Key Insights

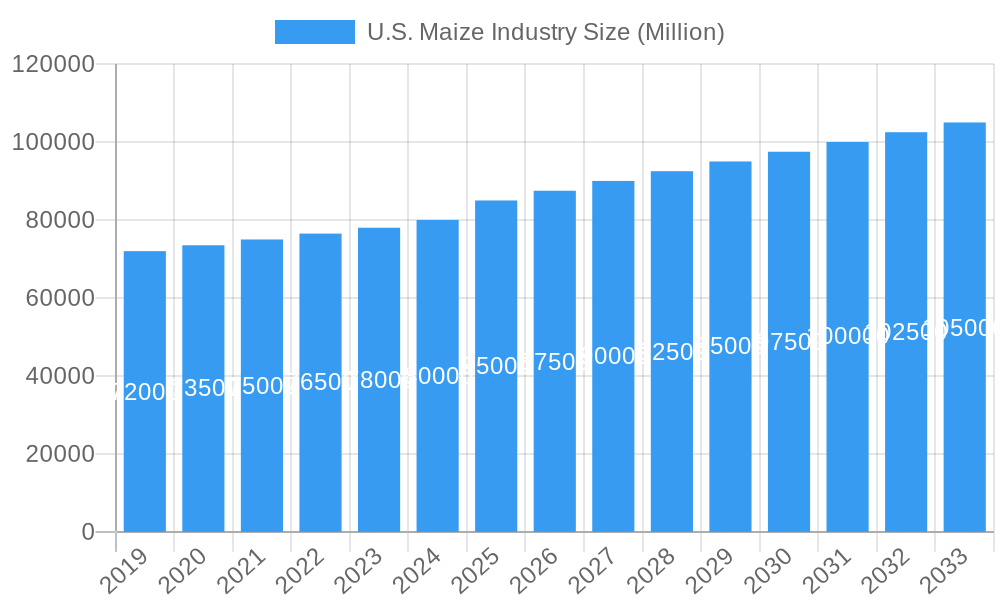

The U.S. maize industry is projected to reach a substantial market size, estimated at approximately \$85,000 million in 2025. Driven by robust demand from animal feed, food & beverage, and industrial applications, the sector is poised for steady growth, with a projected Compound Annual Growth Rate (CAGR) of 4.10% through 2033. Key drivers fueling this expansion include increasing global demand for corn-based products, advancements in agricultural technology enhancing yield and efficiency, and the growing utilization of maize in biofuels. Despite potential challenges such as fluctuating commodity prices and regulatory shifts impacting agricultural practices, the U.S. maize market is expected to maintain a positive trajectory. The industry is characterized by significant production volumes, substantial domestic consumption, and active import and export markets, all contributing to its economic significance. Price trends will likely reflect a balance between supply-side factors, such as weather patterns and farmer planting decisions, and demand-side pressures from various end-use sectors.

U.S. Maize Industry Market Size (In Billion)

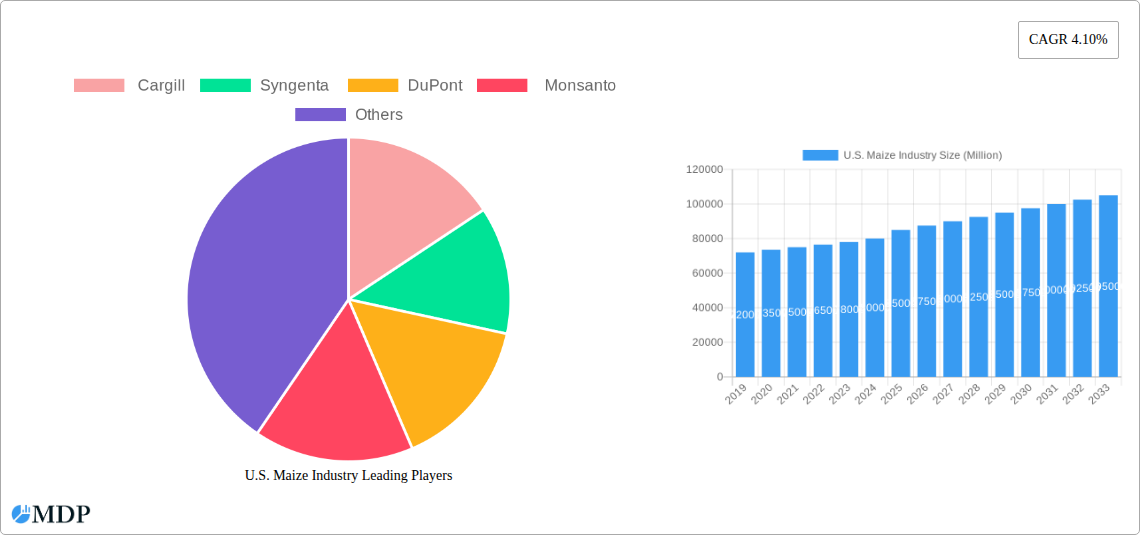

Analysis of the U.S. maize industry reveals a dynamic landscape shaped by both production efficiencies and evolving consumption patterns. The market segments, encompassing production, consumption, imports, exports, and price trends, are interconnected and influence overall market performance. The U.S. holds a dominant position in global maize production, with significant volumes channeled into both domestic use and international trade. While animal feed remains a primary consumer, the food & beverage sector and the burgeoning industrial applications, including bioplastics and ethanol production, are increasingly contributing to demand. Major players like Cargill, Syngenta, DuPont, and Monsanto are actively involved in various aspects of the maize value chain, from seed development and crop protection to processing and distribution, further shaping market dynamics and innovation. The historical performance from 2019-2024 indicates resilience and adaptability, setting a strong foundation for the projected growth from 2025-2033.

U.S. Maize Industry Company Market Share

Here's the SEO-optimized and engaging report description for the U.S. Maize Industry, designed for maximum visibility and stakeholder attraction.

U.S. Maize Industry Market Dynamics & Concentration Report: 2019-2033

Unlock the strategic insights into the burgeoning U.S. Maize Industry with our comprehensive market analysis. This report delves deep into market concentration, innovation drivers, evolving regulatory frameworks, the impact of product substitutes, crucial end-user trends, and significant M&A activities. Understand the competitive landscape, where major players like Cargill, Syngenta, DuPont, and Monsanto are shaping the future. We provide critical metrics, including estimated market share of leading entities and a detailed count of M&A deals, offering a clear picture of industry consolidation and strategic maneuvering. Explore the dynamics that govern this multi-million dollar sector and anticipate future shifts in market dominance and collaborative ventures.

U.S. Maize Industry Trends & Analysis: A Deep Dive into Growth Drivers

The U.S. Maize Industry is poised for substantial growth, driven by a confluence of factors including expanding applications in biofuels, animal feed, and food processing, coupled with advancements in agricultural technology. This report provides an in-depth analysis of market growth drivers, exploring how increased demand for high-value corn derivatives, coupled with innovations in genetically modified seeds and precision agriculture, are propelling the sector forward. We will examine the impact of technological disruptions, such as AI-driven farming and advanced pest management solutions, on improving yields and reducing costs. Consumer preferences are also playing a pivotal role, with a growing demand for non-GMO and sustainably sourced maize, influencing production practices and product development. The competitive dynamics are intensifying, with key companies investing heavily in research and development to gain a competitive edge. The Compound Annual Growth Rate (CAGR) is projected to be approximately 4.5%, reaching an estimated market size of XXX Million USD by 2033. Market penetration of advanced farming techniques is anticipated to increase significantly, reaching over 70% by the end of the forecast period. This section meticulously dissects the forces shaping the U.S. Maize Industry, offering a robust understanding of its trajectory and the underlying economic and technological underpinnings. The study period spans from 2019 to 2033, with a base year of 2025, providing a detailed historical context and forward-looking projections.

Leading Markets & Segments in U.S. Maize Industry

This section meticulously dissects the leading markets and segments within the U.S. Maize Industry, offering granular insights into Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. The dominant region for maize production and consumption continues to be the Midwest, driven by its fertile land, favorable climate, and robust agricultural infrastructure. Key economic policies, such as government subsidies for corn farming and ethanol production mandates, significantly influence production volumes and market stability.

Production Analysis:

- Dominant States: Iowa, Illinois, Nebraska, Minnesota, and Indiana consistently lead in U.S. maize production, contributing over 60% of the national output. This dominance is attributed to the Corn Belt's ideal soil conditions and extensive farming networks.

- Technological Adoption: High adoption rates of advanced farming technologies, including GPS-guided planting, soil moisture sensors, and drone-based crop monitoring, are optimizing yields and resource utilization in these leading production areas.

Consumption Analysis:

- Biofuel Sector: The ethanol industry remains a primary driver of maize consumption, utilizing approximately 35% of the annual harvest. Government mandates and fluctuating energy prices directly impact demand.

- Animal Feed: Maize is a staple in animal feed for poultry, swine, and cattle, accounting for roughly 30% of consumption. The growth of the meat industry fuels this demand.

- Food & Industrial Uses: Food products, corn sweeteners, starch, and industrial applications contribute the remaining consumption, with trends towards specialized corn varieties for these sectors.

Import Market Analysis (Value & Volume):

- Limited Domestic Imports: The U.S. is a net exporter of maize, so its import market is relatively small, primarily consisting of specialized varieties or for specific research purposes. Imports are valued at approximately $50 Million and volumes at 100,000 metric tons annually.

- Key Supplying Countries: Canada and Mexico are the primary sources, supplying niche corn products.

Export Market Analysis (Value & Volume):

- Global Dominance: The U.S. is a leading global maize exporter, with exports valued at over $15,000 Million and volumes exceeding 50 Million metric tons annually.

- Key Export Destinations: Mexico, China, Japan, South Korea, and European Union countries are the major importers of U.S. maize, driven by demand for animal feed and food processing. Favorable trade agreements and logistical infrastructure are critical factors.

Price Trend Analysis:

- Influencing Factors: Global supply and demand dynamics, weather patterns, geopolitical events, energy prices (impacting biofuel demand), and government policies are the principal determinants of U.S. maize prices.

- Historical Volatility: Prices have historically shown volatility, influenced by factors like crop yields and international market conditions. The forecast period anticipates a stable, yet responsive pricing environment, with an estimated average price of $4.50 per bushel in 2025.

U.S. Maize Industry Product Developments

The U.S. Maize Industry is witnessing significant product developments centered on enhanced yield, disease resistance, and specialized applications. Companies are investing in genetically modified (GM) traits that offer improved nutrient uptake and tolerance to environmental stresses, leading to higher productivity and reduced input costs. Innovations in herbicide tolerance and insect resistance continue to offer farmers greater flexibility and control over their crops. Furthermore, there's a growing focus on developing corn varieties tailored for specific end-uses, such as higher starch content for industrial applications or improved nutritional profiles for food and feed markets. These advancements provide a competitive advantage by increasing farm profitability and meeting evolving market demands for sustainable and specialized maize products.

Key Drivers of U.S. Maize Industry Growth

The U.S. Maize Industry's growth is propelled by several key factors. Technological advancements in seed genetics, precision agriculture, and sustainable farming practices are significantly boosting yields and efficiency. The growing global demand for animal feed, driven by an expanding middle class and increasing meat consumption worldwide, provides a consistent market for maize. Furthermore, the robust demand for biofuels, particularly ethanol, as an alternative energy source, creates a substantial and often policy-supported market. Favorable government policies and subsidies aimed at supporting agricultural production and promoting renewable energy further stimulate growth.

Challenges in the U.S. Maize Industry Market

Despite its strong growth trajectory, the U.S. Maize Industry faces significant challenges. Volatile weather patterns and climate change pose a persistent threat to crop yields, leading to price fluctuations and supply chain disruptions. Stringent regulatory hurdles for new seed technologies and international trade can impede market access and innovation. Intense global competition from other maize-producing nations, coupled with fluctuating commodity prices, can impact export competitiveness. Supply chain bottlenecks and rising input costs, including fertilizers and labor, also present ongoing economic pressures for producers.

Emerging Opportunities in U.S. Maize Industry

Catalysts driving long-term growth in the U.S. Maize Industry lie in technological breakthroughs and market expansion strategies. The development of climate-resilient maize varieties capable of withstanding extreme weather conditions presents a significant opportunity to mitigate the impacts of climate change. Increased utilization of maize in novel food products and bioplastics offers diversification beyond traditional uses. Strategic partnerships between research institutions and private companies can accelerate the development and adoption of next-generation agricultural technologies, such as advanced biotechnologies and digital farming platforms. Furthermore, exploring new international markets and strengthening existing trade relationships can unlock further export potential.

Leading Players in the U.S. Maize Industry Sector

- Cargill

- Syngenta

- DuPont

- Monsanto

- ADM (Archer Daniels Midland)

- Bunge

- Corteva Agriscience

- CHS Inc.

- The Scoular Company

- Green Plains Inc.

Key Milestones in U.S. Maize Industry Industry

- 2019: Launch of new drought-tolerant maize varieties by leading seed companies, enhancing crop resilience.

- 2020: Significant increase in U.S. maize exports to China, driven by trade agreements.

- 2021: Increased investment in precision agriculture technologies by farmers, leveraging data for improved yields.

- 2022: Development of advanced bio-refining processes for more efficient ethanol production from maize.

- 2023: Introduction of enhanced pest-resistant maize traits, reducing reliance on chemical pesticides.

- 2024: Growing consumer demand for non-GMO and sustainably produced maize products influences market trends.

Strategic Outlook for U.S. Maize Industry Market

The strategic outlook for the U.S. Maize Industry is characterized by continued innovation and market resilience. Growth accelerators include the ongoing development of climate-smart agricultural practices and the expansion of value-added products derived from maize, such as high-protein ingredients and specialized starches. The industry will likely witness further consolidation and strategic alliances as companies seek to leverage R&D capabilities and market access. Embracing digital transformation and sustainable farming methods will be crucial for long-term success, ensuring the U.S. Maize Industry remains a global leader in meeting the world's growing demand for food, feed, and fuel.

U.S. Maize Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

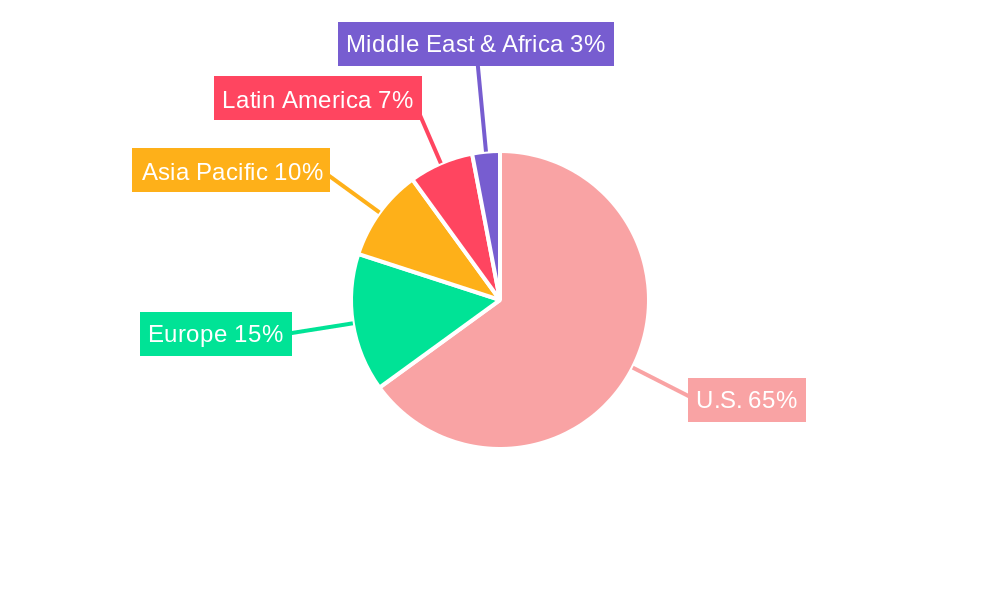

U.S. Maize Industry Segmentation By Geography

- 1. U.S.

U.S. Maize Industry Regional Market Share

Geographic Coverage of U.S. Maize Industry

U.S. Maize Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Various Industrial Application of Maize

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.S. Maize Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. U.S.

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Syngenta

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DuPont

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Monsanto

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.1 Cargill

List of Figures

- Figure 1: U.S. Maize Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: U.S. Maize Industry Share (%) by Company 2025

List of Tables

- Table 1: U.S. Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: U.S. Maize Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: U.S. Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 4: U.S. Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: U.S. Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: U.S. Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: U.S. Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: U.S. Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: U.S. Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: U.S. Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: U.S. Maize Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 12: U.S. Maize Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: U.S. Maize Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: U.S. Maize Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: U.S. Maize Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 16: U.S. Maize Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: U.S. Maize Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: U.S. Maize Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: U.S. Maize Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: U.S. Maize Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: U.S. Maize Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: U.S. Maize Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: U.S. Maize Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: U.S. Maize Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.S. Maize Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the U.S. Maize Industry?

Key companies in the market include Cargill, Syngenta , DuPont, Monsanto .

3. What are the main segments of the U.S. Maize Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts in the Country; Favorable Government Initiatives.

6. What are the notable trends driving market growth?

Various Industrial Application of Maize.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related to Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.S. Maize Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.S. Maize Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.S. Maize Industry?

To stay informed about further developments, trends, and reports in the U.S. Maize Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence