Key Insights

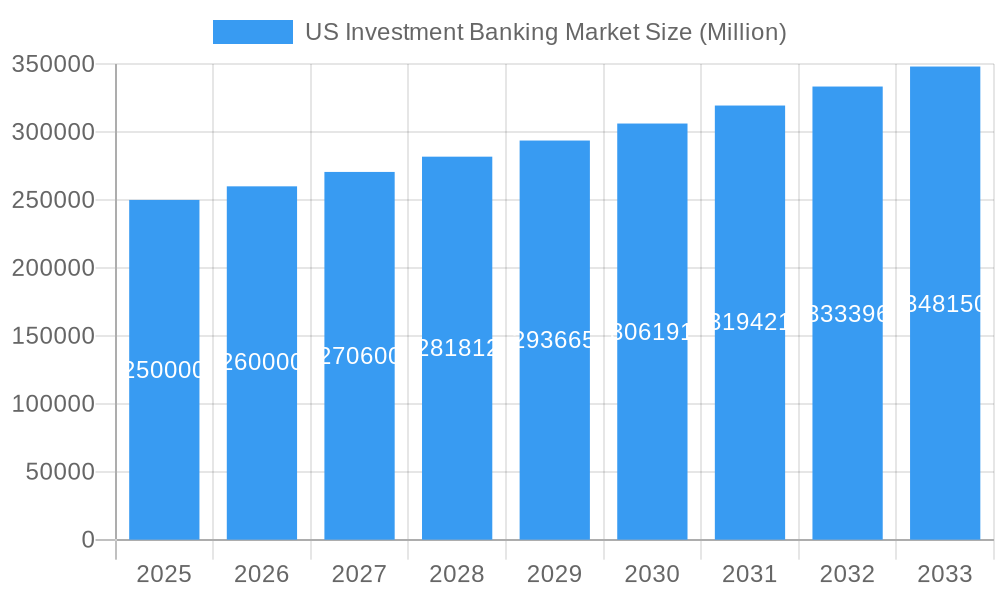

The U.S. Investment Banking Market is poised for significant expansion, driven by escalating mergers and acquisitions (M&A) activity across technology and healthcare, alongside a robust pipeline of initial public offerings (IPOs) and a thriving private equity sector. The market is projected to reach a valuation of 150.49 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.6%. This growth is further bolstered by the increasing complexity of global financial markets, presenting U.S. investment banks with expanded opportunities in facilitating international transactions and advising on cross-border deals. While regulatory shifts and economic volatility pose challenges, the fundamental demand for expert financial guidance in an increasingly intricate global economy ensures a positive market outlook.

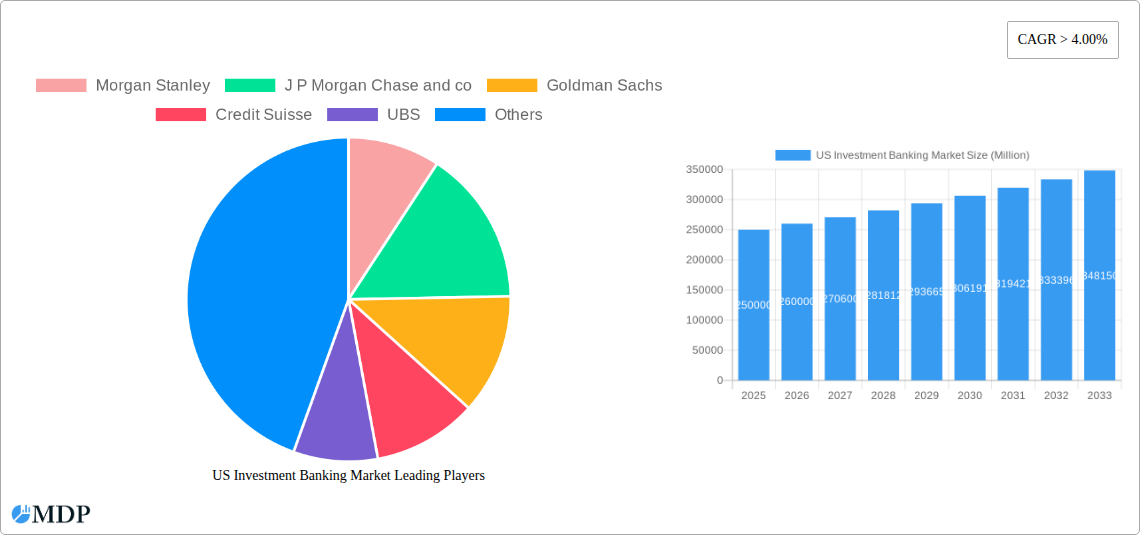

US Investment Banking Market Market Size (In Billion)

The market's diverse service portfolio includes advisory functions such as M&A, restructuring, and equity capital markets, alongside debt and equity underwriting and trading. Key industry leaders, including Morgan Stanley, JPMorgan Chase & Co., Goldman Sachs, and Bank of America, are at the forefront, utilizing their extensive networks, deep expertise, and technological prowess to capture market share. This competitive environment spurs continuous innovation and operational efficiency, ultimately benefiting clients seeking optimized financial strategies. While specific regional data is pending, a concentrated activity within major financial centers like New York is anticipated. The overarching trend indicates sustained and healthy market growth, propelled by core economic drivers and strategic financial engagements.

US Investment Banking Market Company Market Share

US Investment Banking Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the US Investment Banking Market, covering market dynamics, leading players, emerging trends, and future growth prospects. From 2019 to 2033, we delve into the intricacies of this dynamic sector, offering actionable insights for investors, industry professionals, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects market performance until the estimated year (2025) and forecast period (2025-2033).

US Investment Banking Market Market Dynamics & Concentration

The US investment banking market is characterized by high concentration among a few major players, with the top ten firms consistently commanding a significant share of the market. While precise market share figures fluctuate annually, Morgan Stanley, J.P. Morgan Chase & Co., Goldman Sachs, and Bank of America consistently rank among the leading players. The market's dynamism is shaped by several factors:

- Market Concentration: The top 5 firms command approximately xx% of the market in 2025 (estimated). Smaller boutique firms and specialized players occupy the remaining market share.

- Innovation Drivers: Technological advancements in areas like AI and machine learning are driving efficiency improvements and enhancing deal execution. The rise of fintech is also impacting market structure.

- Regulatory Frameworks: Stringent regulatory oversight, particularly post-2008, continues to shape market practices and risk management strategies. Recent regulatory changes have impacted deal flow and profitability for some players.

- Product Substitutes: The increasing sophistication of alternative financing options, such as private equity and crowdfunding, provides some level of competition for traditional investment banking services.

- End-User Trends: The demand for advisory services, particularly in M&A activity, remains robust, driven by industry consolidation and strategic shifts among large corporations.

- M&A Activities: The number of M&A deals facilitated by US investment banks has seen fluctuations but overall maintains a significant level of activity. In 2024, there were approximately xx,xxx deals (estimated). The average deal value is estimated at $xx Million.

US Investment Banking Market Industry Trends & Analysis

The US investment banking market experienced a CAGR of xx% during the historical period (2019-2024). This growth is projected to moderate slightly during the forecast period (2025-2033), with an anticipated CAGR of xx%. Several factors fuel this trend:

- Market Growth Drivers: Continued corporate activity, including M&A, IPOs, and debt financing, remains a primary growth driver. Global economic expansion (with varying regional strength) contributes to increased transactional activity.

- Technological Disruptions: Technological advancements in data analytics and automation are reshaping business models, enabling more efficient deal execution and improved risk management.

- Consumer Preferences: Institutional investors are increasingly focused on ESG (environmental, social, and governance) factors, influencing deal-making and investment strategies within the industry.

- Competitive Dynamics: The highly competitive landscape necessitates continuous innovation, strategic partnerships, and efficient operational models to maintain market share. Increased competition from fintech firms is a notable aspect of this.

Leading Markets & Segments in US Investment Banking Market

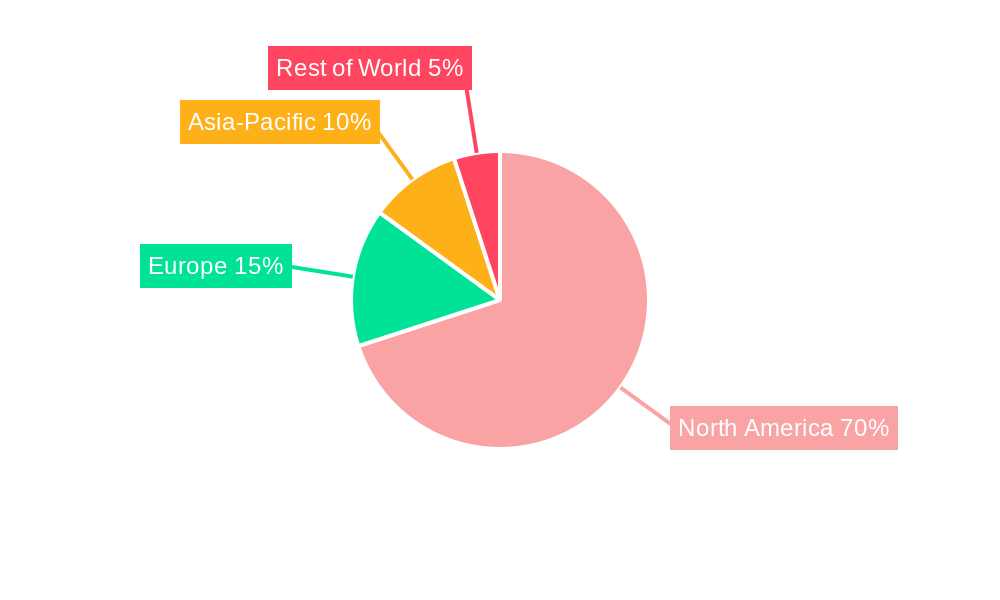

The US Investment Banking Market shows regional variations, with the largest financial centers (New York, San Francisco, Boston) concentrating most of the activity.

- Key Drivers: Strong economic activity, access to capital, and a highly skilled workforce in these areas contribute to their dominance. Supportive regulatory environments and existing infrastructure also play a crucial role.

- Dominance Analysis: The concentration of financial institutions, legal expertise, and sophisticated investors in these hubs fuels their consistent market leadership in the provision of investment banking services.

US Investment Banking Market Product Developments

Recent product innovations have focused on improving deal execution speed, enhancing risk management tools, and meeting investor demand for transparency and ESG compliance. Investment banks are leveraging technology to streamline processes and deliver more efficient services, often integrating advanced data analytics and AI for better deal sourcing and valuation.

Key Drivers of US Investment Banking Market Growth

The continued growth of the US investment banking market is fueled by several factors:

- Technological Advancements: AI, machine learning, and blockchain technologies are significantly influencing deal execution, risk management, and client service delivery.

- Economic Growth: Periods of economic expansion lead to increased M&A activity and a higher demand for capital markets services.

- Regulatory Changes: While regulatory changes sometimes present challenges, they also create opportunities for innovative solutions and new service offerings.

Challenges in the US Investment Banking Market Market

The US investment banking market faces several challenges:

- Regulatory Hurdles: Compliance costs and regulatory scrutiny continue to impact profitability and operational efficiency.

- Competitive Pressures: Intense competition from both established players and emerging fintech firms necessitates constant innovation.

- Geopolitical Uncertainty: Global political and economic instability can impact deal flow and investor sentiment.

Emerging Opportunities in US Investment Banking Market

Several factors suggest significant long-term growth potential:

- Expansion into Emerging Markets: Leveraging expertise and networks to capture growth opportunities in developing economies.

- Strategic Partnerships: Collaborating with fintech firms to integrate advanced technologies and enhance service offerings.

- ESG Investing: Meeting the rising demand for sustainable and responsible investments.

Leading Players in the US Investment Banking Market Sector

- Morgan Stanley

- J.P. Morgan Chase & Co.

- Goldman Sachs

- Credit Suisse

- UBS

- Bank of America

- Evercore

- Citi

- HSBC

- Rothschild & Co

- List Not Exhaustive

Key Milestones in US Investment Banking Market Industry

- October 2022: Michael Klein combines his consultancy business with Credit Suisse, potentially reshaping the competitive landscape.

- October 2022: J.P. Morgan expands its Merchant Services capabilities in the Asia-Pacific region, aiming to capture a significant share of the growing e-commerce market.

Strategic Outlook for US Investment Banking Market Market

The US investment banking market is poised for continued growth, driven by technological innovation, evolving investor preferences, and ongoing corporate activity. Strategic partnerships, expansion into new markets, and a focus on ESG investing will be crucial for maintaining competitiveness and capturing future market share. The market is expected to benefit from long-term economic growth and the ongoing digital transformation of financial services.

US Investment Banking Market Segmentation

-

1. Type of Product

- 1.1. Mergers and Acquisitions

- 1.2. Debt Capital Markets

- 1.3. Equity Capitals Market

- 1.4. Syndicated Loans

- 1.5. Others

US Investment Banking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Investment Banking Market Regional Market Share

Geographic Coverage of US Investment Banking Market

US Investment Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Artificial Intelligence is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. Mergers and Acquisitions

- 5.1.2. Debt Capital Markets

- 5.1.3. Equity Capitals Market

- 5.1.4. Syndicated Loans

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. North America US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. Mergers and Acquisitions

- 6.1.2. Debt Capital Markets

- 6.1.3. Equity Capitals Market

- 6.1.4. Syndicated Loans

- 6.1.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. South America US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. Mergers and Acquisitions

- 7.1.2. Debt Capital Markets

- 7.1.3. Equity Capitals Market

- 7.1.4. Syndicated Loans

- 7.1.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. Europe US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. Mergers and Acquisitions

- 8.1.2. Debt Capital Markets

- 8.1.3. Equity Capitals Market

- 8.1.4. Syndicated Loans

- 8.1.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Middle East & Africa US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. Mergers and Acquisitions

- 9.1.2. Debt Capital Markets

- 9.1.3. Equity Capitals Market

- 9.1.4. Syndicated Loans

- 9.1.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. Asia Pacific US Investment Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. Mergers and Acquisitions

- 10.1.2. Debt Capital Markets

- 10.1.3. Equity Capitals Market

- 10.1.4. Syndicated Loans

- 10.1.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Morgan Stanley

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 J P Morgan Chase and co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goldman Sachs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Credit Suisse

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 UBS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of America

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evercore

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CITI

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HSBC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rothschild & Co *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Morgan Stanley

List of Figures

- Figure 1: Global US Investment Banking Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 3: North America US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 4: North America US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 7: South America US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 8: South America US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 9: South America US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 11: Europe US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 12: Europe US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 15: Middle East & Africa US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 16: Middle East & Africa US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific US Investment Banking Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 19: Asia Pacific US Investment Banking Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 20: Asia Pacific US Investment Banking Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific US Investment Banking Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 2: Global US Investment Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 4: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 9: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 14: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 25: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global US Investment Banking Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 33: Global US Investment Banking Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific US Investment Banking Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Investment Banking Market?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the US Investment Banking Market?

Key companies in the market include Morgan Stanley, J P Morgan Chase and co, Goldman Sachs, Credit Suisse, UBS, Bank of America, Evercore, CITI, HSBC, Rothschild & Co *List Not Exhaustive.

3. What are the main segments of the US Investment Banking Market?

The market segments include Type of Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 150.49 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Artificial Intelligence is driving the market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Michael Klein will combine his consultancy business with the investment bank Credit Suisse.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Investment Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Investment Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Investment Banking Market?

To stay informed about further developments, trends, and reports in the US Investment Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence