Key Insights

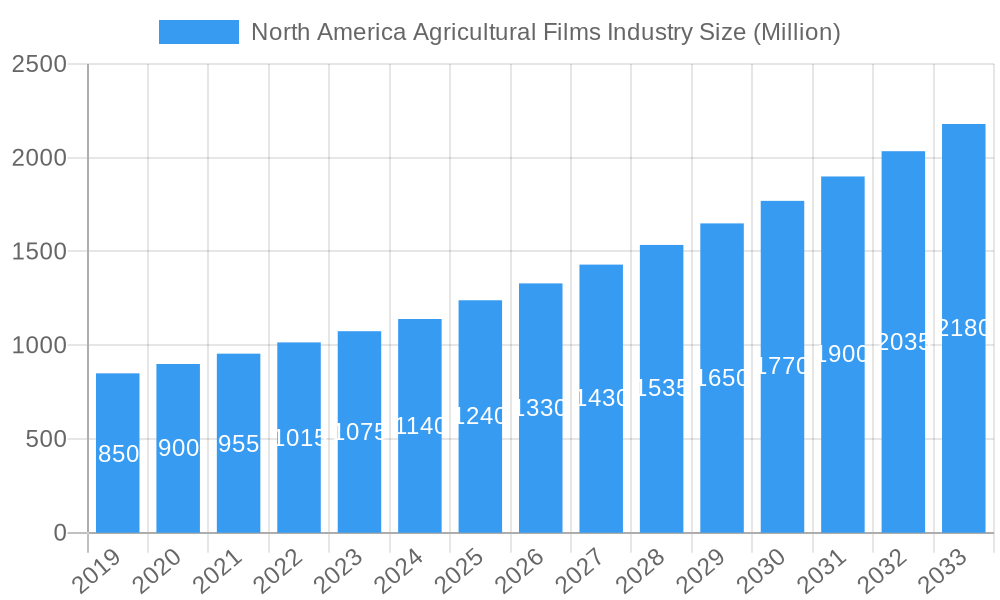

The North America agricultural films market is poised for significant expansion, projected to reach a substantial 1.24 Million value by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.20%. This growth is primarily fueled by the increasing adoption of advanced farming techniques that enhance crop yield and quality, alongside a growing demand for efficient food production to meet the needs of a rising population. Key drivers include the necessity for improved resource management, such as water and nutrient conservation, which agricultural films facilitate. Furthermore, the escalating focus on sustainable agricultural practices and the development of biodegradable and recyclable film options are also contributing to market momentum. The industry is witnessing a surge in demand for specialized films that offer UV protection, light diffusion, and temperature regulation, thereby optimizing growing conditions and reducing pest-related crop losses. Technological advancements in film manufacturing, leading to thinner yet more durable and effective products, are also a significant growth factor.

North America Agricultural Films Industry Market Size (In Million)

The North American agricultural films market is characterized by a dynamic landscape with a strong emphasis on innovation and sustainability. While the market is robust, certain restraints such as fluctuating raw material prices and the initial investment costs for advanced film technologies can present challenges. However, the long-term outlook remains exceptionally positive, with continuous research and development efforts focused on creating high-performance, eco-friendly solutions. Major players like ExxonMobil Chemical, BASF, and The Dow Chemical Company are actively investing in R&D and expanding their product portfolios to cater to evolving market demands. The market segmentation spans production, consumption, imports, exports, and price trends, all indicating a healthy and growing industry. The United States, Canada, and Mexico are the primary regions contributing to this growth, with each country demonstrating a unique set of demands and adoption rates for various agricultural film applications, from greenhouse coverings to mulching films.

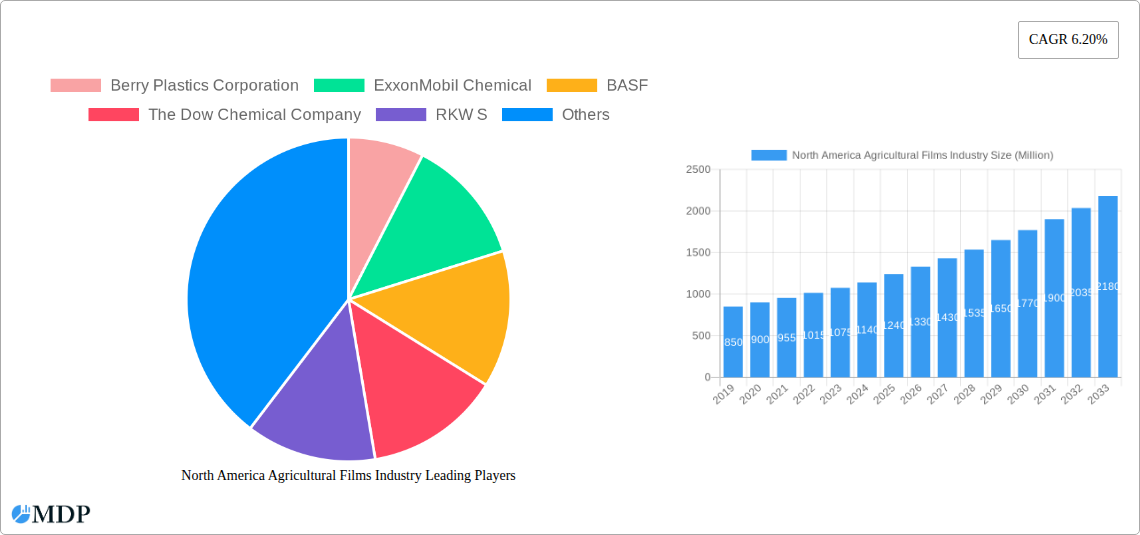

North America Agricultural Films Industry Company Market Share

North America Agricultural Films Industry: A Comprehensive Market Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the North American agricultural films market, covering production, consumption, trade, pricing, and key industry developments. With a study period spanning from 2019 to 2033, and a base year of 2025, this report offers unparalleled insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. We delve into critical segments including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, all supported by a robust forecast period from 2025 to 2033, building upon historical data from 2019-2024. This report is designed for immediate use without requiring any modifications.

North America Agricultural Films Industry Market Dynamics & Concentration

The North American agricultural films market exhibits moderate to high concentration, with several key players dominating significant market shares. Berry Plastics Corporation, ExxonMobil Chemical, BASF, The Dow Chemical Company, and RKW S are among the prominent entities driving innovation and production. The market's concentration is influenced by substantial capital investments required for advanced manufacturing capabilities and the stringent quality standards prevalent in the sector. Innovation drivers are primarily focused on enhancing film performance, such as increased UV resistance, improved light diffusion properties, and enhanced barrier capabilities to protect crops and optimize yields. Regulatory frameworks, including environmental regulations concerning plastic waste management and sustainable sourcing, play a crucial role in shaping product development and market access. Product substitutes, while present in the form of traditional farming methods, are increasingly being outperformed by the efficiency gains offered by advanced agricultural films. End-user trends are shifting towards sustainable and biodegradable film options, driven by growing environmental awareness and government initiatives. Mergers and acquisitions (M&A) activities are sporadic but significant, aimed at expanding product portfolios, geographical reach, and technological expertise. For instance, the market share of the top 5 players is estimated to be around 65% of the total market value. M&A deal counts have averaged 2-3 significant transactions annually over the historical period, indicating strategic consolidation efforts.

North America Agricultural Films Industry Industry Trends & Analysis

The North American agricultural films industry is poised for robust growth, driven by a confluence of factors. The increasing demand for efficient and sustainable agricultural practices, coupled with the need to enhance crop yields and reduce resource wastage, serves as a primary market growth driver. Technological disruptions, such as the development of multi-layered films with tailored properties for specific crop types and climatic conditions, are transforming the market. Advancements in material science are leading to the creation of films with improved thermal insulation, light management, and durability, contributing to higher crop quality and reduced pest infestations. Consumer preferences are increasingly leaning towards domestically grown produce, necessitating enhanced agricultural output and, consequently, higher consumption of agricultural films for crop protection and yield optimization. The competitive dynamics are characterized by a blend of established global chemical giants and specialized film manufacturers, all vying for market share through product differentiation, price competitiveness, and strategic partnerships. The Compound Annual Growth Rate (CAGR) for the North American agricultural films market is projected to be approximately 5.5% during the forecast period. Market penetration for advanced agricultural films, particularly in greenhouse applications and mulching, is steadily increasing, currently estimated at around 70% in key agricultural regions. The rising adoption of precision agriculture technologies further amplifies the demand for specialized films that integrate with sensor-based systems for optimized irrigation and nutrient delivery. Furthermore, government incentives promoting sustainable farming and reducing food loss are creating a favorable environment for market expansion. The exploration of bio-based and biodegradable agricultural films is a significant trend, catering to the growing environmental consciousness among farmers and consumers alike, and offering a sustainable alternative to conventional plastic films.

Leading Markets & Segments in North America Agricultural Films Industry

The United States stands as the dominant market within North America for agricultural films, driven by its vast agricultural expanse and the adoption of advanced farming techniques. This dominance is evident across all analyzed segments.

Production Analysis: The US leads in the production of a wide array of agricultural films, including greenhouse films, mulch films, silage films, and crop covers. Key drivers include substantial government support for agriculture, extensive research and development in agricultural technologies, and the presence of major chemical and plastics manufacturers. The production volume in the US is estimated to be over 2,500 Million square meters annually.

Consumption Analysis: The extensive agricultural sector in the US, encompassing large-scale commercial farms and diverse crop cultivation, fuels the highest consumption of agricultural films. This is particularly true for greenhouse films, used to extend growing seasons and cultivate high-value crops, and mulch films, which enhance soil moisture retention and weed suppression. Estimated consumption volume in the US is approximately 2,200 Million square meters.

Import Market Analysis (Value & Volume): While the US is a major producer, it also imports specialized agricultural films to supplement its domestic production and cater to niche requirements. Imports are driven by specific technological advancements or cost-effective sourcing. The import market value is projected to reach USD 600 Million in 2025. Import volume is estimated at 350 Million square meters.

Export Market Analysis (Value & Volume): The US is also a significant exporter of agricultural films, particularly to Canada and Mexico, leveraging its technological expertise and production capacity. Exports are driven by demand for high-performance films and competitive pricing. The export market value is projected to reach USD 550 Million in 2025. Export volume is estimated at 300 Million square meters.

Price Trend Analysis: Price trends in North America are influenced by raw material costs (e.g., polyethylene), manufacturing efficiencies, and market demand. The US market, due to its scale and competitive landscape, often sets price benchmarks. The average price for key agricultural films is expected to range between USD 1.80 - USD 2.50 per square meter, with fluctuations based on specific film types and market conditions. The increasing demand for sustainable and biodegradable films is also beginning to influence price points, with these premium options commanding higher values.

North America Agricultural Films Industry Product Developments

Product developments in the North American agricultural films sector are aggressively focused on enhancing sustainability and performance. Innovations include the introduction of multi-layered films with superior UV stabilization for extended field life, improved light diffusion properties for optimized plant growth in greenhouses, and advanced barrier films to prevent gas exchange and moisture loss. The development of biodegradable and compostable agricultural films derived from renewable resources is gaining significant traction, offering an eco-friendly alternative to conventional plastics. Furthermore, "smart" films incorporating features like temperature regulation and pest repellency are emerging, providing farmers with enhanced control over crop environments and contributing to significant yield improvements. These developments aim to reduce plastic waste, minimize environmental impact, and boost agricultural productivity.

Key Drivers of North America Agricultural Films Industry Growth

Several factors are propelling the growth of the North American agricultural films industry. The escalating global population necessitates increased food production, driving the demand for technologies that enhance crop yields and efficiency. Advances in material science are leading to the development of high-performance, durable, and environmentally friendly agricultural films, catering to evolving farmer needs. Government initiatives promoting sustainable agriculture, coupled with favorable regulatory landscapes supporting the adoption of modern farming techniques, further stimulate market expansion. The increasing adoption of protected cultivation methods, such as greenhouses and high tunnels, also directly boosts the demand for specialized agricultural films.

Challenges in the North America Agricultural Films Industry Market

Despite the robust growth prospects, the North American agricultural films market faces several challenges. Fluctuations in raw material prices, particularly for polyethylene, can impact profit margins and lead to price volatility. Stringent environmental regulations regarding plastic waste management and disposal necessitate significant investment in recycling infrastructure and the development of biodegradable alternatives. Intense competition among market players, leading to price pressures, can also hinder profitability. Furthermore, the initial cost of adopting advanced agricultural film technologies can be a barrier for smaller farmers, limiting market penetration in certain segments. Supply chain disruptions, as witnessed in recent years, can also impact the availability and cost of essential raw materials and finished products.

Emerging Opportunities in North America Agricultural Films Industry

The North American agricultural films industry is ripe with emerging opportunities. The growing consumer demand for organic and sustainably produced food is a significant catalyst for the expansion of biodegradable and compostable agricultural films. Technological breakthroughs in bioplastics and advanced polymer science are creating new avenues for high-performance, eco-friendly film solutions. Strategic partnerships between agricultural film manufacturers and agricultural technology providers can lead to the development of integrated solutions, such as films designed for use with automated farming systems. Market expansion into regions with developing agricultural sectors, offering tailored film solutions to meet local needs, also presents substantial growth potential. The increasing focus on vertical farming and controlled environment agriculture further amplifies the demand for specialized films with precise light and thermal management properties.

Leading Players in the North America Agricultural Films Industry Sector

- Berry Plastics Corporation

- ExxonMobil Chemical

- BASF

- The Dow Chemical Company

- RKW S

- AB Rani Plast Oy

- Hyplast NV

- Britton Group

- Trioplast Industries AB

- Armando Alvarez Group

Key Milestones in North America Agricultural Films Industry Industry

- 2019: Introduction of advanced UV-stabilized greenhouse films offering extended lifespan and enhanced light transmission.

- 2020: Increased focus on biodegradable mulch films due to growing environmental concerns.

- 2021: Significant investment in R&D for bio-based agricultural film formulations by major chemical companies.

- 2022: Launch of multi-layered agricultural films with tailored properties for specific crop types and regional climates.

- 2023: Growing adoption of "smart" agricultural films with integrated features for climate control and pest management.

- 2024: Major acquisitions aimed at consolidating market share and expanding product portfolios in the agricultural films sector.

Strategic Outlook for North America Agricultural Films Market

The strategic outlook for the North American agricultural films market is overwhelmingly positive, fueled by the imperative for increased food production and the accelerating adoption of sustainable agricultural practices. Growth accelerators include ongoing innovation in biodegradable and bio-based materials, the development of smart films that integrate with precision agriculture technologies, and strategic expansions into niche markets and geographical regions. The industry's focus on enhancing film performance, reducing environmental impact, and supporting efficient crop cultivation positions it for sustained growth and increased market penetration. The potential for further consolidation through M&A activities also remains a key strategic element for market leaders seeking to expand their capabilities and reach.

North America Agricultural Films Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

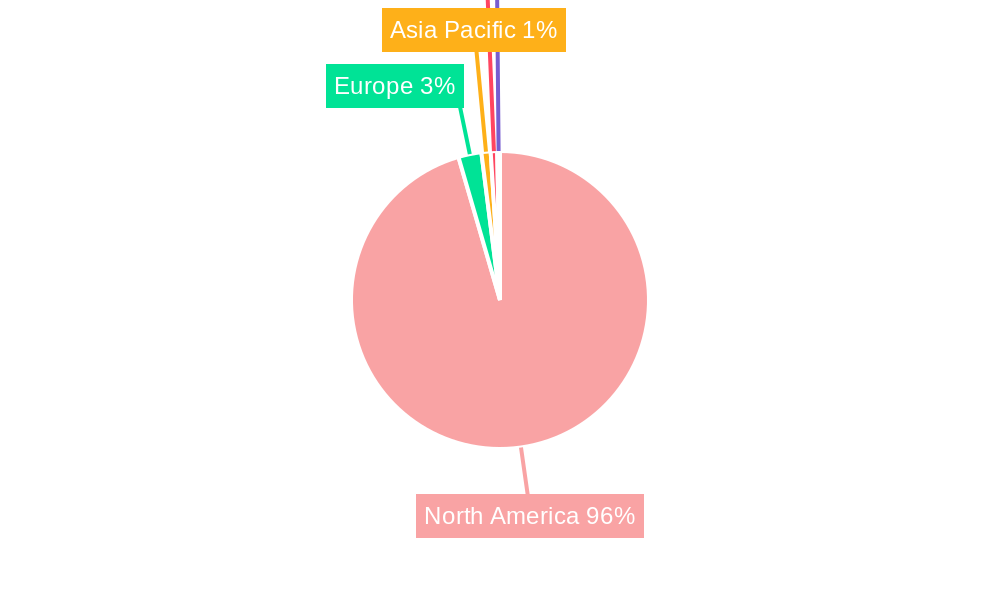

North America Agricultural Films Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Films Industry Regional Market Share

Geographic Coverage of North America Agricultural Films Industry

North America Agricultural Films Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Shrinking Farm Lands Necessitating to Increase the Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Films Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Berry Plastics Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Chemical

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Dow Chemical Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 RKW S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AB Rani Plast Oy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyplast NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Britton Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trioplast Industries AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Armando Alvarez Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Berry Plastics Corporation

List of Figures

- Figure 1: North America Agricultural Films Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Agricultural Films Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Agricultural Films Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Agricultural Films Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Agricultural Films Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Agricultural Films Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Agricultural Films Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Agricultural Films Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Agricultural Films Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Agricultural Films Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Agricultural Films Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Agricultural Films Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Agricultural Films Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Agricultural Films Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Agricultural Films Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Agricultural Films Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Agricultural Films Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Films Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the North America Agricultural Films Industry?

Key companies in the market include Berry Plastics Corporation, ExxonMobil Chemical, BASF, The Dow Chemical Company, RKW S, AB Rani Plast Oy, Hyplast NV, Britton Group, Trioplast Industries AB, Armando Alvarez Group.

3. What are the main segments of the North America Agricultural Films Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Shrinking Farm Lands Necessitating to Increase the Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Films Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Films Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Films Industry?

To stay informed about further developments, trends, and reports in the North America Agricultural Films Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence