Key Insights

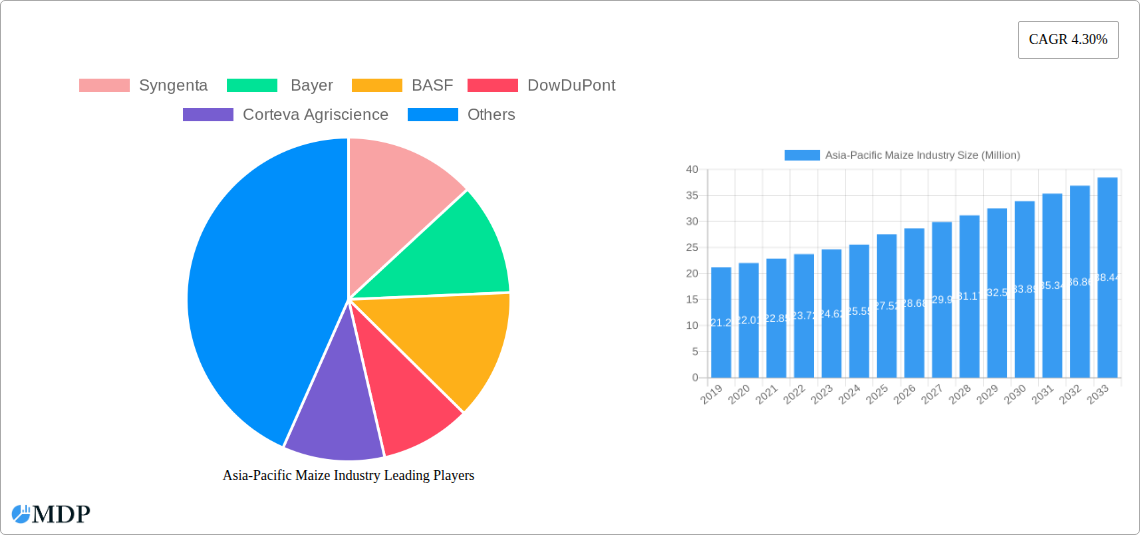

The Asia-Pacific Maize Industry is poised for significant expansion, projected to reach a substantial market size of USD 27.52 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 4.30% through 2033. This growth is underpinned by several key drivers, primarily the escalating demand for maize as a crucial feedstock in animal nutrition, driven by the rising global consumption of meat and dairy products. Furthermore, the increasing utilization of maize in the food and beverage sector, particularly in processed foods, sweeteners, and biofuels, significantly contributes to market expansion. Technological advancements in maize cultivation, including the development of higher-yielding and disease-resistant hybrid seeds, coupled with improved farming practices and precision agriculture techniques, are enhancing production efficiency and output, thereby fueling market growth. The substantial agricultural base and increasing disposable incomes across many Asia-Pacific nations also contribute to a steady rise in demand for maize-based products.

Asia-Pacific Maize Industry Market Size (In Million)

The market landscape in Asia-Pacific is characterized by dynamic trends and evolving consumption patterns. A notable trend is the increasing focus on sustainable and climate-resilient maize varieties, responding to growing environmental concerns and the need for food security. Investments in research and development by leading agrochemical and seed companies are central to introducing these advanced hybrids. However, the industry faces certain restraints, including fluctuating commodity prices, the impact of adverse weather conditions and climate change on crop yields, and evolving regulatory landscapes concerning genetically modified organisms (GMOs) in some countries. Trade policies and import/export dynamics also play a crucial role in shaping regional market accessibility and profitability. Key players like Syngenta, Bayer, BASF, DowDuPont, Corteva Agriscience, and Cargill are actively engaged in the region, driving innovation and market development across the production, consumption, import, export, and pricing segments. The robust growth trajectory is expected to continue, driven by sustained demand and ongoing technological advancements within the maize value chain.

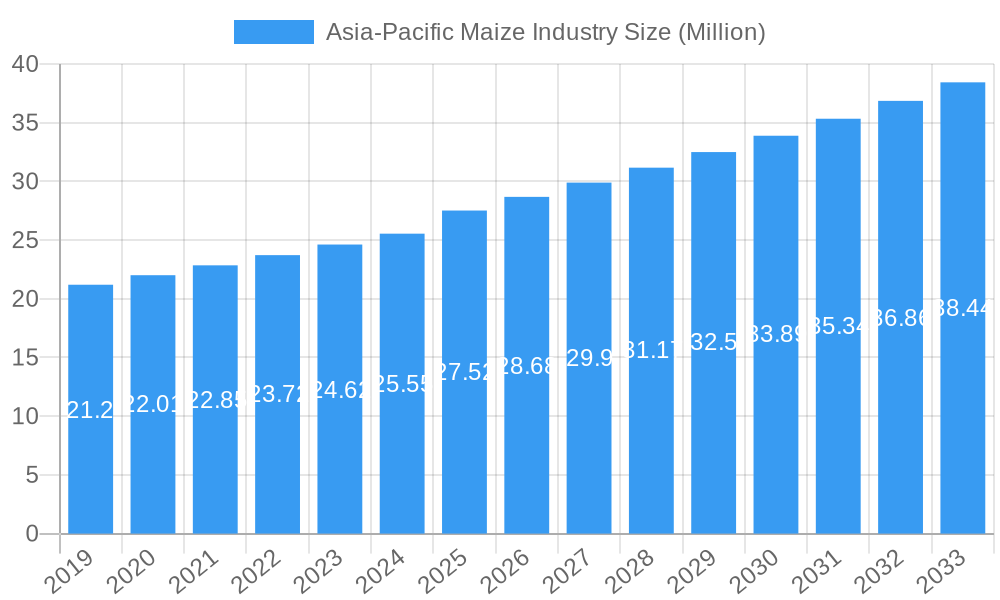

Asia-Pacific Maize Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the Asia-Pacific maize industry, providing critical insights into market dynamics, leading trends, and future projections. Covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to navigate and capitalize on this rapidly evolving sector. It incorporates detailed segment analysis, including Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis, alongside an examination of Industry Developments. High-traffic keywords such as "maize market Asia," "corn industry APAC," "agricultural commodities," "feed grain," "biofuel feedstock," and "food security Asia" are integrated to maximize search visibility and attract industry professionals.

Asia-Pacific Maize Industry Market Dynamics & Concentration

The Asia-Pacific maize industry exhibits moderate to high market concentration, with key players like Syngenta, Bayer, BASF, DowDuPont, Corteva Agriscience, and Cargill holding significant market shares. Innovation drivers are largely centered around enhancing crop yields through advanced seed genetics, precision agriculture techniques, and sustainable farming practices. Regulatory frameworks vary significantly across the region, influencing trade policies, import/export regulations, and the adoption of genetically modified organisms (GMOs). Product substitutes, such as other grains and alternative feed sources, present a constant competitive pressure. End-user trends are increasingly driven by rising demand for animal feed, growing biofuel production, and the direct consumption of maize in food products. Mergers and acquisitions (M&A) activities, while not at an extreme peak, are strategic, aimed at consolidating market positions, acquiring new technologies, and expanding geographical reach. For instance, M&A deal counts have averaged around 5-10 major transactions per year in the historical period, indicating a dynamic yet focused consolidation landscape. Market share distribution among the top five players is estimated to be over 65% in key producing nations.

Asia-Pacific Maize Industry Industry Trends & Analysis

The Asia-Pacific maize industry is poised for substantial growth, driven by several interconnected trends. A primary growth driver is the escalating demand for animal feed, fueled by the expanding middle class and increasing meat consumption across the region, particularly in China, India, and Southeast Asian nations. This trend is projected to contribute to a Compound Annual Growth Rate (CAGR) of approximately 4.5% over the forecast period. Technological disruptions are transforming maize cultivation and processing. The adoption of advanced seed varieties with improved resilience to pests, diseases, and climate change is on the rise. Precision agriculture, including the use of drones, sensors, and AI-powered analytics, is optimizing resource management, leading to higher yields and reduced environmental impact. Consumer preferences are evolving, with a growing emphasis on food safety, nutritional value, and sustainably sourced maize. This is pushing for greater transparency in the supply chain and the adoption of eco-friendly farming methods. Competitive dynamics are intensifying, with both multinational corporations and regional players vying for market share. Strategic partnerships, joint ventures, and R&D collaborations are becoming crucial for companies to stay ahead. Market penetration of high-yield seed varieties is estimated to reach over 70% in major producing countries by 2033, signifying a significant shift in agricultural practices. The increasing application of maize in industrial sectors, including biofuels and bioplastics, further bolsters market expansion.

Leading Markets & Segments in Asia-Pacific Maize Industry

China stands out as the dominant market in the Asia-Pacific maize industry, significantly influencing global supply and demand dynamics. Its dominance is evident across all analyzed segments:

- Production Analysis: China is the largest maize producer globally, consistently contributing over 200 Million tons annually. Its vast agricultural land, coupled with government support for maize cultivation, forms the bedrock of its production prowess. Key drivers include favorable government policies promoting food security, substantial investment in agricultural infrastructure, and the widespread adoption of improved farming techniques.

- Consumption Analysis: China also leads in maize consumption, primarily driven by its massive animal feed industry. The growing demand for poultry, pork, and aquaculture products directly translates into increased maize requirements for feed. Additionally, direct human consumption and industrial applications further bolster its consumption figures. Economic policies aimed at increasing domestic protein production are a major catalyst.

- Import Market Analysis (Value & Volume): While a major producer, China also engages in significant maize imports to meet its burgeoning demand, especially when domestic supply faces challenges or price differentials are favorable. Its import volume is estimated to be around 20-30 Million tons annually, making it a critical destination for exporting nations. The value of these imports can reach billions of US dollars.

- Export Market Analysis (Value & Volume): While China primarily consumes its maize domestically, it does have a niche export market, particularly for processed maize products. However, its overall export volume is relatively small compared to its production and consumption.

- Price Trend Analysis: Maize prices in China are heavily influenced by government policies, domestic supply-demand, and global market fluctuations. The government's strategic reserves and interventionist policies often help stabilize prices, though periods of volatility can occur.

Other significant markets include India, with substantial production and consumption driven by its large population and agricultural sector, and Southeast Asian nations like Vietnam, Indonesia, and Thailand, which are key importers for their growing feed industries. The feed segment represents the largest share of consumption across the Asia-Pacific region, followed by food and industrial applications.

Asia-Pacific Maize Industry Product Developments

Product innovation in the Asia-Pacific maize industry is heavily focused on enhancing crop resilience, nutritional content, and processing efficiency. Companies are developing genetically modified and conventionally bred maize varieties with improved resistance to pests, diseases (like fall armyworm), and adverse weather conditions, crucial for the region's diverse climate. Advancements in biofortification are leading to maize with higher levels of essential nutrients, addressing nutritional deficiencies in target populations. Furthermore, research is ongoing into maize varieties optimized for specific industrial applications, such as higher starch content for ethanol production or improved oil profiles for food processing. These developments aim to provide farmers with higher yields, reduced input costs, and a more reliable harvest, while meeting the evolving demands of consumers and industries.

Key Drivers of Asia-Pacific Maize Industry Growth

The Asia-Pacific maize industry is propelled by a confluence of robust growth drivers. The escalating demand for animal feed, driven by a growing middle class and increased meat consumption, is paramount. Furthermore, the expanding biofuel sector in several Asia-Pacific countries is creating significant demand for maize as a feedstock. Government initiatives aimed at enhancing food security and promoting agricultural self-sufficiency are also critical, leading to increased investment in maize production. Technological advancements in seed genetics and precision agriculture are boosting yields and improving crop resilience, making maize cultivation more viable and profitable. Economic growth and urbanization across the region further underpin the demand for maize-based products.

Challenges in the Asia-Pacific Maize Industry Market

Despite its growth potential, the Asia-Pacific maize industry faces significant challenges. Climate change poses a substantial threat, with unpredictable weather patterns, droughts, and floods impacting yields and increasing crop losses. Pest and disease outbreaks, such as the persistent threat of the fall armyworm, require continuous investment in management strategies. Regulatory hurdles and trade barriers between countries can impede the smooth flow of maize, affecting import and export dynamics. Fluctuating global commodity prices create economic uncertainty for farmers and processors. Limited access to advanced technology and finance for smallholder farmers in some developing nations also restricts overall productivity and adoption of best practices, impacting overall market expansion.

Emerging Opportunities in Asia-Pacific Maize Industry

The Asia-Pacific maize industry is brimming with emerging opportunities for long-term growth. The increasing global focus on sustainability and climate-resilient agriculture presents a significant opportunity for companies offering drought-tolerant and pest-resistant maize varieties. Strategic partnerships and collaborations between seed companies, technology providers, and local agricultural organizations can accelerate the adoption of modern farming practices. The growing demand for specialty maize products, such as high-amylose maize for packaging or waxy maize for food applications, opens up new market niches. Furthermore, investments in value-added processing and the development of diversified maize-based products, including snacks, biofuels, and bioplastics, can unlock substantial market potential and drive economic development across the region.

Leading Players in the Asia-Pacific Maize Industry Sector

- Syngenta

- Bayer

- BASF

- DowDuPont

- Corteva Agriscience

- Cargill

Key Milestones in Asia-Pacific Maize Industry Industry

- 2019: Launch of novel fall armyworm resistant maize varieties in Southeast Asia.

- 2020: Significant increase in government subsidies for maize cultivation in India to bolster domestic production.

- 2021: Major investment in biofuel production facilities utilizing maize in China.

- 2022: Introduction of advanced precision agriculture platforms for maize farmers in Australia.

- 2023: Merger of two leading regional seed companies to enhance R&D capabilities.

- 2024: Implementation of new trade agreements facilitating maize imports into several ASEAN countries.

Strategic Outlook for Asia-Pacific Maize Industry Market

The strategic outlook for the Asia-Pacific maize industry is one of continued robust growth, fueled by increasing demand from feed, food, and industrial sectors. Key growth accelerators will include the relentless pursuit of yield enhancement through advanced seed technologies and precision farming, coupled with a growing emphasis on sustainable and climate-resilient practices. Diversification into higher-value specialty maize products and the expansion of biofuel production will present significant opportunities. Strategic investments in research and development, alongside collaborations that bridge technological gaps and improve market access for farmers, will be crucial for capitalizing on the region's vast potential and ensuring long-term market dominance.

Asia-Pacific Maize Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Maize Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Maize Industry Regional Market Share

Geographic Coverage of Asia-Pacific Maize Industry

Asia-Pacific Maize Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Maize as Animal Feed Protein Source

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Maize Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Syngenta

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DowDuPont

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corteva Agriscience

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cargill

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Syngenta

List of Figures

- Figure 1: Asia-Pacific Maize Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Maize Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Asia-Pacific Maize Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Asia-Pacific Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Asia-Pacific Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Asia-Pacific Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Asia-Pacific Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Asia-Pacific Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Asia-Pacific Maize Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Asia-Pacific Maize Industry Volume Kiloton Forecast, by Country 2020 & 2033

- Table 25: China Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 27: Japan Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 29: South Korea Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: India Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: Australia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Australia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: New Zealand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: New Zealand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Indonesia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Indonesia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: Malaysia Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Malaysia Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Singapore Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Singapore Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Thailand Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Thailand Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Vietnam Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Vietnam Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: Philippines Asia-Pacific Maize Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Philippines Asia-Pacific Maize Industry Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Maize Industry?

The projected CAGR is approximately 4.30%.

2. Which companies are prominent players in the Asia-Pacific Maize Industry?

Key companies in the market include Syngenta , Bayer , BASF, DowDuPont , Corteva Agriscience , Cargill.

3. What are the main segments of the Asia-Pacific Maize Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Increasing Demand for Maize as Animal Feed Protein Source.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Maize Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Maize Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Maize Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Maize Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence