Key Insights

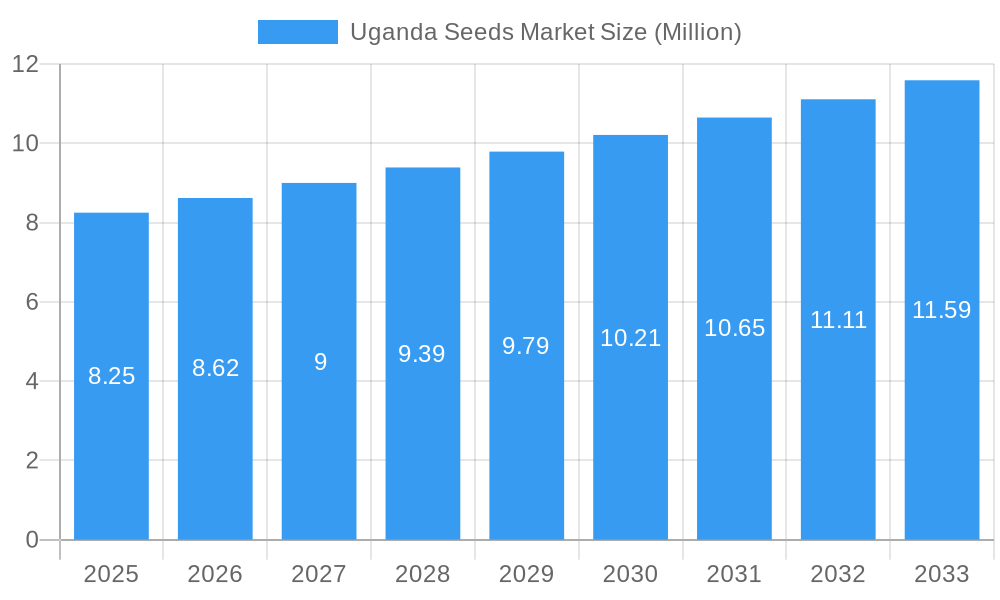

The Uganda Seeds Market is poised for significant expansion, projecting a market size of $8.25 million by 2025, driven by a robust CAGR of 4.40%. This growth is fundamentally underpinned by the increasing adoption of improved seed varieties, which are crucial for enhancing agricultural productivity and ensuring food security across the nation. Key drivers include government initiatives promoting modern farming practices, substantial investments in agricultural research and development, and a growing farmer awareness regarding the economic benefits of high-yielding and disease-resistant seeds. The market is witnessing a surge in demand for hybrid seeds, treated seeds, and genetically modified varieties, reflecting a shift towards more efficient and resilient agricultural systems. Furthermore, the growing export potential of Ugandan agricultural produce also fuels the demand for premium quality seeds that can support the production of competitive crops in the international market.

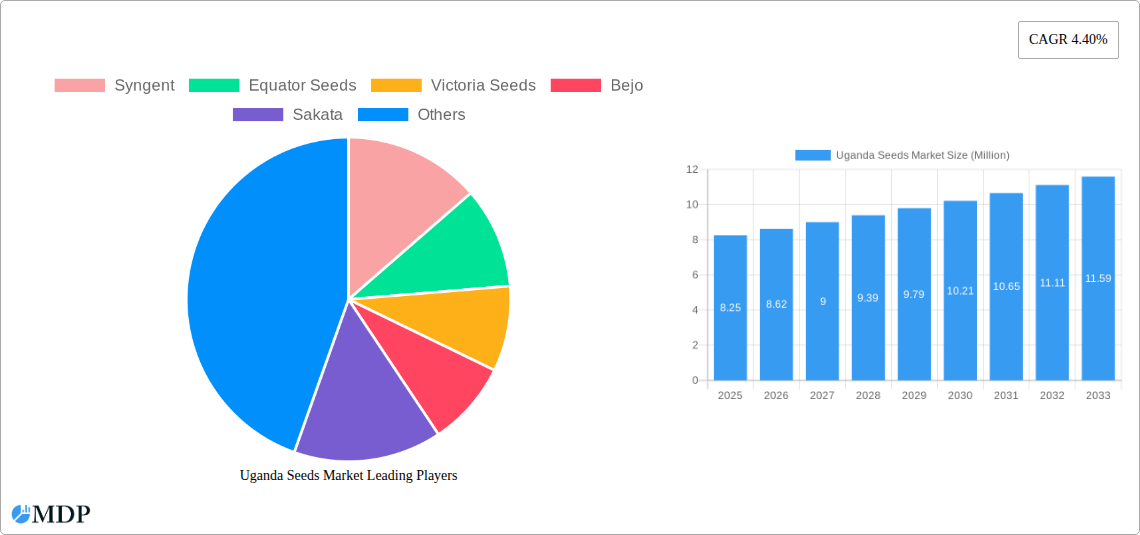

Uganda Seeds Market Market Size (In Million)

The market dynamics are further shaped by evolving trends such as precision agriculture, the integration of biotechnology in seed development, and a rising preference for organic and climate-resilient seed options. While the market presents substantial opportunities, it also faces certain restraints. These include challenges related to the accessibility of quality seeds in remote rural areas, the prevalence of counterfeit seeds, and the need for enhanced extension services to educate farmers on optimal seed utilization. Nevertheless, the concerted efforts of both public and private sector players, including leading companies like Syngenta, Rijk Zwaan, and East-West Seed, are instrumental in overcoming these hurdles and steering the Uganda Seeds Market towards sustained growth and increased contribution to the nation's agricultural economy. The market's segmentation into production, consumption, import/export, and price trends provides a comprehensive view of its multifaceted landscape.

Uganda Seeds Market Company Market Share

Uganda Seeds Market: Comprehensive Analysis & Forecast (2019-2033)

Unlock lucrative investment opportunities and strategic insights into Uganda's rapidly expanding seeds market. This in-depth report provides a 360-degree view of the Uganda seeds industry, meticulously analyzing production, consumption, imports, exports, and price trends. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report leverages high-traffic keywords like "Uganda seeds," "agricultural seeds Uganda," "vegetable seeds market Uganda," and "seed industry Uganda" to ensure maximum search visibility. Essential for stakeholders including seed producers, distributors, farmers, government agencies, and investors, this report delivers actionable intelligence on market dynamics, industry trends, leading players, product developments, growth drivers, challenges, and emerging opportunities. Gain a competitive edge with data-driven projections and strategic recommendations.

Uganda Seeds Market Market Dynamics & Concentration

The Uganda seeds market is characterized by a moderate to high concentration, with a few key players holding significant market share. Innovation drivers are primarily focused on developing climate-resilient crop varieties, enhancing seed quality, and improving seed treatment technologies. The regulatory framework, spearheaded by bodies like the National Agricultural Research Organization (NARO) and the Uganda Seed Trade Association (USTA), is evolving to promote seed quality and fair trade practices, though challenges in enforcement persist. Product substitutes primarily include traditional farming methods and uncertified seeds, which pose a threat to the formal seed market. End-user trends indicate a growing demand for high-yielding, disease-resistant seeds among smallholder farmers, driven by the need for increased food security and income generation. Merger and acquisition (M&A) activities are anticipated to increase as larger international seed companies seek to expand their footprint in the promising Ugandan agricultural landscape. While specific M&A deal counts are not publicly disclosed, anecdotal evidence suggests consolidation within the seed distribution channels. Estimated market share by key players like Syngenta and East-West Seed Company is expected to represent a substantial portion of the formal seed market in Uganda.

Uganda Seeds Market Industry Trends & Analysis

The Uganda seeds market is poised for significant growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including government initiatives to boost agricultural productivity, increasing adoption of improved seed varieties by farmers, and a rising demand for high-quality food products. Technological disruptions are playing a crucial role, with advancements in seed breeding, biotechnology, and precision agriculture enhancing the efficacy and yield potential of seeds. Farmers are increasingly embracing hybrid seeds and genetically improved varieties that offer better resistance to pests and diseases, thereby reducing crop losses and improving overall farm output. Consumer preferences are shifting towards the consumption of diverse and nutritious food, which in turn is driving demand for a wider range of improved vegetable and cereal seeds. The competitive dynamics within the market are intensifying, with both local and international players vying for market share. Leading companies are investing in research and development to introduce innovative seed products tailored to specific agro-ecological zones in Uganda. Market penetration for certified seeds is steadily increasing, moving away from traditional informal seed systems. The growth in the agriculture sector, which contributes a significant portion to Uganda's GDP, directly translates into a robust demand for quality seeds.

Leading Markets & Segments in Uganda Seeds Market

The Production Analysis within the Uganda seeds market is dominated by key players focusing on staple crops like maize, beans, and cassava, alongside a growing segment for high-value vegetables. The leading country for seed production, encompassing both local breeding and international company operations, is Uganda itself, driven by supportive government policies and its strategic position in East Africa.

- Consumption Analysis: The largest consumption segment by volume is cereals, particularly maize, due to its importance as a food staple and for animal feed. Demand for vegetable seeds is rapidly increasing, driven by urbanization and changing dietary habits.

- Key Drivers: Growing population, increasing disposable incomes, and government emphasis on food security and nutrition.

- Import Market Analysis (Value & Volume): Uganda's import market for seeds is significant, particularly for specialized hybrid varieties and crops not extensively bred locally. The value of imports is projected to reach approximately $150 Million by 2025, with a volume of over 50,000 metric tons.

- Key Drivers: Need for advanced seed technology, access to a wider range of crop varieties, and the desire for higher yields than locally available options.

- Export Market Analysis (Value & Volume): Uganda's seed export market is growing, with a focus on regional markets within East Africa. Exports are estimated to reach around $40 Million in value and 15,000 metric tons by 2025.

- Key Drivers: Competitive pricing of locally produced seeds, growing demand in neighboring countries, and improving seed quality standards.

- Price Trend Analysis: Seed prices in Uganda exhibit an upward trend, influenced by factors such as production costs, global commodity prices, currency exchange rates, and the introduction of premium hybrid seeds. The average price for certified maize seeds is expected to range between $2.50-$3.50 per kilogram.

- Key Drivers: Input costs (fertilizers, labor), research and development investment by seed companies, and market demand.

Uganda Seeds Market Product Developments

Product innovation in the Uganda seeds market is centered on developing seeds with enhanced resilience to drought and pests, higher nutritional content, and improved yield potential. Companies are actively introducing new hybrid varieties of staple crops like maize and beans, as well as a diverse range of vegetable seeds such as heat-tolerant tomatoes, disease-resistant peppers, and improved indigenous leafy vegetables. These advancements provide farmers with greater crop reliability and profitability. For instance, East-West Seed Company's recent launch of specific hybrid vegetable varieties like Tomato Diva F1 and Hot Pepper Spicy F1 highlights the trend towards specialized seed solutions catering to evolving market demands and agricultural challenges. These developments are crucial for increasing agricultural productivity and ensuring food security across Uganda.

Key Drivers of Uganda Seeds Market Growth

The Uganda seeds market is propelled by several key drivers. Firstly, government support and agricultural policies aimed at modernizing the sector, including investments in research and extension services, are crucial. Secondly, the increasing awareness among farmers about the benefits of using certified, high-quality seeds, leading to higher yields and improved income, is a significant factor. Thirdly, a growing demand for food products, driven by population growth and urbanization, necessitates increased agricultural output, thus stimulating seed demand. Finally, the advancements in seed technology and breeding techniques, enabling the development of climate-resilient and disease-resistant varieties, are pivotal for sustained growth.

Challenges in the Uganda Seeds Market Market

Despite its growth potential, the Uganda seeds market faces several challenges. Regulatory hurdles and a complex seed certification process can hinder the timely market entry of new varieties. Limited access to finance for smallholder farmers restricts their ability to purchase certified seeds. Furthermore, the presence of a significant informal seed sector, characterized by the sale of uncertified or counterfeit seeds, undermines the market for legitimate seed businesses and compromises yield potential. Inadequate infrastructure, including poor road networks and limited cold storage facilities, also poses challenges for seed distribution and quality maintenance across the country.

Emerging Opportunities in Uganda Seeds Market

Emerging opportunities in the Uganda seeds market are abundant, driven by a growing demand for specialty seeds and niche crops, such as high-value fruits and vegetables for export markets and local premium consumption. The government's focus on agro-processing and value addition presents opportunities for seed varieties that enhance the quality and yield of raw materials for these industries. Furthermore, the increasing adoption of digital technologies and precision agriculture in farming creates a demand for data-driven seed solutions and smart farming practices. Strategic partnerships between local seed companies and international research institutions or technology providers can unlock further potential for innovation and market expansion, particularly in developing climate-smart seed varieties.

Leading Players in the Uganda Seeds Market Sector

- Syngenta

- Equator Seeds

- Victoria Seeds

- Bejo

- Sakata

- Kenya Highland Seed

- Rijk Zwaan

- Seed Co

- East-West Seed

- East African Seed

- Limagrain

- FICA Seeds

- NASECO

Key Milestones in Uganda Seeds Market Industry

- August 2022: The Government of Uganda, with support from the Government of the Republic of Korea through KOICA, launched a nine-year project focused on developing new vegetable varieties, strengthening seed certification capacity, and improving farmer technical skills.

- July 2022: Sixteen farmer groups in Odek Sub-county, Omoro district, acquired planting seeds from East African Ministries (EAM) under the Seed Effect Uganda Project.

- November 2021: East-West Seed Company introduced a new range of vegetable seeds into the African market, including Tomato Diva F1, Papa Gymbia F1, Hot Pepper Spicy F1, Hot Pepper Piquante Yellow F1, Watermelon Sweet Sangria F1, Gboma Eggplant (African Leafy Vegetables) Sika, and Cucumber Daewy F1.

Strategic Outlook for Uganda Seeds Market Market

The strategic outlook for the Uganda seeds market is highly positive, driven by ongoing government support for agricultural modernization and increasing farmer adoption of improved seed technologies. Future growth will likely be accelerated by a greater focus on developing climate-resilient and drought-tolerant seed varieties to address the impacts of climate change. Strategic partnerships with international organizations and private sector players will be instrumental in driving innovation and expanding market access. The expanding middle class and rising consumer demand for diverse and nutritious food will continue to fuel growth in the vegetable seed segment. Furthermore, the integration of digital solutions for seed traceability and farmer advisory services presents significant opportunities for market differentiation and enhanced customer engagement, positioning Uganda to become a more significant player in the regional seed market.

Uganda Seeds Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Uganda Seeds Market Segmentation By Geography

- 1. Uganda

Uganda Seeds Market Regional Market Share

Geographic Coverage of Uganda Seeds Market

Uganda Seeds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis

- 3.3. Market Restrains

- 3.3.1. Lack of Data on Dosages and Results; Lack of Access to Financial Assistance

- 3.4. Market Trends

- 3.4.1. Government Support to the Seed Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Uganda Seeds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Uganda

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syngent

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equator Seeds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Victoria Seeds

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bejo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sakata

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kenya Highland Seed

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rijk Zwaan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seed Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 East-West Seed

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 East African Seed

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Limagrain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 FICA Seeds

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 NASECO

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Syngent

List of Figures

- Figure 1: Uganda Seeds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Uganda Seeds Market Share (%) by Company 2025

List of Tables

- Table 1: Uganda Seeds Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Uganda Seeds Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Uganda Seeds Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Uganda Seeds Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Uganda Seeds Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Uganda Seeds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Uganda Seeds Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Uganda Seeds Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Uganda Seeds Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Uganda Seeds Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Uganda Seeds Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Uganda Seeds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Uganda Seeds Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Uganda Seeds Market?

Key companies in the market include Syngent, Equator Seeds, Victoria Seeds, Bejo, Sakata, Kenya Highland Seed, Rijk Zwaan, Seed Co, East-West Seed, East African Seed, Limagrain, FICA Seeds, NASECO.

3. What are the main segments of the Uganda Seeds Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Legalization of Cannabis; Growing Focus on Health Benefits of Cannabis.

6. What are the notable trends driving market growth?

Government Support to the Seed Industry.

7. Are there any restraints impacting market growth?

Lack of Data on Dosages and Results; Lack of Access to Financial Assistance.

8. Can you provide examples of recent developments in the market?

August 2022: The Government of Uganda, with support from the Government of the Republic of Korea through the Korea International Cooperation Agency (KOICA), has launched a nine-year project to develop new varieties of vegetables, strengthen seed certification capacity, and improve the technical skills of vegetable farmers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Uganda Seeds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Uganda Seeds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Uganda Seeds Market?

To stay informed about further developments, trends, and reports in the Uganda Seeds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence