Key Insights

The African dairy-based beverage market, valued at $23.17 billion in 2025, is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This upward trajectory is propelled by escalating disposable incomes, particularly in urban centers, driving demand for convenient and nutritious dairy beverages. A burgeoning young demographic and rapid urbanization further bolster this growth. The market is segmented by beverage type (milk, yogurt, etc.), flavor (unflavored, flavored), and distribution channels (supermarkets, convenience stores, etc.). Flavored dairy drinks are expected to lead in urban areas due to greater exposure to diverse tastes and effective marketing, while unflavored options may perform better in rural regions. Key industry players such as Nestle SA and Danone SA influence the competitive landscape, though opportunities exist for regional brands catering to local preferences. Key challenges include maintaining a robust cold chain for perishable goods and managing volatile milk prices. Future expansion hinges on extending distribution networks, enhancing product availability, and effectively communicating the health and convenience benefits of these beverages. Innovations in packaging that extend shelf life and minimize waste present considerable growth avenues. South Africa, Kenya, and Uganda are anticipated to be primary growth drivers due to their more developed economies and larger populations.

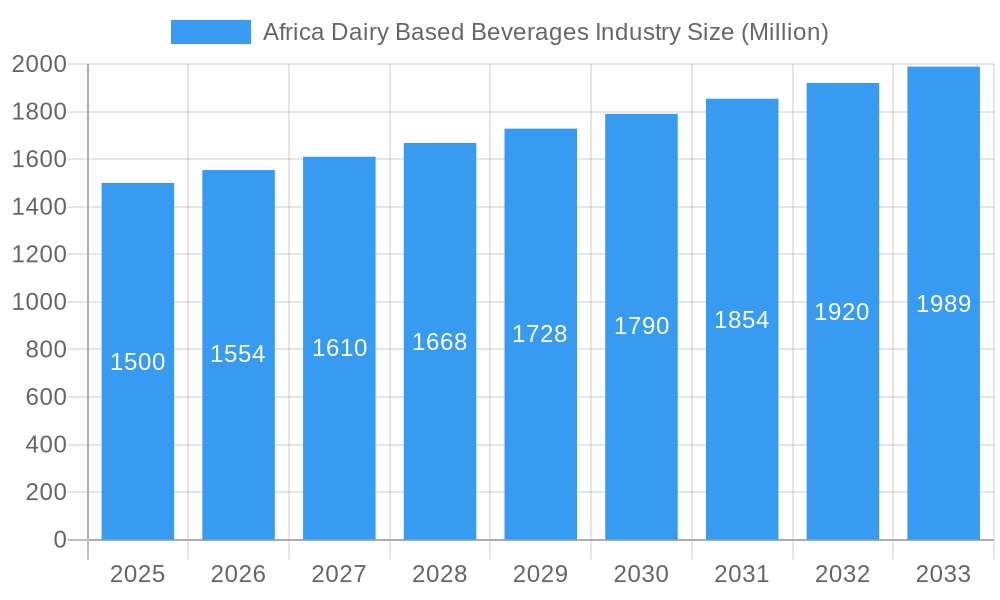

Africa Dairy Based Beverages Industry Market Size (In Billion)

Forecasting the market size for 2033 involves applying the projected CAGR to the 2025 market valuation. With a base of $23.17 billion in 2025 and a CAGR of 5.5%, the market is anticipated to reach approximately $35.56 billion by 2033. Market dynamics will be shaped by evolving consumer preferences, economic shifts, and regulatory frameworks. Strategic initiatives, including new product introductions, brand line extensions, and partnerships, will be crucial. Understanding diverse consumption patterns across segments and regions is vital for optimizing growth strategies within this dynamic African market.

Africa Dairy Based Beverages Industry Company Market Share

Africa Dairy Based Beverages Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Africa Dairy Based Beverages industry, offering invaluable insights for stakeholders seeking to understand market dynamics, opportunities, and challenges. Covering the period 2019-2033, with a focus on 2025, this report analyzes key trends, leading players, and future growth prospects.

Keywords: Africa Dairy, Dairy Beverages Market, Milk Market Africa, Yogurt Market Africa, Dairy Drinks Africa, Dairy Industry Africa, Africa Food and Beverage, Dairy Processing Africa, Dairy Market Analysis, Dairy Industry Trends, Market Growth, CAGR, Market Share, Market Segmentation, Competitive Landscape, Investment Opportunities.

Africa Dairy Based Beverages Industry Market Dynamics & Concentration

This section analyzes the competitive landscape of the African dairy-based beverage market, evaluating market concentration, innovation, regulatory influences, and market forces. The analysis spans the historical period (2019-2024) and extends to the forecast period (2025-2033).

- Market Concentration: The market exhibits a moderately concentrated structure, with key players such as Nestle SA, Danone S.A., and Groupe Lactalis holding significant market share (estimated at xx% combined in 2025). However, smaller regional players and emerging brands are increasingly challenging the dominance of multinational corporations. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately competitive landscape.

- Innovation Drivers: Product innovation, focusing on healthier options (e.g., low-sugar, high-protein) and convenient packaging formats, are driving market growth. Technological advancements in processing and preservation are also significant contributors.

- Regulatory Frameworks: Varying regulations across African countries regarding food safety, labeling, and import/export impact market dynamics. Harmonization of regulations is anticipated to positively influence market growth during the forecast period.

- Product Substitutes: Plant-based beverages and other non-dairy alternatives pose a competitive threat, albeit currently limited in market penetration (estimated at xx% in 2025).

- End-User Trends: Growing urban populations, rising disposable incomes, and changing consumer preferences towards convenient and nutritious food and beverages are key drivers of market growth. Health consciousness is driving demand for low-fat and sugar-free options.

- M&A Activities: The number of M&A deals in the African dairy industry from 2019 to 2024 was approximately xx, reflecting the consolidation efforts of major players to expand their market reach and product portfolios.

Africa Dairy Based Beverages Industry Industry Trends & Analysis

This section delves into the key market trends shaping the Africa Dairy Based Beverages industry, examining growth drivers, technological advancements, evolving consumer preferences, and competitive pressures.

Market growth is largely fueled by population growth and rising per capita incomes, leading to increased disposable spending on food and beverages. The CAGR for the industry is estimated at xx% during the forecast period (2025-2033). Market penetration, while varying across different regions, is expected to increase, with higher penetration rates in urban areas compared to rural areas. Technological advancements, such as improved processing techniques and packaging solutions, enhance product shelf life and reduce waste. Consumer preferences are increasingly focused on health and wellness, driving demand for products with added nutritional value and reduced sugar content. Competitive dynamics are characterized by both local and international players vying for market share, leading to intense competition based on price, innovation, and distribution networks.

Leading Markets & Segments in Africa Dairy Based Beverages Industry

This section identifies the leading regions, countries, and product segments within the African dairy-based beverage industry, analyzing their market dominance and key growth drivers.

Dominant Segments:

- Type: Milk holds the largest market share (estimated at xx% in 2025), followed by yogurt (xx%) and other types (xx%). The growth of the yogurt segment is particularly noteworthy, driven by its perceived health benefits and diverse flavor profiles.

- Category: Flavored drinks account for a larger share of the market (xx%) compared to unflavored drinks (xx%) owing to consumer preference for varied tastes.

- Distribution Channel: Supermarket/Hypermarkets command the largest market share (xx%) due to their widespread presence and ability to offer a broader product selection. Convenience/grocery stores and specialist stores also represent significant distribution channels.

Key Drivers for Leading Markets:

- Economic policies: Government initiatives promoting agricultural development and food security create a positive environment for industry growth.

- Infrastructure: Improved infrastructure (e.g., transportation, cold chain logistics) enhances the efficient distribution of perishable dairy products.

- Regional Variations: Specific regional factors, including climate, consumer preferences, and the level of economic development, significantly affect market dynamics.

Africa Dairy Based Beverages Industry Product Developments

Recent years have witnessed significant product innovations, driven by evolving consumer preferences and technological advancements. The focus has been on introducing healthier options, such as low-fat, low-sugar, and high-protein dairy beverages, catering to the growing health consciousness among consumers. Improved packaging technologies enhance product shelf life and reduce spoilage. This has also facilitated the expansion of distribution networks, reaching wider markets. These innovations are key to enhancing the competitive advantages of brands and securing market leadership.

Key Drivers of Africa Dairy Based Beverages Industry Growth

The growth trajectory of the African dairy-based beverages industry is propelled by a confluence of factors. Firstly, a rapidly expanding population translates into a burgeoning consumer base. Secondly, the steady rise in disposable incomes boosts purchasing power, increasing affordability for dairy products. Finally, favorable government policies and investments in infrastructure are creating a more conducive business environment for industry expansion and technological improvements.

Challenges in the Africa Dairy Based Beverages Industry Market

Several factors impede the growth trajectory of the African dairy-based beverages sector. Fluctuations in raw material prices and supply chain disruptions caused by inadequate infrastructure present significant challenges. Further, intense competition from both local and international players, coupled with the emergence of substitute products (plant-based alternatives) place additional pressure on market participants. Stringent regulatory requirements for food safety and labeling also add to the operational complexities. These challenges collectively impact profitability and sustainability of businesses operating within this sector.

Emerging Opportunities in Africa Dairy Based Beverages Industry

The African dairy-based beverages industry presents significant long-term growth prospects. Strategic partnerships with local dairy farmers and other stakeholders in the value chain can enhance supply security and efficiency. Leveraging technological advancements, such as improved processing and packaging techniques, can enhance product quality and shelf life. Exploring niche market segments, for example offering functional dairy beverages tailored to specific health needs, offers additional growth avenues. Expansion into untapped markets and regions with strong growth potential holds further potential for sustained expansion.

Leading Players in the Africa Dairy Based Beverages Industry Sector

- Nestle SA

- Morinaga Nutritional Foods Inc

- First Choice Dairy

- Danone S.A.

- Clover S.A. (Pty) Ltd

- Chobani LLC

- Groupe Lactalis

Key Milestones in Africa Dairy Based Beverages Industry Industry

- December 2020: MB Plc's installation of an automatic UHT milk processing plant in Addis Ababa significantly boosts local production capacity and extends product shelf life.

- June 2021: Chobani LLC's launch of zero-sugar yogurt flavors targets the growing health-conscious market segment, expanding product portfolio and market reach.

Strategic Outlook for Africa Dairy Based Beverages Industry Market

The African dairy-based beverage industry is poised for robust growth, driven by demographic shifts, rising incomes, and increasing consumer demand for convenient and nutritious food and beverage options. Companies that adopt proactive strategies to address challenges, such as infrastructure limitations and competitive pressures, while capitalizing on opportunities in product innovation and market expansion, are better positioned to succeed in this dynamic market. The focus should be on sustainable and ethical sourcing of raw materials, coupled with a strong commitment to enhancing product quality and consumer experience.

Africa Dairy Based Beverages Industry Segmentation

-

1. Type

- 1.1. Milk

- 1.2. Yogurt

- 1.3. Other Types

-

2. Category

- 2.1. Unflavored Drinks

- 2.2. Flavored Drinks

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Specialist Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. South Africa

- 4.2. Egypt

- 4.3. Others

Africa Dairy Based Beverages Industry Segmentation By Geography

- 1. South Africa

- 2. Egypt

- 3. Others

Africa Dairy Based Beverages Industry Regional Market Share

Geographic Coverage of Africa Dairy Based Beverages Industry

Africa Dairy Based Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits

- 3.3. Market Restrains

- 3.3.1. Popularity Of Healthy Snacking And Other Alternatives

- 3.4. Market Trends

- 3.4.1. Rising Demand for Probiotic Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Milk

- 5.1.2. Yogurt

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Unflavored Drinks

- 5.2.2. Flavored Drinks

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Specialist Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Egypt

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Egypt

- 5.5.3. Others

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Milk

- 6.1.2. Yogurt

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Category

- 6.2.1. Unflavored Drinks

- 6.2.2. Flavored Drinks

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarket/Hypermarkets

- 6.3.2. Convenience/Grocery Stores

- 6.3.3. Specialist Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Egypt

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Egypt Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Milk

- 7.1.2. Yogurt

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Category

- 7.2.1. Unflavored Drinks

- 7.2.2. Flavored Drinks

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarket/Hypermarkets

- 7.3.2. Convenience/Grocery Stores

- 7.3.3. Specialist Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Egypt

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Others Africa Dairy Based Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Milk

- 8.1.2. Yogurt

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Category

- 8.2.1. Unflavored Drinks

- 8.2.2. Flavored Drinks

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarket/Hypermarkets

- 8.3.2. Convenience/Grocery Stores

- 8.3.3. Specialist Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Egypt

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Nestle SA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Morinaga Nutritional Foods Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 First Choice Dairy*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Danone S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Clover S A (Pty) Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Chobani LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Groupe Lactalis

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Nestle SA

List of Figures

- Figure 1: Africa Dairy Based Beverages Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Dairy Based Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 3: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 8: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 13: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 18: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Africa Dairy Based Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Dairy Based Beverages Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Africa Dairy Based Beverages Industry?

Key companies in the market include Nestle SA, Morinaga Nutritional Foods Inc, First Choice Dairy*List Not Exhaustive, Danone S A, Clover S A (Pty) Ltd, Chobani LLC, Groupe Lactalis.

3. What are the main segments of the Africa Dairy Based Beverages Industry?

The market segments include Type, Category, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.17 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovation In Flavors And Ingredients; Inclination Towards Fortified Biscuits.

6. What are the notable trends driving market growth?

Rising Demand for Probiotic Beverages.

7. Are there any restraints impacting market growth?

Popularity Of Healthy Snacking And Other Alternatives.

8. Can you provide examples of recent developments in the market?

June 2021: Chobani LLC launched new flavors (mixed berry and strawberry) of zero-sugar yogurt in the market. As per the company's claim, the product launch and innovation strategy is to offer consumers sugar-free products to target diabetic patients. As a result, it will enable the company to expand its business and helps to enlarge its product portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Dairy Based Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Dairy Based Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Dairy Based Beverages Industry?

To stay informed about further developments, trends, and reports in the Africa Dairy Based Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence