Key Insights

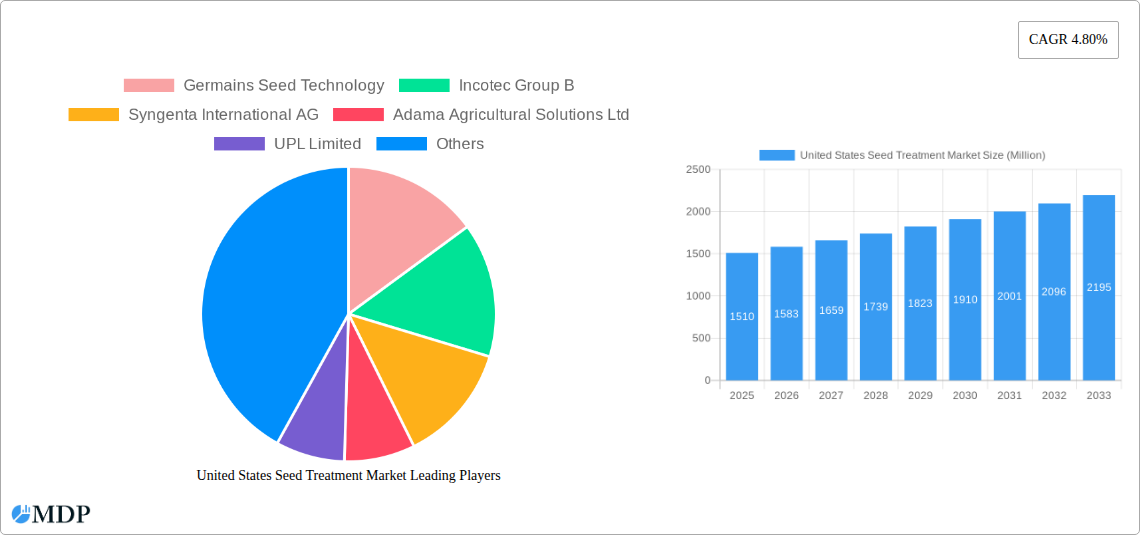

The United States seed treatment market is poised for significant expansion, with a projected market size of $1,510 million in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 4.80%, indicating sustained demand and innovation within the sector. A key driver for this upward trajectory is the increasing adoption of advanced seed technologies that enhance crop yield, quality, and resilience against pests and diseases. Farmers are increasingly recognizing the economic benefits of seed treatments, which offer a cost-effective and environmentally conscious alternative to broadcast applications of pesticides and fertilizers. This shift towards precision agriculture and sustainable farming practices is a major impetus for market expansion, as seed treatments allow for targeted application and reduced overall chemical usage. Furthermore, ongoing research and development efforts by leading companies are introducing novel seed coating formulations and biological treatments, further broadening the market's appeal and effectiveness.

United States Seed Treatment Market Market Size (In Billion)

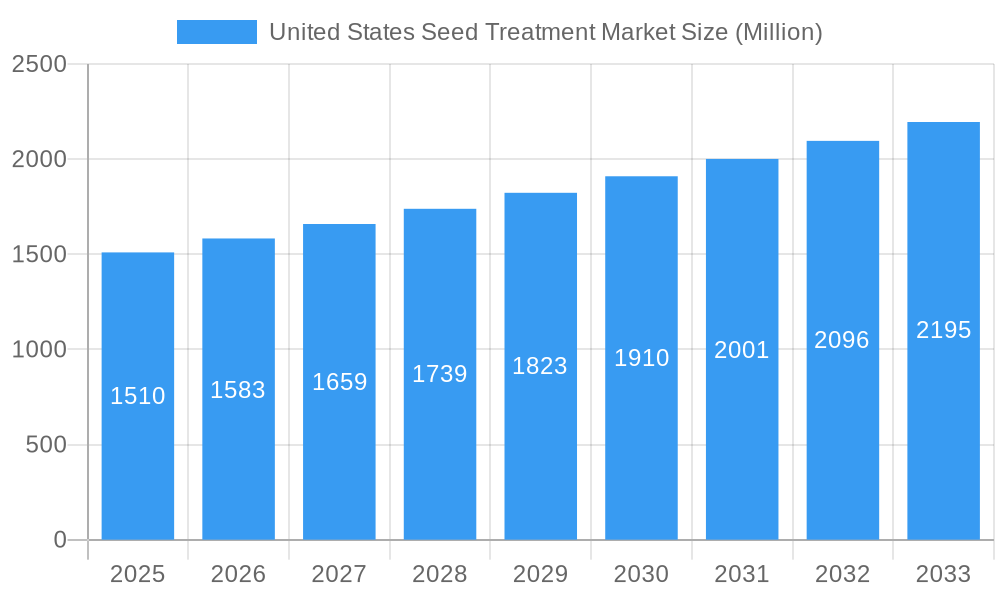

The United States seed treatment market is characterized by dynamic trends and strategic plays from major industry players. Emerging trends include the growing demand for biological seed treatments, which offer an eco-friendly alternative to conventional chemical treatments, and the integration of digital technologies for enhanced application precision and monitoring. While the market enjoys strong growth, it faces certain restraints. These include the high initial cost of some advanced treatment technologies and evolving regulatory landscapes that can impact product approvals and market access. However, the inherent benefits of improved plant establishment, disease resistance, and nutrient uptake continue to drive adoption. Companies like Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, Corteva Agriscience, Bayer CropScience AG, and BASF SE are actively innovating and competing to capture market share. The United States, being a significant agricultural hub, represents a crucial region for these advancements and is expected to lead in the adoption of next-generation seed treatment solutions.

United States Seed Treatment Market Company Market Share

This in-depth report provides a definitive analysis of the United States Seed Treatment Market, forecasting significant growth and identifying key market dynamics from 2019 to 2033. With a base year of 2025, the report offers detailed insights into market trends, competitive landscapes, and strategic opportunities for industry stakeholders. Explore the intricate workings of this vital agricultural sector, driven by technological advancements and evolving farming practices.

United States Seed Treatment Market Market Dynamics & Concentration

The United States Seed Treatment Market is characterized by a moderate to high concentration of key players, with companies like Syngenta International AG, Corteva Agriscience, and Bayer CropScience AG holding substantial market shares. Innovation is a primary driver, fueled by ongoing research and development in biopesticides, enhanced seed coatings, and precision application technologies. The regulatory framework, governed by agencies such as the Environmental Protection Agency (EPA), plays a crucial role in product approvals and market access, influencing the adoption of new seed treatment solutions. Product substitutes, primarily conventional pesticide application, are gradually being displaced by the efficacy and targeted benefits of seed treatments. End-user trends are leaning towards sustainable agriculture, increased crop yields, and reduced environmental impact, all of which are favorably addressed by advanced seed treatment technologies. Mergers and acquisitions (M&A) activities have been instrumental in shaping the market landscape. For instance, recent years have seen significant consolidation, with an estimated XX M&A deals contributing to market integration and synergy realization. This trend is expected to continue as companies seek to expand their product portfolios and geographical reach.

United States Seed Treatment Market Industry Trends & Analysis

The United States Seed Treatment Market is poised for robust expansion, driven by a confluence of technological innovations, evolving agricultural practices, and a growing demand for enhanced crop productivity and sustainability. The market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% from the base year 2025 through the forecast period ending 2033. Technological disruptions, including the development of novel biological seed treatments, advanced delivery systems, and gene-editing technologies impacting seed performance, are fundamentally reshaping the industry. These advancements not only improve crop resilience against pests and diseases but also enhance nutrient uptake and germination rates, leading to higher yields and reduced input costs for farmers. Consumer preferences are increasingly shifting towards food products grown with fewer chemical inputs, driving the demand for seed-treated crops that offer inherent protection and improved quality. This, coupled with the growing awareness of the economic and environmental benefits of seed treatments – such as reduced application of broad-spectrum pesticides and enhanced soil health – further propels market penetration. Competitive dynamics are intense, with leading global agrochemical companies investing heavily in research and development to gain a competitive edge. Market penetration is expected to rise as more farmers recognize the return on investment and the long-term benefits of adopting seed treatment technologies for a wider range of crops. The increasing adoption of precision agriculture techniques also aligns perfectly with the targeted application capabilities of modern seed treatments.

Leading Markets & Segments in United States Seed Treatment Market

The United States Seed Treatment Market exhibits strong performance across its key segments. In terms of Production Analysis, the Midwest region, often referred to as the "breadbasket of America," demonstrates significant production volumes due to its extensive agricultural land and high crop output. Key drivers for this dominance include favorable economic policies supporting agricultural innovation, robust infrastructure for distribution and logistics, and a deep-rooted farming culture that embraces technological advancements.

Consumption Analysis also heavily favors the Midwest, driven by the widespread cultivation of major row crops like corn, soybeans, and wheat, which are prime candidates for seed treatment. The growing emphasis on yield optimization and disease management in these high-volume crops directly translates to substantial demand for seed treatments.

The Import Market Analysis (Value & Volume) indicates a notable inflow of specialized seed treatment formulations and active ingredients, particularly from international manufacturers with advanced R&D capabilities. The value of imports is estimated to reach USD 2,500 Million by 2025, with a projected volume of 2.8 Million metric tons. Key drivers here include the need for cutting-edge chemical and biological agents that may not be fully developed domestically, as well as cost-effectiveness in sourcing certain components.

Conversely, the Export Market Analysis (Value & Volume) highlights the United States' strength in exporting advanced seed treatment technologies and proprietary formulations, particularly to regions with developing agricultural sectors seeking to enhance their crop yields. Export values are projected to be around USD 1,800 Million in 2025, with a volume of 2.1 Million metric tons. This segment is propelled by the strong reputation of U.S. agricultural research and the high quality of domestically produced seed treatments.

The Price Trend Analysis reveals a steady upward trajectory for seed treatments, influenced by the rising cost of raw materials, the increasing complexity of research and development, and the demonstrated value proposition in terms of yield enhancement and risk reduction. The average price per ton is estimated to hover around USD 900 in 2025, with an anticipated increase of 3-5% annually in the coming years. Economic policies that incentivize sustainable farming practices and government support for agricultural research can further influence these price trends, either by encouraging adoption or by spurring competition that may moderate price hikes.

United States Seed Treatment Market Product Developments

Product developments in the United States Seed Treatment Market are rapidly advancing, focusing on efficacy, sustainability, and targeted applications. Innovations in biological seed treatments, leveraging beneficial microbes to enhance plant health and nutrient uptake, are gaining significant traction. Advanced coating technologies are improving the longevity and precision of active ingredient delivery, minimizing off-target effects. Furthermore, the development of seed treatments tailored for specific crop varieties and regional pest pressures offers farmers enhanced control and improved yields. These developments provide competitive advantages by addressing evolving agricultural challenges and meeting the growing demand for environmentally friendly solutions.

Key Drivers of United States Seed Treatment Market Growth

Several key factors are propelling the growth of the United States Seed Treatment Market. Technological advancements in both chemical and biological seed treatments are leading to more effective and targeted pest and disease control, as well as enhanced nutrient delivery. The increasing adoption of sustainable agricultural practices by farmers, driven by consumer demand and regulatory pressures, favors seed treatments that reduce the need for broadcast pesticide applications. Economic incentives, such as government programs supporting precision agriculture and yield improvement, further encourage the uptake of these technologies. The growing awareness of the return on investment provided by seed treatments through increased yields and reduced crop losses is a significant economic driver.

Challenges in the United States Seed Treatment Market Market

Despite the positive growth trajectory, the United States Seed Treatment Market faces several challenges. Regulatory hurdles related to the approval of new active ingredients and formulations can be time-consuming and costly, impacting market entry for innovative products. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of raw materials essential for seed treatment production. Competitive pressures from both established agrochemical giants and emerging biopesticide companies necessitate continuous innovation and competitive pricing. Additionally, the initial cost of seed treatments can be a barrier for some smaller farms, requiring robust educational outreach and demonstration of economic benefits.

Emerging Opportunities in United States Seed Treatment Market

Emerging opportunities in the United States Seed Treatment Market lie in the continued development and adoption of biological and integrated seed treatment solutions. Technological breakthroughs in gene editing and synthetic biology are opening new avenues for enhancing seed resilience and performance. Strategic partnerships between seed companies, chemical manufacturers, and research institutions can accelerate product development and market penetration. Furthermore, expanding market reach into niche crop segments and exploring international markets through strategic alliances represent significant growth catalysts. The increasing demand for traceable and sustainably produced food will also drive the demand for seed treatments that contribute to these objectives.

Leading Players in the United States Seed Treatment Market Sector

- Germains Seed Technology

- Incotec Group B

- Syngenta International AG

- Adama Agricultural Solutions Ltd

- UPL Limited

- Corteva Agriscience

- Bayer CropScience AG

- BASF SE

Key Milestones in United States Seed Treatment Market Industry

- 2019: Increased regulatory scrutiny on neonicotinoid seed treatments prompts intensified research into alternative solutions.

- 2020: Launch of several novel biological seed treatment formulations targeting specific soil-borne diseases.

- 2021: Significant M&A activity as larger agrochemical companies consolidate their seed treatment portfolios.

- 2022: Growing adoption of precision application technologies for seed treatments, optimizing efficacy and reducing environmental impact.

- 2023: Increased investment in R&D for seed treatments addressing climate change impacts, such as drought and heat tolerance.

- 2024: Expansion of seed treatment applications to a wider range of specialty crops.

Strategic Outlook for United States Seed Treatment Market Market

The strategic outlook for the United States Seed Treatment Market is one of sustained innovation and market expansion. Growth accelerators will include the continued integration of biological and chemical solutions to offer comprehensive crop protection and enhancement. Companies focusing on sustainable and environmentally friendly seed treatments are well-positioned for future success. Strategic investments in advanced R&D, coupled with targeted marketing and educational initiatives to farmers, will be crucial for capturing market share. The potential for developing customized seed treatment packages for specific regional needs and crop types presents a significant avenue for growth and differentiation in the evolving agricultural landscape.

United States Seed Treatment Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United States Seed Treatment Market Segmentation By Geography

- 1. United States

United States Seed Treatment Market Regional Market Share

Geographic Coverage of United States Seed Treatment Market

United States Seed Treatment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increase in Cost of High-quality Seeds

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Seed Treatment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Germains Seed Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Incotec Group B

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Syngenta International AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adama Agricultural Solutions Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corteva Agriscience

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bayer CropScience AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Germains Seed Technology

List of Figures

- Figure 1: United States Seed Treatment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Seed Treatment Market Share (%) by Company 2025

List of Tables

- Table 1: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United States Seed Treatment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United States Seed Treatment Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United States Seed Treatment Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United States Seed Treatment Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United States Seed Treatment Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United States Seed Treatment Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United States Seed Treatment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Seed Treatment Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the United States Seed Treatment Market?

Key companies in the market include Germains Seed Technology, Incotec Group B, Syngenta International AG, Adama Agricultural Solutions Ltd, UPL Limited, Corteva Agriscience, Bayer CropScience AG, BASF SE.

3. What are the main segments of the United States Seed Treatment Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increase in Cost of High-quality Seeds.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Seed Treatment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Seed Treatment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Seed Treatment Market?

To stay informed about further developments, trends, and reports in the United States Seed Treatment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence