Key Insights

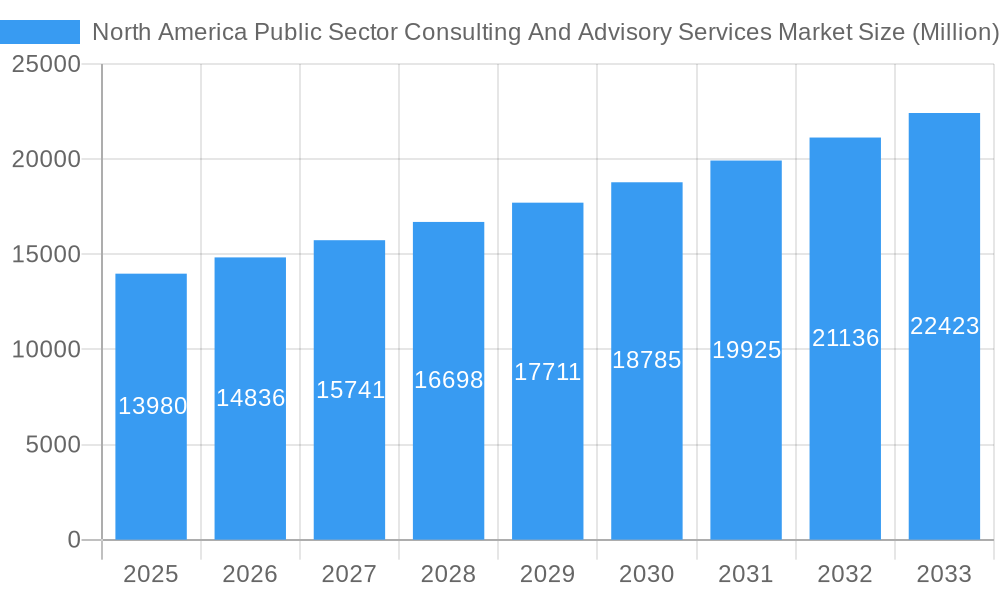

The North America Public Sector Consulting and Advisory Services market is poised for robust growth, projected to reach USD 13.98 billion by 2025, driven by an estimated Compound Annual Growth Rate (CAGR) of 6.19% through 2033. This expansion is fueled by a confluence of critical factors including the increasing need for specialized policy analysis to navigate complex socio-economic challenges, the growing demand for sophisticated bond issuance services to finance public infrastructure, and the vital role of major project advisory services in ensuring the successful execution of large-scale public initiatives. Furthermore, stringent program evaluation services are becoming indispensable for accountability and efficiency in government spending, while financial management advisory services are crucial for optimizing public resource allocation in an era of fiscal responsibility. The market's dynamism is further shaped by escalating government investments in digital transformation, cybersecurity, and sustainable development, all requiring expert guidance to implement effectively. Emerging trends point towards a greater emphasis on data-driven decision-making, citizen-centric service delivery, and innovative solutions for urban development and resilience, further stimulating demand for consulting and advisory expertise.

North America Public Sector Consulting And Advisory Services Market Market Size (In Billion)

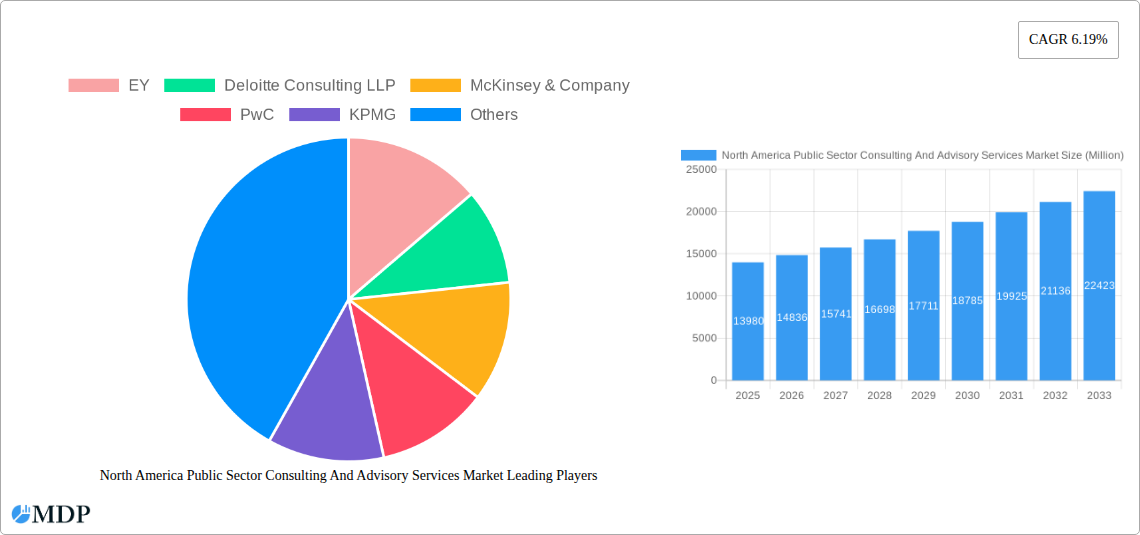

The market segments indicate a broad spectrum of service offerings catering to diverse public sector entities. Policy Analysis Services, Bond Issuance Services, Major Project Advisory Services, Program Evaluation Services, and Financial Management Advisory Services represent the core pillars of this market, with "Other Types" encompassing niche but growing areas like procurement reform and public-private partnership development. At the application level, Central, State, and Urban Local Bodies are the primary consumers of these services, reflecting the hierarchical structure of governance. Project size is also a significant determinant, with Large Scale Projects demanding more comprehensive and specialized advisory, while Mid-Small Scale Projects still require efficient and cost-effective solutions. Key players like EY, Deloitte Consulting LLP, McKinsey & Company, PwC, and KPMG are at the forefront, offering a wide array of specialized services across North America. This competitive landscape, while mature, continues to evolve with the emergence of new digital advisory firms and a focus on specialized expertise in areas such as AI integration in public services and climate change adaptation strategies.

North America Public Sector Consulting And Advisory Services Market Company Market Share

This comprehensive report delves into the North America Public Sector Consulting and Advisory Services Market, providing a detailed analysis of its dynamics, trends, and future trajectory. Spanning the historical period from 2019 to 2024, with the base and estimated year of 2025 and a forecast period extending to 2033, this report is an essential resource for understanding market concentration, innovation drivers, regulatory frameworks, and the competitive landscape. With an estimated market size of $XX Billion in 2025, projected to reach $YY Billion by 2033 at a Compound Annual Growth Rate (CAGR) of ZZ%, this market is poised for significant expansion. We dissect key segments including Policy Analysis Services, Bond Issuance Services, Major Project Advisory Services, Program Evaluation Services, Financial Management Advisory Services, and Other Types, across Central, State, and Urban Local Bodies, and for Large Scale Projects and Mid-Small Scale Projects.

North America Public Sector Consulting And Advisory Services Market Market Dynamics & Concentration

The North America Public Sector Consulting and Advisory Services Market exhibits a moderately concentrated structure, with a few dominant players holding substantial market share. In 2025, the top 5 firms are estimated to command approximately 60% of the market. Innovation is primarily driven by the increasing demand for digital transformation, data analytics, and AI-powered solutions to enhance public service delivery and operational efficiency. Regulatory frameworks, such as evolving data privacy laws and public procurement regulations, significantly influence service offerings and market entry. Product substitutes are emerging in the form of in-house government data science teams and specialized software solutions, although the complexity and scale of public sector projects often necessitate external expertise. End-user trends indicate a growing preference for integrated advisory services that address multifaceted challenges, from policy implementation to financial sustainability. Mergers and Acquisitions (M&A) activities are moderate, with an estimated 5-7 significant deals annually. These M&A activities are strategically focused on acquiring niche capabilities in areas like cybersecurity, sustainable infrastructure, and digital governance, aiming to consolidate market presence and broaden service portfolios.

North America Public Sector Consulting And Advisory Services Market Industry Trends & Analysis

The North America Public Sector Consulting and Advisory Services Market is experiencing robust growth, driven by several interconnected trends. A primary growth driver is the continuous need for governments at all levels to modernize infrastructure, enhance public services, and address complex societal challenges, from climate change adaptation to public health crises. This necessitates specialized expertise in areas such as strategic planning, program management, and financial optimization, pushing market penetration upwards. Technological disruptions are playing a transformative role; the integration of Artificial Intelligence (AI), machine learning, and big data analytics is revolutionizing how public sector entities operate. For instance, AI is being leveraged for predictive analytics in resource allocation, fraud detection, and citizen engagement. Consumer preferences, or rather, the expectations of government stakeholders, are shifting towards agile, data-driven, and cost-effective solutions. There's an increasing demand for consultants who can not only advise but also implement and manage complex digital transformation initiatives. Competitive dynamics are intensifying as established consulting giants like Deloitte Consulting LLP, Accenture, and McKinsey & Company compete with specialized boutique firms and emerging technology providers. The market penetration for advanced digital advisory services is expected to grow by 15% annually. The CAGR for the overall market is projected at ZZ%, reflecting sustained demand and increasing service sophistication.

Leading Markets & Segments in North America Public Sector Consulting And Advisory Services Market

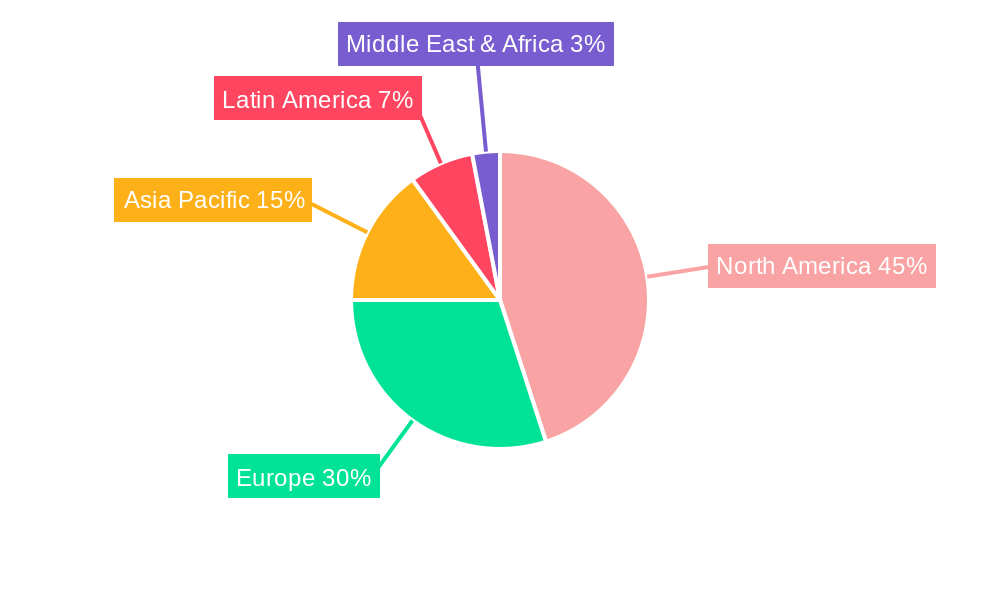

The North America Public Sector Consulting and Advisory Services Market is predominantly led by the United States, accounting for an estimated 75% of the total market value in 2025. Within the United States, Central government agencies represent the largest application segment, followed by State governments.

Dominant Region & Country:

- United States: Its vast public sector, complex regulatory environment, and significant investment in infrastructure and technology make it the largest and most dynamic market.

Leading Application Segments:

- Central Government: Drives demand for policy analysis, major project advisory, and large-scale program evaluations across national initiatives. Economic stimulus packages and defense spending are key drivers here.

- State Governments: Exhibit strong demand for financial management advisory, bond issuance services, and program evaluation related to state-specific infrastructure projects and social services.

- Urban Local Bodies: Growing need for consulting services related to smart city initiatives, public transportation development, and local infrastructure improvements.

Dominant Type Segments:

- Major Project Advisory Services: This segment is experiencing substantial growth due to ongoing large-scale infrastructure development and modernization efforts across North America. Key drivers include investments in renewable energy, transportation networks, and digital infrastructure.

- Financial Management Advisory Services: Essential for optimizing public spending, managing debt, and ensuring fiscal sustainability, particularly in the wake of economic uncertainties and increased public service demands.

- Policy Analysis Services: Crucial for developing evidence-based policies to address pressing societal issues like climate change, healthcare access, and social equity.

Dominant Project Size:

- Large Scale Projects: These projects, often multi-billion dollar initiatives in infrastructure, defense, and technology, represent a significant portion of the market revenue, demanding specialized expertise and extensive advisory support.

North America Public Sector Consulting And Advisory Services Market Product Developments

Recent product developments in the North America Public Sector Consulting and Advisory Services Market are heavily influenced by the drive towards digital transformation and AI integration. Firms are increasingly offering data analytics platforms and AI-powered tools designed to enhance efficiency, transparency, and citizen engagement in public services. For instance, the development of generative AI solutions aims to streamline document analysis, policy drafting, and citizen communication. These innovations provide a competitive advantage by enabling more predictive, personalized, and proactive service delivery. The focus is on creating scalable, secure, and compliant solutions that meet the unique needs of government agencies, thereby improving operational outcomes and fostering public trust.

Key Drivers of North America Public Sector Consulting And Advisory Services Market Growth

The growth of the North America Public Sector Consulting and Advisory Services Market is propelled by several critical factors. Firstly, the ongoing need for digital transformation across government agencies to improve service delivery and operational efficiency. Secondly, substantial government investments in infrastructure modernization, including transportation, energy, and digital networks, create significant demand for advisory services. Thirdly, evolving regulatory landscapes and the increasing complexity of public policy challenges, such as climate change and public health, necessitate expert guidance. Finally, the growing emphasis on data analytics and AI adoption within the public sector to enhance decision-making and resource allocation fuels the demand for specialized consulting.

Challenges in the North America Public Sector Consulting And Advisory Services Market Market

Despite robust growth, the North America Public Sector Consulting and Advisory Services Market faces several challenges. Navigating complex and often bureaucratic public procurement processes can be time-consuming and resource-intensive. Budgetary constraints and fiscal austerity measures in some government entities can limit the scope and scale of consulting engagements. Furthermore, the need for robust cybersecurity measures and data privacy compliance presents a significant hurdle, requiring specialized expertise and stringent adherence to regulations. Intense competition among a large number of service providers also exerts downward pressure on pricing.

Emerging Opportunities in North America Public Sector Consulting And Advisory Services Market

Emerging opportunities in the North America Public Sector Consulting and Advisory Services Market are centered around sustainability and resilience initiatives, including climate change adaptation and renewable energy transitions. The continued push for digital government and citizen-centric services, leveraging AI and data analytics for personalized service delivery, presents a significant growth avenue. Furthermore, opportunities exist in assisting government agencies with supply chain resilience, cybersecurity enhancements, and the ethical implementation of emerging technologies. Strategic partnerships between consulting firms and technology providers are becoming increasingly crucial for delivering comprehensive solutions.

Leading Players in the North America Public Sector Consulting And Advisory Services Market Sector

- EY

- Deloitte Consulting LLP

- McKinsey & Company

- PwC

- KPMG

- Grand Thornton

- BCG

- Bain & Company

- Accenture

- Oliver Wyman

Key Milestones in North America Public Sector Consulting And Advisory Services Market Industry

- April 2024: Deloitte, in partnership with Google Public Sector, introduced the EDGE platform. This cutting-edge solution, backed by Google Cloud's generative AI, is set to revolutionize how government agencies provide information and services to their constituents.

- June 2023: Accenture inked a deal to purchase Anser Advisory, a US-based firm specializing in advisory and management services for infrastructure projects.

Strategic Outlook for North America Public Sector Consulting And Advisory Services Market Market

The strategic outlook for the North America Public Sector Consulting and Advisory Services Market is overwhelmingly positive, driven by sustained government spending on modernization and innovation. Key growth accelerators include the continued adoption of digital technologies like AI and cloud computing, with a focus on enhancing public service delivery and operational efficiency. Strategic opportunities lie in expanding services related to sustainability, cybersecurity, and resilient infrastructure development. Firms that can effectively integrate technological solutions with deep public sector expertise and offer end-to-end implementation support will be best positioned for long-term success in this evolving market. The market's future will be shaped by its ability to adapt to new technologies and address increasingly complex public sector demands.

North America Public Sector Consulting And Advisory Services Market Segmentation

-

1. Type

- 1.1. Policy Analysis Services

- 1.2. Bond Issuance Services

- 1.3. Major Project Advisory Services

- 1.4. Program Evaluation Services

- 1.5. Financial Management Advisory Services

- 1.6. Other Types

-

2. Application

- 2.1. Central

- 2.2. State

- 2.3. Urban Local Bodies

- 2.4. Other Applications

-

3. Project Size

- 3.1. Large Scale Projects

- 3.2. Mid-Small Scale Projects

North America Public Sector Consulting And Advisory Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Public Sector Consulting And Advisory Services Market Regional Market Share

Geographic Coverage of North America Public Sector Consulting And Advisory Services Market

North America Public Sector Consulting And Advisory Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Consulting Firms Drive Government Tech Integration with AI

- 3.2.2 Big Data

- 3.2.3 and Blockchain; Safeguarding Government Agencies Against Cyber Threats

- 3.3. Market Restrains

- 3.3.1 Consulting Firms Drive Government Tech Integration with AI

- 3.3.2 Big Data

- 3.3.3 and Blockchain; Safeguarding Government Agencies Against Cyber Threats

- 3.4. Market Trends

- 3.4.1 Consulting Firms Drive Government Tech Integration with AI

- 3.4.2 Big Data

- 3.4.3 and Blockchain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Public Sector Consulting And Advisory Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Policy Analysis Services

- 5.1.2. Bond Issuance Services

- 5.1.3. Major Project Advisory Services

- 5.1.4. Program Evaluation Services

- 5.1.5. Financial Management Advisory Services

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Central

- 5.2.2. State

- 5.2.3. Urban Local Bodies

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Project Size

- 5.3.1. Large Scale Projects

- 5.3.2. Mid-Small Scale Projects

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 EY

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deloitte Consulting LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 McKinsey & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PwC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KPMG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Grand Thornton

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BCG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bain & Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Accenture

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oliver Wyman**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 EY

List of Figures

- Figure 1: North America Public Sector Consulting And Advisory Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Public Sector Consulting And Advisory Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Project Size 2020 & 2033

- Table 6: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Project Size 2020 & 2033

- Table 7: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Application 2020 & 2033

- Table 13: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Project Size 2020 & 2033

- Table 14: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Project Size 2020 & 2033

- Table 15: North America Public Sector Consulting And Advisory Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Public Sector Consulting And Advisory Services Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Public Sector Consulting And Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Public Sector Consulting And Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Public Sector Consulting And Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Public Sector Consulting And Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Public Sector Consulting And Advisory Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Public Sector Consulting And Advisory Services Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Public Sector Consulting And Advisory Services Market?

The projected CAGR is approximately 6.19%.

2. Which companies are prominent players in the North America Public Sector Consulting And Advisory Services Market?

Key companies in the market include EY, Deloitte Consulting LLP, McKinsey & Company, PwC, KPMG, Grand Thornton, BCG, Bain & Company, Accenture, Oliver Wyman**List Not Exhaustive.

3. What are the main segments of the North America Public Sector Consulting And Advisory Services Market?

The market segments include Type, Application, Project Size.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.98 Million as of 2022.

5. What are some drivers contributing to market growth?

Consulting Firms Drive Government Tech Integration with AI. Big Data. and Blockchain; Safeguarding Government Agencies Against Cyber Threats.

6. What are the notable trends driving market growth?

Consulting Firms Drive Government Tech Integration with AI. Big Data. and Blockchain.

7. Are there any restraints impacting market growth?

Consulting Firms Drive Government Tech Integration with AI. Big Data. and Blockchain; Safeguarding Government Agencies Against Cyber Threats.

8. Can you provide examples of recent developments in the market?

April 2024: Deloitte, in partnership with Google Public Sector, introduced the EDGE platform. This cutting-edge solution, backed by Google Cloud's generative AI, is set to revolutionize how government agencies provide information and services to their constituents.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Public Sector Consulting And Advisory Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Public Sector Consulting And Advisory Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Public Sector Consulting And Advisory Services Market?

To stay informed about further developments, trends, and reports in the North America Public Sector Consulting And Advisory Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence