Key Insights

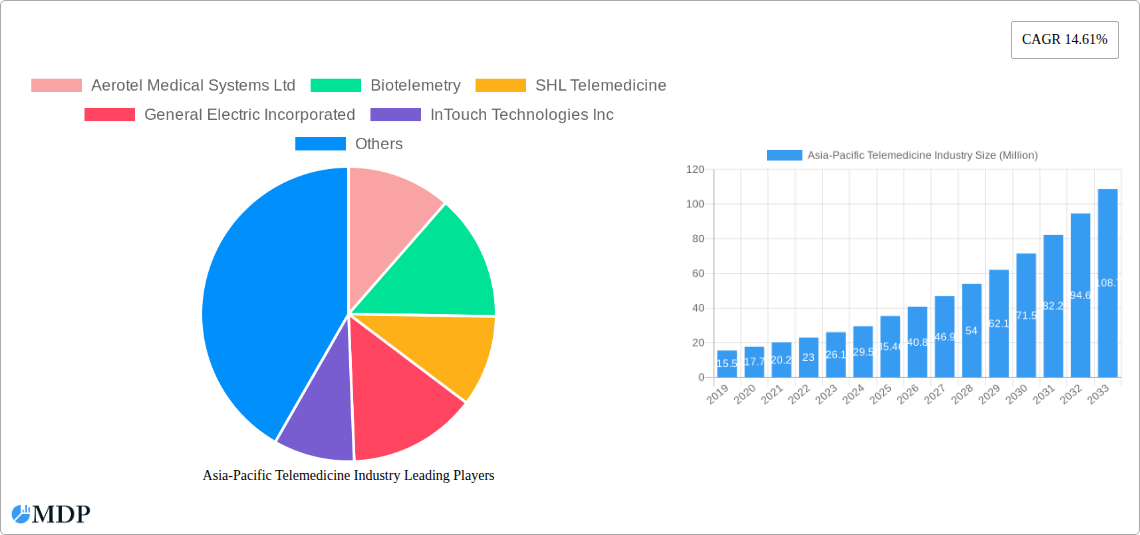

The Asia-Pacific telemedicine market is poised for remarkable expansion, projected to reach a substantial $35.46 million by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 14.61% during the forecast period of 2025-2033. This significant growth is fueled by a confluence of factors including the increasing adoption of mobile health (mHealth) solutions, advancements in telehospital and telehome care models, and the growing demand for specialized remote healthcare services like telepathology, telecardiology, and teleradiology. The region's rapidly developing economies, coupled with a rising prevalence of chronic diseases and an aging population, are creating an unprecedented need for accessible and efficient healthcare delivery. Furthermore, government initiatives supporting digital health infrastructure and the increasing patient comfort with virtual consultations are powerful catalysts for this market's ascent.

Asia-Pacific Telemedicine Industry Market Size (In Million)

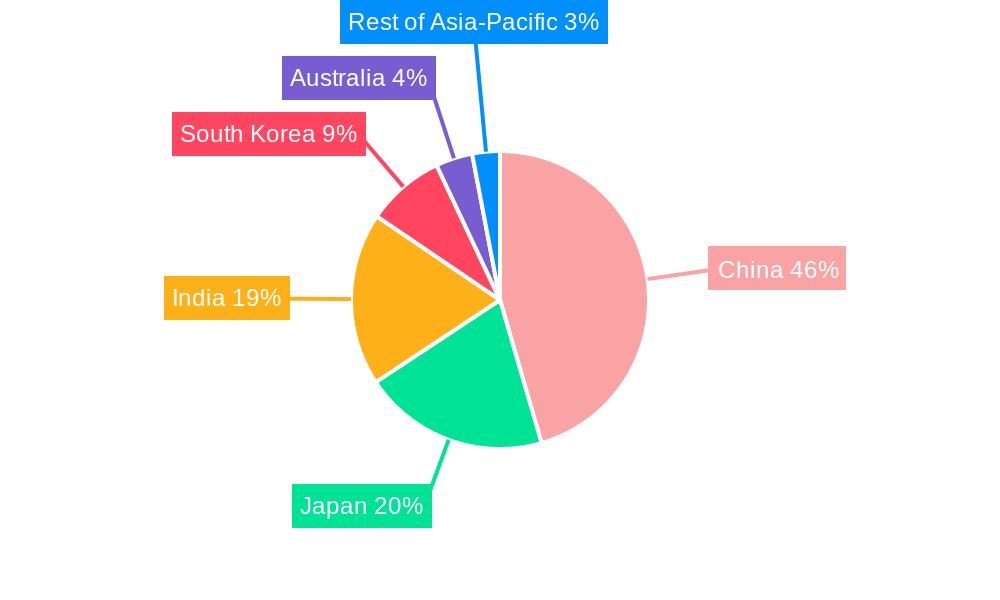

The telemedicine landscape in Asia-Pacific is characterized by a dynamic segmentation across various fronts. In terms of Type, mHealth solutions are expected to dominate due to the widespread smartphone penetration. Component-wise, while both products (hardware, software) and services will witness robust growth, the demand for innovative software and integrated service platforms will be particularly pronounced. Delivery modes are shifting towards cloud-based solutions, offering greater scalability and accessibility. Geographically, China, with its vast population and advanced digital infrastructure, is expected to lead the market, followed by India and Japan, both of which are investing heavily in digital health initiatives. The growing adoption of on-premise delivery in certain institutional settings will also contribute, but the agility and cost-effectiveness of cloud solutions are likely to set the overall trend. Key players like Koninklijke Philips NV, Medtronic PLC, and General Electric Incorporated are actively shaping this market through strategic investments and technological innovations.

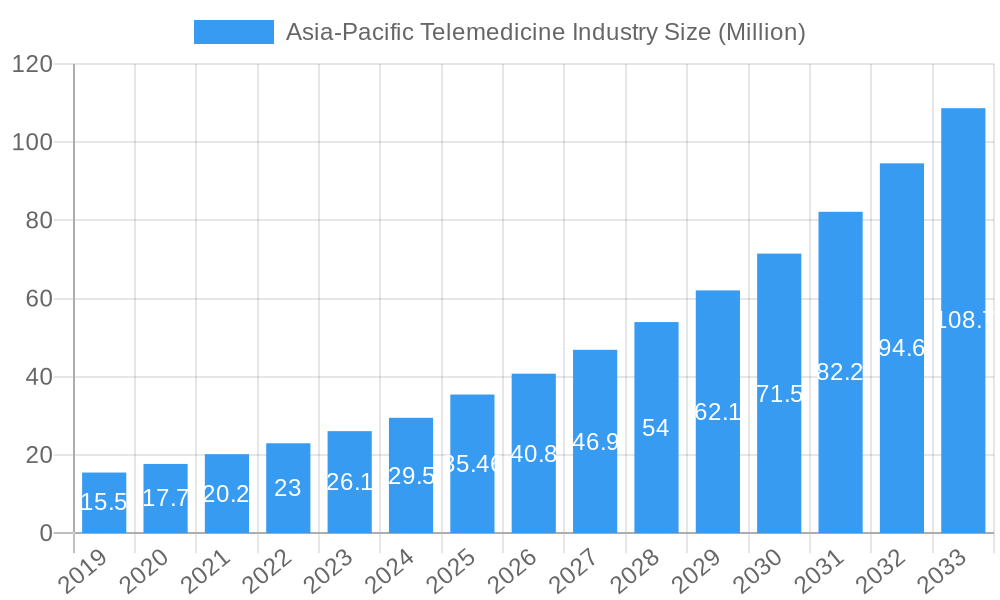

Asia-Pacific Telemedicine Industry Company Market Share

Here is the SEO-optimized, engaging report description for the Asia-Pacific Telemedicine Industry, designed for maximum visibility and to attract industry stakeholders.

Report Title: Asia-Pacific Telemedicine Industry: Market Dynamics, Trends, and Future Outlook (2025-2033)

Report Description:

Unlock the immense potential of the burgeoning Asia-Pacific telemedicine market. This comprehensive report provides in-depth analysis of market dynamics, key trends, and future growth trajectories for the Asia-Pacific telemedicine industry. With an estimated market size projected to reach USD 500 Million by 2033, driven by a robust CAGR of XX% from 2025 to 2033, this study offers critical insights for stakeholders looking to capitalize on this rapidly evolving sector. Dive deep into market concentration, innovation drivers, regulatory landscapes, and emerging opportunities. Analyze the impact of technological advancements, evolving consumer preferences, and competitive strategies across key segments like telehospitals, telehomes, and mHealth. Understand the dominance of major players and pinpoint growth pockets within China, Japan, India, Australia, and South Korea. This report is an essential guide for investors, healthcare providers, technology developers, and policymakers seeking to navigate and thrive in the dynamic Asia-Pacific telemedicine ecosystem.

Asia-Pacific Telemedicine Industry Market Dynamics & Concentration

The Asia-Pacific telemedicine market exhibits a moderate concentration, with a mix of established global players and agile regional innovators. Key innovation drivers include the escalating demand for accessible and affordable healthcare, advancements in internet connectivity and mobile penetration, and supportive government initiatives aimed at digitalizing healthcare services. Regulatory frameworks are evolving, with many countries actively developing policies to standardize telemedicine practices, ensure data privacy, and facilitate cross-border healthcare services. Product substitutes, such as traditional in-person consultations, are gradually being displaced by the convenience and efficiency offered by telemedicine. End-user trends are shifting towards greater acceptance and adoption of remote healthcare solutions, particularly among younger demographics and those in remote or underserved areas. Mergers and acquisitions (M&A) activities are on the rise as larger companies seek to expand their service offerings and market reach. For instance, XX M&A deals were observed in the historical period (2019-2024), indicating a consolidating market. Companies like Aerotel Medical Systems Ltd, Biotelemetry, and SHL Telemedicine are actively shaping this landscape through strategic partnerships and product development.

- Market Share Drivers: Growing aging population, increasing prevalence of chronic diseases, and government push for digital health initiatives.

- Innovation Focus: AI-powered diagnostics, remote patient monitoring devices, and integrated telehealth platforms.

- Regulatory Landscape: Focus on data security, interoperability standards, and reimbursement policies for telemedicine services.

- End-User Preferences: Demand for convenience, personalized care, and faster access to medical consultations.

- M&A Activity: Strategic acquisitions to gain market share, acquire new technologies, and expand service portfolios.

Asia-Pacific Telemedicine Industry Industry Trends & Analysis

The Asia-Pacific telemedicine industry is experiencing a transformative period, fueled by a confluence of compelling market growth drivers and disruptive technological advancements. The increasing prevalence of chronic diseases, coupled with an aging demographic across the region, is creating an unparalleled demand for continuous and accessible healthcare solutions. Telemedicine effectively bridges geographical barriers and reduces the burden on overcrowded healthcare facilities, making it an indispensable tool for patient care. The rapid proliferation of high-speed internet and smartphones further amplifies market penetration, enabling seamless remote consultations and data exchange. Consumer preferences are undergoing a significant shift; patients now actively seek convenience, affordability, and personalized healthcare experiences, all of which telemedicine is exceptionally positioned to deliver. The COVID-19 pandemic served as a significant catalyst, accelerating the adoption of telehealth services and familiarizing a broader population with its benefits. Looking ahead, market penetration is expected to reach XX% by 2033. Key market growth drivers include the expansion of healthcare infrastructure in emerging economies, the integration of artificial intelligence (AI) and machine learning (ML) for enhanced diagnostics and treatment, and the increasing adoption of remote patient monitoring (RPM) devices. Technological disruptions, such as the integration of wearable devices, virtual reality (VR) for therapeutic interventions, and blockchain for secure data management, are poised to revolutionize the industry. Competitive dynamics are characterized by intense innovation, with companies vying to offer comprehensive and integrated telehealth platforms that cater to a diverse range of medical specialties. The market is moving towards value-based care models, where telemedicine plays a crucial role in improving patient outcomes and reducing overall healthcare costs. Strategic investments in research and development are paramount for companies to maintain a competitive edge and capitalize on the immense growth potential. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at XX%, underscoring the sector's robust expansion.

Leading Markets & Segments in Asia-Pacific Telemedicine Industry

China currently dominates the Asia-Pacific telemedicine industry, driven by its vast population, significant government investment in digital health infrastructure, and widespread adoption of mobile technologies. The country’s focus on expanding healthcare access to remote regions and the increasing prevalence of chronic diseases make telemedicine a critical solution. India follows closely, with a rapidly growing internet user base, a burgeoning healthcare sector, and a strong government push for digital inclusion, making it a hotbed for telemedicine innovation.

The mHealth (mobile health) segment is poised for exponential growth, owing to the ubiquitous nature of smartphones and the increasing development of health-focused mobile applications. This segment offers unparalleled accessibility and convenience, catering to a wide range of user needs from appointment scheduling to remote diagnostics. Within the Services component, Telecardiology, Teleradiology, and Telepsychiatry are emerging as high-demand areas, driven by the rising incidence of cardiovascular diseases, the need for specialized diagnostic imaging, and the growing awareness and de-stigmatization of mental health issues.

The Cloud-based Delivery mode is gaining significant traction over on-premise solutions due to its scalability, cost-effectiveness, and ease of deployment. Cloud platforms enable seamless data management, enhanced security, and accessibility from anywhere, anytime, crucial for a geographically dispersed region like the Asia-Pacific.

- Dominant Geography: China

- Key Drivers: Massive population, government digital health initiatives, high smartphone penetration, and focus on rural healthcare.

- Emerging Geography: India

- Key Drivers: Rapidly growing internet user base, expanding private healthcare sector, government focus on digital health initiatives, and affordability of telemedicine solutions.

- Dominant Segment (Type): mHealth (mobile health)

- Key Drivers: Ubiquitous smartphone ownership, development of user-friendly health apps, remote patient monitoring capabilities, and convenience for consumers.

- High-Growth Segments (Services): Telecardiology, Teleradiology, Telepsychiatry

- Key Drivers: Rising chronic disease burden, demand for specialized diagnostics, increasing mental health awareness, and need for remote expert consultations.

- Dominant Mode of Delivery: Cloud-based Delivery

- Key Drivers: Scalability, cost-effectiveness, remote accessibility, enhanced data security, and ease of integration with existing healthcare systems.

Asia-Pacific Telemedicine Industry Product Developments

Product innovations in the Asia-Pacific telemedicine industry are increasingly focused on enhancing diagnostic accuracy, improving user experience, and expanding the scope of remote care. Advancements in AI-powered diagnostic tools are enabling more precise and faster analysis of medical images and patient data. Wearable technology and Internet of Medical Things (IoMT) devices are enabling continuous remote patient monitoring for chronic conditions, facilitating early intervention and personalized treatment plans. The development of integrated telehealth platforms that offer a seamless patient journey, from appointment booking to virtual consultations and e-prescriptions, is a key trend. These products offer competitive advantages by improving healthcare accessibility, reducing costs, and enhancing patient outcomes, aligning with the evolving needs of the Asia-Pacific healthcare landscape.

Key Drivers of Asia-Pacific Telemedicine Industry Growth

The Asia-Pacific telemedicine industry is propelled by a potent combination of factors. Technologically, the widespread adoption of smartphones, high-speed internet infrastructure, and advancements in AI and IoMT devices are fundamental enablers. Economically, the increasing burden of chronic diseases, the demand for affordable and accessible healthcare, and growing disposable incomes are fueling market expansion. Regulatory support, with governments increasingly introducing favorable policies, reimbursement frameworks, and data security standards, further accelerates growth. For example, initiatives like China's "Healthy China 2030" vision and India's National Digital Health Mission are creating a fertile ground for telemedicine adoption.

Challenges in the Asia-Pacific Telemedicine Industry Market

Despite its promising trajectory, the Asia-Pacific telemedicine industry faces several significant challenges. Regulatory hurdles, including inconsistent cross-border telemedicine laws and varying data privacy regulations across different countries, create complexities for service providers. Supply chain issues for medical devices and hardware can impact the availability and cost of essential telemedicine equipment. Furthermore, intense competitive pressures from both established players and new entrants necessitate continuous innovation and cost optimization. Bridging the digital divide and ensuring equitable access to telemedicine services for all segments of the population, particularly in rural and low-income areas, remains a critical challenge.

Emerging Opportunities in Asia-Pacific Telemedicine Industry

Emerging opportunities in the Asia-Pacific telemedicine industry are ripe for strategic exploration. Technological breakthroughs in areas like AI-driven personalized medicine and virtual reality-based therapy offer novel avenues for enhanced patient care. Strategic partnerships between technology providers, healthcare institutions, and insurance companies can unlock new market segments and revenue streams. Market expansion strategies, particularly focusing on underserved regions and specialized medical fields like geriatric care and mental health, present significant growth potential. The increasing demand for remote diagnostics and chronic disease management solutions continues to drive innovation and market development.

Leading Players in the Asia-Pacific Telemedicine Industry Sector

- Aerotel Medical Systems Ltd

- Biotelemetry

- SHL Telemedicine

- General Electric Incorporated

- InTouch Technologies Inc

- Medtronic PLC

- Cerner Corporation

- AMD Global Telemedicine Inc

- Koninklijke Philips NV

- Resideo Technologies Inc

- Allscripts Healthcare Solutions Inc

Key Milestones in Asia-Pacific Telemedicine Industry Industry

- 2019: Increased adoption of remote patient monitoring solutions for chronic disease management.

- 2020: Significant surge in telemedicine usage due to the COVID-19 pandemic, leading to accelerated regulatory approvals and infrastructure development.

- 2021: Launch of AI-powered diagnostic tools by several leading companies, enhancing accuracy and speed of medical image analysis.

- 2022: Major investments in mHealth platforms and wearable technology for enhanced personal health tracking and virtual consultations.

- 2023: Governments in key Asia-Pacific nations introduce enhanced reimbursement policies for telemedicine services, boosting provider adoption.

- 2024: Increased focus on cybersecurity and data privacy within telemedicine platforms to build patient trust.

Strategic Outlook for Asia-Pacific Telemedicine Industry Market

The strategic outlook for the Asia-Pacific telemedicine industry is exceptionally bright, driven by a sustained demand for convenient and accessible healthcare. Growth accelerators include the continued integration of cutting-edge technologies like AI and IoMT, the expansion of cloud-based delivery models for enhanced scalability, and strategic collaborations across the healthcare ecosystem. The increasing focus on preventive care and personalized medicine further solidifies telemedicine's role in future healthcare delivery. Companies that can effectively navigate the evolving regulatory landscape, offer innovative and user-friendly solutions, and adapt to the diverse needs of the Asia-Pacific region are poised for substantial growth and market leadership in the coming years.

Asia-Pacific Telemedicine Industry Segmentation

-

1. Type

- 1.1. Telehospitals

- 1.2. Telehomes

- 1.3. mHealth (mobile health)

-

2. Component

-

2.1. Products

- 2.1.1. Hardware

- 2.1.2. Software

- 2.1.3. Other Products

-

2.2. Services

- 2.2.1. Telepathology

- 2.2.2. Telecardiology

- 2.2.3. Teleradiology

- 2.2.4. Teledermatology

- 2.2.5. Telepsychiatry

- 2.2.6. Other Services

-

2.1. Products

-

3. Mode of Delivery

- 3.1. On-premise Delivery

- 3.2. Cloud-based Delivery

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia-Pacific Telemedicine Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Telemedicine Industry Regional Market Share

Geographic Coverage of Asia-Pacific Telemedicine Industry

Asia-Pacific Telemedicine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Healthcare Expenditure; Technological Innovations; Increasing Remote Patient Monitoring; Growing Burden of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. Legal and Reimbursement Issues; High Initial Capital Requirements and Lack of Physician Support

- 3.4. Market Trends

- 3.4.1. mHealth Segment is Expected to Witness Rapid Growth Rate in the Asia-Pacific Telemedicine Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Telehospitals

- 5.1.2. Telehomes

- 5.1.3. mHealth (mobile health)

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Products

- 5.2.1.1. Hardware

- 5.2.1.2. Software

- 5.2.1.3. Other Products

- 5.2.2. Services

- 5.2.2.1. Telepathology

- 5.2.2.2. Telecardiology

- 5.2.2.3. Teleradiology

- 5.2.2.4. Teledermatology

- 5.2.2.5. Telepsychiatry

- 5.2.2.6. Other Services

- 5.2.1. Products

- 5.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 5.3.1. On-premise Delivery

- 5.3.2. Cloud-based Delivery

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Telehospitals

- 6.1.2. Telehomes

- 6.1.3. mHealth (mobile health)

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Products

- 6.2.1.1. Hardware

- 6.2.1.2. Software

- 6.2.1.3. Other Products

- 6.2.2. Services

- 6.2.2.1. Telepathology

- 6.2.2.2. Telecardiology

- 6.2.2.3. Teleradiology

- 6.2.2.4. Teledermatology

- 6.2.2.5. Telepsychiatry

- 6.2.2.6. Other Services

- 6.2.1. Products

- 6.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 6.3.1. On-premise Delivery

- 6.3.2. Cloud-based Delivery

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Telehospitals

- 7.1.2. Telehomes

- 7.1.3. mHealth (mobile health)

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Products

- 7.2.1.1. Hardware

- 7.2.1.2. Software

- 7.2.1.3. Other Products

- 7.2.2. Services

- 7.2.2.1. Telepathology

- 7.2.2.2. Telecardiology

- 7.2.2.3. Teleradiology

- 7.2.2.4. Teledermatology

- 7.2.2.5. Telepsychiatry

- 7.2.2.6. Other Services

- 7.2.1. Products

- 7.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 7.3.1. On-premise Delivery

- 7.3.2. Cloud-based Delivery

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Telehospitals

- 8.1.2. Telehomes

- 8.1.3. mHealth (mobile health)

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Products

- 8.2.1.1. Hardware

- 8.2.1.2. Software

- 8.2.1.3. Other Products

- 8.2.2. Services

- 8.2.2.1. Telepathology

- 8.2.2.2. Telecardiology

- 8.2.2.3. Teleradiology

- 8.2.2.4. Teledermatology

- 8.2.2.5. Telepsychiatry

- 8.2.2.6. Other Services

- 8.2.1. Products

- 8.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 8.3.1. On-premise Delivery

- 8.3.2. Cloud-based Delivery

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Telehospitals

- 9.1.2. Telehomes

- 9.1.3. mHealth (mobile health)

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Products

- 9.2.1.1. Hardware

- 9.2.1.2. Software

- 9.2.1.3. Other Products

- 9.2.2. Services

- 9.2.2.1. Telepathology

- 9.2.2.2. Telecardiology

- 9.2.2.3. Teleradiology

- 9.2.2.4. Teledermatology

- 9.2.2.5. Telepsychiatry

- 9.2.2.6. Other Services

- 9.2.1. Products

- 9.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 9.3.1. On-premise Delivery

- 9.3.2. Cloud-based Delivery

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Korea Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Telehospitals

- 10.1.2. Telehomes

- 10.1.3. mHealth (mobile health)

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Products

- 10.2.1.1. Hardware

- 10.2.1.2. Software

- 10.2.1.3. Other Products

- 10.2.2. Services

- 10.2.2.1. Telepathology

- 10.2.2.2. Telecardiology

- 10.2.2.3. Teleradiology

- 10.2.2.4. Teledermatology

- 10.2.2.5. Telepsychiatry

- 10.2.2.6. Other Services

- 10.2.1. Products

- 10.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 10.3.1. On-premise Delivery

- 10.3.2. Cloud-based Delivery

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Telemedicine Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Telehospitals

- 11.1.2. Telehomes

- 11.1.3. mHealth (mobile health)

- 11.2. Market Analysis, Insights and Forecast - by Component

- 11.2.1. Products

- 11.2.1.1. Hardware

- 11.2.1.2. Software

- 11.2.1.3. Other Products

- 11.2.2. Services

- 11.2.2.1. Telepathology

- 11.2.2.2. Telecardiology

- 11.2.2.3. Teleradiology

- 11.2.2.4. Teledermatology

- 11.2.2.5. Telepsychiatry

- 11.2.2.6. Other Services

- 11.2.1. Products

- 11.3. Market Analysis, Insights and Forecast - by Mode of Delivery

- 11.3.1. On-premise Delivery

- 11.3.2. Cloud-based Delivery

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Aerotel Medical Systems Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Biotelemetry

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SHL Telemedicine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 General Electric Incorporated

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 InTouch Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cerner Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 AMD Global Telemedicine Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Koninklijke Philips NV

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Resideo Technologies Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Allscripts Healthcare Solutions Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Aerotel Medical Systems Ltd

List of Figures

- Figure 1: Asia-Pacific Telemedicine Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Telemedicine Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 4: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 5: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 6: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 7: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 13: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 14: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 15: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 16: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 17: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 23: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 24: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 25: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 26: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 27: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 34: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 35: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 36: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 37: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 42: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 44: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 45: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 46: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 47: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 48: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 53: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 54: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 55: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 56: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 57: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 58: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 63: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Component 2020 & 2033

- Table 64: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Component 2020 & 2033

- Table 65: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Mode of Delivery 2020 & 2033

- Table 66: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Mode of Delivery 2020 & 2033

- Table 67: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 68: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Asia-Pacific Telemedicine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Asia-Pacific Telemedicine Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Telemedicine Industry?

The projected CAGR is approximately 14.61%.

2. Which companies are prominent players in the Asia-Pacific Telemedicine Industry?

Key companies in the market include Aerotel Medical Systems Ltd, Biotelemetry, SHL Telemedicine, General Electric Incorporated, InTouch Technologies Inc, Medtronic PLC, Cerner Corporation, AMD Global Telemedicine Inc, Koninklijke Philips NV, Resideo Technologies Inc, Allscripts Healthcare Solutions Inc.

3. What are the main segments of the Asia-Pacific Telemedicine Industry?

The market segments include Type, Component, Mode of Delivery, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.46 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Healthcare Expenditure; Technological Innovations; Increasing Remote Patient Monitoring; Growing Burden of Chronic Diseases.

6. What are the notable trends driving market growth?

mHealth Segment is Expected to Witness Rapid Growth Rate in the Asia-Pacific Telemedicine Market.

7. Are there any restraints impacting market growth?

Legal and Reimbursement Issues; High Initial Capital Requirements and Lack of Physician Support.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Telemedicine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Telemedicine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Telemedicine Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Telemedicine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence