Key Insights

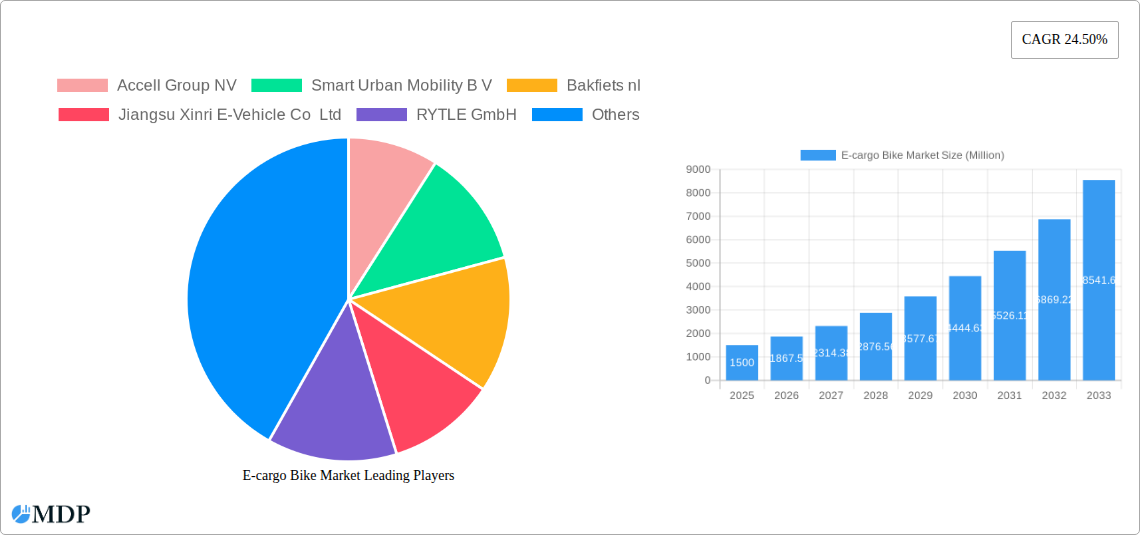

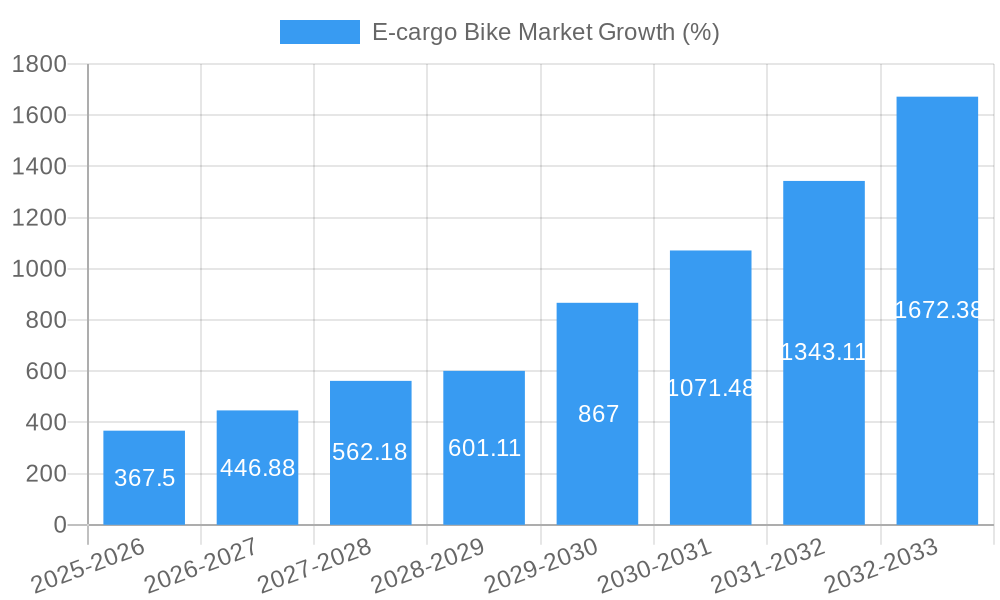

The e-cargo bike market is experiencing robust growth, driven by increasing urbanization, rising fuel costs, and a growing awareness of environmental sustainability. A compound annual growth rate (CAGR) of 24.50% from 2019 to 2024 suggests a significant market expansion. This surge is fueled by several key factors: the rising popularity of last-mile delivery services, particularly in densely populated areas where traditional vehicles face logistical challenges; the increasing adoption of e-cargo bikes by businesses seeking eco-friendly and cost-effective transportation solutions; and supportive government policies promoting sustainable urban mobility in many regions. The market segmentation reveals diverse consumer needs, with pedal-assisted, speed pedelec, and throttle-assisted propulsion types catering to different usage patterns. Similarly, battery technology choices, ranging from lead-acid to lithium-ion, reflect varying performance requirements and budget considerations. Leading manufacturers like Accell Group NV, Yadea Group Holdings Ltd, and Riese & Müller are driving innovation and competition, shaping product features and market penetration strategies.

The market's future trajectory suggests continued growth through 2033. While challenges remain, such as high initial purchase costs and limited infrastructure for charging and maintenance in some regions, ongoing technological advancements (in battery life and range), coupled with increasing consumer awareness and government incentives, are expected to mitigate these hurdles. The growing demand for efficient urban logistics and the rising popularity of cargo bikes for personal use (e.g., family transportation) are likely to further fuel market expansion. The competition among manufacturers is expected to intensify, prompting innovation in design, performance, and affordability. This will ultimately benefit consumers, driving wider adoption of e-cargo bikes as a viable and sustainable transportation solution.

E-Cargo Bike Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global E-cargo Bike market, offering invaluable insights for stakeholders across the value chain. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis and expert insights to illuminate current market dynamics and future growth trajectories. The report covers key market segments, leading players, and emerging trends, enabling informed strategic decision-making. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

E-cargo Bike Market Market Dynamics & Concentration

The E-cargo bike market is experiencing significant growth, driven by a confluence of factors including increasing urbanization, rising environmental concerns, and the need for efficient last-mile delivery solutions. Market concentration is currently moderate, with several key players holding significant market share, but a fragmented landscape with numerous smaller players also exists. The market share of the top 5 players is estimated at xx%, indicating a competitive yet not overly consolidated environment. Innovation is a key driver, with continuous advancements in battery technology, motor efficiency, and design leading to improved performance and consumer appeal. Regulatory frameworks, particularly those promoting sustainable transportation and e-mobility, are also playing a crucial role. Product substitutes, such as traditional cargo bikes and delivery vans, face competition from the growing efficiency and cost-effectiveness of e-cargo bikes. End-user trends are shifting towards environmentally friendly and efficient transportation solutions, further fueling market demand. M&A activity in the sector has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024.

- Market Concentration: Moderate, Top 5 players holding xx% market share.

- Innovation Drivers: Battery technology advancements, motor efficiency improvements, design innovations.

- Regulatory Frameworks: Government incentives and regulations promoting sustainable transportation.

- Product Substitutes: Traditional cargo bikes, delivery vans.

- End-User Trends: Growing preference for sustainable and efficient last-mile delivery.

- M&A Activity: Approximately xx deals between 2019 and 2024.

E-cargo Bike Market Industry Trends & Analysis

The E-cargo bike market is experiencing robust growth, fueled by several key trends. The increasing adoption of e-commerce and the last-mile delivery challenge is driving strong demand for efficient and sustainable delivery solutions. Technological advancements, such as improved battery technology and motor efficiency, are enhancing the performance and practicality of e-cargo bikes. Consumer preferences are shifting towards eco-friendly transportation options, further bolstering market growth. Competitive dynamics are shaping the market, with leading players focusing on product innovation, strategic partnerships, and expansion into new markets. The market is expected to witness a significant increase in market penetration, reaching xx% by 2033, driven by increased consumer awareness and government support. The overall market is exhibiting strong growth with a projected CAGR of xx% during the forecast period.

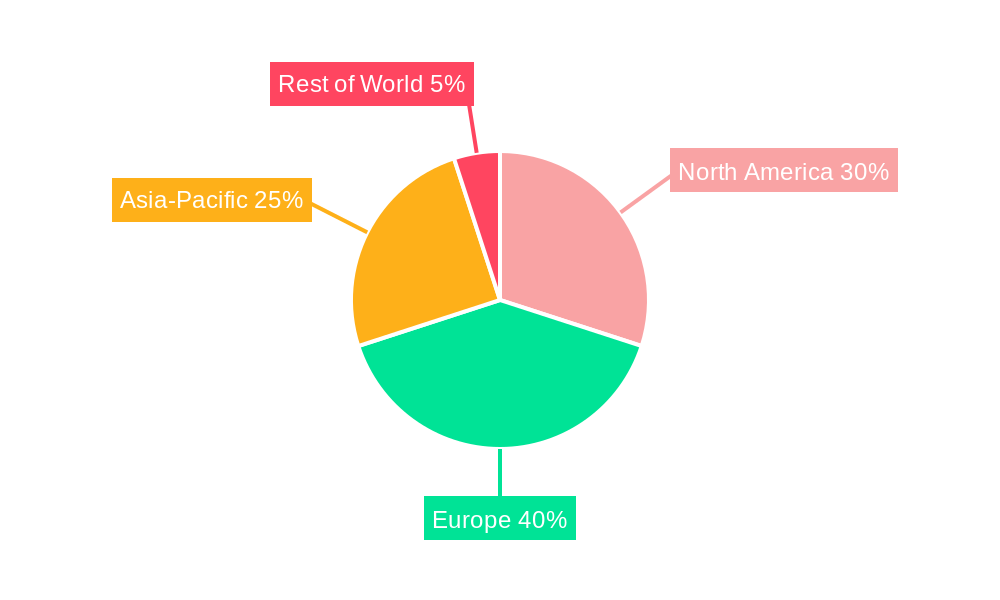

Leading Markets & Segments in E-cargo Bike Market

The European market currently dominates the global E-cargo bike market, driven by strong government support for sustainable transportation, well-developed cycling infrastructure, and high consumer awareness of environmental issues. Within Europe, countries like the Netherlands and Germany are particularly strong markets. The Pedal Assisted propulsion type holds the largest market share, accounting for approximately xx% of the total market. Lithium-ion batteries dominate the battery market segment due to their superior energy density and lifespan compared to lead-acid batteries.

- Key Drivers for European Dominance:

- Strong government incentives for e-bike adoption.

- Well-established cycling infrastructure.

- High consumer awareness of environmental sustainability.

- Dominant Propulsion Type: Pedal Assisted (xx% market share)

- Dominant Battery Type: Lithium-ion Battery (xx% market share)

E-cargo Bike Market Product Developments

Recent product developments focus on enhancing the carrying capacity, range, and user experience of e-cargo bikes. Innovations include improved battery technology for extended range, more efficient motors, and integrated cargo solutions. Manufacturers are also focusing on enhanced safety features and improved design ergonomics to make these bikes more user-friendly and appealing to a wider range of users. This focus on technological advancements aims to cater to the evolving needs of various user segments, expanding the market's applications and boosting market adoption.

Key Drivers of E-cargo Bike Market Growth

The E-cargo bike market is experiencing rapid growth due to several key drivers. Firstly, increasing urbanization and the subsequent rise in last-mile delivery challenges necessitate efficient and sustainable transportation solutions. Secondly, growing environmental concerns and government regulations promoting sustainable transportation are fueling demand for eco-friendly alternatives to traditional vehicles. Thirdly, technological advancements, like improved battery technology and more efficient motors, make e-cargo bikes more practical and attractive. Finally, favorable government incentives and subsidies are further stimulating market growth.

Challenges in the E-cargo Bike Market Market

Despite the significant growth potential, the E-cargo bike market faces several challenges. High initial purchase costs can be a barrier to entry for some consumers. Concerns about range anxiety, particularly for longer journeys, remain a hurdle for wider adoption. Regulatory hurdles and inconsistent infrastructure development across different regions can also hinder growth. Supply chain disruptions, especially concerning battery components, can also impact production and availability. Lastly, Intense competition among numerous market players creates pressure on pricing and profitability.

Emerging Opportunities in E-cargo Bike Market

Long-term growth in the E-cargo bike market is expected to be driven by several emerging opportunities. Technological advancements, such as advancements in solid-state battery technology, will likely lead to increased range and reduced charging times. Strategic partnerships between e-cargo bike manufacturers and logistics companies can expand the market’s reach into various industry applications. Expansion into new markets, particularly in developing countries with growing urban populations, presents significant untapped potential. The development of specialized e-cargo bike models designed for diverse applications such as food delivery or package transport will also contribute to substantial future market expansion.

Leading Players in the E-cargo Bike Market Sector

- Accell Group NV

- Smart Urban Mobility B V

- Bakfiets nl

- Jiangsu Xinri E-Vehicle Co Ltd

- RYTLE GmbH

- Rad Power Bikes

- Yadea Group Holdings Ltd

- The Cargo Bike Company

- Jinhua Jobo Technology Co

- Tern Bicycles

- XYZ CARGO

- Xtracycle Inc

- Pedego Electric Bikes

- Riese & Müller

- DOUZE Factory SAS

- YUBA BICYCLES LL

- Aima Technology Group Co Ltd

Key Milestones in E-cargo Bike Market Industry

- June 2022: Tern launched NBD, a low-step e-bike with a maximum gross vehicle weight of 140 kg and can handle up to 27 kg on the rear rack, and up to 20 kg on a front rack. This launch broadened Tern's product portfolio and appealed to a wider range of consumers.

- August 2022: The release of the MovR3 e-pedelec with a 25 km/h speed limit demonstrated advancement in urban cargo bike technology. The enhanced speed caters to users needing quicker transport within urban settings.

- October 2022: Douze Cycles launched a cargo bike series with a 205 kg hauling capacity. This marked a significant step in increasing the utility and functionality of e-cargo bikes for businesses and consumers needing higher carrying capacities.

Strategic Outlook for E-cargo Bike Market Market

The future of the E-cargo bike market looks exceptionally promising. Continued technological advancements, supportive government policies, and the increasing focus on sustainable transportation will propel significant market growth in the coming years. Strategic partnerships between manufacturers, logistics companies, and municipalities will be crucial for scaling adoption and maximizing market potential. The market's expansion into new geographical regions and the emergence of new applications will create significant opportunities for industry players to gain market share and drive innovation.

E-cargo Bike Market Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Battery Type

- 2.1. Lead Acid Battery

- 2.2. Lithium-ion Battery

- 2.3. Others

E-cargo Bike Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

E-cargo Bike Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 24.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exponential Increase in Automotive Sector

- 3.3. Market Restrains

- 3.3.1. Digitization of R&D Operations in Automotive Sector

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lead Acid Battery

- 5.2.2. Lithium-ion Battery

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Battery Type

- 6.2.1. Lead Acid Battery

- 6.2.2. Lithium-ion Battery

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Battery Type

- 7.2.1. Lead Acid Battery

- 7.2.2. Lithium-ion Battery

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Battery Type

- 8.2.1. Lead Acid Battery

- 8.2.2. Lithium-ion Battery

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Battery Type

- 9.2.1. Lead Acid Battery

- 9.2.2. Lithium-ion Battery

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific E-cargo Bike Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Battery Type

- 10.2.1. Lead Acid Battery

- 10.2.2. Lithium-ion Battery

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Accell Group NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smart Urban Mobility B V

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bakfiets nl

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jiangsu Xinri E-Vehicle Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RYTLE GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rad Power Bikes

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yadea Group Holdings Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 The Cargo Bike Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jinhua Jobo Technology Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tern Bicycles

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 XYZ CARGO

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Xtracycle Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Pedego Electric Bikes

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Riese & Müller

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 DOUZE Factory SAS

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 YUBA BICYCLES LL

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Aima Technology Group Co Ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Accell Group NV

List of Figures

- Figure 1: Global E-cargo Bike Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America E-cargo Bike Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 3: North America E-cargo Bike Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 4: North America E-cargo Bike Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 5: North America E-cargo Bike Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 6: North America E-cargo Bike Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America E-cargo Bike Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America E-cargo Bike Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 9: South America E-cargo Bike Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 10: South America E-cargo Bike Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 11: South America E-cargo Bike Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 12: South America E-cargo Bike Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America E-cargo Bike Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe E-cargo Bike Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 15: Europe E-cargo Bike Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 16: Europe E-cargo Bike Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 17: Europe E-cargo Bike Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 18: Europe E-cargo Bike Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe E-cargo Bike Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa E-cargo Bike Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 21: Middle East & Africa E-cargo Bike Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 22: Middle East & Africa E-cargo Bike Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 23: Middle East & Africa E-cargo Bike Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 24: Middle East & Africa E-cargo Bike Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa E-cargo Bike Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific E-cargo Bike Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 27: Asia Pacific E-cargo Bike Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 28: Asia Pacific E-cargo Bike Market Revenue (Million), by Battery Type 2024 & 2032

- Figure 29: Asia Pacific E-cargo Bike Market Revenue Share (%), by Battery Type 2024 & 2032

- Figure 30: Asia Pacific E-cargo Bike Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific E-cargo Bike Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global E-cargo Bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 4: Global E-cargo Bike Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 7: Global E-cargo Bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 12: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 13: Global E-cargo Bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 18: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 19: Global E-cargo Bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 30: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 31: Global E-cargo Bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global E-cargo Bike Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 39: Global E-cargo Bike Market Revenue Million Forecast, by Battery Type 2019 & 2032

- Table 40: Global E-cargo Bike Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific E-cargo Bike Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the E-cargo Bike Market?

The projected CAGR is approximately 24.50%.

2. Which companies are prominent players in the E-cargo Bike Market?

Key companies in the market include Accell Group NV, Smart Urban Mobility B V, Bakfiets nl, Jiangsu Xinri E-Vehicle Co Ltd, RYTLE GmbH, Rad Power Bikes, Yadea Group Holdings Ltd, The Cargo Bike Company, Jinhua Jobo Technology Co, Tern Bicycles, XYZ CARGO, Xtracycle Inc, Pedego Electric Bikes, Riese & Müller, DOUZE Factory SAS, YUBA BICYCLES LL, Aima Technology Group Co Ltd.

3. What are the main segments of the E-cargo Bike Market?

The market segments include Propulsion Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exponential Increase in Automotive Sector.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Digitization of R&D Operations in Automotive Sector.

8. Can you provide examples of recent developments in the market?

October 2022: Douze Cycles, a French business, has launched a cargo bike series consisting of four models, three of which incorporate electric help. The range of bikes boasts an outstanding hauling capacity of up to 205 kg.August 2022: The company released MovR3, the newest model of the cargo bike for urban areas. The MovR3 acts as an e-pedelec with a speed range of up to 25 km/h.June 2022: Tern launched NBD, a low-step e-bike with a maximum gross vehicle weight of 140 kg and can handle up to 27 kg on the rear rack, and up to 20 kg on a front rack.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "E-cargo Bike Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the E-cargo Bike Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the E-cargo Bike Market?

To stay informed about further developments, trends, and reports in the E-cargo Bike Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence