Key Insights

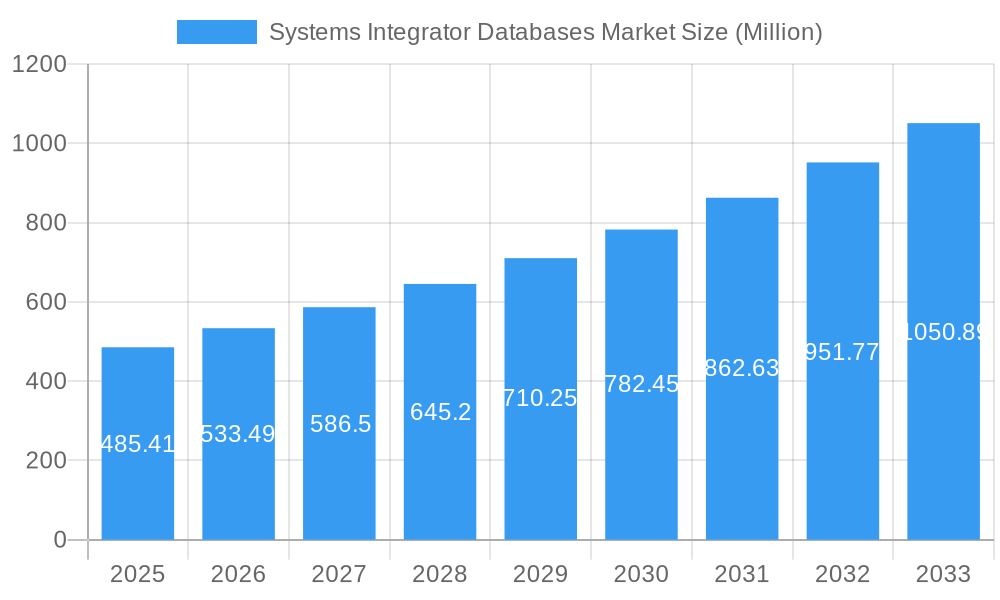

The global Systems Integrator Databases Market is poised for substantial growth, projected to reach approximately $485.41 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 9.92% during the forecast period of 2025-2033. This significant expansion is propelled by the increasing complexity of IT infrastructures across diverse end-user industries, demanding seamless integration of disparate systems and applications. The growing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) further fuels the need for sophisticated systems integration solutions to manage and derive value from these interconnected technologies. Key drivers include the imperative for enhanced operational efficiency, improved data management, and the necessity to leverage real-time insights for strategic decision-making. Industries such as IT and Telecom, BFSI, and Healthcare are leading this surge, investing heavily in integrating their core systems to offer superior customer experiences and streamline internal processes.

Systems Integrator Databases Market Market Size (In Million)

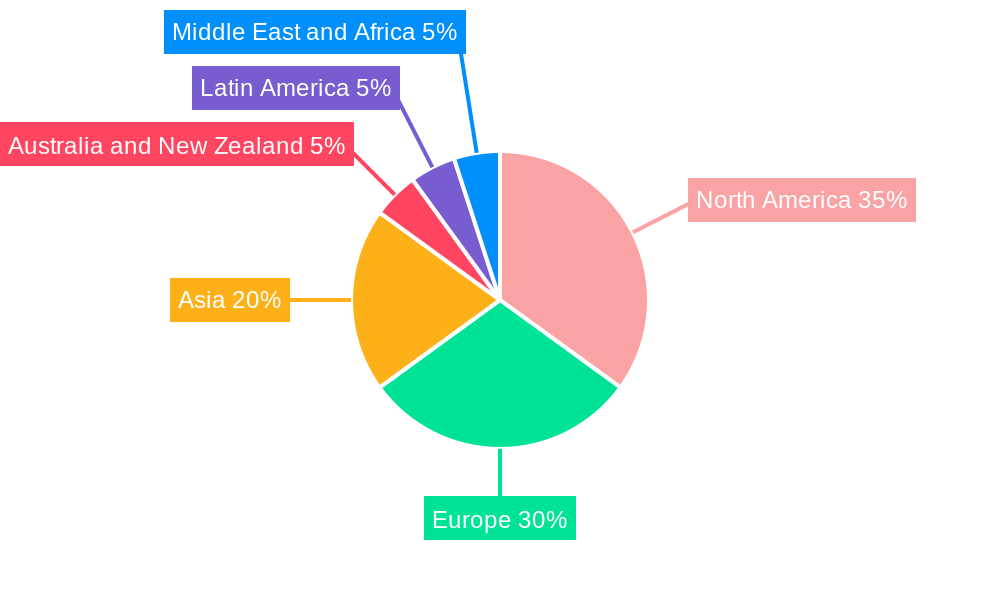

The market's trajectory is also influenced by emerging trends like the rise of hybrid and multi-cloud integration strategies, the growing demand for AI-powered integration platforms, and the increasing focus on cybersecurity as systems become more interconnected. While the market presents a lucrative opportunity, certain restraints, such as the high cost of implementation and a shortage of skilled integration professionals, could pose challenges. However, the persistent need for digital transformation and the continuous evolution of technology are expected to outweigh these limitations. Major players like Accenture, IBM, and Infosys are at the forefront, offering a comprehensive suite of services encompassing infrastructure, software, and consulting to cater to the evolving needs of enterprises. The market's growth is geographically diverse, with North America and Europe currently holding significant market share, while the Asia Pacific region shows immense potential for future expansion.

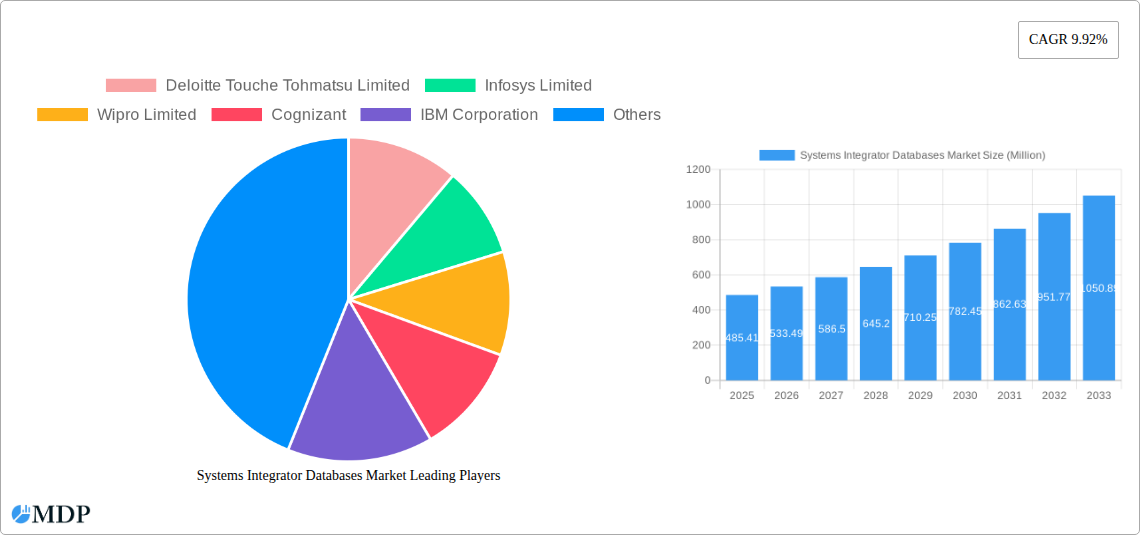

Systems Integrator Databases Market Company Market Share

Systems Integrator Databases Market Report: Unlocking Growth in a Connected Future (2019–2033)

Dive deep into the dynamic Systems Integrator Databases Market, a critical sector powering digital transformation across industries. This comprehensive report, spanning from 2019 to 2033 with a base year of 2025, offers unparalleled insights for stakeholders seeking to navigate this rapidly evolving landscape. Discover key market dynamics, innovative trends, leading segments, and strategic opportunities poised to shape the future. Understand the intricate interplay of technology, regulation, and end-user demands driving the global integration of complex database systems. With an estimated market size of XX Million USD in 2025, this report is your essential guide to capitalizing on the burgeoning opportunities within systems integration.

Systems Integrator Databases Market Market Dynamics & Concentration

The Systems Integrator Databases Market is characterized by a moderate to high concentration, with a few dominant players like IBM Corporation, Accenture, and Tata Consultancy Services Limited holding significant market share. However, the market is increasingly influenced by specialized niche players and regional integrators, leading to a fragmented competitive landscape in certain segments. Innovation is primarily driven by the relentless demand for data agility, real-time analytics, and seamless interoperability between disparate systems. As businesses grapple with escalating data volumes and complexity, the need for sophisticated database integration solutions is paramount. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA) and cybersecurity, are becoming more stringent, acting as both a challenge and a driver for enhanced integration security and compliance. Product substitutes, such as fully managed cloud database services or in-house integration efforts, exist but often fall short in addressing the comprehensive requirements of large-scale enterprise deployments. End-user trends show a strong preference for hybrid and multi-cloud strategies, demanding integration solutions that can span across various cloud environments and on-premises infrastructure. Mergers and Acquisitions (M&A) activities are moderately active, with larger players acquiring specialized firms to expand their service portfolios, technological capabilities, and geographic reach. For instance, the acquisition of smaller cloud-native integration specialists by established IT service giants is a recurring theme. The overall market concentration is expected to shift gradually as specialized firms gain traction and larger players consolidate their offerings.

Systems Integrator Databases Market Industry Trends & Analysis

The Systems Integrator Databases Market is experiencing robust growth, fueled by the pervasive digital transformation initiatives across all major industries. The increasing volume and velocity of data generated by businesses necessitate sophisticated integration strategies to unlock actionable insights and drive operational efficiency. A key growth driver is the rapid adoption of cloud computing, compelling organizations to integrate their on-premises databases with cloud-based solutions and to manage multi-cloud environments seamlessly. This trend is particularly evident in the IT and Telecom and BFSI sectors, which are at the forefront of digital innovation. Technological disruptions, such as the rise of AI and machine learning, are further accelerating market expansion as businesses seek to leverage integrated databases for advanced analytics, predictive modeling, and automated decision-making. The demand for real-time data processing and analytics is also a significant catalyst, pushing for faster and more efficient integration methods. Consumer preferences are evolving towards personalized experiences and instant gratification, placing immense pressure on businesses to have unified and accessible data across all touchpoints. This translates into a higher demand for robust data integration services that can provide a 360-degree view of the customer. Competitive dynamics are intensifying, with a clear distinction emerging between providers offering end-to-end integration services and those specializing in specific technologies or industries. The market penetration of advanced integration techniques, such as API-led connectivity and data virtualization, is steadily increasing, offering new avenues for growth and differentiation. The projected Compound Annual Growth Rate (CAGR) for the Systems Integrator Databases Market is estimated to be XX% over the forecast period, driven by these multifaceted trends. The overarching need for enterprises to break down data silos and achieve data fluidity remains the most significant impetus for market expansion.

Leading Markets & Segments in Systems Integrator Databases Market

The IT and Telecom sector is poised to be a dominant end-user industry in the Systems Integrator Databases Market, driven by its inherent reliance on robust data infrastructure and the constant need for seamless connectivity and service delivery. Countries with advanced technological adoption and significant investments in digital infrastructure, such as the United States and China, are expected to lead market growth.

Service Type Dominance:

- Software/Application Integration: This segment is projected to witness the highest growth due to the proliferation of cloud-native applications, microservices architectures, and the increasing need to connect disparate software systems across enterprises. The demand for integrating legacy systems with modern applications also fuels this segment.

- Infrastructure Integration: While a foundational service, its dominance is closely tied to the overall digital transformation agenda. Organizations are increasingly outsourcing the complexity of integrating cloud and on-premises infrastructure, ensuring scalability and reliability.

- Consulting: As database integration becomes more complex, consulting services are crucial for strategic planning, solution design, and implementation guidance. This segment is essential for ensuring that integration efforts align with overarching business objectives.

End-user Industry Dominance:

- IT and Telecom: This industry's continuous innovation and reliance on data flow make it a prime market. The deployment of 5G, IoT, and advanced networking solutions requires sophisticated database integration.

- BFSI: The financial sector's stringent regulatory requirements, the need for real-time fraud detection, personalized customer services, and robust risk management drive significant demand for integrated database solutions.

- Automotive: The rise of connected vehicles, autonomous driving technologies, and the increasing use of data for manufacturing and supply chain optimization are creating substantial opportunities for systems integrators.

- Healthcare: The digitization of patient records, the demand for telemedicine, and the need for efficient data sharing among healthcare providers are significant drivers for database integration.

- Aerospace and Defense: This sector requires highly secure and reliable data integration for complex systems, R&D, and operational efficiency, contributing a significant share to the market.

- Others (Energy, Chemical, Mining etc.): These industries are increasingly adopting data-driven approaches for operational efficiency, predictive maintenance, and resource management, leading to a growing demand for integration services.

Key drivers for the dominance of these segments and regions include strong economic policies supporting technological advancement, substantial investments in digital infrastructure, a skilled workforce, and proactive regulatory environments that encourage innovation.

Systems Integrator Databases Market Product Developments

The Systems Integrator Databases Market is witnessing a surge in product developments focused on enhancing data accessibility, security, and real-time processing. Innovations in cloud-native integration platforms, AI-powered data transformation tools, and advanced API management solutions are key trends. Companies are developing solutions that simplify the integration of diverse data sources, including structured, semi-structured, and unstructured data, across hybrid and multi-cloud environments. Competitive advantages are being gained through offerings that provide faster deployment times, reduced integration complexity, improved data governance, and enhanced cybersecurity features. The focus is on creating intelligent integration capabilities that can adapt to evolving business needs and emerging technologies, enabling organizations to derive maximum value from their data assets.

Key Drivers of Systems Integrator Databases Market Growth

The growth of the Systems Integrator Databases Market is propelled by several powerful drivers. The overarching need for digital transformation across all industries necessitates the seamless integration of disparate data sources and applications to create unified business processes. The proliferation of cloud computing mandates solutions that can effectively bridge on-premises infrastructure with various cloud environments. Big Data analytics and the rise of AI/ML require robust integration to feed these technologies with clean, accessible data for advanced insights and automation. Furthermore, increasing data volumes and complexity, coupled with stringent data privacy regulations, compel organizations to seek expert integration services to ensure compliance and security. The demand for real-time data processing for decision-making and operational efficiency also plays a crucial role.

Challenges in the Systems Integrator Databases Market Market

Despite its growth, the Systems Integrator Databases Market faces several challenges. The complexity of integrating legacy systems with modern architectures often proves to be a significant hurdle, leading to increased project timelines and costs. Data security and privacy concerns remain paramount, requiring integrators to implement stringent security measures and comply with evolving regulations, which can be costly and resource-intensive. Talent scarcity in specialized integration skills, particularly in cloud-native technologies and advanced data management, poses a constraint on service delivery capacity. Vendor lock-in concerns with proprietary integration platforms and the interoperability issues between different technologies can also impede seamless integration. Finally, budgetary constraints for large-scale integration projects can limit adoption for some organizations.

Emerging Opportunities in Systems Integrator Databases Market

Emerging opportunities in the Systems Integrator Databases Market are being driven by several catalysts. The accelerating adoption of the Internet of Things (IoT) is generating massive amounts of real-time data, creating a demand for integration solutions that can handle device-to-cloud connectivity and data processing. The continued growth of hybrid and multi-cloud strategies presents a significant opportunity for integrators who can offer seamless data management and application connectivity across diverse cloud ecosystems. The increasing focus on data democratization within organizations is driving the need for user-friendly integration tools and platforms that empower business users to access and analyze data. Strategic partnerships between systems integrators and cloud providers, as well as specialized technology vendors, are opening new avenues for market expansion and service innovation. Furthermore, the growing demand for industry-specific integration solutions tailored to the unique data challenges of sectors like healthcare, manufacturing, and logistics presents lucrative niche opportunities.

Leading Players in the Systems Integrator Databases Market Sector

- Deloitte Touche Tohmatsu Limited

- Infosys Limited

- Wipro Limited

- Cognizant

- IBM Corporation

- MDS Systems Integration (MDS SI)

- BAE Systems

- Accenture

- Tata Consultancy Services Limited

- Oracle Corporation

Key Milestones in Systems Integrator Databases Market Industry

- September 2022: NVIDIA launched its first software- and infrastructure-as-a-service offering NVIDIA Omniverse Cloud, a comprehensive suite of cloud services for artists, developers, and enterprise teams to design, publish, operate, and experience metaverse applications anywhere. Using Omniverse Cloud, individuals and teams can experience in one click the ability to create and collaborate on 3D workflows without the need for any local computing power. This move signifies the growing importance of integrated cloud platforms for immersive digital experiences and collaborative workflows, impacting the demand for underlying database integration capabilities.

- April 2022: With a mission to develop an electric vehicle range, Mercedes-Benz opened a software integration factory, Electric Software Hub, at the Mercedes Technology Centre (MTC) in Germany. Numerous software, hardware, system integration, and testing functions have been combined under one roof in an eight-floor, 70,000-meter square. This development highlights the increasing trend of in-house specialized software and system integration centers within large manufacturing organizations, particularly in the automotive sector, emphasizing the critical role of integrated databases in complex product development and operations.

Strategic Outlook for Systems Integrator Databases Market Market

The strategic outlook for the Systems Integrator Databases Market is highly positive, characterized by continuous innovation and expanding adoption. Growth accelerators include the persistent drive towards digital transformation, the widespread embrace of cloud technologies, and the burgeoning field of AI and machine learning. Organizations will increasingly rely on sophisticated integration strategies to unlock the full potential of their data assets, enabling smarter decision-making and enhanced operational efficiency. The market will see a rise in demand for specialized integration services catering to specific industry verticals and a greater emphasis on automation and AI-driven integration solutions. Strategic partnerships between technology providers and service integrators will be crucial for delivering comprehensive, end-to-end solutions that address the evolving data integration needs of enterprises. The future success will hinge on the ability of players to offer scalable, secure, and agile integration platforms that can seamlessly connect a diverse and ever-expanding digital landscape.

Systems Integrator Databases Market Segmentation

-

1. Service Type

- 1.1. Infrastructure Integration

- 1.2. Software/Application Integration

- 1.3. Consulting

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Aerospace and Defense

- 2.3. IT and Telecom

- 2.4. BFSI

- 2.5. Healthcare

- 2.6. Oil and Gas

- 2.7. Others (Energy, Chemical, Mining etc.)

Systems Integrator Databases Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

-

3. Asia

- 3.1. India

- 3.2. China

- 3.3. Japan

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Systems Integrator Databases Market Regional Market Share

Geographic Coverage of Systems Integrator Databases Market

Systems Integrator Databases Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.92% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements and adoption of cloud-technologies; Benefits of increasing productivity while reducing IT Management cost

- 3.3. Market Restrains

- 3.3.1. Inability of Service Providers to Provide Real-time Insights

- 3.4. Market Trends

- 3.4.1. Software/Application Integration to have a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Infrastructure Integration

- 5.1.2. Software/Application Integration

- 5.1.3. Consulting

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Aerospace and Defense

- 5.2.3. IT and Telecom

- 5.2.4. BFSI

- 5.2.5. Healthcare

- 5.2.6. Oil and Gas

- 5.2.7. Others (Energy, Chemical, Mining etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Infrastructure Integration

- 6.1.2. Software/Application Integration

- 6.1.3. Consulting

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Aerospace and Defense

- 6.2.3. IT and Telecom

- 6.2.4. BFSI

- 6.2.5. Healthcare

- 6.2.6. Oil and Gas

- 6.2.7. Others (Energy, Chemical, Mining etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Infrastructure Integration

- 7.1.2. Software/Application Integration

- 7.1.3. Consulting

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Aerospace and Defense

- 7.2.3. IT and Telecom

- 7.2.4. BFSI

- 7.2.5. Healthcare

- 7.2.6. Oil and Gas

- 7.2.7. Others (Energy, Chemical, Mining etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Infrastructure Integration

- 8.1.2. Software/Application Integration

- 8.1.3. Consulting

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Aerospace and Defense

- 8.2.3. IT and Telecom

- 8.2.4. BFSI

- 8.2.5. Healthcare

- 8.2.6. Oil and Gas

- 8.2.7. Others (Energy, Chemical, Mining etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Infrastructure Integration

- 9.1.2. Software/Application Integration

- 9.1.3. Consulting

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Aerospace and Defense

- 9.2.3. IT and Telecom

- 9.2.4. BFSI

- 9.2.5. Healthcare

- 9.2.6. Oil and Gas

- 9.2.7. Others (Energy, Chemical, Mining etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Latin America Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Infrastructure Integration

- 10.1.2. Software/Application Integration

- 10.1.3. Consulting

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Aerospace and Defense

- 10.2.3. IT and Telecom

- 10.2.4. BFSI

- 10.2.5. Healthcare

- 10.2.6. Oil and Gas

- 10.2.7. Others (Energy, Chemical, Mining etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Middle East and Africa Systems Integrator Databases Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 11.1.1. Infrastructure Integration

- 11.1.2. Software/Application Integration

- 11.1.3. Consulting

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Automotive

- 11.2.2. Aerospace and Defense

- 11.2.3. IT and Telecom

- 11.2.4. BFSI

- 11.2.5. Healthcare

- 11.2.6. Oil and Gas

- 11.2.7. Others (Energy, Chemical, Mining etc.)

- 11.1. Market Analysis, Insights and Forecast - by Service Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Deloitte Touche Tohmatsu Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Infosys Limited

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Wipro Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cognizant

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 IBM Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MDS Systems Integration (MDS SI)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 BAE systems

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Accenture

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Tata Consultancy Services Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Oracle Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Deloitte Touche Tohmatsu Limited

List of Figures

- Figure 1: Global Systems Integrator Databases Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Systems Integrator Databases Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 5: North America Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: North America Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 16: Europe Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 17: Europe Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 18: Europe Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 19: Europe Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Europe Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 28: Asia Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 29: Asia Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Asia Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 31: Asia Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Asia Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 40: Australia and New Zealand Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 41: Australia and New Zealand Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 42: Australia and New Zealand Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 43: Australia and New Zealand Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Australia and New Zealand Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Australia and New Zealand Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Australia and New Zealand Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Australia and New Zealand Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 52: Latin America Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 53: Latin America Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 54: Latin America Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 55: Latin America Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Latin America Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Latin America Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Latin America Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Latin America Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Systems Integrator Databases Market Revenue (Million), by Service Type 2025 & 2033

- Figure 64: Middle East and Africa Systems Integrator Databases Market Volume (K Unit), by Service Type 2025 & 2033

- Figure 65: Middle East and Africa Systems Integrator Databases Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 66: Middle East and Africa Systems Integrator Databases Market Volume Share (%), by Service Type 2025 & 2033

- Figure 67: Middle East and Africa Systems Integrator Databases Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Middle East and Africa Systems Integrator Databases Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Middle East and Africa Systems Integrator Databases Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Middle East and Africa Systems Integrator Databases Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Middle East and Africa Systems Integrator Databases Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Systems Integrator Databases Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Systems Integrator Databases Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Systems Integrator Databases Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 3: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Systems Integrator Databases Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Systems Integrator Databases Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 9: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 18: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 19: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 23: Germany Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 30: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 31: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: India Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: India Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: China Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: China Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Japan Systems Integrator Databases Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Japan Systems Integrator Databases Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 42: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 43: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 44: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 47: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 48: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 49: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 50: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 51: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 53: Global Systems Integrator Databases Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 54: Global Systems Integrator Databases Market Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 55: Global Systems Integrator Databases Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 56: Global Systems Integrator Databases Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 57: Global Systems Integrator Databases Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: Global Systems Integrator Databases Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Systems Integrator Databases Market?

The projected CAGR is approximately 9.92%.

2. Which companies are prominent players in the Systems Integrator Databases Market?

Key companies in the market include Deloitte Touche Tohmatsu Limited, Infosys Limited, Wipro Limited, Cognizant, IBM Corporation, MDS Systems Integration (MDS SI), BAE systems, Accenture, Tata Consultancy Services Limited, Oracle Corporation.

3. What are the main segments of the Systems Integrator Databases Market?

The market segments include Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 485.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements and adoption of cloud-technologies; Benefits of increasing productivity while reducing IT Management cost.

6. What are the notable trends driving market growth?

Software/Application Integration to have a Significant Growth.

7. Are there any restraints impacting market growth?

Inability of Service Providers to Provide Real-time Insights.

8. Can you provide examples of recent developments in the market?

September 2022 - NVIDIA launched its first software- and infrastructure-as-a-service offering NVIDIA Omniverse Cloud, a comprehensive suite of cloud services for artists, developers, and enterprise teams to design, publish, operate, and experience metaverse applications anywhere. Using Omniverse Cloud, individuals and teams can experience in one click the ability to create and collaborate on 3D workflows without the need for any local computing power.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Systems Integrator Databases Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Systems Integrator Databases Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Systems Integrator Databases Market?

To stay informed about further developments, trends, and reports in the Systems Integrator Databases Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence