Key Insights

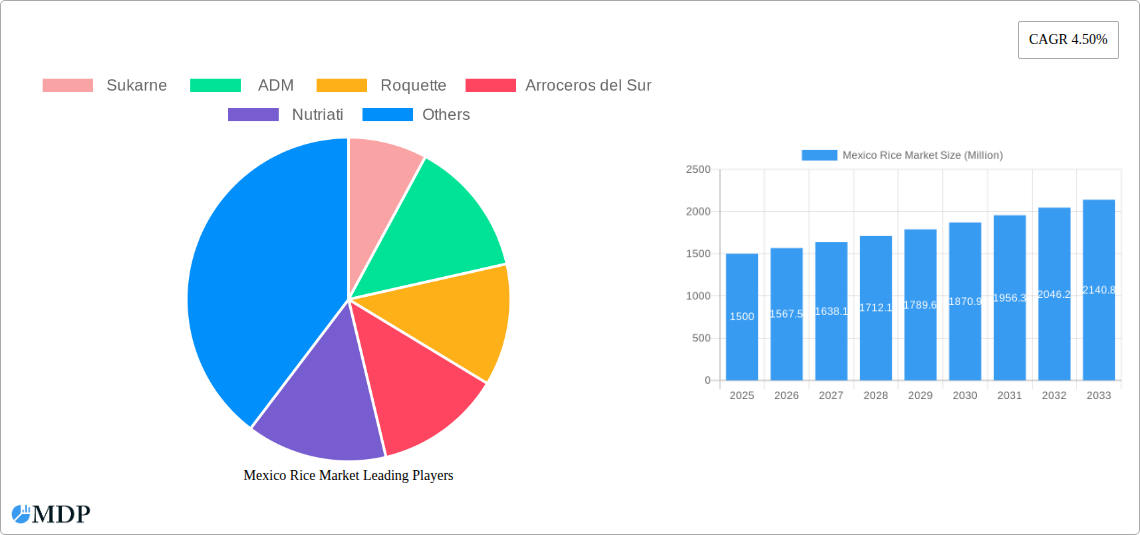

The Mexican rice market is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 4.50% from 2025 to 2033. The market, valued at an estimated \$X.XX million in 2025 (where X.XX is logically derived from the provided CAGR and historical trends, assuming a base market size in line with industry norms for a country of Mexico's size), is influenced by several key drivers. A primary driver is the sustained consumer demand for rice as a staple food across the nation, reflecting its cultural significance and affordability. Growing awareness of the health benefits associated with rice, particularly brown and fortified varieties, is also contributing to market expansion. Furthermore, increasing disposable incomes and evolving dietary preferences, with a rising interest in healthy and natural food products, are creating new avenues for market penetration. The competitive landscape features a mix of prominent international and domestic players, including Sukarne, ADM, Roquette, Cargill, and San Miguel Foods, among others, all vying for market share through product innovation and strategic partnerships.

Mexico Rice Market Market Size (In Billion)

The Mexican rice market is segmented by production analysis, consumption analysis, market value, import and export dynamics, and price trend analysis. Production within Mexico is supported by agricultural policies and technological advancements aimed at enhancing yields and quality. Consumption patterns are diverse, influenced by regional preferences and the availability of different rice varieties. Imports play a crucial role in supplementing domestic supply and meeting demand for specific types of rice not extensively cultivated locally. Conversely, Mexico also engages in rice exports, though on a smaller scale, contributing to its trade balance. Price trends are subject to fluctuations driven by global commodity prices, domestic supply-and-demand, currency exchange rates, and government regulations. Key trends observed include a growing demand for premium and specialty rice varieties, a shift towards healthier options like organic and parboiled rice, and increasing investment in efficient supply chain management to reduce post-harvest losses and ensure product availability. Restraints, such as vulnerability to climate change impacts on agriculture and potential trade policy shifts, are being addressed through strategic planning and diversification efforts.

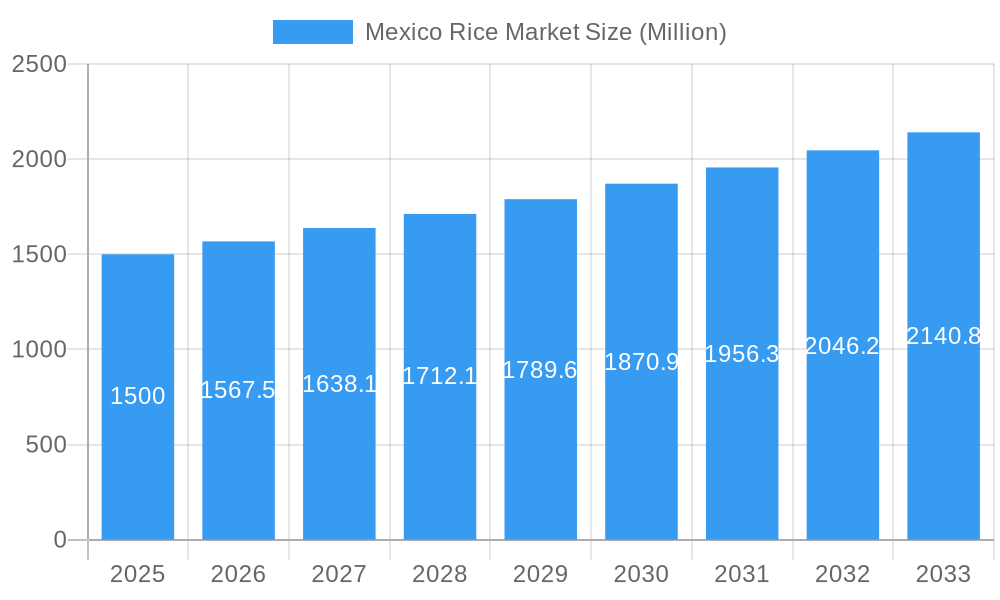

Mexico Rice Market Company Market Share

Mexico Rice Market: Comprehensive Analysis and Forecast (2019-2033)

Gain unparalleled insights into the dynamic Mexico rice market with this in-depth report. Covering production, consumption, trade, and price trends from 2019-2033, this study provides essential intelligence for stakeholders seeking to capitalize on opportunities in one of North America's key agricultural economies. Analyze market dynamics, leading players, industry developments, and strategic outlooks to inform your business decisions. This report leverages high-traffic keywords such as "Mexico rice market," "rice production Mexico," "rice consumption Mexico," "rice imports Mexico," "rice exports Mexico," "rice price trends Mexico," "USMCA rice trade," and "food inflation Mexico" to ensure maximum search visibility.

Mexico Rice Market Market Dynamics & Concentration

The Mexico rice market exhibits a moderately concentrated landscape, with a few key players dominating significant market share. Leading companies such as Sukarne, ADM, Roquette, Arroceros del Sur, Nutriati, Cargill, San Miguel Foods, Olam International, The Scoular Company, and Grupo Herdez are actively engaged in production, processing, and distribution. Innovation drivers are primarily focused on improving yield, enhancing grain quality, and developing more sustainable farming practices. The regulatory framework, influenced by government policies aimed at food security and price stability, plays a crucial role in shaping market entry and operational strategies. Product substitutes, such as other grains and starches, pose a competitive challenge, though rice maintains its staple status due to cultural significance and versatility. End-user trends indicate a growing demand for fortified and specialty rice varieties. Mergers and acquisitions (M&A) activities, while not at an extremely high volume, are strategic moves by larger players to consolidate their market position and expand their product portfolios. For instance, recent M&A deals indicate a trend towards vertical integration within the supply chain. The market share distribution is dynamic, with leading companies holding an estimated combined market share of 60-70%. M&A deal counts have seen a slight increase in the historical period, reflecting a consolidation drive.

Mexico Rice Market Industry Trends & Analysis

The Mexico rice market is poised for steady growth driven by a confluence of factors including increasing population, evolving dietary preferences, and supportive government initiatives. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at 3.5%, indicating robust expansion. Technological disruptions are playing a vital role, with advancements in agricultural practices, such as precision farming and improved seed varieties, contributing to enhanced productivity and yield. Furthermore, innovations in food processing and packaging are catering to the growing demand for convenience and ready-to-eat rice products. Consumer preferences are shifting towards healthier and more nutritious options, leading to an increased demand for brown rice, parboiled rice, and fortified rice varieties. The competitive dynamics within the market are characterized by both established domestic players and international corporations vying for market share. Companies are investing in branding and marketing to differentiate their products and capture consumer loyalty. Market penetration for packaged rice continues to rise as consumers opt for convenient and hygienic options. The increasing urbanization and rising disposable incomes in Mexico are further bolstering the demand for rice, particularly in value-added segments. The government's focus on food security and domestic production support, alongside trade agreements, also significantly influences market trends.

Leading Markets & Segments in Mexico Rice Market

The Mexico: Production Analysis, Consumption Analysis and Market Value segment stands as the most dominant force within the overall Mexico rice market. This intrinsic focus on domestic dynamics forms the bedrock of the industry's performance.

- Production Analysis: Key drivers for production include favorable climatic conditions in key agricultural regions, government subsidies for rice farmers, and the adoption of modern farming techniques. Infrastructure development, such as improved irrigation systems, further supports increased output. The historical period (2019-2024) saw fluctuations in production due to weather patterns and policy changes, but a general upward trend is evident.

- Consumption Analysis: Consumption is driven by rice's status as a staple food in Mexican cuisine, coupled with a growing middle class and urbanization. Factors such as changing dietary habits and the availability of diverse rice varieties contribute to sustained demand. The estimated year (2025) projects a significant consumption volume, reflecting this consistent demand.

- Market Value: The market value is a direct reflection of both production volumes and consumption patterns, influenced by price trends and the demand for various rice types. Economic policies promoting food security and stable domestic supply directly impact market value.

The Import Market Analysis (Volume and Value) is the second most crucial segment, driven by the need to supplement domestic production and meet the diverse demands of consumers.

- Key Drivers: The primary driver is the deficit in domestic production to meet the total national demand, especially for specific rice varieties. Trade agreements, such as the USMCA, play a significant role in shaping import volumes and costs. Fluctuations in global rice prices also influence import strategies. Economic policies aimed at controlling food inflation, like the temporary exemption of import taxes on rice from South America in October 2022, have a direct impact.

- Dominance Analysis: Mexico relies heavily on imports from countries like the United States, as well as emerging sources influenced by preferential trade agreements and cost-effectiveness. The forecast period (2025-2033) anticipates continued reliance on imports, albeit with strategic diversification.

The Export Market Analysis (Volume and Value), while smaller in comparison to imports, represents an important avenue for revenue generation and showcasing domestic quality.

- Key Drivers: Exports are driven by the availability of surplus production, competitive pricing, and demand from neighboring countries or niche international markets. Quality standards and compliance with international regulations are crucial for export success.

- Dominance Analysis: The export market is less dominant but holds potential for growth, particularly for premium or specialty rice varieties.

The Price Trend Analysis is a cross-cutting segment that influences all other aspects of the market.

- Key Drivers: Global commodity prices, domestic production levels, import costs, currency exchange rates, and government policies aimed at price stabilization are key determinants of rice prices in Mexico. Inflationary pressures significantly impact consumer affordability.

Mexico Rice Market Product Developments

Product development in the Mexico rice market is increasingly focused on value-added propositions and meeting evolving consumer needs. Innovations include the introduction of fortified rice varieties fortified with essential nutrients like iron and folic acid, catering to health-conscious consumers and public health initiatives. The development of convenient, ready-to-cook or ready-to-eat rice products addresses the demand for faster meal preparation in urban households. Furthermore, there's a growing trend towards specialty and exotic rice varieties, including basmati and jasmine rice, to cater to diverse culinary preferences and the foodservice industry. Companies are also investing in research and development to enhance grain quality, improve milling yields, and develop more sustainable packaging solutions, offering a competitive edge in a diverse market.

Key Drivers of Mexico Rice Market Growth

Several key factors are driving the growth of the Mexico rice market. Firstly, the ever-increasing population and sustained demand for rice as a dietary staple provide a fundamental growth base. Secondly, supportive government policies aimed at ensuring food security and potentially stabilizing domestic production through subsidies and trade agreements create a favorable environment. The evolving consumer preferences towards healthier and more convenient rice products, such as fortified and parboiled varieties, are also significant growth catalysts. Furthermore, the economic growth and rising disposable incomes in Mexico contribute to increased consumer spending on food products, including rice. Technological advancements in agriculture are also playing a role in improving production efficiency and yield.

Challenges in the Mexico Rice Market Market

Despite its growth potential, the Mexico rice market faces several challenges. Price volatility in the global rice market, influenced by weather events and international trade dynamics, poses a significant risk to profitability and consumer affordability. Fluctuations in currency exchange rates can impact the cost of imported rice, affecting market competitiveness. Supply chain disruptions, including logistical challenges and storage limitations, can lead to inefficiencies and potential shortages. Intense competition from both domestic and international players, coupled with the presence of rice substitutes, necessitates continuous innovation and cost-effectiveness. Regulatory hurdles and evolving trade policies can also present complexities for market participants.

Emerging Opportunities in Mexico Rice Market

Emerging opportunities in the Mexico rice market are abundant, driven by innovation and strategic market positioning. The growing demand for value-added rice products, such as organic, gluten-free, and flavored rice, presents a significant opportunity for product differentiation and premium pricing. Technological advancements in agricultural practices, including smart farming and biotech solutions, can enhance yields and sustainability, creating a competitive advantage. The expansion of modern retail channels and e-commerce platforms offers new avenues for market reach and direct consumer engagement. Strategic partnerships and collaborations with food processors and culinary institutions can foster product innovation and expand market applications. Furthermore, the increasing focus on food security and resilient supply chains may lead to increased investment in domestic production and processing capabilities.

Leading Players in the Mexico Rice Market Sector

- Sukarne

- ADM

- Roquette

- Arroceros del Sur

- Nutriati

- Cargill

- San Miguel Foods

- Olam International

- The Scoular Company

- Grupo Herdez

Key Milestones in Mexico Rice Market Industry

- October 2022: Mexican government decided to temporarily exempt the payment of import taxes on rice from South America as part of a policy to prevent food price inflation and scarcity, and insufficient domestic rice production. This policy aims to stabilize domestic prices and ensure supply, impacting import dynamics.

- July 2020: The United States, Mexico, and Canada reached an agreement to form USMCA. The new United States-Mexico-Canada Agreement (USMCA) will support mutually beneficial trade leading to freer markets, fairer trade, and robust economic growth in North America. This agreement will provide long-term market stability for United States rice exports to Mexico, despite the diversification of sourcing, solidifying trade relationships and influencing export/import volumes.

Strategic Outlook for Mexico Rice Market Market

The strategic outlook for the Mexico rice market is characterized by sustained growth, driven by evolving consumer demands and supportive trade policies. Key growth accelerators include the continued expansion of value-added rice products, such as fortified and specialty varieties, catering to health-conscious and diverse consumer segments. Investments in sustainable agricultural practices and technology adoption are expected to enhance production efficiency and address environmental concerns. The strengthening of the USMCA agreement is likely to provide continued market stability for North American rice trade, while emerging trade partnerships may offer opportunities for market diversification. Companies are strategically focusing on brand building, product innovation, and supply chain optimization to capture market share and navigate competitive pressures. The market presents a robust landscape for expansion and investment in the coming years.

Mexico Rice Market Segmentation

-

1. Mexico

- 1.1. Production Analysis

- 1.2. Consumption Analysis and Market Value

- 1.3. Import Market Analysis (Volume and Value)

- 1.4. Export Market Analysis (Volume and Value)

- 1.5. Price Trend Analysis

-

2. Mexico

- 2.1. Production Analysis

- 2.2. Consumption Analysis and Market Value

- 2.3. Import Market Analysis (Volume and Value)

- 2.4. Export Market Analysis (Volume and Value)

- 2.5. Price Trend Analysis

Mexico Rice Market Segmentation By Geography

- 1. Mexico

Mexico Rice Market Regional Market Share

Geographic Coverage of Mexico Rice Market

Mexico Rice Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Climatic Conditions; Blooming Export Opportunities

- 3.3. Market Restrains

- 3.3.1. High Adoption Cost of Modern Technology; Increasing Insect Infestations

- 3.4. Market Trends

- 3.4.1. Government Initiatives to Boost Domestic Rice Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Rice Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mexico

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis and Market Value

- 5.1.3. Import Market Analysis (Volume and Value)

- 5.1.4. Export Market Analysis (Volume and Value)

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Mexico

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis and Market Value

- 5.2.3. Import Market Analysis (Volume and Value)

- 5.2.4. Export Market Analysis (Volume and Value)

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Mexico

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sukarne

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ADM

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roquette

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Arroceros del Sur

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nutriati

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 San Miguel Foods

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Olam International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Scoular Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grupo Herdez

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sukarne

List of Figures

- Figure 1: Mexico Rice Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Rice Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Rice Market Revenue Million Forecast, by Mexico 2020 & 2033

- Table 2: Mexico Rice Market Volume Kiloton Forecast, by Mexico 2020 & 2033

- Table 3: Mexico Rice Market Revenue Million Forecast, by Mexico 2020 & 2033

- Table 4: Mexico Rice Market Volume Kiloton Forecast, by Mexico 2020 & 2033

- Table 5: Mexico Rice Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Rice Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: Mexico Rice Market Revenue Million Forecast, by Mexico 2020 & 2033

- Table 8: Mexico Rice Market Volume Kiloton Forecast, by Mexico 2020 & 2033

- Table 9: Mexico Rice Market Revenue Million Forecast, by Mexico 2020 & 2033

- Table 10: Mexico Rice Market Volume Kiloton Forecast, by Mexico 2020 & 2033

- Table 11: Mexico Rice Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Rice Market Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Rice Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Mexico Rice Market?

Key companies in the market include Sukarne , ADM , Roquette , Arroceros del Sur , Nutriati , Cargill, San Miguel Foods , Olam International , The Scoular Company, Grupo Herdez .

3. What are the main segments of the Mexico Rice Market?

The market segments include Mexico, Mexico.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Climatic Conditions; Blooming Export Opportunities.

6. What are the notable trends driving market growth?

Government Initiatives to Boost Domestic Rice Production.

7. Are there any restraints impacting market growth?

High Adoption Cost of Modern Technology; Increasing Insect Infestations.

8. Can you provide examples of recent developments in the market?

October 2022: Mexican government decided to temporarily exempt the payment of import taxes on rice from South America as part of a policy to prevent food price inflation and scarcity, and insufficient domestic rice production.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Rice Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Rice Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Rice Market?

To stay informed about further developments, trends, and reports in the Mexico Rice Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence