Key Insights

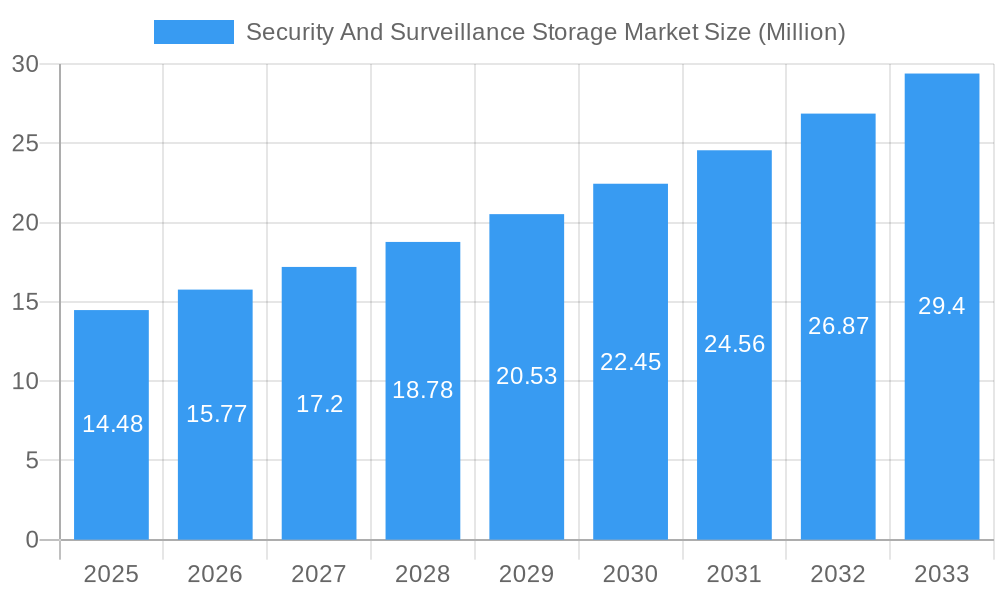

The Security and Surveillance Storage Market is poised for robust expansion, driven by escalating global security concerns and the increasing adoption of sophisticated surveillance technologies across diverse sectors. The market is valued at $14.48 million and is projected to grow at a compelling Compound Annual Growth Rate (CAGR) of 8.94%, reaching significant figures by the end of the forecast period. This growth is fueled by the indispensable need for reliable and high-capacity storage solutions to manage the ever-increasing volume of video data generated by an expanding network of cameras. Key drivers include the surge in smart city initiatives, the rising threat landscape necessitating advanced threat detection and response capabilities, and the growing demand for cloud-based storage for enhanced accessibility and scalability. Furthermore, the integration of AI and analytics into surveillance systems amplifies the need for powerful storage infrastructure to process and store large datasets for real-time insights and historical analysis.

Security And Surveillance Storage Market Market Size (In Million)

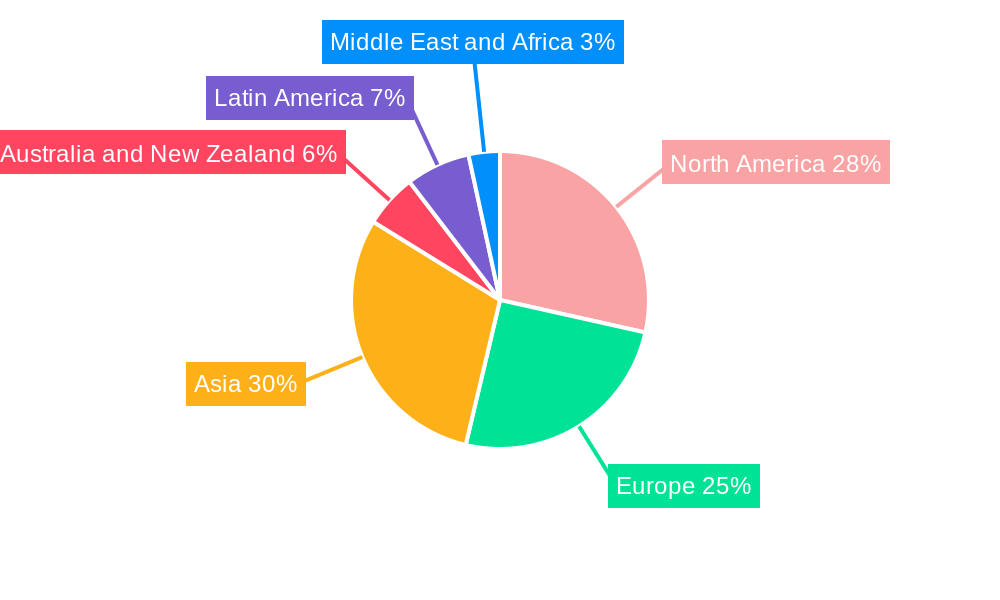

The market landscape is characterized by dynamic segmentation. In terms of product, Network Attached Storage (NAS) and Storage Area Network (SAN) solutions are expected to dominate, catering to the demanding requirements of enterprise-level surveillance. Solid-State Drives (SSDs) are gaining traction within storage media due to their superior performance and durability, although Hard Disk Drives (HDDs) will continue to be a cost-effective option for mass storage. The shift towards cloud deployment for its flexibility and cost-efficiency is a prominent trend, though on-premise solutions will remain crucial for organizations with stringent data sovereignty and security requirements, particularly within government and defense sectors. Major end-user verticals like BFSI, Retail, and Healthcare are significant contributors, driven by regulatory compliance and loss prevention needs. Geographically, North America and Asia are anticipated to lead market growth due to substantial investments in smart city projects and increasing security infrastructure development.

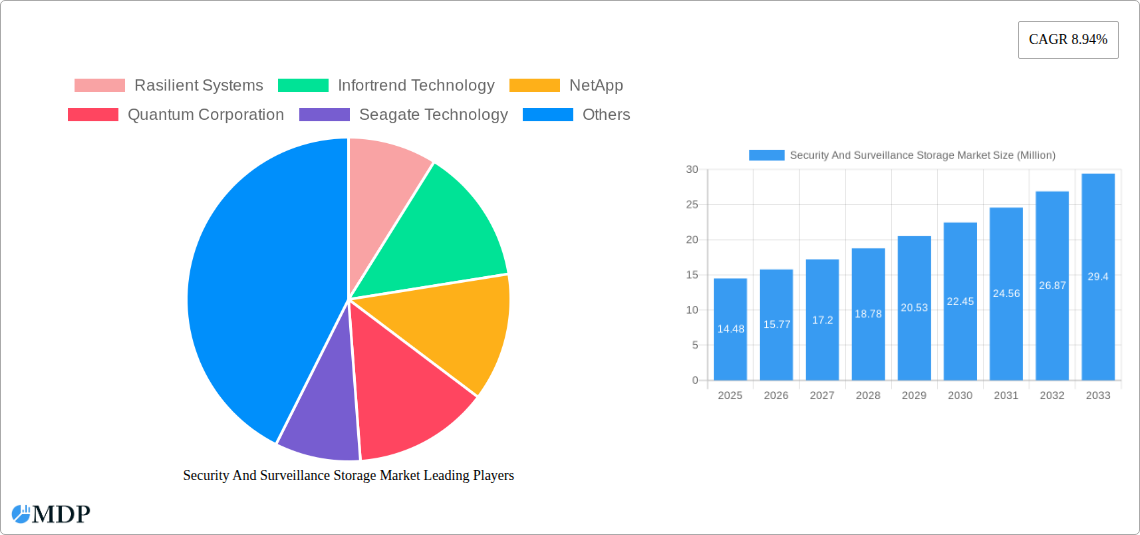

Security And Surveillance Storage Market Company Market Share

Unlocking Insights: The Global Security And Surveillance Storage Market Report 2025-2033

Gain unparalleled visibility into the rapidly evolving Security And Surveillance Storage Market with this comprehensive, data-driven report. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this analysis delves deep into market dynamics, key trends, leading players, and future opportunities. With a base year of 2025 and estimations for the same year, this report is your essential guide to navigating the complexities and capitalizing on the immense potential of this critical industry. Discover how advanced storage solutions are reshaping security landscapes across diverse verticals, from government and defense to smart homes.

Security And Surveillance Storage Market Dynamics & Concentration

The Security And Surveillance Storage Market exhibits a dynamic and evolving concentration, driven by relentless innovation and strategic consolidations. Key innovation drivers include the escalating demand for high-resolution video footage, the proliferation of IoT devices, and the need for robust data analytics. Regulatory frameworks, particularly those concerning data privacy and retention, are increasingly influencing storage choices and driving compliance. Product substitutes, such as advanced analytics platforms and edge computing solutions, are emerging but often complement rather than replace dedicated surveillance storage. End-user trends indicate a clear shift towards hybrid and cloud-based solutions for scalability and accessibility. Merger and Acquisition (M&A) activities are shaping market concentration, with significant deals aimed at expanding product portfolios and geographical reach. For instance, in the historical period, we observed an estimated XX M&A deals within the sector, impacting the market share of key players like NetApp and Seagate Technology. While market share distribution varies by segment, key players are consistently vying for dominance, with consolidated revenues estimated in the tens of billions.

Security And Surveillance Storage Market Industry Trends & Analysis

The Security And Surveillance Storage Market is experiencing robust growth, propelled by a confluence of technological advancements and evolving security imperatives. The Compound Annual Growth Rate (CAGR) is projected to be a significant xx% over the forecast period (2025–2033), driven by increasing global adoption of advanced surveillance systems. Key growth drivers include the relentless expansion of smart cities, enhanced security requirements in critical infrastructure, and the growing need for efficient data management for AI-powered video analytics. Technological disruptions, such as the advent of AI-driven video analytics, demand higher storage capacities and faster data retrieval, pushing the boundaries of traditional storage solutions. The market penetration of cloud-based storage for surveillance data is steadily increasing, offering scalability, cost-effectiveness, and enhanced accessibility for remote monitoring and management. Conversely, on-premise solutions remain crucial for sectors with stringent data sovereignty and security concerns, like Government and Defense. Consumer preferences are shifting towards solutions that offer seamless integration, ease of use, and the ability to store vast amounts of data cost-effectively. Competitive dynamics are intensifying, with established players like Dell Technologies and Cisco Systems investing heavily in R&D and strategic partnerships to maintain their market leadership. The rise of specialized storage providers, offering tailored solutions for surveillance needs, is also a notable trend. Furthermore, the increasing sophistication of cyber threats necessitates more resilient and secure storage architectures, prompting further innovation in data protection and encryption technologies. The overall market size is estimated to reach approximately $XX Billion by 2033, reflecting a substantial upward trajectory.

Leading Markets & Segments in Security And Surveillance Storage Market

The Government and Defense vertical emerges as a dominant segment within the Security And Surveillance Storage Market, driven by the critical need for secure, high-capacity, and reliable data storage for national security, border control, and defense operations. The increasing geopolitical tensions and the imperative to monitor vast territories and complex operations necessitate sophisticated surveillance infrastructure.

- Product:

- NAS (Network Attached Storage): Dominates due to its ease of deployment and scalability, ideal for centralized video management systems. Its accessibility and cost-effectiveness make it a popular choice for numerous government agencies.

- SAN (Storage Area Network): Crucial for high-performance applications requiring simultaneous access to large datasets, such as real-time video analytics and forensic investigations within defense organizations.

- Storage Media:

- HDD (Hard Disk Drive): Remains the workhorse for mass storage due to its high capacity and cost-per-terabyte advantage, essential for archiving long-term surveillance footage.

- SSD (Solid State Drive): Increasingly adopted for critical operational storage, offering faster read/write speeds for real-time processing and immediate access to critical data.

- Deployment:

- On Premise: The preferred deployment model for Government and Defense, ensuring maximum data control, security, and compliance with stringent data sovereignty regulations. This allows for direct management and protection against external breaches.

- End-User Vertical:

- Government and Defense: Leads the market share due to extensive surveillance requirements in public safety, intelligence gathering, and military operations.

- Retail: Significant growth driven by loss prevention, customer behavior analysis, and inventory management needs. The deployment of advanced CCTV systems in retail environments fuels demand for robust storage solutions.

- Transportation and Logistics: Essential for monitoring traffic flow, ensuring public safety in transit hubs, and tracking high-value cargo, leading to substantial investments in surveillance storage.

The BFSI (Banking, Financial Services, and Insurance) sector also represents a substantial market, driven by regulatory compliance mandates for transaction recording, fraud prevention, and customer security. The escalating threat of financial crime necessitates continuous, high-fidelity video surveillance.

- Product: NAS solutions are widely adopted for their centralized data management capabilities in retail and BFSI environments, facilitating easy access for audits and investigations.

- Storage Media: The balance between HDD for bulk storage and SSD for faster transaction processing is crucial.

- Deployment: While on-premise remains prevalent for highly sensitive financial data, hybrid cloud solutions are gaining traction for enhanced disaster recovery and scalability.

The Education sector is witnessing a surge in demand for surveillance storage, driven by the need to enhance campus safety, monitor facilities, and protect valuable assets. The increasing adoption of smart classroom technologies also contributes to data generation requiring storage.

- Product: NAS solutions are cost-effective and scalable for educational institutions managing multiple camera feeds across campuses.

- Deployment: A mix of on-premise for core administrative buildings and cloud solutions for remote campus monitoring is becoming common.

Security And Surveillance Storage Market Product Developments

Product developments in the Security And Surveillance Storage Market are characterized by a relentless pursuit of enhanced capacity, speed, and intelligence. Innovations are focused on integrating advanced technologies like AI and machine learning directly into storage devices, enabling intelligent video analysis at the edge, thereby reducing bandwidth requirements and facilitating faster threat detection. The development of hybrid cloud storage solutions, exemplified by Tdsi's Gardisvu, offers a compelling blend of on-premises data control and cloud-based accessibility for monitoring and management. Furthermore, specialized storage media, such as high-density HDDs and faster SSDs optimized for continuous video recording, are continuously being refined. These advancements ensure that surveillance systems can effectively capture and retain the ever-increasing volume of high-resolution video data, while also providing efficient access for forensic analysis and real-time monitoring, offering a competitive advantage through improved security and operational efficiency.

Key Drivers of Security And Surveillance Storage Market Growth

The Security And Surveillance Storage Market is propelled by a powerful set of drivers. The escalating global threat landscape necessitates continuous enhancement of surveillance capabilities, leading to increased demand for storage. The proliferation of smart city initiatives and IoT devices generates vast amounts of data requiring robust storage solutions. Technological advancements in AI and machine learning are driving the need for higher capacity and faster access to enable advanced video analytics. Stricter regulatory compliance across various industries, particularly in BFSI and government sectors, mandates long-term data retention. The decreasing cost of storage technology makes advanced surveillance solutions more accessible.

Challenges in the Security And Surveillance Storage Market Market

Despite its growth, the Security And Surveillance Storage Market faces significant challenges. Data security and privacy concerns remain paramount, with a constant threat of cyberattacks and data breaches demanding robust encryption and access control. The sheer volume of data generated by high-resolution cameras and extensive deployment periods presents a continuous challenge for storage capacity and management. Interoperability issues between different surveillance systems and storage solutions can hinder seamless integration. The rapid pace of technological evolution requires continuous investment in upgrades and replacements, leading to significant capital expenditure. Supply chain disruptions can impact the availability and cost of critical hardware components.

Emerging Opportunities in Security And Surveillance Storage Market

Emerging opportunities within the Security And Surveillance Storage Market are substantial, fueled by ongoing technological innovation and expanding applications. The growing adoption of AI-powered video analytics for predictive policing, anomaly detection, and facial recognition presents a significant opportunity for high-performance, intelligent storage solutions. The expansion of smart cities and critical infrastructure security projects worldwide will continue to drive demand for large-scale surveillance storage. The development of edge computing solutions that process data closer to the source offers new avenues for distributed storage architectures. Furthermore, the increasing demand for video-as-a-service (VaaS) models, facilitated by cloud storage, opens up new revenue streams and service offerings. Strategic partnerships between storage providers and AI analytics companies are poised to unlock innovative, end-to-end security solutions.

Leading Players in the Security And Surveillance Storage Market Sector

- Rasilient Systems

- Infortrend Technology

- NetApp

- Quantum Corporation

- Seagate Technology

- Honeywell International

- Cisco Systems

- VIVOTEK

- Dell Technologies

Key Milestones in Security And Surveillance Storage Market Industry

- May 2023: Tdsi unveiled Gardisvu, a hybrid-cloud CCTV video management solution designed to integrate with their Gardis ecosystem, combining on-premises storage with cloud supervision.

- February 2023: Wasabi Technologies launched the Wasabi surveillance cloud, enabling unlimited cloud capacity for video surveillance data transfer from local storage.

Strategic Outlook for Security And Surveillance Storage Market Market

The strategic outlook for the Security And Surveillance Storage Market is overwhelmingly positive, driven by the persistent global need for enhanced security and the accelerating pace of technological innovation. Key growth accelerators include the increasing adoption of AI and machine learning for intelligent video analysis, which necessitates more sophisticated storage capabilities. The ongoing expansion of smart cities and the IoT ecosystem will continue to fuel demand for high-capacity, scalable storage solutions. Furthermore, the trend towards hybrid and cloud-based storage offers significant opportunities for service providers to deliver flexible, cost-effective, and accessible surveillance data management. Strategic partnerships, focused on integrating advanced storage with cutting-edge analytics and cybersecurity measures, will be crucial for sustained growth and market leadership in this dynamic sector.

Security And Surveillance Storage Market Segmentation

-

1. Product

- 1.1. NAS

- 1.2. SAN

- 1.3. DAS

- 1.4. Other Products

-

2. Storage Media

- 2.1. HDD

- 2.2. SSD

-

3. Deployment

- 3.1. Cloud

- 3.2. On Premise

-

4. End-User Vertical

- 4.1. Government and Defense

- 4.2. Education

- 4.3. BFSI

- 4.4. Retail

- 4.5. Transportation and Logistics

- 4.6. Utilities

- 4.7. Healthcare

- 4.8. Home Security

- 4.9. Other End-User Verticals

Security And Surveillance Storage Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Security And Surveillance Storage Market Regional Market Share

Geographic Coverage of Security And Surveillance Storage Market

Security And Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Necessity for Surveillance across Industry Verticals; Growing Investments by Governments and Stakeholders for Developing Smart Cities

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Expenditure due to Deployment of Network Architecture Model and Spectrum Challenges

- 3.4. Market Trends

- 3.4.1. Healthcare Sector to Occupy Considerable Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. NAS

- 5.1.2. SAN

- 5.1.3. DAS

- 5.1.4. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Storage Media

- 5.2.1. HDD

- 5.2.2. SSD

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On Premise

- 5.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.4.1. Government and Defense

- 5.4.2. Education

- 5.4.3. BFSI

- 5.4.4. Retail

- 5.4.5. Transportation and Logistics

- 5.4.6. Utilities

- 5.4.7. Healthcare

- 5.4.8. Home Security

- 5.4.9. Other End-User Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia

- 5.5.4. Australia and New Zealand

- 5.5.5. Latin America

- 5.5.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. NAS

- 6.1.2. SAN

- 6.1.3. DAS

- 6.1.4. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Storage Media

- 6.2.1. HDD

- 6.2.2. SSD

- 6.3. Market Analysis, Insights and Forecast - by Deployment

- 6.3.1. Cloud

- 6.3.2. On Premise

- 6.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 6.4.1. Government and Defense

- 6.4.2. Education

- 6.4.3. BFSI

- 6.4.4. Retail

- 6.4.5. Transportation and Logistics

- 6.4.6. Utilities

- 6.4.7. Healthcare

- 6.4.8. Home Security

- 6.4.9. Other End-User Verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. NAS

- 7.1.2. SAN

- 7.1.3. DAS

- 7.1.4. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Storage Media

- 7.2.1. HDD

- 7.2.2. SSD

- 7.3. Market Analysis, Insights and Forecast - by Deployment

- 7.3.1. Cloud

- 7.3.2. On Premise

- 7.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 7.4.1. Government and Defense

- 7.4.2. Education

- 7.4.3. BFSI

- 7.4.4. Retail

- 7.4.5. Transportation and Logistics

- 7.4.6. Utilities

- 7.4.7. Healthcare

- 7.4.8. Home Security

- 7.4.9. Other End-User Verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. NAS

- 8.1.2. SAN

- 8.1.3. DAS

- 8.1.4. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Storage Media

- 8.2.1. HDD

- 8.2.2. SSD

- 8.3. Market Analysis, Insights and Forecast - by Deployment

- 8.3.1. Cloud

- 8.3.2. On Premise

- 8.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 8.4.1. Government and Defense

- 8.4.2. Education

- 8.4.3. BFSI

- 8.4.4. Retail

- 8.4.5. Transportation and Logistics

- 8.4.6. Utilities

- 8.4.7. Healthcare

- 8.4.8. Home Security

- 8.4.9. Other End-User Verticals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia and New Zealand Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. NAS

- 9.1.2. SAN

- 9.1.3. DAS

- 9.1.4. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Storage Media

- 9.2.1. HDD

- 9.2.2. SSD

- 9.3. Market Analysis, Insights and Forecast - by Deployment

- 9.3.1. Cloud

- 9.3.2. On Premise

- 9.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 9.4.1. Government and Defense

- 9.4.2. Education

- 9.4.3. BFSI

- 9.4.4. Retail

- 9.4.5. Transportation and Logistics

- 9.4.6. Utilities

- 9.4.7. Healthcare

- 9.4.8. Home Security

- 9.4.9. Other End-User Verticals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Latin America Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. NAS

- 10.1.2. SAN

- 10.1.3. DAS

- 10.1.4. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Storage Media

- 10.2.1. HDD

- 10.2.2. SSD

- 10.3. Market Analysis, Insights and Forecast - by Deployment

- 10.3.1. Cloud

- 10.3.2. On Premise

- 10.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 10.4.1. Government and Defense

- 10.4.2. Education

- 10.4.3. BFSI

- 10.4.4. Retail

- 10.4.5. Transportation and Logistics

- 10.4.6. Utilities

- 10.4.7. Healthcare

- 10.4.8. Home Security

- 10.4.9. Other End-User Verticals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Middle East and Africa Security And Surveillance Storage Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. NAS

- 11.1.2. SAN

- 11.1.3. DAS

- 11.1.4. Other Products

- 11.2. Market Analysis, Insights and Forecast - by Storage Media

- 11.2.1. HDD

- 11.2.2. SSD

- 11.3. Market Analysis, Insights and Forecast - by Deployment

- 11.3.1. Cloud

- 11.3.2. On Premise

- 11.4. Market Analysis, Insights and Forecast - by End-User Vertical

- 11.4.1. Government and Defense

- 11.4.2. Education

- 11.4.3. BFSI

- 11.4.4. Retail

- 11.4.5. Transportation and Logistics

- 11.4.6. Utilities

- 11.4.7. Healthcare

- 11.4.8. Home Security

- 11.4.9. Other End-User Verticals

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Rasilient Systems

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Infortrend Technology

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NetApp

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Quantum Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Seagate Technology

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Honeywell International

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cisco Systems

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 VIVOTEK

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Dell Technologies

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Rasilient Systems

List of Figures

- Figure 1: Global Security And Surveillance Storage Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 5: North America Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 6: North America Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 7: North America Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 8: North America Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 9: North America Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 10: North America Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 13: Europe Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 15: Europe Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 16: Europe Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 17: Europe Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 18: Europe Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 19: Europe Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 20: Europe Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 23: Asia Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 24: Asia Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 25: Asia Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 26: Asia Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 27: Asia Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Asia Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 29: Asia Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 30: Asia Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 33: Australia and New Zealand Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 34: Australia and New Zealand Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 35: Australia and New Zealand Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 36: Australia and New Zealand Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 37: Australia and New Zealand Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 38: Australia and New Zealand Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 39: Australia and New Zealand Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 40: Australia and New Zealand Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Australia and New Zealand Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Latin America Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 43: Latin America Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 44: Latin America Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 45: Latin America Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 46: Latin America Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 47: Latin America Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 48: Latin America Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 49: Latin America Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 50: Latin America Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Latin America Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

- Figure 52: Middle East and Africa Security And Surveillance Storage Market Revenue (Million), by Product 2025 & 2033

- Figure 53: Middle East and Africa Security And Surveillance Storage Market Revenue Share (%), by Product 2025 & 2033

- Figure 54: Middle East and Africa Security And Surveillance Storage Market Revenue (Million), by Storage Media 2025 & 2033

- Figure 55: Middle East and Africa Security And Surveillance Storage Market Revenue Share (%), by Storage Media 2025 & 2033

- Figure 56: Middle East and Africa Security And Surveillance Storage Market Revenue (Million), by Deployment 2025 & 2033

- Figure 57: Middle East and Africa Security And Surveillance Storage Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 58: Middle East and Africa Security And Surveillance Storage Market Revenue (Million), by End-User Vertical 2025 & 2033

- Figure 59: Middle East and Africa Security And Surveillance Storage Market Revenue Share (%), by End-User Vertical 2025 & 2033

- Figure 60: Middle East and Africa Security And Surveillance Storage Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Security And Surveillance Storage Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 3: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 4: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 5: Global Security And Surveillance Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 8: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 9: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 10: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 12: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 13: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 14: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 15: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 18: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 19: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 20: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 22: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 23: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 24: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 25: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 27: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 28: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 29: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 30: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Global Security And Surveillance Storage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 32: Global Security And Surveillance Storage Market Revenue Million Forecast, by Storage Media 2020 & 2033

- Table 33: Global Security And Surveillance Storage Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 34: Global Security And Surveillance Storage Market Revenue Million Forecast, by End-User Vertical 2020 & 2033

- Table 35: Global Security And Surveillance Storage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Security And Surveillance Storage Market?

The projected CAGR is approximately 8.94%.

2. Which companies are prominent players in the Security And Surveillance Storage Market?

Key companies in the market include Rasilient Systems, Infortrend Technology, NetApp, Quantum Corporation, Seagate Technology, Honeywell International, Cisco Systems, VIVOTEK, Dell Technologies.

3. What are the main segments of the Security And Surveillance Storage Market?

The market segments include Product, Storage Media, Deployment, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Necessity for Surveillance across Industry Verticals; Growing Investments by Governments and Stakeholders for Developing Smart Cities.

6. What are the notable trends driving market growth?

Healthcare Sector to Occupy Considerable Share.

7. Are there any restraints impacting market growth?

High Initial Capital Expenditure due to Deployment of Network Architecture Model and Spectrum Challenges.

8. Can you provide examples of recent developments in the market?

May 2023: Tdsi unveiled its latest innovation, Gardisvu, a cutting-edge video management solution. This hybrid-cloud-based CCTV offering has been meticulously designed to seamlessly integrate with and enhance the Gardis ecosystem, a comprehensive suite of integrated access control and security solutions. Gardisvu's hybrid-cloud architecture combines on-premises video storage with cloud-based supervision and monitoring, delivering a powerful solution for enhanced security.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Security And Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Security And Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Security And Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the Security And Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence