Key Insights

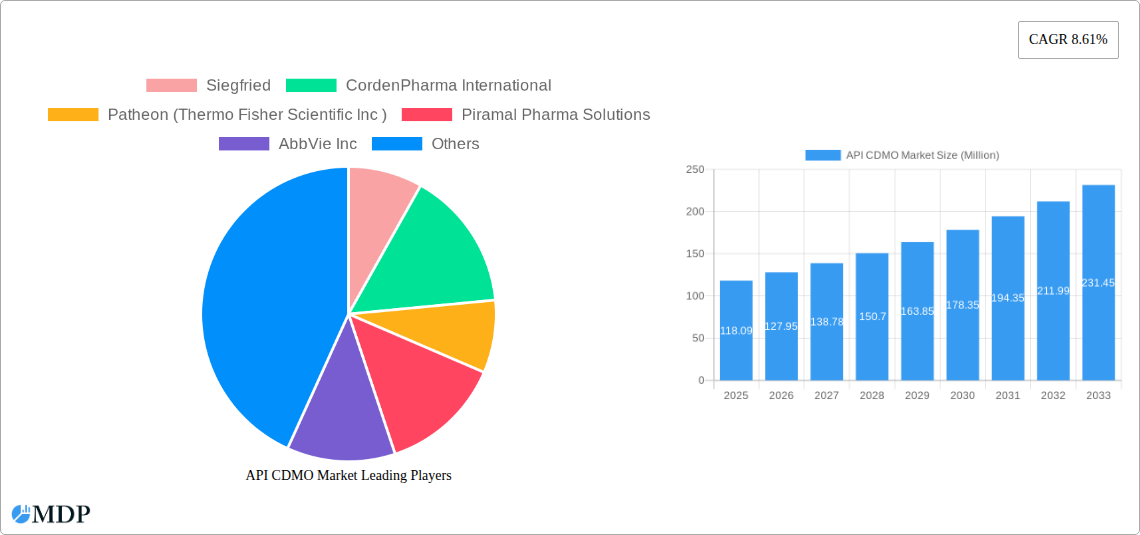

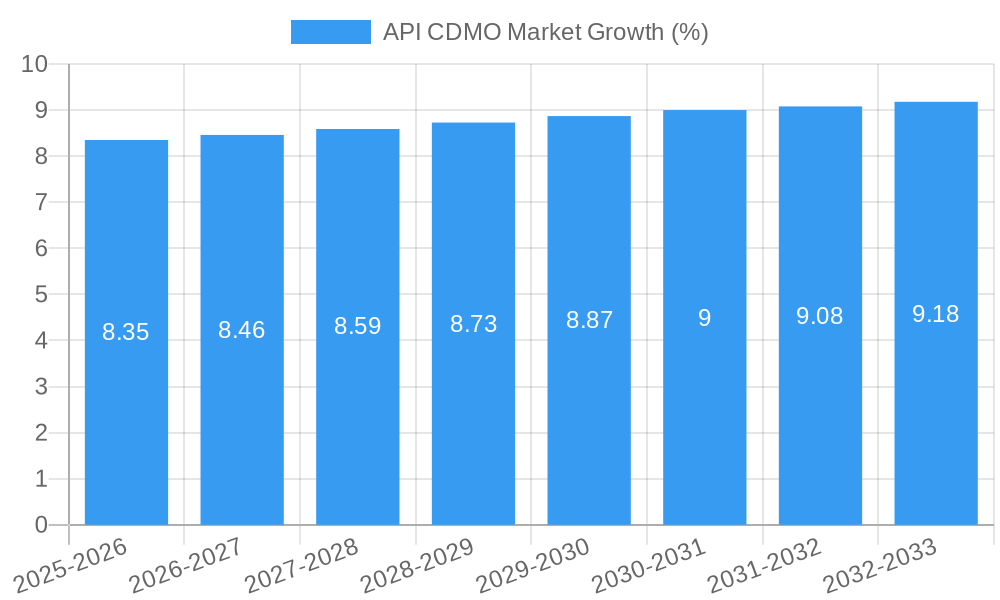

The global API Contract Development and Manufacturing Organization (CDMO) market is projected for substantial growth, reaching an estimated \$118.09 million in 2025. This upward trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.61% anticipated over the forecast period (2025-2033). This expansion signifies a burgeoning demand for specialized outsourcing services within the pharmaceutical industry, driven by several key factors. Pharmaceutical companies are increasingly leveraging CDMOs to accelerate drug development pipelines, manage complex manufacturing processes, and gain access to specialized expertise and advanced technologies. The trend towards outsourcing is particularly pronounced for innovative drug development, where the complexities and high costs associated with research and production necessitate collaboration with experienced partners. Furthermore, the growing prevalence of chronic diseases and the continuous pursuit of novel therapies across various therapeutic areas, including oncology, cardiology, and neurology, are fueling the demand for a diverse range of APIs. The market is witnessing a significant emphasis on both small and large molecules, with advancements in biotechnology playing a crucial role in the synthesis of complex biologics.

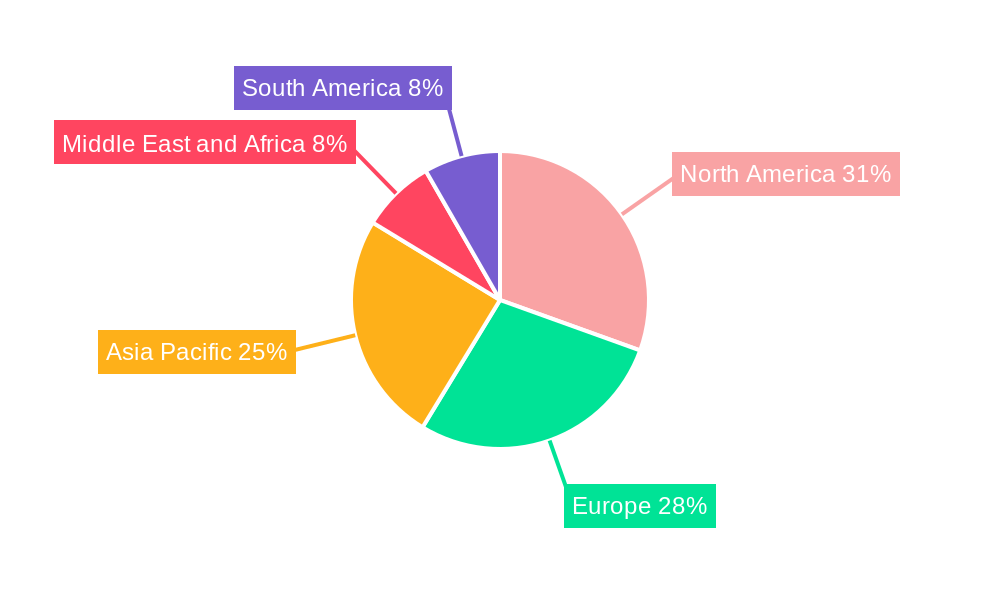

The market landscape is characterized by a dynamic interplay of drivers and restraints. Key drivers include the escalating R&D investments by pharmaceutical and biopharmaceutical companies, the growing pipeline of complex biologics and novel small molecules, and the increasing need for efficient and cost-effective manufacturing solutions. The pressure to bring new drugs to market faster, coupled with the inherent challenges in drug discovery and development, positions CDMOs as indispensable strategic partners. Moreover, stringent regulatory requirements and the need for specialized quality control in API manufacturing further bolster the demand for experienced CDMOs. However, challenges such as intense competition among CDMOs, potential intellectual property concerns, and the need for significant capital investment in advanced manufacturing capabilities present certain restraints. Despite these challenges, the market is expected to witness a surge in demand for both innovative and generic APIs, with the commercial workflow segment expected to dominate as more drugs move from clinical trials to market. The Asia Pacific region, with its rapidly expanding pharmaceutical manufacturing infrastructure and cost advantages, is anticipated to emerge as a significant growth hub.

Unlocking the Future of Pharmaceutical Outsourcing: API CDMO Market Insights (2019–2033)

Gain a competitive edge in the rapidly expanding API CDMO market with this comprehensive report. Delve into critical market dynamics, emerging trends, and leading player strategies from 2019 to 2033, with a core focus on the 2025 base and estimated year. This in-depth analysis is your essential guide to navigating the complexities of active pharmaceutical ingredient contract development and manufacturing, featuring high-traffic keywords like "API CDMO market," "pharmaceutical outsourcing," "drug development services," "small molecule API," "large molecule API," "biotech synthesis," and "generic API manufacturing."

This report is meticulously crafted for pharmaceutical companies, biotech innovators, investors, and regulatory bodies seeking to understand the intricate landscape of API CDMO services. With a historical period from 2019–2024 and a robust forecast period from 2025–2033, this analysis provides actionable intelligence to drive strategic decision-making.

API CDMO Market Market Dynamics & Concentration

The API CDMO market is characterized by a dynamic interplay of innovation, regulatory stringency, and evolving pharmaceutical development needs. Market concentration remains moderately fragmented, with a blend of large, established players and agile, specialized service providers. Key innovation drivers stem from the increasing complexity of drug molecules, the demand for personalized medicine, and advancements in manufacturing technologies such as continuous manufacturing and biocatalysis. Regulatory frameworks, particularly those set by the FDA and EMA, play a pivotal role, demanding high standards for quality, safety, and compliance, thereby influencing the strategic decisions and operational expenditures of CDMOs. Product substitutes are limited in core API manufacturing, but the rise of biosimil development and novel drug delivery systems indirectly impacts demand for specific API types. End-user trends reveal a growing reliance on CDMOs for both early-stage clinical supply and large-scale commercial manufacturing, driven by cost-efficiency and specialized expertise. Mergers and acquisitions (M&A) activity is a significant trend, with major players seeking to expand their service offerings, geographical reach, and technological capabilities. For instance, numerous M&A deals are projected to occur throughout the forecast period, driven by the desire for vertical integration and enhanced market penetration. M&A deal counts are expected to show a steady increase, reflecting the industry's consolidation phase.

API CDMO Market Industry Trends & Analysis

The API CDMO market is experiencing substantial growth, fueled by a confluence of factors that are reshaping the pharmaceutical outsourcing landscape. The increasing R&D investment by pharmaceutical and biotechnology companies, coupled with the growing complexity and novelty of drug candidates, has led to a pronounced demand for specialized API development and manufacturing expertise. This trend is further amplified by the rising prevalence of chronic diseases and the unmet medical needs across various therapeutic areas, necessitating accelerated drug development timelines and efficient production capabilities. The market penetration of advanced manufacturing technologies, such as continuous flow chemistry and single-use bioreactors, is a significant technological disruption, offering enhanced efficiency, scalability, and quality control. These innovations are not only streamlining production processes but also enabling the cost-effective manufacturing of intricate molecules. Consumer preferences are increasingly leaning towards personalized medicine and targeted therapies, which often involve complex small molecules and biologics, thereby driving demand for specialized CDMO services. The competitive dynamics within the API CDMO market are intensifying, with companies differentiating themselves through niche expertise, technological prowess, and a robust regulatory track record. The overall market is projected to exhibit a compelling Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033, reflecting robust market penetration driven by these overarching trends. This growth is underpinned by the increasing outsourcing of both early-stage research and late-stage commercial manufacturing activities by drug developers seeking to optimize their internal resources and leverage external specialized capabilities. The continuous pipeline of new drug approvals further bolsters the market’s expansion, as these new entities require reliable and scalable API manufacturing solutions.

Leading Markets & Segments in API CDMO Market

North America, led by the United States, currently holds the dominant position in the global API CDMO market. This dominance is attributed to a robust pharmaceutical R&D ecosystem, significant government funding for life sciences research, and a high concentration of leading pharmaceutical and biotechnology companies. Favorable economic policies, including tax incentives for research and development, further bolster this leadership.

Molecule Type:

- Small Molecule: This segment remains the largest and fastest-growing, driven by the continued development of novel small molecule drugs for a wide range of therapeutic applications. The increasing complexity of synthetic chemistry and the demand for highly potent APIs (HPAPIs) contribute significantly to this segment's growth.

- Large Molecule: While smaller in market share, the large molecule segment, encompassing biologics and peptides, is experiencing rapid expansion. Advancements in biotechnology and the growing pipeline of biopharmaceuticals, including monoclonal antibodies and recombinant proteins, are key drivers.

Synthesis:

- Synthetic: This remains the cornerstone of API manufacturing, covering a vast array of chemical synthesis processes for both small and large molecules.

- Biotech: The biotech synthesis segment is witnessing substantial growth, driven by the increasing demand for biologics, vaccines, and gene therapies.

Drug Type:

- Innovative: The demand for novel drug development services is a primary growth engine, as pharmaceutical companies increasingly outsource the complex manufacturing of their proprietary molecules.

- Generics: The mature generics market continues to be a significant contributor, with CDMOs providing cost-effective manufacturing solutions for established drug products.

Workflow:

- Clinical: This segment is experiencing robust growth as more drug candidates progress through clinical trials, requiring specialized and scalable API production for various phases.

- Commercial: The commercial workflow segment represents the largest share, driven by the need for large-scale, consistent, and high-quality API supply for approved drug products.

Application:

- Oncology: This therapeutic area consistently leads in demand for API CDMO services due to the high R&D investment and the development of numerous novel cancer therapies.

- Cardiology: Significant ongoing research and a large patient population ensure sustained demand for API manufacturing in cardiology.

- Neurology: The increasing understanding of neurological disorders and the development of targeted therapies are driving growth in this application segment.

- Ophthalmology & Orthopedic: While smaller, these segments exhibit steady growth driven by advancements in treatment modalities and an aging global population.

API CDMO Market Product Developments

Product developments in the API CDMO market are primarily focused on enhancing manufacturing efficiency, improving product quality, and enabling the production of increasingly complex molecules. Innovations in synthetic chemistry, such as the adoption of continuous manufacturing techniques and advanced crystallization methods, are leading to higher yields, reduced waste, and improved purity profiles for both small and large molecules. Furthermore, CDMOs are investing in specialized capabilities for highly potent active pharmaceutical ingredients (HPAPIs) and antibody-drug conjugates (ADCs), catering to the growing demand for targeted therapies, particularly in oncology. Technological advancements in biotechnology are also driving the development of novel platforms for the production of biologics, including cell and gene therapies, requiring specialized expertise and infrastructure. These developments provide competitive advantages by allowing CDMOs to offer end-to-end solutions and cater to the evolving needs of pharmaceutical innovators.

Key Drivers of API CDMO Market Growth

The API CDMO market's growth is propelled by several key drivers. Firstly, the escalating R&D expenditures by pharmaceutical and biotechnology companies, coupled with the increasing complexity of drug molecules, necessitate specialized outsourcing for efficient development and manufacturing. Secondly, the growing prevalence of chronic diseases worldwide fuels the demand for a consistent supply of pharmaceuticals, requiring scalable API production capabilities. Thirdly, the stringent regulatory landscape, while posing challenges, also drives demand for CDMOs with robust quality and compliance systems, offering expertise in navigating these requirements. Technological advancements in synthesis, such as continuous manufacturing and biocatalysis, are enabling more efficient and cost-effective API production, further stimulating market expansion. Finally, the strategic outsourcing by large pharmaceutical companies to focus on core competencies like drug discovery and marketing contributes significantly to the growth of the CDMO sector.

Challenges in the API CDMO Market Market

Despite its robust growth, the API CDMO market faces several significant challenges. Regulatory Hurdles: Navigating the ever-evolving and increasingly stringent global regulatory frameworks for drug manufacturing and quality control requires substantial investment in compliance and expertise. Supply Chain Disruptions: Geopolitical factors, raw material shortages, and logistical complexities can lead to unpredictable disruptions in the API supply chain, impacting production timelines and costs. Intense Competition: The market is highly competitive, with numerous players vying for market share, leading to pressure on pricing and margins, especially for generic APIs. Intellectual Property Protection: Ensuring the robust protection of clients' intellectual property is paramount, and any lapses can have severe repercussions for both the CDMO and its clients. Skilled Workforce Shortage: The specialized nature of API development and manufacturing creates a demand for highly skilled scientists and technicians, and a shortage of qualified personnel can hinder operational capacity and growth.

Emerging Opportunities in API CDMO Market

The API CDMO market is ripe with emerging opportunities driven by technological advancements and evolving pharmaceutical needs. The surge in biologics, particularly monoclonal antibodies and advanced therapies like cell and gene therapies, presents a significant growth avenue for CDMOs with specialized expertise in large molecule manufacturing. The increasing demand for personalized medicine and targeted therapies, often involving highly potent APIs (HPAPIs), is creating a niche for CDMOs with containment and handling capabilities. Furthermore, the growing trend of virtual and small biotech companies, which often lack in-house manufacturing infrastructure, presents a substantial opportunity for CDMOs to provide end-to-end development and manufacturing solutions. Strategic partnerships and collaborations between CDMOs and pharmaceutical companies, as well as collaborations with technology providers, are also expected to foster innovation and expand service portfolios, unlocking new market potential.

Leading Players in the API CDMO Market Sector

- Siegfried

- CordenPharma International

- Patheon (Thermo Fisher Scientific Inc)

- Piramal Pharma Solutions

- AbbVie Inc

- Lonza

- Catalent Inc

- Samsung Biologics

- Recipharm AB

- Cambrex Corporation

Key Milestones in API CDMO Market Industry

- May 2022: Piramal Pharma Solutions announced that its new active pharmaceutical ingredient (API) plant in Aurora, Ontario, went online and successfully completed its initial production runs, enhancing its North American manufacturing capacity.

- June 2021: Lonza Group invested CHF 20 million (USD 21 million) to expand its API development and manufacturing facility in China, bolstering its presence in the Asian market and catering to growing regional demand.

Strategic Outlook for API CDMO Market Market

The strategic outlook for the API CDMO market is exceptionally positive, characterized by continuous growth accelerators. The increasing trend of outsourcing complex drug development and manufacturing processes by pharmaceutical and biotechnology companies will remain a primary growth engine. The market will witness a significant expansion in services catering to biologics and advanced therapies, driven by breakthroughs in biotechnology and the demand for novel treatments. CDMOs that invest in cutting-edge technologies, such as artificial intelligence for process optimization and advanced analytical techniques, will gain a significant competitive advantage. Furthermore, strategic acquisitions and partnerships will continue to shape the market landscape, enabling CDMOs to broaden their service portfolios, expand their geographical reach, and enhance their specialized capabilities. The growing focus on supply chain resilience and localized manufacturing will also present opportunities for regional expansion and diversification.

API CDMO Market Segmentation

-

1. Molecule Type

- 1.1. Small Molecule

- 1.2. Large Molecule

-

2. Synthesis

- 2.1. Biotech

- 2.2. Synthetic

-

3. Drug Type

- 3.1. Innovative

- 3.2. Generics

-

4. Workflow

- 4.1. Clinical

- 4.2. Commercial

-

5. Application

- 5.1. Cardiology

- 5.2. Oncology

- 5.3. Ophthalmology

- 5.4. Neurology

- 5.5. Orthopedic

- 5.6. Other Applications

API CDMO Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

API CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Pharmaceutical R&D Investment; Rising Demand for Generic Drugs; Complex Manufacturing; Patent Expiration

- 3.3. Market Restrains

- 3.3.1. Compliance Issues while Outsourcing; Concerns about Data Quality and Security

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is Expected to Hold the Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Molecule Type

- 5.1.1. Small Molecule

- 5.1.2. Large Molecule

- 5.2. Market Analysis, Insights and Forecast - by Synthesis

- 5.2.1. Biotech

- 5.2.2. Synthetic

- 5.3. Market Analysis, Insights and Forecast - by Drug Type

- 5.3.1. Innovative

- 5.3.2. Generics

- 5.4. Market Analysis, Insights and Forecast - by Workflow

- 5.4.1. Clinical

- 5.4.2. Commercial

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Cardiology

- 5.5.2. Oncology

- 5.5.3. Ophthalmology

- 5.5.4. Neurology

- 5.5.5. Orthopedic

- 5.5.6. Other Applications

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Middle East and Africa

- 5.6.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Molecule Type

- 6. North America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Molecule Type

- 6.1.1. Small Molecule

- 6.1.2. Large Molecule

- 6.2. Market Analysis, Insights and Forecast - by Synthesis

- 6.2.1. Biotech

- 6.2.2. Synthetic

- 6.3. Market Analysis, Insights and Forecast - by Drug Type

- 6.3.1. Innovative

- 6.3.2. Generics

- 6.4. Market Analysis, Insights and Forecast - by Workflow

- 6.4.1. Clinical

- 6.4.2. Commercial

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Cardiology

- 6.5.2. Oncology

- 6.5.3. Ophthalmology

- 6.5.4. Neurology

- 6.5.5. Orthopedic

- 6.5.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Molecule Type

- 7. Europe API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Molecule Type

- 7.1.1. Small Molecule

- 7.1.2. Large Molecule

- 7.2. Market Analysis, Insights and Forecast - by Synthesis

- 7.2.1. Biotech

- 7.2.2. Synthetic

- 7.3. Market Analysis, Insights and Forecast - by Drug Type

- 7.3.1. Innovative

- 7.3.2. Generics

- 7.4. Market Analysis, Insights and Forecast - by Workflow

- 7.4.1. Clinical

- 7.4.2. Commercial

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Cardiology

- 7.5.2. Oncology

- 7.5.3. Ophthalmology

- 7.5.4. Neurology

- 7.5.5. Orthopedic

- 7.5.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Molecule Type

- 8. Asia Pacific API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Molecule Type

- 8.1.1. Small Molecule

- 8.1.2. Large Molecule

- 8.2. Market Analysis, Insights and Forecast - by Synthesis

- 8.2.1. Biotech

- 8.2.2. Synthetic

- 8.3. Market Analysis, Insights and Forecast - by Drug Type

- 8.3.1. Innovative

- 8.3.2. Generics

- 8.4. Market Analysis, Insights and Forecast - by Workflow

- 8.4.1. Clinical

- 8.4.2. Commercial

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Cardiology

- 8.5.2. Oncology

- 8.5.3. Ophthalmology

- 8.5.4. Neurology

- 8.5.5. Orthopedic

- 8.5.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Molecule Type

- 9. Middle East and Africa API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Molecule Type

- 9.1.1. Small Molecule

- 9.1.2. Large Molecule

- 9.2. Market Analysis, Insights and Forecast - by Synthesis

- 9.2.1. Biotech

- 9.2.2. Synthetic

- 9.3. Market Analysis, Insights and Forecast - by Drug Type

- 9.3.1. Innovative

- 9.3.2. Generics

- 9.4. Market Analysis, Insights and Forecast - by Workflow

- 9.4.1. Clinical

- 9.4.2. Commercial

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Cardiology

- 9.5.2. Oncology

- 9.5.3. Ophthalmology

- 9.5.4. Neurology

- 9.5.5. Orthopedic

- 9.5.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Molecule Type

- 10. South America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Molecule Type

- 10.1.1. Small Molecule

- 10.1.2. Large Molecule

- 10.2. Market Analysis, Insights and Forecast - by Synthesis

- 10.2.1. Biotech

- 10.2.2. Synthetic

- 10.3. Market Analysis, Insights and Forecast - by Drug Type

- 10.3.1. Innovative

- 10.3.2. Generics

- 10.4. Market Analysis, Insights and Forecast - by Workflow

- 10.4.1. Clinical

- 10.4.2. Commercial

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Cardiology

- 10.5.2. Oncology

- 10.5.3. Ophthalmology

- 10.5.4. Neurology

- 10.5.5. Orthopedic

- 10.5.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Molecule Type

- 11. North America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. GCC API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Rest of Middle East

- 16. South America API CDMO Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Brazil

- 16.1.2 Argentina

- 16.1.3 Rest of South America

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Siegfried

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 CordenPharma International

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Patheon (Thermo Fisher Scientific Inc )

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Piramal Pharma Solutions

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 AbbVie Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Lonza

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Catalent Inc *List Not Exhaustive

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Samsung Biologics

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Recipharm AB

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Cambrex Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Siegfried

List of Figures

- Figure 1: Global API CDMO Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: GCC API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 11: GCC API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 13: South America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 15: North America API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 16: North America API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 17: North America API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 18: North America API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 19: North America API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 20: North America API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 21: North America API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 22: North America API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 23: North America API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: North America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 25: North America API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 27: Europe API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 28: Europe API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 29: Europe API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 30: Europe API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 31: Europe API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 32: Europe API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 33: Europe API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 34: Europe API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Europe API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Europe API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Europe API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Asia Pacific API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 39: Asia Pacific API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 40: Asia Pacific API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 41: Asia Pacific API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 42: Asia Pacific API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 43: Asia Pacific API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 44: Asia Pacific API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 45: Asia Pacific API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 46: Asia Pacific API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Asia Pacific API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Asia Pacific API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Pacific API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East and Africa API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 51: Middle East and Africa API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 52: Middle East and Africa API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 53: Middle East and Africa API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 54: Middle East and Africa API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 55: Middle East and Africa API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 56: Middle East and Africa API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 57: Middle East and Africa API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 58: Middle East and Africa API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 59: Middle East and Africa API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 60: Middle East and Africa API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa API CDMO Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: South America API CDMO Market Revenue (Million), by Molecule Type 2024 & 2032

- Figure 63: South America API CDMO Market Revenue Share (%), by Molecule Type 2024 & 2032

- Figure 64: South America API CDMO Market Revenue (Million), by Synthesis 2024 & 2032

- Figure 65: South America API CDMO Market Revenue Share (%), by Synthesis 2024 & 2032

- Figure 66: South America API CDMO Market Revenue (Million), by Drug Type 2024 & 2032

- Figure 67: South America API CDMO Market Revenue Share (%), by Drug Type 2024 & 2032

- Figure 68: South America API CDMO Market Revenue (Million), by Workflow 2024 & 2032

- Figure 69: South America API CDMO Market Revenue Share (%), by Workflow 2024 & 2032

- Figure 70: South America API CDMO Market Revenue (Million), by Application 2024 & 2032

- Figure 71: South America API CDMO Market Revenue Share (%), by Application 2024 & 2032

- Figure 72: South America API CDMO Market Revenue (Million), by Country 2024 & 2032

- Figure 73: South America API CDMO Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global API CDMO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 3: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 4: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 5: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 6: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global API CDMO Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Germany API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: France API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Asia Pacific API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Middle East API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of South America API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 36: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 37: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 38: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 39: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United States API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Canada API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Mexico API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 45: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 46: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 47: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 48: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 49: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Germany API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: United Kingdom API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: France API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Italy API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Spain API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 57: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 58: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 59: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 60: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: China API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Japan API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: India API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Australia API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: South Korea API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Rest of Asia Pacific API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 69: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 70: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 71: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 72: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 73: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 74: GCC API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: South Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Middle East and Africa API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Global API CDMO Market Revenue Million Forecast, by Molecule Type 2019 & 2032

- Table 78: Global API CDMO Market Revenue Million Forecast, by Synthesis 2019 & 2032

- Table 79: Global API CDMO Market Revenue Million Forecast, by Drug Type 2019 & 2032

- Table 80: Global API CDMO Market Revenue Million Forecast, by Workflow 2019 & 2032

- Table 81: Global API CDMO Market Revenue Million Forecast, by Application 2019 & 2032

- Table 82: Global API CDMO Market Revenue Million Forecast, by Country 2019 & 2032

- Table 83: Brazil API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: Argentina API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 85: Rest of South America API CDMO Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the API CDMO Market?

The projected CAGR is approximately 8.61%.

2. Which companies are prominent players in the API CDMO Market?

Key companies in the market include Siegfried, CordenPharma International, Patheon (Thermo Fisher Scientific Inc ), Piramal Pharma Solutions, AbbVie Inc, Lonza, Catalent Inc *List Not Exhaustive, Samsung Biologics, Recipharm AB, Cambrex Corporation.

3. What are the main segments of the API CDMO Market?

The market segments include Molecule Type, Synthesis, Drug Type, Workflow, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 118.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Pharmaceutical R&D Investment; Rising Demand for Generic Drugs; Complex Manufacturing; Patent Expiration.

6. What are the notable trends driving market growth?

The Commercial Segment is Expected to Hold the Major Market Share.

7. Are there any restraints impacting market growth?

Compliance Issues while Outsourcing; Concerns about Data Quality and Security.

8. Can you provide examples of recent developments in the market?

In May 2022, Piramal Pharma Solutions stated that the company's new active pharmaceutical ingredient (API) plant in Aurora, Ontario, went online and successfully completed its initial production runs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "API CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the API CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the API CDMO Market?

To stay informed about further developments, trends, and reports in the API CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence