Key Insights

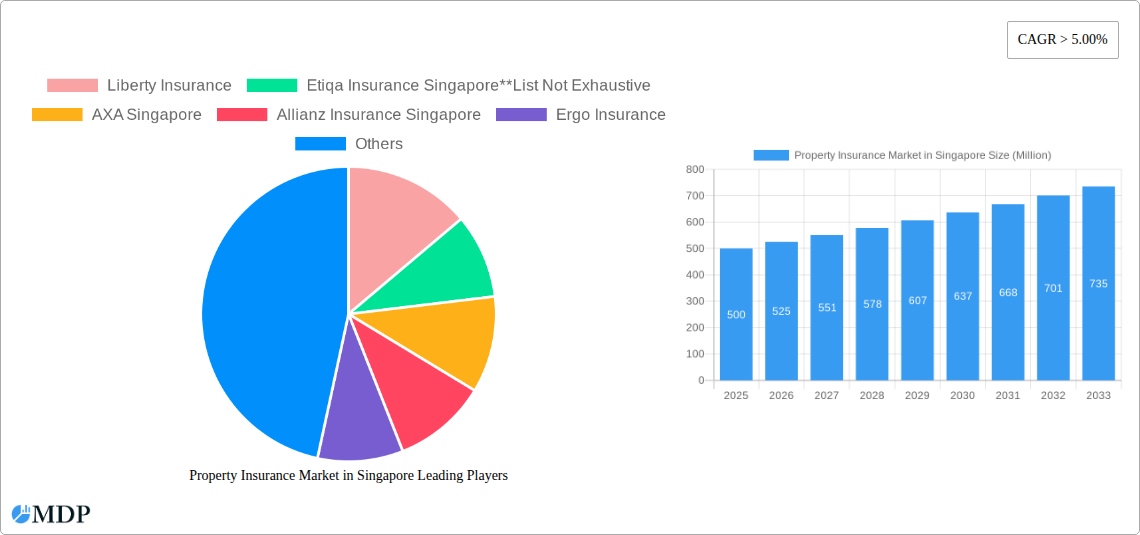

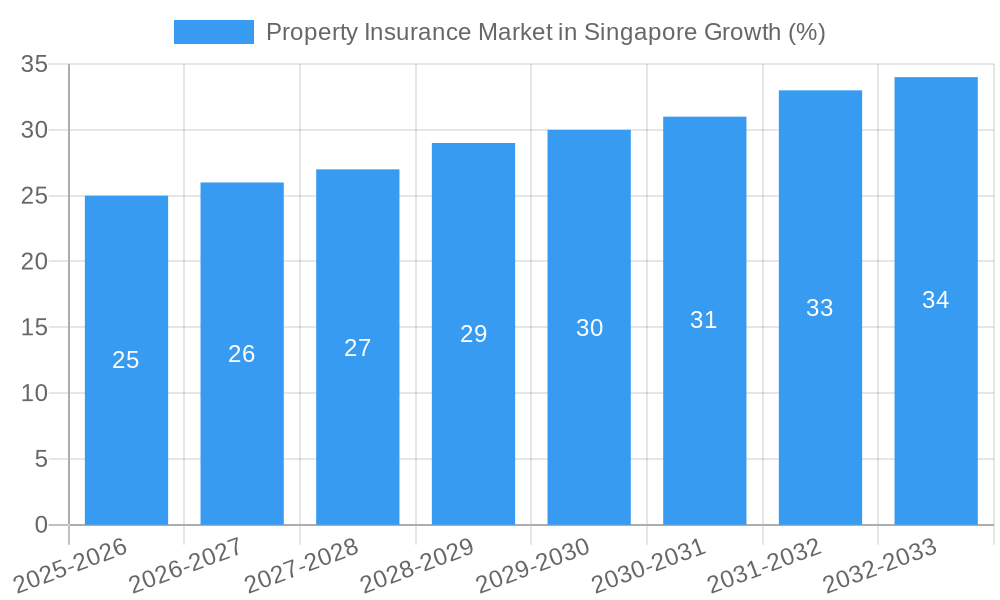

The Singaporean property insurance market, exhibiting a robust CAGR exceeding 5%, presents a compelling investment landscape. Driven by factors such as increasing property values, stringent government regulations emphasizing insurance coverage for new developments, and a growing awareness of potential risks like natural disasters and unforeseen circumstances, the market is poised for significant expansion. The market is segmented by product type (Motor Insurance, Fire and Property Insurance, Employer's Liability Insurance, and Others) and distribution channels (Agents, Brokers, Banks, Online, and Others). Fire and Property Insurance, a substantial portion of the market, is experiencing growth fueled by rising construction activity and the increasing value of both residential and commercial properties. The dominance of traditional distribution channels like agents and brokers is gradually being challenged by the rise of online platforms, offering greater convenience and accessibility to consumers. However, the market faces constraints such as the relatively high cost of insurance premiums and the competitive landscape featuring established players like Liberty Insurance, Etiqa Insurance Singapore, AXA Singapore, and others. The competitive intensity requires insurers to offer innovative products, competitive pricing, and superior customer service to secure market share. The forecast period (2025-2033) anticipates a continued upward trajectory, shaped by sustained economic growth and evolving consumer preferences.

Despite the competitive landscape, opportunities exist for insurers to capitalize on underserved segments, such as offering specialized insurance packages tailored to specific property types or risk profiles. Leveraging advanced technologies like AI and data analytics for improved risk assessment and fraud detection can enhance profitability and efficiency. Furthermore, the growing adoption of digital distribution channels provides avenues for expansion and reaching wider consumer bases. The market's overall growth trajectory is largely influenced by Singapore's economic stability and the government's focus on infrastructure development, creating a positive environment for continued expansion in the property insurance sector. With a market size (in 2025) estimated conservatively at $500 million based on industry trends and reported CAGRs for similar markets, the forecast suggests a considerable increase throughout the forecast period.

Unlock Growth Opportunities: Singapore's Property Insurance Market Report (2019-2033)

This comprehensive report delivers in-depth analysis of Singapore's dynamic property insurance market, projecting a strong growth trajectory from 2025 to 2033. Ideal for insurers, investors, and industry stakeholders, this report provides critical insights into market dynamics, competitive landscapes, and emerging opportunities. Benefit from detailed segmentation analysis, forecasting, and expert assessments to inform strategic decision-making. Download now to navigate the complexities of this lucrative market and capitalize on its vast potential.

Keywords: Singapore property insurance market, insurance market analysis, Singapore insurance industry, property insurance trends, motor insurance Singapore, fire insurance Singapore, insurance market size Singapore, insurance market growth Singapore, AXA Singapore, Allianz Insurance Singapore, Chubb Singapore, NTUC Income, Tokio Marine Singapore, insurance market forecast, market share analysis, M&A activity insurance.

Property Insurance Market in Singapore Market Dynamics & Concentration

Singapore's property insurance market exhibits a moderately concentrated landscape, with key players such as AXA Singapore, Allianz Insurance Singapore, Chubb Singapore, NTUC Income, and Tokio Marine Singapore holding significant market share (estimated at xx% collectively in 2025). Market concentration is influenced by factors like regulatory frameworks, such as the Monetary Authority of Singapore's (MAS) guidelines on solvency and consumer protection. Innovation drivers include the adoption of Insurtech solutions and the increasing use of data analytics for risk assessment. Product substitutes, such as self-insurance options for smaller businesses, pose a moderate challenge. End-user trends show a growing demand for customized and digital insurance solutions. M&A activities have been relatively low in recent years, with only xx deals recorded between 2019 and 2024, indicating a stable but consolidating market.

- Market Share: Top 5 players hold an estimated xx% in 2025.

- M&A Activity: xx deals between 2019-2024.

- Regulatory Impact: MAS regulations significantly impact market structure and competition.

- Innovation Drivers: Insurtech adoption and data analytics are key growth catalysts.

Property Insurance Market in Singapore Industry Trends & Analysis

Singapore's property insurance market is projected to grow at a CAGR of xx% from 2025 to 2033, driven by factors such as increasing urbanization, rising construction activity, and a growing middle class demanding higher levels of protection. Technological advancements, such as AI and IoT, are transforming the industry, enhancing risk assessment, fraud detection, and customer service. Shifting consumer preferences towards digital platforms and personalized insurance solutions are reshaping distribution channels. The competitive landscape is marked by intense rivalry among established players and the emergence of Insurtech startups. Market penetration for property insurance currently stands at xx% in 2025, with significant growth potential in underpenetrated segments. The market is also experiencing challenges such as increasing claims frequency due to natural disasters and the need for improved cybersecurity measures.

Leading Markets & Segments in Property Insurance Market in Singapore

Dominant Segments:

- By Product Type: Fire and property insurance constitutes the largest segment, driven by Singapore's high-value real estate market. Motor insurance is the second largest, reflecting the high vehicle ownership rates. Employer's liability insurance is experiencing moderate growth due to stringent labor regulations.

- By Distribution Channel: Agents and brokers remain the dominant distribution channels, though online channels are gaining traction, fueled by increasing digital literacy and convenience. Banks also play a significant role, offering bundled insurance products.

Key Drivers:

- Economic Growth: Singapore's robust economy and sustained infrastructure development fuel demand for property insurance.

- Government Policies: Supportive government policies and regulations encourage insurance penetration.

- Technological Advancements: Digitalization and Insurtech are driving efficiency and innovation in the market.

Property Insurance Market in Singapore Product Developments

Recent product innovations focus on incorporating technology to enhance customer experience and risk management. The use of AI-powered risk assessment tools, telematics for motor insurance, and bundled insurance packages are becoming increasingly common. These developments aim to provide more accurate pricing, personalized offerings, and efficient claims processing. The market is witnessing the integration of IoT devices for risk monitoring and predictive analytics, further optimizing risk assessment and claim management. The focus is on creating innovative, data-driven products that address specific customer needs and enhance market fit.

Key Drivers of Property Insurance Market in Singapore Growth

Growth in Singapore's property insurance sector is spurred by several factors: the nation's robust economic growth fuels investment in real estate and infrastructure, necessitating increased insurance coverage. Stringent regulatory frameworks ensure market stability and consumer protection. Technological advancements, particularly in Insurtech, are enhancing efficiency and creating opportunities for personalized insurance offerings.

Challenges in the Property Insurance Market in Singapore Market

The market faces challenges such as increasing claims costs driven by natural disasters and cyberattacks, resulting in higher premiums. Intense competition among established players and the emergence of Insurtech disruptors put pressure on profitability. Balancing regulatory compliance with innovation and achieving customer satisfaction in a rapidly evolving digital landscape requires agile strategies. The increasing complexity of risks, particularly in the context of climate change, necessitates advanced risk management capabilities.

Emerging Opportunities in Property Insurance Market in Singapore

The long-term growth of Singapore's property insurance market hinges on leveraging technological advancements. Strategic partnerships between established insurers and Insurtech companies can unlock innovation and create new product offerings. Expansion into specialized niche segments, such as high-net-worth individuals or unique property types, offers significant growth potential. The adoption of sustainable insurance practices, addressing climate-related risks, presents a strategic opportunity to attract environmentally conscious consumers and investors.

Leading Players in the Property Insurance Market in Singapore Sector

- Liberty Insurance

- Etiqa Insurance Singapore

- AXA Singapore

- Allianz Insurance Singapore

- Ergo Insurance

- Sompo Insurance Singapore

- Pacific Prime CXA

- Great Eastern

- MSIG

- Tokio Marine Singapore

- NTUC Income

- Chubb Singapore

Key Milestones in Property Insurance Market in Singapore Industry

- June 2023: Chubb launches an aviation hub in Singapore, expanding its presence in the aerospace insurance sector. This signals a commitment to growth and innovation within a specialized segment.

- January 2022: AXA Insurance introduces "My FinScore," an AI-powered financial planning tool, enhancing customer engagement and personalized financial advice. This highlights the growing use of technology for customer-centric solutions.

Strategic Outlook for Property Insurance Market in Singapore Market

The Singapore property insurance market is poised for robust growth, driven by economic expansion, technological advancements, and evolving consumer needs. Strategic partnerships and investments in Insurtech solutions will be key to maintaining a competitive edge. Focusing on developing personalized and digital products, coupled with proactive risk management strategies, will be crucial for long-term success. The market's future hinges on embracing innovation, adapting to changing regulatory landscapes, and meeting the evolving needs of a sophisticated customer base.

Property Insurance Market in Singapore Segmentation

-

1. Product Type

- 1.1. Motor Insurance

- 1.2. Fire and Property Insurance

- 1.3. Employer's Liability Insurance

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Property Insurance Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Property Insurance Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Embedded Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Inflation is Restraining the Property and Casualty Insurance Market of Singapore

- 3.4. Market Trends

- 3.4.1. Motor Insurance Dominates the Property and Casualty Insurance of Singapore

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Motor Insurance

- 5.1.2. Fire and Property Insurance

- 5.1.3. Employer's Liability Insurance

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Motor Insurance

- 6.1.2. Fire and Property Insurance

- 6.1.3. Employer's Liability Insurance

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Agents

- 6.2.2. Brokers

- 6.2.3. Banks

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Motor Insurance

- 7.1.2. Fire and Property Insurance

- 7.1.3. Employer's Liability Insurance

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Agents

- 7.2.2. Brokers

- 7.2.3. Banks

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Motor Insurance

- 8.1.2. Fire and Property Insurance

- 8.1.3. Employer's Liability Insurance

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Agents

- 8.2.2. Brokers

- 8.2.3. Banks

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Motor Insurance

- 9.1.2. Fire and Property Insurance

- 9.1.3. Employer's Liability Insurance

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Agents

- 9.2.2. Brokers

- 9.2.3. Banks

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Property Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Motor Insurance

- 10.1.2. Fire and Property Insurance

- 10.1.3. Employer's Liability Insurance

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Agents

- 10.2.2. Brokers

- 10.2.3. Banks

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Liberty Insurance

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Etiqa Insurance Singapore**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AXA Singapore

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allianz Insurance Singapore

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ergo Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sompo Insurance Singapore

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pacific Prime CXA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Great Eastern

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MSIG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokio Marine Singapore

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NTUC Income

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Chubb Singapore

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Liberty Insurance

List of Figures

- Figure 1: Global Property Insurance Market in Singapore Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Singapore Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 3: Singapore Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Property Insurance Market in Singapore Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America Property Insurance Market in Singapore Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America Property Insurance Market in Singapore Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 7: North America Property Insurance Market in Singapore Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 8: North America Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Property Insurance Market in Singapore Revenue (Million), by Product Type 2024 & 2032

- Figure 11: South America Property Insurance Market in Singapore Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: South America Property Insurance Market in Singapore Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: South America Property Insurance Market in Singapore Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: South America Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Property Insurance Market in Singapore Revenue (Million), by Product Type 2024 & 2032

- Figure 17: Europe Property Insurance Market in Singapore Revenue Share (%), by Product Type 2024 & 2032

- Figure 18: Europe Property Insurance Market in Singapore Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 19: Europe Property Insurance Market in Singapore Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 20: Europe Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Property Insurance Market in Singapore Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Middle East & Africa Property Insurance Market in Singapore Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Middle East & Africa Property Insurance Market in Singapore Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 25: Middle East & Africa Property Insurance Market in Singapore Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 26: Middle East & Africa Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Property Insurance Market in Singapore Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Property Insurance Market in Singapore Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Property Insurance Market in Singapore Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 31: Asia Pacific Property Insurance Market in Singapore Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 32: Asia Pacific Property Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Property Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Property Insurance Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Property Insurance Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Property Insurance Market in Singapore Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global Property Insurance Market in Singapore Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Property Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Property Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Property Insurance Market in Singapore?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Property Insurance Market in Singapore?

Key companies in the market include Liberty Insurance, Etiqa Insurance Singapore**List Not Exhaustive, AXA Singapore, Allianz Insurance Singapore, Ergo Insurance, Sompo Insurance Singapore, Pacific Prime CXA, Great Eastern, MSIG, Tokio Marine Singapore, NTUC Income, Chubb Singapore.

3. What are the main segments of the Property Insurance Market in Singapore?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Embedded Insurance is Driving the Market.

6. What are the notable trends driving market growth?

Motor Insurance Dominates the Property and Casualty Insurance of Singapore.

7. Are there any restraints impacting market growth?

Inflation is Restraining the Property and Casualty Insurance Market of Singapore.

8. Can you provide examples of recent developments in the market?

June 2023: Chubb, the publicly traded property and casualty insurance company, has launched an aviation hub in Singapore. This strategic move serves to bolster the company's general aviation and aerospace business, demonstrating its commitment to growth and innovation in the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Property Insurance Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Property Insurance Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Property Insurance Market in Singapore?

To stay informed about further developments, trends, and reports in the Property Insurance Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence