Key Insights

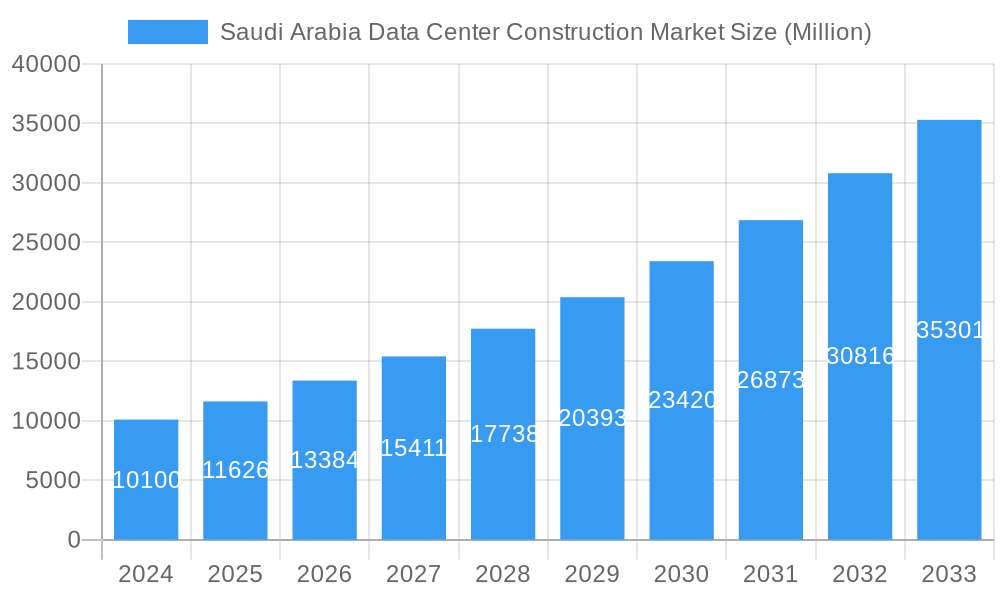

The Saudi Arabian data center construction market is poised for substantial expansion, projecting a market size of $10.1 billion in 2024, driven by a remarkable CAGR of 15.1%. This robust growth is primarily fueled by the Kingdom's ambitious digital transformation initiatives, including Vision 2030, which necessitates a significant increase in data storage and processing capabilities. Key drivers include escalating demand for cloud services, the burgeoning e-commerce sector, and the growing adoption of technologies like AI and IoT across various industries. Furthermore, government investments in digital infrastructure and foreign direct investment are creating a fertile ground for data center development. The market is segmented by electrical infrastructure, encompassing power distribution and backup solutions, and mechanical infrastructure, focusing on advanced cooling systems. The increasing demand for hyperscale and colocation facilities, coupled with the need for robust and efficient power solutions, is shaping the competitive landscape. The focus on Tier 3 and Tier 4 data centers signifies a commitment to high availability and resilience, essential for critical operations.

Saudi Arabia Data Center Construction Market Market Size (In Billion)

The market's trajectory is further bolstered by trends such as the adoption of liquid cooling solutions to manage the heat generated by high-density computing, and the integration of smart technologies for enhanced operational efficiency and security. However, challenges such as the availability of skilled labor for complex construction projects and the stringent regulatory environment, while beneficial for standards, can also present hurdles. Despite these, the strategic importance of Saudi Arabia as a regional hub for digital services is attracting significant investment from both local and international players. Companies like ABB, Rittal, Daikin Industries, and Schneider Electric are key contributors, offering a wide array of solutions for electrical and mechanical infrastructure. The ongoing development of hyperscale and edge data centers across the Kingdom underscores a strategic move to localize data processing and reduce latency, catering to the evolving needs of the BFSI, IT and Telecommunications, and Government sectors.

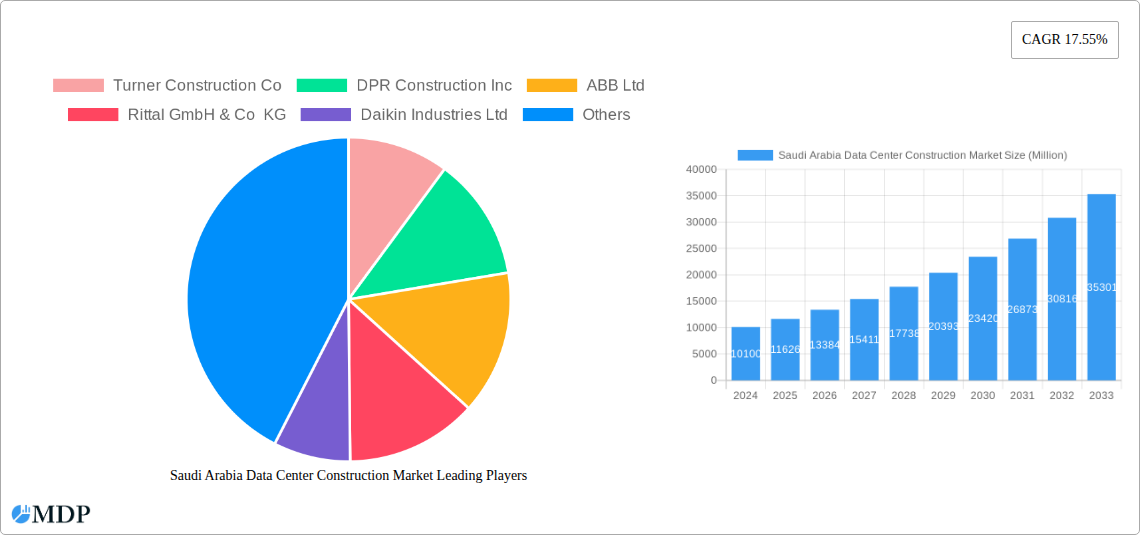

Saudi Arabia Data Center Construction Market Company Market Share

Saudi Arabia Data Center Construction Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an exhaustive analysis of the Saudi Arabia Data Center Construction Market, forecasting significant growth and transformation. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this study delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook. The Saudi Arabian market is poised for substantial expansion, driven by digital transformation initiatives, cloud adoption, and government investments in technology.

Saudi Arabia Data Center Construction Market Market Dynamics & Concentration

The Saudi Arabia Data Center Construction Market is characterized by moderate to high concentration, with a few key players dominating project execution and supply chains. Innovation drivers are primarily fueled by the demand for hyperscale and colocation facilities, pushing for advancements in power efficiency, cooling technologies, and modular construction. Regulatory frameworks are increasingly supportive, with government initiatives like Saudi Vision 2030 actively promoting digital infrastructure development and foreign investment. Product substitutes are limited in the core construction services, but advancements in cooling and power solutions offer alternatives to traditional methods. End-user trends show a strong shift towards cloud-based services, AI, and IoT, necessitating robust data center capacity. Mergers and Acquisitions (M&A) activities, while not yet at a fever pitch, are expected to increase as larger players seek to expand their footprint and smaller specialized firms are acquired. The market share distribution is influenced by the successful completion of mega-projects. M&A deal counts are projected to rise as consolidation and strategic partnerships become more prevalent to meet the burgeoning demand.

Saudi Arabia Data Center Construction Market Industry Trends & Analysis

The Saudi Arabia Data Center Construction Market is experiencing an unprecedented surge, projected to achieve a Compound Annual Growth Rate (CAGR) of over 15% during the forecast period. This robust growth is propelled by Saudi Arabia's ambitious Vision 2030, which emphasizes digital transformation across all sectors, driving massive demand for advanced data center infrastructure. The increasing adoption of cloud computing services by enterprises and government entities is a significant market penetration driver. Furthermore, the burgeoning e-commerce sector and the expansion of 5G networks necessitate the development of hyperscale and edge data centers to support the ever-growing data traffic and low-latency application requirements. Technological disruptions are evident in the adoption of AI-powered cooling systems, liquid cooling solutions for high-density computing, and the increasing utilization of modular and pre-fabricated construction techniques to accelerate deployment times. Consumer preferences are evolving towards highly available, secure, and energy-efficient data centers, with a growing emphasis on sustainability and renewable energy sources. Competitive dynamics are intensifying, with both local and international players vying for significant market share. The trend towards colocation and hyperscale data centers is also reshaping the competitive landscape, encouraging strategic partnerships and joint ventures. Market penetration for advanced data center solutions is rapidly increasing as organizations recognize the critical role of robust digital infrastructure in their operational efficiency and competitive advantage.

Leading Markets & Segments in Saudi Arabia Data Center Construction Market

The IT and Telecommunications sector emerges as the dominant end-user segment within the Saudi Arabia Data Center Construction Market, accounting for a substantial portion of demand. This dominance is fueled by ongoing investments in 5G infrastructure, cloud services expansion, and the proliferation of digital platforms. The Government and Defense sector also represents a significant and growing market, driven by national cybersecurity initiatives and the digitization of public services.

Within Infrastructure, Electrical Infrastructure is a critical area of focus.

- Power Distribution Solutions are paramount, with a high demand for:

- Power Distribution Units (PDUs), encompassing both Basic and Smart Metered & Switched solutions for precise power management.

- Transfer Switches, particularly Automatic Transfer Switches (ATS) to ensure uninterrupted power supply.

- Switchgear, including Low-Voltage and Medium-Voltage components for robust power distribution networks.

- Power Panels and Components for comprehensive electrical system integration.

- Other Power Distribution Solutions catering to specialized requirements.

- Power Backup Solutions, including advanced UPS (Uninterruptible Power Supply) systems and high-capacity Generators, are essential for maintaining operational continuity.

- Service offerings related to electrical infrastructure, including installation, maintenance, and optimization, are also in high demand.

Mechanical Infrastructure is equally vital, with a significant push towards advanced solutions:

- Cooling Systems are seeing rapid innovation and adoption, including:

- Immersion Cooling for high-density computing environments.

- Direct-To-Chip Cooling for targeted heat removal.

- Rear Door Heat Exchangers and In-Row and In-Rack Cooling solutions for efficient localized cooling.

- Racks designed for modern server densities and specialized cooling needs are a foundational element.

- Other Mechanical Infrastructure components that contribute to overall data center efficiency.

General Construction forms the backbone of all data center builds, with a consistent demand for skilled labor and project management.

In terms of Tier Type, Tier 3 facilities are experiencing the highest demand due to their balance of redundancy and cost-effectiveness, making them ideal for a wide range of enterprise and colocation needs. However, there is a growing interest in Tier 4 facilities for critical government and financial applications requiring maximum uptime.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives like Saudi Vision 2030, which actively promote digital infrastructure development and attract foreign investment.

- Infrastructure Development: Large-scale projects aimed at building robust connectivity and power grids across the Kingdom.

- Technological Advancements: The adoption of cutting-edge technologies like AI, IoT, and cloud computing necessitates advanced data center capabilities.

- Growing Data Consumption: Increased internet penetration, smartphone usage, and the proliferation of digital services are creating an insatiable appetite for data storage and processing.

Saudi Arabia Data Center Construction Market Product Developments

Product developments in the Saudi Arabia Data Center Construction Market are largely focused on enhancing efficiency, sustainability, and scalability. Innovations in liquid cooling technologies, such as immersion and direct-to-chip cooling, are becoming crucial for managing the thermal loads of high-density computing environments. Advancements in intelligent power distribution units (PDUs) with granular monitoring and remote management capabilities are also gaining traction, alongside more efficient and compact UPS systems and generator solutions for enhanced power backup. The development of modular and pre-fabricated data center components allows for faster deployment and greater flexibility. These product innovations are driven by the need to reduce operational costs, minimize environmental impact, and meet the evolving demands of cloud providers and enterprises for high-performance and reliable data center infrastructure.

Key Drivers of Saudi Arabia Data Center Construction Market Growth

The Saudi Arabia Data Center Construction Market is experiencing robust growth driven by several key factors. Foremost among these is the Saudi Vision 2030 initiative, which prioritizes digital transformation, smart city development, and the localization of technology services, directly fueling the demand for data center capacity. The rapid adoption of cloud computing by both public and private sectors necessitates significant investment in hyperscale and colocation facilities. Furthermore, the expansion of 5G networks and the burgeoning Internet of Things (IoT) ecosystem are creating an exponential increase in data generation, requiring more localized and performant data processing and storage capabilities. Government incentives and favorable regulatory environments are also attracting substantial foreign and domestic investment into the sector.

Challenges in the Saudi Arabia Data Center Construction Market Market

Despite the strong growth trajectory, the Saudi Arabia Data Center Construction Market faces several challenges. Skilled labor shortages in specialized construction roles and data center operations can lead to project delays and increased costs. Supply chain disruptions for critical components and equipment, especially in a globalized market, can impact project timelines and budgets. Navigating complex regulatory frameworks and obtaining necessary permits can also present administrative hurdles for new construction projects. Furthermore, the increasing demand for sustainable and energy-efficient data centers requires significant upfront investment in advanced cooling and power management solutions, which can be a barrier for some smaller players. The highly competitive nature of the market also puts pressure on pricing and profit margins.

Emerging Opportunities in Saudi Arabia Data Center Construction Market

The Saudi Arabia Data Center Construction Market presents numerous emerging opportunities. The ongoing digital transformation initiatives across industries like healthcare, education, and finance are creating sustained demand for modern data center facilities. The development of AI and machine learning capabilities requires high-performance computing infrastructure, driving the need for specialized data centers. Strategic partnerships between hyperscale cloud providers and local enterprises or construction firms can unlock significant growth. Furthermore, the increasing focus on sustainability and green data centers presents an opportunity for companies offering energy-efficient solutions and renewable energy integration. The government's commitment to diversifying its economy beyond oil also signifies a long-term commitment to building a robust digital ecosystem.

Leading Players in the Saudi Arabia Data Center Construction Market Sector

- Turner Construction Co

- DPR Construction Inc

- ABB Ltd

- Rittal GmbH & Co KG

- Daikin Industries Ltd

- Fortis Construction

- Delta Electronics

- Mercury Engineering

- STULZ GMBH

- AECOM Limited

- Legrand

- CyrusOne Inc

- Mitsubishi Electric

- AECOM

- Aru

- Johnson Controls International Plc

- Canovate

- EAE Group

- Delta Group

- M+W Group (Exyte)

- Schneider Electric SE

Key Milestones in Saudi Arabia Data Center Construction Market Industry

- April 2022: Saudi Telecom Company (STC) announced plans to deliver 16 facilities with 17,000 storing units serving eight parallel sites across six cities. The maximum capacity is expected to reach 125MW. The project will be completed in three phases: phase 1, three data centers in Riyadh, Jeddah, and Medina; four in the second phase; and the remaining nine in the third phase, significantly boosting the Kingdom's data center capacity.

- February 2022: Saudi Telecom Company (STC) announced its intention to separate its data center business into a new wholly-owned subsidiary, signaling a strategic focus on expanding its data center operations and services within the growing Saudi market.

Strategic Outlook for Saudi Arabia Data Center Construction Market Market

The strategic outlook for the Saudi Arabia Data Center Construction Market is exceptionally positive, characterized by sustained growth and significant investment. The ongoing push for digital economic diversification, coupled with a proactive government stance on technology infrastructure, will continue to be the primary growth accelerators. Future market expansion will likely see increased development of hyperscale and edge data centers to support the expanding digital economy. Strategic opportunities lie in embracing and integrating advanced cooling technologies, enhancing cybersecurity measures, and focusing on energy-efficient and sustainable construction practices. Partnerships between global technology giants and local construction and service providers will be crucial for successful project execution and market penetration. The market is well-positioned to become a regional hub for data center services.

Saudi Arabia Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. By Electrical Infrastructure

-

1.1.1. Power Distribution Solution

- 1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

-

1.1.1.2. Transfer Switches

- 1.1.1.2.1. Static

- 1.1.1.2.2. Automatic (ATS)

-

1.1.1.3. Switchgear

- 1.1.1.3.1. Low-Voltage

- 1.1.1.3.2. Medium-Voltage

- 1.1.1.4. Power Panels and Components

- 1.1.1.5. Other Power Distribution Solutions

-

1.1.2. Power Backup Solutions

- 1.1.2.1. UPS

- 1.1.2.2. Generators

- 1.1.3. Service

-

1.1.1. Power Distribution Solution

-

1.2. By Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.2.1.1. Immersion Cooling

- 1.2.1.2. Direct-To-Chip Cooling

- 1.2.1.3. Rear Door Heat Exchanger

- 1.2.1.4. In-Row and In-Rack Cooling

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

-

1.2.1. Cooling Systems

- 1.3. General Construction

-

1.1. By Electrical Infrastructure

-

2. Tier Type

- 2.1. Tier 1 and 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. End User

- 3.1. Banking, Financial Services, and Insurance

- 3.2. IT and Telecommunications

- 3.3. Government and Defense

- 3.4. Healthcare

- 3.5. Other End Users

Saudi Arabia Data Center Construction Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Data Center Construction Market Regional Market Share

Geographic Coverage of Saudi Arabia Data Center Construction Market

Saudi Arabia Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments

- 3.3. Market Restrains

- 3.3.1. 10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Data Center Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. By Electrical Infrastructure

- 5.1.1.1. Power Distribution Solution

- 5.1.1.1.1. PDU - Basic & Smart - Metered & Switched solutions

- 5.1.1.1.2. Transfer Switches

- 5.1.1.1.2.1. Static

- 5.1.1.1.2.2. Automatic (ATS)

- 5.1.1.1.3. Switchgear

- 5.1.1.1.3.1. Low-Voltage

- 5.1.1.1.3.2. Medium-Voltage

- 5.1.1.1.4. Power Panels and Components

- 5.1.1.1.5. Other Power Distribution Solutions

- 5.1.1.2. Power Backup Solutions

- 5.1.1.2.1. UPS

- 5.1.1.2.2. Generators

- 5.1.1.3. Service

- 5.1.1.1. Power Distribution Solution

- 5.1.2. By Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.1.1. Immersion Cooling

- 5.1.2.1.2. Direct-To-Chip Cooling

- 5.1.2.1.3. Rear Door Heat Exchanger

- 5.1.2.1.4. In-Row and In-Rack Cooling

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.3. General Construction

- 5.1.1. By Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 and 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Banking, Financial Services, and Insurance

- 5.3.2. IT and Telecommunications

- 5.3.3. Government and Defense

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Turner Construction Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DPR Construction Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rittal GmbH & Co KG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daikin Industries Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fortis Construction

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Delta Electronics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mercury Engineering

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 STULZ GMBH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AECOM Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Legrand

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CyrusOne Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mitsubishi Electric

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 AECOM

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Aru

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Johnson Controls International Plc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Canovate

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 EAE Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Delta Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 M+W Group (Exyte)

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Schneider Electric SE

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.1 Turner Construction Co

List of Figures

- Figure 1: Saudi Arabia Data Center Construction Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Data Center Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 2: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 3: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Infrastructure 2020 & 2033

- Table 6: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 7: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Saudi Arabia Data Center Construction Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Data Center Construction Market?

The projected CAGR is approximately 15.1%.

2. Which companies are prominent players in the Saudi Arabia Data Center Construction Market?

Key companies in the market include Turner Construction Co, DPR Construction Inc, ABB Ltd, Rittal GmbH & Co KG, Daikin Industries Ltd, Fortis Construction, Delta Electronics, Mercury Engineering, STULZ GMBH, AECOM Limited, Legrand, CyrusOne Inc, Mitsubishi Electric, AECOM, Aru, Johnson Controls International Plc, Canovate, EAE Group, Delta Group, M+W Group (Exyte), Schneider Electric SE.

3. What are the main segments of the Saudi Arabia Data Center Construction Market?

The market segments include Infrastructure, Tier Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

9.1 Rising Adoption of Renewable Energy Sources9.2 Increase in 5G Deployments Fueling Edge Data Center Investments9.3 Smart City Initiatives Driving Data Center Investments.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

10.1 Security Challenges in Data Centers10.2 Location Constraints on the Development of Data Centers.

8. Can you provide examples of recent developments in the market?

April 2022: Saudi Telecom Company (STC) to deliver 16 facilities with 17,000 storing units serving eight parallel sites across six cities. The maximum capacity is expected to reach 125MW. The project will be completed in three phases: phase 1, three data centers in Riyadh, Jeddah, and Medina; four in the second phase; and the remaining nine in the third phase.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Data Center Construction Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence