Key Insights

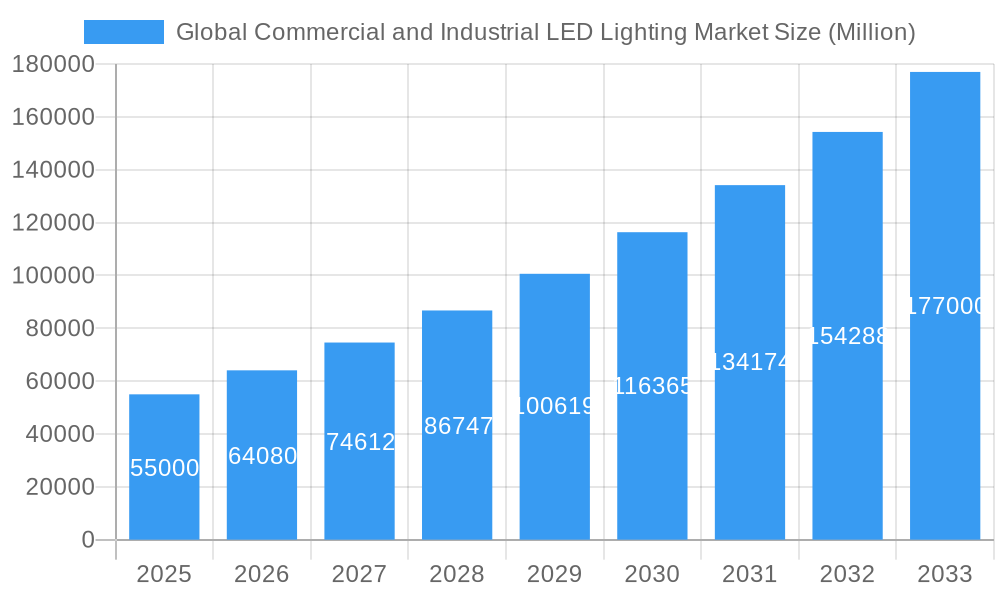

The Global Commercial and Industrial LED Lighting Market is experiencing robust expansion, projected to reach a market size of $XX Million in 2025, driven by a remarkable Compound Annual Growth Rate (CAGR) of 16.40% over the forecast period of 2025-2033. This significant growth is fueled by a confluence of factors, including escalating demand for energy-efficient lighting solutions across various commercial and industrial applications. Government regulations promoting energy conservation and reduced carbon emissions are a primary catalyst, pushing businesses to adopt advanced LED technologies. Furthermore, the decreasing cost of LED components, coupled with their superior performance characteristics such as longer lifespan, enhanced durability, and improved light quality, further accelerate market penetration. The market is segmented by product type into Lamps and Luminaries, with Luminaries likely holding a dominant share due to their integration into architectural designs and complete lighting systems. Distribution channels are diverse, encompassing Direct Sales, Wholesalers, Architects, Integrators, and Retailers, indicating a multi-faceted approach to market reach. Key end-user segments include Commercial Offices, Retail, Hospitals, Healthcare facilities, Industrial spaces, and Architectural projects, all seeking to optimize operational costs and enhance their environments.

Global Commercial and Industrial LED Lighting Market Market Size (In Billion)

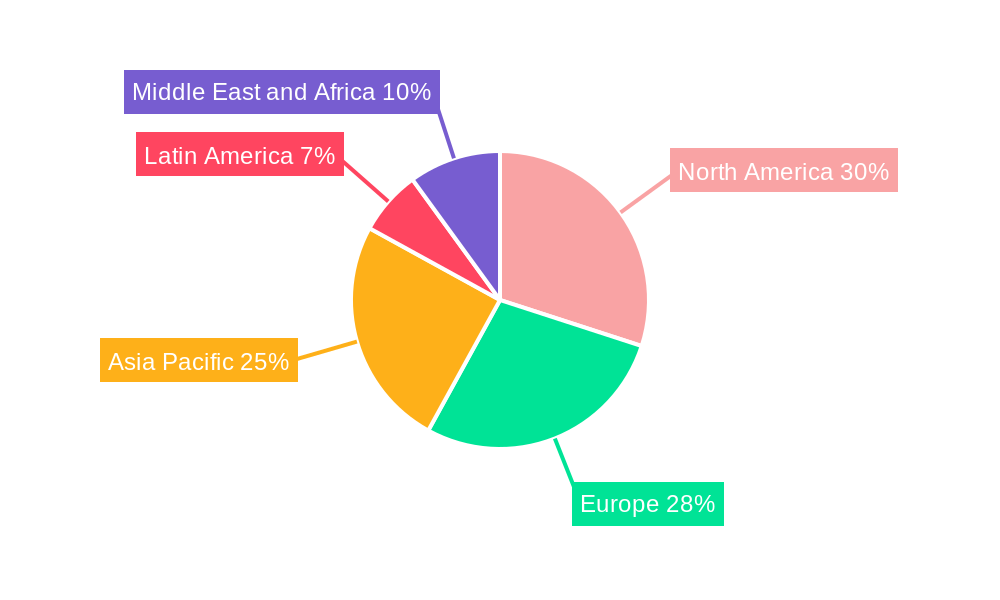

Key market drivers include increasing government incentives for energy-efficient lighting, growing awareness of the environmental benefits of LED technology, and the continuous innovation in LED product development leading to enhanced performance and functionality. The trend towards smart lighting solutions, incorporating features like dimming, color tuning, and IoT connectivity, is also significantly shaping the market. However, the market faces certain restraints, such as the initial high upfront cost of some advanced LED systems compared to traditional lighting, and the potential need for specialized installation and maintenance expertise. Despite these challenges, the significant energy savings, reduced maintenance costs, and extended product lifecycles offered by LED lighting are strong compelling factors for adoption. Geographically, North America and Europe are expected to lead the market due to established infrastructure and stringent energy efficiency standards, while the Asia Pacific region is poised for rapid growth driven by industrialization and increasing adoption of smart technologies.

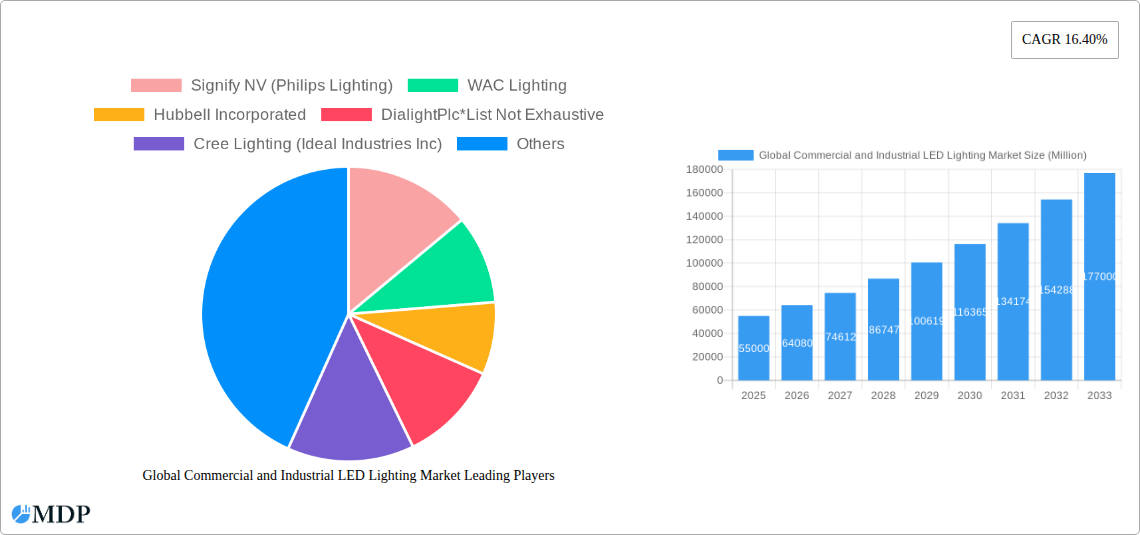

Global Commercial and Industrial LED Lighting Market Company Market Share

Global Commercial and Industrial LED Lighting Market: Comprehensive Analysis and Growth Forecast (2019–2033)

This in-depth market research report provides a holistic overview of the global commercial and industrial LED lighting market, offering actionable insights and strategic guidance for industry stakeholders. Covering the historical period of 2019–2024 and a robust forecast period from 2025–2033, with 2025 serving as the base and estimated year, this report is your definitive guide to understanding market dynamics, identifying growth opportunities, and navigating challenges in the rapidly evolving LED lighting landscape. Explore the burgeoning demand for energy-efficient lighting solutions across various end-user segments, driven by stringent environmental regulations and a global push towards sustainability. Uncover key industry trends, leading market players, and groundbreaking product developments that are shaping the future of commercial and industrial illumination.

Global Commercial and Industrial LED Lighting Market Market Dynamics & Concentration

The global commercial and industrial LED lighting market is characterized by moderate to high concentration, with a significant market share held by a few leading manufacturers. Innovation drivers are primarily fueled by the continuous pursuit of higher energy efficiency, extended product lifespans, and advanced smart lighting functionalities such as IoT integration and predictive maintenance. Regulatory frameworks, particularly energy efficiency standards and government incentives for adopting LED technology, play a crucial role in market expansion. Product substitutes, such as traditional lighting technologies like HID and fluorescent lamps, are steadily losing ground due to their inferior energy performance and higher operational costs. End-user trends are leaning towards sophisticated lighting solutions that enhance productivity, occupant comfort, and operational cost savings. Mergers and acquisitions (M&A) activities are a notable aspect of market dynamics, aimed at consolidating market presence, expanding product portfolios, and acquiring innovative technologies. The number of M&A deals in the last three years has been observed to be in the range of 10-15 annually. Key players like Signify NV (Philips Lighting) and Acuity Brands Inc. command substantial market shares, estimated to be between 8-12% each for the top two entities.

Global Commercial and Industrial LED Lighting Market Industry Trends & Analysis

The global commercial and industrial LED lighting market is experiencing robust growth, driven by a confluence of technological advancements, increasing environmental consciousness, and favorable economic policies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 12-15% during the forecast period of 2025–2033. This surge is largely attributable to the escalating demand for energy-efficient lighting solutions, which offer significant cost savings in electricity consumption and reduced maintenance needs compared to traditional lighting systems. Technological disruptions, including the advent of smart lighting systems with integrated sensors and controls, are further accelerating market penetration. These smart systems enable dynamic lighting adjustments, daylight harvesting, and remote monitoring, leading to enhanced operational efficiency and personalized lighting experiences. Consumer preferences are shifting towards solutions that not only provide superior illumination but also contribute to sustainability goals and improve workplace environments. The competitive landscape is dynamic, with established players continuously investing in research and development to introduce innovative products and expand their market reach. Emerging markets, particularly in Asia Pacific and Latin America, present substantial growth opportunities due to rapid industrialization and increasing adoption of energy-efficient technologies. The market penetration of LED lighting in the commercial and industrial sectors is already high, exceeding 70% in developed economies, and is expected to further climb in developing regions. The ongoing transition from legacy lighting systems to LED technology, coupled with the increasing adoption of connected lighting for smart buildings and infrastructure, are key pillars of this market's impressive trajectory.

Leading Markets & Segments in Global Commercial and Industrial LED Lighting Market

The global commercial and industrial LED lighting market exhibits significant regional and segment-wise dominance, reflecting diverse economic development, regulatory landscapes, and industry-specific demands.

Dominant Region: North America and Europe currently lead the market due to stringent energy efficiency regulations, substantial government incentives for green building initiatives, and a high concentration of advanced industrial and commercial infrastructure. Asia Pacific is emerging as a rapid growth region, fueled by increasing investments in infrastructure development and a growing awareness of energy conservation.

Dominant Type Segment:

- Luminaires: This segment holds the largest market share, driven by demand for integrated lighting solutions in new construction projects and retrofitting existing facilities. The development of specialized luminaires for specific applications, such as high-bay lights for industrial settings and architectural lighting for commercial facades, further bolsters this segment.

- Lamps: While the luminaire segment is dominant, LED lamps continue to be a significant component, particularly for replacement and retrofit projects, offering an easier and often more cost-effective transition for end-users.

Dominant Distribution Channel:

- Wholesalers/Architects/Integrators/Retail: This channel commands the largest share due to its reach and ability to cater to a broad spectrum of customers, from large-scale commercial projects managed by architects and integrators to smaller retail and office spaces. The expertise offered by these channels in product selection and installation is highly valued.

- Direct Sales: Direct sales are crucial for large industrial projects and government tenders where customized solutions and extensive technical support are required.

Dominant End User Segment:

- Industrial: This segment is a major driver of growth, with industries such as manufacturing, warehousing, and oil and gas requiring robust, energy-efficient, and often hazardous-location-certified LED lighting solutions. The drive for increased productivity and safety directly correlates with demand for advanced industrial LED lighting.

- Commercial Offices: The increasing focus on employee well-being, productivity, and sustainability in office environments fuels the demand for intelligent and human-centric LED lighting solutions.

- Retail: Retailers are leveraging LED lighting to enhance product visibility, create appealing store ambiances, and reduce operational costs, thereby impacting sales and customer experience.

- Healthcare & Hospital: These sectors are increasingly adopting LED lighting for its sterile properties, energy efficiency, and ability to provide precise illumination for medical procedures.

Global Commercial and Industrial LED Lighting Market Product Developments

Recent product developments in the global commercial and industrial LED lighting market highlight a strong emphasis on enhanced performance and sustainability. Companies are focusing on developing high-output, energy-efficient solutions that offer significant operational cost savings. Innovations include advanced optics for better light distribution, extended product lifespans, and integrated smart technologies for improved control and connectivity. For instance, solutions designed to replace older, less efficient lighting technologies like HPS lamps are gaining traction, offering substantial energy savings and improved yields in applications like controlled environment agriculture. The integration of features that reduce installation complexity and maintenance requirements is also a key trend, making LED lighting more accessible and cost-effective for a wider range of businesses.

Key Drivers of Global Commercial and Industrial LED Lighting Market Growth

Several pivotal factors are propelling the growth of the global commercial and industrial LED lighting market. Foremost among these is the increasing global focus on energy conservation and sustainability, leading to stringent government regulations and incentives that favor energy-efficient lighting technologies. The significant reduction in operational and maintenance costs offered by LED lighting, compared to traditional alternatives, presents a compelling economic argument for businesses seeking to optimize their expenditure. Technological advancements, including the development of smarter, connected lighting systems with advanced controls and sensors, are enhancing functionality and driving adoption. Furthermore, the growing demand for improved lighting quality in workspaces to boost productivity and employee well-being is a significant catalyst. Infrastructure development and smart city initiatives worldwide also contribute to the expansion of the LED lighting market.

Challenges in the Global Commercial and Industrial LED Lighting Market Market

Despite its robust growth, the global commercial and industrial LED lighting market faces certain challenges. The initial upfront cost of LED lighting systems can be a barrier for some small and medium-sized enterprises, despite the long-term savings. Intense competition within the market leads to price pressures, impacting profit margins for manufacturers. Furthermore, the complexity of smart lighting system integration and the need for skilled labor for installation and maintenance can pose challenges. Supply chain disruptions and the volatility of raw material prices, particularly for rare earth elements used in some LED components, can also affect production and cost stability. Regulatory inconsistencies across different regions can create complexities for global manufacturers.

Emerging Opportunities in Global Commercial and Industrial LED Lighting Market

The global commercial and industrial LED lighting market presents numerous emerging opportunities for growth and innovation. The expanding adoption of smart building technologies and the Internet of Things (IoT) is creating demand for connected LED lighting systems that integrate with other building management systems for enhanced efficiency and automation. The growing controlled environment agriculture sector, including indoor farming and vertical farming, represents a significant untapped market for specialized horticultural LED lighting solutions that optimize plant growth and energy usage. The ongoing retrofitting of existing commercial and industrial infrastructure in developing economies offers substantial potential for market penetration. Furthermore, the development of advanced LED technologies, such as human-centric lighting that mimics natural daylight patterns, is opening new avenues in applications focused on well-being and productivity.

Leading Players in the Global Commercial and Industrial LED Lighting Market Sector

- Signify NV (Philips Lighting)

- WAC Lighting

- Hubbell Incorporated

- Dialight Plc

- Cree Lighting (Ideal Industries Inc)

- Wipro Lighting Limited

- Siteco GmbH

- Acuity Brands Inc

- Zumtobel Group AG

- Technical Consumer Products Inc

Key Milestones in Global Commercial and Industrial LED Lighting Market Industry

- June 2022: Fluence, a developer of energy-efficient LED lighting solutions for commercial cannabis and food production, introduced RAPTR, its newest high-output lighting solution designed to replace 1,000-watt high-pressure sodium (HPS) lamps while maximizing energy efficiency. This development addresses the growing need for efficient, higher-output lighting solutions in the horticulture sector, promising cost savings and improved yields for greenhouse and indoor growers.

- October 2021: In honor of Energy Awareness Month, Dialight Plc, a key innovator in hazardous and industrial LED lighting, launched the Ultra-Efficient Vigilant LED High Bay. This fixture, designed for heavy industrial applications, offers superior energy efficiency and a faster return on investment, up to a full year sooner than previous models, assisting businesses in achieving carbon-neutral targets and reducing energy expenditures.

Strategic Outlook for Global Commercial and Industrial LED Lighting Market Market

The strategic outlook for the global commercial and industrial LED lighting market remains exceptionally positive, driven by the sustained global imperative for energy efficiency and sustainability. Key growth accelerators include the continued integration of smart technologies, enabling greater control, automation, and data analytics for optimized energy consumption and operational performance. The expansion of specialized LED applications, particularly in horticulture and high-bay industrial settings, presents significant untapped market potential. Strategic partnerships between lighting manufacturers, technology providers, and building management system developers will be crucial for offering comprehensive, integrated solutions. Furthermore, a focus on developing circular economy principles in product design and manufacturing, alongside efforts to address supply chain vulnerabilities, will be vital for long-term resilience and market leadership. The market is poised for sustained innovation and expansion, driven by a clear demand for smarter, more efficient, and sustainable illumination solutions.

Global Commercial and Industrial LED Lighting Market Segmentation

-

1. Type

- 1.1. Lamps

- 1.2. Luminaries

-

2. Distribution Channel

- 2.1. DirectSales

- 2.2. Wholesalers/Architects/Integrators/Retail

-

3. End User

- 3.1. Commercial Offices

- 3.2. Retail

- 3.3. Hospital

- 3.4. Healthcare

- 3.5. Industrial

- 3.6. Architectural

- 3.7. Other End Users

Global Commercial and Industrial LED Lighting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Commercial and Industrial LED Lighting Market Regional Market Share

Geographic Coverage of Global Commercial and Industrial LED Lighting Market

Global Commercial and Industrial LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Move toward Energy-efficient and Connected Lighting Solutions driven by Growing Awareness and Smart Office Initiatives; Availability of LED-based Lighting Solutions as a Standardized Feature Coupled with Incremental Technological Advancements in the Sector

- 3.3. Market Restrains

- 3.3.1. Limited Range and Connectivity and Lack of Awareness about the Technology

- 3.4. Market Trends

- 3.4.1. The Retail Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lamps

- 5.1.2. Luminaries

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. DirectSales

- 5.2.2. Wholesalers/Architects/Integrators/Retail

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial Offices

- 5.3.2. Retail

- 5.3.3. Hospital

- 5.3.4. Healthcare

- 5.3.5. Industrial

- 5.3.6. Architectural

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Lamps

- 6.1.2. Luminaries

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. DirectSales

- 6.2.2. Wholesalers/Architects/Integrators/Retail

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial Offices

- 6.3.2. Retail

- 6.3.3. Hospital

- 6.3.4. Healthcare

- 6.3.5. Industrial

- 6.3.6. Architectural

- 6.3.7. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Lamps

- 7.1.2. Luminaries

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. DirectSales

- 7.2.2. Wholesalers/Architects/Integrators/Retail

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial Offices

- 7.3.2. Retail

- 7.3.3. Hospital

- 7.3.4. Healthcare

- 7.3.5. Industrial

- 7.3.6. Architectural

- 7.3.7. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Lamps

- 8.1.2. Luminaries

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. DirectSales

- 8.2.2. Wholesalers/Architects/Integrators/Retail

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial Offices

- 8.3.2. Retail

- 8.3.3. Hospital

- 8.3.4. Healthcare

- 8.3.5. Industrial

- 8.3.6. Architectural

- 8.3.7. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Lamps

- 9.1.2. Luminaries

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. DirectSales

- 9.2.2. Wholesalers/Architects/Integrators/Retail

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial Offices

- 9.3.2. Retail

- 9.3.3. Hospital

- 9.3.4. Healthcare

- 9.3.5. Industrial

- 9.3.6. Architectural

- 9.3.7. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Commercial and Industrial LED Lighting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Lamps

- 10.1.2. Luminaries

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. DirectSales

- 10.2.2. Wholesalers/Architects/Integrators/Retail

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Commercial Offices

- 10.3.2. Retail

- 10.3.3. Hospital

- 10.3.4. Healthcare

- 10.3.5. Industrial

- 10.3.6. Architectural

- 10.3.7. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Signify NV (Philips Lighting)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WAC Lighting

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hubbell Incorporated

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DialightPlc*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cree Lighting (Ideal Industries Inc)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wipro Lighting Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SitecoGmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Acuity Brands Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZumtobelGroup AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Technical Consumer Products Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Signify NV (Philips Lighting)

List of Figures

- Figure 1: Global Global Commercial and Industrial LED Lighting Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: North America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 13: Europe Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Europe Global Commercial and Industrial LED Lighting Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Global Commercial and Industrial LED Lighting Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 21: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Latin America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 29: Latin America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Latin America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Latin America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Type 2025 & 2033

- Figure 35: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 37: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Global Commercial and Industrial LED Lighting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 14: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: China Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Japan Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: India Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Global Commercial and Industrial LED Lighting Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 28: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 33: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Commercial and Industrial LED Lighting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Commercial and Industrial LED Lighting Market?

The projected CAGR is approximately 20.2%.

2. Which companies are prominent players in the Global Commercial and Industrial LED Lighting Market?

Key companies in the market include Signify NV (Philips Lighting), WAC Lighting, Hubbell Incorporated, DialightPlc*List Not Exhaustive, Cree Lighting (Ideal Industries Inc), Wipro Lighting Limited, SitecoGmbH, Acuity Brands Inc, ZumtobelGroup AG, Technical Consumer Products Inc.

3. What are the main segments of the Global Commercial and Industrial LED Lighting Market?

The market segments include Type, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Move toward Energy-efficient and Connected Lighting Solutions driven by Growing Awareness and Smart Office Initiatives; Availability of LED-based Lighting Solutions as a Standardized Feature Coupled with Incremental Technological Advancements in the Sector.

6. What are the notable trends driving market growth?

The Retail Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Limited Range and Connectivity and Lack of Awareness about the Technology.

8. Can you provide examples of recent developments in the market?

June 2022 - Fluence, a developer of energy-efficient LED lighting solutions for commercial cannabis and food production, has introduced RAPTR, its newest high-output lighting solution designed to replace 1,000-watt high-pressure sodium (HPS) lamps while maximizing energy efficiency. Greenhouse and indoor growers are increasingly looking for more efficient, higher-output lighting solutions to save money on installation, operation, and maintenance while improving yield and plant quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Commercial and Industrial LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Commercial and Industrial LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Commercial and Industrial LED Lighting Market?

To stay informed about further developments, trends, and reports in the Global Commercial and Industrial LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence