Key Insights

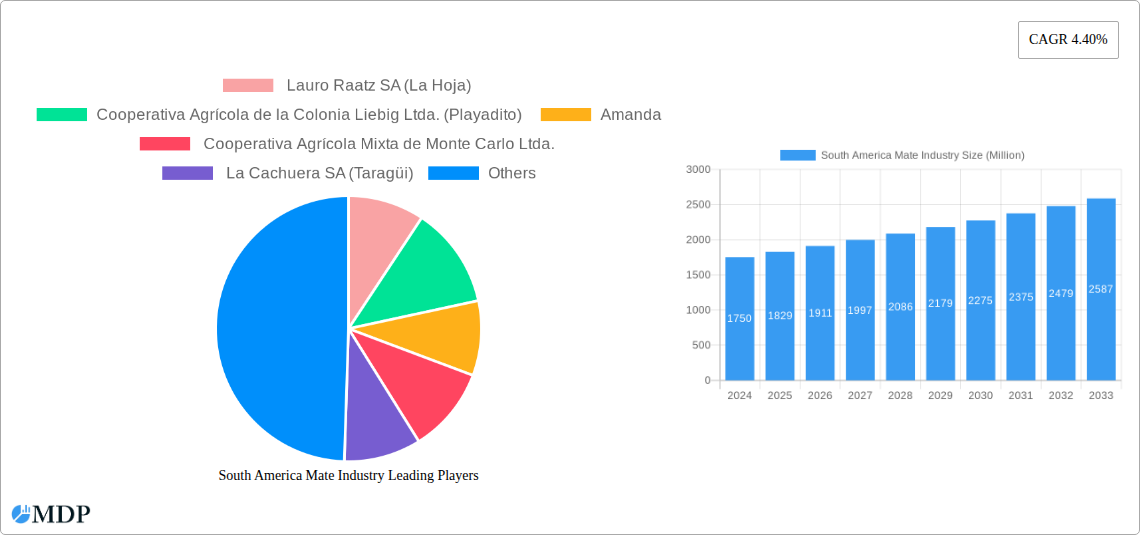

The South American Mate industry is poised for robust growth, driven by increasing consumer preference for natural and healthy beverages and the deep-rooted cultural significance of mate across the region. With a market size of approximately USD 1.75 billion in 2024, the industry is projected to expand at a Compound Annual Growth Rate (CAGR) of 4.6% through 2033. This growth is underpinned by expanding production capabilities, rising consumption patterns, and dynamic trade flows within key markets like Brazil, Argentina, and Paraguay. The perceived health benefits, including antioxidant properties and potential for improved cognitive function, are increasingly attracting a broader consumer base, extending beyond traditional aficionados. Furthermore, the growing interest in functional beverages and sustainable sourcing is expected to fuel demand for high-quality mate products.

South America Mate Industry Market Size (In Billion)

Despite the strong upward trajectory, the market faces certain challenges. Fluctuations in agricultural yields due to weather patterns, evolving regulatory landscapes concerning food and beverages, and the intense competition from other popular regional and global beverages present potential restraints. However, the established infrastructure for mate production and consumption, coupled with the strong export potential to niche international markets, provides a significant buffer and opportunity for sustained expansion. Key players are investing in product innovation, exploring new flavor profiles, and enhancing their distribution networks to capture a larger market share. The continuous evolution of consumer tastes and the increasing demand for premium and organic mate varieties will shape the competitive landscape and future market dynamics.

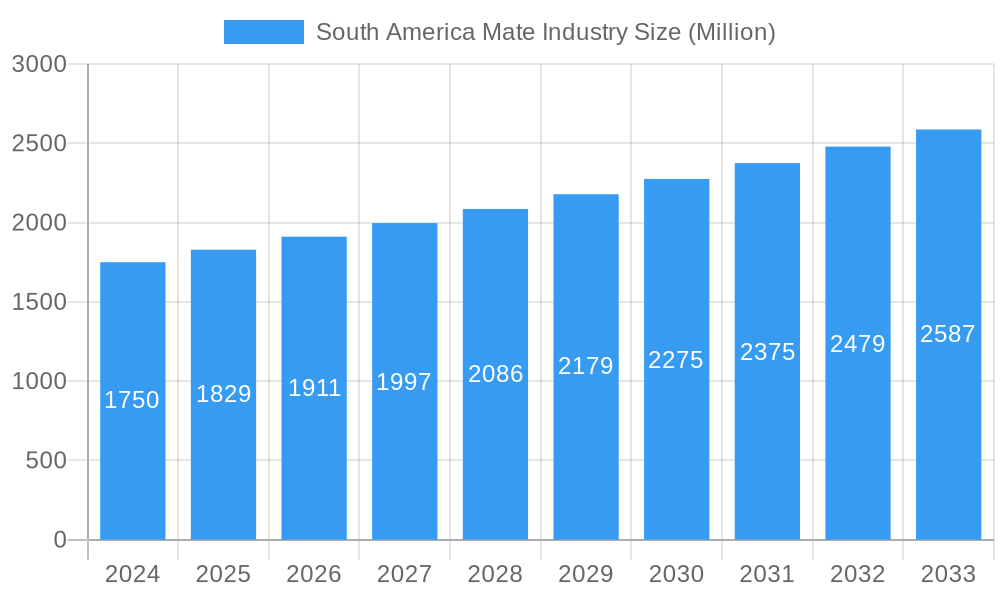

South America Mate Industry Company Market Share

This comprehensive report offers an unparalleled deep dive into the South American Mate industry, spanning a critical study period from 2019 to 2033, with 2025 as the base and estimated year. We meticulously analyze the market's intricate dynamics, from production and consumption trends to import/export volumes and price fluctuations across key nations including Argentina, Brazil, Paraguay, Chile, and Uruguay. Our analysis delves into the current state of market concentration, highlighting the influence of major players such as Lauro Raatz SA (La Hoja), Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito), Amanda, Cooperativa Agrícola Mixta de Monte Carlo Ltda., La Cachuera SA (Taragüi), Establecimiento Las Marías, and Industrias de Mision S.A. (Rosamonte). Furthermore, we explore the impact of innovation drivers, the evolving regulatory frameworks governing the yerba mate market, the threat posed by product substitutes, and emerging end-user preferences. Crucially, the report quantifies the recent surge in Mergers & Acquisitions (M&A) activities, providing actionable insights into market consolidation and strategic shifts within this billion-dollar industry. Expect detailed metrics on market share evolution and M&A deal counts, presented in clear paragraphs and easily digestible bullet points for strategic decision-making.

South America Mate Industry Industry Trends & Analysis

The South American Mate industry is poised for significant expansion, driven by a confluence of compelling market growth drivers, disruptive technological advancements, evolving consumer preferences, and an increasingly dynamic competitive landscape. Over the forecast period of 2025–2033, the market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5%, reaching a market size estimated at over $15 billion by 2033. This robust growth is underpinned by the increasing global awareness of mate's health benefits, including its antioxidant properties and energizing effects, which are resonating with health-conscious consumers worldwide. Technological disruptions are manifesting in enhanced cultivation techniques, advanced processing methods leading to improved product quality and shelf life, and innovative packaging solutions that cater to convenience and portability. Consumer preferences are shifting towards premium and organic yerba mate offerings, with a growing demand for ready-to-drink (RTD) mate beverages and flavored variants. The competitive dynamics are intensifying, characterized by strategic partnerships, product differentiation, and aggressive market penetration strategies by leading players seeking to capture a larger share of this burgeoning market. Our analysis details how these trends are reshaping the industry's trajectory, with market penetration for specialized mate products projected to increase by over 20% within the study period.

Leading Markets & Segments in South America Mate Industry

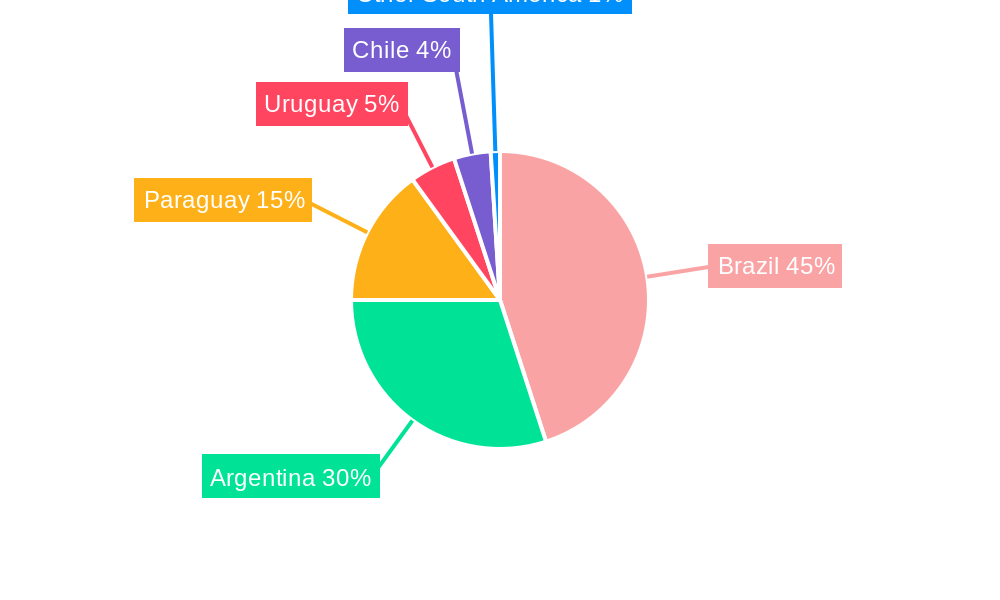

Argentina stands as the undisputed leader in the South American Mate industry, commanding a dominant share in production, consumption, and export markets throughout the study period. The country's deep-rooted cultural tradition of mate consumption, coupled with its extensive agricultural infrastructure and established supply chains, positions it at the forefront.

- Argentina's Dominance:

- Production Analysis: Argentina consistently accounts for over 60% of the total South American mate production, leveraging its favorable climate and fertile lands.

- Consumption Analysis & Market Size: The domestic consumption in Argentina remains exceptionally high, forming the bedrock of its market size, estimated to exceed $8 billion by 2033.

- Import Market Analysis (Volume & Value): While primarily an exporter, Argentina’s import market for specialized or value-added mate products is steadily growing, albeit representing a smaller fraction.

- Export Market Analysis (Volume & Value): Argentina is the largest exporter of mate, with volumes projected to surpass 500 million kilograms annually by 2030, contributing over $3 billion in export value.

- Price Trend Analysis: Stable price trends are observed due to consistent production, with minor fluctuations influenced by seasonal yields and global demand.

Brazil emerges as the second-largest market, showcasing significant growth potential, particularly in its production and consumption segments.

- Brazil's Growing Influence:

- Production Analysis: Brazil's production is steadily increasing, driven by expanding cultivation areas and improved agricultural practices, reaching over 200 million kilograms annually.

- Consumption Analysis & Market Size: Domestic consumption is robust, with a growing appreciation for mate's health benefits, contributing to a market size estimated at $4 billion.

- Import Market Analysis (Volume & Value): Brazil's imports are minimal, primarily focusing on niche markets or specialty blends.

- Export Market Analysis (Volume & Value): Brazil is a significant exporter, with its export volume projected to reach 150 million kilograms by 2030, valued at approximately $1.5 billion.

- Price Trend Analysis: Price trends in Brazil are influenced by domestic supply and demand dynamics, often exhibiting slight variations based on regional agricultural output.

Paraguay, Chile, and Uruguay, while smaller markets, exhibit distinct consumption patterns and contribute to the overall regional trade of yerba mate. Paraguay is a key producer and exporter, while Chile and Uruguay demonstrate a growing interest in imported mate products.

South America Mate Industry Product Developments

The South American Mate industry is witnessing exciting product developments focused on enhancing consumer experience and market appeal. Innovations are centered around ready-to-drink (RTD) mate beverages, offering convenience and a refreshing alternative to traditional preparation. The introduction of flavored mate, incorporating natural fruit essences and herbal blends, is expanding the product category and attracting a wider demographic. Furthermore, premiumization is a key trend, with a focus on organic, shade-grown, and single-origin yerba mate offerings, appealing to discerning consumers seeking high-quality and ethically sourced products. Advances in processing technologies are improving the shelf life and flavor profiles of dried mate, while sustainable packaging solutions are gaining traction. These developments are crucial for competitive advantage and capturing new market segments.

Key Drivers of South America Mate Industry Growth

Several key drivers are propelling the growth of the South American Mate industry. The increasing global health and wellness trend is a significant catalyst, as consumers actively seek natural, energizing beverages with purported health benefits, such as antioxidants and metabolic support. Growing awareness of yerba mate's unique profile, distinct from coffee and tea, is expanding its market reach beyond traditional South American borders. Technological advancements in cultivation, processing, and packaging are enhancing product quality, accessibility, and consumer convenience, further fueling demand. Favorable economic policies and trade agreements within South America are also streamlining the flow of goods and promoting market integration.

Challenges in the South America Mate Industry Market

Despite robust growth, the South American Mate industry faces several challenges. Fluctuations in climate can impact crop yields and quality, posing a significant supply chain risk. Regulatory hurdles and differing import/export policies across various countries can create complexities for market expansion and trade. Intense competition from established beverage categories like coffee and tea, as well as the emergence of new functional drinks, necessitates continuous innovation and effective marketing. Furthermore, the reliance on traditional consumption methods in some segments can limit broader appeal, requiring efforts to adapt products for modern lifestyles. Supply chain disruptions due to logistical challenges or geopolitical instability can also impact profitability.

Emerging Opportunities in South America Mate Industry

Emerging opportunities in the South American Mate industry lie in several key areas. The expanding global market for natural and functional beverages presents a significant avenue for growth, particularly in North America and Europe. Strategic partnerships with international distributors and retailers can unlock new distribution channels. The development of innovative product formats, such as energy shots, sparkling mate, and powdered instant mate, caters to evolving consumer lifestyles and preferences. Investments in sustainable and ethical sourcing practices can enhance brand reputation and attract environmentally conscious consumers. Furthermore, leveraging digital marketing and e-commerce platforms can directly reach a wider customer base and foster brand loyalty.

Leading Players in the South America Mate Industry Sector

- Lauro Raatz SA (La Hoja)

- Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito)

- Amanda

- Cooperativa Agrícola Mixta de Monte Carlo Ltda.

- La Cachuera SA (Taragüi)

- Establecimiento Las Marías

- Industrias de Mision S.A. (Rosamonte)

Key Milestones in South America Mate Industry Industry

- 2019: Launch of organic yerba mate lines by major producers, responding to growing consumer demand for natural products.

- 2020: Increased investment in RTD mate beverage production and marketing by leading companies, targeting younger demographics.

- 2021: Introduction of advanced processing technologies to enhance mate's shelf life and flavor profiles, expanding export potential.

- 2022: Several M&A activities reported, indicating consolidation and strategic expansion within the industry.

- 2023: Expansion of export markets into Asia and Oceania, driven by increased global awareness of mate's health benefits.

- 2024: Focus on sustainable packaging solutions and ethical sourcing practices by key industry players.

Strategic Outlook for South America Mate Industry Market

The strategic outlook for the South American Mate industry is exceptionally bright, driven by a convergence of factors poised to accelerate growth and market penetration. The increasing global demand for natural, healthy, and functional beverages provides a significant tailwind. Key growth accelerators include continued product innovation, particularly in ready-to-drink formats and novel flavor profiles, to capture new consumer segments. Strategic market expansion into untapped international territories, supported by robust distribution networks and targeted marketing campaigns, will be crucial. Furthermore, fostering deeper consumer engagement through digital platforms and highlighting the cultural heritage and health benefits of mate will solidify its position as a preferred beverage choice, leading to sustained market expansion and increased revenue streams estimated to reach over $20 billion by the end of the forecast period.

South America Mate Industry Segmentation

-

1. Argentina

- 1.1. Production Analysis

- 1.2. Consumption Analysis & Market Size

- 1.3. Import Market Analysis (Volume & Value)

- 1.4. Export Market Analysis (Volume & Value)

- 1.5. Price Trend Analysis

-

2. Brazil

- 2.1. Production Analysis

- 2.2. Consumption Analysis & Market Size

- 2.3. Import Market Analysis (Volume & Value)

- 2.4. Export Market Analysis (Volume & Value)

- 2.5. Price Trend Analysis

-

3. Paraguay

- 3.1. Production Analysis

- 3.2. Consumption Analysis & Market Size

- 3.3. Import Market Analysis (Volume & Value)

- 3.4. Export Market Analysis (Volume & Value)

- 3.5. Price Trend Analysis

-

4. Chile

- 4.1. Production Analysis

- 4.2. Consumption Analysis & Market Size

- 4.3. Import Market Analysis (Volume & Value)

- 4.4. Export Market Analysis (Volume & Value)

- 4.5. Price Trend Analysis

-

5. Uruguay

- 5.1. Production Analysis

- 5.2. Consumption Analysis & Market Size

- 5.3. Import Market Analysis (Volume & Value)

- 5.4. Export Market Analysis (Volume & Value)

- 5.5. Price Trend Analysis

-

6. Argentina

- 6.1. Production Analysis

- 6.2. Consumption Analysis & Market Size

- 6.3. Import Market Analysis (Volume & Value)

- 6.4. Export Market Analysis (Volume & Value)

- 6.5. Price Trend Analysis

-

7. Brazil

- 7.1. Production Analysis

- 7.2. Consumption Analysis & Market Size

- 7.3. Import Market Analysis (Volume & Value)

- 7.4. Export Market Analysis (Volume & Value)

- 7.5. Price Trend Analysis

-

8. Paraguay

- 8.1. Production Analysis

- 8.2. Consumption Analysis & Market Size

- 8.3. Import Market Analysis (Volume & Value)

- 8.4. Export Market Analysis (Volume & Value)

- 8.5. Price Trend Analysis

-

9. Chile

- 9.1. Production Analysis

- 9.2. Consumption Analysis & Market Size

- 9.3. Import Market Analysis (Volume & Value)

- 9.4. Export Market Analysis (Volume & Value)

- 9.5. Price Trend Analysis

-

10. Uruguay

- 10.1. Production Analysis

- 10.2. Consumption Analysis & Market Size

- 10.3. Import Market Analysis (Volume & Value)

- 10.4. Export Market Analysis (Volume & Value)

- 10.5. Price Trend Analysis

South America Mate Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Mate Industry Regional Market Share

Geographic Coverage of South America Mate Industry

South America Mate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan

- 3.3. Market Restrains

- 3.3.1. ; Volatility in the Prices; Adverse Weather Conditions Affecting Yield

- 3.4. Market Trends

- 3.4.1. Emerging Export Potential Driving Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Mate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Argentina

- 5.1.1. Production Analysis

- 5.1.2. Consumption Analysis & Market Size

- 5.1.3. Import Market Analysis (Volume & Value)

- 5.1.4. Export Market Analysis (Volume & Value)

- 5.1.5. Price Trend Analysis

- 5.2. Market Analysis, Insights and Forecast - by Brazil

- 5.2.1. Production Analysis

- 5.2.2. Consumption Analysis & Market Size

- 5.2.3. Import Market Analysis (Volume & Value)

- 5.2.4. Export Market Analysis (Volume & Value)

- 5.2.5. Price Trend Analysis

- 5.3. Market Analysis, Insights and Forecast - by Paraguay

- 5.3.1. Production Analysis

- 5.3.2. Consumption Analysis & Market Size

- 5.3.3. Import Market Analysis (Volume & Value)

- 5.3.4. Export Market Analysis (Volume & Value)

- 5.3.5. Price Trend Analysis

- 5.4. Market Analysis, Insights and Forecast - by Chile

- 5.4.1. Production Analysis

- 5.4.2. Consumption Analysis & Market Size

- 5.4.3. Import Market Analysis (Volume & Value)

- 5.4.4. Export Market Analysis (Volume & Value)

- 5.4.5. Price Trend Analysis

- 5.5. Market Analysis, Insights and Forecast - by Uruguay

- 5.5.1. Production Analysis

- 5.5.2. Consumption Analysis & Market Size

- 5.5.3. Import Market Analysis (Volume & Value)

- 5.5.4. Export Market Analysis (Volume & Value)

- 5.5.5. Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Argentina

- 5.6.1. Production Analysis

- 5.6.2. Consumption Analysis & Market Size

- 5.6.3. Import Market Analysis (Volume & Value)

- 5.6.4. Export Market Analysis (Volume & Value)

- 5.6.5. Price Trend Analysis

- 5.7. Market Analysis, Insights and Forecast - by Brazil

- 5.7.1. Production Analysis

- 5.7.2. Consumption Analysis & Market Size

- 5.7.3. Import Market Analysis (Volume & Value)

- 5.7.4. Export Market Analysis (Volume & Value)

- 5.7.5. Price Trend Analysis

- 5.8. Market Analysis, Insights and Forecast - by Paraguay

- 5.8.1. Production Analysis

- 5.8.2. Consumption Analysis & Market Size

- 5.8.3. Import Market Analysis (Volume & Value)

- 5.8.4. Export Market Analysis (Volume & Value)

- 5.8.5. Price Trend Analysis

- 5.9. Market Analysis, Insights and Forecast - by Chile

- 5.9.1. Production Analysis

- 5.9.2. Consumption Analysis & Market Size

- 5.9.3. Import Market Analysis (Volume & Value)

- 5.9.4. Export Market Analysis (Volume & Value)

- 5.9.5. Price Trend Analysis

- 5.10. Market Analysis, Insights and Forecast - by Uruguay

- 5.10.1. Production Analysis

- 5.10.2. Consumption Analysis & Market Size

- 5.10.3. Import Market Analysis (Volume & Value)

- 5.10.4. Export Market Analysis (Volume & Value)

- 5.10.5. Price Trend Analysis

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Argentina

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lauro Raatz SA (La Hoja)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amanda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cooperativa Agrícola Mixta de Monte Carlo Ltda.

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 La Cachuera SA (Taragüi)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Establecimiento Las Marías

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Industrias de Mision S.A. (Rosamonte)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Lauro Raatz SA (La Hoja)

List of Figures

- Figure 1: South America Mate Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Mate Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Mate Industry Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 2: South America Mate Industry Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 3: South America Mate Industry Revenue undefined Forecast, by Paraguay 2020 & 2033

- Table 4: South America Mate Industry Revenue undefined Forecast, by Chile 2020 & 2033

- Table 5: South America Mate Industry Revenue undefined Forecast, by Uruguay 2020 & 2033

- Table 6: South America Mate Industry Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 7: South America Mate Industry Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 8: South America Mate Industry Revenue undefined Forecast, by Paraguay 2020 & 2033

- Table 9: South America Mate Industry Revenue undefined Forecast, by Chile 2020 & 2033

- Table 10: South America Mate Industry Revenue undefined Forecast, by Uruguay 2020 & 2033

- Table 11: South America Mate Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: South America Mate Industry Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 13: South America Mate Industry Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 14: South America Mate Industry Revenue undefined Forecast, by Paraguay 2020 & 2033

- Table 15: South America Mate Industry Revenue undefined Forecast, by Chile 2020 & 2033

- Table 16: South America Mate Industry Revenue undefined Forecast, by Uruguay 2020 & 2033

- Table 17: South America Mate Industry Revenue undefined Forecast, by Argentina 2020 & 2033

- Table 18: South America Mate Industry Revenue undefined Forecast, by Brazil 2020 & 2033

- Table 19: South America Mate Industry Revenue undefined Forecast, by Paraguay 2020 & 2033

- Table 20: South America Mate Industry Revenue undefined Forecast, by Chile 2020 & 2033

- Table 21: South America Mate Industry Revenue undefined Forecast, by Uruguay 2020 & 2033

- Table 22: South America Mate Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: Brazil South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Argentina South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Chile South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Colombia South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Peru South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Venezuela South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Ecuador South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Bolivia South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Paraguay South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Uruguay South America Mate Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Mate Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the South America Mate Industry?

Key companies in the market include Lauro Raatz SA (La Hoja) , Cooperativa Agrícola de la Colonia Liebig Ltda. (Playadito) , Amanda, Cooperativa Agrícola Mixta de Monte Carlo Ltda. , La Cachuera SA (Taragüi), Establecimiento Las Marías, Industrias de Mision S.A. (Rosamonte).

3. What are the main segments of the South America Mate Industry?

The market segments include Argentina, Brazil , Paraguay , Chile , Uruguay, Argentina, Brazil , Paraguay , Chile , Uruguay.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Awareness About Health Benefits Associated With Pecan Consumption; Wide Application of Pecan.

6. What are the notable trends driving market growth?

Emerging Export Potential Driving Production.

7. Are there any restraints impacting market growth?

; Volatility in the Prices; Adverse Weather Conditions Affecting Yield.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Mate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Mate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Mate Industry?

To stay informed about further developments, trends, and reports in the South America Mate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence