Key Insights

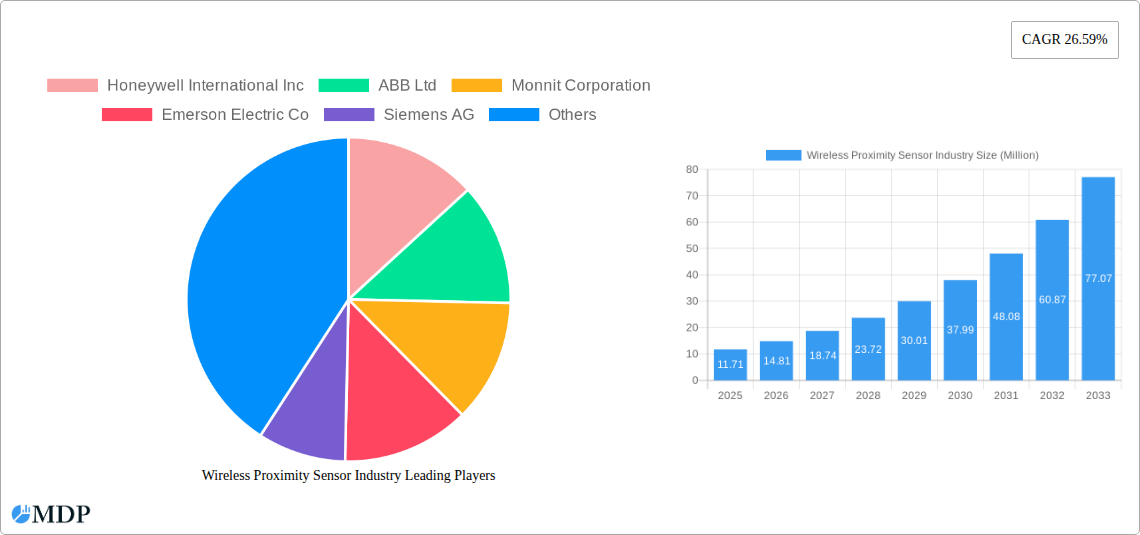

The Wireless Proximity Sensor market is poised for exceptional growth, projected to reach $11.71 Million by 2025, exhibiting a remarkable compound annual growth rate (CAGR) of 26.59% during the forecast period of 2025-2033. This robust expansion is primarily driven by the escalating demand for automation across various industries, including automotive, healthcare, and manufacturing, coupled with the increasing adoption of the Internet of Things (IoT) for enhanced connectivity and data collection. The inherent benefits of wireless proximity sensors, such as simplified installation, reduced cabling costs, and enhanced flexibility, are further fueling their widespread integration. Key industry players like Honeywell International Inc., ABB Ltd., and Siemens AG are actively investing in research and development, introducing innovative sensor technologies that cater to evolving market needs. The market's trajectory is significantly influenced by trends in smart manufacturing, predictive maintenance, and the development of advanced robotics, all of which rely heavily on accurate and reliable proximity sensing.

Wireless Proximity Sensor Industry Market Size (In Million)

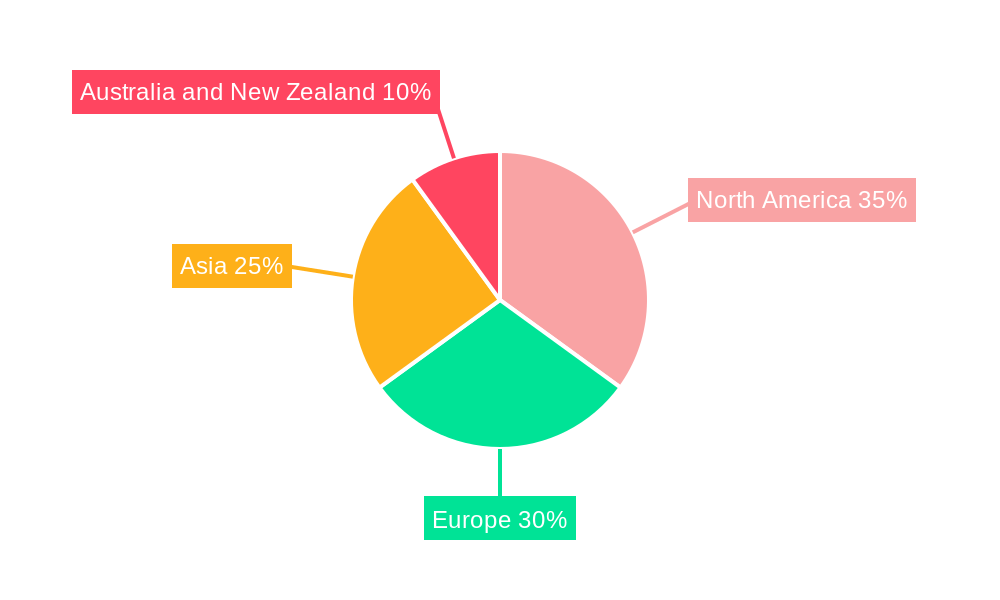

Despite the promising outlook, certain restraints could potentially temper the market's pace. These include the initial cost of deployment for large-scale systems, concerns regarding data security and wireless interference in certain environments, and the need for standardized communication protocols to ensure interoperability. However, continuous technological advancements are addressing these challenges, with miniaturization, improved battery life, and enhanced security features becoming more prevalent. The market is segmented across various sensor types, with Pressure Sensors, Temperature Sensors, and Chemical and Gas Sensors expected to witness significant adoption. Geographically, North America and Europe are leading the market, driven by early adoption of advanced technologies and strong industrial bases. Asia is expected to emerge as a high-growth region due to rapid industrialization and increasing investments in smart infrastructure.

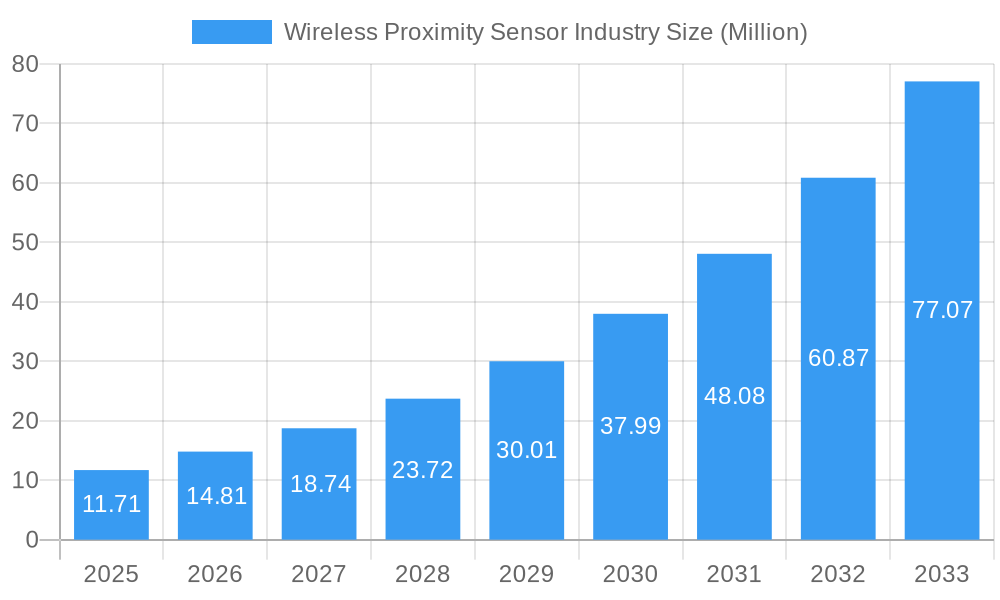

Wireless Proximity Sensor Industry Company Market Share

Gain unparalleled insights into the dynamic wireless proximity sensor market, a sector poised for exponential growth driven by the pervasive demand for industrial automation, IoT integration, and enhanced safety across critical industries. This comprehensive report, meticulously analyzing the period from 2019 to 2033 with a base and estimated year of 2025, delivers actionable intelligence on market drivers, trends, competitive landscapes, and future opportunities. Discover how innovations in pressure sensors, temperature sensors, chemical and gas sensors, and position and proximity sensors are revolutionizing sectors like automotive, healthcare, aerospace and defense, energy and power, and food and beverage.

Wireless Proximity Sensor Industry Market Dynamics & Concentration

The wireless proximity sensor industry is characterized by a moderate to high market concentration, with leading players investing heavily in research and development to drive innovation. Key drivers include the escalating adoption of Industry 4.0 principles, the proliferation of the Internet of Things (IoT) for real-time data acquisition, and stringent safety regulations across various end-user industries. Product substitution is a growing concern, particularly from wired alternatives in less demanding applications, but the inherent flexibility and ease of deployment of wireless solutions maintain their competitive edge. End-user trends are strongly leaning towards miniaturization, enhanced power efficiency, and increased data security. Mergers and acquisitions (M&A) activity is a significant factor in shaping the market landscape, with companies strategically acquiring niche technologies and expanding their geographical reach. For instance, an estimated 15-20 M&A deals were recorded in the historical period (2019-2024), indicating consolidation and strategic portfolio expansion by major stakeholders. The market share of the top five players is estimated to be around 45-55% of the total market value.

Wireless Proximity Sensor Industry Industry Trends & Analysis

The wireless proximity sensor market is experiencing robust growth, fueled by technological advancements and expanding application horizons. The increasing demand for real-time monitoring and control in industrial processes, coupled with the pervasive integration of IoT devices, serves as a primary growth driver. Technological disruptions, such as advancements in low-power wireless communication protocols (e.g., LoRaWAN, NB-IoT) and miniaturization of sensor components, are enabling more sophisticated and cost-effective solutions. Consumer preferences are shifting towards smart, connected devices that offer predictive maintenance capabilities and enhanced operational efficiency. Competitive dynamics are characterized by intense innovation, with companies focusing on developing sensors with higher accuracy, longer battery life, and greater environmental resistance. The market penetration of wireless proximity sensors is projected to reach 55-65% by the end of the forecast period. The Compound Annual Growth Rate (CAGR) for the wireless proximity sensor market is estimated at a healthy 12-15% from 2025 to 2033. The evolving landscape also sees a growing emphasis on cybersecurity for wireless sensor networks, ensuring data integrity and preventing unauthorized access, a trend that will continue to shape product development and market strategies.

Leading Markets & Segments in Wireless Proximity Sensor Industry

North America currently dominates the wireless proximity sensor market, driven by a mature industrial base, significant investments in automation and IoT, and robust adoption in the automotive and aerospace sectors. Within North America, the United States leads due to its strong manufacturing ecosystem and government initiatives promoting technological adoption.

- Dominant Region: North America

- Key Countries: United States, Canada, Mexico

Segment Analysis:

Type:

- Position and Proximity Sensors: This segment holds a significant market share due to its critical role in automation, robotics, and safety systems across various industries. Their ability to detect the presence or absence of objects and measure distances makes them indispensable.

- Pressure Sensors: Crucial for monitoring fluid and gas levels and flows in industries like energy, automotive, and food & beverage, driving substantial demand.

- Temperature Sensors: Essential for process control, safety monitoring, and environmental compliance across all major end-user industries.

- Chemical and Gas Sensors: Growing importance in environmental monitoring, industrial safety, and process optimization, particularly in energy and manufacturing.

- Other Types of Sensors: Encompasses specialized sensors that cater to niche applications, contributing to overall market diversification.

End-user Industry:

- Automotive: High adoption for advanced driver-assistance systems (ADAS), in-cabin monitoring, and manufacturing automation, representing a substantial market segment.

- Energy and Power: Critical for grid monitoring, renewable energy integration, and industrial plant safety, with a significant demand for robust and reliable sensors.

- Aerospace and Defense: Requires high-precision, reliable sensors for critical applications where performance and safety are paramount.

- Healthcare: Growing use in medical devices, patient monitoring, and laboratory automation, emphasizing accuracy and biocompatibility.

- Food and Beverage: Essential for quality control, process automation, and hygiene monitoring, driving demand for food-grade sensors.

- Other End-user Industries: Includes sectors like logistics, agriculture, and smart cities, each contributing to the overall market expansion.

Wireless Proximity Sensor Industry Product Developments

Product developments in the wireless proximity sensor industry are focused on enhancing performance, expanding functionality, and improving ease of integration. Key trends include the miniaturization of sensor modules, extended battery life for remote deployments, and improved data security protocols. Innovations in materials science and manufacturing processes are leading to more ruggedized and environmentally resistant sensors capable of operating in harsh conditions. Furthermore, the development of intelligent sensors with embedded analytics is enabling predictive maintenance and proactive issue resolution, offering significant competitive advantages to manufacturers and end-users alike. The integration of advanced wireless communication technologies further optimizes data transmission and network scalability, driving market adoption across diverse applications.

Key Drivers of Wireless Proximity Sensor Industry Growth

The wireless proximity sensor industry is propelled by several key drivers. The accelerating adoption of the Industrial Internet of Things (IIoT) and Industry 4.0 initiatives mandates real-time data from sensors for automated processes and enhanced efficiency. The increasing global focus on industrial safety and regulatory compliance necessitates reliable sensor technology for hazard detection and risk mitigation. Furthermore, the growing demand for predictive maintenance, enabled by continuous monitoring, reduces downtime and operational costs. Advancements in wireless communication technologies, such as low-power, long-range protocols, are making wireless sensors more practical and cost-effective for a wider range of applications. The constant drive for miniaturization and improved energy efficiency in electronic devices also contributes to the development of smaller, more capable wireless proximity sensors.

Challenges in the Wireless Proximity Sensor Industry Market

Despite its strong growth trajectory, the wireless proximity sensor industry faces several challenges. Regulatory hurdles related to spectrum allocation and data security can slow down adoption in certain regions. Supply chain disruptions, as witnessed in recent years, can impact the availability and cost of essential components. Interference from other wireless devices can compromise the reliability of sensor networks, necessitating robust signal management solutions. Cybersecurity threats targeting wireless sensor data pose a significant risk, requiring advanced encryption and authentication mechanisms. Additionally, initial deployment costs for large-scale wireless sensor networks can be a barrier for some smaller enterprises, though the long-term benefits often outweigh these upfront investments.

Emerging Opportunities in Wireless Proximity Sensor Industry

Emerging opportunities within the wireless proximity sensor industry are vast and diverse. The burgeoning smart city initiatives worldwide present a significant avenue for growth, with applications in traffic management, environmental monitoring, and public safety. The continuous evolution of autonomous vehicles and advanced driver-assistance systems (ADAS) will drive demand for highly accurate and reliable proximity sensors. Furthermore, the increasing focus on sustainability and decarbonization in industries like energy and manufacturing will create opportunities for sensors that monitor emissions and optimize resource utilization. Strategic partnerships between sensor manufacturers, software developers, and cloud service providers will foster integrated solutions, unlocking new application areas and revenue streams. The expansion of IoT in emerging economies also presents a substantial opportunity for market players to capture new market share.

Leading Players in the Wireless Proximity Sensor Industry Sector

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Emerson Electric Co

- Siemens AG

- Phoenix Sensors LLC

- Schneider Electric SE

- Texas Instruments Incorporated

- Rockwell Automation Inc

- Pasco Scientific

Key Milestones in Wireless Proximity Sensor Industry Industry

August 2022: Emerson announced the opening of a Cumbernauld, Scotland facility equipped with engineering, development, and manufacturing resources for sensor, mechanical, electronics, and software design for the company's gas analysis portfolio. Spurred by the demand to reduce the environmental impact of industrial process facilities, the new gas analysis solutions center will produce more than ten different sensing technologies that can measure more than 60 various gas components, delivering on Emerson's commitment to supporting customers' decarbonization efforts. This development significantly bolsters Emerson's capabilities in advanced gas sensing technologies, aligning with the growing demand for environmental monitoring and compliance solutions within the industry.

March 2022: Monnit Corporation announced the availability of its intrinsically safe ALTA-ISX long-range wireless sensors to protect workers and facilities in industrial environments with explosive atmospheres. Monnit is releasing its first three sensors that are IECEx-certified—the ALTA-ISX Temperature and Dry Contact Sensors and the 300 PSIG Pressure Meter. IECEx is the International Electrotechnical Commission (IEC) System for Certification to Standards Relating to Equipment for Use in Explosive Atmospheres. By the end of 2022, Monnit will add three to six more sensors to its ALTA-ISX product line. This milestone addresses a critical market need for safety-certified wireless sensors in hazardous environments, expanding the application reach of wireless proximity sensors into previously underserved sectors.

Strategic Outlook for Wireless Proximity Sensor Industry Market

The strategic outlook for the wireless proximity sensor industry is exceptionally positive. The continued integration of IoT and AI will drive demand for smarter, more predictive sensor capabilities. Companies that focus on developing solutions with enhanced data analytics, cybersecurity features, and seamless integration into existing industrial ecosystems will gain a competitive advantage. Expansion into emerging markets and strategic collaborations to address specific industry challenges, such as decarbonization and sustainable manufacturing, will be crucial for long-term growth. The development of ultra-low-power sensors and advancements in energy harvesting technologies will further reduce operational costs and expand deployment possibilities. Overall, the market is poised for sustained innovation and significant expansion, driven by the relentless pursuit of efficiency, safety, and connectivity across global industries.

Wireless Proximity Sensor Industry Segmentation

-

1. Type

- 1.1. Pressure Sensors

- 1.2. Temperature Sensors

- 1.3. Chemical and Gas Sensors

- 1.4. Position and Proximity Sensors

- 1.5. Other Types of Sensors

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

Wireless Proximity Sensor Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

Wireless Proximity Sensor Industry Regional Market Share

Geographic Coverage of Wireless Proximity Sensor Industry

Wireless Proximity Sensor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors

- 3.4. Market Trends

- 3.4.1. Energy and Power to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wireless Proximity Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensors

- 5.1.2. Temperature Sensors

- 5.1.3. Chemical and Gas Sensors

- 5.1.4. Position and Proximity Sensors

- 5.1.5. Other Types of Sensors

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wireless Proximity Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Pressure Sensors

- 6.1.2. Temperature Sensors

- 6.1.3. Chemical and Gas Sensors

- 6.1.4. Position and Proximity Sensors

- 6.1.5. Other Types of Sensors

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Healthcare

- 6.2.3. Aerospace and Defense

- 6.2.4. Energy and Power

- 6.2.5. Food and Beverage

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wireless Proximity Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Pressure Sensors

- 7.1.2. Temperature Sensors

- 7.1.3. Chemical and Gas Sensors

- 7.1.4. Position and Proximity Sensors

- 7.1.5. Other Types of Sensors

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Healthcare

- 7.2.3. Aerospace and Defense

- 7.2.4. Energy and Power

- 7.2.5. Food and Beverage

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Wireless Proximity Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Pressure Sensors

- 8.1.2. Temperature Sensors

- 8.1.3. Chemical and Gas Sensors

- 8.1.4. Position and Proximity Sensors

- 8.1.5. Other Types of Sensors

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Healthcare

- 8.2.3. Aerospace and Defense

- 8.2.4. Energy and Power

- 8.2.5. Food and Beverage

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Wireless Proximity Sensor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Pressure Sensors

- 9.1.2. Temperature Sensors

- 9.1.3. Chemical and Gas Sensors

- 9.1.4. Position and Proximity Sensors

- 9.1.5. Other Types of Sensors

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Healthcare

- 9.2.3. Aerospace and Defense

- 9.2.4. Energy and Power

- 9.2.5. Food and Beverage

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Monnit Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Phoenix Sensors LLC*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Schneider Electric SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Texas Instruments Incorporated

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rockwell Automation Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Pasco Scientific

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Wireless Proximity Sensor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wireless Proximity Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Wireless Proximity Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wireless Proximity Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Wireless Proximity Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Wireless Proximity Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wireless Proximity Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wireless Proximity Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wireless Proximity Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wireless Proximity Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Wireless Proximity Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Wireless Proximity Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wireless Proximity Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Wireless Proximity Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Wireless Proximity Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Wireless Proximity Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Wireless Proximity Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Wireless Proximity Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Wireless Proximity Sensor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Wireless Proximity Sensor Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Wireless Proximity Sensor Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Wireless Proximity Sensor Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Wireless Proximity Sensor Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Wireless Proximity Sensor Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Wireless Proximity Sensor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Wireless Proximity Sensor Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wireless Proximity Sensor Industry?

The projected CAGR is approximately 26.59%.

2. Which companies are prominent players in the Wireless Proximity Sensor Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Siemens AG, Phoenix Sensors LLC*List Not Exhaustive, Schneider Electric SE, Texas Instruments Incorporated, Rockwell Automation Inc, Pasco Scientific.

3. What are the main segments of the Wireless Proximity Sensor Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Energy and Power to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Cost Implications In Line With Retrofits; European Macroeconomic and Geopolitical Factors.

8. Can you provide examples of recent developments in the market?

August 2022 - Emerson announced the opening of a Cumbernauld, Scotland facility equipped with engineering, development, and manufacturing resources for sensor, mechanical, electronics, and software design for the company's gas analysis portfolio. Spurred by the demand to reduce the environmental impact of industrial process facilities, the new gas analysis solutions center will produce more than ten different sensing technologies that can measure more than 60 various gas components, delivering on Emerson's commitment to supporting customers' decarbonization efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wireless Proximity Sensor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wireless Proximity Sensor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wireless Proximity Sensor Industry?

To stay informed about further developments, trends, and reports in the Wireless Proximity Sensor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence