Key Insights

The Indonesian agrochemical market is projected for significant expansion, with an estimated market size of $3.7 billion by 2033, growing at a CAGR of 2.7% from its 2025 baseline. This growth is driven by the escalating need to boost agricultural productivity for domestic consumption and a strong export sector. Key factors include the adoption of advanced farming methods, increased farmer awareness of crop protection and nutrient management benefits, and supportive government initiatives promoting agricultural modernization. The market analysis covers production, consumption, import/export dynamics, and price trends. Production is expected to rise in both formulation and active ingredient manufacturing. Consumption will see increased demand for herbicides, insecticides, fungicides, and fertilizers, adapted to Indonesia's diverse agricultural landscape.

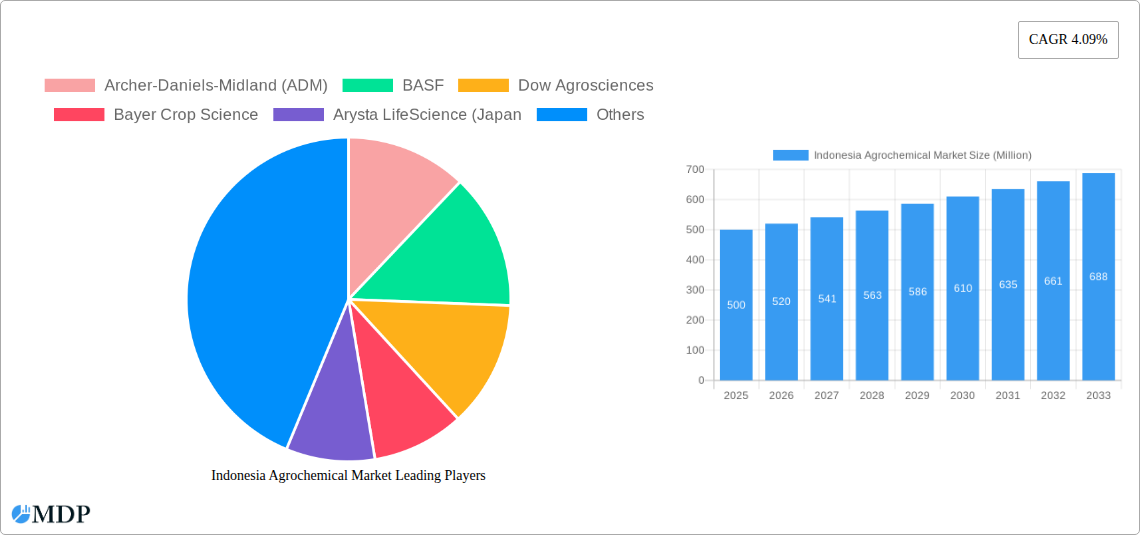

Indonesia Agrochemical Market Market Size (In Billion)

The Indonesian agrochemical market exhibits a dynamic interplay of imports and exports. While imports will remain crucial for specialized products, exports are anticipated to grow as local production scales and meets international quality standards. Price trends will be shaped by raw material costs, regulatory shifts, and market competition. Major global players and prominent regional entities are actively involved in R&D, product innovation, and strategic partnerships. The Indonesian government's emphasis on food security and agricultural sustainability will continue to influence market dynamics, promoting the use of efficient and environmentally sound agrochemical solutions.

Indonesia Agrochemical Market Company Market Share

Gain comprehensive insights into the Indonesian agrochemical market with this SEO-optimized report. Covering 2019–2033, with 2025 as the base and estimated year, and a forecast to 2033, this report offers granular analysis of agrochemical market size in Indonesia, pesticide market dynamics, fertilizer market trends, and crop protection solutions. Key segments include production analysis, consumption patterns, import and export market analysis (value & volume), and price trend analysis. Essential for agrochemical companies, farmers, agricultural input suppliers, and investors in Indonesian agriculture, this report details market drivers, industry trends, leading companies, and future opportunities. Understand groundbreaking developments, regulatory frameworks, and actionable strategies for the dynamic Indonesian agricultural chemicals sector.

Indonesia Agrochemical Market Market Dynamics & Concentration

The Indonesian agrochemical market exhibits a moderately concentrated landscape, characterized by the presence of both multinational giants and strong domestic players. Innovation drivers are primarily centered around the development of more sustainable and targeted solutions, including biopesticides and precision agriculture technologies, responding to increasing environmental concerns and regulatory pressures. The regulatory framework, while evolving, aims to balance agricultural productivity with ecological protection. Product substitutes, such as organic farming practices and integrated pest management (IPM) approaches, are gaining traction but are not yet widespread enough to significantly erode the market share of conventional agrochemicals. End-user trends reveal a growing demand for crop protection products that offer higher efficacy, reduced environmental impact, and improved crop yields, particularly for staple crops like rice and palm oil. Mergers and acquisitions (M&A) activities, though not at an extremely high frequency, have played a role in market consolidation and the expansion of product portfolios. For instance, the acquisition of Arysta LifeScience by UPL demonstrated a strategic move to enhance global reach and product offerings. The market share of leading players like BASF and Syngenta AG remains substantial, indicating a competitive environment where strategic partnerships and product innovation are crucial for sustained growth. The overall market concentration is influenced by the investment capacity for research and development and the ability to navigate complex distribution channels across the archipelago.

Indonesia Agrochemical Market Industry Trends & Analysis

The Indonesian agrochemical market is experiencing robust growth, driven by the nation's strong emphasis on food security and the continuous need to enhance agricultural productivity to feed its burgeoning population and support its significant agricultural export sector. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.2% over the forecast period. Market penetration of agrochemicals remains high, with a significant portion of cultivated land relying on these inputs to combat pests, diseases, and weeds that threaten crop yields. Technological disruptions are reshaping the industry, with the advent of digital farming solutions, drone-based application of agrochemicals, and the increasing adoption of bio-based pesticides and fertilizers. These innovations are not only enhancing the efficiency and sustainability of agricultural practices but also catering to a growing consumer preference for sustainably produced food. Consumer preferences are also shifting towards agrochemical products that are safer for human health and the environment, leading to increased demand for low-toxicity formulations and biological alternatives. The competitive dynamics are intense, with global leaders like Bayer Crop Science, Syngenta AG, and Corteva Agriscience actively participating alongside domestic players such as PT Pupuk Iskandar Muda (PIM). The market penetration of advanced crop protection solutions is steadily increasing, especially in key agricultural regions and for high-value crops. The government's focus on modernizing agriculture and promoting sustainable farming practices further fuels the demand for innovative agrochemical solutions. Furthermore, the growing awareness among farmers about the benefits of using quality agrochemicals to improve yield and quality is a significant market penetration driver. The rising disposable incomes in rural areas also contribute to the increased affordability and adoption of these products.

Leading Markets & Segments in Indonesia Agrochemical Market

The Production Analysis: for agrochemicals in Indonesia is largely dominated by the production of fertilizers, driven by the substantial domestic demand for enhancing crop yields across major agricultural commodities like rice, palm oil, and rubber. Key drivers for this dominance include supportive government policies promoting agricultural self-sufficiency and substantial investments in fertilizer manufacturing infrastructure by companies like PT Pupuk Iskandar Muda (PIM).

The Consumption Analysis: is heavily influenced by the vast agricultural land holdings and the need for effective pest and disease management to protect crops. Rice cultivation, being the staple food, consumes a significant portion of insecticides and herbicides. Palm oil plantations, a major export commodity, also represent a substantial market for a wide range of agrochemicals, including pesticides and growth regulators.

The Import Market Analysis (Value & Volume): showcases a strong demand for specialized and advanced crop protection products that may not be readily manufactured domestically. Insecticides, fungicides, and herbicides constitute the largest import categories by volume. The value of imports is often driven by higher-priced, patented formulations from global manufacturers. Key drivers include the need to combat evolving pest resistance and the introduction of novel crop protection technologies.

The Export Market Analysis (Value & Volume): for Indonesian agrochemicals is relatively less developed compared to imports, primarily focusing on bulk fertilizers and generic pesticide formulations. However, there is potential for growth in niche markets for bio-based agrochemicals.

The Price Trend Analysis: indicates a general upward trend in agrochemical prices, influenced by global raw material costs, currency fluctuations, and domestic supply-demand dynamics. Government subsidies on certain fertilizers also play a role in price stabilization for these specific products. The increasing adoption of premium and technologically advanced products contributes to an increase in the average market price. Economic policies aimed at supporting agricultural productivity and infrastructure development for efficient distribution networks are critical factors in determining market accessibility and price competitiveness.

Indonesia Agrochemical Market Product Developments

Product innovation in the Indonesian agrochemical market is increasingly focused on sustainable and targeted solutions. Recent developments include the introduction of novel mating disruption solutions for pest control, such as Provivi and Syngenta Crop Protection's Nelvium for rice cultivation, which offers a more environmentally friendly alternative to traditional insecticides. Additionally, the development of mobile applications like BASF Sahabat Planters demonstrates a commitment to digital integration, providing farmers with agronomic support, weather predictions, and training resources. These innovations aim to improve efficacy, reduce environmental impact, and enhance farmer convenience and knowledge.

Key Drivers of Indonesia Agrochemical Market Growth

Several key drivers are propelling the growth of the Indonesian agrochemical market. Firstly, the government's unwavering commitment to achieving food security for its large population necessitates increased agricultural output, directly boosting the demand for agrochemicals. Secondly, the continuous need to combat the evolving threats of pests and diseases, which can decimate crop yields, requires the adoption of advanced crop protection solutions. Thirdly, the economic importance of agricultural exports, particularly palm oil, drives investments in maintaining and enhancing crop productivity through the use of agrochemicals. Furthermore, technological advancements in agrochemical formulation, leading to more efficient and environmentally friendly products, are fostering market adoption. Finally, a growing awareness among farmers about the benefits of using quality inputs to improve farm profitability and crop quality is a significant growth accelerato

Challenges in the Indonesia Agrochemical Market Market

Despite strong growth prospects, the Indonesian agrochemical market faces several challenges. Regulatory hurdles, including stringent registration processes for new products and evolving environmental regulations, can slow down market entry for innovative solutions. Supply chain issues, such as the vast geographical dispersion of the archipelago and logistical complexities, can impact the timely and cost-effective distribution of agrochemicals to remote farming communities. Moreover, the prevalence of counterfeit or substandard agrochemicals poses a threat to both farmer yields and the reputation of legitimate products. Competitive pressures from both domestic and international players, coupled with price volatility of raw materials, add to the operational challenges. Educating farmers on the safe and effective use of agrochemicals and promoting integrated pest management alongside chemical solutions also remains an ongoing challenge.

Emerging Opportunities in Indonesia Agrochemical Market

Emerging opportunities in the Indonesian agrochemical market are predominantly driven by the growing demand for sustainable and bio-based solutions. The increasing global and domestic focus on environmentally friendly agricultural practices presents a significant avenue for the growth of biopesticides and biofertilizers. Technological breakthroughs in precision agriculture, including the use of drones for targeted application and sensor-based monitoring, offer opportunities to enhance efficiency and reduce agrochemical usage. Strategic partnerships between technology providers, agrochemical companies, and farmer cooperatives can facilitate the adoption of these advanced solutions. Furthermore, the expansion of agricultural land for high-value crops and the government's initiatives to modernize the agricultural sector create fertile ground for market expansion and the introduction of novel product portfolios.

Leading Players in the Indonesia Agrochemical Market Sector

- Archer-Daniels-Midland (ADM)

- BASF

- Dow Agrosciences

- Bayer Crop Science

- Arysta LifeScience

- FMC Corporation

- Yara International

- PT Pupuk Iskandar Muda (PIM)

- Syngenta AG

- Corteva Agriscience

Key Milestones in Indonesia Agrochemical Market Industry

- March 2022: Provivi and Syngenta Crop Protection commercialized the Nelvium, a new mating disruption solution, to effectively and more safely control detrimental pests in rice. While pheromones have been utilized in agriculture for more than 30 years as a pest control method, this marked the first time this innovation was applied to rice in Indonesia, signifying a leap in sustainable pest management.

- October 2021: BASF launched BASF Sahabat Planters, a new mobile app designed to empower plantation managers and staff. This digital tool facilitates easy access to solutions for common agronomic problems, multimedia-based learning materials, weather predictions, and streamlines staff training and documentation for certifications like RSPO and FSC, highlighting a move towards digital farmer support.

Strategic Outlook for Indonesia Agrochemical Market Market

The strategic outlook for the Indonesian agrochemical market is characterized by continued growth fueled by a combination of factors. The increasing adoption of sustainable agricultural practices presents a significant opportunity for companies offering bio-based agrochemicals and integrated pest management solutions. Furthermore, the ongoing digital transformation within the agriculture sector, including the use of precision farming technologies and data analytics, will enable more targeted and efficient application of agrochemicals, leading to enhanced crop yields and reduced environmental impact. Government support for agricultural modernization and the growing demand for food security will continue to drive the market. Strategic partnerships between local and international players, along with a focus on product innovation that addresses specific Indonesian agricultural challenges, will be crucial for sustained success and market leadership in the coming years.

Indonesia Agrochemical Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Agrochemical Market Segmentation By Geography

- 1. Indonesia

Indonesia Agrochemical Market Regional Market Share

Geographic Coverage of Indonesia Agrochemical Market

Indonesia Agrochemical Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. The Need for Increased Land Productivity is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Agrochemical Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Archer-Daniels-Midland (ADM)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dow Agrosciences

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer Crop Science

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arysta LifeScience (Japan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FMC Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Pupuk Iskandar Muda (PIM)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Syngenta AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Archer-Daniels-Midland (ADM)

List of Figures

- Figure 1: Indonesia Agrochemical Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Agrochemical Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Indonesia Agrochemical Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Agrochemical Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Indonesia Agrochemical Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Indonesia Agrochemical Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Indonesia Agrochemical Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Indonesia Agrochemical Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Indonesia Agrochemical Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Agrochemical Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the Indonesia Agrochemical Market?

Key companies in the market include Archer-Daniels-Midland (ADM), BASF, Dow Agrosciences, Bayer Crop Science, Arysta LifeScience (Japan, FMC Corporation, Yara International, PT Pupuk Iskandar Muda (PIM), Syngenta AG, Corteva Agriscience.

3. What are the main segments of the Indonesia Agrochemical Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

The Need for Increased Land Productivity is Driving the Market.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

March 2022: Provivi and Syngenta Crop Protection commercialized the Nelvium, a new mating disruption solution, to effectively and more safely control detrimental pests in rice. While pheromones have been utilized in agriculture for more than 30 years as a pest control method, this will be the first time this innovation has been applied to rice in Indonesia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Agrochemical Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Agrochemical Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Agrochemical Market?

To stay informed about further developments, trends, and reports in the Indonesia Agrochemical Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence