Key Insights

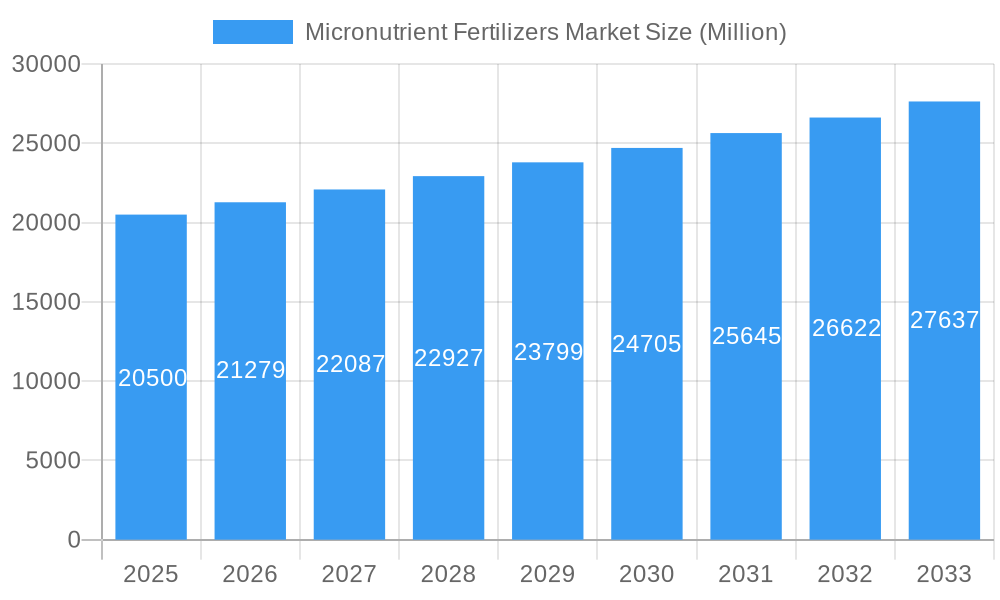

The global Micronutrient Fertilizers Market is projected to reach approximately $20,500 million by 2025, driven by a steady Compound Annual Growth Rate (CAGR) of 3.80%. This growth is fundamentally propelled by the increasing global demand for enhanced agricultural productivity and improved crop quality. As arable land becomes scarcer and the need to feed a growing population intensifies, farmers are recognizing the critical role of micronutrients – essential elements like zinc, iron, manganese, copper, boron, and molybdenum – in optimizing plant health and yield. The rising awareness of soil deficiencies, exacerbated by intensive farming practices and declining soil fertility, further fuels the adoption of micronutrient fertilizers. Technological advancements in fertilizer formulations, including chelated and slow-release versions, are also contributing to market expansion by offering improved nutrient uptake efficiency and reduced environmental impact. The growing emphasis on sustainable agriculture and precision farming techniques also plays a significant role, as these methods rely on targeted nutrient application to maximize resource utilization and minimize waste.

Micronutrient Fertilizers Market Market Size (In Billion)

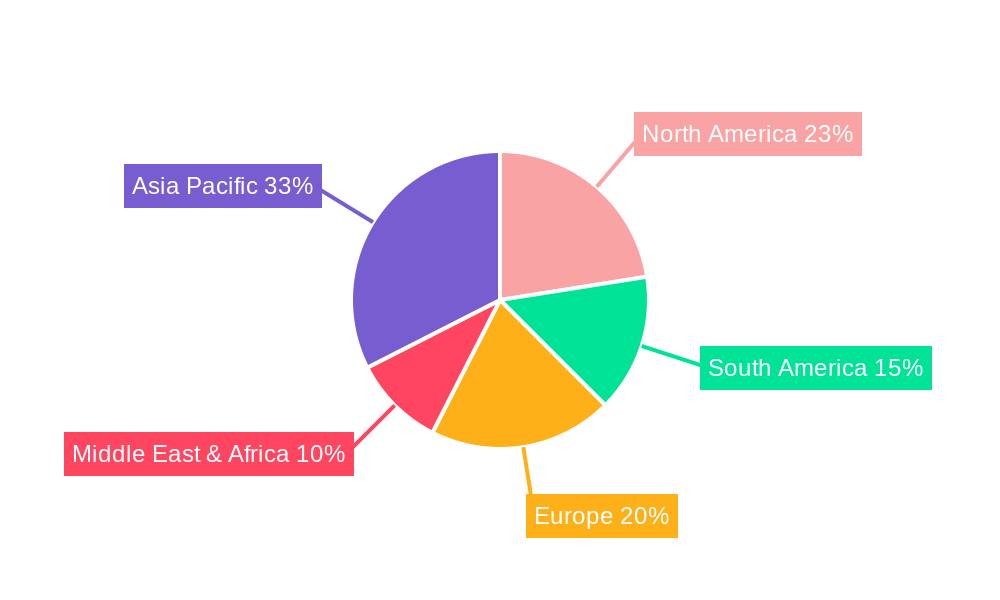

The market is characterized by a dynamic interplay of growth drivers and restraining factors. Key drivers include the escalating need for nutrient-dense food products, government initiatives promoting soil health and sustainable farming, and the expanding agricultural sector in emerging economies. However, challenges such as the high cost of certain micronutrient formulations, lack of awareness among smallholder farmers, and the availability of alternative nutrient management strategies can pose limitations. Geographically, Asia Pacific, with its vast agricultural base and increasing adoption of modern farming practices, is expected to be a dominant region. North America and Europe are also significant markets due to their advanced agricultural technologies and strong focus on crop quality. Companies like Coromandel International Ltd, Yara International AS, and The Mosaic Company are key players actively innovating and expanding their product portfolios to cater to the evolving demands of the global micronutrient fertilizer landscape.

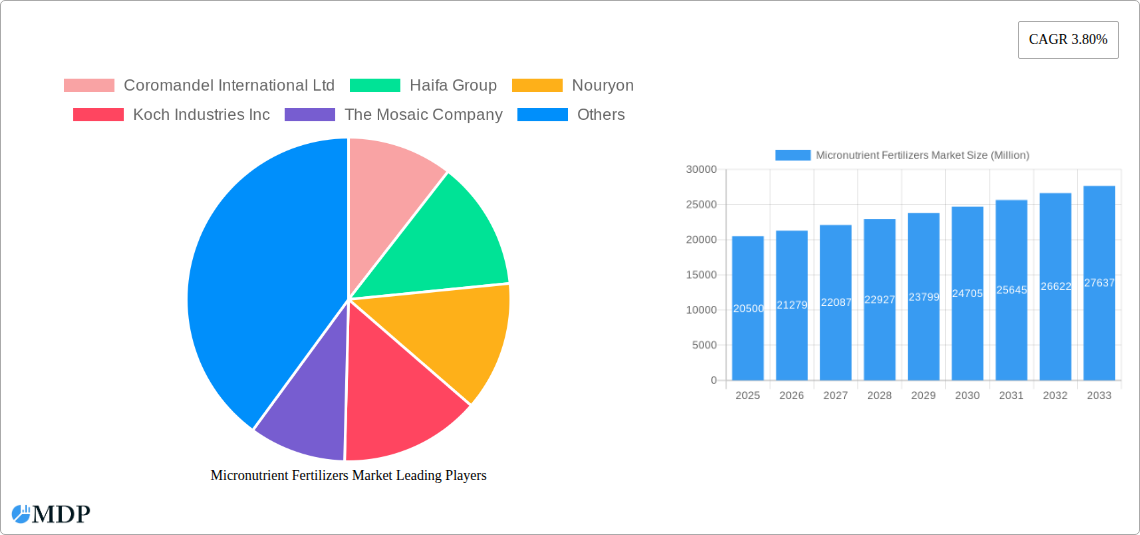

Micronutrient Fertilizers Market Company Market Share

This comprehensive report provides an in-depth analysis of the global Micronutrient Fertilizers Market, a critical sector driving enhanced crop yields and sustainable agricultural practices. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report offers unparalleled insights into market dynamics, leading players, and future trajectories. Explore key segments such as Production Analysis, Consumption Analysis, Import/Export Market Analysis, and Price Trend Analysis. Identify strategic growth opportunities, navigate market challenges, and understand the impact of key industry developments, including recent acquisitions by K+S Aktiengesellschaft and Nouryon, and product innovations from ICL Group Ltd. This report is essential for fertilizer manufacturers, agricultural input suppliers, distributors, government bodies, investors, and crop science professionals seeking to capitalize on the burgeoning demand for advanced crop nutrition solutions.

Micronutrient Fertilizers Market Dynamics & Concentration

The Micronutrient Fertilizers Market is characterized by moderate to high concentration, with a few key players dominating global production and distribution. Innovation drivers are primarily focused on developing efficient delivery systems for essential trace elements like zinc, iron, manganese, copper, boron, and molybdenum, which are crucial for plant health and maximizing crop yields. The increasing awareness among farmers about the impact of micronutrient deficiencies on agricultural productivity is a significant catalyst. Regulatory frameworks are evolving to promote the use of these specialized fertilizers, often driven by environmental sustainability goals and the need for precision agriculture. Product substitutes, while existing in the form of organic nutrient sources, often lack the targeted efficacy and rapid availability of synthetic micronutrient fertilizers. End-user trends are shifting towards integrated nutrient management strategies, where micronutrients play a vital role in complementing macro-nutrient application. Mergers and acquisition (M&A) activities are notable, reflecting the strategic consolidation within the industry aimed at expanding market reach and product portfolios. For instance, in April 2023, K+S Aktiengesellschaft’s acquisition of a 75% share of Industrial Commodities Holdings (Pty) Ltd (ICH) in South Africa signifies an expansion into new geographical markets and a strengthening of their presence in Southern and Eastern Africa. Similarly, Nouryon’s acquisition of ADOB in April 2023 broadened its innovative crop nutrition offerings, particularly in chelating micronutrients. Market share is gradually consolidating as companies invest in research and development to offer superior formulations. The M&A deal count within this sector indicates a trend towards strategic partnerships and acquisitions to gain competitive advantages.

Micronutrient Fertilizers Market Industry Trends & Analysis

The Micronutrient Fertilizers Market is poised for robust growth, driven by a confluence of factors that are reshaping global agriculture. The increasing global population necessitates higher food production, putting immense pressure on existing arable land and demanding enhanced crop yields per unit area. Micronutrient fertilizers are instrumental in achieving this by addressing specific deficiencies that limit plant growth, even when macro-nutrients are adequately supplied. The Compound Annual Growth Rate (CAGR) for this market is projected to be approximately 5.8% during the forecast period. Market penetration is steadily increasing as farmers become more educated about the detrimental effects of micronutrient deficiencies, which can lead to reduced crop quality, disease susceptibility, and ultimately, lower profitability. Technological advancements are playing a pivotal role, with the development of slow-release and controlled-release formulations, as well as chelating agents that improve the bioavailability of micronutrients to plants, especially in challenging soil conditions. These innovations enhance nutrient use efficiency, reduce environmental losses, and optimize application strategies, aligning with the principles of sustainable agriculture and precision farming. Consumer preferences are increasingly leaning towards nutrient-dense food products, indirectly driving the demand for micronutrient-fortified crops. Moreover, government initiatives promoting soil health and balanced fertilization further support market expansion. Competitive dynamics are intensifying, with companies investing heavily in R&D to develop differentiated products and expand their global footprints. The rise of digital agriculture platforms and soil testing services also facilitates the targeted application of micronutrient fertilizers, making their use more economically viable and environmentally responsible for farmers. The increasing adoption of drip irrigation and foliar application methods further enhances the effectiveness and efficiency of micronutrient delivery, contributing to market expansion.

Leading Markets & Segments in Micronutrient Fertilizers Market

The global Micronutrient Fertilizers Market exhibits distinct regional dominance and segment-specific growth drivers.

Dominant Region: Asia Pacific

- Production Analysis: Asia Pacific, particularly countries like China and India, leads in the production of micronutrient fertilizers due to a vast agricultural base, significant government support for fertilizer production, and the presence of numerous domestic manufacturers. The production capacity is estimated to be over 5 Million Metric Tons in the base year 2025.

- Consumption Analysis: This region also commands the largest share in consumption, driven by the intensive agricultural practices employed to feed a massive population. Smallholder farming, which relies heavily on maximizing yields from limited land, makes micronutrient application increasingly critical. The consumption volume is projected to exceed 4.5 Million Metric Tons in 2025.

- Import Market Analysis (Value & Volume): While production is high, certain specialized micronutrients or advanced formulations might be imported. The import market value is estimated to be around USD 800 Million and volume around 250,000 Metric Tons in 2025, primarily from developed nations offering high-value products.

- Export Market Analysis (Value & Volume): Asia Pacific is also a significant exporter of micronutrient fertilizers, with an export market value of approximately USD 1.2 Billion and volume of 400,000 Metric Tons in 2025. China and India are major contributors to this export volume.

Key Segments & Their Drivers:

- Production Analysis: The production landscape is shaped by the availability of raw materials, manufacturing capabilities, and economies of scale. Companies with integrated production facilities and access to key raw materials have a competitive edge.

- Consumption Analysis: Drivers include crop types, soil health conditions, farmer education levels, and government subsidy policies. High-value crops like fruits, vegetables, and plantation crops typically exhibit higher demand for micronutrients.

- Import Market Analysis (Value & Volume): This segment is driven by the demand for specialized, high-purity micronutrients, innovative formulations (e.g., nano-fertilizers), and products that address specific regional deficiencies not easily met by local production. Technological advancements and intellectual property often dictate import trends.

- Export Market Analysis (Value & Volume): Export competitiveness is influenced by production costs, product quality, adherence to international standards, and effective distribution networks. Countries with strong manufacturing bases and competitive pricing strategies tend to dominate exports.

- Price Trend Analysis: Price trends are influenced by raw material costs (e.g., zinc oxide, ferrous sulfate, copper sulfate), energy prices, global supply-demand dynamics, and currency fluctuations. The average price of micronutrient fertilizers is estimated to be around USD 300 per Metric Ton in 2025, with variations based on product type and purity.

Micronutrient Fertilizers Market Product Developments

Product innovation in the Micronutrient Fertilizers Market is primarily focused on enhancing nutrient delivery, efficacy, and sustainability. Companies are developing advanced formulations such as chelated micronutrients (e.g., EDDHA iron, EDTA zinc) that offer superior solubility and uptake, particularly in alkaline soils. The introduction of nano-fertilizers is another significant trend, promising improved nutrient use efficiency and reduced application rates. Furthermore, there's a growing emphasis on multi-micronutrient blends tailored for specific crops and soil types, offering convenience to farmers. Product developments are driven by the need to address micronutrient deficiencies more effectively, minimize environmental impact through reduced nutrient leaching, and improve overall crop health and yield potential, thereby offering a competitive advantage in the market.

Key Drivers of Micronutrient Fertilizers Market Growth

Several key drivers are propelling the growth of the Micronutrient Fertilizers Market.

- Technological Advancements: The development of efficient delivery systems like chelates and nano-formulations significantly enhances nutrient bioavailability and uptake, leading to improved crop yields and quality.

- Increasing Awareness of Soil Health and Deficiencies: A growing understanding among farmers about the critical role of micronutrients in plant physiology and the negative impact of deficiencies on crop productivity is a major catalyst.

- Rising Global Food Demand: The imperative to increase food production to meet the demands of a growing global population necessitates optimizing crop yields, making micronutrient fertilizers indispensable tools for modern agriculture.

- Government Initiatives and Policies: Many governments are actively promoting balanced fertilization and soil health management, often through subsidies and awareness programs, thereby encouraging the adoption of micronutrient fertilizers.

Challenges in the Micronutrient Fertilizers Market Market

Despite its growth potential, the Micronutrient Fertilizers Market faces several challenges.

- High Cost of Specialized Formulations: Advanced micronutrient fertilizers, especially chelated and nano-formulations, can be significantly more expensive than conventional fertilizers, posing a barrier for smallholder farmers.

- Lack of Farmer Education and Awareness: In certain regions, a lack of awareness regarding the specific micronutrient needs of different crops and soils can hinder optimal product selection and application.

- Complex Regulatory Frameworks: Navigating varied and evolving regulatory requirements for fertilizer registration and labeling across different countries can be a cumbersome and time-consuming process for manufacturers.

- Supply Chain Volatility: Fluctuations in the availability and cost of raw materials, coupled with logistical challenges, can impact the stable supply and pricing of micronutrient fertilizers.

Emerging Opportunities in Micronutrient Fertilizers Market

The Micronutrient Fertilizers Market is ripe with emerging opportunities.

- Sustainable and Organic Micronutrient Solutions: Growing consumer demand for organic produce is driving the development of naturally derived and sustainable micronutrient fertilizers, creating a niche market segment.

- Precision Agriculture Integration: The widespread adoption of precision agriculture technologies, including soil sensors and data analytics, allows for highly targeted application of micronutrients, optimizing their use and boosting demand.

- Emerging Markets Expansion: Untapped potential exists in developing economies where agricultural practices are gradually modernizing and awareness of advanced crop nutrition is rising.

- Biotechnology and Bio-fertilizer Synergies: Exploring synergies between micronutrient fertilizers and bio-fertilizers (e.g., microbial inoculants that enhance nutrient availability) presents an opportunity for innovative, integrated crop solutions.

Leading Players in the Micronutrient Fertilizers Market Sector

- Coromandel International Ltd

- Haifa Group

- Nouryon

- Koch Industries Inc

- The Mosaic Company

- K+S Aktiengesellschaft

- Yara International AS

- ICL Group Ltd

- BMS Micro-Nutrients NV

Key Milestones in Micronutrient Fertilizers Market Industry

- April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of Fertiv Pty Ltd.

- April 2023: ADOB, a major provider of chelating micronutrients, foliar, and other specialty farming solutions based in Poland, was acquired by Nouryon. Through the acquisition, the company broadened its innovative crop nutrition portfolio.

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

Strategic Outlook for Micronutrient Fertilizers Market Market

The strategic outlook for the Micronutrient Fertilizers Market is overwhelmingly positive, fueled by the increasing necessity for global food security and sustainable agricultural intensification. Key growth accelerators include continued investment in research and development for novel formulations that enhance nutrient efficiency and reduce environmental impact. Strategic partnerships between fertilizer manufacturers, technology providers, and agricultural research institutions will be crucial for driving innovation and market penetration. The market will likely witness further consolidation through mergers and acquisitions as companies seek to expand their geographical reach and product portfolios. A significant opportunity lies in leveraging digital tools and precision agriculture technologies to promote the intelligent and targeted application of micronutrients, thereby maximizing crop potential and farmer profitability. The growing demand for nutrient-dense foods will also continue to be a strong market driver.

Micronutrient Fertilizers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Micronutrient Fertilizers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Micronutrient Fertilizers Market Regional Market Share

Geographic Coverage of Micronutrient Fertilizers Market

Micronutrient Fertilizers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Micronutrient Fertilizers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Coromandel International Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haifa Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nouryon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Koch Industries Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Mosaic Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 K+S Aktiengesellschaft

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yara International AS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ICL Group Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BMS Micro-Nutrients NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Coromandel International Ltd

List of Figures

- Figure 1: Global Micronutrient Fertilizers Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Micronutrient Fertilizers Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Micronutrient Fertilizers Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Micronutrient Fertilizers Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Micronutrient Fertilizers Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Micronutrient Fertilizers Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Micronutrient Fertilizers Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Micronutrient Fertilizers Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Micronutrient Fertilizers Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Micronutrient Fertilizers Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Micronutrient Fertilizers Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Micronutrient Fertilizers Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Micronutrient Fertilizers Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Micronutrient Fertilizers Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Micronutrient Fertilizers Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Micronutrient Fertilizers Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Micronutrient Fertilizers Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Micronutrient Fertilizers Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Micronutrient Fertilizers Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Micronutrient Fertilizers Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Micronutrient Fertilizers Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Micronutrient Fertilizers Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Micronutrient Fertilizers Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Micronutrient Fertilizers Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Micronutrient Fertilizers Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Micronutrient Fertilizers Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Micronutrient Fertilizers Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Micronutrient Fertilizers Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Micronutrient Fertilizers Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Micronutrient Fertilizers Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Micronutrient Fertilizers Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Micronutrient Fertilizers Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Micronutrient Fertilizers Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Micronutrient Fertilizers Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Micronutrient Fertilizers Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Micronutrient Fertilizers Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Micronutrient Fertilizers Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Micronutrient Fertilizers Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Micronutrient Fertilizers Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Micronutrient Fertilizers Market Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Micronutrient Fertilizers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Micronutrient Fertilizers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Micronutrient Fertilizers Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micronutrient Fertilizers Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Micronutrient Fertilizers Market?

Key companies in the market include Coromandel International Ltd, Haifa Group, Nouryon, Koch Industries Inc, The Mosaic Company, K+S Aktiengesellschaft, Yara International AS, ICL Group Ltd, BMS Micro-Nutrients NV.

3. What are the main segments of the Micronutrient Fertilizers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

April 2023: K+S acquired a 75% share of the fertilizer business of a South African trading company, Industrial Commodities Holdings (Pty) Ltd (ICH). In addition to expanding the core business, K+S is strengthening its operations in southern and eastern Africa as a result of this acquisition. The newly acquired fertilizer business in the future is to be operated in a joint venture under the name of FertivPty Ltd.April 2023: ADOB, a major provider of chelating micronutrients, foliar, and other specialty farming solutions based in Poland, was acquired by Nouryon. Through the acquisition, the company broadened its innovative crop nutrition portfolio.May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micronutrient Fertilizers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micronutrient Fertilizers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micronutrient Fertilizers Market?

To stay informed about further developments, trends, and reports in the Micronutrient Fertilizers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence