Key Insights

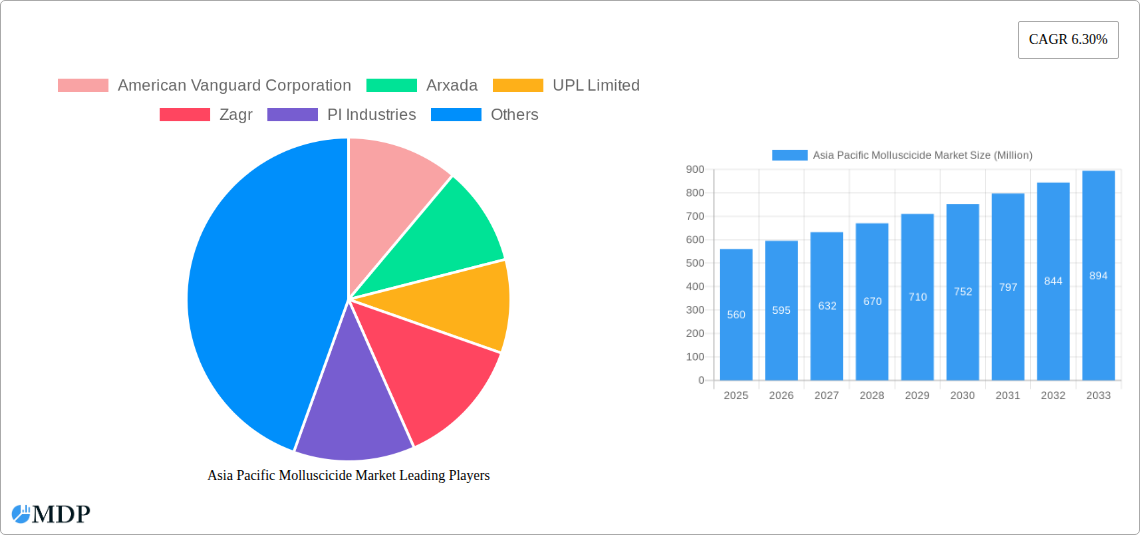

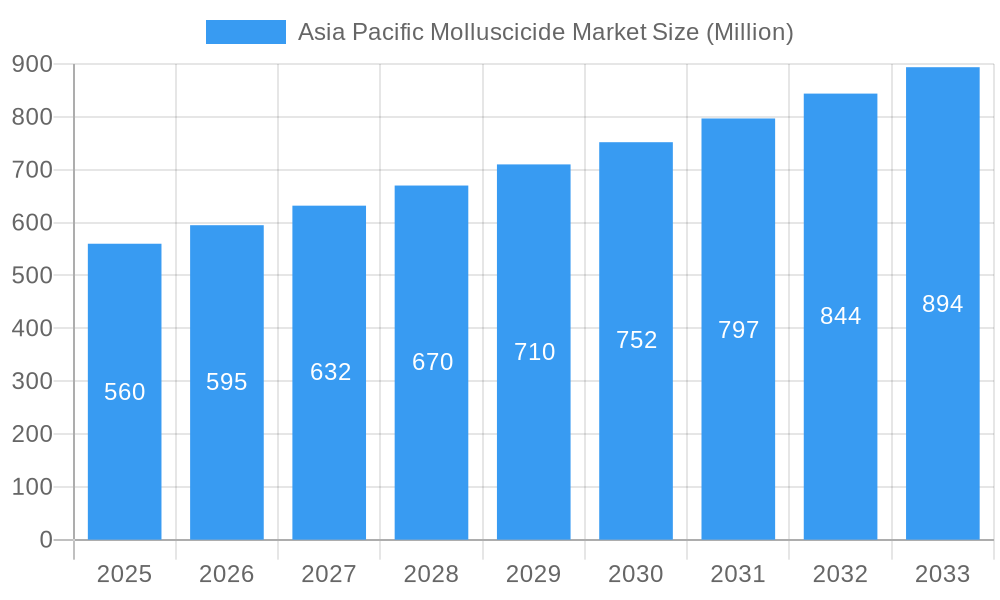

The Asia Pacific Molluscicide Market is poised for robust expansion, projected to reach approximately USD 750 million by the end of the forecast period in 2033, with a Compound Annual Growth Rate (CAGR) of 6.30% from its base year of 2025. This growth is primarily propelled by the increasing demand for crop protection solutions in the region's burgeoning agricultural sector, driven by a growing population and the need for enhanced food security. Key drivers include the escalating incidence of mollusc infestations, particularly in rice paddies and vegetable farms, which significantly impact crop yields and quality. Furthermore, the rising adoption of advanced molluscicide formulations, offering greater efficacy and reduced environmental impact, is stimulating market penetration. Government initiatives aimed at promoting sustainable agriculture and integrated pest management (IPM) also contribute to the market's upward trajectory by encouraging the responsible use of molluscicides. Emerging economies within Asia Pacific, such as India and Vietnam, are expected to witness particularly strong growth due to expanding agricultural land and increasing farmer awareness regarding pest control.

Asia Pacific Molluscicide Market Market Size (In Million)

The market dynamics are further shaped by a confluence of trends and restraints. Technological advancements in molluscicide application, including precision spraying and slow-release formulations, are enhancing product effectiveness and farmer convenience. The growing preference for eco-friendly and biologically derived molluscicides presents a significant opportunity for innovation and market differentiation. However, the market also faces challenges such as stringent regulatory frameworks governing the use of chemical pesticides and concerns regarding their potential environmental and health implications. Fluctuations in raw material prices and the cost-intensive nature of research and development for novel molluscicide solutions can also pose restraints. Nevertheless, the proactive strategies adopted by leading companies, including strategic partnerships and product portfolio expansion, alongside increasing investment in R&D for sustainable alternatives, are expected to mitigate these challenges and sustain the market's positive growth momentum. The competitive landscape features prominent players like UPL Limited and PI Industries, actively vying for market share through product innovation and regional expansion.

Asia Pacific Molluscicide Market Company Market Share

Dive deep into the burgeoning Asia Pacific molluscicide market with this in-depth report. Uncover critical insights into the factors driving demand for snail and slug control solutions across the region, from agricultural pest management to public health initiatives. This comprehensive analysis provides actionable intelligence for industry stakeholders, including manufacturers, distributors, researchers, and investors, navigating the dynamic Asia Pacific pesticide market and its specialized molluscicide segment.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

This report meticulously examines the Asia Pacific molluscicide market size, market share, CAGR, and market trends. We provide detailed production analysis, consumption analysis, import market analysis (value & volume), export market analysis (value & volume), and price trend analysis for key countries within the region. Gain a competitive edge with our analysis of leading players, industry developments, product developments, growth drivers, challenges, emerging opportunities, and a strategic outlook. Understand the impact of major mergers and acquisitions, technological advancements, and evolving regulatory landscapes on the Asia Pacific molluscicide industry.

Asia Pacific Molluscicide Market Market Dynamics & Concentration

The Asia Pacific molluscicide market exhibits a moderate to high level of concentration, with key players like American Vanguard Corporation, Arxada, UPL Limited, Zagr, PI Industries, and Nufarm Ltd dominating significant market shares. Innovation drivers are primarily centered around developing safer and more eco-friendly molluscicide formulations, such as bio-based molluscicides and integrated pest management (IPM) solutions, to address growing environmental concerns and stringent regulatory frameworks across countries like Japan, Australia, and South Korea. Product substitutes, including non-chemical control methods and resistant crop varieties, pose a growing challenge, necessitating continuous product innovation and efficacy improvements. End-user trends reveal an increasing demand from the agricultural sector for enhanced crop yields and reduced damage from mollusc pests, particularly in rice cultivation and horticulture. Simultaneously, urban and public health applications for mollusc control, especially in regions prone to diseases transmitted by snails, are also contributing to market expansion. Merger and acquisition (M&A) activities are a significant aspect of market dynamics, with companies strategically acquiring others to expand their product portfolios, manufacturing capabilities, and geographical reach. For instance, American Vanguard Corporation's acquisition of AgNova Technologies Pty Ltd in August 2020 significantly boosted its presence in the Australian agrochemical market. Similarly, PI Industries Limited's acquisition of Isagro Asia Agrochemicals Private Ltd in December 2019 enhanced its manufacturing and distribution network. UPL Limited's acquisition of Arysta LifeScience Inc. in January 2019 for USD 4.2 billion further consolidated its global position. These M&A activities, along with strategic partnerships and R&D investments, are crucial for maintaining market competitiveness and capturing new growth opportunities in the Asia Pacific molluscicide market. The market share of leading companies is estimated to be around 60-70% collectively, with the number of significant M&A deals in the past five years estimated at 15-20.

Asia Pacific Molluscicide Market Industry Trends & Analysis

The Asia Pacific molluscicide market is poised for robust growth, driven by a confluence of factors that are reshaping agricultural practices and pest management strategies across the region. The increasing global population and the subsequent demand for food security are placing immense pressure on agricultural productivity, making effective pest control a paramount concern. Molluscs, including snails and slugs, pose a significant threat to a wide array of crops, leading to substantial yield losses estimated to be in the billions of dollars annually across the Asia Pacific. This direct economic impact fuels the demand for efficacious molluscicides. Furthermore, the agricultural sector in many Asia Pacific countries is undergoing modernization, with a greater adoption of advanced farming techniques and a heightened awareness of the economic implications of pest infestations. This trend directly translates into increased spending on crop protection chemicals, including molluscicides.

Technological disruptions are playing a pivotal role in the evolution of the molluscicide market. The development of novel, more targeted, and environmentally benign molluscicide formulations is a key area of innovation. This includes the research and development of compounds with reduced toxicity to non-target organisms, lower persistence in the environment, and enhanced efficacy against resistant mollusc populations. The market penetration of these advanced formulations is steadily increasing as regulatory bodies and consumers alike prioritize sustainable pest management practices. Consumer preferences are also shifting towards products that are perceived as safer and more responsible. This has led to a growing demand for molluscicides that comply with stringent environmental regulations and carry eco-labels. Farmers and agricultural organizations are actively seeking solutions that minimize environmental impact while ensuring effective pest control.

The competitive dynamics within the Asia Pacific molluscicide market are characterized by the presence of both established global players and emerging regional manufacturers. Companies are increasingly focusing on strategic collaborations, research partnerships, and product differentiation to gain a competitive edge. The market is also witnessing consolidation through mergers and acquisitions, as seen with the significant deals by UPL Limited and PI Industries Limited, aimed at expanding market reach and product offerings. The compound annual growth rate (CAGR) for the Asia Pacific molluscicide market is projected to be between 4.5% and 5.8% during the forecast period, indicating a healthy expansion trajectory. Market penetration of molluscicides is estimated to reach over 75% in key agricultural nations like China and India, with the total market value expected to surpass USD 1.2 billion by 2033. This growth is underpinned by escalating concerns over crop damage, particularly in high-value crops such as fruits, vegetables, and ornamental plants, where mollusc infestations can decimate harvests. Moreover, the rising awareness of the role of molluscs in transmitting diseases in both agricultural and public health contexts further bolsters the demand for effective control measures.

Leading Markets & Segments in Asia Pacific Molluscicide Market

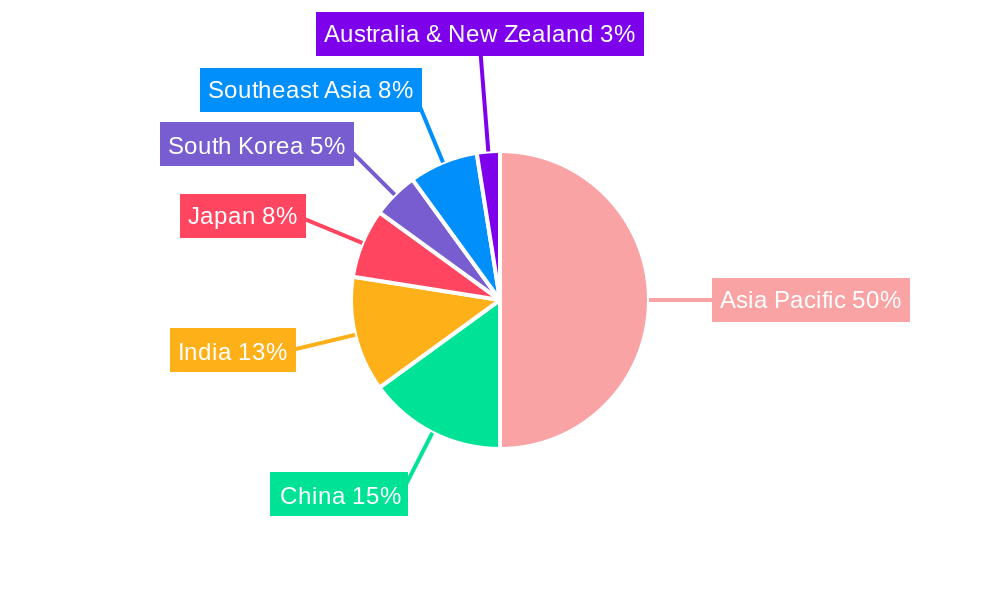

The Asia Pacific molluscicide market is characterized by significant regional variations in production, consumption, and trade, with distinct leading markets and segments.

Production Analysis:

- Dominant Region: Southeast Asia, particularly countries like Vietnam, Thailand, and Indonesia, along with China, represent key production hubs for molluscicides. This is driven by lower manufacturing costs, established chemical industries, and a strong domestic agricultural demand.

- Key Drivers: Access to raw materials, government support for the chemical industry, and availability of skilled labor are crucial for production dominance.

- Country-Specific Production: China is a major producer, accounting for an estimated 30-35% of the region's total production volume. India is also a significant contributor, with a growing agrochemical manufacturing sector.

Consumption Analysis:

- Dominant Segment: Agriculture remains the largest consumer of molluscicides, with significant demand from countries like India, China, Japan, and Australia. Rice paddies, vegetable farms, and fruit orchards are major end-use areas.

- Key Drivers: Increasing crop cultivation area, rising awareness of economic losses due to mollusc pests, and government initiatives promoting efficient agriculture contribute to high consumption.

- Country-Specific Consumption: India's vast agricultural landscape and the prevalence of mollusc pests in crops like rice and sugarcane make it a leading consumer, accounting for approximately 25-30% of the regional consumption. Japan's high-value horticultural sector also drives substantial molluscicide usage.

Import Market Analysis (Value & Volume):

- Dominant Markets: Countries with high agricultural intensity and a demand for specialized or advanced molluscicide formulations, such as Japan, South Korea, and Australia, are significant importers. These nations often rely on imports for specific active ingredients or formulated products not readily manufactured domestically.

- Key Drivers: Technological advancements in imported products, adherence to international quality standards, and gaps in domestic production capabilities fuel import demand.

- Import Value: The import market value is estimated to reach over USD 500 Million by 2033, with Japan and Australia contributing significantly due to their advanced agricultural sectors. The import volume is projected to be in the range of 100,000-120,000 metric tons.

Export Market Analysis (Value & Volume):

- Dominant Exporters: China and India are the primary exporters of molluscicides from the Asia Pacific region, leveraging their robust manufacturing capabilities and cost competitiveness. They export to other Asian countries, as well as to markets in Africa and Latin America.

- Key Drivers: Competitive pricing, large-scale production capacities, and a wide range of product offerings enable these countries to be leading exporters.

- Export Value: Export revenues are projected to exceed USD 600 Million by 2033, with a significant portion originating from China. The export volume is estimated at 130,000-150,000 metric tons.

Price Trend Analysis:

- Factors Influencing Prices: Fluctuations in raw material costs, currency exchange rates, regulatory compliance expenses, and supply-demand dynamics significantly impact molluscicide prices in the Asia Pacific. The price of metaldehyde, a common active ingredient, is a key determinant.

- Trend: Prices are expected to see a moderate upward trend due to increasing raw material costs and stricter environmental regulations, with an estimated average annual increase of 2-3%. The price per kilogram is projected to range from USD 4.50 to USD 7.00, depending on the active ingredient and formulation.

Asia Pacific Molluscicide Market Product Developments

The Asia Pacific molluscicide market is witnessing a surge in product development driven by the need for more effective, sustainable, and environmentally responsible solutions. Innovations are focused on advanced formulations that offer enhanced target specificity, reduced toxicity to non-target organisms, and improved user safety. This includes the development of slow-release formulations, granular baits with irresistible attractants, and novel active ingredients that overcome mollusc resistance. For instance, companies are investing in research for bio-molluscicides derived from natural sources, offering a greener alternative to synthetic chemicals. These product developments aim to address evolving regulatory landscapes and increasing consumer demand for eco-friendly pest management, thereby creating new market opportunities and competitive advantages for pioneering companies.

Key Drivers of Asia Pacific Molluscicide Market Growth

The growth of the Asia Pacific molluscicide market is propelled by several interconnected factors. Primarily, the escalating demand for food security in the region, driven by a burgeoning population, necessitates increased agricultural output. Molluscs, such as snails and slugs, are significant pests that cause considerable damage to crops, leading to substantial economic losses. This drives the need for effective molluscicides to protect yields. Furthermore, the modernization of agricultural practices across many Asia Pacific nations, coupled with a growing awareness of the economic impact of pest infestations, is leading to increased investment in crop protection solutions. Technological advancements in the development of safer, more potent, and environmentally friendly molluscicides are also a crucial growth catalyst. The emergence of new pest strains and increasing resistance to older formulations further necessitates the adoption of innovative products. Lastly, government initiatives aimed at promoting efficient agriculture and ensuring food safety indirectly support the market by encouraging the use of effective pest management tools.

Challenges in the Asia Pacific Molluscicide Market Market

Despite the promising growth trajectory, the Asia Pacific molluscicide market faces several significant challenges. Stringent and evolving regulatory frameworks across different countries can lead to increased compliance costs and longer approval times for new products, potentially hindering market entry and expansion. The rise in mollusc resistance to existing chemical compounds is a growing concern, diminishing the efficacy of traditional molluscicides and necessitating the development of new active ingredients or integrated pest management strategies. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, can impact production costs and product availability. Furthermore, the increasing demand for organic and eco-friendly farming practices poses a challenge for conventional synthetic molluscicides, pushing manufacturers to develop sustainable alternatives. Competitive pressures from generic manufacturers and the availability of alternative pest control methods also contribute to market constraints.

Emerging Opportunities in Asia Pacific Molluscicide Market

The Asia Pacific molluscicide market presents several compelling opportunities for growth and innovation. The increasing adoption of integrated pest management (IPM) strategies creates avenues for companies to develop complementary molluscicide products and services that work in synergy with biological control agents and cultural practices. The growing awareness of mollusc-borne diseases in both agricultural and public health sectors, particularly in tropical and subtropical regions, is opening new market segments for targeted molluscicidal interventions. Technological breakthroughs in precision agriculture and smart farming offer opportunities for the development of sensor-based and targeted molluscicide application systems, reducing overall chemical usage and environmental impact. Furthermore, strategic partnerships between chemical manufacturers, research institutions, and agricultural cooperatives can accelerate the development and adoption of novel and sustainable molluscicide solutions. The untapped potential in emerging economies within the Asia Pacific also presents significant expansion opportunities.

Leading Players in the Asia Pacific Molluscicide Market Sector

- American Vanguard Corporation

- Arxada

- UPL Limited

- Zagr

- PI Industries

- Nufarm Ltd

Key Milestones in Asia Pacific Molluscicide Market Industry

- August 2020: American Vanguard Corporation acquired all the stock in AgNova Technologies Pty Ltd, an Australian agrochemicals specialist. Its presence in the Australian and Asia-Pacific agrochemical markets has been strengthened by this acquisition.

- December 2019: Isagro Asia Agrochemicals Private Ltd (Isagro Asia) was acquired by PI Industries Limited (PI). Through this acquisition, PI will gain access to additional manufacturing capabilities, which will help it strengthen its position in the domestic crop protection market by utilizing the acquired entity's complementary product portfolio and pan-India distribution network.

- January 2019: UPL Limited acquired Arysta LifeScience Inc. (Arysta) for USD 4.2 billion, further strengthening its position on a global scale.

Strategic Outlook for Asia Pacific Molluscicide Market Market

The Asia Pacific molluscicide market is set for sustained growth, driven by an increasing need for effective pest management solutions in agriculture and public health. Key growth accelerators include the ongoing focus on food security, the modernization of farming practices, and the demand for sustainable pest control methods. Strategic opportunities lie in the development and commercialization of innovative, eco-friendly molluscicides, such as bio-based alternatives and precision application technologies. Companies that invest in research and development to address mollusc resistance and meet evolving regulatory standards will be well-positioned for success. Furthermore, strategic collaborations and market expansion into rapidly developing economies within the Asia Pacific will be crucial for capturing future market potential. The emphasis on integrated pest management and residue-free produce will also shape product development and market strategies.

Asia Pacific Molluscicide Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Molluscicide Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Molluscicide Market Regional Market Share

Geographic Coverage of Asia Pacific Molluscicide Market

Asia Pacific Molluscicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increased need for molluscicides in major crops like rice is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Molluscicide Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 American Vanguard Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arxada

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 UPL Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zagr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PI Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nufarm Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 American Vanguard Corporation

List of Figures

- Figure 1: Asia Pacific Molluscicide Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Molluscicide Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia Pacific Molluscicide Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia Pacific Molluscicide Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Molluscicide Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Asia Pacific Molluscicide Market?

Key companies in the market include American Vanguard Corporation, Arxada, UPL Limited, Zagr, PI Industries, Nufarm Ltd.

3. What are the main segments of the Asia Pacific Molluscicide Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increased need for molluscicides in major crops like rice is driving the market.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

August 2020: American Vanguard Corporation acquired all the stock in AgNova Technologies Pty Ltd, an Australian agrochemicals specialist. Its presence in the Australian and Asia-Pacific agrochemical markets has been strengthened by this acquisition.December 2019: Isagro Asia Agrochemicals Private Ltd (Isagro Asia) was acquired by PI Industries Limited (PI). Through this acquisition, PI will gain access to additional manufacturing capabilities, which will help it strengthen its position in the domestic crop protection market by utilizing the acquired entity's complementary product portfolio and pan-India distribution network.January 2019: UPL Limited acquired Arysta LifeScience Inc. (Arysta) for USD 4.2 billion, further strengthening its position on a global scale.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Molluscicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Molluscicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Molluscicide Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Molluscicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence