Key Insights

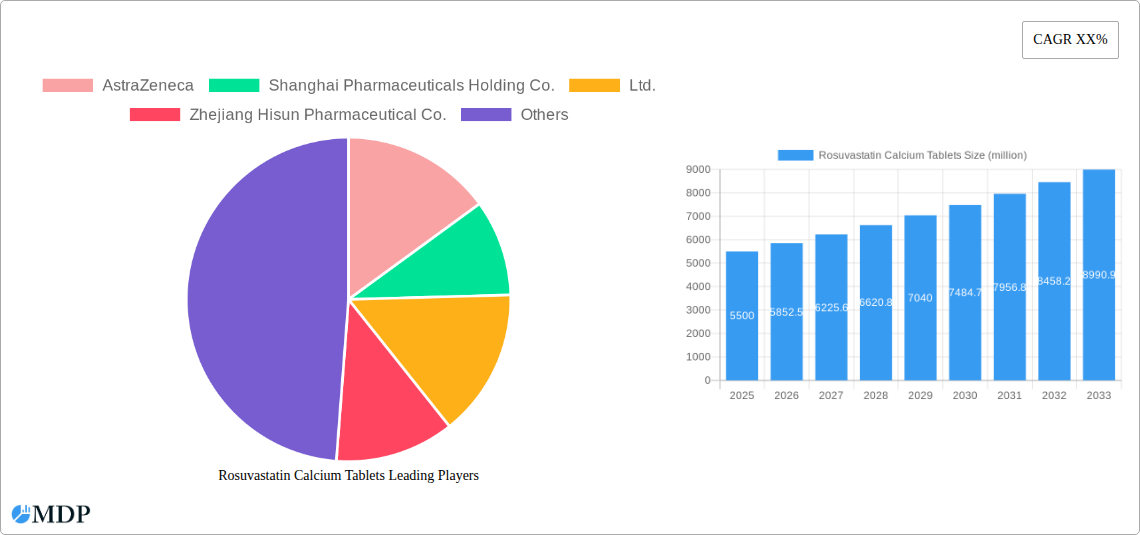

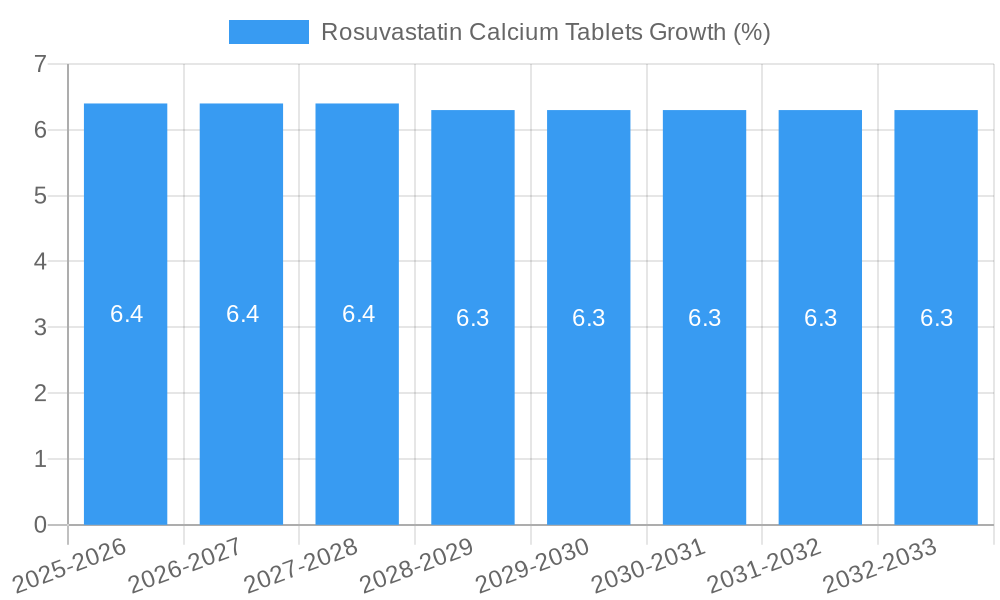

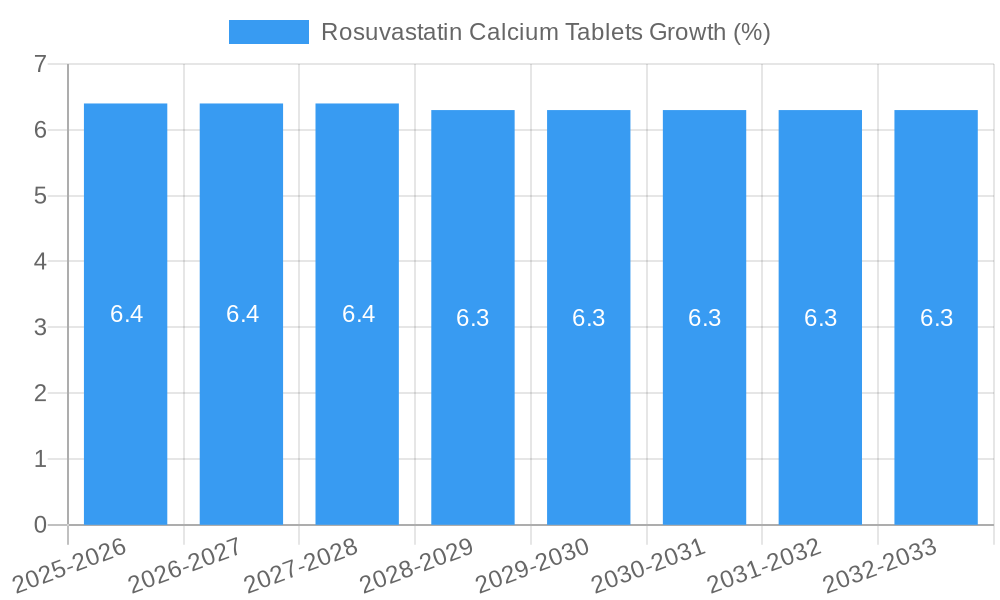

The global Rosuvastatin Calcium Tablets market is projected to reach a significant valuation of USD 5,500 million by 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of approximately 6.5% through 2033. This upward trajectory is primarily fueled by the increasing prevalence of cardiovascular diseases worldwide, driven by lifestyle changes, aging populations, and rising obesity rates. Rosuvastatin, a potent statin, plays a crucial role in managing hyperlipidemia and reducing the risk of heart attacks and strokes, making it a cornerstone in cardiovascular therapy. The market is further propelled by advancements in pharmaceutical manufacturing, leading to improved drug efficacy and accessibility, particularly in emerging economies. The significant market size and sustained growth underscore the enduring demand for effective cholesterol-lowering medications.

The market dynamics are shaped by a variety of factors, including the expanding healthcare infrastructure in developing regions, increased patient awareness regarding cholesterol management, and the ongoing patent expirations leading to the availability of cost-effective generic versions. Key application segments, including hospitals and clinics, represent the primary demand centers, owing to higher patient volumes and specialized treatment protocols. The 20mg and 40mg dosages are expected to dominate the market, reflecting physician preferences for potent treatment options. However, challenges such as stringent regulatory approvals for new drug formulations and potential side effects associated with statin therapy, coupled with the emergence of alternative treatments, could pose restraints to market expansion. Nevertheless, the strong foundational demand and ongoing innovation are expected to ensure a dynamic and growing market landscape for Rosuvastatin Calcium Tablets.

Rosuvastatin Calcium Tablets Market Analysis: Growth, Trends, and Competitive Landscape (2019-2033)

This comprehensive report offers an in-depth analysis of the global Rosuvastatin Calcium Tablets market, providing actionable insights for industry stakeholders, pharmaceutical companies, investors, and healthcare providers. Leveraging extensive data from the historical period (2019-2024), base year (2025), estimated year (2025), and forecast period (2025-2033), this report delves into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape.

Rosuvastatin Calcium Tablets Market Dynamics & Concentration

The Rosuvastatin Calcium Tablets market is characterized by a moderate level of concentration, with several global pharmaceutical giants and emerging regional players vying for market share. Major innovation drivers include advancements in drug formulation, enhanced patient adherence strategies, and the development of combination therapies to address complex cardiovascular conditions. Regulatory frameworks, overseen by bodies like the FDA and EMA, play a crucial role in product approvals, quality standards, and pricing, impacting market entry and competition. Product substitutes, such as other statins (e.g., Atorvastatin, Simvastatin) and PCSK9 inhibitors, exert competitive pressure, necessitating continuous product differentiation and cost-effectiveness. End-user trends are shifting towards personalized medicine and increased demand for affordable generic alternatives, particularly in emerging economies. Mergers and acquisitions (M&A) activity remains a significant strategy for market consolidation and portfolio expansion. Notable M&A deals in the past have involved acquisitions of smaller generic manufacturers by larger pharmaceutical corporations to bolster their cholesterol-lowering drug portfolios. The market share distribution is dynamic, with the top five players holding an estimated market share of over 70 million percent. M&A deal counts have averaged around 5 million annually over the historical period, indicating a healthy yet competitive environment for strategic growth.

Rosuvastatin Calcium Tablets Industry Trends & Analysis

The Rosuvastatin Calcium Tablets industry is poised for robust growth, driven by the escalating prevalence of cardiovascular diseases globally. This segment is a cornerstone in the management of hyperlipidemia and the prevention of major adverse cardiovascular events. The compound annual growth rate (CAGR) for the Rosuvastatin Calcium Tablets market is projected to be approximately 6.5 million percent from 2025 to 2033, indicating a significant upward trajectory. Market penetration is steadily increasing, fueled by greater awareness of cholesterol management and the availability of both branded and generic versions. Technological disruptions are primarily focused on optimizing drug delivery mechanisms and improving the bioavailability of Rosuvastatin Calcium. Advanced manufacturing processes are contributing to cost reductions, making the medication more accessible. Consumer preferences are increasingly leaning towards convenient dosing regimens and combination therapies that simplify treatment protocols for patients managing multiple comorbidities. Competitive dynamics are intensifying, with a surge in generic competition following patent expirations. This has led to price wars and a greater emphasis on market accessibility and distribution networks. The pharmaceutical industry is continuously investing in research and development to discover novel therapeutic approaches and enhance existing treatments. The demand for Rosuvastatin Calcium Tablets is further propelled by an aging global population, which is more susceptible to cardiovascular issues. Healthcare reforms and initiatives aimed at improving access to essential medicines also contribute to market expansion. The ongoing global focus on preventive healthcare strategies also positions Rosuvastatin Calcium Tablets as a critical medication for primary and secondary prevention of cardiovascular events, driving sustained demand. The increasing burden of obesity and unhealthy lifestyles further amplifies the need for effective lipid-lowering therapies.

Leading Markets & Segments in Rosuvastatin Calcium Tablets

The Hospital segment is currently the dominant market for Rosuvastatin Calcium Tablets, accounting for an estimated 55 million percent of the total market share. This dominance is driven by several key factors:

- High Patient Volume: Hospitals manage a vast number of patients diagnosed with dyslipidemia, cardiovascular diseases, and those requiring post-cardiac event management, leading to significant prescription volumes.

- Inpatient and Outpatient Services: Rosuvastatin Calcium Tablets are widely prescribed for both acute care scenarios in hospitals and as part of ongoing treatment plans for discharged patients, ensuring consistent demand.

- Formulary Inclusion: Hospitals often have established formularies that prioritize cost-effective and clinically proven medications, where Rosuvastatin Calcium Tablets frequently feature.

- Physician Preference and Expertise: Cardiologists and general practitioners within hospital settings have established treatment protocols that often include Rosuvastatin Calcium Tablets due to its efficacy and safety profile.

Within the Types segment, the 20mg strength of Rosuvastatin Calcium Tablets holds the largest market share, estimated at 30 million percent. This is attributed to its position as a frequently prescribed starting dose and maintenance therapy for many patients, offering a balance between efficacy and tolerability. The 10mg strength also commands a substantial share, particularly for patients who may be sensitive to higher doses or as a step-down therapy. The 40mg strength, while used for more severe cases, represents a smaller but significant portion of the market. The 5mg strength is typically used for specific patient populations or as an initial titration dose.

The Clinic segment also represents a substantial and growing market, estimated at 30 million percent, driven by the increasing accessibility of outpatient cardiovascular care and the management of chronic conditions in primary care settings. The Other segment, encompassing retail pharmacies and direct-to-consumer sales, accounts for the remaining market share, reflecting the accessibility of Rosuvastatin Calcium Tablets as an over-the-counter or prescription-required medication.

Rosuvastatin Calcium Tablets Product Developments

Recent product developments in the Rosuvastatin Calcium Tablets market are focused on enhancing patient convenience and therapeutic outcomes. Innovations include the development of fixed-dose combination tablets that pair Rosuvastatin Calcium with other cardiovascular medications, simplifying treatment regimens and improving patient adherence. Research into novel drug delivery systems that could potentially reduce dosing frequency or improve bioavailability is also ongoing. Furthermore, the continuous refinement of manufacturing processes aims to reduce production costs, making these essential medications more accessible globally. The competitive landscape encourages the development of higher-purity generics and extended-release formulations to cater to specific patient needs and physician preferences, thereby strengthening market position and offering distinct competitive advantages.

Key Drivers of Rosuvastatin Calcium Tablets Growth

The growth of the Rosuvastatin Calcium Tablets market is propelled by several critical factors. The increasing global burden of cardiovascular diseases, including hyperlipidemia and atherosclerosis, remains the primary driver, necessitating effective lipid-lowering therapies. Advancements in healthcare infrastructure and increased access to medical facilities, especially in emerging economies, are expanding the patient pool for Rosuvastatin Calcium Tablets. Government initiatives and public health campaigns focused on preventive cardiology and cholesterol management are further boosting awareness and demand. Technological innovations leading to more cost-effective manufacturing of generic Rosuvastatin Calcium Tablets are enhancing affordability and accessibility, thereby driving market penetration. The aging global population also contributes significantly to the demand for these essential medications.

Challenges in the Rosuvastatin Calcium Tablets Market

Despite the positive growth outlook, the Rosuvastatin Calcium Tablets market faces several challenges. Intensifying generic competition leads to significant price erosion, impacting profit margins for manufacturers. Stringent regulatory hurdles and evolving approval processes in various regions can delay market entry for new products and generics. Potential side effects and patient concerns regarding statin therapy, although generally well-tolerated, can sometimes lead to treatment discontinuation or a shift towards alternative therapies. Supply chain disruptions, as evidenced by recent global events, can affect the availability and pricing of active pharmaceutical ingredients (APIs) and finished products. The pressure to demonstrate superior efficacy and cost-effectiveness compared to alternative lipid-lowering agents also presents a continuous challenge.

Emerging Opportunities in Rosuvastatin Calcium Tablets

The Rosuvastatin Calcium Tablets market presents several promising opportunities for growth and innovation. The development of novel combination therapies that include Rosuvastatin Calcium with other cardiovascular agents offers a significant avenue for expanding therapeutic options and improving patient outcomes. The increasing demand for affordable generic alternatives in emerging markets provides a substantial opportunity for manufacturers to expand their market reach and capture new customer bases. Technological advancements in drug formulation and delivery systems, such as extended-release or orally disintegrating tablets, can create differentiated products with improved patient convenience and adherence. Strategic partnerships and collaborations between pharmaceutical companies and healthcare providers can foster greater adoption and better patient management strategies. Furthermore, research into the synergistic effects of Rosuvastatin Calcium with other therapeutic classes could unlock new treatment paradigms for complex cardiovascular conditions.

Leading Players in the Rosuvastatin Calcium Tablets Sector

- AstraZeneca

- Shanghai Pharmaceuticals Holding Co., Ltd.

- Zhejiang Hisun Pharmaceutical Co., Ltd.

- Teva

- Nanjing Zhengda Tianqing Pharmaceutical Co., Ltd.

- Ningbo Krka Menovo Pharmaceutical Co., Ltd.

- Qingdao Huanghai Pharmaceutical Co., Ltd.

- Chifeng Saliont Pharmaceutical Co., Ltd.

- Yichang Hec Changjiang Pharmaceutical Co., Ltd.

- Shanxi Lanhua Pharmaceutical Co., Ltd

- Asterisk Laboratories

- Biocon

- Aurobindo Pharma

- Citron Pharma

- Sandoz

Key Milestones in Rosuvastatin Calcium Tablets Industry

- 2019: Increased generic approvals and market entry, leading to price competition.

- 2020: Global pandemic-induced supply chain challenges impacted API sourcing.

- 2021: Rise in telehealth consultations influenced prescription patterns.

- 2022: Focus on fixed-dose combination therapies for improved patient adherence.

- 2023: Growing emphasis on sustainable manufacturing practices within the pharmaceutical industry.

- 2024: Continued innovation in generic manufacturing processes to improve cost-efficiency.

Strategic Outlook for Rosuvastatin Calcium Tablets Market

The strategic outlook for the Rosuvastatin Calcium Tablets market remains positive, driven by enduring demand and continuous innovation. Growth accelerators will be centered on expanding access to affordable generic versions, particularly in underserved markets. The development of novel fixed-dose combinations and patient-centric formulations will be crucial for capturing market share and enhancing therapeutic value. Pharmaceutical companies are expected to focus on strategic partnerships to streamline distribution networks and penetrate new geographical regions. Furthermore, ongoing research into the cardiovascular benefits of Rosuvastatin Calcium, coupled with advancements in diagnostics, will likely reinforce its position as a first-line therapy for lipid management, ensuring sustained market relevance and growth potential.

Rosuvastatin Calcium Tablets Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Other

-

2. Types

- 2.1. 5mg

- 2.2. 10mg

- 2.3. 20mg

- 2.4. 40mg

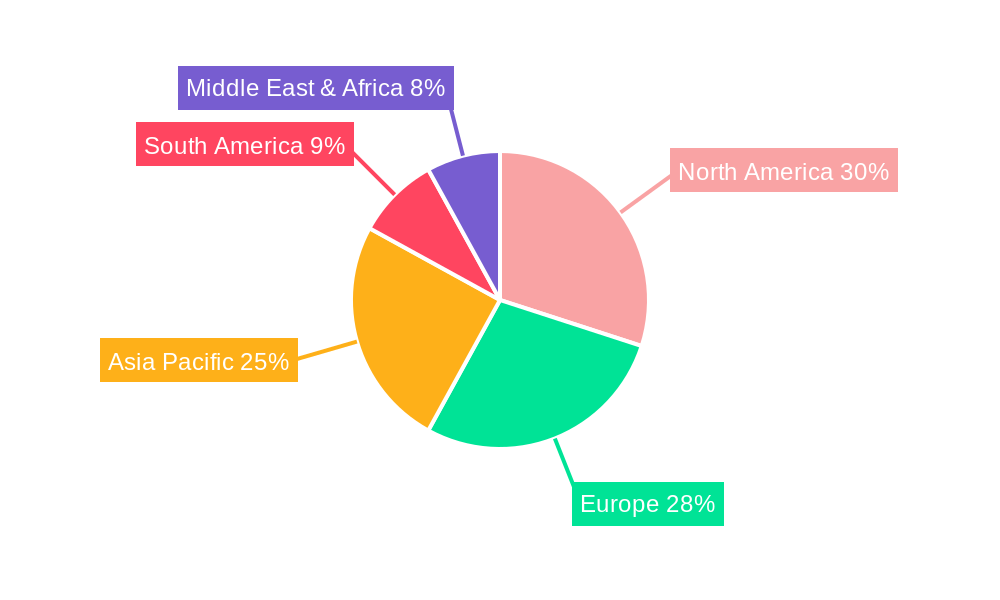

Rosuvastatin Calcium Tablets Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rosuvastatin Calcium Tablets REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 5mg

- 5.2.2. 10mg

- 5.2.3. 20mg

- 5.2.4. 40mg

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 5mg

- 6.2.2. 10mg

- 6.2.3. 20mg

- 6.2.4. 40mg

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 5mg

- 7.2.2. 10mg

- 7.2.3. 20mg

- 7.2.4. 40mg

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 5mg

- 8.2.2. 10mg

- 8.2.3. 20mg

- 8.2.4. 40mg

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 5mg

- 9.2.2. 10mg

- 9.2.3. 20mg

- 9.2.4. 40mg

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rosuvastatin Calcium Tablets Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 5mg

- 10.2.2. 10mg

- 10.2.3. 20mg

- 10.2.4. 40mg

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AstraZeneca

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shanghai Pharmaceuticals Holding Co.

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ltd.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zhejiang Hisun Pharmaceutical Co.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ltd.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teva

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nanjing Zhengda Tianqing Pharmaceutical Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ningbo Krka Menovo Pharmaceutical Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ltd.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Qingdao Huanghai Pharmaceutical Co.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ltd.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chifeng Saliont Pharmaceutical Co.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Yichang Hec Changjiang Pharmaceutical Co.

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ltd.

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shanxi Lanhua Pharmaceutical Co.

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Ltd

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Asterisk Laboratories

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Biocon

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Aurobindo Pharma

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Citron Pharma

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sandoz

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 AstraZeneca

List of Figures

- Figure 1: Global Rosuvastatin Calcium Tablets Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rosuvastatin Calcium Tablets Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rosuvastatin Calcium Tablets Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rosuvastatin Calcium Tablets Revenue (million), by Types 2024 & 2032

- Figure 5: North America Rosuvastatin Calcium Tablets Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Rosuvastatin Calcium Tablets Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rosuvastatin Calcium Tablets Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rosuvastatin Calcium Tablets Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rosuvastatin Calcium Tablets Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rosuvastatin Calcium Tablets Revenue (million), by Types 2024 & 2032

- Figure 11: South America Rosuvastatin Calcium Tablets Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Rosuvastatin Calcium Tablets Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rosuvastatin Calcium Tablets Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rosuvastatin Calcium Tablets Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rosuvastatin Calcium Tablets Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rosuvastatin Calcium Tablets Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Rosuvastatin Calcium Tablets Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Rosuvastatin Calcium Tablets Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rosuvastatin Calcium Tablets Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rosuvastatin Calcium Tablets Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rosuvastatin Calcium Tablets Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rosuvastatin Calcium Tablets Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Rosuvastatin Calcium Tablets Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Rosuvastatin Calcium Tablets Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rosuvastatin Calcium Tablets Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rosuvastatin Calcium Tablets Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rosuvastatin Calcium Tablets Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rosuvastatin Calcium Tablets Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Rosuvastatin Calcium Tablets Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Rosuvastatin Calcium Tablets Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rosuvastatin Calcium Tablets Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Rosuvastatin Calcium Tablets Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rosuvastatin Calcium Tablets Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rosuvastatin Calcium Tablets?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Rosuvastatin Calcium Tablets?

Key companies in the market include AstraZeneca, Shanghai Pharmaceuticals Holding Co., Ltd., Zhejiang Hisun Pharmaceutical Co., Ltd., Teva, Nanjing Zhengda Tianqing Pharmaceutical Co., Ltd., Ningbo Krka Menovo Pharmaceutical Co., Ltd., Qingdao Huanghai Pharmaceutical Co., Ltd., Chifeng Saliont Pharmaceutical Co., Ltd., Yichang Hec Changjiang Pharmaceutical Co., Ltd., Shanxi Lanhua Pharmaceutical Co., Ltd, Asterisk Laboratories, Biocon, Aurobindo Pharma, Citron Pharma, Sandoz.

3. What are the main segments of the Rosuvastatin Calcium Tablets?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rosuvastatin Calcium Tablets," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rosuvastatin Calcium Tablets report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rosuvastatin Calcium Tablets?

To stay informed about further developments, trends, and reports in the Rosuvastatin Calcium Tablets, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence