Key Insights

The North American feed testing market is experiencing significant expansion, driven by escalating consumer demand for secure and premium animal products. Stringent regulatory mandates for food safety and the increasing incidence of foodborne diseases are key drivers of this growth. The market is segmented by testing methodologies, including pathogen detection, pesticide residue analysis, nutritional content verification, lipid profiling, mycotoxin identification, and ancillary services. Feed categories encompass ruminant, avian, swine, aquaculture, and companion animal nutrition. Pathogen testing dominates market share, attributed to zoonotic disease concerns and biosecurity imperatives. Pesticide residue analysis is also a critical segment, reflecting consumer apprehension regarding chemical contaminants in feed. Growth in aquaculture and pet food sectors directly influences overall market expansion, particularly impacting demand for mycotoxin assessment and nutritional analysis. Substantial investments in sophisticated analytical instrumentation, such as PCR and LC-MS/MS, are enhancing testing precision and speed, thereby stimulating market growth.

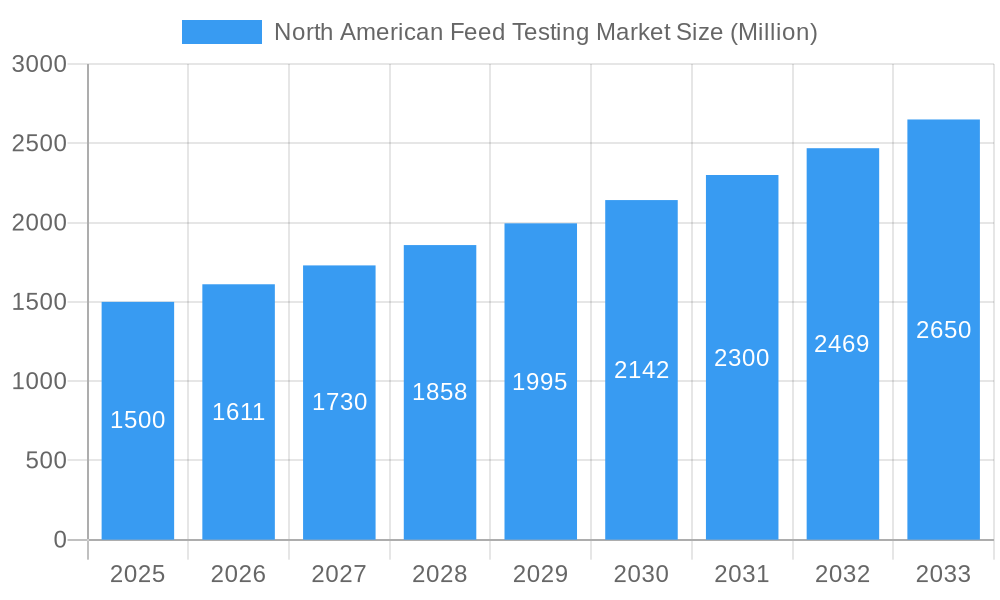

North American Feed Testing Market Market Size (In Million)

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.7%, reaching a market size of $539.05 million by 2025 (base year). This expansion is fueled by heightened consumer and producer awareness of food safety, ongoing advancements in analytical techniques, and the growth of the animal feed sector. Primary market constraints involve the substantial investment required for advanced testing infrastructure and the necessity for specialized expertise. Nevertheless, the persistent demand for stringent quality assurance throughout the feed production lifecycle will sustain market momentum. Leading entities in the North American feed testing market, such as SGS SA, NSF International, and Intertek Group PLC, are committed to service enhancement through technological innovation and strategic alliances, fostering a competitive environment that propels industry-wide efficiency improvements.

North American Feed Testing Market Company Market Share

North American Feed Testing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American feed testing market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, trends, leading players, and future growth prospects. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Key segments analyzed include pathogen testing, pesticide residue analysis, nutritional labeling analysis, fats and oils analysis, mycotoxin testing, and other types across ruminant, poultry, swine, aquaculture, and pet food feeds.

North American Feed Testing Market Market Dynamics & Concentration

The North American feed testing market exhibits a moderately consolidated structure, with several major players holding significant market share. SGS SA, NSF International, and Intertek Group PLC are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. Market concentration is influenced by factors such as economies of scale, technological advancements, and regulatory compliance. Innovation is a key driver, with companies investing heavily in developing advanced testing methodologies like PCR and ELISA for rapid and accurate results. Stringent regulatory frameworks, particularly concerning food safety and animal health, necessitate continuous improvement in testing capabilities. Substitute products are limited, as accurate and reliable feed testing is crucial for maintaining animal health and ensuring product quality. End-user trends, such as increasing demand for sustainable and traceable feed, are further shaping market dynamics. M&A activity has been moderate in recent years, with an estimated xx M&A deals concluded between 2019 and 2024. This activity is expected to continue, driven by the desire to expand geographic reach, enhance technological capabilities, and optimize operational efficiency.

- Market Share: Top 3 players hold xx% (estimated 2025).

- M&A Activity: xx deals (2019-2024).

- Key Drivers: Technological advancements, stringent regulations, increasing demand for sustainable feed.

North American Feed Testing Market Industry Trends & Analysis

The North American feed testing market is experiencing robust growth, driven by a confluence of factors. Heightened consumer awareness regarding food safety and animal welfare is significantly increasing the demand for comprehensive feed analysis. This demand is further amplified by the rising incidence of foodborne illnesses linked to contaminated feed, necessitating stringent quality control measures throughout the supply chain. Technological advancements, particularly the development of rapid, high-throughput testing methods like mass spectrometry and next-generation sequencing, are enhancing efficiency and reducing turnaround times, making testing more accessible and cost-effective. The integration of precision agriculture and data analytics provides valuable insights into feed quality and animal health, fostering the creation of customized testing solutions tailored to specific needs. The market is also witnessing a shift towards natural and organic feed, requiring specialized testing protocols to ensure compliance and quality. This increasing demand for sophisticated testing solutions is fueling market growth, alongside the ongoing development and adoption of advanced analytical techniques. The competitive landscape is characterized by intense rivalry, with companies continuously striving for innovation, superior service quality, and cost optimization to maintain a leading position.

Leading Markets & Segments in North American Feed Testing Market

Within the North American feed testing market, the Poultry Feed segment holds a significant market share driven by the large-scale poultry industry and strict regulations. The Pathogen Testing type dominates due to the critical need for disease prevention and control in animal feed. Geographically, the United States represents the largest market, fueled by a large animal agriculture sector and stringent regulatory standards.

- Dominant Segment (Type): Pathogen Testing (driven by food safety concerns).

- Dominant Segment (Feed Type): Poultry Feed (large-scale production and strict regulations).

- Dominant Region: United States (large agricultural sector and stringent regulations).

- Key Drivers (US): Stringent food safety regulations, large livestock population, advanced research facilities.

North American Feed Testing Market Product Developments

Recent product innovations are focused on enhancing the speed, accuracy, and cost-effectiveness of feed testing. Advancements in molecular biology, including PCR and ELISA technologies, have revolutionized pathogen detection. The emergence of rapid diagnostic tests allows for on-site testing, significantly reducing turnaround times and enabling quicker responses to potential contamination issues. Multiplex assays enable the simultaneous detection of multiple contaminants, maximizing efficiency and minimizing the need for repetitive testing. These innovations provide considerable competitive advantages, enabling companies to deliver faster, more comprehensive, and more affordable services to their clients.

Key Drivers of North American Feed Testing Market Growth

The growth of the North American feed testing market is primarily driven by stringent government regulations related to food safety and animal health. Increasing consumer demand for safe and high-quality food products also fuels this growth. Technological advancements in analytical techniques allow for more rapid and accurate testing, enhancing efficiency and reducing costs. The growing adoption of precision agriculture and data analytics contributes to better feed management, further strengthening the demand for testing services.

Challenges in the North American Feed Testing Market Market

The market faces challenges such as high testing costs, particularly for advanced techniques. Complex regulatory landscapes can create hurdles for smaller companies. The potential for variations in testing methods across different laboratories can also pose challenges to standardization. Furthermore, fluctuating raw material prices and supply chain disruptions can affect the overall cost and availability of testing services.

Emerging Opportunities in North American Feed Testing Market

Several key opportunities are shaping the future of the North American feed testing market. The development of portable and on-site testing devices is expanding access to testing capabilities, particularly in remote areas. Strategic alliances between testing companies and feed manufacturers are creating customized solutions that address specific client needs. The growing adoption of big data and predictive analytics is transforming feed quality management, allowing for proactive measures to prevent contamination and optimize feed formulations. Expansion into emerging market segments within North America, such as the rapidly growing organic and sustainable feed sectors, offers significant potential for new growth avenues.

Leading Players in the North American Feed Testing Market Sector

- SGS SA

- NSF International

- Intertek Group PLC

- Adpen Laboratories Inc

- Bruker Biosciences Corporation

- Genetic ID NA Inc

- Genon Laboratories Ltd

- Eurofins Scientific

- Invisible Sentinel Inc

Key Milestones in North American Feed Testing Market Industry

- 2020: Increased regulatory scrutiny and stricter enforcement regarding mycotoxin contamination in animal feed led to heightened demand for testing services.

- 2021: The introduction of rapid, PCR-based tests for pathogen detection by several leading companies significantly improved testing speed and accuracy.

- 2022: Consolidation within the market through several mergers and acquisitions among smaller testing laboratories reshaped the competitive landscape.

- 2023: The launch of several new software platforms for managing feed testing data enhanced data analysis and reporting capabilities.

Strategic Outlook for North American Feed Testing Market Market

The North American feed testing market is poised for significant growth driven by technological advancements, stringent regulations, and a growing focus on food safety and animal welfare. Strategic partnerships, investments in R&D, and expansion into niche segments like organic and sustainable feed will be crucial for success. The development and adoption of innovative testing technologies will continue to shape the future of the market.

North American Feed Testing Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North American Feed Testing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North American Feed Testing Market Regional Market Share

Geographic Coverage of North American Feed Testing Market

North American Feed Testing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Decreasing Per Capita Arable Land; Increased Demand for Food

- 3.3. Market Restrains

- 3.3.1. High Initial Investments; Requirement of Precision Agriculture

- 3.4. Market Trends

- 3.4.1. Increasing Government Regulations Driving Growth of Pet Food Testing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North American Feed Testing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NSF Internationa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Adpen Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bruker Biosciences Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Genetic ID NA Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genon Laboratories Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eurofins Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Invisible Sentinel Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGS SA

List of Figures

- Figure 1: North American Feed Testing Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North American Feed Testing Market Share (%) by Company 2025

List of Tables

- Table 1: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 2: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North American Feed Testing Market Revenue million Forecast, by Region 2020 & 2033

- Table 7: North American Feed Testing Market Revenue million Forecast, by Production Analysis 2020 & 2033

- Table 8: North American Feed Testing Market Revenue million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North American Feed Testing Market Revenue million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North American Feed Testing Market Revenue million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North American Feed Testing Market Revenue million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North American Feed Testing Market Revenue million Forecast, by Country 2020 & 2033

- Table 13: United States North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Canada North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North American Feed Testing Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North American Feed Testing Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the North American Feed Testing Market?

Key companies in the market include SGS SA, NSF Internationa, Intertek Group PLC, Adpen Laboratories Inc, Bruker Biosciences Corporation, Genetic ID NA Inc, Genon Laboratories Ltd, Eurofins Scientific, Invisible Sentinel Inc.

3. What are the main segments of the North American Feed Testing Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 539.05 million as of 2022.

5. What are some drivers contributing to market growth?

Decreasing Per Capita Arable Land; Increased Demand for Food.

6. What are the notable trends driving market growth?

Increasing Government Regulations Driving Growth of Pet Food Testing Market.

7. Are there any restraints impacting market growth?

High Initial Investments; Requirement of Precision Agriculture.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North American Feed Testing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North American Feed Testing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North American Feed Testing Market?

To stay informed about further developments, trends, and reports in the North American Feed Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence