Key Insights

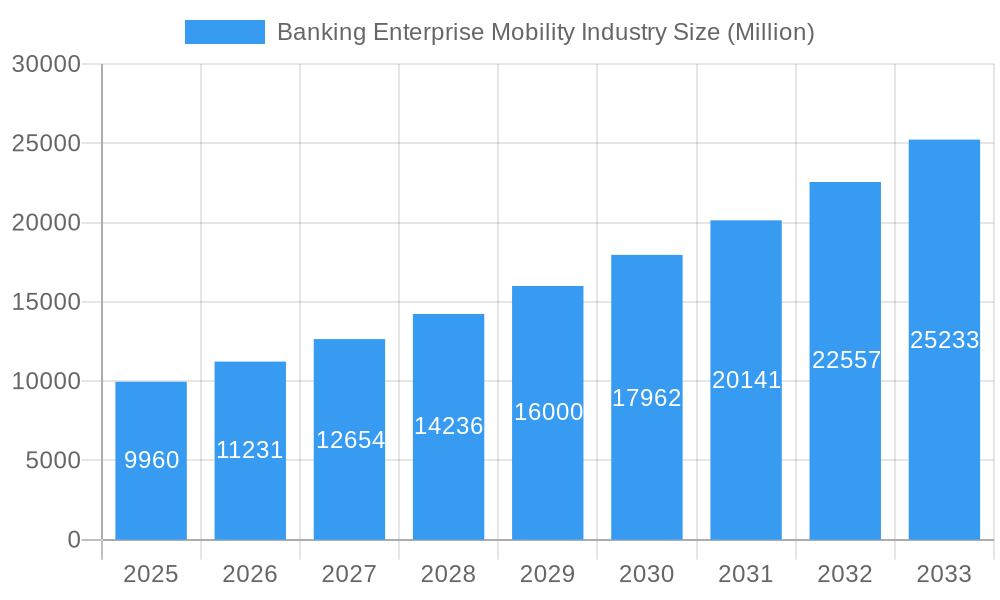

The Banking Enterprise Mobility market is poised for significant expansion, projected to reach USD 9.96 billion in 2025 and sustain a robust CAGR of 12.65% throughout the forecast period of 2019-2033. This growth is underpinned by the increasing demand for secure, efficient, and customer-centric mobile banking solutions. Key drivers include the escalating adoption of digital banking channels by consumers, the imperative for financial institutions to enhance operational agility and employee productivity through mobile technology, and the growing need for robust data security and compliance measures in the highly regulated banking sector. The market is segmented into Solutions and Services, with Solutions encompassing Device Management, Access Management, and Application Management, all critical for enabling seamless and secure mobile operations. The continuous evolution of mobile technologies, such as 5G, AI-powered analytics, and advanced encryption, further fuels this expansion, allowing banks to offer more personalized and intuitive experiences.

Banking Enterprise Mobility Industry Market Size (In Billion)

The burgeoning adoption of mobile technologies in banking is not without its challenges. Restraints such as stringent data privacy regulations, the ever-present threat of cyberattacks, and the complexity of integrating new mobile solutions with legacy banking infrastructure require strategic and consistent investment in security protocols and talent. However, these challenges are being effectively addressed by leading companies like Microsoft Corporation, IBM Corporation, and Accenture Plc, who are at the forefront of developing innovative enterprise mobility management (EMM) and security solutions tailored for the banking industry. The Asia Pacific region is emerging as a significant growth engine, driven by a large and digitally adept population and a rapidly expanding financial services sector. As banks globally continue to prioritize digital transformation to maintain a competitive edge, the enterprise mobility market within the banking sector is set to witness sustained and dynamic growth.

Banking Enterprise Mobility Industry Company Market Share

Unlock critical insights into the banking enterprise mobility industry with this comprehensive report. Navigate the evolving landscape of mobile banking solutions, BFSI mobility, and digital transformation in banking. This in-depth analysis covers market dynamics, key trends, leading players, and future strategies, providing actionable intelligence for stakeholders seeking to capitalize on the billion-dollar banking mobility market.

Banking Enterprise Mobility Industry Market Dynamics & Concentration

The banking enterprise mobility industry is characterized by a dynamic interplay of innovation, evolving regulatory landscapes, and intense competition. Market concentration remains moderate, with key players like Infosys Limited, Newgen Software Technologies Limited, IBM Corporation, HCL Technologies, and Microsoft Corporation holding significant influence through their extensive solution portfolios and strategic partnerships. The drive for enhanced customer experience and operational efficiency fuels continuous innovation in areas such as device management, access management, and application management. Regulatory frameworks, while crucial for security and compliance, can also present hurdles to rapid adoption. Product substitutes are emerging, from traditional web-based banking to more advanced AI-driven financial advisory services, necessitating a focus on unique value propositions. End-user trends overwhelmingly favor seamless, secure, and personalized mobile banking experiences. Merger and acquisition activities are a significant feature, driven by the need to acquire new technologies, expand market reach, and consolidate competitive advantages. The estimated M&A deal count is projected to be in the double digits annually, with deal values reaching billions. Market share is fragmented across various solution and service providers, but leaders in specific niches are emerging, demonstrating a market poised for both consolidation and specialized growth.

Banking Enterprise Mobility Industry Industry Trends & Analysis

The banking enterprise mobility industry is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of xx% from 2025 to 2033. This expansion is propelled by several key trends. Firstly, the increasing adoption of smartphones and tablets by both customers and bank employees has created a fertile ground for mobile-first banking strategies. This shift in consumer preferences towards convenient and on-demand financial services is a primary growth driver. Secondly, technological disruptions, including the integration of Artificial Intelligence (AI), Machine Learning (ML), and blockchain, are revolutionizing the capabilities of banking applications. These technologies enable personalized customer interactions, enhanced security features, and more efficient back-office operations. The market penetration of advanced mobile banking solutions is expected to exceed xx% of the total banking customer base by 2033. Thirdly, competitive dynamics are intensifying, with traditional banks, neobanks, and fintech companies vying for market share. This competition fosters innovation and pushes for the development of more sophisticated and user-friendly mobile banking platforms. The industry is also witnessing a significant rise in demand for secure and compliant mobility solutions, driven by increasing cyber threats and stringent data privacy regulations. The estimated total market value is projected to reach billions by 2033, underscoring the immense opportunity within this sector.

Leading Markets & Segments in Banking Enterprise Mobility Industry

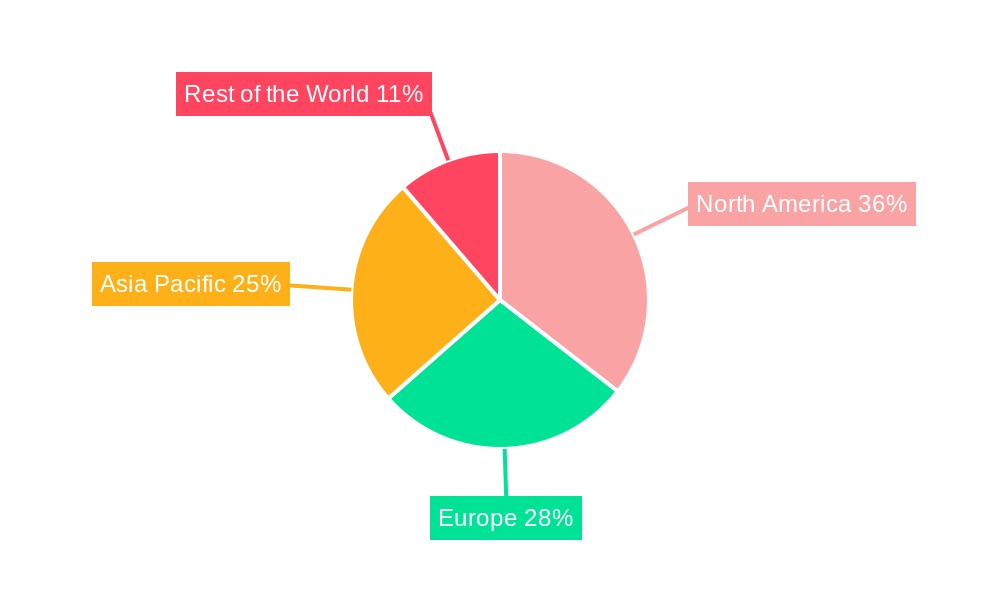

The North America region is currently the dominant market within the banking enterprise mobility industry, driven by its advanced technological infrastructure, high smartphone penetration rates, and a strong regulatory environment that supports digital innovation. The United States, in particular, represents a significant portion of this regional dominance, fueled by substantial investments in financial technology and a proactive approach to embracing new banking solutions. Economic policies in this region have consistently encouraged digital transformation, providing a supportive ecosystem for companies operating in this space.

Within the segments, Solutions are outpacing Services in terms of market share and growth trajectory. Among the various solutions, Device Management and Access Management are key drivers, ensuring secure access to sensitive financial data across a multitude of endpoints. The demand for robust Application Management is also soaring as financial institutions seek to deliver seamless and feature-rich mobile banking experiences.

- Device Management: This segment benefits from the increasing diversity of devices used in the banking sector, from corporate-issued smartphones to employees' personal devices (BYOD policies). Key drivers include the need for centralized control, security patching, and remote wiping capabilities to protect against data breaches. The market size for device management solutions is estimated to be in the billions.

- Access Management: Critical for maintaining regulatory compliance and preventing unauthorized access, this segment is propelled by the demand for multi-factor authentication, single sign-on (SSO), and identity and access management (IAM) solutions. The escalating threat landscape further solidifies its importance, with a projected market value in the billions.

- Application Management: This segment is driven by the need for efficient deployment, updates, and maintenance of mobile banking applications. Financial institutions are investing heavily in platforms that offer seamless user experiences, personalized services, and integration with core banking systems.

- Services: While Solutions currently lead, the Services segment, encompassing consulting, implementation, and support, is also experiencing steady growth. Banks are increasingly relying on expert assistance to navigate the complexities of enterprise mobility strategy and deployment, contributing billions to the overall market.

Banking Enterprise Mobility Industry Product Developments

Product innovations in the banking enterprise mobility industry are focused on enhancing security, user experience, and operational efficiency. Companies are actively developing advanced solutions that leverage AI for fraud detection, biometric authentication for secure access, and personalized customer engagement through mobile channels. The integration of robust Unified Endpoint Management (UEM) solutions is a key trend, ensuring secure management of all devices accessing banking networks. Competitive advantages are being gained through the development of intuitive interfaces, seamless integration with existing banking infrastructure, and the ability to offer a comprehensive suite of financial services via mobile platforms. The market is witnessing a rapid evolution of mobile banking apps, moving beyond basic transactions to include sophisticated wealth management tools, AI-powered financial advisors, and seamless onboarding processes, all contributing to a market valued in the billions.

Key Drivers of Banking Enterprise Mobility Industry Growth

The banking enterprise mobility industry's growth is primarily fueled by accelerating digital transformation initiatives within financial institutions. This includes the imperative to enhance customer engagement through intuitive and feature-rich mobile banking platforms. Furthermore, the widespread adoption of smartphones and the growing demand for anytime, anywhere financial services are significant catalysts. Regulatory mandates promoting digital transactions and data security also play a crucial role, driving investment in secure mobility solutions. The increasing prevalence of remote work environments within the banking sector further amplifies the need for robust enterprise mobility management tools. These interconnected factors contribute to a market projected to reach billions in value.

Challenges in the Banking Enterprise Mobility Industry Market

Despite significant growth, the banking enterprise mobility industry faces several challenges. Regulatory hurdles, particularly concerning data privacy and compliance with diverse international financial regulations, can slow down adoption and increase implementation costs. The complexity of integrating new mobility solutions with legacy banking systems presents a substantial technical challenge, often requiring significant investment and specialized expertise. Furthermore, the escalating threat of cyberattacks and data breaches necessitates continuous investment in advanced security measures, adding to operational expenses. Competitive pressures from nimble fintech companies also force traditional banks to innovate at a faster pace, demanding efficient product development and deployment cycles, impacting market dynamics.

Emerging Opportunities in Banking Enterprise Mobility Industry

Emerging opportunities in the banking enterprise mobility industry are abundant, driven by technological breakthroughs and evolving consumer expectations. The integration of advanced AI and machine learning presents a significant catalyst for personalized banking experiences, offering predictive analytics for customer needs and automated financial advice. Strategic partnerships between traditional banks and innovative fintech firms are creating synergistic opportunities, combining established trust with cutting-edge technology. The expansion of open banking initiatives globally is further opening avenues for new service development and cross-platform integrations, driving a market valued in the billions. The development of secure and scalable blockchain solutions for financial transactions also presents a transformative opportunity for enhancing security and transparency in mobile banking.

Leading Players in the Banking Enterprise Mobility Industry Sector

- Infosys Limited

- Newgen Software Technologies Limited

- IBM Corporation

- HCL Technologies

- Microsoft Corporation

- Accenture Plc

- Mobile Iron Inc

- BlackBerry Limited

- VMware Inc

- Citrix Systems Inc

Key Milestones in Banking Enterprise Mobility Industry Industry

- May 2022: Bank of Baroda, an Indian public sector bank, was awarded the Express BFSI Technology Awards 2022 in two categories. BoB World, the Bank's mobile banking platform, won in the Enterprise Mobility category. Analytics-driven lending through the bank's digital lending platform was adjudged the best in the Analytics/Big Data category.

- May 2022: BlackBerry Limited announced the launch of Chrome Enterprise Management with BlackBerry UEM, providing the full suite of Unified Endpoint Management (UEM) support for the growing number of devices running the popular Google Chrome OS and Chrome browser in enterprises.

Strategic Outlook for Banking Enterprise Mobility Industry Market

The strategic outlook for the banking enterprise mobility industry remains exceptionally positive, with growth accelerators centered on leveraging emerging technologies and fostering strategic alliances. The continued evolution of AI and ML will drive hyper-personalization of banking services, enhancing customer loyalty and engagement. The expansion of open banking and the increasing demand for seamless cross-border financial transactions will fuel the development of integrated mobility platforms. Furthermore, a strong focus on cybersecurity and regulatory compliance will remain paramount, driving investments in advanced security solutions. Strategic acquisitions and partnerships will be crucial for market players to expand their service offerings, geographical reach, and technological capabilities, ensuring sustained growth in this dynamic, multi-billion dollar market.

Banking Enterprise Mobility Industry Segmentation

-

1. Type

-

1.1. Solutions

- 1.1.1. Device Management

- 1.1.2. Access Management

- 1.1.3. Application Management

- 1.1.4. Other Solutions

- 1.2. Services

-

1.1. Solutions

Banking Enterprise Mobility Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Banking Enterprise Mobility Industry Regional Market Share

Geographic Coverage of Banking Enterprise Mobility Industry

Banking Enterprise Mobility Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth of Mobile Devices as the Preferred Medium of Accessing Internet

- 3.2.2 Enterprise Data

- 3.2.3 and Various Other Information; Rising Trend of BYOD

- 3.3. Market Restrains

- 3.3.1. Security Vulnerability for Manufacturing Vendors is Discouraging the Market Growth.; Government Regulations and Infrastructure Maintenance act as Market Challenges

- 3.4. Market Trends

- 3.4.1. Increase in Cyber Attacks to Drive Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Banking Enterprise Mobility Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Solutions

- 5.1.1.1. Device Management

- 5.1.1.2. Access Management

- 5.1.1.3. Application Management

- 5.1.1.4. Other Solutions

- 5.1.2. Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Banking Enterprise Mobility Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Solutions

- 6.1.1.1. Device Management

- 6.1.1.2. Access Management

- 6.1.1.3. Application Management

- 6.1.1.4. Other Solutions

- 6.1.2. Services

- 6.1.1. Solutions

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Banking Enterprise Mobility Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Solutions

- 7.1.1.1. Device Management

- 7.1.1.2. Access Management

- 7.1.1.3. Application Management

- 7.1.1.4. Other Solutions

- 7.1.2. Services

- 7.1.1. Solutions

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Banking Enterprise Mobility Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Solutions

- 8.1.1.1. Device Management

- 8.1.1.2. Access Management

- 8.1.1.3. Application Management

- 8.1.1.4. Other Solutions

- 8.1.2. Services

- 8.1.1. Solutions

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Banking Enterprise Mobility Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Solutions

- 9.1.1.1. Device Management

- 9.1.1.2. Access Management

- 9.1.1.3. Application Management

- 9.1.1.4. Other Solutions

- 9.1.2. Services

- 9.1.1. Solutions

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infosys Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Newgen Software Technologies Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 IBM Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HCL Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Microsoft Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Accenture Plc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mobile Iron Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BlackBerry Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 VMware Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Citrix Systems Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Infosys Limited

List of Figures

- Figure 1: Global Banking Enterprise Mobility Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Banking Enterprise Mobility Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Banking Enterprise Mobility Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Banking Enterprise Mobility Industry Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Banking Enterprise Mobility Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Banking Enterprise Mobility Industry Revenue (undefined), by Type 2025 & 2033

- Figure 7: Europe Banking Enterprise Mobility Industry Revenue Share (%), by Type 2025 & 2033

- Figure 8: Europe Banking Enterprise Mobility Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Banking Enterprise Mobility Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Banking Enterprise Mobility Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Asia Pacific Banking Enterprise Mobility Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Banking Enterprise Mobility Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Banking Enterprise Mobility Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Banking Enterprise Mobility Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Rest of the World Banking Enterprise Mobility Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Rest of the World Banking Enterprise Mobility Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Banking Enterprise Mobility Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Banking Enterprise Mobility Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Banking Enterprise Mobility Industry?

The projected CAGR is approximately 12.65%.

2. Which companies are prominent players in the Banking Enterprise Mobility Industry?

Key companies in the market include Infosys Limited, Newgen Software Technologies Limited, IBM Corporation, HCL Technologies, Microsoft Corporation, Accenture Plc, Mobile Iron Inc, BlackBerry Limited, VMware Inc, Citrix Systems Inc.

3. What are the main segments of the Banking Enterprise Mobility Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growth of Mobile Devices as the Preferred Medium of Accessing Internet. Enterprise Data. and Various Other Information; Rising Trend of BYOD.

6. What are the notable trends driving market growth?

Increase in Cyber Attacks to Drive Market Growth.

7. Are there any restraints impacting market growth?

Security Vulnerability for Manufacturing Vendors is Discouraging the Market Growth.; Government Regulations and Infrastructure Maintenance act as Market Challenges.

8. Can you provide examples of recent developments in the market?

May 2022: Bank of Baroda, an Indian public sector bank, announced that it had been awarded the Express BFSI Technology Awards 2022 in two categories. BoB World, the Bank's mobile banking platform, won in the Enterprise Mobility category. Analytics-driven lending through the bank's digital lending platform was adjudged the best in the Analytics/Big Data category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Banking Enterprise Mobility Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Banking Enterprise Mobility Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Banking Enterprise Mobility Industry?

To stay informed about further developments, trends, and reports in the Banking Enterprise Mobility Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence