Key Insights

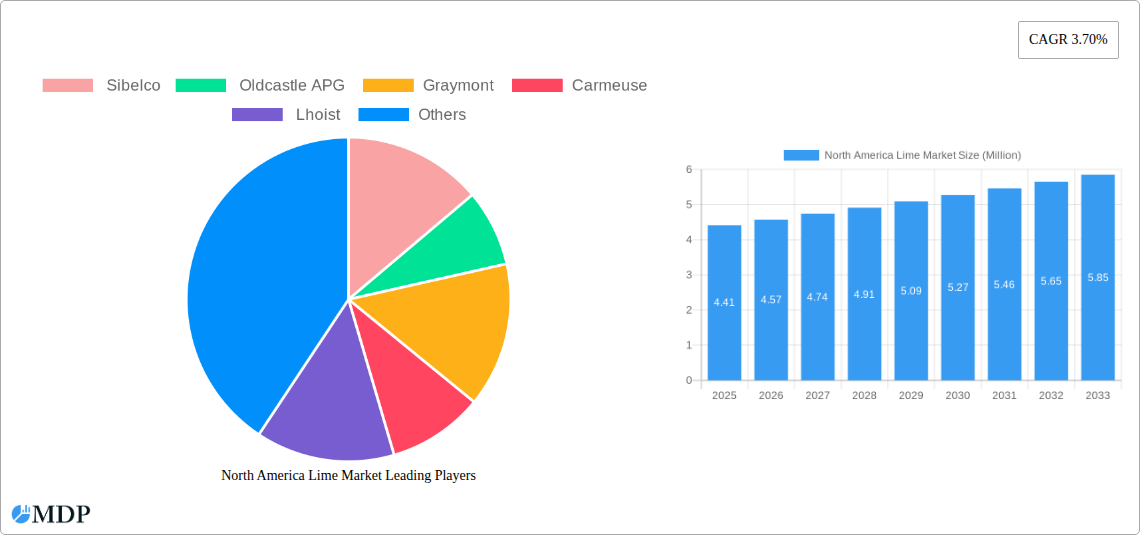

The North America lime market is poised for steady expansion, currently valued at an estimated \$4.41 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 3.70% through 2033. This growth is primarily fueled by the robust demand from key end-use industries, particularly construction, steel manufacturing, and environmental applications. The construction sector's continuous development, driven by infrastructure projects and residential building, necessitates substantial quantities of lime for cement production, soil stabilization, and asphalt paving. Similarly, the steel industry relies heavily on lime as a fluxing agent to remove impurities during the smelting process, making it an indispensable component in metallurgical operations. Furthermore, the increasing focus on environmental regulations and sustainable practices is a significant growth driver, with lime playing a crucial role in flue gas desulfurization (FGD) for power plants and wastewater treatment processes. These applications are gaining prominence as North American countries prioritize cleaner air and water quality.

North America Lime Market Market Size (In Million)

The market dynamics are further shaped by prevailing trends such as the rising adoption of advanced manufacturing techniques in lime production, leading to improved efficiency and product quality. Innovations in calcination technology and the development of specialized lime products tailored for specific industrial needs are contributing to market evolution. However, the market also faces certain restraints, including fluctuating raw material costs, particularly for limestone, and the energy-intensive nature of lime production, which can impact operational expenses. The logistical challenges associated with transporting bulk lime across vast geographical regions in North America also present a hurdle. Despite these challenges, the strategic importance of lime in essential industries, coupled with ongoing technological advancements and a growing emphasis on environmental stewardship, ensures a resilient and expanding North American lime market in the coming years.

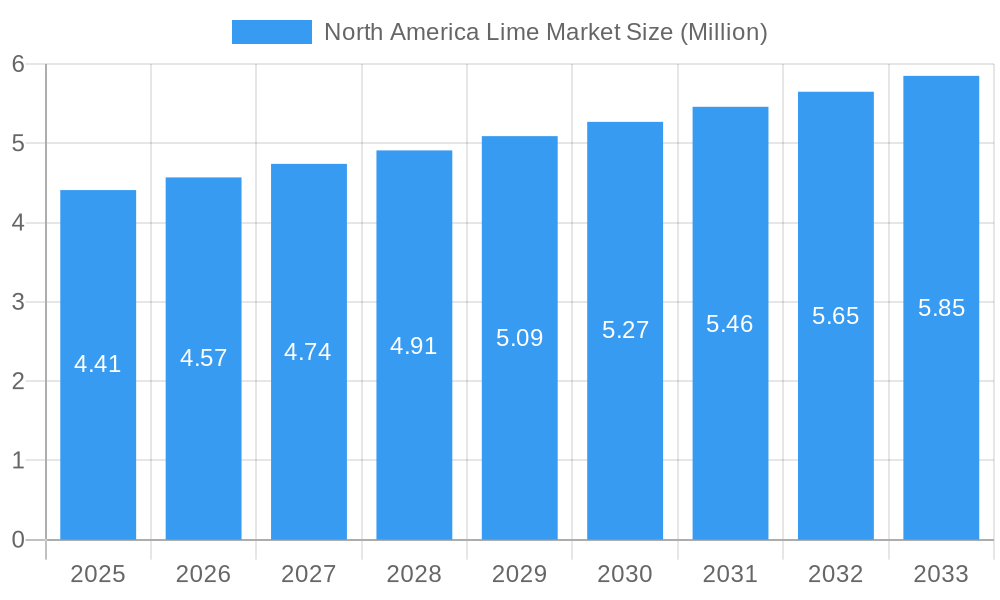

North America Lime Market Company Market Share

This in-depth report provides a definitive analysis of the North America lime market, meticulously examining historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study offers unparalleled insights for industry stakeholders. Covering key segments including the United States, Canada, and Mexico, and analyzing critical aspects like production, consumption, import/export, and price trends, this report is an indispensable tool for strategic decision-making. The market is anticipated to witness robust growth driven by infrastructure development and industrial expansion across the region.

North America Lime Market Market Dynamics & Concentration

The North America lime market exhibits a moderate to high concentration, with a few key players dominating production and distribution. Companies such as Sibelco, Oldcastle APG, Graymont, Carmeuse, and Lhoist hold significant market share, influencing pricing and supply dynamics. Innovation drivers are primarily focused on enhancing production efficiency, reducing environmental impact, and developing specialized lime products for niche applications. Stringent environmental regulations, particularly concerning emissions from lime kilns, are shaping production processes and encouraging investment in cleaner technologies. The threat of product substitutes, while present in certain applications like construction aggregates, remains limited for core industrial uses of lime where its chemical properties are indispensable. End-user trends show a growing demand for high-purity lime in sectors like environmental remediation, water treatment, and advanced manufacturing. Mergers and acquisitions (M&A) activities have been sporadic but strategic, aimed at consolidating market presence and expanding geographical reach. For instance, recent M&A deals have focused on acquiring regional lime producers to strengthen supply chains and enhance customer service. The overall market concentration is characterized by a balance between established giants and smaller, specialized producers.

North America Lime Market Industry Trends & Analysis

The North America lime market is poised for significant expansion, driven by a confluence of robust economic growth, ongoing infrastructure projects, and a resurgence in industrial manufacturing. A projected Compound Annual Growth Rate (CAGR) of approximately 4.2% is expected from 2025 to 2033, propelled by the indispensable role of lime in critical sectors. In construction, lime's use in soil stabilization for roads, dams, and building foundations is a major demand driver, further amplified by government initiatives to upgrade aging infrastructure. The environmental sector is another key growth engine, with increasing applications of lime in flue gas desulfurization (FGD) to mitigate air pollution from power plants and industrial facilities, as well as in water and wastewater treatment for pH adjustment and contaminant removal. The steel industry, a traditional large-scale consumer of lime as a fluxing agent, continues to be a stable demand contributor, with projected production increases in the coming years. Furthermore, the agricultural sector's demand for agricultural lime to neutralize soil acidity and improve crop yields adds a consistent baseline of consumption. Technological advancements are focusing on energy-efficient kiln technologies and the development of specialized lime products with tailored chemical compositions for advanced industrial processes, such as in the pulp and paper and chemical manufacturing industries. Consumer preferences, while indirect, are influencing demand through the growth of industries that rely heavily on lime. For example, the growing demand for electric vehicles indirectly boosts the steel industry, thus indirectly impacting lime demand. The competitive landscape is characterized by a mix of large, vertically integrated players and regional suppliers, with competition intensifying around price, product quality, and logistical efficiency. Market penetration for specialized lime products is on the rise as industries seek customized solutions to enhance their own product quality and operational efficiency.

Leading Markets & Segments in North America Lime Market

The United States stands as the dominant market within the North America lime sector, driven by its vast industrial base, extensive infrastructure development programs, and significant agricultural activity. Its Production Analysis reveals a substantial capacity across numerous strategically located facilities, catering to both domestic and international demand. The Consumption Analysis is equally robust, with key end-use industries like steel manufacturing, construction, environmental services, and chemical production consuming an estimated market value of over $6,000 Million in 2025. The Import Market Analysis indicates a steady inflow of specialized lime products, valued at approximately $300 Million, primarily for niche industrial applications where domestic production might be limited or highly specialized. Conversely, the Export Market Analysis showcases the United States as a significant exporter of standard and high-calcium lime, with volumes exceeding 8 Million metric tons and a value of over $900 Million, supplying neighboring countries and other international markets. The Price Trend Analysis for the United States shows a gradual upward trajectory, influenced by energy costs, raw material availability, and logistical expenses, with an average price per ton estimated around $115.

Canada represents a significant, albeit smaller, market for lime. Its Production Analysis is concentrated in regions with accessible limestone reserves, serving key industries such as steel, pulp and paper, and mining. The Consumption Analysis is driven by these core sectors, with an estimated market value of over $800 Million in 2025. Canada's Import Market Analysis is relatively modest, focusing on specialized lime derivatives, valued at around $50 Million. Its Export Market Analysis is also limited, primarily to border regions of the United States, with a value of approximately $150 Million. Price Trend Analysis in Canada mirrors global trends, with prices for lime hovering around $120 per ton, influenced by domestic transportation costs and energy prices.

Mexico presents a growing market with substantial potential. Its Production Analysis is expanding to meet increasing domestic demand from its burgeoning manufacturing and construction sectors. The Consumption Analysis, estimated at over $600 Million in 2025, is increasingly driven by infrastructure projects and the automotive industry. Mexico's Import Market Analysis is focused on advanced lime products not yet produced domestically, valued at approximately $70 Million. The Export Market Analysis is still developing, with a smaller but growing presence, valued at around $100 Million. Price Trend Analysis in Mexico shows a more volatile pattern due to currency fluctuations and evolving supply chain logistics, with average prices around $105 per ton.

North America Lime Market Product Developments

Product innovation in the North America lime market is increasingly focused on enhancing purity and developing specialized grades for advanced applications. Manufacturers are investing in technologies to produce high-calcium lime and dolomitic lime with precisely controlled chemical compositions, catering to sectors like pharmaceuticals, food processing, and environmental engineering. For instance, ultra-fine lime powders are being developed for use in specialized coatings and adhesives, offering improved performance characteristics. Furthermore, research into reactive calcium oxide and hydroxide is driving new applications in chemical synthesis and advanced materials. These product developments provide a competitive advantage by addressing specific industry needs, improving process efficiencies for end-users, and opening up new market segments.

Key Drivers of North America Lime Market Growth

Several key factors are propelling the growth of the North America lime market. A significant driver is the ongoing investment in infrastructure development across the United States, Canada, and Mexico, which increases the demand for lime in soil stabilization, road construction, and cement production. The increasing stringency of environmental regulations, particularly concerning air and water quality, is a major catalyst, boosting demand for lime in flue gas desulfurization and wastewater treatment processes. Furthermore, the resurgent manufacturing sector, especially in steel production and chemical industries, continues to be a robust consumer of lime. Technological advancements in kiln efficiency and the development of specialized lime products for emerging applications are also contributing to market expansion.

Challenges in the North America Lime Market Market

Despite its growth trajectory, the North America lime market faces several challenges. Stringent environmental regulations, while driving demand for lime-based abatement technologies, also impose significant compliance costs on producers, particularly concerning CO2 emissions from lime kilns. Fluctuations in energy prices, a major operational cost for lime production, can impact profitability and market competitiveness. Supply chain disruptions, exacerbated by logistical complexities and the availability of raw materials like high-quality limestone, can lead to price volatility and affect product availability. Furthermore, the relatively mature nature of some core lime applications, like steel production, limits exponential growth in these segments, requiring producers to focus on innovation and niche markets.

Emerging Opportunities in North America Lime Market

Emerging opportunities in the North America lime market lie in the expanding applications of lime in green technologies and sustainable development. The growing emphasis on circular economy principles is driving demand for lime in industrial by-product recycling and waste management solutions. Advancements in carbon capture technologies utilizing lime-based sorbents present a significant long-term growth potential. Furthermore, the increasing demand for high-purity lime in the battery manufacturing sector and in the production of advanced ceramics offers lucrative new avenues. Strategic partnerships between lime producers and technology providers are crucial for developing and commercializing these innovative applications, further solidifying lime's role in a sustainable future.

Leading Players in the North America Lime Market Sector

- Sibelco

- Oldcastle APG

- Graymont

- Carmeuse

- Lhoist

Key Milestones in North America Lime Market Industry

- 2020: Increased focus on lime-based flue gas desulfurization technologies due to evolving environmental regulations.

- 2021: Significant investments in research and development for specialized lime products in the chemical and pharmaceutical industries.

- 2022: M&A activities by major players aimed at consolidating market share and expanding production capacities.

- 2023: Growing demand for lime in water treatment facilities across North America due to aging infrastructure and increased population.

- 2024: Exploration of new applications for lime in advanced materials and battery manufacturing gaining momentum.

Strategic Outlook for North America Lime Market Market

The strategic outlook for the North America lime market remains highly positive, underpinned by sustained demand from essential industries and the emergence of new growth avenues. Focusing on innovation in high-value, specialized lime products will be critical for market leaders to maintain competitive advantage. Companies that invest in sustainable production methods and explore applications in green technologies, such as carbon capture and circular economy initiatives, are poised for significant long-term growth. Expanding geographical reach through strategic partnerships and targeted acquisitions in under-served regions will further enhance market penetration. The ability to adapt to evolving regulatory landscapes and manage supply chain volatilities will be paramount for navigating the dynamic market environment.

North America Lime Market Segmentation

-

1. North America

-

1.1. United States

- 1.1.1. Production Analysis

- 1.1.2. Consumption Analysis and Market Value

- 1.1.3. Import Market Analysis (Volume and Value)

- 1.1.4. Export Market Analysis (Volume and Value)

- 1.1.5. Price Trend Analysis

- 1.2. Canada

- 1.3. Mexico

-

1.1. United States

-

2. North America

-

2.1. United States

- 2.1.1. Production Analysis

- 2.1.2. Consumption Analysis and Market Value

- 2.1.3. Import Market Analysis (Volume and Value)

- 2.1.4. Export Market Analysis (Volume and Value)

- 2.1.5. Price Trend Analysis

- 2.2. Canada

- 2.3. Mexico

-

2.1. United States

North America Lime Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Lime Market Regional Market Share

Geographic Coverage of North America Lime Market

North America Lime Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Cashew Nuts as a Healthy Snack; Increasing Government initiatives; Growing Cashew Nut Imports in The United States

- 3.3. Market Restrains

- 3.3.1. Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related To Food Quality Standards

- 3.4. Market Trends

- 3.4.1. Increasing Lime Consumption Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Lime Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by North America

- 5.1.1. United States

- 5.1.1.1. Production Analysis

- 5.1.1.2. Consumption Analysis and Market Value

- 5.1.1.3. Import Market Analysis (Volume and Value)

- 5.1.1.4. Export Market Analysis (Volume and Value)

- 5.1.1.5. Price Trend Analysis

- 5.1.2. Canada

- 5.1.3. Mexico

- 5.1.1. United States

- 5.2. Market Analysis, Insights and Forecast - by North America

- 5.2.1. United States

- 5.2.1.1. Production Analysis

- 5.2.1.2. Consumption Analysis and Market Value

- 5.2.1.3. Import Market Analysis (Volume and Value)

- 5.2.1.4. Export Market Analysis (Volume and Value)

- 5.2.1.5. Price Trend Analysis

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.2.1. United States

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by North America

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sibelco

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oldcastle APG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Graymont

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Carmeuse

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lhoist

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Sibelco

List of Figures

- Figure 1: North America Lime Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Lime Market Share (%) by Company 2025

List of Tables

- Table 1: North America Lime Market Revenue Million Forecast, by North America 2020 & 2033

- Table 2: North America Lime Market Volume Kiloton Forecast, by North America 2020 & 2033

- Table 3: North America Lime Market Revenue Million Forecast, by North America 2020 & 2033

- Table 4: North America Lime Market Volume Kiloton Forecast, by North America 2020 & 2033

- Table 5: North America Lime Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Lime Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 7: North America Lime Market Revenue Million Forecast, by North America 2020 & 2033

- Table 8: North America Lime Market Volume Kiloton Forecast, by North America 2020 & 2033

- Table 9: North America Lime Market Revenue Million Forecast, by North America 2020 & 2033

- Table 10: North America Lime Market Volume Kiloton Forecast, by North America 2020 & 2033

- Table 11: North America Lime Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Lime Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 13: United States North America Lime Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Lime Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Lime Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Lime Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Lime Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Lime Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Lime Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the North America Lime Market?

Key companies in the market include Sibelco, Oldcastle APG , Graymont , Carmeuse , Lhoist .

3. What are the main segments of the North America Lime Market?

The market segments include North America, North America.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Cashew Nuts as a Healthy Snack; Increasing Government initiatives; Growing Cashew Nut Imports in The United States.

6. What are the notable trends driving market growth?

Increasing Lime Consumption Drives the Market.

7. Are there any restraints impacting market growth?

Hazardous Climatic Condition Hinders Cashew Production; Stringent Regulations Related To Food Quality Standards.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Lime Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Lime Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Lime Market?

To stay informed about further developments, trends, and reports in the North America Lime Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence