Key Insights

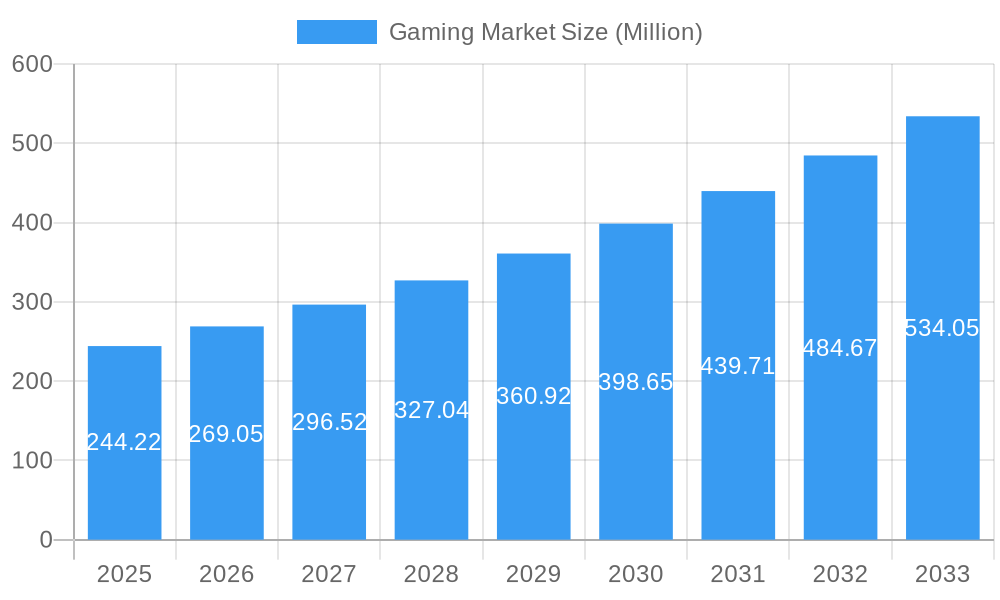

The global Gaming Market is poised for significant expansion, projected to reach $244.22 million by 2025. This impressive growth is driven by a robust Compound Annual Growth Rate (CAGR) of 10.17% over the forecast period. A primary catalyst for this surge is the widespread adoption of mobile gaming, fueled by the proliferation of smartphones and accessible internet connectivity across emerging economies. Furthermore, the burgeoning esports scene, with its professional leagues, massive viewership, and lucrative sponsorship deals, is attracting a new generation of players and spectators. Innovations in console gaming, including advancements in graphics, virtual reality (VR) integration, and cloud gaming services, are also contributing to sustained consumer engagement and spending. The increasing disposable income in key regions and the continuous release of high-quality, immersive game titles are expected to maintain this upward trajectory.

Gaming Market Market Size (In Million)

Several factors are shaping the future landscape of the Gaming Market. The increasing integration of augmented reality (AR) in mobile games is creating novel gameplay experiences, blending the digital and physical worlds. Subscription-based gaming models and free-to-play (F2P) titles with in-app purchases are also proving to be highly effective in monetizing a broad player base. While the market is experiencing substantial growth, potential restraints include rising game development costs and the intense competition among a large number of established and emerging players. Regulatory scrutiny regarding in-game purchases and data privacy in certain regions could also pose challenges. Nevertheless, the relentless pursuit of innovation, coupled with a deep understanding of player preferences, by key companies like Tencent, Microsoft, and Nintendo, is expected to propel the market forward. The Asia-Pacific region, particularly China and Japan, is anticipated to remain a dominant force due to its large gaming population and rapid technological adoption.

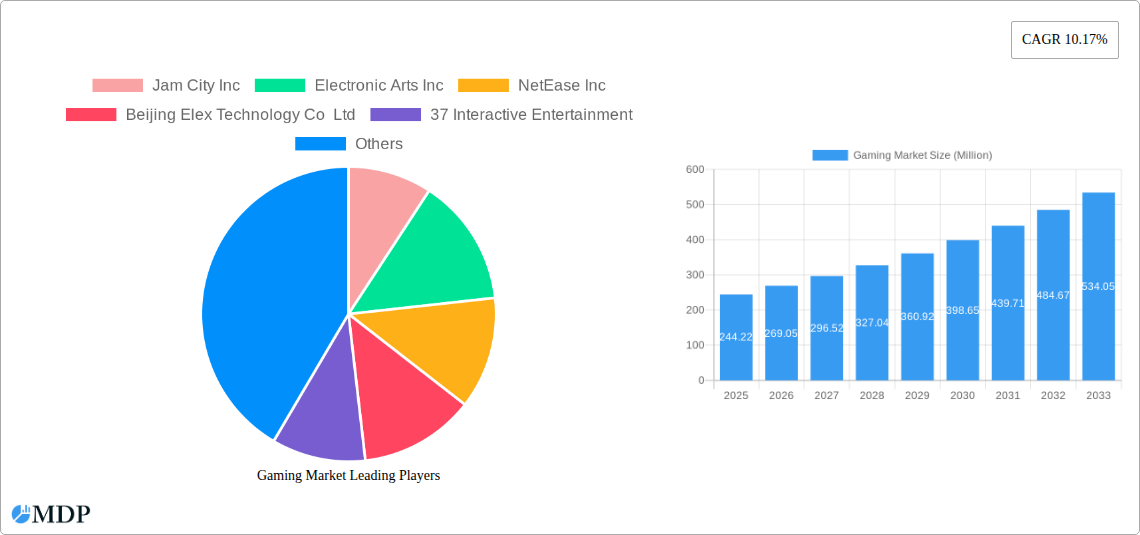

Gaming Market Company Market Share

Gaming Market: Global Outlook 2025-2033 with Deep Dive into Industry Trends, Dynamics, and Leading Players

This comprehensive report provides an in-depth analysis of the global Gaming Market, encompassing a study period from 2019 to 2033, with a base year and estimated year of 2025. The forecast period extends from 2025 to 2033, building upon historical data from 2019 to 2024. Delve into critical industry developments, market dynamics, key trends, leading segments, and strategic insights for stakeholders navigating the rapidly evolving gaming landscape. This report is essential for understanding the market's trajectory, competitive forces, and future growth accelerators, offering actionable intelligence for businesses, investors, and policymakers.

Gaming Market Market Dynamics & Concentration

The Gaming Market exhibits a moderate to high concentration, with a few dominant players controlling significant market share. Innovation remains a primary driver, fueled by advancements in graphics, AI, virtual reality (VR), augmented reality (AR), and cloud gaming technologies. Regulatory frameworks are evolving to address in-game purchases, data privacy, and e-sports integrity, impacting operational strategies. Product substitutes, such as mobile apps and other entertainment forms, pose a constant competitive challenge, necessitating continuous engagement and value proposition enhancement. End-user trends are increasingly shifting towards immersive experiences, social gaming, and cross-platform play, driving demand for versatile and accessible gaming solutions. Mergers and acquisitions (M&A) activities are prevalent, as companies seek to expand their portfolios, acquire talent, and consolidate market positions. For instance, recent M&A activities in the historical period have seen strategic acquisitions aimed at bolstering mobile gaming presence and expanding into new geographical markets, with an estimated XX M&A deals in the past year. Market share within key segments like mobile gaming is estimated to be dominated by a few large publishers, each holding between XX% and XX% of the respective sub-segment.

- Market Concentration: Moderate to High

- Innovation Drivers: VR/AR, AI, Cloud Gaming, Next-Gen Graphics

- Regulatory Frameworks: Evolving (in-game purchases, data privacy)

- Product Substitutes: Streaming Services, Social Media, Other Entertainment

- End-User Trends: Immersive Experiences, Social Gaming, Cross-Platform Play

- M&A Activities: Significant, driven by market consolidation and expansion

Gaming Market Industry Trends & Analysis

The global Gaming Market is experiencing robust growth, propelled by several interconnected trends. The increasing penetration of smartphones and affordable internet access worldwide has democratized access to mobile gaming, making it the largest and fastest-growing segment. Advancements in console technology, exemplified by the launch of new hardware generations, continue to drive demand for high-fidelity, immersive experiences. The rise of e-sports as a legitimate spectator sport and competitive profession has created entirely new revenue streams through sponsorships, media rights, and merchandise, attracting substantial investment and viewership. Cloud gaming platforms are also gaining traction, offering a subscription-based model that reduces hardware barriers and allows for seamless play across devices, further expanding the addressable market. Technological disruptions, including the integration of AI in game development for more dynamic narratives and personalized experiences, alongside the exploration of blockchain for digital asset ownership, are shaping the future of gaming. Consumer preferences are increasingly gravitating towards free-to-play models with in-app purchases, live-service games offering continuous content updates, and user-generated content platforms that empower players to create and share their own experiences. The competitive dynamics are characterized by intense innovation, strategic partnerships, and significant marketing expenditure to capture player attention and loyalty. The compound annual growth rate (CAGR) for the Gaming Market is projected to be approximately XX% over the forecast period, indicating substantial market expansion. Market penetration for gaming across various demographics is steadily increasing, with an estimated XX% of the global population actively engaging in gaming activities.

Leading Markets & Segments in Gaming Market

The Mobile Games segment continues to dominate the global Gaming Market, driven by its accessibility, diverse gameplay options, and widespread smartphone adoption. Countries with high population density and increasing disposable incomes, particularly in Asia-Pacific, are leading this segment's growth. The Console Games segment remains a significant contributor, with a dedicated player base that values high-quality graphics and immersive storytelling. North America and Europe are the leading regions for console gaming, supported by strong economic conditions and established gaming cultures. The Downloaded/Box PC segment, while mature, still holds a strong position, particularly among PC gaming enthusiasts who prefer owning physical or digital copies and have access to high-performance hardware. E-sports has emerged as a rapidly growing segment, transcending geographical boundaries and attracting millions of viewers and participants globally. Key drivers for the dominance of mobile games include:

- Ubiquitous Device Availability: Smartphones are prevalent across all socioeconomic strata.

- Low Barrier to Entry: Free-to-play models make games instantly accessible.

- Continuous Content Updates: Live-service games keep players engaged with fresh content.

For console gaming, the following are key drivers:

- Technological Advancements: Powerful hardware delivers unparalleled graphical fidelity and gameplay.

- Exclusive Franchises: Highly anticipated titles drive hardware sales and player loyalty.

- Strong Retail and Digital Distribution Networks: Ensuring widespread availability of games.

E-sports growth is fueled by:

- Increasing Prize Pools and Professional Leagues: Attracting top talent and significant investment.

- Livestreaming Platforms: Providing accessible platforms for viewership and community building.

- Global Esports Tournaments: Creating highly anticipated international events.

Gaming Market Product Developments

Product developments in the Gaming Market are rapidly advancing, focusing on enhanced immersion and accessibility. Microsoft's recent unveiling of an all-digital Xbox Series X and S, along with a premium Series X model featuring 2-terabytes of storage, signals a strong push towards disc-less gaming and greater convenience. Sony's introduction of the PlayStation 5 Slim, a lighter and more compact version of its flagship console, caters to evolving consumer preferences for space-saving designs while retaining core hardware capabilities and expandable storage. These developments highlight a trend towards offering diverse hardware options to meet varied consumer needs and budgets. Furthermore, the integration of advanced graphics processing units (GPUs) and faster solid-state drives (SSDs) across all platforms is significantly reducing load times and improving visual fidelity, creating more captivating gaming experiences. The emphasis on improved connectivity, as seen with the PlayStation 5 Slim's dual USB-C ports, further enhances user interaction and peripheral support.

Key Drivers of Gaming Market Growth

Several key factors are driving the substantial growth of the Gaming Market. The relentless pace of technological innovation, particularly in areas like cloud gaming, virtual reality (VR), and augmented reality (AR), is creating new ways to play and expanding the market's reach. The widespread adoption of high-speed internet and mobile devices globally has democratized access, allowing billions to engage with gaming content. The increasing popularity and professionalization of e-sports have not only boosted viewership but also attracted significant sponsorship and advertising revenue. Furthermore, the growing demand for interactive entertainment and the social aspects of gaming, where players connect with friends and communities online, are powerful motivators for engagement and spending. Favorable economic conditions in emerging markets, coupled with increasing disposable incomes, are also contributing to market expansion.

- Technological Advancements: VR/AR, Cloud Gaming, AI in game development.

- Increased Internet & Mobile Penetration: Broadening access to gaming platforms.

- Growth of E-sports: Attracting new audiences and investment.

- Social Connectivity: Online multiplayer and community features.

- Emerging Market Economies: Rising disposable income and gaming adoption.

Challenges in the Gaming Market Market

Despite its robust growth, the Gaming Market faces several significant challenges. Regulatory scrutiny regarding in-game monetization practices, loot boxes, and data privacy can lead to compliance costs and potential restrictions. The intense competition among a vast number of game developers and publishers necessitates substantial investment in marketing and development to stand out, leading to high customer acquisition costs. Supply chain disruptions, particularly for hardware components, can impact the availability and pricing of gaming consoles and related peripherals. Furthermore, the increasing cost of game development for AAA titles can deter smaller studios and lead to higher game prices for consumers. Piracy remains a persistent issue, impacting revenue for digital content.

- Regulatory Hurdles: In-game purchases, data privacy, age restrictions.

- Intense Competition: High marketing and development costs.

- Hardware Supply Chain Issues: Affecting console and component availability.

- Rising Development Costs: For high-fidelity AAA titles.

- Digital Piracy: Impacting revenue streams.

Emerging Opportunities in Gaming Market

The Gaming Market is ripe with emerging opportunities that promise long-term growth. The continued development and mainstream adoption of virtual reality (VR) and augmented reality (AR) technologies are poised to unlock entirely new immersive gaming experiences and hardware markets. The expansion of cloud gaming services presents a significant opportunity to reach a wider audience by removing traditional hardware barriers, making gaming accessible on a broader range of devices. Strategic partnerships between gaming companies and other entertainment sectors, such as film, music, and sports, can create cross-promotional synergies and expand intellectual property reach. The growing demand for user-generated content platforms also offers opportunities for developers to empower players to create and monetize their own in-game assets and experiences, fostering vibrant ecosystems. Exploring untapped geographical markets, particularly in developing regions with growing digital economies, presents a substantial opportunity for market expansion.

Leading Players in the Gaming Market Sector

- Jam City Inc

- Electronic Arts Inc

- NetEase Inc

- Beijing Elex Technology Co Ltd

- 37 Interactive Entertainment

- Microsoft Corporation

- Sega Sammy Holdings Inc

- Square Enix Holdings Co Ltd

- Ubisoft Entertainment SA

- Tencent Holdings Ltd

- Nintendo Co Ltd

- ZeptoLab UK limited

- Realnetworks LLC (Gamehouse)

- Take-Two Interactive Software Inc

- Apple Inc

- Bandai Namco Holdings Inc

- Nexon Co Ltd

- Sony Corporation

- Capcom Co Ltd

Key Milestones in Gaming Market Industry

- June 2024: Microsoft unveiled an all-digital variant of its Xbox Series X and S consoles alongside previews for over a dozen games, notably the next "Call of Duty" installment. The tech giant showcased not just one but three consoles: a disc-less iteration of the Xbox Series X and S and a premium Series X model boasting a capacious 2-terabyte storage.

- April 2024: Sony introduced the PlayStation 5 Slim to the Indian market. The version of its flagship gaming console is 25% lighter and takes up 30% less space than its predecessor. The console retains the original PS5's hardware, boasting 1TB of internal storage that can be expanded using external SSDs. Catering to both disc-based and digital gamers, the PlayStation 5 Slim is equipped with two USB-C ports, enhancing connectivity options.

Strategic Outlook for Gaming Market Market

The strategic outlook for the Gaming Market remains exceptionally strong, driven by continuous innovation and evolving consumer engagement. Future growth will be accelerated by the increasing integration of AI and machine learning in game development, leading to more personalized and adaptive experiences. The maturation of cloud gaming infrastructure will further democratize access, enabling seamless play across a multitude of devices and significantly expanding the player base. Strategic investments in emerging markets, coupled with the development of localized content and pricing strategies, will be crucial for capturing new revenue streams. Furthermore, the continued evolution and mainstream acceptance of VR and AR technologies offer a significant opportunity for creating novel, deeply immersive gaming experiences that will drive future hardware and software sales, solidifying gaming's position as a leading form of interactive entertainment.

Gaming Market Segmentation

-

1. Gaming Type

- 1.1. Mobile Games

- 1.2. Console Games

- 1.3. Downloaded/Box PC

- 1.4. E-sports

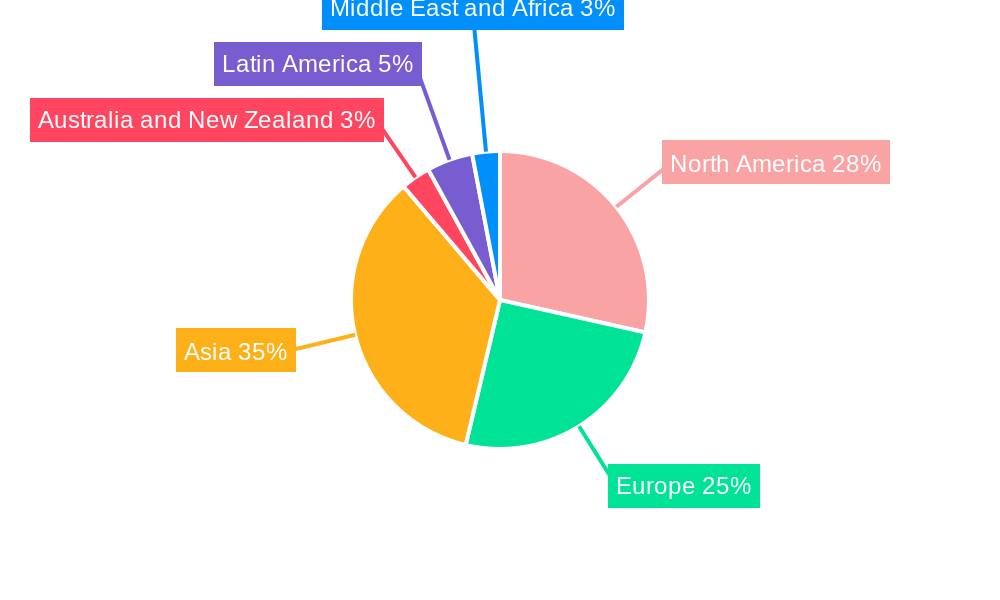

Gaming Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. Iran

- 6.4. Egypt

Gaming Market Regional Market Share

Geographic Coverage of Gaming Market

Gaming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Internet Penetration; Emergence of Cloud Gaming; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1 Issues such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Console Games Gaming Type Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 5.1.1. Mobile Games

- 5.1.2. Console Games

- 5.1.3. Downloaded/Box PC

- 5.1.4. E-sports

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Australia and New Zealand

- 5.2.5. Latin America

- 5.2.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6. North America Gaming Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 6.1.1. Mobile Games

- 6.1.2. Console Games

- 6.1.3. Downloaded/Box PC

- 6.1.4. E-sports

- 6.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7. Europe Gaming Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 7.1.1. Mobile Games

- 7.1.2. Console Games

- 7.1.3. Downloaded/Box PC

- 7.1.4. E-sports

- 7.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8. Asia Gaming Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 8.1.1. Mobile Games

- 8.1.2. Console Games

- 8.1.3. Downloaded/Box PC

- 8.1.4. E-sports

- 8.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9. Australia and New Zealand Gaming Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 9.1.1. Mobile Games

- 9.1.2. Console Games

- 9.1.3. Downloaded/Box PC

- 9.1.4. E-sports

- 9.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10. Latin America Gaming Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 10.1.1. Mobile Games

- 10.1.2. Console Games

- 10.1.3. Downloaded/Box PC

- 10.1.4. E-sports

- 10.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11. Middle East and Africa Gaming Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 11.1.1. Mobile Games

- 11.1.2. Console Games

- 11.1.3. Downloaded/Box PC

- 11.1.4. E-sports

- 11.1. Market Analysis, Insights and Forecast - by Gaming Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Jam City Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Electronic Arts Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NetEase Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Beijing Elex Technology Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 37 Interactive Entertainment

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sega Sammy Holdings Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Square Enix Holdings Co Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ubisoft Entertainment SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tencent Holdings Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Nintendo Co Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ZeptoLab UK limited

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Realnetworks LLC (Gamehouse)

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Take-Two Interactive Software Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Apple Inc

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Bandai Namco Holdings Inc

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.17 Nexon Co Ltd

- 12.2.17.1. Overview

- 12.2.17.2. Products

- 12.2.17.3. SWOT Analysis

- 12.2.17.4. Recent Developments

- 12.2.17.5. Financials (Based on Availability)

- 12.2.18 Sony Corporation

- 12.2.18.1. Overview

- 12.2.18.2. Products

- 12.2.18.3. SWOT Analysis

- 12.2.18.4. Recent Developments

- 12.2.18.5. Financials (Based on Availability)

- 12.2.19 Capcom Co Ltd

- 12.2.19.1. Overview

- 12.2.19.2. Products

- 12.2.19.3. SWOT Analysis

- 12.2.19.4. Recent Developments

- 12.2.19.5. Financials (Based on Availability)

- 12.2.1 Jam City Inc

List of Figures

- Figure 1: Global Gaming Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 3: North America Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 4: North America Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 7: Europe Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 8: Europe Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 11: Asia Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 12: Asia Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Australia and New Zealand Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 15: Australia and New Zealand Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 16: Australia and New Zealand Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Australia and New Zealand Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 19: Latin America Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 20: Latin America Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Latin America Gaming Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Gaming Market Revenue (Million), by Gaming Type 2025 & 2033

- Figure 23: Middle East and Africa Gaming Market Revenue Share (%), by Gaming Type 2025 & 2033

- Figure 24: Middle East and Africa Gaming Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Gaming Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 2: Global Gaming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 4: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 8: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Germany Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Russia Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 16: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: China Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: South Korea Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 21: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 23: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Brazil Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Argentina Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Gaming Market Revenue Million Forecast, by Gaming Type 2020 & 2033

- Table 28: Global Gaming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: United Arab Emirates Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Saudi Arabia Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Iran Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Egypt Gaming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Market?

The projected CAGR is approximately 10.17%.

2. Which companies are prominent players in the Gaming Market?

Key companies in the market include Jam City Inc, Electronic Arts Inc, NetEase Inc, Beijing Elex Technology Co Ltd, 37 Interactive Entertainment, Microsoft Corporation, Sega Sammy Holdings Inc, Square Enix Holdings Co Ltd, Ubisoft Entertainment SA, Tencent Holdings Ltd, Nintendo Co Ltd, ZeptoLab UK limited, Realnetworks LLC (Gamehouse), Take-Two Interactive Software Inc, Apple Inc, Bandai Namco Holdings Inc, Nexon Co Ltd, Sony Corporation, Capcom Co Ltd.

3. What are the main segments of the Gaming Market?

The market segments include Gaming Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 244.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration; Emergence of Cloud Gaming; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Console Games Gaming Type Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Issues such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

June 2024: Microsoft unveiled an all-digital variant of its Xbox Series X and S consoles alongside previews for over a dozen games, notably the next "Call of Duty" installment. The tech giant showcased not just one but three consoles: a disc-less iteration of the Xbox Series X and S and a premium Series X model boasting a capacious 2-terabyte storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Market?

To stay informed about further developments, trends, and reports in the Gaming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence