Key Insights

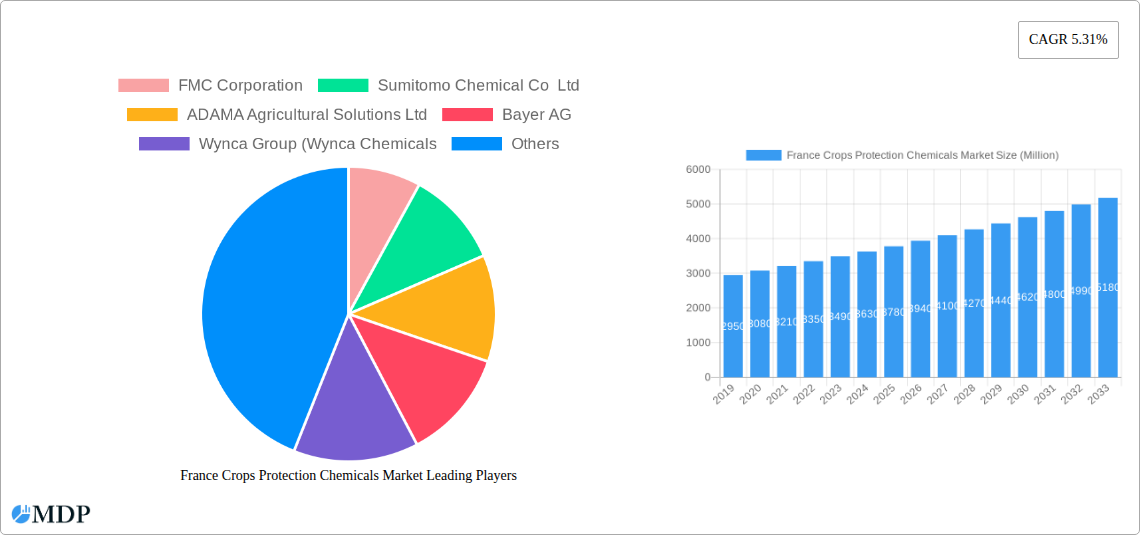

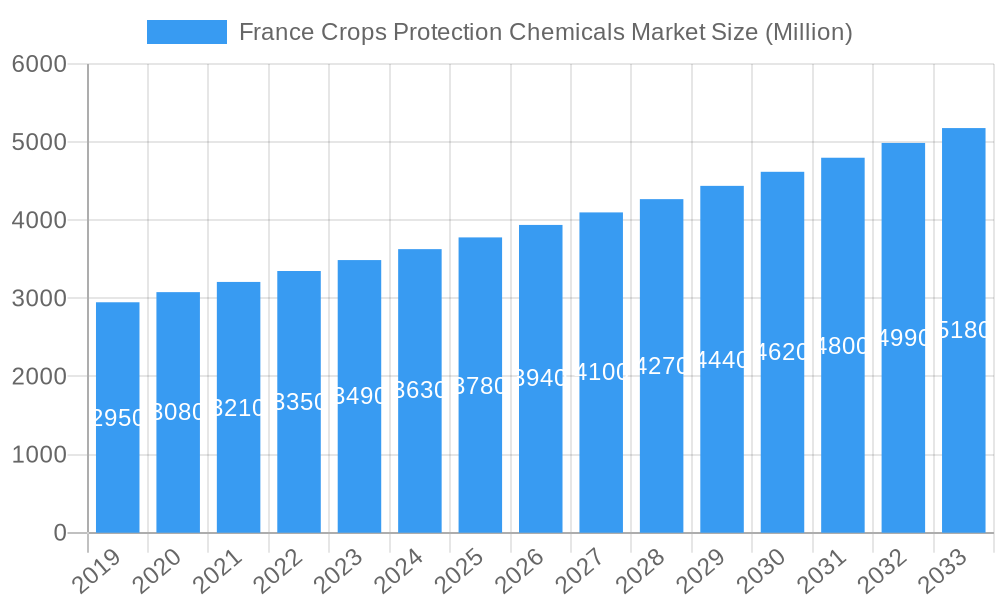

The French crop protection chemicals market is set for substantial growth, with a projected market size of 87.4 billion in 2025. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 4.6%, forecasting the market to reach an estimated value by 2033. Key growth factors include the increasing demand for higher crop yields to support a growing population and a competitive agricultural sector. The adoption of advanced farming techniques, greater emphasis on pest and disease management, and government support for agricultural productivity are also significant contributors. The market is segmented by application, with fungicides, herbicides, and insecticides holding the largest share due to their crucial role in crop defense. Chemigation and foliar application methods are expected to see increased adoption for efficient and targeted delivery of crop protection solutions. The cultivation of grains and cereals, fruits and vegetables, and commercial crops underpins market demand, underscoring the importance of these chemicals for food security and farm profitability in France.

France Crops Protection Chemicals Market Market Size (In Billion)

The competitive environment for crop protection chemicals in France features prominent global companies such as Bayer AG, Syngenta Group, BASF SE, and Corteva Agriscience, along with key regional players like FMC Corporation and UPL Limited. These companies are investing in research and development to create innovative formulations that enhance efficacy, minimize environmental impact, and improve safety. Emerging trends include the integration of precision agriculture, the development of biological crop protection alternatives, and a growing focus on sustainable farming practices. However, challenges such as stringent regulatory frameworks for agrochemicals, environmental sustainability concerns, and the emergence of pest resistance to existing treatments persist. Successfully navigating these complexities and leveraging the strong demand for effective crop protection solutions will be critical for market participants in the evolving French agricultural landscape.

France Crops Protection Chemicals Market Company Market Share

France Crop Protection Chemicals Market: Key Trends, Market Size, and Future Outlook (2025-2033)

This comprehensive report offers deep insights into the French crop protection chemicals market from 2025 to 2033. With a base year of 2025, the analysis explores market dynamics, significant trends, leading segments, and future projections. Understand the strategies of key players like FMC Corporation, Syngenta Group, Bayer AG, and BASF SE, the impact of industry innovations, and navigate the regulatory environment. This report is invaluable for agricultural input manufacturers, distributors, researchers, and policymakers aiming to capitalize on the evolving needs of French agriculture.

Market Size and Forecast: The France crop protection chemicals market is projected to reach approximately 87.4 billion by 2033, demonstrating a CAGR of 4.6% during the forecast period (2025-2033). Historical data indicates a consistent growth trajectory fueled by agricultural modernization and the increasing demand for improved crop yields.

France Crops Protection Chemicals Market Market Dynamics & Concentration

The France crop protection chemicals market is characterized by a moderate to high concentration, with a few key global players dominating significant market share. The innovation drivers are primarily focused on developing more sustainable, targeted, and efficient crop protection solutions to address evolving pest resistance, environmental concerns, and regulatory pressures. Regulatory frameworks, spearheaded by the European Union and French agricultural policies, play a crucial role in shaping market access and product approvals, emphasizing safety and environmental impact. Product substitutes, including biological control agents and integrated pest management (IPM) strategies, are gaining traction, influencing the demand for conventional chemicals. End-user trends reveal a growing preference for precision agriculture techniques and products that minimize environmental footprint, pushing manufacturers towards R&D in bio-based and low-impact solutions. Merger and acquisition (M&A) activities, though perhaps less frequent in recent times, have historically consolidated market power and expanded portfolios. The M&A deal count in this segment has been approximately XX over the past five years, indicating strategic consolidations and market expansion efforts. Key companies like Bayer AG and Syngenta Group maintain substantial market influence through extensive product portfolios and strong distribution networks.

France Crops Protection Chemicals Market Industry Trends & Analysis

The France crop protection chemicals market is experiencing a significant transformation driven by a confluence of factors including the imperative for enhanced food security, the increasing sophistication of agricultural practices, and the unyielding pressure to adopt more environmentally sustainable methods. Market growth drivers are predominantly fueled by the need to protect high-value crops from a diverse array of pests, diseases, and weeds that threaten yield and quality. The CAGR for the market is estimated to be around XX% during the forecast period, reflecting robust expansion. Technological disruptions, such as the integration of digital farming solutions and precision application technologies, are revolutionizing how crop protection chemicals are used. These innovations enable more targeted application, thereby reducing chemical usage and minimizing off-target effects. Consumer preferences are increasingly leaning towards sustainably produced food, which indirectly influences the demand for crop protection solutions that align with these values. This translates to a growing market penetration for products that are perceived as safer and more eco-friendly. The competitive landscape is dynamic, with established global giants and agile regional players vying for market dominance. Companies are investing heavily in research and development to bring novel active ingredients and formulations to market that offer improved efficacy, reduced environmental impact, and better resistance management. The market penetration of advanced crop protection solutions is steadily increasing as farmers recognize their long-term economic and environmental benefits. Furthermore, the ongoing challenges posed by climate change, leading to new pest pressures and disease outbreaks, necessitate continuous innovation and adaptation within the crop protection sector. The adoption of novel herbicides, fungicides, and insecticides is crucial for maintaining agricultural productivity and ensuring the economic viability of farming operations across France.

Leading Markets & Segments in France Crops Protection Chemicals Market

The France crop protection chemicals market is characterized by the strong dominance of specific segments, driven by the country's agricultural landscape and crop production priorities.

Dominant Segments by Function:

- Herbicides: This segment holds a significant share due to the widespread cultivation of grains and cereals, as well as commercial crops, where effective weed management is paramount for maximizing yields. The economic policies promoting crop efficiency and the high cost of manual weed control further bolster herbicide demand.

- Fungicides: Given France's significant production of fruits, vegetables, and wine grapes, fungal diseases pose a persistent threat. The emphasis on disease-free produce for both domestic consumption and export markets makes fungicides a critical component of crop protection. The increasing frequency of favorable weather conditions for fungal growth further amplifies their importance.

- Insecticides: While not as dominant as herbicides or fungicides, insecticides are crucial for protecting a wide array of crops, including fruits, vegetables, and commercial crops, from damaging insect infestations. The growing consumer demand for aesthetically pleasing and pest-free produce contributes to the sustained need for effective insecticide solutions.

Dominant Segments by Application Mode:

- Foliar Application: This is the most prevalent application mode across various crop types. Its versatility in delivering protection directly to plant surfaces makes it highly effective for fungicides, insecticides, and some herbicides. The ease of use and broad applicability contribute to its market leadership.

- Seed Treatment: With advancements in seed technology, seed treatment has gained considerable traction, especially for grains, cereals, and pulses. This method provides early-stage protection against soil-borne pests and diseases, leading to improved germination and seedling vigor, thereby enhancing overall crop establishment and yield potential.

Dominant Segments by Crop Type:

- Grains & Cereals: As a major agricultural producer, France's extensive cultivation of wheat, barley, and corn makes this segment a cornerstone of the crop protection chemicals market. The need for robust weed, disease, and pest control to ensure high yields for these staple crops is substantial.

- Fruits & Vegetables: This segment commands significant market value due to the high unit price of produce and the stringent quality standards required for both domestic and international markets. The diverse range of pests and diseases affecting fruits and vegetables necessitates a broad spectrum of protection solutions. The economic policies supporting high-value agriculture further reinforce the demand within this segment.

- Commercial Crops: This broad category, encompassing crops like oilseeds and other industrial plants, also contributes significantly to the demand for crop protection chemicals, driven by their economic importance in various value chains.

France Crops Protection Chemicals Market Product Developments

The France crop protection chemicals market is witnessing a surge in product innovations focused on enhancing efficacy, reducing environmental impact, and combating resistance. Companies are actively developing advanced formulations, including microencapsulated products and targeted delivery systems, to improve the precision and longevity of protection. Key trends include the development of novel active ingredients with unique modes of action and the expansion of bio-pesticide portfolios. These innovations aim to offer farmers more sustainable and integrated pest management (IPM) solutions that align with stringent regulatory requirements and growing consumer demand for eco-friendly produce. The competitive advantage for market players lies in their ability to introduce differentiated products that address specific pest challenges while adhering to evolving environmental standards.

Key Drivers of France Crops Protection Chemicals Market Growth

The growth of the France crop protection chemicals market is propelled by several key factors. Technologically, the increasing adoption of precision agriculture and digital farming tools enables more targeted and efficient application of crop protection agents, optimizing their effectiveness and minimizing environmental impact. Economically, the need to enhance crop yields and quality to meet growing global food demand, coupled with rising input costs for farmers, drives the demand for effective solutions. Regulatory frameworks, while stringent, also encourage innovation towards safer and more sustainable products, creating opportunities for companies developing advanced solutions. For instance, the push for reduced pesticide use encourages the development of highly potent, low-application rate products.

Challenges in the France Crops Protection Chemicals Market Market

Despite robust growth prospects, the France crop protection chemicals market faces significant challenges. Stringent regulatory hurdles, particularly from the European Union, often lead to lengthy approval processes for new active ingredients and can restrict the use of existing ones, impacting product availability. Supply chain disruptions, exacerbated by global geopolitical events and logistical complexities, can affect the timely delivery of essential chemicals to farmers. Furthermore, the increasing prevalence of pest and disease resistance to conventional chemicals necessitates continuous research and development efforts, adding to product lifecycle costs and market volatility. Competitive pressures from both established global players and emerging biological alternatives also present a constant challenge.

Emerging Opportunities in France Crops Protection Chemicals Market

The France crop protection chemicals market is ripe with emerging opportunities driven by technological breakthroughs and evolving agricultural practices. The growing demand for sustainable agriculture is creating a significant market for biopesticides and integrated pest management (IPM) solutions, offering a substantial growth avenue for companies investing in these areas. Strategic partnerships between chemical manufacturers, technology providers, and research institutions are fostering innovation in areas like drone-based application and AI-driven pest detection, leading to more efficient and targeted crop protection. Furthermore, market expansion strategies focusing on niche crop segments and addressing specific regional pest challenges can unlock new revenue streams.

Leading Players in the France Crops Protection Chemicals Market Sector

- FMC Corporation

- Sumitomo Chemical Co Ltd

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group

- Syngenta Group

- UPL Limited

- Corteva Agriscience

- Nufarm Ltd

- BASF SE

Key Milestones in France Crops Protection Chemicals Market Industry

- January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

- November 2022: Syngenta launched the new A.I.R. TM technology, which is the most powerful herbicide tolerance system for sunflower agriculture that helps farmers in Europe overcome the difficulties associated with weed management.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

Strategic Outlook for France Crops Protection Chemicals Market Market

The strategic outlook for the France crop protection chemicals market is characterized by a strong emphasis on innovation and sustainability. Growth accelerators include the continued development and adoption of precision agriculture technologies, which enable optimized chemical application and reduced environmental impact. The increasing market demand for biological control agents and organic solutions presents a significant opportunity for diversification and market expansion. Strategic partnerships aimed at developing novel, eco-friendly crop protection products will be crucial for maintaining competitive advantage. Furthermore, companies that can effectively navigate the evolving regulatory landscape and demonstrate a commitment to sustainable farming practices are poised for long-term success in this dynamic market.

France Crops Protection Chemicals Market Segmentation

-

1. Function

- 1.1. Fungicide

- 1.2. Herbicide

- 1.3. Insecticide

- 1.4. Molluscicide

- 1.5. Nematicide

-

2. Application Mode

- 2.1. Chemigation

- 2.2. Foliar

- 2.3. Fumigation

- 2.4. Seed Treatment

- 2.5. Soil Treatment

-

3. Crop Type

- 3.1. Commercial Crops

- 3.2. Fruits & Vegetables

- 3.3. Grains & Cereals

- 3.4. Pulses & Oilseeds

- 3.5. Turf & Ornamental

-

4. Function

- 4.1. Fungicide

- 4.2. Herbicide

- 4.3. Insecticide

- 4.4. Molluscicide

- 4.5. Nematicide

-

5. Application Mode

- 5.1. Chemigation

- 5.2. Foliar

- 5.3. Fumigation

- 5.4. Seed Treatment

- 5.5. Soil Treatment

-

6. Crop Type

- 6.1. Commercial Crops

- 6.2. Fruits & Vegetables

- 6.3. Grains & Cereals

- 6.4. Pulses & Oilseeds

- 6.5. Turf & Ornamental

France Crops Protection Chemicals Market Segmentation By Geography

- 1. France

France Crops Protection Chemicals Market Regional Market Share

Geographic Coverage of France Crops Protection Chemicals Market

France Crops Protection Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Various social and economic factors are reasons for the increased use of herbicides in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Crops Protection Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Fungicide

- 5.1.2. Herbicide

- 5.1.3. Insecticide

- 5.1.4. Molluscicide

- 5.1.5. Nematicide

- 5.2. Market Analysis, Insights and Forecast - by Application Mode

- 5.2.1. Chemigation

- 5.2.2. Foliar

- 5.2.3. Fumigation

- 5.2.4. Seed Treatment

- 5.2.5. Soil Treatment

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Commercial Crops

- 5.3.2. Fruits & Vegetables

- 5.3.3. Grains & Cereals

- 5.3.4. Pulses & Oilseeds

- 5.3.5. Turf & Ornamental

- 5.4. Market Analysis, Insights and Forecast - by Function

- 5.4.1. Fungicide

- 5.4.2. Herbicide

- 5.4.3. Insecticide

- 5.4.4. Molluscicide

- 5.4.5. Nematicide

- 5.5. Market Analysis, Insights and Forecast - by Application Mode

- 5.5.1. Chemigation

- 5.5.2. Foliar

- 5.5.3. Fumigation

- 5.5.4. Seed Treatment

- 5.5.5. Soil Treatment

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Commercial Crops

- 5.6.2. Fruits & Vegetables

- 5.6.3. Grains & Cereals

- 5.6.4. Pulses & Oilseeds

- 5.6.5. Turf & Ornamental

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. France

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Chemical Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ADAMA Agricultural Solutions Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wynca Group (Wynca Chemicals

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UPL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nufarm Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: France Crops Protection Chemicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Crops Protection Chemicals Market Share (%) by Company 2025

List of Tables

- Table 1: France Crops Protection Chemicals Market Revenue billion Forecast, by Function 2020 & 2033

- Table 2: France Crops Protection Chemicals Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 3: France Crops Protection Chemicals Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 4: France Crops Protection Chemicals Market Revenue billion Forecast, by Function 2020 & 2033

- Table 5: France Crops Protection Chemicals Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 6: France Crops Protection Chemicals Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 7: France Crops Protection Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: France Crops Protection Chemicals Market Revenue billion Forecast, by Function 2020 & 2033

- Table 9: France Crops Protection Chemicals Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 10: France Crops Protection Chemicals Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 11: France Crops Protection Chemicals Market Revenue billion Forecast, by Function 2020 & 2033

- Table 12: France Crops Protection Chemicals Market Revenue billion Forecast, by Application Mode 2020 & 2033

- Table 13: France Crops Protection Chemicals Market Revenue billion Forecast, by Crop Type 2020 & 2033

- Table 14: France Crops Protection Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Crops Protection Chemicals Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the France Crops Protection Chemicals Market?

Key companies in the market include FMC Corporation, Sumitomo Chemical Co Ltd, ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, Corteva Agriscience, Nufarm Ltd, BASF SE.

3. What are the main segments of the France Crops Protection Chemicals Market?

The market segments include Function, Application Mode, Crop Type, Function, Application Mode, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Various social and economic factors are reasons for the increased use of herbicides in the country.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.November 2022: Syngenta launched the new A.I.R. TM technology, which is the most powerful herbicide tolerance system for sunflower agriculture that helps farmers in Europe overcome the difficulties associated with weed management.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Crops Protection Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Crops Protection Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Crops Protection Chemicals Market?

To stay informed about further developments, trends, and reports in the France Crops Protection Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence