drivers. The shift towards home settings for certain devices is also notable.

- M&A Activities: A moderate level of mergers and acquisitions is observed as larger companies seek to expand their product portfolios and market reach. Deal counts are expected to rise as consolidation continues. For instance, a significant portion of market share for dermal fillers is held by a few key companies, indicating potential acquisition targets for competitors seeking to bolster their offerings.

Australia Aesthetic Devices Market Industry Trends & Analysis

The Australia Aesthetic Devices Market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of approximately 8.5% over the forecast period. This expansion is primarily fueled by increasing consumer demand for aesthetic enhancements, a rising disposable income, and a growing awareness of the latest beauty technology and cosmetic surgery devices. Technological disruptions are continuously reshaping the market, with advancements in laser-based aesthetic devices, radiofrequency (RF) based aesthetic devices, and ultrasound aesthetic devices offering more effective and less invasive treatment options for a wide array of applications, including skin resurfacing, body contouring and cellulite reduction, and facial aesthetic procedures. The preference for non-surgical alternatives is a dominant trend, driving the adoption of Botulinum Toxin, dermal fillers and aesthetic threads, and other non-energy-based aesthetic devices.

The competitive landscape is dynamic, with both international and domestic players vying for market share. Companies are increasingly focusing on product innovation, clinical research, and strategic marketing to capture a larger audience. The aesthetic clinics segment remains the largest end-user category, accounting for over 60% of the market revenue, owing to the specialized nature of many aesthetic procedures and the expertise of trained professionals. However, the growing adoption of aesthetic devices in home settings, particularly for treatments like hair removal and skin tightening, presents a significant emerging market segment. The increasing prevalence of aesthetic clinics and hospitals offering a wider range of treatments, coupled with rising patient confidence in these procedures, further propels market growth. The aging population in Australia also contributes to the demand for anti-aging treatments, thereby boosting the market for devices used in facial aesthetic procedures and skin tightening. The penetration of medical aesthetics Australia into mainstream wellness is a testament to its growing acceptance and market significance.

Leading Markets & Segments in Australia Aesthetic Devices Market

The Australia Aesthetic Devices Market exhibits distinct leadership across its various segments, driven by specific consumer needs and technological advancements.

Type of Device:

The Energy-based Aesthetic Device segment currently holds the dominant market share, primarily driven by the widespread adoption and proven efficacy of Laser-based Aesthetic Devices and Radiofrequency (RF) Based Aesthetic Devices. These technologies are integral to numerous popular treatments such as hair removal, skin resurfacing, and skin tightening. The market penetration of these devices is high due to continuous innovation leading to improved treatment outcomes and reduced recovery times.

- Laser-based Aesthetic Devices: Dominates the energy-based segment due to its versatility in treating various skin concerns like pigmentation, acne scars, and wrinkles.

- Radiofrequency (RF) Based Aesthetic Devices: Rapidly gaining traction for skin tightening and body contouring applications, offering non-invasive collagen stimulation.

- Light-based Aesthetic Devices: Significant demand for IPL (Intense Pulsed Light) for hair removal and skin rejuvenation.

- Ultrasound Aesthetic Devices: Growing adoption for deep tissue stimulation and non-surgical facelifts.

Conversely, the Non-energy-based Aesthetic Device segment, particularly Botulinum Toxin and Dermal Fillers and Aesthetic Threads, is also a substantial contributor and experiences consistent growth. The ease of administration and immediate results associated with these injectables make them highly popular for facial aesthetic procedures.

- Botulinum Toxin: Consistently ranks as a top-selling aesthetic product for wrinkle reduction and facial rejuvenation.

- Dermal Fillers and Aesthetic Threads: High demand for lip augmentation, cheek contouring, and subtle lifting effects.

- Microdermabrasion: Popular for superficial skin exfoliation and improving skin texture.

- Implants: Primarily driven by breast augmentation procedures, though demand can fluctuate with aesthetic trends.

Application:

Within applications, Facial Aesthetic Procedures represent the largest and fastest-growing segment. This is attributable to the high prevalence of aging concerns, demand for rejuvenation, and the continuous introduction of novel injectables and energy-based devices targeting facial aesthetics. Skin Resurfacing and Skin Tightening are also significant applications, driven by the desire for improved skin quality and a more youthful appearance.

- Facial Aesthetic Procedures: Driven by anti-aging demand and the popularity of injectables and non-invasive treatments.

- Skin Resurfacing: Fueled by laser and chemical peel technologies addressing scars, pigmentation, and texture.

- Body Contouring and Cellulite Reduction: Growing interest in non-invasive fat reduction technologies.

- Skin Tightening: Significant demand driven by aging populations and the effectiveness of RF and ultrasound devices.

- Hair Removal: A mature but consistently strong market, especially with advanced laser and IPL technologies.

End User:

Aesthetic Clinics are the primary end-users in the Australia Aesthetic Devices Market, accounting for the largest market share. This is due to their specialization in delivering aesthetic treatments, the presence of skilled practitioners, and their direct marketing efforts towards consumers seeking cosmetic enhancements.

- Aesthetic Clinics: Dominant segment due to specialized services and physician expertise.

- Hospitals: Significant for more complex surgical aesthetic procedures and reconstruction.

- Home Settings: Emerging segment with increasing availability of user-friendly devices for personal use.

Australia Aesthetic Devices Market Product Developments

The Australia Aesthetic Devices Market is characterized by a continuous stream of product innovations aimed at enhancing treatment efficacy, safety, and patient comfort. Key developments include the integration of advanced technologies like AI-powered diagnostics for personalized treatment plans, multi-modality devices offering versatile treatment options from a single platform, and increasingly sophisticated energy delivery systems for lasers and RF treatments. There's a notable trend towards less invasive and faster procedures, appealing to consumers seeking quick results with minimal downtime. Companies like Alma Lasers and Cutera Inc are at the forefront, introducing devices with enhanced cooling systems and broader wavelength capabilities. The development of novel formulations for dermal fillers and aesthetic threads by companies such as Laboratoires VIVACY and Teoxane Laboratories is also a significant trend, offering improved longevity and aesthetic outcomes. These advancements are crucial for maintaining a competitive edge and meeting the evolving demands of the Australian market.

Key Drivers of Australia Aesthetic Devices Market Growth

The Australia Aesthetic Devices Market is propelled by a confluence of powerful drivers.

- Increasing Consumer Demand: A growing awareness and acceptance of aesthetic procedures, fueled by social media and celebrity influence, is leading to higher demand for cosmetic surgery devices and medical aesthetics Australia.

- Technological Advancements: Continuous innovation in energy-based aesthetic devices (laser, RF, ultrasound) and non-energy-based aesthetic devices (Botulinum Toxin, fillers) offers more effective, safer, and less invasive treatment options.

- Aging Population: The demographic shift towards an older population in Australia significantly boosts the demand for anti-aging treatments and rejuvenation procedures, driving the market for devices used in facial aesthetic procedures and skin tightening.

- Rising Disposable Income: Increased disposable income allows a larger segment of the population to afford aesthetic treatments, translating into higher market penetration for beauty technology and related devices.

- Shift Towards Minimally Invasive Procedures: Growing preference for non-surgical and minimally invasive treatments over traditional surgery drives the demand for devices like dermal fillers Australia and laser hair removal devices.

Challenges in the Australia Aesthetic Devices Market Market

Despite its robust growth, the Australia Aesthetic Devices Market faces several challenges that can impede its full potential.

- Regulatory Hurdles: The stringent approval processes by the Therapeutic Goods Administration (TGA) for new devices can be time-consuming and costly, delaying market entry for innovative products.

- High Cost of Devices and Procedures: The substantial investment required for purchasing advanced aesthetic devices and the subsequent cost of treatments can be a barrier for a significant portion of the population.

- Stringent Advertising Regulations: Regulations governing the advertising of cosmetic procedures and devices can limit promotional activities and consumer outreach.

- Skilled Workforce Shortage: A potential shortage of highly trained and certified professionals to operate advanced aesthetic devices could limit the expansion of services.

- Reimbursement Policies: The limited availability of health insurance coverage for elective aesthetic procedures restricts accessibility and market size.

Emerging Opportunities in Australia Aesthetic Devices Market

The Australia Aesthetic Devices Market presents numerous emerging opportunities for growth and innovation.

- Home-Use Aesthetic Devices: The increasing popularity of user-friendly, at-home devices for treatments like hair removal, skin tightening, and LED therapy offers a significant untapped market.

- Combination Therapies: The development of devices and protocols that combine different technologies (e.g., laser with RF) to achieve synergistic results in skin resurfacing and body contouring presents a key opportunity.

- Personalized and AI-Driven Treatments: The integration of AI and machine learning to offer personalized treatment plans and optimize device settings for individual patient needs is a growing area.

- Focus on Male Aesthetics: The expanding market for aesthetic treatments among men, particularly for procedures like body contouring and facial aesthetic procedures, presents a new consumer demographic.

- Advancements in Biocompatible Materials: Innovations in materials used for dermal fillers and aesthetic threads are creating opportunities for longer-lasting, more natural-looking results.

Leading Players in the Australia Aesthetic Devices Market Sector

- Abbvie Inc (Allergan Inc )

- Galderma SA

- Laboratoires VIVACY

- Alma Lasers (Sisram Medical Ltd)

- Candela Corporation

- Cryomed Aesthetics

- Cutera Inc

- Lumenis Inc

- Venus Concept

- Bausch Health Companies Inc (Solta Medical Inc )

- Merz Pharma GmbH & Co KGaA

- Sinclair Pharma PLC

- Cynosure Inc

- Sciton Inc

- Teoxane Laboratories

Key Milestones in Australia Aesthetic Devices Market Industry

- July 2022: CurrentBody, a prominent beauty tech leader, launched its new Lip LED perfector in Australia, expanding the range of home-use aesthetic devices.

- June 2022: Beauty Expo launched The Australian Beauty and Aesthetics Conference in Sydney, fostering networking and knowledge exchange for industry professionals in medical aesthetics Australia. This event highlights the growing importance of continuous professional development and industry collaboration.

Strategic Outlook for Australia Aesthetic Devices Market Market

The strategic outlook for the Australia Aesthetic Devices Market is highly promising, driven by sustained consumer interest and ongoing technological innovation. Future growth will likely be accelerated by a focus on less invasive and more personalized treatment modalities, catering to the increasing demand for natural-looking results and minimal downtime. The expansion of the home-use aesthetic devices segment, coupled with advancements in AI and combination therapies, will unlock new market potential. Strategic partnerships between device manufacturers, aesthetic clinics, and technology providers will be crucial for developing integrated solutions and expanding market reach. Furthermore, the growing adoption of aesthetic treatments by a wider demographic, including men, presents a significant opportunity for market diversification and sustained revenue growth. Continuous investment in research and development to address unmet patient needs and improve treatment outcomes will be paramount for players seeking to maintain a competitive advantage in this dynamic market.

Australia Aesthetic Devices Market Segmentation

-

1. Type of Device

-

1.1. Energy-based Aesthetic Device

- 1.1.1. Laser-based Aesthetic Device

- 1.1.2. Radiofrequency (RF) Based Aesthetic Device

- 1.1.3. Light-based Aesthetic Device

- 1.1.4. Ultrasound Aesthetic Device

-

1.2. Non-energy-based Aesthetic Device

- 1.2.1. Botulinum Toxin

- 1.2.2. Dermal Fillers and Aesthetic Threads

- 1.2.3. Microdermabrasion

- 1.2.4. Implants

- 1.2.5. Other Aesthetic Devices

-

1.1. Energy-based Aesthetic Device

-

2. Application

- 2.1. Skin Resurfacing

- 2.2. Body Contouring and Cellulite Reduction

- 2.3. Hair Removal

- 2.4. Facial Aesthetic Procedures

- 2.5. Breast Augmentation

- 2.6. Skin Tightening

- 2.7. Other Applications

-

3. End User

- 3.1. Hospital

- 3.2. Aesthetic Clinics

- 3.3. Home Settings

Australia Aesthetic Devices Market Segmentation By Geography

- 1. Australia

Australia Aesthetic Devices Market Regional Market Share

Geographic Coverage of Australia Aesthetic Devices Market

Australia Aesthetic Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.08% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Regarding Aesthetic Procedures; Rapid Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated With Cosmetic Surgery

- 3.4. Market Trends

- 3.4.1. The Dermal Fillers and Aesthetic Threads Segment Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Aesthetic Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Energy-based Aesthetic Device

- 5.1.1.1. Laser-based Aesthetic Device

- 5.1.1.2. Radiofrequency (RF) Based Aesthetic Device

- 5.1.1.3. Light-based Aesthetic Device

- 5.1.1.4. Ultrasound Aesthetic Device

- 5.1.2. Non-energy-based Aesthetic Device

- 5.1.2.1. Botulinum Toxin

- 5.1.2.2. Dermal Fillers and Aesthetic Threads

- 5.1.2.3. Microdermabrasion

- 5.1.2.4. Implants

- 5.1.2.5. Other Aesthetic Devices

- 5.1.1. Energy-based Aesthetic Device

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Skin Resurfacing

- 5.2.2. Body Contouring and Cellulite Reduction

- 5.2.3. Hair Removal

- 5.2.4. Facial Aesthetic Procedures

- 5.2.5. Breast Augmentation

- 5.2.6. Skin Tightening

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Aesthetic Clinics

- 5.3.3. Home Settings

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abbvie Inc (Allergan Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Galderma SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Laboratoires VIVACY

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alma Lasers (Sisram Medical Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Candela Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cryomed Aesthetics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cutera Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lumenis Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Venus Concept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bausch Health Companies Inc (Solta Medical Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Merz Pharma GmbH & Co KGaA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sinclair Pharma PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cynosure Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Sciton Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Teoxane Laboratories

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Abbvie Inc (Allergan Inc )

List of Figures

- Figure 1: Australia Aesthetic Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Aesthetic Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Aesthetic Devices Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: Australia Aesthetic Devices Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: Australia Aesthetic Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Australia Aesthetic Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Australia Aesthetic Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Australia Aesthetic Devices Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Australia Aesthetic Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Australia Aesthetic Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Australia Aesthetic Devices Market Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 10: Australia Aesthetic Devices Market Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 11: Australia Aesthetic Devices Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Australia Aesthetic Devices Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Australia Aesthetic Devices Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Australia Aesthetic Devices Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Australia Aesthetic Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Aesthetic Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Aesthetic Devices Market?

The projected CAGR is approximately 12.08%.

2. Which companies are prominent players in the Australia Aesthetic Devices Market?

Key companies in the market include Abbvie Inc (Allergan Inc ), Galderma SA, Laboratoires VIVACY, Alma Lasers (Sisram Medical Ltd), Candela Corporation, Cryomed Aesthetics, Cutera Inc, Lumenis Inc, Venus Concept, Bausch Health Companies Inc (Solta Medical Inc ), Merz Pharma GmbH & Co KGaA, Sinclair Pharma PLC, Cynosure Inc, Sciton Inc, Teoxane Laboratories.

3. What are the main segments of the Australia Aesthetic Devices Market?

The market segments include Type of Device, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Regarding Aesthetic Procedures; Rapid Technological Advancements.

6. What are the notable trends driving market growth?

The Dermal Fillers and Aesthetic Threads Segment Dominates the Market.

7. Are there any restraints impacting market growth?

Side Effects Associated With Cosmetic Surgery.

8. Can you provide examples of recent developments in the market?

In July 2022, CurrentBody, the global leader in beauty tech and beauty LED, launched its new Lip LED perfector in Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Aesthetic Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Aesthetic Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Aesthetic Devices Market?

To stay informed about further developments, trends, and reports in the Australia Aesthetic Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence