Key Insights

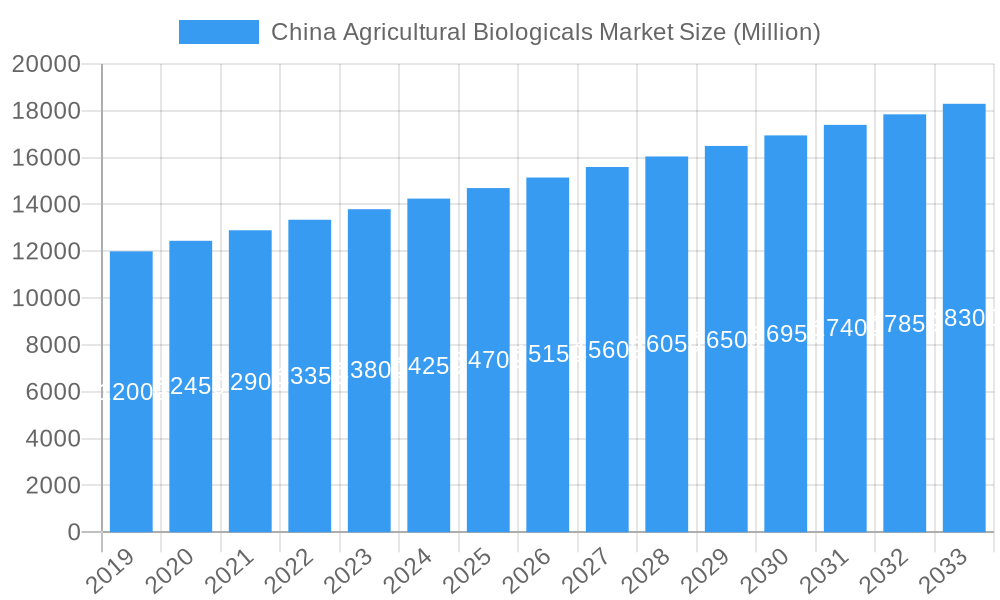

China's Agricultural Biologicals Market is projected for significant expansion, forecasted to reach $18.44 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 13.7% through 2033. Key growth drivers include rising demand for sustainable agriculture, increased farmer adoption of biological solutions for crop protection and yield enhancement, and supportive government initiatives promoting eco-friendly farming practices and reduced chemical pesticide use. The market is witnessing a notable shift towards biological fertilizers, biopesticides, and biostimulants to improve soil health, minimize environmental impact, and produce healthier crops. Emerging trends include the integration of precision agriculture with biological inputs and continuous innovation in product development. Significant R&D investments by leading companies further fuel market growth.

China Agricultural Biologicals Market Market Size (In Billion)

Market restraints may include perceived higher initial costs of biologicals, the necessity for enhanced farmer education on application and efficacy, and potential regulatory challenges for new product introductions. However, the imperative for food security and the global drive towards sustainable agriculture provide strong market resilience. China's extensive agricultural sector and commitment to modernization present substantial opportunities for biological agricultural products. Production, consumption, import, export, and price trends are all expected to reflect this positive trajectory, with China exhibiting particularly strong growth potential due to its vast agricultural base and favorable policy landscape. Leading companies are strategically expanding product portfolios and distribution networks to leverage these opportunities.

China Agricultural Biologicals Market Company Market Share

China Agricultural Biologicals Market: Unlocking Sustainable Growth and Innovation

This comprehensive report delves into the dynamic China Agricultural Biologicals Market, offering in-depth analysis and actionable insights for stakeholders navigating this rapidly evolving landscape. With a study period spanning from 2019 to 2033, and a base year of 2025, this report provides a robust understanding of market dynamics, key trends, and future projections. We meticulously examine production, consumption, import/export activities, price trends, and pivotal industry developments, supported by a forecast period of 2025–2033.

High-traffic keywords: China agricultural biologicals, biopesticides China, biofertilizers China, biostimulants China, agricultural biotechnology China, China crop protection, sustainable agriculture China, China agri-inputs, biological solutions China, China agricultural market.

China Agricultural Biologicals Market Market Dynamics & Concentration

The China Agricultural Biologicals Market exhibits a moderate to high concentration, with a blend of established global players and rapidly growing domestic enterprises vying for market share. Innovation drivers are primarily fueled by the increasing demand for sustainable agricultural practices, driven by government policies promoting eco-friendly farming and a growing consumer awareness of food safety and environmental impact. Regulatory frameworks are becoming more stringent, encouraging the adoption of biological solutions over synthetic alternatives. Product substitutes, while present in the form of conventional chemical inputs, are steadily losing ground as the efficacy and environmental benefits of biologicals gain traction. End-user trends are leaning towards precision agriculture, integrated pest management, and soil health enhancement, all of which are well-aligned with the capabilities of agricultural biologicals. Mergers and acquisitions (M&A) activities are on the rise as companies seek to consolidate their market positions, expand their product portfolios, and gain access to new technologies and distribution networks. For instance, several strategic acquisitions have occurred in the past two years, leading to an estimated 5-10 significant M&A deal counts annually. Market share is fragmenting, with the top 5 players holding an estimated 35-40% of the market, while numerous smaller companies contribute to the remaining share.

China Agricultural Biologicals Market Industry Trends & Analysis

The China Agricultural Biologicals Market is poised for substantial expansion, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025-2033). This growth is underpinned by a significant shift away from conventional chemical pesticides and fertilizers towards more environmentally benign biological alternatives. Technological disruptions, including advancements in microbial fermentation, genetic engineering, and delivery systems, are continuously enhancing the efficacy and application range of biopesticides, biofertilizers, and biostimulants. Consumer preferences are increasingly prioritizing safe, residue-free produce, directly fueling the demand for biological crop protection and enhancement solutions. This trend is further amplified by heightened awareness regarding the long-term health and environmental consequences associated with synthetic agricultural inputs. Competitive dynamics within the market are intensifying, characterized by both price-based competition for established products and innovation-led competition for novel biological solutions. The market penetration of agricultural biologicals is steadily increasing, projected to reach around 20-25% by 2030, up from an estimated 12-15% in 2024. The Chinese government's unwavering commitment to sustainable agriculture, through initiatives like the "Zero Growth" policy for pesticide use and subsidies for eco-friendly farming, acts as a powerful catalyst for market growth. Furthermore, the increasing adoption of digital agriculture and precision farming techniques creates fertile ground for the targeted and efficient application of biological inputs, maximizing their effectiveness and economic viability for farmers. The rising disposable incomes of the Chinese population also contribute to a greater demand for premium, health-conscious food products, indirectly boosting the market for agricultural biologicals.

Leading Markets & Segments in China Agricultural Biologicals Market

The Biofertilizers segment is emerging as a dominant force within the China Agricultural Biologicals Market, driven by increasing awareness of soil health and the detrimental effects of chemical fertilizer overuse. The economic policies favoring sustainable land management and soil remediation initiatives play a crucial role in this segment's ascendance. Infrastructure development, particularly in rural areas, has improved the accessibility and adoption of biofertilizers.

- Production Analysis: China's domestic production of biofertilizers is substantial, with a focus on microbial inoculants such as nitrogen-fixing bacteria, phosphorus-solubilizing bacteria, and potassium-mobilizing bacteria. Production volume is estimated to have grown by 12% year-on-year in the historical period (2019-2024).

- Consumption Analysis: The consumption of biofertilizers is highly concentrated in key agricultural provinces like Shandong, Henan, and Jiangsu, where intensive farming practices have led to soil degradation. Consumer preferences are shifting towards organic and sustainable farming, further propelling consumption. Estimated consumption volume is projected to reach over 5 Million tons by 2025.

- Import Market Analysis (Value & Volume): While domestic production is strong, China also imports specialized biofertilizer strains and advanced formulations. The import market value is estimated at around $150 Million in 2024, with a volume of approximately 0.5 Million tons. Key import drivers include technological advancements and unique product offerings not yet widely available domestically.

- Export Market Analysis (Value & Volume): China is increasingly becoming an exporter of biofertilizers, particularly to Southeast Asian and African markets. The export market value is estimated at $80 Million in 2024, with a volume of around 0.3 Million tons. Competitive pricing and a growing understanding of biological inputs in developing nations are key drivers.

- Price Trend Analysis: The price of biofertilizers in China has seen a steady increase, driven by higher production costs, R&D investments, and increasing demand. Prices are estimated to have risen by an average of 5% annually during the historical period. The price per ton ranges from $250 to $400, depending on the product type and efficacy.

The Biopesticides segment also holds significant sway, with a strong emphasis on controlling prevalent crop pests and diseases in rice, wheat, and fruit cultivation. Government mandates to reduce chemical pesticide usage provide a strong impetus for biopesticide adoption.

- Production Analysis: China is a global leader in biopesticide production, with a particular focus on microbial pesticides like Bt (Bacillus thuringiensis) and Beauveria bassiana. Production capacity is estimated to be over 2 Million tons annually.

- Consumption Analysis: The consumption of biopesticides is widespread across major agricultural regions, with increasing adoption in horticultural crops and specialty farming. The demand for residue-free produce is a significant consumption driver. Estimated consumption volume is projected to exceed 1.5 Million tons by 2025.

- Import Market Analysis (Value & Volume): Imports of high-value, specialized biopesticides, particularly those with novel modes of action, contribute to the import market. The import market value is estimated at $200 Million in 2024, with a volume of approximately 0.4 Million tons.

- Export Market Analysis (Value & Volume): China is a major exporter of biopesticides, supplying active ingredients and formulated products to global markets. The export market value is estimated at $300 Million in 2024, with a volume of around 0.8 Million tons.

- Price Trend Analysis: Biopesticide prices have remained relatively stable, with some fluctuations based on raw material availability and production efficiency. The price per ton typically ranges from $300 to $600.

The Biostimulants segment is the fastest-growing, driven by a focus on enhancing crop yield, quality, and resilience to environmental stresses. Farmers are increasingly recognizing the benefits of biostimulants in optimizing nutrient uptake and improving overall crop performance.

- Production Analysis: Domestic production of biostimulants is rapidly expanding, with a growing range of products based on seaweed extracts, humic substances, and amino acids. Production volume is estimated to be growing at a CAGR of 15%.

- Consumption Analysis: Adoption of biostimulants is high in horticulture, fruits, and vegetables, where improved quality and yield command higher market prices. The demand for stress-tolerant crops in the face of climate change is a key driver. Estimated consumption volume is projected to reach 0.8 Million tons by 2025.

- Import Market Analysis (Value & Volume): China imports advanced biostimulant formulations and novel active ingredients. The import market value is estimated at $100 Million in 2024, with a volume of approximately 0.2 Million tons.

- Export Market Analysis (Value & Volume): The export of Chinese biostimulants is still nascent but growing, targeting markets with increasing interest in sustainable agriculture. The export market value is estimated at $40 Million in 2024, with a volume of around 0.1 Million tons.

- Price Trend Analysis: Biostimulant prices are generally higher than biofertilizers and biopesticides, reflecting their specialized formulations and targeted benefits. Prices per ton can range from $500 to $1500.

China Agricultural Biologicals Market Product Developments

Recent product developments in the China Agricultural Biologicals Market are characterized by a focus on enhancing efficacy, expanding application areas, and improving user convenience. Innovations in microbial strains, formulation technologies, and delivery systems are leading to more potent and targeted biological solutions. Companies are actively developing integrated product lines that combine biopesticides, biofertilizers, and biostimulants to offer holistic crop management strategies. For example, the development of novel microbial consortia that address multiple soil deficiencies and pest challenges simultaneously is gaining traction. Furthermore, advancements in biodegradable packaging and easy-to-apply formulations are making biological products more accessible and appealing to farmers. These developments are crucial for achieving higher crop yields, improving crop quality, and promoting sustainable agricultural practices across the nation.

Key Drivers of China Agricultural Biologicals Market Growth

The growth of the China Agricultural Biologicals Market is propelled by several key factors. The stringent government policies promoting sustainable agriculture and reducing reliance on chemical inputs are paramount. The increasing consumer demand for safe, residue-free food products directly fuels the adoption of biological solutions. Technological advancements in research and development are leading to more effective and diverse biological products. Furthermore, the growing awareness among farmers about the long-term benefits of soil health and biodiversity, coupled with the economic advantages of improved crop yields and quality, are significant drivers. The continuous investment in R&D by both domestic and international players further accelerates innovation and market expansion.

Challenges in the China Agricultural Biologicals Market Market

Despite the promising growth trajectory, the China Agricultural Biologicals Market faces several challenges. Regulatory hurdles, while evolving towards supporting biologicals, can still be complex and time-consuming for new product approvals. Supply chain issues, including the availability of high-quality raw materials and efficient distribution networks, can impact product consistency and reach. Farmer education and adoption barriers persist, as some farmers are hesitant to transition from conventional chemical inputs due to perceived risks or lack of familiarity with biological alternatives. Price sensitivity in certain market segments can also be a restraint, with biologicals sometimes having a higher upfront cost compared to established chemical options. The competitive pressure from large chemical manufacturers, who are also increasingly investing in biologicals, adds another layer of complexity.

Emerging Opportunities in China Agricultural Biologicals Market

The China Agricultural Biologicals Market presents numerous emerging opportunities. The increasing adoption of precision agriculture and smart farming technologies allows for the targeted application of biologicals, optimizing their efficacy and cost-effectiveness. Strategic partnerships and collaborations between research institutions, universities, and private companies can accelerate technological breakthroughs and the development of next-generation biological solutions. The growing demand for organic and sustainable food products in both domestic and international markets opens avenues for premium biological inputs. Furthermore, the expansion into emerging agricultural regions within China and the potential for exports to neighboring countries represent significant market expansion strategies. The development of novel biologicals for soil remediation and climate change adaptation offers long-term growth potential.

Leading Players in the China Agricultural Biologicals Market Sector

- Valent Biosciences LL

- Biolchim SPA

- Novozymes

- Shandong Sukahan Bio-Technology Co Ltd

- Suståne Natural Fertilizer Inc

- Haifa Group

- Genliduo Bio-tech Corporation Ltd

- Trade Corporation International

- Biobest Group NV

- Henan Jiyuan Baiyun Industry Co Ltd

Key Milestones in China Agricultural Biologicals Market Industry

- September 2021: Tradecorp launched Biimore worldwide, a biostimulant obtained from a plant fermentation process. Biimore is made up of a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds, enhancing crop resilience and nutrient uptake.

- August 2021: A company released a new biocontrol agent, Trichogramma chilonis, a parasitic wasp to cover up to 333 hectares of paddy field to control Chilo suppressalis (rice stem borer) in Xinyang of the Henan Province, China, showcasing advancements in biological pest control.

Strategic Outlook for China Agricultural Biologicals Market Market

The strategic outlook for the China Agricultural Biologicals Market is exceptionally strong, driven by an unwavering commitment to sustainability and innovation. The market is expected to witness continued robust growth, fueled by supportive government policies, evolving consumer demands for healthier food, and ongoing technological advancements. Companies that invest in research and development to bring novel, high-efficacy biological solutions to market will be well-positioned for success. Furthermore, strategic partnerships, mergers, and acquisitions will continue to play a crucial role in consolidating market share and expanding product portfolios. The increasing adoption of digital agriculture and precision farming will create new avenues for the targeted and efficient deployment of biological inputs, maximizing their economic and environmental benefits for Chinese agriculture. The long-term potential lies in developing integrated biological solutions that address the multifaceted challenges of modern agriculture, from soil health to climate resilience.

China Agricultural Biologicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Agricultural Biologicals Market Segmentation By Geography

- 1. China

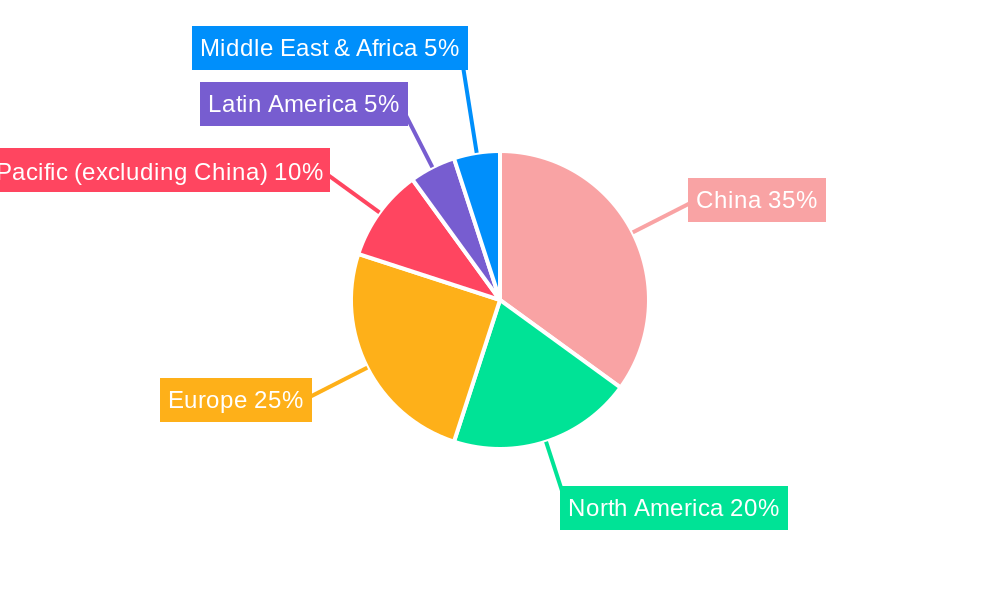

China Agricultural Biologicals Market Regional Market Share

Geographic Coverage of China Agricultural Biologicals Market

China Agricultural Biologicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Agricultural Biologicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Valent Biosciences LL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biolchim SPA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novozymes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Sukahan Bio-Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suståne Natural Fertilizer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haifa Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genliduo Bio-tech Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Corporation International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Biobest Group NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Henan Jiyuan Baiyun Industry Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Valent Biosciences LL

List of Figures

- Figure 1: China Agricultural Biologicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Agricultural Biologicals Market Share (%) by Company 2025

List of Tables

- Table 1: China Agricultural Biologicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Agricultural Biologicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Agricultural Biologicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Agricultural Biologicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Agricultural Biologicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Agricultural Biologicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: China Agricultural Biologicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: China Agricultural Biologicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Agricultural Biologicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Agricultural Biologicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Agricultural Biologicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Agricultural Biologicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Agricultural Biologicals Market?

The projected CAGR is approximately 13.7%.

2. Which companies are prominent players in the China Agricultural Biologicals Market?

Key companies in the market include Valent Biosciences LL, Biolchim SPA, Novozymes, Shandong Sukahan Bio-Technology Co Ltd, Suståne Natural Fertilizer Inc, Haifa Group, Genliduo Bio-tech Corporation Ltd, Trade Corporation International, Biobest Group NV, Henan Jiyuan Baiyun Industry Co Ltd.

3. What are the main segments of the China Agricultural Biologicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

September 2021: Tradecorp launched Biimore worldwide, a biostimulant obtained from a plant fermentation process. Biimore is made up of a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds.August 2021: The company released a new biocontrol agent, Trichogramma chilonis, a parasitic wasp to cover up to 333 hectares of paddy field to control Chilo suppressalis (rice stem borer) in Xinyang of the Henan Province, China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Agricultural Biologicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Agricultural Biologicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Agricultural Biologicals Market?

To stay informed about further developments, trends, and reports in the China Agricultural Biologicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence