Key Insights

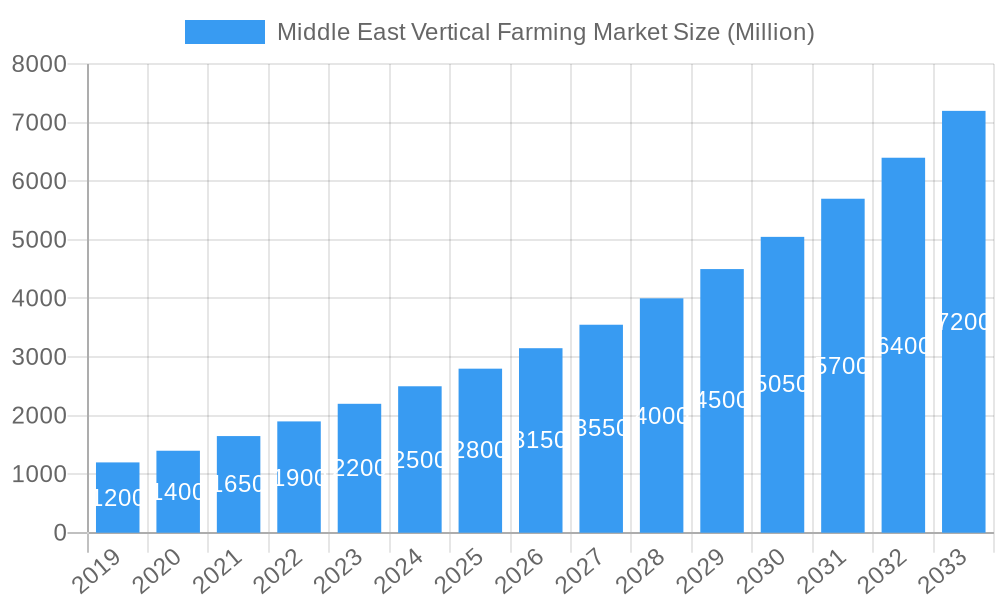

The Middle East Vertical Farming Market is poised for remarkable expansion, projected to reach approximately USD 8,000 million by 2033, driven by a compelling compound annual growth rate (CAGR) of 14.20% from its estimated 2025 value of USD 2,800 million. This significant surge is propelled by a confluence of factors, most notably the region's pressing need for enhanced food security and reduced reliance on imports. Governments across the Middle East are actively investing in and promoting vertical farming as a strategic solution to combat water scarcity and arid conditions, leveraging advanced technologies like hydroponics, aeroponics, and aquaponics. Key market drivers include increasing consumer demand for fresh, locally sourced produce year-round, government initiatives supporting sustainable agriculture, and the declining cost of LED lighting and automation technologies, which are making vertical farms more economically viable. The market is also benefiting from a growing awareness of the environmental advantages of vertical farming, such as reduced water usage and minimized pesticide application.

Middle East Vertical Farming Market Market Size (In Billion)

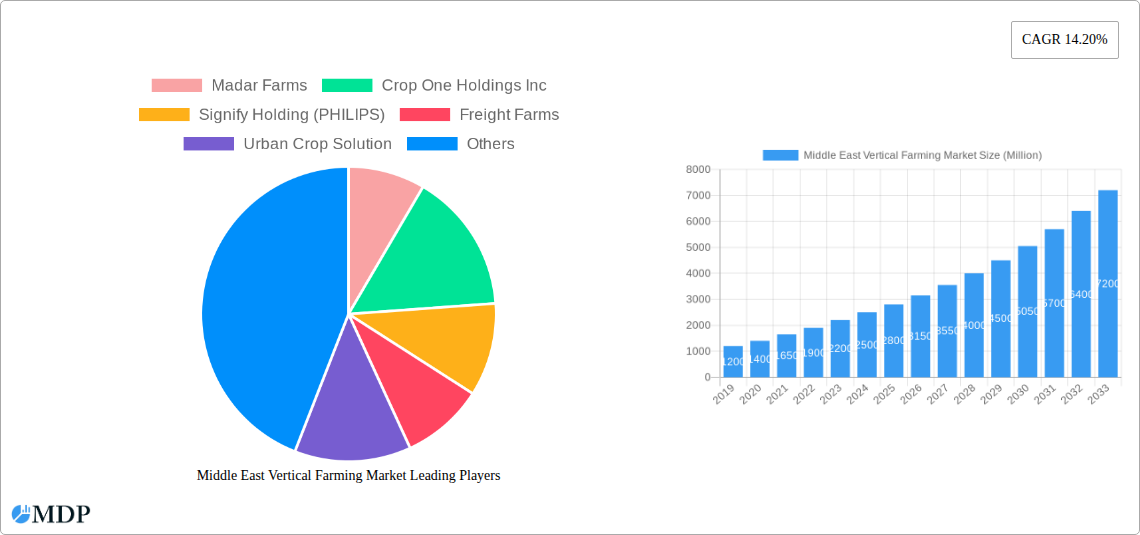

The competitive landscape is characterized by the presence of innovative companies like Madar Farms, Crop One Holdings Inc., Signify Holding (PHILIPS), Freight Farms, Urban Crop Solution, Intelligent Growth Solutions, and AeroFarms, all contributing to the market's dynamism. These players are focused on developing scalable and efficient vertical farming systems, alongside partnerships with local entities to establish robust supply chains. The market's segmentation includes detailed production and consumption analyses, alongside robust import and export market analyses (both value and volume). Price trend analysis further highlights the evolving economics of the sector. Regionally, the Middle East, encompassing countries like Saudi Arabia, the United Arab Emirates, and Israel, is experiencing substantial growth, with significant investments being channeled into developing large-scale vertical farms. Emerging trends point towards increased adoption of AI and machine learning for optimizing crop yields and resource management, alongside a growing emphasis on specialized crop cultivation to meet diverse consumer preferences. While the initial capital investment for setting up vertical farms can be a restraint, the long-term benefits in terms of resource efficiency and consistent produce availability are steadily overcoming these challenges, paving the way for sustained market dominance.

Middle East Vertical Farming Market Company Market Share

Unlock the immense potential of the burgeoning Middle East vertical farming market with this comprehensive, SEO-optimized report. Dive deep into market dynamics, industry trends, leading players, and future opportunities shaping this transformative sector. This report provides actionable intelligence for investors, agritech companies, and government bodies seeking to capitalize on the region's drive for food security and sustainable agriculture. Our analysis covers the Study Period (2019–2033), with a Base Year (2025), Estimated Year (2025), and a detailed Forecast Period (2025–2033), drawing on extensive Historical Data (2019–2024).

Middle East Vertical Farming Market Market Dynamics & Concentration

The Middle East vertical farming market is characterized by a moderate concentration, with key players actively investing in scaling operations and technological advancements. Innovation drivers are primarily centered on enhancing crop yields, reducing water consumption, and optimizing energy efficiency through LED lighting and advanced climate control systems. Regulatory frameworks are evolving, with governments in countries like the UAE and Saudi Arabia actively promoting agri-tech through supportive policies, subsidies, and land allocation initiatives to bolster food security and reduce import dependency. Product substitutes, while traditional, are gradually being outcompeted by the consistent quality and year-round availability offered by vertical farms, especially for high-value crops like leafy greens and herbs. End-user trends reflect a growing consumer demand for locally sourced, fresh, and pesticide-free produce, directly aligning with the value proposition of vertical farming. Merger and acquisition (M&A) activities, while still nascent, are expected to increase as larger corporations and investment funds recognize the strategic importance and growth potential of this sector. The market is witnessing a steady influx of new entrants alongside consolidation among established players, indicating a dynamic and competitive landscape.

Middle East Vertical Farming Market Industry Trends & Analysis

The Middle East vertical farming market is experiencing robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of xx% over the forecast period. This expansion is driven by a confluence of factors, including the region's arid climate, increasing water scarcity, and a strong governmental push towards achieving food self-sufficiency. Technological disruptions are at the forefront of this growth, with advancements in hydroponics, aeroponics, and aquaponics systems, coupled with sophisticated Artificial Intelligence (AI) and Internet of Things (IoT) integration for precise environmental control, dramatically improving operational efficiency and crop yields. Consumer preferences are increasingly shifting towards locally grown, high-quality, and sustainable produce, creating a strong demand for vertical farm products that can consistently meet these criteria. Competitive dynamics are intensifying as both established international players and emerging local companies vie for market share. Key market penetration strategies involve strategic partnerships with food retailers, restaurants, and hospitality sectors, as well as direct-to-consumer models. The development of specialized lighting solutions, automation technologies, and water recycling systems are further accelerating market adoption and operational viability. The demand for specific crop types, such as leafy greens, herbs, and certain fruits, is particularly strong, driving focused investment in specialized vertical farming facilities. Market penetration is projected to reach xx% by the end of the forecast period, indicating a significant shift in the region's agricultural landscape.

Leading Markets & Segments in Middle East Vertical Farming Market

The United Arab Emirates (UAE) stands out as the leading market within the Middle East vertical farming sector, propelled by visionary government initiatives, substantial foreign investment, and a concentrated focus on food security.

- Production Analysis: The UAE leads in the establishment of large-scale, technologically advanced vertical farms, driven by substantial investments from both government entities and private corporations. Saudi Arabia is rapidly emerging as a significant player, with increasing investments in agricultural technology and vertical farming projects aimed at diversifying its economy and enhancing food production.

- Consumption Analysis: Demand is highest in urban centers across the GCC, particularly in Dubai, Abu Dhabi, and Riyadh, where a growing population and a discerning consumer base prioritize fresh, locally sourced, and high-quality produce. The food service and hospitality sectors are significant consumers, driving demand for consistent supply of premium ingredients.

- Import Market Analysis (Value & Volume): While the region has historically relied heavily on imports for fresh produce, the growth of domestic vertical farming is gradually moderating import volumes. Key import markets for vertical farming equipment and technologies remain strong, indicating continued investment in infrastructure. The import market for specific high-value seeds and nutrients also remains significant.

- Export Market Analysis (Value & Volume): Currently, the export market for vertically farmed produce from the Middle East is nascent but shows potential for growth, particularly for specialized crops destined for neighboring countries or niche international markets. The focus remains primarily on fulfilling domestic demand.

- Price Trend Analysis: The price of vertically farmed produce in the Middle East is generally at a premium compared to conventionally grown produce, reflecting higher operational costs associated with advanced technology and energy consumption. However, price trends are expected to stabilize and potentially decrease as economies of scale are achieved and energy efficiency improves.

Middle East Vertical Farming Market Product Developments

Product developments in the Middle East vertical farming market are characterized by a strong emphasis on localized solutions and technological integration. Innovations are focused on optimizing crop yields for regional climate conditions, developing energy-efficient LED lighting systems tailored for specific crops, and implementing advanced automation for planting, harvesting, and monitoring. The integration of AI and IoT platforms to manage environmental parameters, predict crop cycles, and ensure resource optimization is a key trend. Furthermore, there is a growing focus on developing closed-loop systems that maximize water recirculation and nutrient management, thereby enhancing sustainability. The development of modular and scalable vertical farming units is also gaining traction, catering to diverse operational needs from small-scale urban farms to large commercial ventures.

Key Drivers of Middle East Vertical Farming Market Growth

Several key drivers are propelling the growth of the Middle East vertical farming market. Government support and initiatives for food security and sustainable agriculture, including subsidies and favorable policies, are paramount. Growing awareness of food security challenges due to climate change and water scarcity necessitates innovative agricultural solutions. Rapid advancements in agri-tech, such as AI, IoT, and automation, are making vertical farming more efficient and cost-effective. Increasing consumer demand for fresh, healthy, and locally sourced produce, free from pesticides, is a significant market pull. Finally, significant investments from both public and private sectors are providing the capital necessary for the expansion and technological advancement of the industry.

Challenges in the Middle East Vertical Farming Market Market

Despite its promising growth, the Middle East vertical farming market faces several challenges. High initial capital investment required for setting up advanced vertical farms is a significant barrier for some potential investors. Elevated energy consumption, particularly for lighting and climate control in the hot regional climate, poses an ongoing operational cost challenge, though advancements in energy-efficient technologies are mitigating this. A shortage of skilled labor with expertise in vertical farming operations and technology management can hinder scalability. Regulatory hurdles and complexities in obtaining permits and licenses can slow down project development. Competition from established, lower-cost imported produce continues to be a factor, necessitating effective market positioning and branding.

Emerging Opportunities in Middle East Vertical Farming Market

Emerging opportunities in the Middle East vertical farming market are substantial and diverse. Technological breakthroughs in areas like renewable energy integration (e.g., solar power), advanced nutrient management, and AI-driven predictive analytics offer pathways to further reduce operational costs and enhance yields. Strategic partnerships between technology providers, farm operators, and end-users (e.g., retailers, food service companies) are crucial for market penetration and establishing robust supply chains. Market expansion into new crop varieties, beyond leafy greens and herbs, such as berries, tomatoes, and even certain root vegetables, presents significant untapped potential. The development of “farm-to-fork” traceability solutions and direct-to-consumer (DTC) models can enhance brand loyalty and capture higher margins. Furthermore, the ongoing drive for economic diversification in the region creates a fertile ground for the growth of the agri-tech sector.

Leading Players in the Middle East Vertical Farming Market Sector

- Madar Farms

- Crop One Holdings Inc

- Signify Holding (PHILIPS)

- Freight Farms

- Urban Crop Solution

- Intelligent Growth Solutions

- Aero Farms

Key Milestones in Middle East Vertical Farming Market Industry

- November 2022: AeroFarms announced its plan to expand further in the Middle East with a partnership with QFZA and Doha Venture Capital (DVC) to build a commercial indoor vertical farm in Qatar Free Zones (QFZ) that offers unparalleled connectivity and access to the region.

- July 2022: Crop One Holdings and Emirates Flight Catering opened the world's largest vertical farm in Dubai. The 330,000-square-foot facility is located in Dubai, United Arab Emirates, near Al Maktoum International Airport at Dubai World Central. It has the capacity to produce over 2 million pounds of leafy greens annually.

- February 2022: Silal, Abu Dhabi's leading fresh produce and agri-tech company, and AeroFarms signed a Memorandum of Understanding (MoU) to forge a long-term research and development collaboration involving knowledge and technology transfer of advanced farming systems to local farmers.

Strategic Outlook for Middle East Vertical Farming Market Market

The strategic outlook for the Middle East vertical farming market is exceptionally strong, driven by an unwavering commitment to food security and sustainability. Future growth accelerators include the continued adoption of cutting-edge technologies such as AI-powered farm management systems and advanced automation, leading to increased efficiency and reduced operational costs. The expansion of renewable energy integration to power vertical farms will further enhance their sustainability credentials and mitigate energy price volatility. Strategic collaborations between regional governments, international technology providers, and local agri-businesses will continue to foster innovation and market penetration. Furthermore, the diversification of crop portfolios beyond leafy greens and herbs into more complex produce will unlock new revenue streams and broaden market appeal. The region's proactive approach to embracing innovation positions it as a global leader in the vertical farming revolution.

Middle East Vertical Farming Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

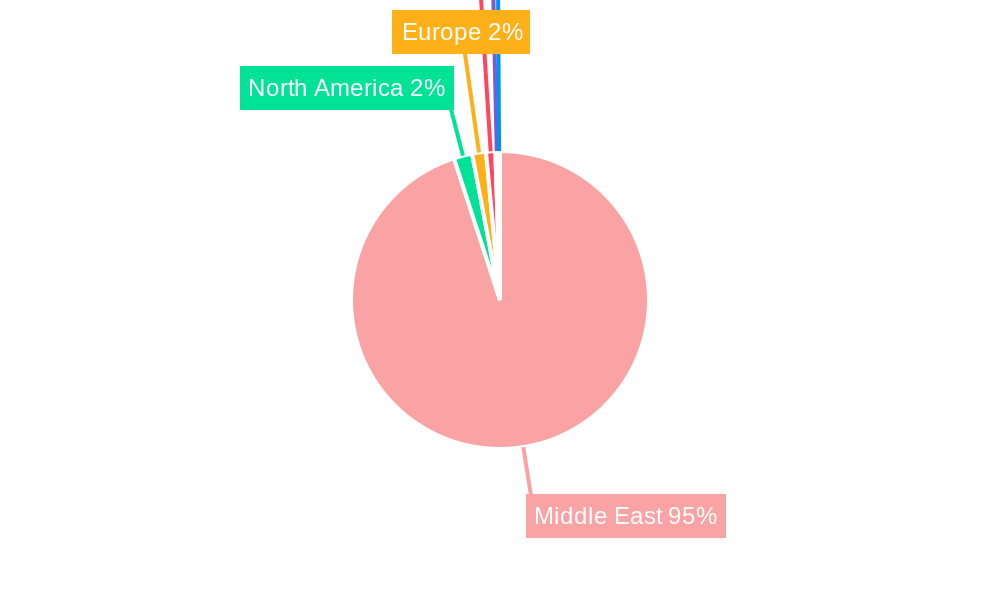

Middle East Vertical Farming Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Vertical Farming Market Regional Market Share

Geographic Coverage of Middle East Vertical Farming Market

Middle East Vertical Farming Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Emphasis of GCC Countries on Food Security

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Vertical Farming Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Madar Farms

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Crop One Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Signify Holding (PHILIPS)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Freight Farms

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Urban Crop Solution

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Intelligent Growth Solutions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aero Farms

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Madar Farms

List of Figures

- Figure 1: Middle East Vertical Farming Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Vertical Farming Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Vertical Farming Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Middle East Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Middle East Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Middle East Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Middle East Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Middle East Vertical Farming Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Middle East Vertical Farming Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Middle East Vertical Farming Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Middle East Vertical Farming Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Middle East Vertical Farming Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Middle East Vertical Farming Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Middle East Vertical Farming Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Arab Emirates Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Israel Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Qatar Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Kuwait Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Oman Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bahrain Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Jordan Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Lebanon Middle East Vertical Farming Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Vertical Farming Market?

The projected CAGR is approximately 14.20%.

2. Which companies are prominent players in the Middle East Vertical Farming Market?

Key companies in the market include Madar Farms, Crop One Holdings Inc, Signify Holding (PHILIPS), Freight Farms, Urban Crop Solution, Intelligent Growth Solutions, Aero Farms.

3. What are the main segments of the Middle East Vertical Farming Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Emphasis of GCC Countries on Food Security.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

November 2022: AeroFarms announced its plan to expand further in the Middle East with a partnership with QFZA and Doha Venture Capital (DVC) to build a commercial indoor vertical farm in Qatar Free Zones (QFZ) that offers unparalleled connectivity and access to the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Vertical Farming Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Vertical Farming Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Vertical Farming Market?

To stay informed about further developments, trends, and reports in the Middle East Vertical Farming Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence