Key Insights

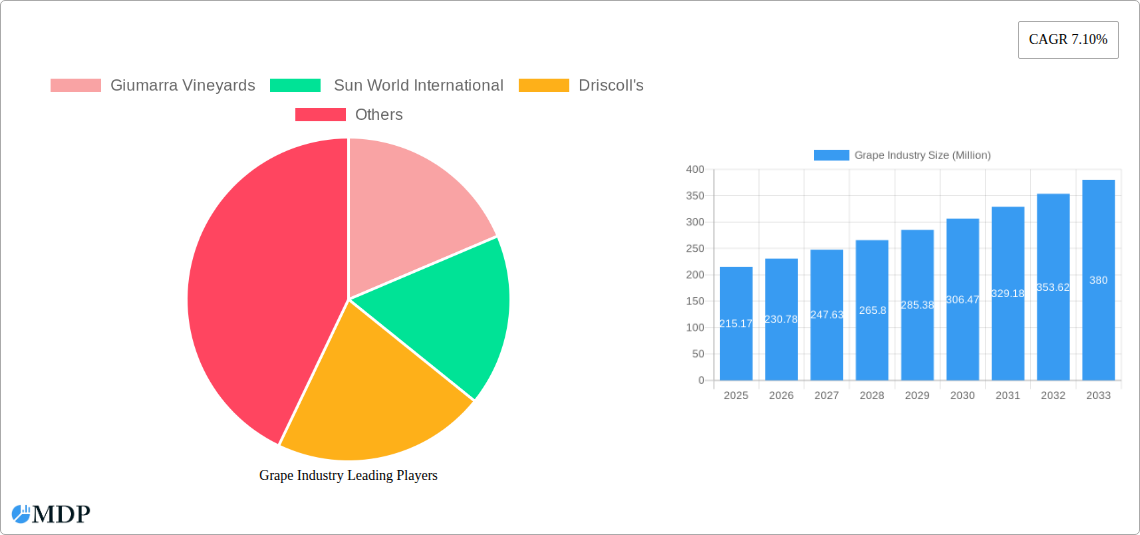

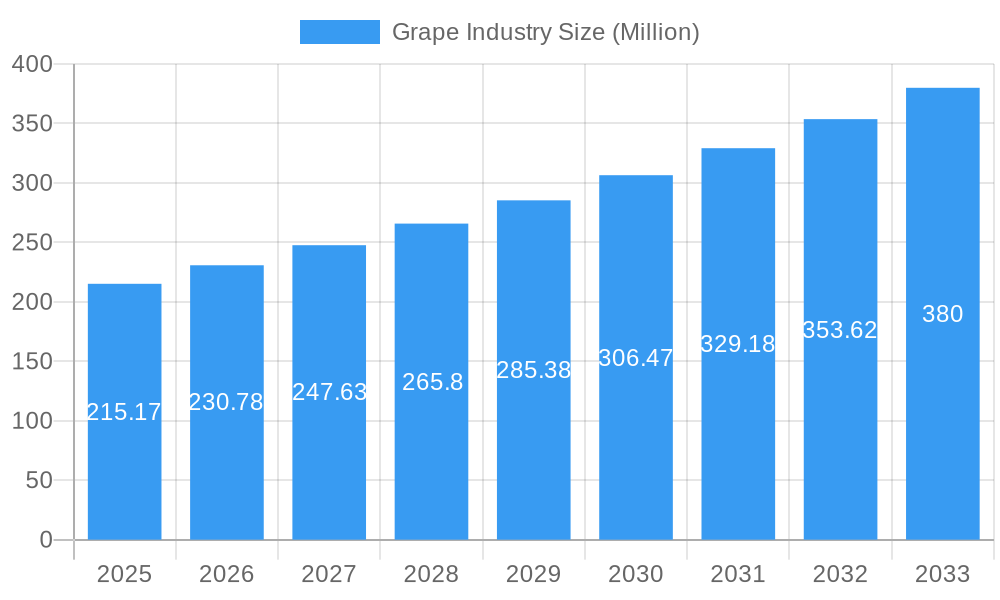

The global grape industry is poised for robust expansion, projected to reach a market size of USD 215.17 million by 2025, with a Compound Annual Growth Rate (CAGR) of 7.10% expected to drive this growth through 2033. This impressive trajectory is fueled by a confluence of increasing consumer demand for healthy and versatile fruit options, a rising awareness of the health benefits associated with grape consumption, and the expanding applications of grapes beyond fresh consumption, including juices, wines, and dried products. Furthermore, advancements in agricultural technology, including improved cultivation techniques, disease management, and post-harvest handling, are contributing to higher yields and better quality produce, thus supporting market expansion. The industry is experiencing significant global trade, with import and export activities playing a crucial role in meeting diverse regional demands and influencing price dynamics. Key drivers include the growing popularity of grape-based beverages and the increasing adoption of innovative packaging solutions that extend shelf life and enhance consumer appeal.

Grape Industry Market Size (In Million)

The market's expansion is further bolstered by emerging trends such as the rise of organic and sustainably grown grapes, catering to a growing segment of environmentally conscious consumers. The development of new grape varieties with enhanced flavor profiles, disease resistance, and extended seasonality is also a significant trend. However, the industry faces certain restraints, including volatile weather patterns impacting crop yields and quality, potential supply chain disruptions, and stringent regulatory frameworks in different regions regarding pesticide use and food safety standards. Despite these challenges, major players like Giumarra Vineyards, Sun World International, and Driscoll's are actively investing in research and development, expanding their production capacities, and forging strategic partnerships to capitalize on global market opportunities. The market segmentation across production, consumption, imports, exports, and price trends will offer detailed insights into the intricate dynamics shaping the future of the global grape industry.

Grape Industry Company Market Share

This comprehensive report offers an in-depth analysis of the global grape industry, exploring market dynamics, pivotal trends, leading players, and future projections. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this report provides actionable insights for stakeholders seeking to navigate the evolving landscape of grape production, consumption, and trade. We delve into detailed analyses of production, consumption, import/export markets, price trends, and groundbreaking industry developments.

Grape Industry Market Dynamics & Concentration

The global grape industry is characterized by a moderate to high concentration, with a few major players holding significant market influence. Key innovation drivers include advancements in viticulture technology, breeding programs for disease resistance and improved yield, and the growing demand for specific grape varieties for wine, table, and raisin production. Regulatory frameworks, varying by region, impact cultivation practices, labeling, and international trade. Product substitutes, such as other fruits for fresh consumption and alternative beverages for wine, present a constant competitive pressure. End-user trends are shifting towards healthier eating habits, demand for organic and sustainable produce, and an increasing preference for seedless and specific flavor profiles in table grapes. Mergers and acquisitions (M&A) activities, though not always frequent, play a crucial role in consolidating market share and expanding geographical reach. For instance, strategic acquisitions by companies like Sun World International have significantly broadened their global footprint. Estimated market share for leading companies like Driscoll's and Giumarra Vineyards is substantial, contributing to the industry's concentrated nature. The number of M&A deals in the last five years has been in the range of 10-15 annually, focusing on acquiring specialized breeding programs or expanding distribution networks.

Grape Industry Industry Trends & Analysis

The grape industry is experiencing robust growth, driven by a confluence of factors including increasing global population, rising disposable incomes in emerging economies, and a persistent consumer demand for healthy and versatile fruits. The Compound Annual Growth Rate (CAGR) for the global grape market is projected to be approximately 5.5% over the forecast period of 2025–2033. Technological disruptions are revolutionizing vineyard management, with precision agriculture tools, autonomous robots for data collection, and advanced irrigation systems enhancing efficiency and sustainability. Consumer preferences are increasingly leaning towards seedless varieties, sweeter flavor profiles, and grapes with enhanced nutritional value. The growing popularity of grape-based products, including juices, wines, and dried grapes (raisins), further fuels market expansion. Competitive dynamics are intensifying, with established players constantly innovating and new entrants emerging, particularly from regions with favorable growing conditions. Market penetration for specialty grape varieties is on the rise, indicating a growing sophistication in consumer demand. The demand for table grapes is projected to reach 25 million metric tons by 2030, a significant increase from the historical figure of 18 million metric tons in 2019. The wine grape segment, while mature in some regions, continues to see innovation in varietal development and sustainable winemaking practices, contributing to an overall market value expected to exceed $100 billion by 2033. The import market, driven by demand in regions with limited production capacity, is projected to grow by 6% annually.

Leading Markets & Segments in Grape Industry

The United States stands out as a dominant region in the global grape industry, excelling across multiple segments.

- Production Analysis: The U.S. leads in both table grape and wine grape production, benefiting from diverse climate zones and advanced agricultural technologies. California alone accounts for the majority of U.S. grape production, with significant contributions from states like Washington for wine grapes. Key drivers include government support for agricultural research, robust infrastructure for harvesting and cold storage, and established trade agreements. Production volume in the U.S. for table grapes is estimated to be around 4.5 million metric tons annually.

- Consumption Analysis: The U.S. exhibits strong per capita consumption of grapes, driven by health consciousness and the widespread availability of various grape types. The demand for seedless green and red varieties is particularly high. Consumer preference for fresh, readily available produce contributes significantly to this segment's dominance. Per capita consumption is estimated at 7.8 kg annually.

- Import Market Analysis (Value & Volume): While a major producer, the U.S. also imports a significant volume of table grapes, especially during off-peak seasons or for specific varietal demands. Countries like Chile, Peru, and Mexico are key suppliers. The import value for grapes into the U.S. is estimated at $1.8 billion annually, with a volume of approximately 700,000 metric tons. Economic policies that promote free trade and efficient customs procedures facilitate this import flow.

- Export Market Analysis (Value & Volume): The U.S. is also a major exporter of both table and wine grapes. The export value for grapes from the U.S. is estimated at $1.2 billion annually, with a volume of around 500,000 metric tons. High demand for premium grape varieties in international markets and established distribution networks drive export success.

- Price Trend Analysis: Grape prices in the U.S. are influenced by supply and demand dynamics, seasonality, and the specific variety. Premium varieties and organic options command higher prices. The average price for table grapes in the U.S. ranges from $2.00 to $4.00 per pound, with organic varieties potentially reaching $5.00 per pound. Economic policies related to tariffs and trade agreements can also impact price fluctuations.

Grape Industry Product Developments

The grape industry is witnessing continuous product innovation focused on enhancing consumer appeal and grower efficiency. This includes the development of new grape varieties with improved disease resistance, extended shelf life, unique flavor profiles (e.g., tropical notes, berry-like sweetness), and seedless characteristics. Technologies like precision breeding and genetic marker analysis are accelerating the introduction of these improved cultivars. The application of autonomous robotics in vineyards, such as Cornell University's PhytoPathol Boots (PPB), offers unprecedented real-time data collection for disease detection and physiological monitoring, leading to more targeted interventions and healthier crops. Competitive advantages are gained through early market entry of novel varieties and the ability to meet specific consumer demands for freshness, taste, and convenience.

Key Drivers of Grape Industry Growth

Several factors are propelling the growth of the grape industry. Technological advancements in viticulture, including precision agriculture and AI-driven vineyard management, are boosting yields and sustainability, contributing to an estimated 8% increase in production efficiency. The growing global awareness of the health benefits associated with grape consumption, such as antioxidant properties and contribution to cardiovascular health, is a significant economic driver, increasing demand across all segments. Furthermore, favorable economic policies in key producing and consuming nations, coupled with expanding trade agreements, are facilitating market access and boosting international trade volumes. The development of novel grape varieties with desirable traits, like extended shelf-life and unique flavors, also acts as a crucial catalyst for market expansion.

Challenges in the Grape Industry Market

Despite its growth, the grape industry faces several significant challenges. Strict and varied regulatory hurdles in different countries, concerning pesticide use and import standards, can impede market access and increase operational costs. Supply chain disruptions, exacerbated by global events and logistical complexities, pose a continuous threat to product availability and freshness. Climate change, leading to unpredictable weather patterns, extreme temperatures, and increased pest and disease pressure, directly impacts yield and quality, with an estimated 15% year-on-year variability in some regions. Intense competitive pressures from other fruit crops and beverage alternatives also require constant innovation and market differentiation.

Emerging Opportunities in Grape Industry

The grape industry is ripe with emerging opportunities for long-term growth. Technological breakthroughs in vertical farming and controlled environment agriculture offer potential for year-round grape production, reducing reliance on seasonal fluctuations. Strategic partnerships between research institutions and private companies, like the collaboration between Cornell AgriTech and Sun World International, are accelerating the development and commercialization of new grape varieties. Market expansion into untapped geographies with growing middle classes and increasing disposable incomes presents a significant opportunity. Furthermore, the rising demand for organic, sustainable, and ethically produced grapes offers a premium market segment for producers adopting responsible practices.

Leading Players in the Grape Industry Sector

- Giumarra Vineyards

- Sun World International

- Driscoll's

Key Milestones in Grape Industry Industry

- November 2022: Cornell University in the United States rolled out its PhytoPathol Boots (PPB), which will be deployed to four grape breeding programs across the U.S. These autonomous robots will roll through vineyards, using computer vision to gather data on the physiological state of each grapevine, allowing breeders and growers to evaluate their vineyards leaf by leaf, in real-time, down to the chemical level. This development signifies a leap in precision viticulture and data-driven breeding.

- March 2022: Two newly released grape varieties, Sugrafiftytwo, an ultra-early ripening green seedless grape variety with a sweet Muscat flavor and firm, crisp texture, and Sugrasixty, a midseason ripening red variety with large berries and a tropical aroma with overtones of mango, were developed collaboratively between Cornell AgriTech and Sun World International, a global fruit genetics and licensing company. This highlights successful public-private partnerships in varietal innovation, catering to evolving consumer preferences.

Strategic Outlook for Grape Industry Market

The strategic outlook for the grape industry market is highly positive, driven by ongoing innovation and expanding global demand. Key growth accelerators include the continued development of novel grape varieties that meet specific consumer preferences for taste, texture, and health benefits, coupled with advancements in sustainable and precision viticulture practices. Strategic opportunities lie in expanding market penetration in emerging economies, capitalizing on the growing middle class and increasing demand for high-quality produce. Furthermore, exploring new applications for grapes beyond fresh consumption, such as in functional foods and beverages, can unlock new revenue streams. The focus on traceability and transparency in the supply chain will also be crucial for building consumer trust and securing market share.

Grape Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

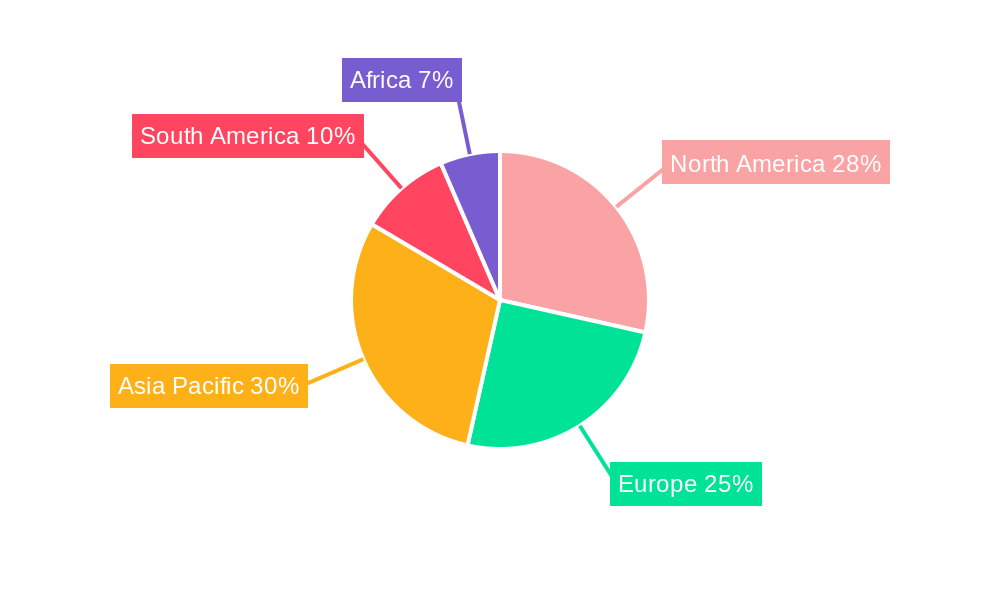

Grape Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Australia

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Chile

- 4.4. Peru

- 4.5. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Egypt

- 5.3. Rest of Africa

Grape Industry Regional Market Share

Geographic Coverage of Grape Industry

Grape Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. The Growth of the Global Wine Industry is Driving the Grapes Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Grape Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Grape Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Grape Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Grape Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Grape Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Africa Grape Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giumarra Vineyards

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sun World International

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Driscoll's

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Giumarra Vineyards

List of Figures

- Figure 1: Global Grape Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Grape Industry Volume Breakdown (Kiloton, %) by Region 2025 & 2033

- Figure 3: North America Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 4: North America Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 5: North America Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 6: North America Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 7: North America Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 8: North America Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 9: North America Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 10: North America Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 11: North America Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 12: North America Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 13: North America Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 14: North America Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 15: North America Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 16: North America Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 17: North America Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 18: North America Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: North America Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 20: North America Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 21: North America Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 22: North America Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 23: North America Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: North America Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 25: North America Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: North America Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 28: Europe Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 29: Europe Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 30: Europe Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 31: Europe Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 32: Europe Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 33: Europe Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 34: Europe Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 35: Europe Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 36: Europe Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 37: Europe Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 38: Europe Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 39: Europe Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 40: Europe Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 41: Europe Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 42: Europe Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Europe Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 44: Europe Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 45: Europe Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 46: Europe Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 47: Europe Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 49: Europe Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 53: Asia Pacific Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 54: Asia Pacific Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 55: Asia Pacific Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 56: Asia Pacific Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 57: Asia Pacific Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 58: Asia Pacific Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 59: Asia Pacific Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 60: Asia Pacific Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 61: Asia Pacific Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 62: Asia Pacific Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 63: Asia Pacific Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 64: Asia Pacific Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 65: Asia Pacific Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 66: Asia Pacific Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 67: Asia Pacific Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 68: Asia Pacific Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 69: Asia Pacific Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 70: Asia Pacific Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 71: Asia Pacific Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Asia Pacific Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 73: Asia Pacific Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Asia Pacific Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 75: South America Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 76: South America Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 77: South America Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 78: South America Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 79: South America Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 80: South America Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 81: South America Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 82: South America Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 83: South America Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 84: South America Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 85: South America Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 86: South America Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 87: South America Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 88: South America Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 89: South America Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 90: South America Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 91: South America Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 92: South America Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 93: South America Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 94: South America Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 95: South America Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 96: South America Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 97: South America Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: South America Grape Industry Volume Share (%), by Country 2025 & 2033

- Figure 99: Africa Grape Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 100: Africa Grape Industry Volume (Kiloton), by Production Analysis 2025 & 2033

- Figure 101: Africa Grape Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 102: Africa Grape Industry Volume Share (%), by Production Analysis 2025 & 2033

- Figure 103: Africa Grape Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 104: Africa Grape Industry Volume (Kiloton), by Consumption Analysis 2025 & 2033

- Figure 105: Africa Grape Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 106: Africa Grape Industry Volume Share (%), by Consumption Analysis 2025 & 2033

- Figure 107: Africa Grape Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 108: Africa Grape Industry Volume (Kiloton), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 109: Africa Grape Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 110: Africa Grape Industry Volume Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 111: Africa Grape Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 112: Africa Grape Industry Volume (Kiloton), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 113: Africa Grape Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 114: Africa Grape Industry Volume Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 115: Africa Grape Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 116: Africa Grape Industry Volume (Kiloton), by Price Trend Analysis 2025 & 2033

- Figure 117: Africa Grape Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 118: Africa Grape Industry Volume Share (%), by Price Trend Analysis 2025 & 2033

- Figure 119: Africa Grape Industry Revenue (Million), by Country 2025 & 2033

- Figure 120: Africa Grape Industry Volume (Kiloton), by Country 2025 & 2033

- Figure 121: Africa Grape Industry Revenue Share (%), by Country 2025 & 2033

- Figure 122: Africa Grape Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Global Grape Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Global Grape Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: United States Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: United States Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Canada Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Canada Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: Mexico Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Rest of North America Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of North America Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 34: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 35: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 36: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 37: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 38: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 40: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 41: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 42: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 43: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 45: Germany Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Germany Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: United Kingdom Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: United Kingdom Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 49: France Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 51: Italy Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 55: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 56: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 57: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 58: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 59: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 60: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 61: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 62: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 63: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 64: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 65: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 67: China Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: China Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 69: India Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: India Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 71: Australia Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Australia Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 73: Japan Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Japan Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 75: Rest of Asia Pacific Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Asia Pacific Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 77: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 78: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 79: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 80: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 81: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 82: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 83: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 84: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 85: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 86: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 87: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 88: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 89: Brazil Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Brazil Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 91: Argentina Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Argentina Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 93: Chile Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: Chile Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 95: Peru Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Peru Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 97: Rest of South America Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: Rest of South America Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 99: Global Grape Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 100: Global Grape Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 101: Global Grape Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 102: Global Grape Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 103: Global Grape Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 104: Global Grape Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 105: Global Grape Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 106: Global Grape Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 107: Global Grape Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 108: Global Grape Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 109: Global Grape Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 110: Global Grape Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 111: South Africa Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: South Africa Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 113: Egypt Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 114: Egypt Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 115: Rest of Africa Grape Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 116: Rest of Africa Grape Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Grape Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the Grape Industry?

Key companies in the market include Giumarra Vineyards, Sun World International, Driscoll's .

3. What are the main segments of the Grape Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 215.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

The Growth of the Global Wine Industry is Driving the Grapes Market.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

November 2022: Cornell University in the United States rolled out its PhytoPathol Boots (PPB), which will be deployed to four grape breeding programs across the U.S. These autonomous robots will roll through vineyards, using computer vision to gather data on the physiological state of each grapevine, allowing breeders and growers to evaluate their vineyards leaf by leaf, in real-time, down to the chemical level.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Grape Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Grape Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Grape Industry?

To stay informed about further developments, trends, and reports in the Grape Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence