Key Insights

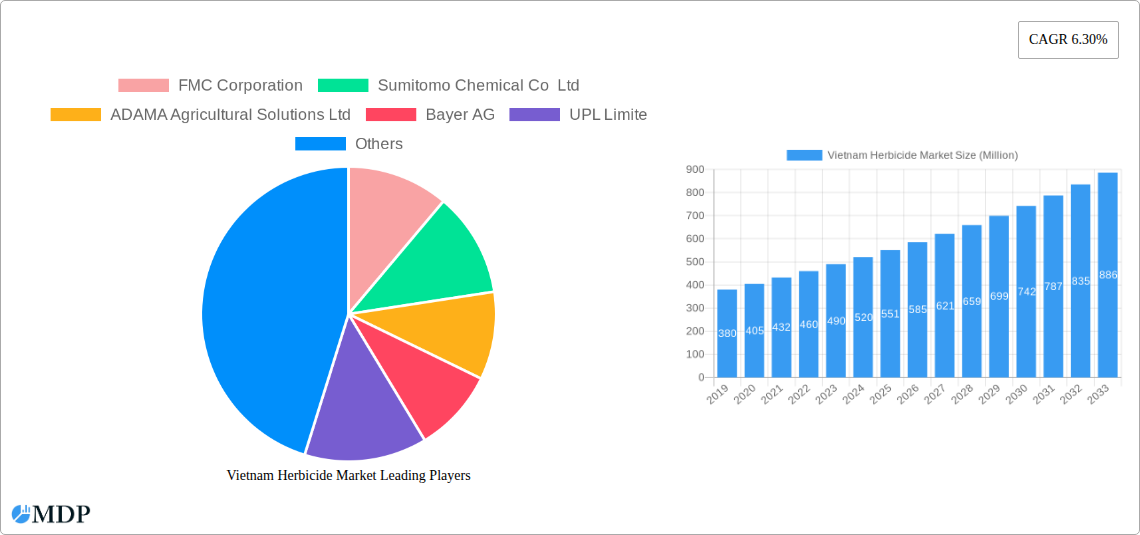

The Vietnam herbicide market is poised for robust growth, projected to reach a market size of approximately USD 520 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.30% through 2033. This expansion is primarily fueled by the escalating demand for higher crop yields to meet the needs of a growing population and increasing export opportunities for Vietnamese agricultural products. Key drivers include the imperative for efficient weed management to minimize crop losses, the adoption of advanced agricultural practices like chemigation and foliar application for enhanced efficacy and reduced environmental impact, and government initiatives promoting sustainable agriculture. The burgeoning commercial crops, fruits & vegetables, and grains & cereals sectors are expected to be the dominant consumers of herbicides, driven by their significant contribution to Vietnam's agricultural economy and export earnings. The country's favorable climate conditions and diverse cropping patterns further necessitate effective weed control solutions.

Vietnam Herbicide Market Market Size (In Million)

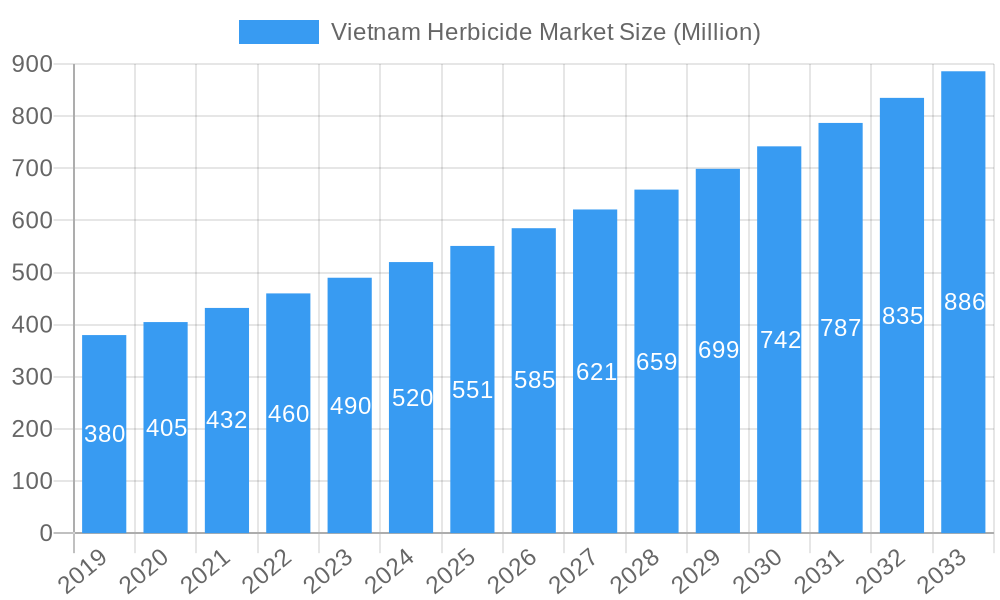

The market landscape is characterized by the presence of major global agrochemical players such as Bayer AG, Syngenta Group, and BASF SE, alongside strong domestic and regional contributors like FMC Corporation and UPL Limited. These companies are actively investing in research and development to introduce newer, more environmentally friendly herbicide formulations and integrated weed management solutions. The adoption of precision agriculture techniques, coupled with an increasing awareness among farmers regarding the economic benefits of timely and effective weed control, will further propel market expansion. While the market demonstrates strong growth potential, potential restraints such as evolving regulatory landscapes and concerns regarding herbicide resistance may necessitate strategic adaptations by market participants. Nonetheless, the overarching demand for enhanced agricultural productivity and food security positions Vietnam as a key growth market for herbicides in the Southeast Asian region.

Vietnam Herbicide Market Company Market Share

This comprehensive report delves into the dynamic Vietnam Herbicide Market, offering in-depth insights and actionable intelligence for industry stakeholders. Analyze critical market trends, competitive landscapes, and future growth trajectories for the period 2019–2033, with a focus on the base year 2025 and a forecast period extending to 2033. Our granular analysis covers key segments including Application Mode (Chemigation, Foliar, Fumigation, Soil Treatment) and Crop Type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental). The report leverages high-traffic keywords such as "Vietnam herbicide market," "crop protection Vietnam," "agricultural chemicals Vietnam," "weed control solutions," and "pesticide market Vietnam" to ensure maximum search visibility.

Vietnam Herbicide Market Market Dynamics & Concentration

The Vietnam Herbicide Market exhibits a moderate to high concentration, with leading global players like Bayer AG, Syngenta Group, FMC Corporation, UPL Limited, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, and Corteva Agriscience dominating significant market shares. The market is driven by continuous innovation in herbicide formulations, focusing on efficacy, environmental safety, and targeted weed control. Regulatory frameworks, governed by the Ministry of Agriculture and Rural Development (MARD), play a crucial role in product registration, usage guidelines, and the phasing out of certain older chemistries. The threat of product substitutes, such as biological control agents and mechanical weed management, is present but currently limited by cost-effectiveness and scalability in large-scale agriculture. End-user trends highlight a growing demand for integrated pest management (IPM) solutions, driving the adoption of selective herbicides and herbicide-tolerant crops. Mergers and acquisitions (M&A) activities, though not as frequent as in more mature markets, are strategic moves by key players to expand their product portfolios and geographical reach. For instance, in the historical period 2019-2024, we observed approximately 3-5 strategic partnerships and small-scale acquisitions aimed at bolstering R&D or distribution networks.

Vietnam Herbicide Market Industry Trends & Analysis

The Vietnam Herbicide Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period 2025–2033. This expansion is fueled by the increasing demand for higher crop yields to support Vietnam's growing population and its vital agricultural export sector. Technological disruptions are a significant driver, with a shift towards precision agriculture and the development of new-generation herbicides that offer enhanced efficacy, reduced environmental impact, and improved resistance management. The adoption of advanced application technologies, such as drone-based spraying and smart irrigation systems integrated with chemigation, is gaining traction. Consumer preferences are evolving, with a growing emphasis on food safety and sustainability, leading to increased demand for herbicides that are compliant with international standards and have a favorable toxicological profile. Competitive dynamics are characterized by intense R&D investment, strategic collaborations, and aggressive market penetration strategies by both multinational corporations and emerging local players. The market penetration of modern herbicides is steadily increasing, particularly in commercial crops and fruits & vegetables, displacing older, less efficient solutions. The rising awareness among farmers about the benefits of modern weed management practices further contributes to market growth.

Leading Markets & Segments in Vietnam Herbicide Market

The Vietnam Herbicide Market is segmented by Application Mode and Crop Type, each presenting distinct growth opportunities.

Application Mode Dominance:

- Foliar Application currently holds the largest market share, driven by its widespread use across diverse crop types due to its ease of application and rapid uptake by weeds. This method is favored by its adaptability to various farming practices in Vietnam.

- Soil Treatment is expected to witness significant growth, particularly with the introduction of pre-emergent herbicides that provide longer-lasting weed control and reduce the need for multiple applications. This segment is crucial for managing persistent weeds in crops like grains and cereals.

- Chemigation is an emerging segment, gaining traction with the increasing adoption of modern irrigation systems. Its efficiency in delivering herbicides directly to the root zone, minimizing drift and optimizing application, positions it for substantial future growth.

- Fumigation remains a niche application, primarily used for specific soil-borne weed problems in high-value crops or for pre-planting soil sterilization.

Crop Type Dominance:

- Grains & Cereals represent the largest crop segment, encompassing rice, maize, and other staple crops vital to Vietnam's food security and exports. Effective weed management in these crops is paramount for maximizing yields.

- Commercial Crops, including coffee, rubber, and sugarcane, constitute a significant market share. The economic importance of these crops necessitates robust weed control solutions to ensure profitability and consistent production.

- Fruits & Vegetables represent a high-value segment where the demand for selective herbicides that do not harm the crop is critical. The growing export market for Vietnamese produce further drives the need for advanced weed management.

- Pulses & Oilseeds are also important segments, benefiting from herbicides that improve crop establishment and yield.

- Turf & Ornamental is a smaller but growing segment, driven by the development of hospitality and recreational infrastructure.

The dominance of these segments is underpinned by Vietnam's agricultural policies promoting mechanization, crop diversification, and export competitiveness, alongside robust infrastructure supporting the distribution of agricultural inputs.

Vietnam Herbicide Market Product Developments

Product developments in the Vietnam Herbicide Market are characterized by a strong emphasis on innovation for improved efficacy and sustainability. Companies are investing in R&D to create novel herbicide chemistries and advanced formulations that offer enhanced weed control spectrum, better crop selectivity, and reduced environmental persistence. The integration of herbicide tolerance traits in crops is also a key area of development, enabling more efficient weed management. Competitive advantages are being carved out through the development of low-dose, high-potency herbicides and those with improved resistance management profiles to combat the growing challenge of weed resistance. Technological advancements are leading to the introduction of smart formulations that respond to environmental conditions, further optimizing their performance and minimizing off-target effects, thus aligning with market demands for eco-friendly and efficient solutions.

Key Drivers of Vietnam Herbicide Market Growth

Several key factors are driving the growth of the Vietnam Herbicide Market. Increasing government initiatives to boost agricultural productivity and ensure food security are paramount. The rising demand for higher crop yields to meet domestic consumption and export requirements directly translates into a greater need for effective weed control. Technological advancements in herbicide formulations, leading to more efficient and environmentally friendly products, are also significant drivers. Furthermore, the growing adoption of modern farming practices, including precision agriculture and integrated pest management, is enhancing the demand for advanced herbicide solutions. Economic factors, such as increased disposable income among farmers and access to credit, enable greater investment in crop protection technologies.

Challenges in the Vietnam Herbicide Market Market

Despite the promising growth outlook, the Vietnam Herbicide Market faces several challenges. Regulatory hurdles and stringent product registration processes can slow down the introduction of new and innovative herbicides. The increasing prevalence of weed resistance to existing herbicides necessitates continuous innovation and the development of new modes of action, which can be costly and time-consuming. Supply chain disruptions, particularly in the sourcing of active ingredients and intermediates, can impact product availability and pricing. Intense competition among local and international players can lead to price wars and compressed profit margins. Furthermore, growing environmental concerns and consumer demand for organic produce pose a long-term challenge, potentially impacting the market share of conventional herbicides.

Emerging Opportunities in Vietnam Herbicide Market

Emerging opportunities in the Vietnam Herbicide Market are ripe for exploration. The increasing adoption of digital agriculture and precision farming techniques presents a significant opportunity for smart herbicide application technologies, such as sensor-based spraying and drone integration. The development and commercialization of biological herbicides and bio-based crop protection solutions are gaining traction, aligning with the global trend towards sustainable agriculture. Strategic partnerships between global agrochemical companies and local distributors or research institutions can unlock new market segments and enhance product penetration. The growing demand for specialty herbicides tailored for high-value crops like fruits, vegetables, and medicinal plants also presents a lucrative niche. Furthermore, government support for modernizing agriculture and promoting sustainable practices creates a fertile ground for innovative and eco-friendly herbicide solutions.

Leading Players in the Vietnam Herbicide Market Sector

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- UPL Limited

- Syngenta Group

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Milestones in Vietnam Herbicide Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions, signaling a commitment to sustainable innovation in the sector.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed, highlighting strategic alliances for product development.

- October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection, underscoring the importance of R&D investment in maintaining a competitive edge.

Strategic Outlook for Vietnam Herbicide Market Market

The strategic outlook for the Vietnam Herbicide Market is one of sustained growth and evolving innovation. Future market expansion will be driven by the continuous development of advanced, residue-compliant herbicides that address weed resistance and environmental concerns. The integration of digital technologies for precision application and data-driven weed management will become increasingly critical. Strategic partnerships and collaborations will be instrumental in fostering innovation and expanding market reach, particularly for companies looking to penetrate emerging segments like biological herbicides. Furthermore, a focus on sustainable agricultural practices and the development of solutions that enhance crop health and yield while minimizing environmental impact will be key to long-term success in this dynamic market.

Vietnam Herbicide Market Segmentation

-

1. Application Mode

- 1.1. Chemigation

- 1.2. Foliar

- 1.3. Fumigation

- 1.4. Soil Treatment

-

2. Crop Type

- 2.1. Commercial Crops

- 2.2. Fruits & Vegetables

- 2.3. Grains & Cereals

- 2.4. Pulses & Oilseeds

- 2.5. Turf & Ornamental

-

3. Application Mode

- 3.1. Chemigation

- 3.2. Foliar

- 3.3. Fumigation

- 3.4. Soil Treatment

-

4. Crop Type

- 4.1. Commercial Crops

- 4.2. Fruits & Vegetables

- 4.3. Grains & Cereals

- 4.4. Pulses & Oilseeds

- 4.5. Turf & Ornamental

Vietnam Herbicide Market Segmentation By Geography

- 1. Vietnam

Vietnam Herbicide Market Regional Market Share

Geographic Coverage of Vietnam Herbicide Market

Vietnam Herbicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Herbicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 5.1.1. Chemigation

- 5.1.2. Foliar

- 5.1.3. Fumigation

- 5.1.4. Soil Treatment

- 5.2. Market Analysis, Insights and Forecast - by Crop Type

- 5.2.1. Commercial Crops

- 5.2.2. Fruits & Vegetables

- 5.2.3. Grains & Cereals

- 5.2.4. Pulses & Oilseeds

- 5.2.5. Turf & Ornamental

- 5.3. Market Analysis, Insights and Forecast - by Application Mode

- 5.3.1. Chemigation

- 5.3.2. Foliar

- 5.3.3. Fumigation

- 5.3.4. Soil Treatment

- 5.4. Market Analysis, Insights and Forecast - by Crop Type

- 5.4.1. Commercial Crops

- 5.4.2. Fruits & Vegetables

- 5.4.3. Grains & Cereals

- 5.4.4. Pulses & Oilseeds

- 5.4.5. Turf & Ornamental

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Application Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nufarm Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BASF SE

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: Vietnam Herbicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Vietnam Herbicide Market Share (%) by Company 2025

List of Tables

- Table 1: Vietnam Herbicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 2: Vietnam Herbicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 3: Vietnam Herbicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 4: Vietnam Herbicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 5: Vietnam Herbicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Vietnam Herbicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 7: Vietnam Herbicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 8: Vietnam Herbicide Market Revenue undefined Forecast, by Application Mode 2020 & 2033

- Table 9: Vietnam Herbicide Market Revenue undefined Forecast, by Crop Type 2020 & 2033

- Table 10: Vietnam Herbicide Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Herbicide Market?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Vietnam Herbicide Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, UPL Limite, Syngenta Group, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the Vietnam Herbicide Market?

The market segments include Application Mode, Crop Type, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Herbicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Herbicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Herbicide Market?

To stay informed about further developments, trends, and reports in the Vietnam Herbicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence