Key Insights

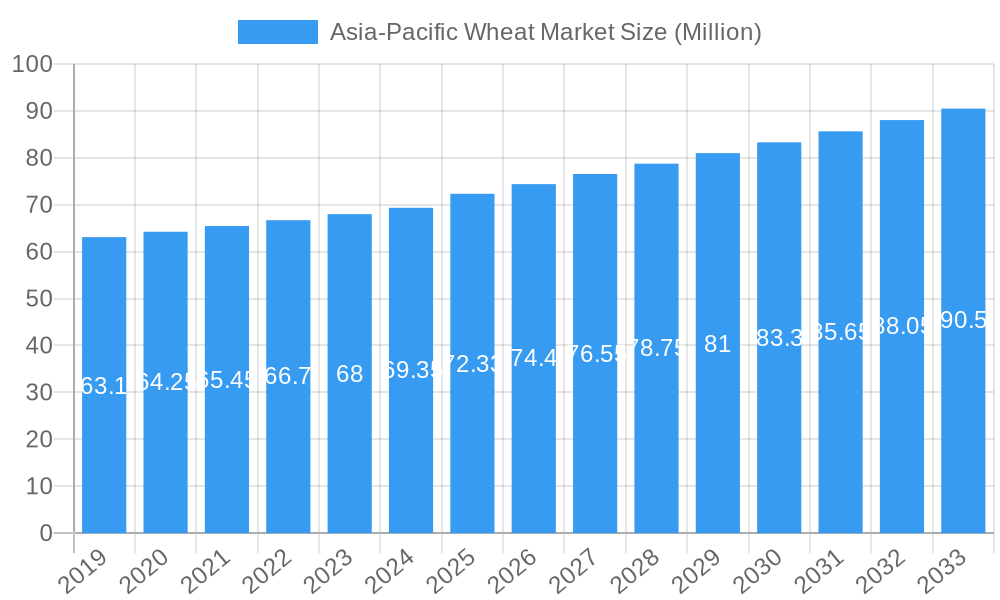

The Asia-Pacific wheat market is poised for steady growth, projected to reach approximately USD 72.33 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.00% from 2019 to 2033. This expansion is primarily fueled by increasing global food demand, particularly in populous Asian nations, and a growing emphasis on agricultural innovation and improved crop yields. The region’s agricultural sector is seeing advancements in seed technology, with companies like Limagrain, BASF, and Syngenta actively contributing to the development of high-yielding and disease-resistant wheat varieties. Furthermore, the rising adoption of modern farming practices and government initiatives aimed at boosting agricultural productivity are significant drivers. Economic development and changing dietary patterns, leaning towards more diverse food consumption, also contribute to the sustained demand for wheat as a staple grain.

Asia-Pacific Wheat Market Market Size (In Million)

The market's trajectory is also influenced by evolving trade dynamics and regional consumption patterns. Production and consumption analyses within key markets like India, China, Japan, Australia, and Pakistan reveal varying levels of self-sufficiency and import dependence. Australia and Pakistan are notable for their significant export contributions, while China and India represent substantial consumption hubs. Emerging trends in sustainable agriculture and the development of specialized wheat varieties for specific food applications, such as premium baking or fortified products, are expected to shape market segmentation. However, challenges such as climate change impacts on crop yields, water scarcity in certain regions, and fluctuating commodity prices could present restraints. Nevertheless, ongoing research and development in crop genetics and agricultural technologies, supported by key players like Bayer CropScience and Nuseed, are instrumental in mitigating these challenges and ensuring the continued growth and resilience of the Asia-Pacific wheat market.

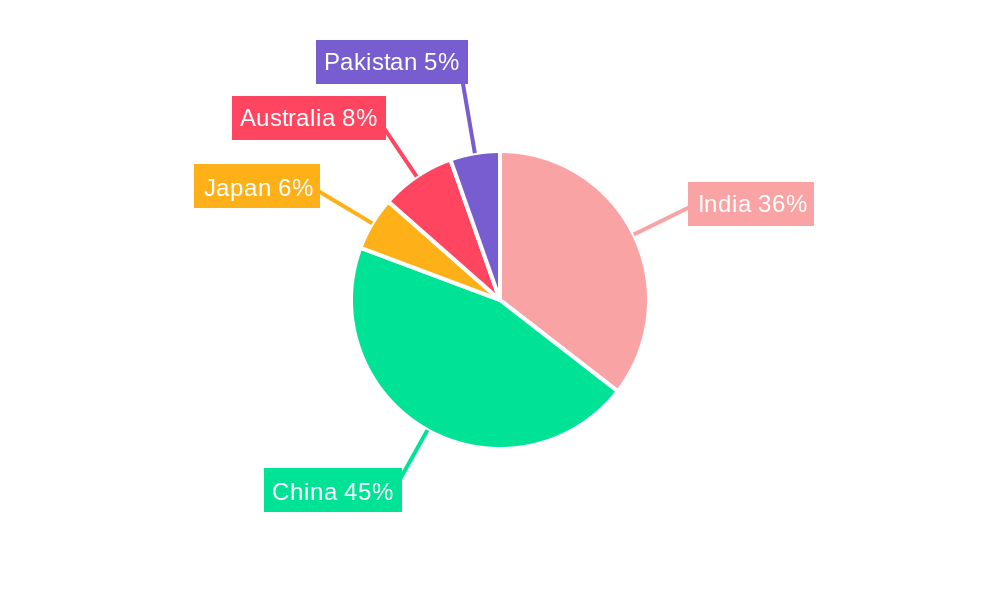

Asia-Pacific Wheat Market Company Market Share

Asia-Pacific Wheat Market: Comprehensive Analysis 2019-2033

Unlock the Future of the Asia-Pacific Wheat Industry. This in-depth report provides a strategic overview of the Asia-Pacific wheat market, crucial for agribusiness, seed manufacturers, governments, and investors. Covering the study period of 2019-2033, with a base and estimated year of 2025, this analysis delves into historical trends (2019-2024) and offers a robust forecast period of 2025-2033. Navigate the complexities of wheat production analysis, wheat consumption analysis, wheat import market analysis (value & volume), wheat export market analysis (value & volume), and wheat price trend analysis. Gain actionable insights into innovation, market dynamics, and strategic opportunities within this vital agricultural sector.

Asia-Pacific Wheat Market Market Dynamics & Concentration

The Asia-Pacific wheat market exhibits a moderate to high concentration, with a few key players dominating technological advancements and market share. Innovation drivers are primarily centered on developing high-yield, disease-resistant, and climate-resilient wheat varieties. Regulatory frameworks vary across countries, impacting seed registration, trade policies, and agricultural subsidies, which significantly influence market accessibility and growth. Product substitutes include other staple grains like rice and corn, though wheat's versatility in food products like bread and noodles ensures its continued demand. End-user trends point towards increasing demand for healthier, whole-grain wheat products and a growing preference for locally adapted and sustainably produced wheat. Mergers and acquisitions (M&A) activities are observed as companies seek to consolidate their market position, expand their product portfolios, and gain access to new geographical regions. For instance, key companies like Bayer CropScience and Syngenta actively engage in strategic partnerships and acquisitions to bolster their R&D capabilities and market reach. The market share of leading seed companies is estimated to be approximately 65% for the top five players. M&A deal counts have seen a steady rise over the past five years, driven by the pursuit of innovation and market consolidation.

Asia-Pacific Wheat Market Industry Trends & Analysis

The Asia-Pacific wheat market is experiencing robust growth, fueled by a burgeoning population, rising disposable incomes, and shifting dietary preferences towards wheat-based products. The compound annual growth rate (CAGR) for the market is projected to be around 4.5% during the forecast period. Increased agricultural investment and the adoption of advanced farming technologies are significantly contributing to the expansion of wheat cultivation. Technological disruptions, such as the development of genetically modified (GM) and hybrid wheat varieties, are enhancing yield potential and disease resistance, thereby improving overall productivity. Consumer preferences are evolving, with a growing demand for diversified wheat products, including whole wheat, organic wheat, and specialty wheat types. This trend is driving innovation in seed development and processing technologies. The competitive dynamics are intensifying, with both established multinational corporations and local players vying for market share. Market penetration of high-yielding seed varieties is steadily increasing across key agricultural nations. The focus on food security and government initiatives promoting domestic wheat production further bolster market growth. The integration of digital agriculture solutions, such as precision farming and crop monitoring, is also gaining traction, leading to more efficient resource utilization and improved crop management practices. The rising awareness about the nutritional benefits of wheat, coupled with its affordability, positions it as a critical component of food security and dietary diversification in the region.

Leading Markets & Segments in Asia-Pacific Wheat Market

The Asia-Pacific Wheat Market is characterized by significant variations in dominance across its key segments.

Dominant Region & Country

- Dominant Region: Asia-Pacific as a whole is a significant consumer and producer of wheat.

- Dominant Countries: China and India stand out as the largest wheat-producing and consuming nations in the region, driven by their massive populations and substantial agricultural sectors. Their economic policies heavily influence global wheat trade flows. The sheer scale of their domestic demand creates a powerful pull for both domestic production and imports.

Production Analysis:

- Key Drivers: Favorable government policies supporting agriculture, increasing adoption of high-yield seeds, and advancements in agricultural machinery are major drivers. China's focus on self-sufficiency in food grains and India's push for enhanced agricultural productivity significantly bolster production. The availability of arable land, though facing pressures, remains a critical factor.

- Dominance: China and India collectively account for over 70% of the total wheat production in the Asia-Pacific region.

Consumption Analysis:

- Key Drivers: Rapid population growth, increasing urbanization, and a shift towards Westernized diets with higher consumption of bread, noodles, and pastries are the primary consumption drivers. Economic growth in countries like Vietnam, Indonesia, and the Philippines is also leading to increased wheat consumption.

- Dominance: China and India also lead in consumption, but the per capita consumption is expected to see higher growth in Southeast Asian nations as their economies develop.

Import Market Analysis (Value & Volume):

- Key Drivers: Domestic production shortfalls, a growing demand for specific wheat varieties (e.g., durum wheat for pasta), and government trade policies influence import volumes. Countries with less arable land or those facing climatic challenges often rely heavily on imports.

- Dominance: China and Indonesia are major wheat importers in terms of volume, driven by their substantial domestic demand that outstrips local production. Vietnam also represents a significant and growing import market.

Export Market Analysis (Value & Volume):

- Key Drivers: Countries with surplus production and competitive pricing strategies are the key exporters. Australia and Russia are significant wheat exporters within or with strong ties to the Asia-Pacific region, influencing regional supply dynamics.

- Dominance: Australia has historically been a dominant exporter to Asia-Pacific, particularly for high-quality milling wheat. Russia's increasing presence in global wheat trade also impacts the regional export landscape.

Price Trend Analysis:

- Key Drivers: Global commodity prices, currency fluctuations, weather patterns affecting major producing regions, and geopolitical events significantly influence wheat prices in the Asia-Pacific market. Domestic supply and demand dynamics also play a crucial role.

- Dominance: While global factors have the most significant impact, regional supply disruptions or policy changes within major producing countries like China and India can lead to localized price volatility.

Asia-Pacific Wheat Market Product Developments

The Asia-Pacific wheat market is witnessing significant innovation in seed technology, driven by companies like Limagrain and BASF. In February 2022, Limagrain launched its first CoAXium Soft White Winter wheat variety, offering high yield potential, excellent straw strength, and superior tolerance to wheat streak mosaic virus and stripe rust, addressing critical agronomic challenges. BASF, in October 2022, introduced two new wheat varieties, Kingston and Reilly, to the Australian market for the 2023 season. Kingston wheat boasts high yield potential, superior grain quality, exceptional straw strength, and outstanding lodging resistance. Reilly wheat, on the other hand, provides excellent grain quality and exceptional resistance to all major pathotypes of stripe rust. Furthermore, BASF's introduction of "Ideltis" as its hybrid wheat brand name in July 2021 signifies a commitment to developing hybrid wheat solutions for farmers seeking higher and more stable performance in yield and quality. These developments highlight a strong market trend towards advanced breeding techniques, disease resistance, and yield enhancement to meet the growing demand for reliable and productive wheat cultivation.

Key Drivers of Asia-Pacific Wheat Market Growth

The Asia-Pacific wheat market is propelled by several key drivers. Population growth in countries like China and India significantly increases the demand for staple foods, with wheat playing a crucial role. Rising disposable incomes lead to dietary diversification, with greater consumption of wheat-based products such as bread, noodles, and pasta. Technological advancements in seed genetics, including the development of high-yield, disease-resistant, and climate-resilient wheat varieties, are enhancing productivity and supporting growth. Government initiatives focused on food security and increasing domestic wheat production, such as subsidies and policy support for farmers, are also critical. Furthermore, the increasing adoption of modern farming practices and precision agriculture contributes to improved yields and efficiency, driving overall market expansion.

Challenges in the Asia-Pacific Wheat Market Market

Despite its growth potential, the Asia-Pacific wheat market faces several challenges. Climate change poses a significant threat, with unpredictable weather patterns, increased frequency of droughts and floods, and extreme temperatures impacting crop yields and quality. Water scarcity in many agricultural regions of Asia further exacerbates production challenges. Stringent and varied regulatory frameworks across different countries regarding seed import, genetically modified organisms (GMOs), and food safety can hinder market access and trade. Price volatility of global wheat commodities, influenced by geopolitical events and supply chain disruptions, can impact farmer profitability and consumer affordability. Limited access to advanced farming technologies and infrastructure in some developing nations restricts productivity gains. Additionally, competition from other staple grains like rice, particularly in countries with a strong traditional preference, presents a continuous challenge.

Emerging Opportunities in Asia-Pacific Wheat Market

The Asia-Pacific wheat market presents numerous emerging opportunities for growth and innovation. The increasing consumer demand for specialty wheat varieties, such as organic, heritage, and gluten-free options, opens new market niches. Technological breakthroughs in precision agriculture, including AI-powered farming, drone technology for crop monitoring, and advanced irrigation systems, offer significant potential for yield optimization and resource efficiency. Strategic partnerships between seed companies, research institutions, and local agricultural cooperatives can accelerate the development and adoption of climate-resilient and high-performing wheat varieties tailored to specific regional conditions. The growing middle class in Southeast Asian countries presents a substantial untapped market for wheat-based products. Furthermore, government investments in agricultural research and development and initiatives promoting sustainable farming practices create a conducive environment for market expansion and innovation.

Leading Players in the Asia-Pacific Wheat Market Sector

- Limagrain

- BASF

- Advanta Seeds

- Syngenta

- Bayer CropScience

- Nuseed

Key Milestones in Asia-Pacific Wheat Market Industry

- February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety with high yield potential, good straw strength, and very good tolerance to wheat streak mosaic virus and stripe rust.

- October 2022: BASF and its commercial partner Seednet released two new wheat varieties, Kingston and Reilly, for the 2023 season to the Australian market. Kingston wheat has high-end yield potential and grain quality, exceptional straw strength, and outstanding lodging resistance. In contrast, Reilly wheat offers excellent grain quality and exceptional resistance to all the major pathotypes of stripe rust.

- July 2021: BASF introduced Ideltis as the seed brand name for its future hybrid wheat to enable higher and more stable performance in yield and quality for farmers.

Strategic Outlook for Asia-Pacific Wheat Market Market

The strategic outlook for the Asia-Pacific wheat market is characterized by continued growth driven by increasing demand and ongoing technological advancements. The focus will remain on developing wheat varieties that are not only high-yielding but also resilient to the challenges posed by climate change, such as drought and disease resistance. Investment in advanced agricultural technologies, including precision farming and biotechnology, will be crucial for enhancing productivity and sustainability. Expansion into emerging markets within Southeast Asia, coupled with strategic partnerships, will be key to capturing new market share. The market will also likely see further consolidation through mergers and acquisitions as companies strive for competitive advantage and portfolio diversification. Emphasis on consumer preferences for healthier and more diverse wheat products will shape product development and marketing strategies, creating significant opportunities for innovation and market leadership.

Asia-Pacific Wheat Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Wheat Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Pakistan

Asia-Pacific Wheat Market Regional Market Share

Geographic Coverage of Asia-Pacific Wheat Market

Asia-Pacific Wheat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. The Increasing Demand for Wheat Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.6.2. China

- 5.6.3. Japan

- 5.6.4. Australia

- 5.6.5. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. India Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. China Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Japan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Australia Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Pakistan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Limagrain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advanta Seeds

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Syngenta

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bayer CropScience

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nuseed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Limagrain

List of Figures

- Figure 1: Asia-Pacific Wheat Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wheat Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Wheat Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 20: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 32: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wheat Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Asia-Pacific Wheat Market?

Key companies in the market include Limagrain, BASF , Advanta Seeds , Syngenta , Bayer CropScience , Nuseed.

3. What are the main segments of the Asia-Pacific Wheat Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.33 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

The Increasing Demand for Wheat Protein.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety with high yield potential, good straw strength, and very good tolerance to wheat streak mosaic virus and stripe rust.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wheat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wheat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wheat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wheat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence