Key Insights

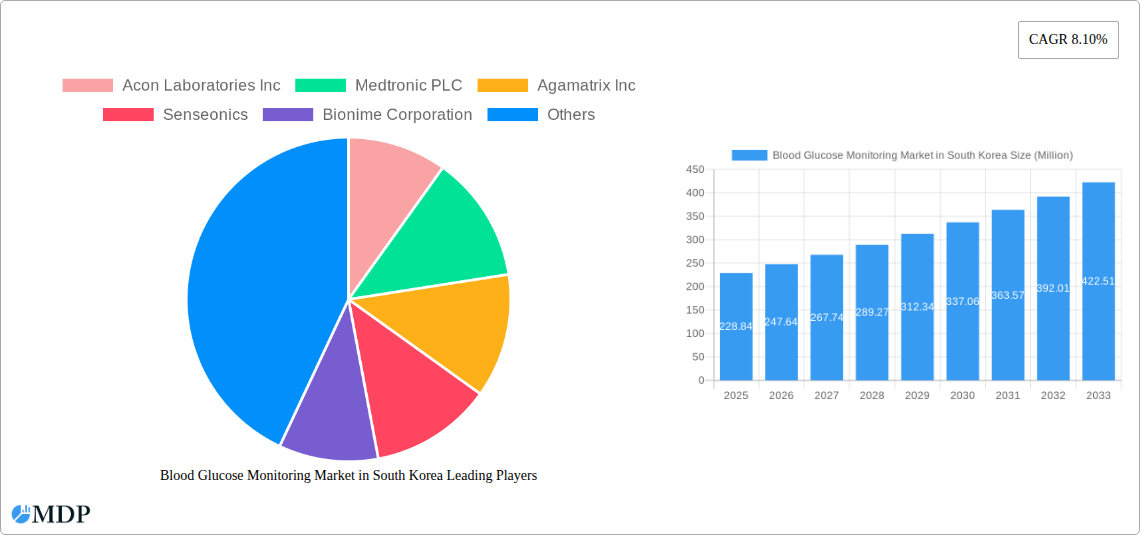

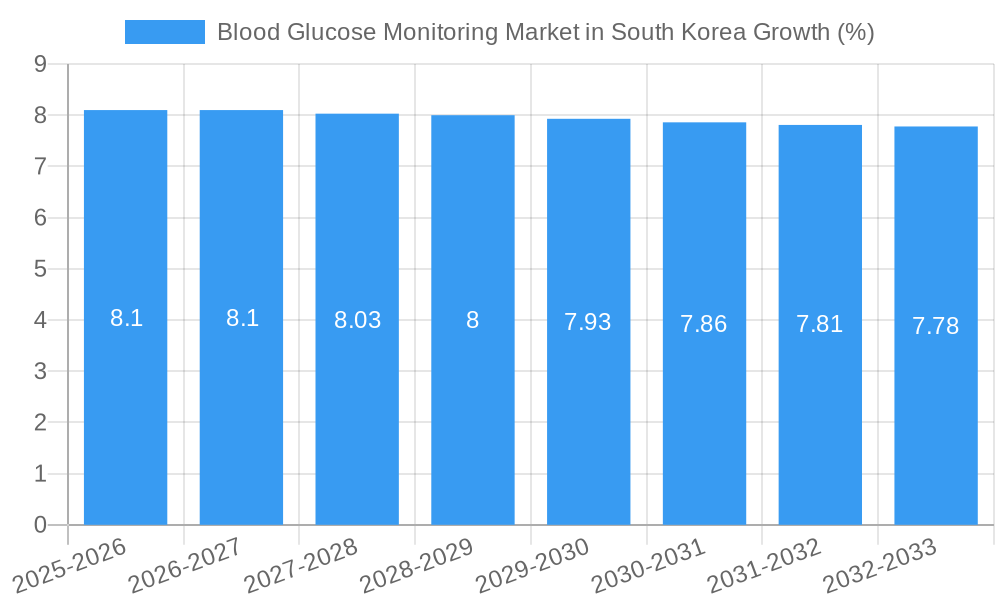

The South Korean Blood Glucose Monitoring (BGM) market is poised for significant expansion, driven by an aging population, rising prevalence of diabetes, and increasing adoption of advanced monitoring technologies. With a projected CAGR of 8.10% and a current market size estimated around USD 228.84 million in 2025, the demand for both self-monitoring blood glucose devices and continuous blood glucose monitoring (CGM) devices is expected to surge. Key growth drivers include government initiatives promoting diabetes awareness and management, a growing health-conscious populace, and the technological advancements in BGM devices, such as improved accuracy, user-friendliness, and data connectivity. The shift towards personalized healthcare and remote patient monitoring further fuels this growth, as individuals increasingly seek convenient and effective ways to manage their diabetes.

The market in South Korea is characterized by a dynamic interplay of established players and emerging innovators, all vying for market share through product diversification and strategic partnerships. The segment of Continuous Blood Glucose Monitoring devices, encompassing sensors, receivers, and transmitters, is anticipated to witness particularly robust growth, owing to the increasing preference for real-time data and proactive diabetes management. While the market benefits from a supportive regulatory environment and a high level of technological adoption, potential restraints might include the initial cost of advanced CGM devices for some segments of the population and the need for continuous patient and healthcare provider education to ensure optimal utilization of these technologies. Nevertheless, the overall outlook for the South Korean BGM market remains exceptionally positive, indicating substantial opportunities for stakeholders.

South Korea Blood Glucose Monitoring Market: Growth, Trends, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the South Korea blood glucose monitoring market, projecting a robust growth trajectory from 2025 to 2033. Covering the historical period of 2019–2024 and focusing on the base year 2025 and estimated year 2025, this research delves into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, and emerging opportunities. With a meticulous examination of industry developments and a spotlight on leading players, this report provides invaluable insights for stakeholders seeking to navigate and capitalize on the expanding diabetes care market in South Korea. High-traffic keywords such as blood glucose meter South Korea, CGM South Korea, diabetes management South Korea, and medical devices South Korea are seamlessly integrated to maximize search visibility.

Blood Glucose Monitoring Market in South Korea Market Dynamics & Concentration

The blood glucose monitoring market in South Korea exhibits a moderately concentrated landscape, characterized by the presence of both established global players and burgeoning domestic innovators. Key innovation drivers include the increasing prevalence of diabetes, a growing emphasis on proactive health management, and advancements in digital health technologies that enhance patient engagement and data accessibility. The regulatory framework, overseen by the Ministry of Food and Drug Safety (MFDS), plays a crucial role in shaping market entry and product approval processes, ensuring patient safety and efficacy. Product substitutes, while present in simpler monitoring tools, are increasingly being surpassed by the technological sophistication and data-driven insights offered by advanced glucose monitoring systems. End-user trends are shifting towards convenience, accuracy, and minimal invasiveness, with a strong preference for continuous glucose monitoring (CGM) devices. Mergers and acquisitions (M&A) activities, while not extensive, are observed as larger entities seek to acquire innovative technologies and expand their market reach. For instance, strategic partnerships aimed at improving access to affordable testing solutions indicate a dynamic market. The market share distribution, while not precisely detailed, suggests a competitive environment where technological innovation and strategic distribution networks are paramount for sustained growth.

Blood Glucose Monitoring Market in South Korea Industry Trends & Analysis

The South Korea blood glucose monitoring market is poised for significant expansion driven by a confluence of factors. A primary growth driver is the rising incidence of diabetes and pre-diabetes within the South Korean population, necessitating more effective and accessible monitoring solutions. Technological disruptions, particularly the rapid evolution of Continuous Glucose Monitoring (CGM) technology, are fundamentally reshaping patient care. CGM devices offer real-time glucose data, trend analysis, and alerts, empowering individuals to make informed lifestyle and treatment decisions. This technological advancement is fostering a shift away from traditional self-monitoring blood glucose devices. Consumer preferences are increasingly leaning towards user-friendly, less invasive, and data-rich monitoring systems that integrate seamlessly with smartphones and digital health platforms. The competitive dynamics are characterized by intense innovation, with companies vying to offer superior accuracy, longer sensor wear times, and enhanced connectivity features. Market penetration of advanced monitoring technologies is steadily increasing as awareness grows and reimbursement policies evolve. The projected Compound Annual Growth Rate (CAGR) for the South Korea blood glucose monitoring market is estimated to be substantial, fueled by the adoption of these next-generation devices. The growing elderly population, coupled with an increasing awareness of diabetes complications, further bolsters demand for reliable and sophisticated blood glucose monitoring solutions.

Leading Markets & Segments in Blood Glucose Monitoring Market in South Korea

Within the South Korea blood glucose monitoring market, both self-monitoring blood glucose devices and continuous blood glucose monitoring devices are experiencing significant demand. However, the continuous blood glucose monitoring devices segment is exhibiting a more accelerated growth trajectory due to its advanced capabilities and increasing adoption by both patients and healthcare professionals.

Continuous Blood Glucose Monitoring Devices: This segment is rapidly emerging as the dominant force.

- Sensors: The innovation and miniaturization of CGM sensors, offering longer wear times and improved accuracy, are key drivers. Developments in sensor technology aim to reduce discomfort and provide more reliable glucose readings, driving higher market penetration.

- Durables (Receivers and Transmitters): The increasing integration of smart features in receivers and transmitters, such as seamless data synchronization with mobile apps and cloud platforms, enhances user experience and data management. The development of rechargeable and more discreet durables is also a significant trend.

Self-Monitoring Blood Glucose Devices: While established, this segment's growth is more moderate, with continued demand for:

- Glucometer Devices: User-friendly, portable, and affordable glucometers remain essential for a large segment of the population. However, the competitive landscape is pushing manufacturers to incorporate advanced features like memory storage and connectivity.

- Test Strips: The consistent need for test strips underpins this sub-segment. Affordability and accessibility are crucial, especially in light of initiatives aimed at improving access for low- and middle-income populations.

- Lancets: As a consumable essential for traditional glucose monitoring, lancets maintain a steady demand. Innovations focus on minimizing pain and improving safety.

The dominance of CGM is underpinned by several factors, including enhanced patient outcomes through better glycemic control, a growing preference for proactive disease management, and supportive government initiatives focused on digital healthcare adoption. Economic policies encouraging the adoption of advanced medical technologies and the robust healthcare infrastructure in South Korea further facilitate the growth of the CGM segment.

Blood Glucose Monitoring Market in South Korea Product Developments

Product development in the South Korea blood glucose monitoring market is intensely focused on enhancing accuracy, usability, and connectivity. Innovations in CGM sensors are leading to longer wear times and reduced invasiveness, providing a more seamless patient experience. The development of smart glucometers with integrated Bluetooth connectivity for effortless data transfer to mobile applications is also a significant trend. These advancements aim to empower individuals with real-time insights and facilitate better communication with healthcare providers, thereby improving overall diabetes management. The competitive advantage lies in offering devices that provide precise readings, long-term trend analysis, and intuitive data interpretation, ultimately leading to improved patient outcomes and a greater market fit.

Key Drivers of Blood Glucose Monitoring Market in South Korea Growth

Several key factors are propelling the growth of the South Korea blood glucose monitoring market.

- Rising Diabetes Prevalence: An increasing number of individuals diagnosed with diabetes and pre-diabetes necessitates continuous and effective blood glucose management.

- Technological Advancements: The rapid evolution of Continuous Glucose Monitoring (CGM) technology, offering real-time data and trend analysis, is a significant catalyst.

- Growing Health Awareness: A heightened awareness among the population regarding diabetes complications and the importance of proactive health management is driving demand for sophisticated monitoring tools.

- Government Support for Digital Healthcare: Initiatives promoting the integration of digital health solutions and telemedicine in patient care are fostering the adoption of connected glucose monitoring devices.

Challenges in the Blood Glucose Monitoring Market in South Korea Market

Despite its growth potential, the South Korea blood glucose monitoring market faces several challenges.

- High Cost of Advanced Devices: The initial investment in advanced CGM systems can be a barrier for some consumers, impacting market penetration.

- Reimbursement Policies: Evolving and sometimes inconsistent reimbursement policies for newer technologies can slow down adoption rates.

- Regulatory Hurdles: While essential for safety, the rigorous approval processes for new medical devices can lead to longer market entry timelines.

- Data Security and Privacy Concerns: As devices become more connected, ensuring the robust security and privacy of sensitive patient data is paramount and requires ongoing attention.

Emerging Opportunities in Blood Glucose Monitoring Market in South Korea

Catalysts driving long-term growth in the South Korea blood glucose monitoring market are abundant. The continued innovation in sensor technology, aiming for greater accuracy, reduced invasiveness, and longer wear times, presents significant opportunities. Strategic partnerships between technology companies and healthcare providers can enhance the integration of glucose monitoring data into comprehensive digital health ecosystems. Furthermore, the increasing focus on personalized medicine and preventative healthcare strategies creates a fertile ground for advanced monitoring solutions that provide actionable insights. Expansion into remote patient monitoring programs and the development of AI-driven predictive analytics for diabetes management represent substantial future growth avenues.

Leading Players in the Blood Glucose Monitoring Market in South Korea Sector

- Acon Laboratories Inc

- Medtronic PLC

- Agamatrix Inc

- Senseonics

- Bionime Corporation

- Trivida Functional Medicine

- Abbott Diabetes Care

- Dexcom Inc

- Roche Holding AG

- Arkray Inc

- Ascensia Diabetes Care

Key Milestones in Blood Glucose Monitoring Market in South Korea Industry

- July 2023: i-SENS, a CGM manufacturer based in South Korea, announced that it has obtained regulatory clearance for CareSens Air, the initial CGM device developed domestically. In March, i-SENS submitted the required documentation to the government for approval. The Ministry of Food and Drug Safety did not require additional supporting paperwork, resulting in an earlier approval than expected.

- August 2021: FIND announced that agreements had been signed with i-SENS, Inc. (Seoul, South Korea) and SD BIOSENSOR, Inc. (Suwon-si, South Korea) to increase low- and middle-income countries (LMIC) access to blood glucose test strips by improving affordability.

Strategic Outlook for Blood Glucose Monitoring Market in South Korea Market

The strategic outlook for the South Korea blood glucose monitoring market is highly optimistic, driven by ongoing technological advancements and a growing demand for integrated diabetes management solutions. The continued development of next-generation CGM systems, focusing on enhanced accuracy, patient comfort, and seamless data integration with digital health platforms, will be critical for capturing market share. Strategic collaborations between device manufacturers, healthcare providers, and technology firms will accelerate the adoption of these advanced solutions and foster the development of comprehensive diabetes care ecosystems. Furthermore, the increasing emphasis on preventative healthcare and personalized medicine presents a significant opportunity for market players to offer data-driven insights that empower individuals to better manage their health and reduce the long-term burden of diabetes.

Blood Glucose Monitoring Market in South Korea Segmentation

-

1. Self-monitoring blood glucose devices

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

-

2. Continuous blood glucose monitoring devices

- 2.1. Sensors

- 2.2. Durables (Receivers and Transmitters)

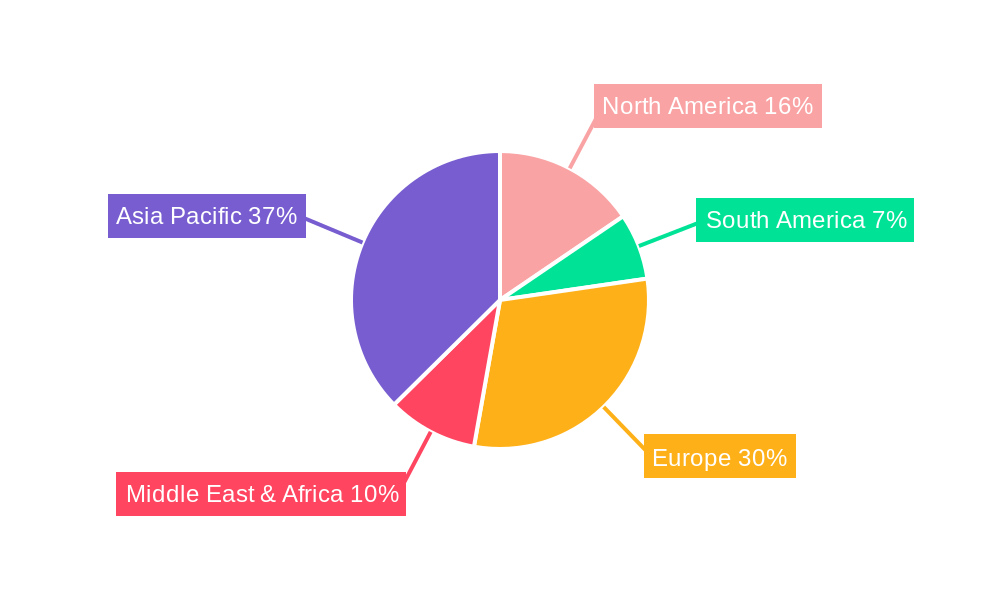

Blood Glucose Monitoring Market in South Korea Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Blood Glucose Monitoring Market in South Korea REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Increasing Type-1 diabetes population across South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 5.2.1. Sensors

- 5.2.2. Durables (Receivers and Transmitters)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 6. North America Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 6.1.1. Glucometer Devices

- 6.1.2. Test Strips

- 6.1.3. Lancets

- 6.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 6.2.1. Sensors

- 6.2.2. Durables (Receivers and Transmitters)

- 6.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 7. South America Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 7.1.1. Glucometer Devices

- 7.1.2. Test Strips

- 7.1.3. Lancets

- 7.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 7.2.1. Sensors

- 7.2.2. Durables (Receivers and Transmitters)

- 7.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 8. Europe Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 8.1.1. Glucometer Devices

- 8.1.2. Test Strips

- 8.1.3. Lancets

- 8.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 8.2.1. Sensors

- 8.2.2. Durables (Receivers and Transmitters)

- 8.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 9. Middle East & Africa Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 9.1.1. Glucometer Devices

- 9.1.2. Test Strips

- 9.1.3. Lancets

- 9.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 9.2.1. Sensors

- 9.2.2. Durables (Receivers and Transmitters)

- 9.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 10. Asia Pacific Blood Glucose Monitoring Market in South Korea Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 10.1.1. Glucometer Devices

- 10.1.2. Test Strips

- 10.1.3. Lancets

- 10.2. Market Analysis, Insights and Forecast - by Continuous blood glucose monitoring devices

- 10.2.1. Sensors

- 10.2.2. Durables (Receivers and Transmitters)

- 10.1. Market Analysis, Insights and Forecast - by Self-monitoring blood glucose devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Acon Laboratories Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medtronic PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Agamatrix Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Senseonics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bionime Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Trivida Functional Medicine

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbott Diabetes Care

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dexcom Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Roche Holding AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arkray Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ascensia Diabetes Care

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Acon Laboratories Inc

List of Figures

- Figure 1: Global Blood Glucose Monitoring Market in South Korea Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Blood Glucose Monitoring Market in South Korea Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: South Korea Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 4: South Korea Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 5: South Korea Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 6: South Korea Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

- Figure 7: North America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 8: North America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 9: North America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 10: North America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 11: North America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 12: North America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 13: North America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 14: North America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 15: North America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 17: North America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 20: South America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 21: South America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 22: South America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 23: South America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 24: South America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 25: South America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 26: South America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 27: South America Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 28: South America Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 29: South America Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

- Figure 31: Europe Blood Glucose Monitoring Market in South Korea Revenue (Million), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 32: Europe Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 33: Europe Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 34: Europe Blood Glucose Monitoring Market in South Korea Volume Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 35: Europe Blood Glucose Monitoring Market in South Korea Revenue (Million), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 36: Europe Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 37: Europe Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 38: Europe Blood Glucose Monitoring Market in South Korea Volume Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 39: Europe Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 40: Europe Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 41: Europe Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 42: Europe Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

- Figure 43: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue (Million), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 44: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 45: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 46: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 47: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue (Million), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 48: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 49: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 50: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 51: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 52: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 53: Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue (Million), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 56: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 57: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 58: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume Share (%), by Self-monitoring blood glucose devices 2024 & 2032

- Figure 59: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue (Million), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 60: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 61: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 62: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume Share (%), by Continuous blood glucose monitoring devices 2024 & 2032

- Figure 63: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue (Million), by Country 2024 & 2032

- Figure 64: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume (K Unit), by Country 2024 & 2032

- Figure 65: Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue Share (%), by Country 2024 & 2032

- Figure 66: Asia Pacific Blood Glucose Monitoring Market in South Korea Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 4: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 5: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 6: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 7: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 12: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 13: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 14: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 15: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United States Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Canada Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Mexico Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Mexico Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 24: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 25: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 26: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 27: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Brazil Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Brazil Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Argentina Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Rest of South America Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 36: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 37: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 38: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 39: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: United Kingdom Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Kingdom Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Germany Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: France Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: France Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Italy Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Italy Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Spain Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Spain Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Russia Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Russia Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Benelux Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Benelux Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Nordics Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Nordics Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of Europe Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Europe Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 60: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 61: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 62: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 63: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 65: Turkey Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Turkey Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: Israel Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Israel Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: GCC Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: GCC Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: North Africa Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: North Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: South Africa Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Rest of Middle East & Africa Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East & Africa Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 78: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Self-monitoring blood glucose devices 2019 & 2032

- Table 79: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 80: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Continuous blood glucose monitoring devices 2019 & 2032

- Table 81: Global Blood Glucose Monitoring Market in South Korea Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Blood Glucose Monitoring Market in South Korea Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: China Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: China Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: India Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: India Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Japan Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Japan Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: South Korea Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: South Korea Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: ASEAN Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: ASEAN Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Oceania Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Oceania Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Rest of Asia Pacific Blood Glucose Monitoring Market in South Korea Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Rest of Asia Pacific Blood Glucose Monitoring Market in South Korea Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Blood Glucose Monitoring Market in South Korea?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Blood Glucose Monitoring Market in South Korea?

Key companies in the market include Acon Laboratories Inc, Medtronic PLC, Agamatrix Inc, Senseonics, Bionime Corporation, Trivida Functional Medicine, Abbott Diabetes Care, Dexcom Inc, Roche Holding AG, Arkray Inc, Ascensia Diabetes Care.

3. What are the main segments of the Blood Glucose Monitoring Market in South Korea?

The market segments include Self-monitoring blood glucose devices, Continuous blood glucose monitoring devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 228.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Increasing Type-1 diabetes population across South Korea.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

July 2023: i-SENS, a CGM manufacturer based in South Korea, announced that it has obtained regulatory clearance for CareSens Air, the initial CGM device developed domestically. In March, i-SENS submitted the required documentation to the government for approval. The Ministry of Food and Drug Safety did not require additional supporting paperwork, resulting in an earlier approval than expected.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Blood Glucose Monitoring Market in South Korea," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Blood Glucose Monitoring Market in South Korea report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Blood Glucose Monitoring Market in South Korea?

To stay informed about further developments, trends, and reports in the Blood Glucose Monitoring Market in South Korea, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence