Key Insights

Brazil's agricultural machinery market is forecast for substantial growth, projected to reach $17.57 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 6.5% from the base year 2024. This expansion is propelled by Brazil's status as a global agricultural leader, producing key commodities like soybeans, sugarcane, and coffee. The imperative for modern, efficient farming operations fuels robust demand for advanced machinery, including tractors across all horsepower segments (under 80 HP, 81-130 HP, and over 130 HP), and comprehensive planting, harvesting, and irrigation equipment. Innovations like precision farming and GPS-guided technology are enhancing resource optimization and yield, further stimulating market development. Government support for agricultural modernization and infrastructure improvements also positively impacts market dynamics. The increasing adoption of mechanization, especially on larger farms, is a primary growth driver.

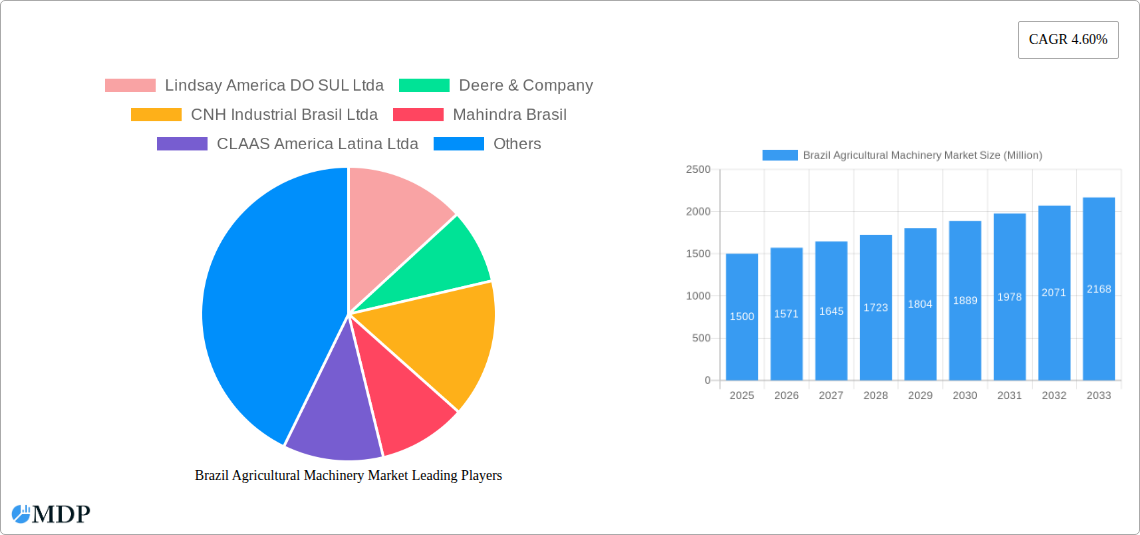

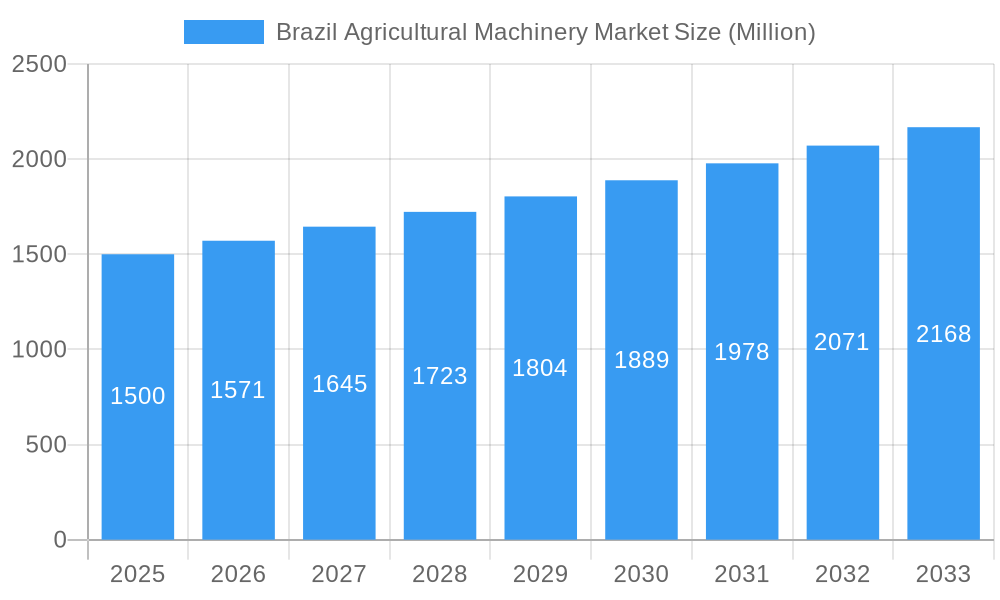

Brazil Agricultural Machinery Market Market Size (In Billion)

Potential challenges include the impact of commodity price volatility on farmer investment and the crucial role of financing accessibility. Broader economic instability in Brazil may also influence demand. Nevertheless, the agricultural machinery market's long-term prospects are strong, underpinned by Brazil's agricultural significance and the continuous pursuit of technological advancements. Market segmentation indicates broad demand across all machinery types, presenting diverse opportunities for global leaders such as Deere & Company and AGCO, alongside domestic manufacturers like Mahindra Brasil. Higher horsepower tractors and advanced harvesting equipment are expected to lead growth.

Brazil Agricultural Machinery Market Company Market Share

Brazil Agricultural Machinery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Brazil Agricultural Machinery Market, offering a comprehensive overview of market dynamics, leading players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry stakeholders, investors, and strategic decision-makers. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

Brazil Agricultural Machinery Market Dynamics & Concentration

The Brazilian agricultural machinery market is characterized by a moderate level of concentration, with several multinational and domestic players vying for market share. Market leaders such as Deere & Company, CNH Industrial Brasil Ltda, and AGCO do Brasil hold significant portions of the market, though the overall landscape is dynamic, with ongoing mergers and acquisitions (M&A) influencing the competitive balance. In the past five years, the number of M&A deals in the sector has averaged xx per year, driven by companies seeking to expand their product portfolios and geographic reach. Innovation is a key driver, with ongoing advancements in precision farming technologies, automation, and sustainable agricultural practices shaping market dynamics. The regulatory environment plays a crucial role, with government policies influencing both investment and adoption of new technologies. The market is also influenced by the availability of substitute products, such as simpler, more manual farming equipment, which can impact the adoption of advanced machinery. End-user trends such as the increasing demand for higher efficiency and lower operating costs significantly impact the type of agricultural machinery in demand.

- Market Share: Deere & Company (xx%), CNH Industrial Brasil Ltda (xx%), AGCO do Brasil (xx%), others (xx%).

- M&A Deal Count (2019-2024): xx

- Key Innovation Drivers: Precision farming, automation, sustainable agriculture.

- Regulatory Framework: Government policies influencing investment and technology adoption.

- Product Substitutes: Manual farming equipment.

Brazil Agricultural Machinery Market Industry Trends & Analysis

The Brazilian agricultural machinery market is experiencing robust growth, driven by several key factors. The country's vast agricultural sector, coupled with increasing demand for food and feed globally, fuels the adoption of advanced agricultural machinery. Technological advancements, such as precision farming tools and automation, are improving efficiency and productivity, leading to higher yields and better resource management. Consumer preferences are shifting towards fuel-efficient, technologically advanced machinery with lower operating costs. This trend is creating opportunities for manufacturers who offer innovative and sustainable solutions. The competitive landscape is highly dynamic, with intense competition among both domestic and international players, driving innovation and efficiency. The market is segmented by various types of agricultural equipment, with tractors (particularly those in the 81-130 HP range), planters, and harvesters representing significant portions of the market. The CAGR for the market during the forecast period is estimated to be xx%. Market penetration of technologically advanced machinery is gradually increasing, particularly in regions with higher agricultural productivity.

Leading Markets & Segments in Brazil Agricultural Machinery Market

The Brazilian agricultural machinery market demonstrates regional variations in demand based on agricultural activity and infrastructure. The Southern and Midwest regions, known for extensive soybean and corn cultivation, represent significant market segments for tractors, planters, and harvesters. Within the various segments, tractors (specifically those in the 81-130 HP range) dominate the market due to their versatility and suitability for various crops. The demand for planting and harvesting machinery also remains substantial, while irrigation machinery is experiencing steady growth due to increasing water scarcity concerns.

- Key Drivers for Dominant Segments:

- Tractors (81-130 HP): Versatility, suitability for various crops, strong demand from large-scale farms.

- Planters & Harvesters: High demand from soybean and corn cultivation.

- Irrigation Machinery: Increasing water scarcity concerns.

- Dominant Regions: Southern and Midwest regions.

Brazil Agricultural Machinery Market Product Developments

Recent product innovations focus on enhancing efficiency, precision, and sustainability. Manufacturers are incorporating advanced technologies such as GPS guidance systems, automated steering, and variable-rate application systems to optimize resource usage and improve yields. The development of more fuel-efficient engines and the integration of smart farming technologies are also significant trends, enhancing overall cost-effectiveness and precision. These products are designed to meet the increasing demands for higher productivity and environmentally responsible farming practices. The market fit of these new products is strong, given the growing need for efficiency improvements in the Brazilian agricultural sector.

Key Drivers of Brazil Agricultural Machinery Market Growth

Several factors drive the growth of the Brazilian agricultural machinery market: Firstly, the expansion of the agricultural sector and increasing land under cultivation. Secondly, a growing preference for mechanization to enhance efficiency and yield. Thirdly, government support for agricultural modernization via subsidies and incentives. Technological advancements in precision farming and automation also play a significant role, increasing productivity and reducing costs. Finally, favorable credit facilities and financing options available to farmers increase accessibility to the latest technologies.

Challenges in the Brazil Agricultural Machinery Market Market

The Brazilian agricultural machinery market faces several challenges: Fluctuating commodity prices impacting farmer investment capacity. High import tariffs affecting the cost and availability of imported equipment. Infrastructure limitations in certain agricultural regions, particularly regarding transportation and logistics. The dependence on external financial markets for financing purchases, leading to vulnerabilities when global interest rates rise. Finally, the need for skilled labor and service technicians to operate and maintain advanced machinery remains a significant factor.

Emerging Opportunities in Brazil Agricultural Machinery Market

The Brazilian agricultural machinery market presents several significant opportunities: The growing adoption of precision farming technologies, smart sensors, and data analytics offers potential for increased efficiency and productivity. Strategic partnerships between machinery manufacturers and agricultural technology providers can drive innovation and new product development. Expanding into underserved agricultural regions with improved infrastructure can unlock significant market potential. Finally, the development of more sustainable and environmentally friendly machinery will cater to the rising global demand for responsible agricultural practices.

Leading Players in the Brazil Agricultural Machinery Market Sector

- Deere & Company

- CNH Industrial Brasil Ltda

- AGCO do Brasil

- Kubota Tractor Corp

- Mahindra Brasil

- CLAAS America Latina Ltda

- Lindsay America DO SUL Ltda

Key Milestones in Brazil Agricultural Machinery Market Industry

- July 2022: Mahindra & Mahindra Company inaugurated an assembly plant in Brazil.

- September 2022: Marcher Brasil unveiled its OUTGRAIN211 grain extractor.

- August 2023: New Holland Agriculture (CNH Industrial) launched the TL5 Acessível tractor for farmers with lower limb disabilities.

Strategic Outlook for Brazil Agricultural Machinery Market Market

The Brazilian agricultural machinery market exhibits strong growth potential, driven by several factors: increasing mechanization rates, technological advancements in precision agriculture, and government initiatives promoting agricultural modernization. Strategic opportunities lie in focusing on the development and deployment of innovative, sustainable, and cost-effective machinery. Partnerships with technology providers and investments in research and development will be crucial to staying ahead of the curve in this competitive landscape. Expanding into underserved regions and addressing infrastructural challenges will further unlock market potential.

Brazil Agricultural Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Brazil Agricultural Machinery Market Segmentation By Geography

- 1. Brazil

Brazil Agricultural Machinery Market Regional Market Share

Geographic Coverage of Brazil Agricultural Machinery Market

Brazil Agricultural Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Brazilian Farm Structure and Consolidation of Smaller Farms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Agricultural Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lindsay America DO SUL Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deere & Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CNH Industrial Brasil Ltda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mahindra Brasil

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CLAAS America Latina Ltda

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kubota Tractor Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AGCO do Brasil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Lindsay America DO SUL Ltda

List of Figures

- Figure 1: Brazil Agricultural Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Agricultural Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Agricultural Machinery Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Brazil Agricultural Machinery Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Brazil Agricultural Machinery Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Brazil Agricultural Machinery Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Brazil Agricultural Machinery Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Brazil Agricultural Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Brazil Agricultural Machinery Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Brazil Agricultural Machinery Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Brazil Agricultural Machinery Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Brazil Agricultural Machinery Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Brazil Agricultural Machinery Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Brazil Agricultural Machinery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Agricultural Machinery Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Brazil Agricultural Machinery Market?

Key companies in the market include Lindsay America DO SUL Ltda, Deere & Company, CNH Industrial Brasil Ltda, Mahindra Brasil, CLAAS America Latina Ltda, Kubota Tractor Corp, AGCO do Brasil.

3. What are the main segments of the Brazil Agricultural Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.57 billion as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2023: New Holland Agriculture, a brand under CNH Industrial, introduced one of the world's pioneering and cost-effective farm tractors created by an automobile manufacturer. The TL5 Acessível model tractor was manufactured at the Curitiba (PR) facility in Brazil. This tractor has been specifically engineered to cater to individuals with lower limb motor disabilities, enabling them to independently engage in agricultural activities. This breakthrough by the company promises to break down barriers that have long hindered many farmers from accessing tractor-operating stations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Agricultural Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Agricultural Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Agricultural Machinery Market?

To stay informed about further developments, trends, and reports in the Brazil Agricultural Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence