Key Insights

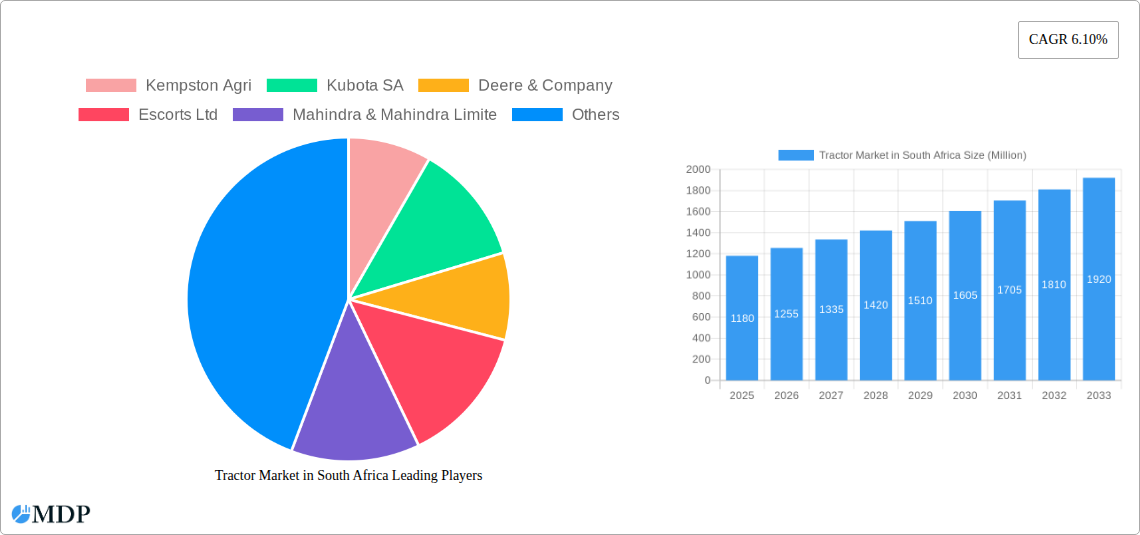

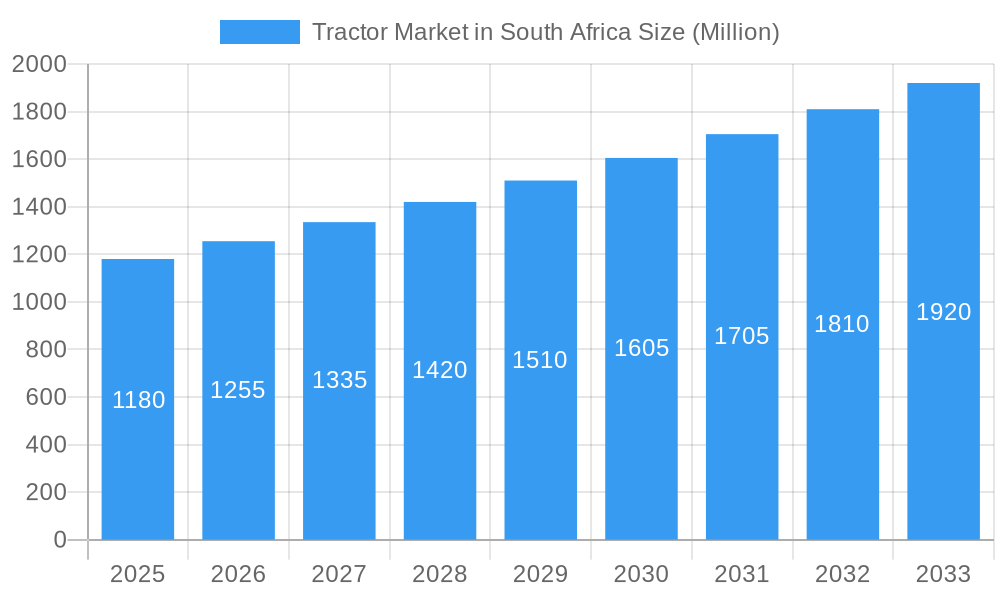

The African tractor market is poised for significant expansion, with a projected market size of USD 1.18 billion in 2025, growing at a robust Compound Annual Growth Rate (CAGR) of 6.10% through 2033. This growth is primarily fueled by increasing agricultural mechanization initiatives across the continent, driven by the need to enhance food security, improve crop yields, and reduce labor dependency in a rapidly urbanizing population. Government support through subsidies and policy frameworks encouraging local manufacturing and adoption of modern farming equipment are also key accelerators. Furthermore, the growing awareness among farmers regarding the benefits of tractors, such as increased efficiency and profitability, coupled with the introduction of technologically advanced and fuel-efficient models, are contributing to market demand. The demand is particularly strong for tractors in the less than 35 HP and 35 to 50 HP segments, catering to the needs of smallholder farmers who constitute a significant portion of the agricultural landscape in many African nations.

Tractor Market in South Africa Market Size (In Billion)

While the overall outlook is optimistic, the market faces certain restraints, including the high initial cost of tractors, limited access to credit and financing for farmers, and the inadequacy of rural infrastructure, such as poor road networks and a lack of servicing facilities. Fluctuations in currency exchange rates can also impact import costs and affordability. Despite these challenges, key players like Mahindra & Mahindra, Kubota SA, and John Deere are actively expanding their presence through strategic partnerships, localized product development, and the establishment of robust distribution and after-sales service networks. The market is witnessing a trend towards more compact and versatile tractors suitable for diverse farming conditions, as well as an increasing interest in electric and hybrid tractor technologies, albeit still in nascent stages of adoption. South Africa, Kenya, and Egypt are identified as key regional markets driving this growth.

Tractor Market in South Africa Company Market Share

South Africa Tractor Market: Deep Dive into Growth, Trends, and Opportunities (2019-2033)

Gain unparalleled insights into the South African tractor market with this comprehensive report, designed to empower industry stakeholders, investors, and decision-makers. Spanning from 2019 to 2033, with a detailed analysis of the 2025 base and estimated year, this report forecasts growth trajectories and identifies key opportunities within this dynamic agricultural machinery sector. Explore the evolving landscape of South African agriculture, tractor sales South Africa, farm equipment market Africa, agri-tech South Africa, and machinery investment Africa. This report is crucial for understanding Kempston Agri, Kubota SA, Deere & Company, Escorts Ltd, Mahindra & Mahindra Limited, CNH Industrial America LLC, Argo Tractors SpA, and AGCO Corporation’s strategies.

Tractor Market in South Africa Market Dynamics & Concentration

The South African tractor market is characterized by a moderate level of concentration, with a few key players holding significant market share, estimated to be around 60-70%. Innovation is primarily driven by advancements in precision agriculture technology, fuel efficiency, and the development of tractors suitable for diverse South African farming conditions, from smallholder farms to large commercial operations. Regulatory frameworks, including import duties and local manufacturing incentives, play a crucial role in shaping market entry and expansion. Product substitutes, such as used tractors and alternative mechanization solutions, present a constant competitive pressure. End-user trends are leaning towards higher horsepower tractors for large-scale operations and technologically advanced, user-friendly models for smaller farms seeking increased productivity. Merger and acquisition (M&A) activities are limited but strategic, focusing on expanding distribution networks and acquiring specialized technologies. For instance, recent M&A deals indicate consolidation to gain market share and access new technologies, with an estimated xx number of significant transactions in the historical period.

Tractor Market in South Africa Industry Trends & Analysis

The South African tractor market is poised for substantial growth, driven by an increasing need for mechanization to boost agricultural productivity and address labor shortages. The South African agricultural sector is a vital contributor to the economy, and modernization is essential for food security and export competitiveness. Technological disruptions, such as the integration of GPS guidance systems, telematics for fleet management, and the development of more fuel-efficient engines, are reshaping the industry. Consumer preferences are shifting towards tractors that offer enhanced operator comfort, reduced emissions, and greater versatility for various farming tasks. The competitive dynamics are intensifying, with both global manufacturers and local distributors vying for market share. The market penetration of advanced tractor technologies is expected to rise significantly, fueled by government initiatives promoting agricultural modernization and increased farmer adoption of technology. The South African tractor market CAGR is projected to be between xx% and xx% during the forecast period. Market growth is further supported by investments in infrastructure and the increasing demand for high-quality agricultural produce both domestically and internationally. The adoption of smart farming solutions is also on the rise, influencing the demand for tractors equipped with advanced digital capabilities.

Leading Markets & Segments in Tractor Market in South Africa

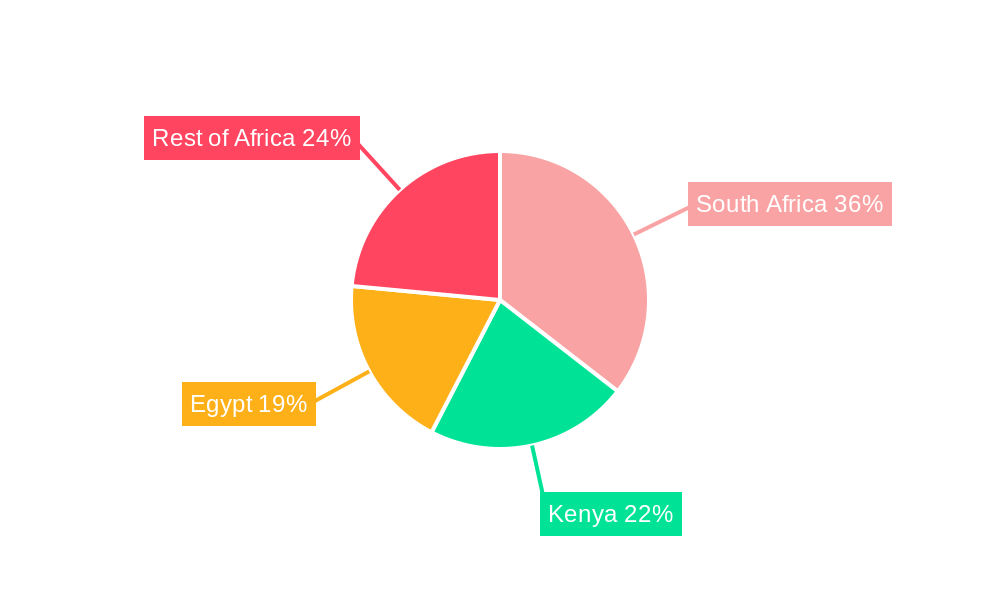

The dominant region within the broader African context is South Africa, driven by its well-established agricultural infrastructure and significant commercial farming operations. Within South Africa, the 76 to 100 HP engine power segment is currently leading, catering to the needs of commercial farms requiring robust and efficient machinery. However, the 35 to 50 HP engine power segment is experiencing rapid growth, fueled by government support for smallholder farmers and the increasing adoption of mechanization among emerging farmers. The "Rest of Africa" segment, while diverse, shows promising growth in countries like Kenya and Egypt, where agricultural development is a key priority.

- Dominant Geography:

- South Africa: The largest market due to its advanced agricultural sector, significant export volumes, and substantial investment in modern farming equipment. Economic policies promoting agricultural exports and land reform initiatives contribute to sustained demand for tractors.

- Leading Engine Power Segments:

- 76 to 100 HP: Essential for large-scale commercial farming operations, offering a balance of power and efficiency for tasks like plowing, planting, and harvesting a wide range of crops.

- 35 to 50 HP: Experiencing the highest growth rate, driven by initiatives to empower smallholder farmers and emerging agricultural entrepreneurs. These tractors are ideal for mixed farming, horticulture, and specific tasks in smaller landholdings.

- Emerging Geographies:

- Kenya: Growing demand driven by government focus on agricultural productivity, development of irrigation projects, and a burgeoning agri-tech ecosystem.

- Egypt: Significant potential due to its large agricultural land base and government investments in modernizing farming practices to enhance food security.

- Key Drivers for Segment Dominance:

- Economic Policies: Government subsidies, tax incentives, and trade agreements that support agricultural mechanization.

- Infrastructure Development: Improved road networks and access to agricultural finance facilitate the distribution and adoption of tractors.

- Technological Advancements: The increasing availability and affordability of tractors with advanced features tailored to specific regional needs.

- Crop Patterns: The prevalent types of crops cultivated in a region influence the demand for specific horsepower ranges and tractor functionalities.

Tractor Market in South Africa Product Developments

Product development in the South African tractor market is increasingly focused on fuel-efficient engines, advanced hydraulics, and integrated GPS and telematics systems for precision farming. Manufacturers are introducing models with enhanced operator comfort and safety features, catering to the diverse needs of both large-scale commercial farmers and emerging smallholders. The trend towards lighter, more agile tractors for specialized horticultural tasks and vineyard management is also evident. Competitive advantages are being built around after-sales support, availability of spare parts, and financing options, alongside innovative product offerings.

Key Drivers of Tractor Market in South Africa Growth

Several key drivers are propelling the growth of the tractor market in South Africa. These include:

- Increasing demand for food security: A growing population necessitates greater agricultural output, driving mechanization.

- Government initiatives: Policies supporting agricultural modernization, subsidies for farm equipment, and programs for emerging farmers.

- Technological advancements: Adoption of precision agriculture, smart farming technologies, and more fuel-efficient tractor designs.

- Economic growth in the agricultural sector: Increased profitability and investment by farmers in upgrading their machinery.

- Labor shortages and rising labor costs: Mechanization offers a solution for efficient and cost-effective farming operations.

Challenges in the Tractor Market in South Africa Market

Despite the positive outlook, the South African tractor market faces several challenges. These include:

- High initial cost of tractors: Making advanced machinery inaccessible for some smaller farmers.

- Limited access to finance: Restricting the purchasing power of many agricultural players.

- Inadequate infrastructure: Poor rural road networks can hinder distribution and after-sales service.

- Availability and cost of spare parts: Can lead to extended downtime for machinery.

- Skilled labor for maintenance and operation: A shortage of trained personnel for complex agricultural machinery.

- Fluctuating currency exchange rates: Impacting the cost of imported components and machinery.

Emerging Opportunities in Tractor Market in South Africa

Emerging opportunities in the South African tractor market are substantial. These include:

- Growth of the smallholder farmer segment: Driven by government support and the increasing adoption of accessible and versatile tractor models.

- Expansion of agri-tech solutions: Integration of smart farming technologies, IoT devices, and data analytics with tractors.

- Leasing and rental models: Providing flexible access to machinery for farmers who cannot afford outright purchase.

- Focus on electric and alternative fuel tractors: Driven by environmental concerns and sustainability initiatives.

- Increased demand for specialized tractors: For niche agricultural sectors like viticulture, horticulture, and forestry.

- Strategic partnerships and collaborations: Between manufacturers, technology providers, and financial institutions to offer comprehensive solutions.

Leading Players in the Tractor Market in South Africa Sector

- Kempston Agri

- Kubota SA

- Deere & Company

- Escorts Ltd

- Mahindra & Mahindra Limited

- CNH Industrial America LLC

- Argo Tractors SpA

- AGCO Corporation

Key Milestones in Tractor Market in South Africa Industry

- June 2022: Agricultural vehicle supplier Argo Tractors South Africa inaugurated its new head office in South Africa. The new premise was built at the cost of USD 5.88 million, hosts a 6000 square meter building, including office space, a 650 square meter showroom, a 100 square meter training facility, 2300 square meters dedicated to assembly, and 2000 square meters designated for spares.

- August 2022: Deere & Company invested in Hello Tractor, an ag-tech company based in Nairobi, Kenya. The company links tractor owners with smallholder farmers in Africa and Asia through a farm equipment-sharing app. It helps farmers to track and manage their fleets, schedule customers, and access financing options.

- November 2021: Mahindra South Africa (SA) launched a new range of tractors and farm equipment in the domestic market. The range included products from Sampo Rosenlew, of Finland, Mitsubishi Mahindra Agri Machinery of Japan, and Hisarlar and Erkunt equipment from Turkey. Together with the Mahindra EarthMaster Yellow Metal and Mahindra Powerol Generators, the company offered these products as a 'World of Solutions' to the South African farmer.

Strategic Outlook for Tractor Market in South Africa Market

The strategic outlook for the South African tractor market is highly positive, driven by a confluence of factors including government support for agricultural modernization, increasing farmer adoption of technology, and a growing demand for efficient food production. Future growth will be accelerated by the expansion of smart farming solutions, the development of accessible financing options, and the introduction of more sustainable and fuel-efficient tractor models. Manufacturers that can offer comprehensive support packages, including robust after-sales service and tailored financing, are best positioned for long-term success. Emerging opportunities in the smallholder farmer segment and the broader African agricultural landscape present significant expansion avenues for key players.

Tractor Market in South Africa Segmentation

-

1. Engine Power

- 1.1. Less than 35 HP

- 1.2. 35 to 50 HP

- 1.3. 51 to 75 HP

- 1.4. 76 to 100 HP

- 1.5. Above 100 HP

-

2. Geography

- 2.1. South Africa

- 2.2. Kenya

- 2.3. Egypt

- 2.4. Rest of Africa

-

3. Engine Power

- 3.1. Less than 35 HP

- 3.2. 35 to 50 HP

- 3.3. 51 to 75 HP

- 3.4. 76 to 100 HP

- 3.5. Above 100 HP

Tractor Market in South Africa Segmentation By Geography

- 1. South Africa

- 2. Kenya

- 3. Egypt

- 4. Rest of Africa

Tractor Market in South Africa Regional Market Share

Geographic Coverage of Tractor Market in South Africa

Tractor Market in South Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increasing Focus on Sustainable Agricultural Mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Tractor Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Engine Power

- 5.1.1. Less than 35 HP

- 5.1.2. 35 to 50 HP

- 5.1.3. 51 to 75 HP

- 5.1.4. 76 to 100 HP

- 5.1.5. Above 100 HP

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. South Africa

- 5.2.2. Kenya

- 5.2.3. Egypt

- 5.2.4. Rest of Africa

- 5.3. Market Analysis, Insights and Forecast - by Engine Power

- 5.3.1. Less than 35 HP

- 5.3.2. 35 to 50 HP

- 5.3.3. 51 to 75 HP

- 5.3.4. 76 to 100 HP

- 5.3.5. Above 100 HP

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Kenya

- 5.4.3. Egypt

- 5.4.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Engine Power

- 6. South Africa Tractor Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Engine Power

- 6.1.1. Less than 35 HP

- 6.1.2. 35 to 50 HP

- 6.1.3. 51 to 75 HP

- 6.1.4. 76 to 100 HP

- 6.1.5. Above 100 HP

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. South Africa

- 6.2.2. Kenya

- 6.2.3. Egypt

- 6.2.4. Rest of Africa

- 6.3. Market Analysis, Insights and Forecast - by Engine Power

- 6.3.1. Less than 35 HP

- 6.3.2. 35 to 50 HP

- 6.3.3. 51 to 75 HP

- 6.3.4. 76 to 100 HP

- 6.3.5. Above 100 HP

- 6.1. Market Analysis, Insights and Forecast - by Engine Power

- 7. Kenya Tractor Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Engine Power

- 7.1.1. Less than 35 HP

- 7.1.2. 35 to 50 HP

- 7.1.3. 51 to 75 HP

- 7.1.4. 76 to 100 HP

- 7.1.5. Above 100 HP

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. South Africa

- 7.2.2. Kenya

- 7.2.3. Egypt

- 7.2.4. Rest of Africa

- 7.3. Market Analysis, Insights and Forecast - by Engine Power

- 7.3.1. Less than 35 HP

- 7.3.2. 35 to 50 HP

- 7.3.3. 51 to 75 HP

- 7.3.4. 76 to 100 HP

- 7.3.5. Above 100 HP

- 7.1. Market Analysis, Insights and Forecast - by Engine Power

- 8. Egypt Tractor Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Engine Power

- 8.1.1. Less than 35 HP

- 8.1.2. 35 to 50 HP

- 8.1.3. 51 to 75 HP

- 8.1.4. 76 to 100 HP

- 8.1.5. Above 100 HP

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. South Africa

- 8.2.2. Kenya

- 8.2.3. Egypt

- 8.2.4. Rest of Africa

- 8.3. Market Analysis, Insights and Forecast - by Engine Power

- 8.3.1. Less than 35 HP

- 8.3.2. 35 to 50 HP

- 8.3.3. 51 to 75 HP

- 8.3.4. 76 to 100 HP

- 8.3.5. Above 100 HP

- 8.1. Market Analysis, Insights and Forecast - by Engine Power

- 9. Rest of Africa Tractor Market in South Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Engine Power

- 9.1.1. Less than 35 HP

- 9.1.2. 35 to 50 HP

- 9.1.3. 51 to 75 HP

- 9.1.4. 76 to 100 HP

- 9.1.5. Above 100 HP

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. South Africa

- 9.2.2. Kenya

- 9.2.3. Egypt

- 9.2.4. Rest of Africa

- 9.3. Market Analysis, Insights and Forecast - by Engine Power

- 9.3.1. Less than 35 HP

- 9.3.2. 35 to 50 HP

- 9.3.3. 51 to 75 HP

- 9.3.4. 76 to 100 HP

- 9.3.5. Above 100 HP

- 9.1. Market Analysis, Insights and Forecast - by Engine Power

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kempston Agri

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kubota SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Deere & Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Escorts Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mahindra & Mahindra Limite

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 CNH Industrial America LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Argo Tractors SpA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AGCO Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Kempston Agri

List of Figures

- Figure 1: Tractor Market in South Africa Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Tractor Market in South Africa Share (%) by Company 2025

List of Tables

- Table 1: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 2: Tractor Market in South Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 4: Tractor Market in South Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 6: Tractor Market in South Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 7: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 8: Tractor Market in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 10: Tractor Market in South Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 11: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 12: Tractor Market in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 14: Tractor Market in South Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 16: Tractor Market in South Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 18: Tractor Market in South Africa Revenue Million Forecast, by Geography 2020 & 2033

- Table 19: Tractor Market in South Africa Revenue Million Forecast, by Engine Power 2020 & 2033

- Table 20: Tractor Market in South Africa Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Market in South Africa?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Tractor Market in South Africa?

Key companies in the market include Kempston Agri, Kubota SA, Deere & Company, Escorts Ltd, Mahindra & Mahindra Limite, CNH Industrial America LLC, Argo Tractors SpA, AGCO Corporation.

3. What are the main segments of the Tractor Market in South Africa?

The market segments include Engine Power, Geography, Engine Power.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increasing Focus on Sustainable Agricultural Mechanization.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

June 2022: Agricultural vehicle supplier Argo Tractors South Africa inaugurated its new head office in South Africa. The new premise was built at the cost of USD 5. 88 million, hosts a 6000 square meter building, including office space, a 650 square meter showroom, a 100 square meter training facility, 2300 square meters dedicated to assembly, and 2000 square meters designated for spares.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Market in South Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Market in South Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Market in South Africa?

To stay informed about further developments, trends, and reports in the Tractor Market in South Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence