Key Insights

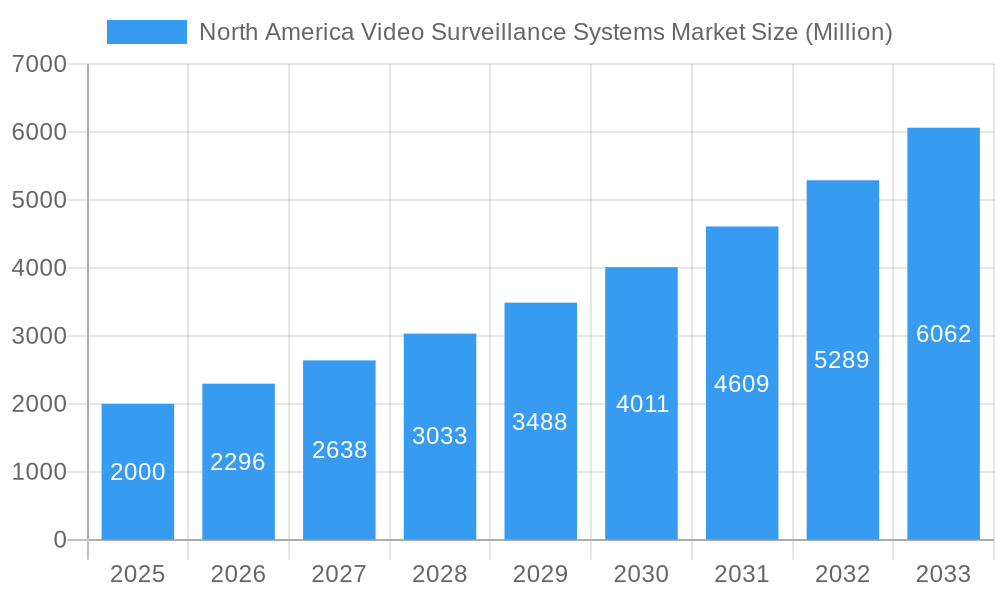

The North American video surveillance systems market is projected for substantial growth, fueled by escalating security demands across commercial, residential, and governmental sectors. The market, valued at $13.93 billion in the base year 2025, is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.2% through the forecast period. Key growth drivers include the widespread adoption of IP-based solutions offering advanced features like remote monitoring and analytics, alongside the increasing preference for scalable and cost-effective Video Surveillance as a Service (VSaaS) models. Urbanization and critical infrastructure security needs also significantly contribute to market demand. While data privacy and cybersecurity concerns present challenges, the overall market outlook remains highly positive, promising significant opportunities.

North America Video Surveillance Systems Market Market Size (In Billion)

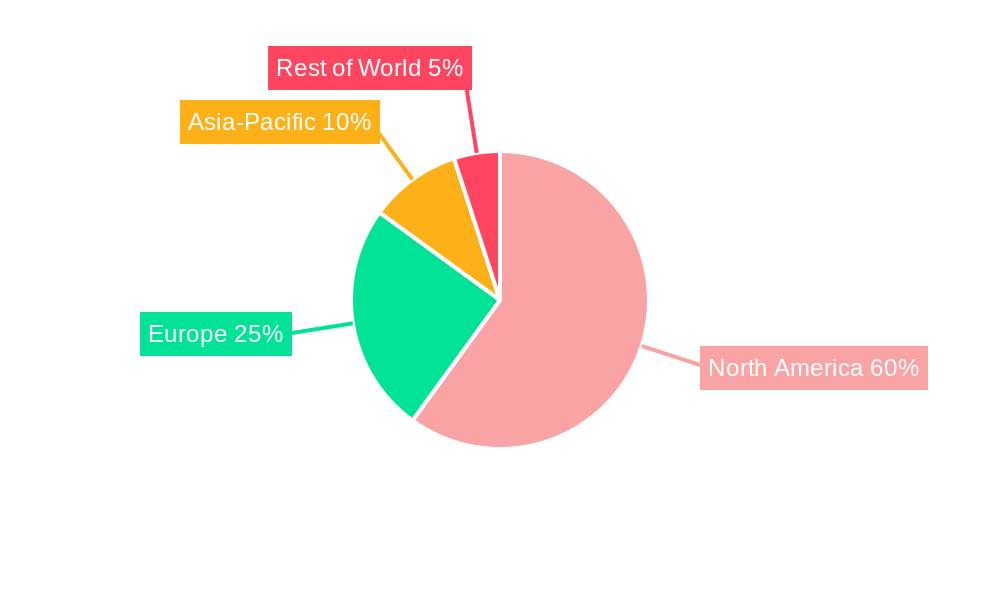

Market segmentation reveals the prevalence of IP cameras over analog systems, indicative of technological evolution. The commercial sector represents the largest market share, driven by enhanced security requirements in retail, banking, and other business environments. The government sector is a significant contributor, supported by national security initiatives and public safety infrastructure upgrades. Geographically, the United States dominates the North American market due to its large population, higher disposable income, and extensive investments in security. The ongoing development of smart cities and the integration of comprehensive security solutions across diverse industries will further accelerate market expansion. The competitive landscape features a dynamic mix of established leaders and innovative new entrants, fostering continuous improvement and competitive pricing.

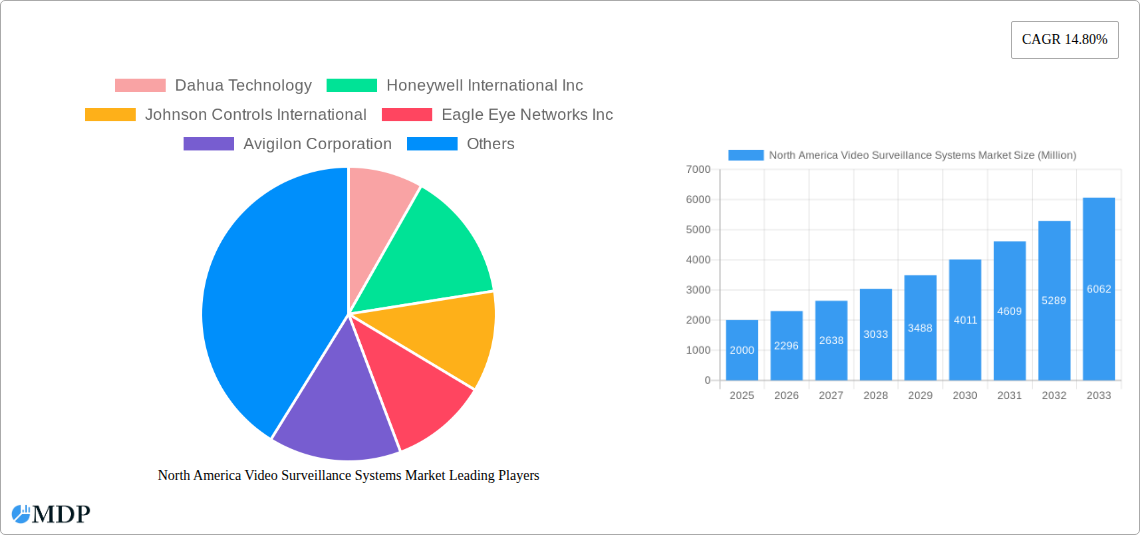

North America Video Surveillance Systems Market Company Market Share

North America Video Surveillance Systems Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Video Surveillance Systems Market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand market dynamics, growth opportunities, and competitive landscapes. With a focus on key segments including Video Management Software (VSaaS), Hardware (Cameras – Analog, IP, Hybrid; Storage – Software), and End-Users (Commercial, Infrastructure, Industrial, Institutional, Residential, Government) across the United States and Canada, this report delivers actionable intelligence for strategic decision-making. The report analyzes market trends from the historical period (2019-2024), base year (2025), and estimated year (2025), offering a robust forecast for 2025-2033. Market size values are expressed in Millions.

North America Video Surveillance Systems Market Dynamics & Concentration

The North American video surveillance systems market is experiencing significant growth driven by factors such as increasing security concerns, technological advancements (like AI and cloud-based solutions), and rising adoption across various sectors. Market concentration is moderate, with several key players holding substantial market share, but also ample room for smaller, specialized companies.

Market Share: Dahua Technology, Honeywell International Inc., and Johnson Controls International collectively hold an estimated xx% market share in 2025, indicating a high level of competition among established players. However, smaller companies specializing in niche areas, like VSaaS, are also gaining traction.

Innovation Drivers: The market is driven by continuous innovation in areas such as Artificial Intelligence (AI)-powered analytics (facial recognition, object detection), high-resolution cameras, and cloud-based video management systems. The increasing demand for advanced features like license plate recognition and perimeter security systems fuels this innovation.

Regulatory Frameworks: Government regulations concerning data privacy (e.g., GDPR compliance for data stored in the cloud) and cybersecurity are influencing market dynamics, prompting the adoption of more secure and compliant solutions.

Product Substitutes: While traditional security measures still exist, the overall trend favors technologically advanced video surveillance solutions due to their enhanced capabilities and remote management potential.

End-User Trends: The commercial sector, particularly retail and banking, accounts for a significant market share due to the high value of assets and the need for robust security. However, growth is also seen in the residential and government sectors.

M&A Activities: An estimated xx M&A deals occurred in the North American video surveillance systems market between 2019 and 2024, signaling consolidation and strategic expansion by major players.

North America Video Surveillance Systems Market Industry Trends & Analysis

The North American video surveillance systems market exhibits a robust growth trajectory, driven by several key factors. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033).

The increasing adoption of cloud-based Video Surveillance as a Service (VSaaS) solutions is a major trend. VSaaS offers scalability, cost-effectiveness, and remote accessibility, making it attractive for various end-users. The market penetration of VSaaS is projected to reach xx% by 2033. Technological advancements in AI, including advanced analytics and improved image processing, are further enhancing the capabilities of video surveillance systems. This, coupled with the rising demand for enhanced security in both commercial and residential settings, is propelling market growth. Consumer preferences are shifting toward integrated solutions offering comprehensive security features, seamless integration with other systems (e.g., access control), and user-friendly interfaces. Competitive dynamics are characterized by intense rivalry among established players and emerging companies, resulting in continuous innovation and product differentiation. The market also observes a continuous focus on cybersecurity improvements, given the sensitive nature of the data handled. Pricing strategies also play a significant role; companies are offering varied pricing models (subscription based, one-time purchase) to cater to diverse budgets.

Leading Markets & Segments in North America Video Surveillance Systems Market

The United States dominates the North American video surveillance systems market, accounting for approximately xx% of the total market value in 2025. This is primarily driven by its larger market size, higher spending on security solutions, and advanced technological infrastructure. Canada holds a significant, but smaller share.

By Component: The hardware segment, particularly IP cameras, accounts for the largest share, driven by their advanced features and networkability.

By Video Management Software: VSaaS is experiencing significant growth, driven by its flexibility, scalability, and cost-effectiveness.

By End-User: The commercial segment leads, fueled by the high demand for security solutions in retail, banking, and other businesses.

Key Drivers (US):

- Strong economic growth fueling investment in security.

- Robust technological infrastructure supporting advanced surveillance systems.

- Stringent regulations driving adoption of advanced security measures.

Key Drivers (Canada):

- Expanding urban infrastructure creating demand for security solutions.

- Growing government initiatives for enhancing public safety.

- Increased adoption of smart city technologies integrating video surveillance.

North America Video Surveillance Systems Market Product Developments

Recent product innovations include the integration of AI-powered analytics for improved threat detection, the increasing use of high-resolution cameras for enhanced image clarity, and the development of cloud-based video management systems for remote accessibility and scalability. The trend is toward solutions that are more user-friendly, scalable, and integrated with other security systems. These developments offer enhanced capabilities, improved security, and better cost efficiency, creating a strong market fit for diverse customer needs.

Key Drivers of North America Video Surveillance Systems Market Growth

Technological advancements like AI, cloud computing, and improved sensor technologies are significantly driving market growth. Economic factors such as increasing investments in security infrastructure by businesses and governments also play a crucial role. Regulatory mandates, including those related to data privacy and public safety, are compelling organizations to adopt advanced video surveillance systems. For example, regulations surrounding critical infrastructure protection and retail security drive demand for high-end systems.

Challenges in the North America Video Surveillance Systems Market

Data privacy concerns and regulations pose a significant challenge, requiring compliance with strict standards. Supply chain disruptions, particularly in the procurement of key components, can impact production and pricing. Intense competition from both established players and new entrants creates pricing pressures and necessitates continuous innovation to maintain market share. The cost of implementation and maintenance, especially for larger scale deployments, can be a barrier to entry for some users.

Emerging Opportunities in North America Video Surveillance Systems Market

The integration of video surveillance systems with IoT devices and other security technologies is creating new opportunities. The increasing demand for advanced analytics and data-driven insights creates opportunities for specialized software and service providers. Strategic partnerships among companies specializing in hardware, software, and data analytics can unlock significant growth potential. Expanding into underserved markets (e.g., smaller towns or rural areas) presents further expansion opportunities.

Leading Players in the North America Video Surveillance Systems Market Sector

- Dahua Technology

- Honeywell International Inc

- Johnson Controls International

- Eagle Eye Networks Inc

- Avigilon Corporation

- Samsara Inc

- Genetec Inc

- AV Costar

- Napco Security Technologies Inc

- March Networks

Key Milestones in North America Video Surveillance Systems Market Industry

November 2021: CBC AMERICA announced a strategic business alliance with NAPCO Security Technologies, Inc., integrating Ganz CORTROL Video Management Software with Napco Access Solutions, creating a comprehensive security solution. This partnership significantly broadened the market reach for both companies.

January 2022: Dahua Technology launched its Three-in-One Camera (TiOC) in North America, adding a unique product to the market focusing on deterring unwanted behavior. This innovative product enhanced its competitive advantage and market appeal.

Strategic Outlook for North America Video Surveillance Systems Market

The North American video surveillance systems market is poised for continued growth, driven by technological advancements, increasing security needs, and government initiatives. Strategic opportunities exist for companies focused on AI-powered analytics, cloud-based solutions, and integrated security systems. Collaborations and strategic partnerships are key to success in this competitive market. Companies that can effectively address data privacy concerns and provide innovative, user-friendly solutions will be well-positioned for long-term growth.

North America Video Surveillance Systems Market Segmentation

-

1. Component

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Video as a Service (VSaaS)

-

1.1. Hardware

-

2. End-User

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Industrial

- 2.4. Institutional

- 2.5. Residential

- 2.6. Government

North America Video Surveillance Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Video Surveillance Systems Market Regional Market Share

Geographic Coverage of North America Video Surveillance Systems Market

North America Video Surveillance Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Widespread Application of Video Surveillance Systems in Retail and Commercial Establishments; Increasing Adoption of Facial Surveillance

- 3.3. Market Restrains

- 3.3.1. Vulnerable To Security Attacks; Redundancy And Lack Of Interoperability

- 3.4. Market Trends

- 3.4.1. Hardware Segment to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Video Surveillance Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Video as a Service (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Industrial

- 5.2.4. Institutional

- 5.2.5. Residential

- 5.2.6. Government

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dahua Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson Controls International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Eye Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Avigilon Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Samsara Inc *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genetec Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AV Costar

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Napco Security Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 March Networks

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dahua Technology

List of Figures

- Figure 1: North America Video Surveillance Systems Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Video Surveillance Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Video Surveillance Systems Market Revenue billion Forecast, by Component 2020 & 2033

- Table 2: North America Video Surveillance Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: North America Video Surveillance Systems Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Video Surveillance Systems Market Revenue billion Forecast, by Component 2020 & 2033

- Table 5: North America Video Surveillance Systems Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: North America Video Surveillance Systems Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Video Surveillance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Video Surveillance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Video Surveillance Systems Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Video Surveillance Systems Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Video Surveillance Systems Market?

Key companies in the market include Dahua Technology, Honeywell International Inc, Johnson Controls International, Eagle Eye Networks Inc, Avigilon Corporation, Samsara Inc *List Not Exhaustive, Genetec Inc, AV Costar, Napco Security Technologies Inc, March Networks.

3. What are the main segments of the North America Video Surveillance Systems Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Widespread Application of Video Surveillance Systems in Retail and Commercial Establishments; Increasing Adoption of Facial Surveillance.

6. What are the notable trends driving market growth?

Hardware Segment to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Vulnerable To Security Attacks; Redundancy And Lack Of Interoperability.

8. Can you provide examples of recent developments in the market?

November 2021 - CBC AMERICA announced a strategic business alliance with NAPCO Security Technologies, Inc. to deliver an intelligent video solution by integrating the Ganz CORTROL Video Management Software with Napco Access Solutions & the Continental Access Control Platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Video Surveillance Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Video Surveillance Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Video Surveillance Systems Market?

To stay informed about further developments, trends, and reports in the North America Video Surveillance Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence