Key Insights

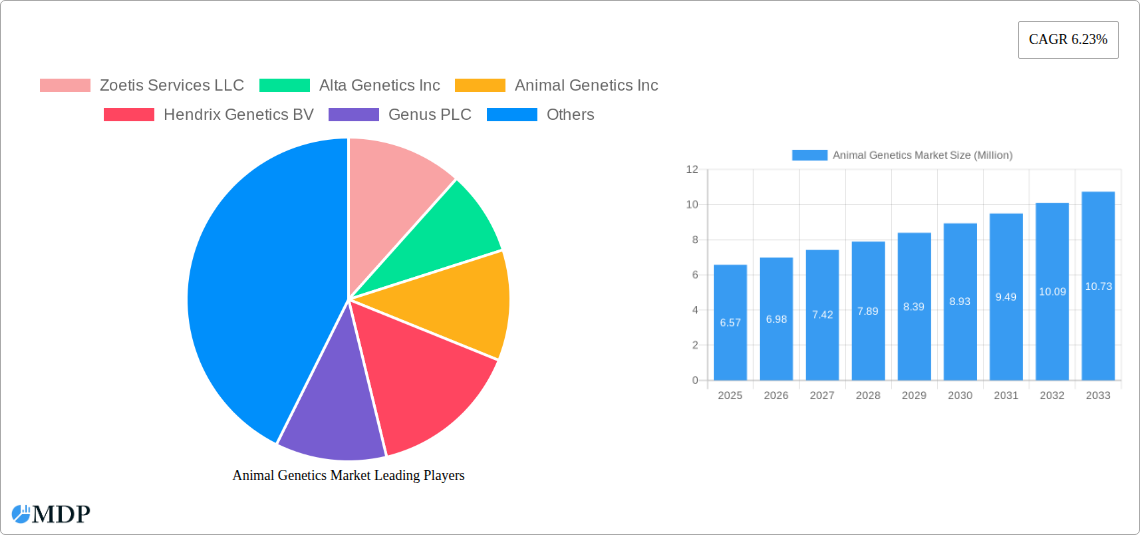

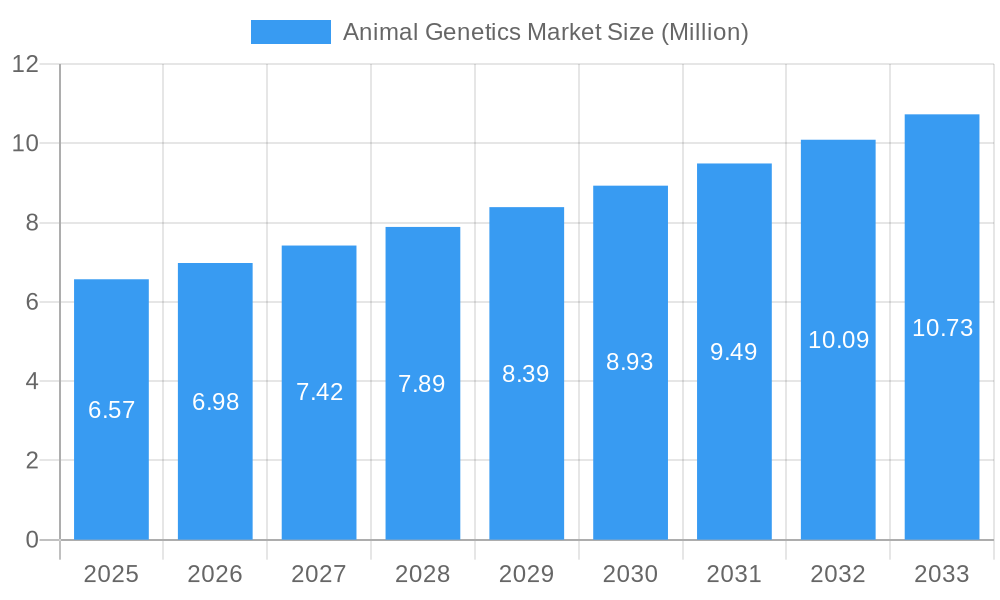

The global Animal Genetics Market is poised for significant expansion, projected to reach approximately USD 6.57 billion by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of 6.23% through 2033. This robust growth is primarily fueled by the increasing demand for high-quality animal protein, driven by a growing global population and rising disposable incomes. Advancements in genetic technologies, such as DNA typing and genetic trait tests, are enabling livestock producers to enhance animal health, productivity, and disease resistance, thereby improving overall farm profitability. The market is experiencing a surge in demand for precision breeding solutions that can accelerate genetic gain and optimize animal performance across various species, including poultry, swine, and cattle. Furthermore, growing awareness among stakeholders about the economic benefits of animal genetic improvement and the rising prevalence of animal diseases are also acting as key catalysts for market expansion. Leading companies are heavily investing in research and development to introduce innovative genetic testing services and breeding programs, catering to the evolving needs of the livestock industry.

Animal Genetics Market Market Size (In Million)

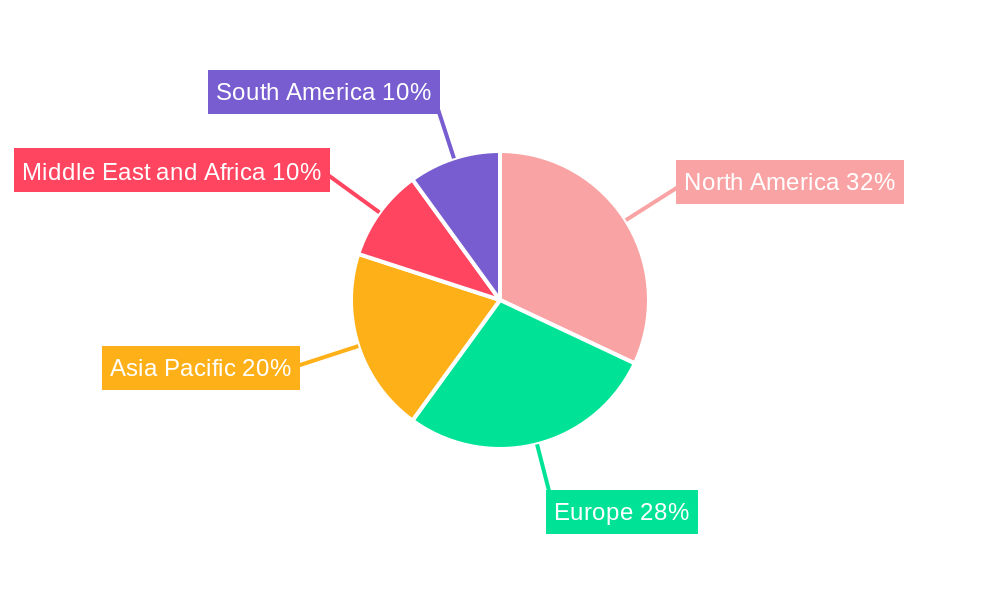

The market's growth is also being shaped by several significant trends, including the increasing adoption of genomic selection in commercial breeding operations, the development of advanced diagnostic tools for early disease detection, and the growing emphasis on animal welfare and sustainable farming practices. North America and Europe currently dominate the market, owing to the presence of well-established livestock industries, strong regulatory frameworks, and significant investments in animal biotechnology. However, the Asia Pacific region is emerging as a high-growth market, driven by the rapid expansion of the animal agriculture sector and increasing government initiatives to promote genetic improvement in livestock. While the market presents substantial opportunities, certain restraints such as the high cost of genetic testing and the need for specialized infrastructure and expertise could pose challenges. Nevertheless, the inherent value proposition of animal genetics in improving livestock efficiency and sustainability ensures continued strong demand and market dynamism.

Animal Genetics Market Company Market Share

Unlocking the Future of Animal Agriculture: A Comprehensive Report on the Animal Genetics Market (2025-2033)

The Animal Genetics Market is experiencing unprecedented growth, driven by the increasing demand for high-quality animal protein, advancements in genomic technologies, and a growing emphasis on animal welfare and sustainability. This report provides an in-depth analysis of the market dynamics, industry trends, leading players, and future outlook, offering actionable insights for stakeholders seeking to capitalize on this burgeoning sector. The study encompasses the period from 2019 to 2033, with a base year of 2025, and includes a detailed forecast for 2025-2033, building upon historical data from 2019-2024.

Animal Genetics Market Market Dynamics & Concentration

The Animal Genetics Market exhibits a moderately concentrated landscape, characterized by the presence of a few dominant players alongside a growing number of specialized service providers. Key innovation drivers include breakthroughs in DNA sequencing, gene editing technologies like CRISPR-Cas9, and advanced bioinformatics. Regulatory frameworks primarily focus on animal health, traceability, and the responsible use of genetic technologies. Product substitutes are limited, with traditional breeding methods representing the primary alternative. End-user trends highlight a strong demand for traits such as disease resistance, enhanced growth rates, and improved feed conversion efficiency. Merger and acquisition (M&A) activities are on the rise as companies seek to consolidate market share, acquire novel technologies, and expand their geographical reach. For instance, the market has seen numerous strategic partnerships and acquisitions aimed at integrating genetic testing services with broader animal health solutions. Industry analysis estimates that M&A deal counts in the past two years have risen by an estimated 15%, indicating significant consolidation efforts. The market share distribution is dynamic, with leading companies holding substantial portions, while niche players focus on specialized segments.

Animal Genetics Market Industry Trends & Analysis

The Animal Genetics Market is poised for robust expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 9.5% over the forecast period. This growth is fueled by several pivotal trends. The escalating global population and the subsequent rise in demand for animal protein are primary market drivers, pushing for increased efficiency and productivity in livestock and poultry farming. Technological disruptions, particularly in the realm of genomics and data analytics, are revolutionizing breeding programs. DNA typing and genetic trait tests are becoming indispensable tools for selecting animals with superior genetic potential, leading to improved health, faster growth, and enhanced product quality. Consumer preferences are also shifting towards ethically and sustainably produced animal products, which can be effectively achieved through advanced genetic selection for disease resistance and reduced environmental impact. Competitive dynamics are intensifying, with companies investing heavily in research and development to stay ahead. Market penetration of advanced genetic technologies is steadily increasing across developed and developing nations, as early adopters demonstrate significant ROI. The integration of artificial intelligence and machine learning into genetic analysis is further accelerating the identification of valuable traits and the development of personalized breeding strategies. The focus on precision agriculture is also driving the adoption of genetic solutions that optimize resource utilization, such as feed and water, in animal production systems.

Leading Markets & Segments in Animal Genetics Market

The Animal Genetics Market is segmented by animal type and by genetic testing services, each presenting unique growth trajectories and opportunities.

Animals:

- Poultry: This segment is a significant revenue generator, driven by the high volume of production, rapid generation turnover, and the demand for traits like efficient feed conversion, disease resistance, and meat yield. Government initiatives promoting poultry farming and disease control further bolster this segment. Economic policies favoring agricultural exports also contribute to the dominance of poultry genetics.

- Porcine: The porcine segment is experiencing substantial growth due to increasing global pork consumption and the relentless pursuit of improved breeding outcomes. Key drivers include the demand for leaner meat, faster growth rates, and enhanced resistance to common swine diseases. Technological advancements in boar stud management and artificial insemination have also amplified the impact of genetic selection in this area.

- Canine: While a smaller segment compared to production animals, the canine sector is growing rapidly, fueled by the humanization of pets and the rising disposable income of pet owners. Demand for genetic testing for health screening, breed identification, and disease susceptibility in companion animals is a key growth catalyst.

- Other Animals: This broad category includes ovine, bovine, aquaculture species, and more. Growth in this segment is influenced by regional agricultural practices, the demand for specific animal products (e.g., wool, dairy), and the development of specialized genetic solutions for niche markets. Infrastructure development supporting livestock management in emerging economies plays a crucial role.

Animal Genetic Testing Services:

- DNA Typing: This foundational service is critical for parentage verification, breed identification, and the development of accurate genetic databases. Its widespread adoption across all animal segments underscores its importance in genetic management.

- Genetic Trait Tests: These tests identify specific genes or genetic markers associated with desirable traits like disease resistance, growth performance, reproductive efficiency, and meat/milk quality. The increasing precision and affordability of these tests are driving their market penetration.

- Other Animal Genetic Testing Services: This encompasses a range of specialized tests, including genetic disease screening, genomic selection, and diagnostic services for genetic disorders. The growing emphasis on animal welfare and preventative healthcare is a significant driver for these services.

Animal Genetics Market Product Developments

Product development in the Animal Genetics Market is heavily focused on enhancing the accuracy, speed, and comprehensiveness of genetic analysis. Innovations in next-generation sequencing (NGS) technologies are enabling faster and more cost-effective genomic profiling. Companies are developing advanced bioinformatics platforms that integrate vast datasets for predictive analytics, identifying complex genetic interactions that influence desirable traits. The application of gene editing tools, while still under regulatory scrutiny, holds immense potential for precisely introducing beneficial traits like disease immunity or enhanced nutritional content. Competitive advantages are being carved out through the development of proprietary algorithms, comprehensive trait libraries, and user-friendly data interpretation tools for producers.

Key Drivers of Animal Genetics Market Growth

Several key factors are propelling the Animal Genetics Market forward. Technological advancements, particularly in genomic sequencing and marker-assisted selection (MAS), are foundational. The increasing global demand for protein, driven by population growth and rising living standards, necessitates more efficient animal production. Economic factors such as increasing disposable incomes, particularly in emerging economies, are fueling demand for higher-quality animal protein. Regulatory support for animal health and biosecurity initiatives often encourages the adoption of genetic technologies. Furthermore, a growing awareness among producers about the long-term economic benefits of genetic improvement, including reduced production costs and improved product quality, acts as a significant catalyst.

Challenges in the Animal Genetics Market Market

Despite the positive outlook, the Animal Genetics Market faces several challenges. High initial investment costs for advanced genomic technologies can be a barrier for smaller producers. Stringent and evolving regulatory landscapes in different regions can create complexities for market entry and product approval. Supply chain disruptions, particularly for specialized reagents and equipment, can impact operational efficiency. Intense competition can lead to price pressures and a need for continuous innovation. Public perception and acceptance of genetic technologies in animal agriculture also remain a factor, necessitating transparent communication and education.

Emerging Opportunities in Animal Genetics Market

The Animal Genetics Market is ripe with emerging opportunities. Technological breakthroughs in gene editing, such as CRISPR, promise to revolutionize trait development for disease resistance and improved production efficiency. Strategic partnerships between genetic companies and feed manufacturers, veterinary service providers, and research institutions are creating integrated solutions that offer greater value to end-users. Market expansion into untapped geographical regions, particularly in developing nations with growing animal agriculture sectors, presents significant growth potential. The increasing demand for specialized genetic traits in niche animal species and the development of genetic solutions for climate change adaptation in livestock are further promising avenues.

Leading Players in the Animal Genetics Market Sector

The Animal Genetics Market is characterized by the presence of several influential companies, including:

- Zoetis Services LLC

- Alta Genetics Inc

- Animal Genetics Inc

- Hendrix Genetics BV

- Genus PLC

- Vetgen

- URUS

- Envigo

- Tropical Bovine Genetics

- Groupe Grimaud

- Topigs Norsvin Holding BV

- Sandor Animal Biogenics Pvt Ltd

- CRV Holding

- Neogen Corporation

Key Milestones in Animal Genetics Market Industry

- March 2022: HKScan, Topigs Norsvin, and Royal Agrifirm Group jointly signed an agreement to establish a research and trial farm in Finland, aiming to develop best practices in pork production for future needs.

- January 2022: The National Institute of Food and Agriculture (NIFA) invested USD 5 million to support the genetic enhancement of animal production throughout the United States.

Strategic Outlook for Animal Genetics Market Market

The strategic outlook for the Animal Genetics Market is exceptionally positive, driven by ongoing innovation and increasing adoption of genetic technologies. Future growth accelerators will likely involve the further integration of AI and machine learning for predictive breeding, the development of precision genetic solutions tailored to specific environmental conditions, and the expansion of genetic services into aquaculture and other emerging animal production systems. Companies that focus on providing comprehensive, data-driven solutions that enhance both productivity and sustainability will be well-positioned for long-term success. Strategic collaborations and a proactive approach to regulatory landscapes will be crucial for navigating market complexities and capitalizing on evolving consumer demands for high-quality, responsibly produced animal products. The market is expected to witness continued consolidation and an increased focus on genetic services that address animal welfare and disease prevention.

Animal Genetics Market Segmentation

-

1. Animals

- 1.1. Poultry

- 1.2. Porcine

- 1.3. Canine

- 1.4. Other Animals

-

2. Animal Genetic Testing Services

- 2.1. DNA Typing

- 2.2. Genetic Trait Tests

- 2.3. Other Animal Genetic Testing Services

Animal Genetics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Animal Genetics Market Regional Market Share

Geographic Coverage of Animal Genetics Market

Animal Genetics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Animal-derived Protein; Rising Focus on Identifying Superior Disease-resistant Breeds; Increased Adoption of Advanced Genetic Technologies for Large-scale Production and Quality Breeds

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Professionals in Veterinary Research

- 3.4. Market Trends

- 3.4.1. The Porcine Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Animals

- 5.1.1. Poultry

- 5.1.2. Porcine

- 5.1.3. Canine

- 5.1.4. Other Animals

- 5.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 5.2.1. DNA Typing

- 5.2.2. Genetic Trait Tests

- 5.2.3. Other Animal Genetic Testing Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Animals

- 6. North America Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Animals

- 6.1.1. Poultry

- 6.1.2. Porcine

- 6.1.3. Canine

- 6.1.4. Other Animals

- 6.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 6.2.1. DNA Typing

- 6.2.2. Genetic Trait Tests

- 6.2.3. Other Animal Genetic Testing Services

- 6.1. Market Analysis, Insights and Forecast - by Animals

- 7. Europe Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Animals

- 7.1.1. Poultry

- 7.1.2. Porcine

- 7.1.3. Canine

- 7.1.4. Other Animals

- 7.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 7.2.1. DNA Typing

- 7.2.2. Genetic Trait Tests

- 7.2.3. Other Animal Genetic Testing Services

- 7.1. Market Analysis, Insights and Forecast - by Animals

- 8. Asia Pacific Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Animals

- 8.1.1. Poultry

- 8.1.2. Porcine

- 8.1.3. Canine

- 8.1.4. Other Animals

- 8.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 8.2.1. DNA Typing

- 8.2.2. Genetic Trait Tests

- 8.2.3. Other Animal Genetic Testing Services

- 8.1. Market Analysis, Insights and Forecast - by Animals

- 9. Middle East and Africa Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Animals

- 9.1.1. Poultry

- 9.1.2. Porcine

- 9.1.3. Canine

- 9.1.4. Other Animals

- 9.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 9.2.1. DNA Typing

- 9.2.2. Genetic Trait Tests

- 9.2.3. Other Animal Genetic Testing Services

- 9.1. Market Analysis, Insights and Forecast - by Animals

- 10. South America Animal Genetics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Animals

- 10.1.1. Poultry

- 10.1.2. Porcine

- 10.1.3. Canine

- 10.1.4. Other Animals

- 10.2. Market Analysis, Insights and Forecast - by Animal Genetic Testing Services

- 10.2.1. DNA Typing

- 10.2.2. Genetic Trait Tests

- 10.2.3. Other Animal Genetic Testing Services

- 10.1. Market Analysis, Insights and Forecast - by Animals

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zoetis Services LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alta Genetics Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Animal Genetics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hendrix Genetics BV

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Genus PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Vetgen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 URUS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Envigo

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tropical Bovine Genetics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Groupe Grimaud

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Topigs Norsvin Holding BV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sandor Animal Biogenics Pvt Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 CRV Holding

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Neogen Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Zoetis Services LLC

List of Figures

- Figure 1: Global Animal Genetics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Animal Genetics Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Animal Genetics Market Revenue (Million), by Animals 2025 & 2033

- Figure 4: North America Animal Genetics Market Volume (K Unit), by Animals 2025 & 2033

- Figure 5: North America Animal Genetics Market Revenue Share (%), by Animals 2025 & 2033

- Figure 6: North America Animal Genetics Market Volume Share (%), by Animals 2025 & 2033

- Figure 7: North America Animal Genetics Market Revenue (Million), by Animal Genetic Testing Services 2025 & 2033

- Figure 8: North America Animal Genetics Market Volume (K Unit), by Animal Genetic Testing Services 2025 & 2033

- Figure 9: North America Animal Genetics Market Revenue Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 10: North America Animal Genetics Market Volume Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 11: North America Animal Genetics Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Animal Genetics Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Animal Genetics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Animal Genetics Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Animal Genetics Market Revenue (Million), by Animals 2025 & 2033

- Figure 16: Europe Animal Genetics Market Volume (K Unit), by Animals 2025 & 2033

- Figure 17: Europe Animal Genetics Market Revenue Share (%), by Animals 2025 & 2033

- Figure 18: Europe Animal Genetics Market Volume Share (%), by Animals 2025 & 2033

- Figure 19: Europe Animal Genetics Market Revenue (Million), by Animal Genetic Testing Services 2025 & 2033

- Figure 20: Europe Animal Genetics Market Volume (K Unit), by Animal Genetic Testing Services 2025 & 2033

- Figure 21: Europe Animal Genetics Market Revenue Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 22: Europe Animal Genetics Market Volume Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 23: Europe Animal Genetics Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Animal Genetics Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Animal Genetics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Animal Genetics Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Animal Genetics Market Revenue (Million), by Animals 2025 & 2033

- Figure 28: Asia Pacific Animal Genetics Market Volume (K Unit), by Animals 2025 & 2033

- Figure 29: Asia Pacific Animal Genetics Market Revenue Share (%), by Animals 2025 & 2033

- Figure 30: Asia Pacific Animal Genetics Market Volume Share (%), by Animals 2025 & 2033

- Figure 31: Asia Pacific Animal Genetics Market Revenue (Million), by Animal Genetic Testing Services 2025 & 2033

- Figure 32: Asia Pacific Animal Genetics Market Volume (K Unit), by Animal Genetic Testing Services 2025 & 2033

- Figure 33: Asia Pacific Animal Genetics Market Revenue Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 34: Asia Pacific Animal Genetics Market Volume Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 35: Asia Pacific Animal Genetics Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Animal Genetics Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Animal Genetics Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Animal Genetics Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Animal Genetics Market Revenue (Million), by Animals 2025 & 2033

- Figure 40: Middle East and Africa Animal Genetics Market Volume (K Unit), by Animals 2025 & 2033

- Figure 41: Middle East and Africa Animal Genetics Market Revenue Share (%), by Animals 2025 & 2033

- Figure 42: Middle East and Africa Animal Genetics Market Volume Share (%), by Animals 2025 & 2033

- Figure 43: Middle East and Africa Animal Genetics Market Revenue (Million), by Animal Genetic Testing Services 2025 & 2033

- Figure 44: Middle East and Africa Animal Genetics Market Volume (K Unit), by Animal Genetic Testing Services 2025 & 2033

- Figure 45: Middle East and Africa Animal Genetics Market Revenue Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 46: Middle East and Africa Animal Genetics Market Volume Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 47: Middle East and Africa Animal Genetics Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Animal Genetics Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Animal Genetics Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Animal Genetics Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Animal Genetics Market Revenue (Million), by Animals 2025 & 2033

- Figure 52: South America Animal Genetics Market Volume (K Unit), by Animals 2025 & 2033

- Figure 53: South America Animal Genetics Market Revenue Share (%), by Animals 2025 & 2033

- Figure 54: South America Animal Genetics Market Volume Share (%), by Animals 2025 & 2033

- Figure 55: South America Animal Genetics Market Revenue (Million), by Animal Genetic Testing Services 2025 & 2033

- Figure 56: South America Animal Genetics Market Volume (K Unit), by Animal Genetic Testing Services 2025 & 2033

- Figure 57: South America Animal Genetics Market Revenue Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 58: South America Animal Genetics Market Volume Share (%), by Animal Genetic Testing Services 2025 & 2033

- Figure 59: South America Animal Genetics Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Animal Genetics Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Animal Genetics Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Animal Genetics Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 2: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 3: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 4: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 5: Global Animal Genetics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Animal Genetics Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 8: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 9: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 10: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 11: Global Animal Genetics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Animal Genetics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 20: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 21: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 22: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 23: Global Animal Genetics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Animal Genetics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 38: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 39: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 40: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 41: Global Animal Genetics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Animal Genetics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 56: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 57: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 58: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 59: Global Animal Genetics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Animal Genetics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Animal Genetics Market Revenue Million Forecast, by Animals 2020 & 2033

- Table 68: Global Animal Genetics Market Volume K Unit Forecast, by Animals 2020 & 2033

- Table 69: Global Animal Genetics Market Revenue Million Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 70: Global Animal Genetics Market Volume K Unit Forecast, by Animal Genetic Testing Services 2020 & 2033

- Table 71: Global Animal Genetics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Animal Genetics Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Animal Genetics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Animal Genetics Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Animal Genetics Market?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the Animal Genetics Market?

Key companies in the market include Zoetis Services LLC, Alta Genetics Inc, Animal Genetics Inc, Hendrix Genetics BV, Genus PLC, Vetgen, URUS, Envigo, Tropical Bovine Genetics, Groupe Grimaud, Topigs Norsvin Holding BV, Sandor Animal Biogenics Pvt Ltd, CRV Holding, Neogen Corporation.

3. What are the main segments of the Animal Genetics Market?

The market segments include Animals, Animal Genetic Testing Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Animal-derived Protein; Rising Focus on Identifying Superior Disease-resistant Breeds; Increased Adoption of Advanced Genetic Technologies for Large-scale Production and Quality Breeds.

6. What are the notable trends driving market growth?

The Porcine Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Shortage of Skilled Professionals in Veterinary Research.

8. Can you provide examples of recent developments in the market?

March 2022- HKScan, Topigs Norsvin, and Royal Agrifirm Group jointly signed an agreement to set up a research and trial farm in Finland. As per the agreement, cooperation will develop best practices in pork production for future needs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Animal Genetics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Animal Genetics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Animal Genetics Market?

To stay informed about further developments, trends, and reports in the Animal Genetics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence