Key Insights

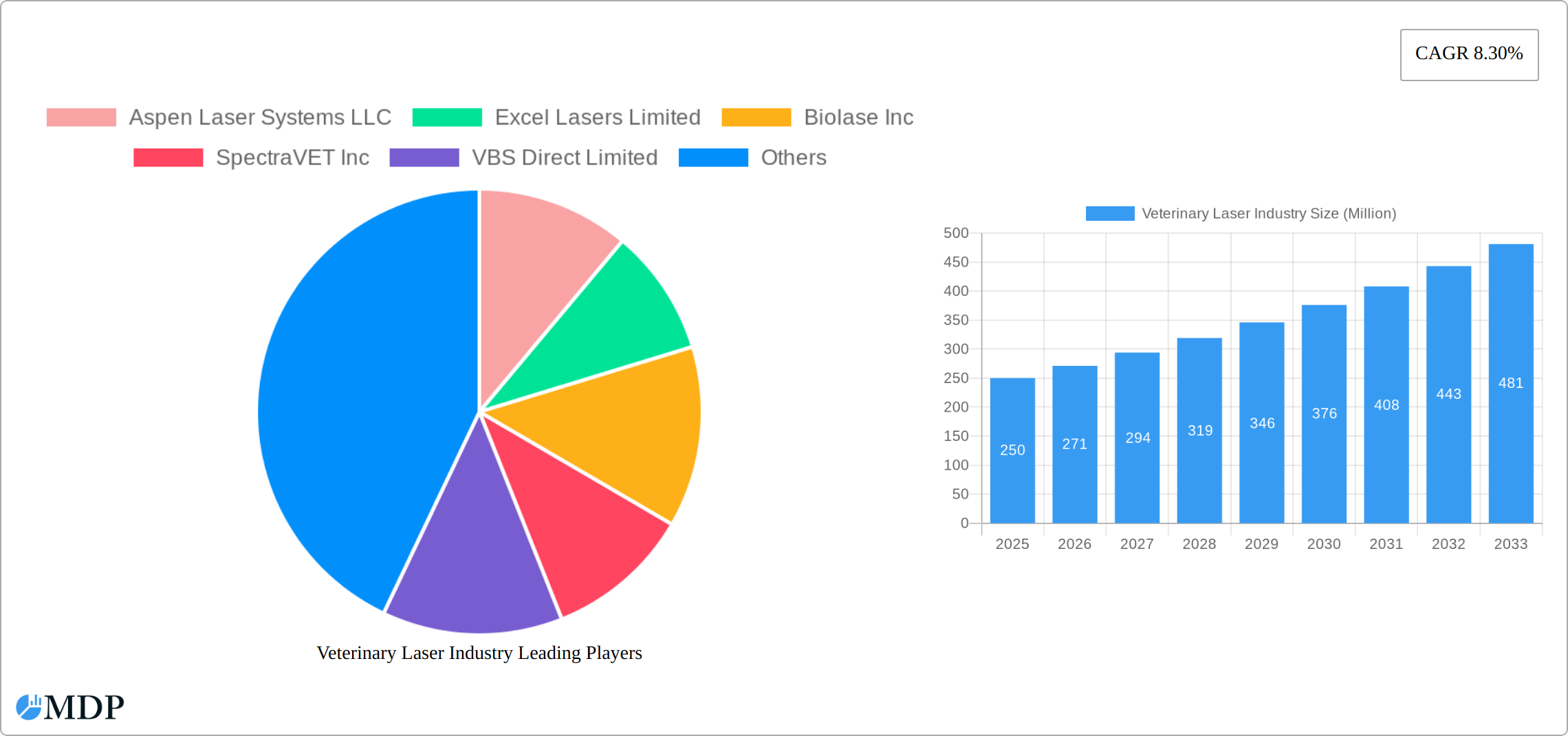

The veterinary laser therapy market is experiencing robust growth, driven by increasing pet ownership, rising veterinary healthcare expenditure, and a growing awareness among veterinarians of the benefits of laser therapy. The market's compound annual growth rate (CAGR) of 8.30% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by the minimally invasive nature of laser treatments, resulting in reduced pain, faster healing times, and improved patient outcomes for various conditions such as pain management, wound healing, and tissue regeneration in animals. Therapeutic lasers currently dominate the product type segment, reflecting the widespread use of laser therapy for pain relief and inflammation reduction in dogs and cats. The North American market, including the United States, Canada, and Mexico, is expected to hold a significant market share, driven by high veterinary spending and early adoption of advanced technologies. However, the Asia-Pacific region, particularly countries like China and India, exhibits promising growth potential due to increasing pet ownership and rising disposable incomes. While the initial investment in laser equipment can be a barrier for some veterinary practices, the long-term cost-effectiveness and enhanced patient care provided by laser therapy are compelling factors driving market expansion.

The segmentation of the market further highlights its diverse applications. Class IV lasers, owing to their higher power output and versatility, are likely to command a larger market share compared to lower-class lasers. The application segment is predominantly led by pain and inflammation management, highlighting the therapeutic benefits of lasers in addressing common canine and feline ailments. The increasing demand for minimally invasive procedures is also fueling the adoption of laser surgery in veterinary practices, particularly for soft tissue surgeries. Though data on the precise market size is unavailable, considering the CAGR and the identified drivers, it's reasonable to project a market value exceeding several hundred million dollars by 2033. This projection considers the ongoing expansion into emerging markets and continuous technological advancements within the veterinary laser industry. Competitive players in the market are continuously investing in research and development to improve the efficacy and range of applications for laser therapies in veterinary care, further fueling market growth.

Veterinary Laser Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Veterinary Laser Industry, projecting a market valued at $XX Million by 2033. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. High-growth segments and key players are thoroughly examined, providing a crucial competitive landscape overview. Download now to gain a strategic advantage!

Veterinary Laser Industry Market Dynamics & Concentration

The veterinary laser market, valued at $XX Million in 2024, exhibits a moderately concentrated landscape with several key players actively shaping its trajectory. Innovation in laser technology, driven by significant advancements in therapeutic applications and the pursuit of unparalleled surgical precision, stands as a primary growth catalyst. Stringent regulatory frameworks, particularly concerning device safety and efficacy, play a crucial role in influencing market dynamics and ensuring responsible innovation. While product substitutes, such as traditional surgical methods, continue to present competitive pressures, the increasing demand for advanced and less invasive treatments is reshaping the competitive landscape. End-user trends, notably the robust growth in pet ownership globally and a discernible surge in demand for minimally invasive veterinary procedures, are profoundly impacting market expansion. The historical period (2019-2024) was characterized by a moderate level of Mergers & Acquisitions (M&A) activity, with approximately xx deals recorded. This trend, reflecting a steady consolidation within the industry, is anticipated to persist, particularly as smaller entities seek to leverage the specialized expertise and broader resources of larger, established players.

- Market Share: Leading market participants collectively command approximately xx% of the overall market share, indicating a notable degree of concentration.

- M&A Activity (2019-2024): A total of approximately xx M&A deals were recorded during this period, underscoring a moderate but consistent trend towards industry consolidation.

- Key Innovation Drivers: The primary drivers of innovation include the development of technologies enabling less invasive surgical procedures, enhanced treatment efficacy for a wider range of conditions, and the integration of superior safety features for both practitioners and animal patients.

- Regulatory Landscape: A comprehensive and stringent regulatory approval process is mandated for all new veterinary laser devices, ensuring adherence to established safety and efficacy standards.

Veterinary Laser Industry Industry Trends & Analysis

The veterinary laser industry is currently experiencing a period of robust and sustained growth. Projections indicate a significant Compound Annual Growth Rate (CAGR) of xx% is expected during the forecast period spanning from 2025 to 2033. This impressive expansion is underpinned by a confluence of powerful growth factors. The ever-increasing global pet ownership, coupled with rising disposable incomes in numerous key economic regions, is directly translating into a heightened demand for sophisticated and advanced veterinary care options. Technological advancements are a cornerstone of this growth, with the development of more compact and portable laser systems, as well as devices boasting enhanced precision and expanded therapeutic capabilities, significantly improving both accessibility and treatment effectiveness. A pronounced shift towards minimally invasive surgical and therapeutic procedures is further propelling market penetration, offering tangible benefits such as reduced recovery times and accelerated healing processes for animal patients. The competitive arena is consequently intensifying, prompting companies to prioritize continuous innovation, forge strategic partnerships, and aggressively pursue market expansion to secure and enhance their competitive standing.

- CAGR (2025-2033): The veterinary laser industry is projected to grow at a healthy CAGR of xx% over the next decade.

- Market Penetration: There is a discernible and increasing adoption of laser therapy across a diverse array of veterinary applications, indicating broader acceptance and integration into standard practice.

- Key Growth Drivers: The primary engines driving market growth are the sustained rise in pet ownership, continuous technological innovation, and a strong and growing preference among veterinarians and pet owners for minimally invasive treatment modalities.

Leading Markets & Segments in Veterinary Laser Industry

The North American region currently dominates the veterinary laser market, driven by factors such as high pet ownership rates, advanced veterinary infrastructure, and increased awareness regarding the benefits of laser therapy. Within the product types, therapeutic lasers represent the larger segment due to their broader applicability in various veterinary procedures. The dog segment holds a larger market share within animal type due to higher pet ownership and frequent treatment of musculoskeletal disorders. Pain and inflammation management remains the dominant application segment, reflecting its immediate clinical benefit.

- Dominant Region: North America

- Dominant Product Type: Therapeutic Lasers

- Dominant Animal Type: Dogs

- Dominant Application: Pain and Inflammation Management

- Key Drivers (North America): High pet ownership, advanced veterinary infrastructure, increased awareness of laser therapy benefits.

Veterinary Laser Industry Product Developments

Recent years have witnessed a dynamic period of significant advancements in veterinary laser technology. The primary focus of these developments has been on refining and enhancing device precision, improving portability for greater accessibility, and increasing overall versatility to cater to a wider range of clinical needs. The introduction of new laser devices is directly contributing to improved therapeutic efficacy, notably shorter treatment durations, and the integration of enhanced safety features for both practitioners and their animal patients. A pronounced trend is the development of multi-functional laser systems designed to address multiple veterinary applications efficiently, thereby offering cost-effectiveness and improved operational efficiency for veterinary practices. These progressive product developments are instrumental in expanding the market's reach and serving as a potent catalyst for sustained growth.

Key Drivers of Veterinary Laser Industry Growth

The expansion of the veterinary laser market is propelled by a synergistic interplay of several critical factors. Foremost among these are continuous technological advancements, which have led to demonstrably improved device efficacy and user-friendliness, making laser therapies more accessible and practical for veterinary professionals. The upward trend in disposable income across many global regions is enhancing the affordability of advanced veterinary care, including sophisticated laser treatments. Furthermore, supportive regulatory frameworks that judiciously balance the encouragement of innovation with the imperative of maintaining stringent safety standards are fostering a conducive environment for market growth. The increasing awareness and understanding of the distinct benefits offered by laser therapy, both among veterinarians and pet owners, are also significantly accelerating market expansion and driving adoption.

Challenges in the Veterinary Laser Industry Market

The veterinary laser industry faces challenges, including high initial investment costs for veterinary practices, which can be a barrier to entry for some clinics. Supply chain disruptions can affect the availability of components and finished devices, limiting market growth. Intense competition among established players and new entrants creates pressure on pricing and profit margins. Regulatory approvals and compliance costs for new devices can present hurdles to market entry.

Emerging Opportunities in Veterinary Laser Industry

The veterinary laser industry presents a landscape ripe with significant long-term growth potential. Ongoing technological advancements, including the pioneering development of novel laser systems and sophisticated software integration, are anticipated to unlock a broad spectrum of new and expanded clinical applications. The establishment of strategic partnerships between innovative laser manufacturers and established veterinary clinics is proving to be a highly effective strategy for expanding market access and reach. Moreover, a concerted effort to expand into emerging markets, characterized by burgeoning pet ownership and a significant unmet demand for advanced veterinary care, holds the key to unlocking substantial and sustained growth opportunities for the industry.

Leading Players in the Veterinary Laser Industry Sector

- Aspen Laser Systems LLC

- Excel Lasers Limited

- Biolase Inc

- SpectraVET Inc

- VBS Direct Limited

- Respond Systems

- K-Laser LLC

- Cutting Edge Laser Technologies

- Aesculight

- Erchonia Corporation

Key Milestones in Veterinary Laser Industry Industry

- June 2022: Cynosure launched the Picosure Pro device, expanding the applicability of laser technology into aesthetic veterinary applications, potentially opening a new market segment.

- February 2021: Medical Plus launched M-VET, broadening treatment options for inflammatory conditions in animals.

Strategic Outlook for Veterinary Laser Industry Market

The veterinary laser market presents significant growth potential over the next decade, driven by ongoing technological innovation, increasing adoption by veterinary practices, and expansion into new geographic markets. Companies focusing on product differentiation, strategic partnerships, and a strong emphasis on customer service will be best positioned to capitalize on this expanding market opportunity.

Veterinary Laser Industry Segmentation

-

1. Product Type

- 1.1. Therapeutic Lasers

- 1.2. Surgery Lasers

-

2. Animal Type

- 2.1. Dogs

- 2.2. Cats

- 2.3. Others

-

3. Application

- 3.1. Pain and Inflammation Management

- 3.2. Regeneration or Tissue Repair

- 3.3. Other Applications

-

4. Class

- 4.1. Class 2

- 4.2. Class 3

- 4.3. Class 4

Veterinary Laser Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary Laser Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Therapeutic Lasers with Improvements in Laser Technology; Reduction of the Recovery Time and Risks Associated with Surgery; Growing Number of Severe Chronic Diseases in Animals

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Surgery and Lasers

- 3.4. Market Trends

- 3.4.1. The Therapeutic Lasers Segment Witnessed Dominant Segment Over the Forecast Period in the Veterinary Laser Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Therapeutic Lasers

- 5.1.2. Surgery Lasers

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs

- 5.2.2. Cats

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Pain and Inflammation Management

- 5.3.2. Regeneration or Tissue Repair

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Class

- 5.4.1. Class 2

- 5.4.2. Class 3

- 5.4.3. Class 4

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Therapeutic Lasers

- 6.1.2. Surgery Lasers

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs

- 6.2.2. Cats

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Pain and Inflammation Management

- 6.3.2. Regeneration or Tissue Repair

- 6.3.3. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Class

- 6.4.1. Class 2

- 6.4.2. Class 3

- 6.4.3. Class 4

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Therapeutic Lasers

- 7.1.2. Surgery Lasers

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs

- 7.2.2. Cats

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Pain and Inflammation Management

- 7.3.2. Regeneration or Tissue Repair

- 7.3.3. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Class

- 7.4.1. Class 2

- 7.4.2. Class 3

- 7.4.3. Class 4

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Therapeutic Lasers

- 8.1.2. Surgery Lasers

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs

- 8.2.2. Cats

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Pain and Inflammation Management

- 8.3.2. Regeneration or Tissue Repair

- 8.3.3. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Class

- 8.4.1. Class 2

- 8.4.2. Class 3

- 8.4.3. Class 4

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Therapeutic Lasers

- 9.1.2. Surgery Lasers

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs

- 9.2.2. Cats

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Pain and Inflammation Management

- 9.3.2. Regeneration or Tissue Repair

- 9.3.3. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Class

- 9.4.1. Class 2

- 9.4.2. Class 3

- 9.4.3. Class 4

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Therapeutic Lasers

- 10.1.2. Surgery Lasers

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs

- 10.2.2. Cats

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Pain and Inflammation Management

- 10.3.2. Regeneration or Tissue Repair

- 10.3.3. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Class

- 10.4.1. Class 2

- 10.4.2. Class 3

- 10.4.3. Class 4

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Veterinary Laser Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Aspen Laser Systems LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Excel Lasers Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Biolase Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SpectraVET Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 VBS Direct Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Respond Systems

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 K-Laser LLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Cutting Edge Laser Technologies

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Aesculight

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Erchonia Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Aspen Laser Systems LLC

List of Figures

- Figure 1: Global Veterinary Laser Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Veterinary Laser Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Veterinary Laser Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Veterinary Laser Industry Revenue (Million), by Animal Type 2024 & 2032

- Figure 15: North America Veterinary Laser Industry Revenue Share (%), by Animal Type 2024 & 2032

- Figure 16: North America Veterinary Laser Industry Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Veterinary Laser Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Veterinary Laser Industry Revenue (Million), by Class 2024 & 2032

- Figure 19: North America Veterinary Laser Industry Revenue Share (%), by Class 2024 & 2032

- Figure 20: North America Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Veterinary Laser Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Europe Veterinary Laser Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Europe Veterinary Laser Industry Revenue (Million), by Animal Type 2024 & 2032

- Figure 25: Europe Veterinary Laser Industry Revenue Share (%), by Animal Type 2024 & 2032

- Figure 26: Europe Veterinary Laser Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Veterinary Laser Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Veterinary Laser Industry Revenue (Million), by Class 2024 & 2032

- Figure 29: Europe Veterinary Laser Industry Revenue Share (%), by Class 2024 & 2032

- Figure 30: Europe Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Veterinary Laser Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 33: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 34: Asia Pacific Veterinary Laser Industry Revenue (Million), by Animal Type 2024 & 2032

- Figure 35: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Animal Type 2024 & 2032

- Figure 36: Asia Pacific Veterinary Laser Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific Veterinary Laser Industry Revenue (Million), by Class 2024 & 2032

- Figure 39: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Class 2024 & 2032

- Figure 40: Asia Pacific Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 43: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 44: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Animal Type 2024 & 2032

- Figure 45: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Animal Type 2024 & 2032

- Figure 46: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Class 2024 & 2032

- Figure 49: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Class 2024 & 2032

- Figure 50: Middle East and Africa Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: South America Veterinary Laser Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 53: South America Veterinary Laser Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 54: South America Veterinary Laser Industry Revenue (Million), by Animal Type 2024 & 2032

- Figure 55: South America Veterinary Laser Industry Revenue Share (%), by Animal Type 2024 & 2032

- Figure 56: South America Veterinary Laser Industry Revenue (Million), by Application 2024 & 2032

- Figure 57: South America Veterinary Laser Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: South America Veterinary Laser Industry Revenue (Million), by Class 2024 & 2032

- Figure 59: South America Veterinary Laser Industry Revenue Share (%), by Class 2024 & 2032

- Figure 60: South America Veterinary Laser Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: South America Veterinary Laser Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Veterinary Laser Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 4: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 6: Global Veterinary Laser Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: GCC Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 35: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 37: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Mexico Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 43: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 45: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Italy Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 53: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 54: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 55: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 56: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 57: China Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: India Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Australia Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Korea Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 64: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 65: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 67: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 68: GCC Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Africa Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Rest of Middle East and Africa Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Global Veterinary Laser Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 72: Global Veterinary Laser Industry Revenue Million Forecast, by Animal Type 2019 & 2032

- Table 73: Global Veterinary Laser Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 74: Global Veterinary Laser Industry Revenue Million Forecast, by Class 2019 & 2032

- Table 75: Global Veterinary Laser Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 76: Brazil Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Argentina Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Rest of South America Veterinary Laser Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Laser Industry?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Veterinary Laser Industry?

Key companies in the market include Aspen Laser Systems LLC, Excel Lasers Limited, Biolase Inc, SpectraVET Inc, VBS Direct Limited, Respond Systems, K-Laser LLC, Cutting Edge Laser Technologies, Aesculight, Erchonia Corporation.

3. What are the main segments of the Veterinary Laser Industry?

The market segments include Product Type, Animal Type, Application, Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Therapeutic Lasers with Improvements in Laser Technology; Reduction of the Recovery Time and Risks Associated with Surgery; Growing Number of Severe Chronic Diseases in Animals.

6. What are the notable trends driving market growth?

The Therapeutic Lasers Segment Witnessed Dominant Segment Over the Forecast Period in the Veterinary Laser Market..

7. Are there any restraints impacting market growth?

High Costs Associated with Surgery and Lasers.

8. Can you provide examples of recent developments in the market?

June 2022: Cynosure launched a next-generation aesthetic laser device (the Picosure Pro device) designed with an advanced platinum focus lens array to increase collagen and elastin to help combat wrinkles, acne scars, and pores. with the addition of a flat lens, as FDA cleared for treating pigment in melasma and other hyperpigmentation issues like the nevus of Tsa and Hori's nevus.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Laser Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Laser Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Laser Industry?

To stay informed about further developments, trends, and reports in the Veterinary Laser Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence