Key Insights

The North American fertilizer market, projected at $63.76 billion in 2025, is poised for robust growth. This expansion is fueled by escalating global food and feed crop demand, necessitating higher agricultural productivity across the US, Canada, and Mexico. The widespread adoption of precision agriculture, including fertigation and variable rate application, enhances fertilizer efficiency and minimizes environmental impact, further stimulating market growth. Supportive government policies promoting sustainable agriculture also encourage the use of advanced nutrient uptake solutions. Key challenges include fluctuating raw material costs and potential supply chain disruptions. The market is segmented by fertilizer type (straight, conventional, specialty), application (fertigation, foliar, soil), and crop (horticultural, turf & ornamental). While the US leads the market, Canada and Mexico offer significant growth potential due to expanding agricultural sectors and favorable government policies. The competitive landscape features established entities like Nutrien Ltd., CF Industries Holdings Inc., and Mosaic Company, alongside specialized regional players. A projected Compound Annual Growth Rate (CAGR) of 5.13% from 2025 to 2033 indicates sustained market expansion, requiring strategic navigation of economic and environmental factors. Specialty fertilizers and precision application methods are expected to outperform conventional approaches.

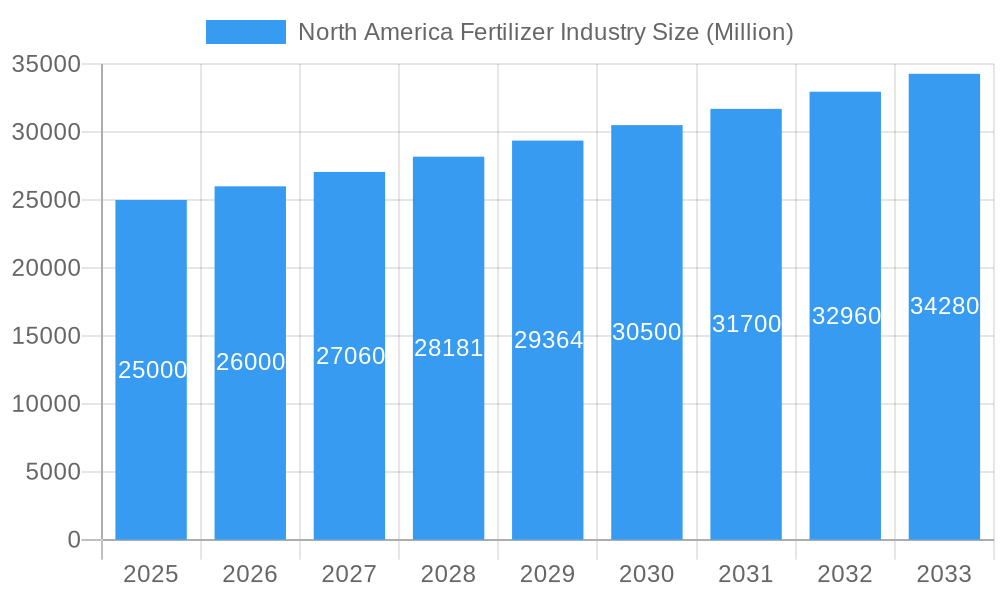

North America Fertilizer Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates consistent market expansion, driven by increasing agricultural output to meet rising global food requirements and continuous advancements in fertilizer technology. This growth trajectory is likely to spur investment in research and development focused on enhanced nutrient efficiency and eco-friendly alternatives. Intensifying competition among major industry players will foster innovation, potentially leading to strategic mergers and acquisitions. Future projections must account for the market's sensitivity to global economic trends and weather patterns. A sustained commitment to sustainable practices and the reduction of environmental impacts will be critical for long-term market stability and acceptance. Regulatory frameworks governing fertilizer use and environmental protection will significantly shape the market's future. Industry participants are strategically aligning to meet escalating demand while adapting to evolving consumer preferences and sustainability mandates.

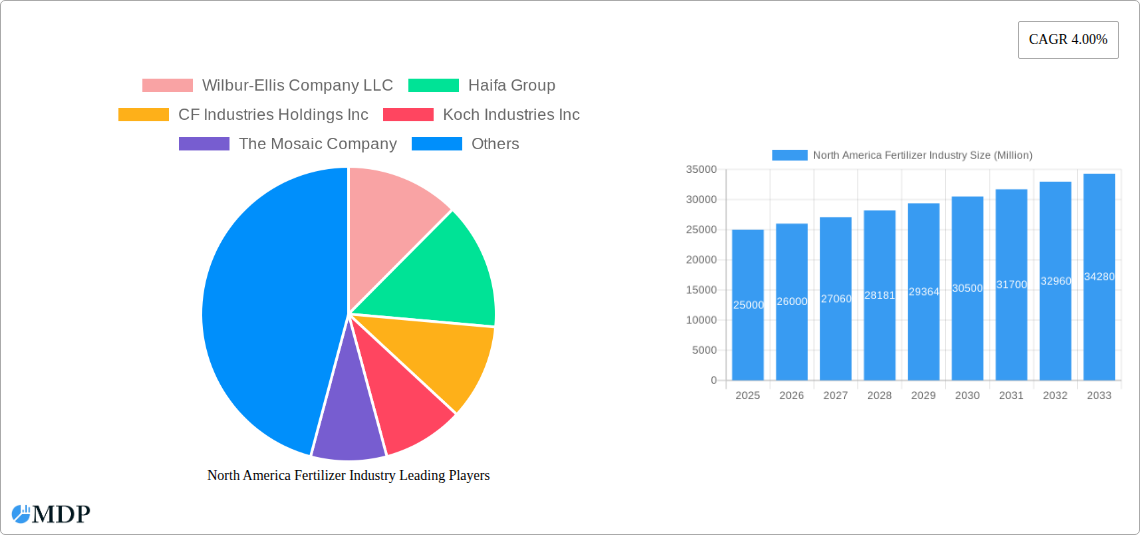

North America Fertilizer Industry Company Market Share

North America Fertilizer Industry Analysis: Market Size, CAGR & Future Outlook (2019-2033)

This comprehensive report analyzes the North American fertilizer industry, detailing market dynamics, emerging trends, key players, and future growth prospects. The study covers the period from 2019 to 2033, with 2025 designated as the base year and 2025-2033 as the forecast period. Essential for industry stakeholders, investors, and market observers, this report utilizes high-impact keywords such as "fertilizer market," "North America," "fertilizer industry," "market analysis," "market growth," and "industry trends" for optimal search engine visibility.

North America Fertilizer Industry Market Dynamics & Concentration

The North American fertilizer market, valued at xx Million in 2024, is characterized by moderate concentration, with several key players commanding significant market share. The market's dynamics are shaped by several factors, including technological innovation, stringent regulatory frameworks, the emergence of product substitutes (e.g., biofertilizers), evolving end-user trends toward sustainable agriculture, and a robust mergers and acquisitions (M&A) landscape.

- Market Concentration: The top five players (Nutrien Ltd, CF Industries Holdings Inc, Mosaic Company, Koch Industries Inc, and Yara International AS) collectively hold an estimated xx% market share.

- Innovation Drivers: Focus on precision agriculture, biofertilizers, and nutrient-use efficiency technologies are driving innovation.

- Regulatory Frameworks: Environmental regulations concerning nutrient runoff and greenhouse gas emissions significantly impact fertilizer production and application methods.

- Product Substitutes: The growing interest in sustainable agriculture is increasing the adoption of biofertilizers and organic alternatives, creating competitive pressure.

- End-User Trends: Demand is driven by the increasing need to enhance crop yields and meet the growing food demand of a burgeoning population.

- M&A Activities: The industry has witnessed xx M&A deals in the last five years, reflecting consolidation efforts and strategic expansion by major players.

North America Fertilizer Industry Industry Trends & Analysis

The North American fertilizer market exhibits a CAGR of xx% during the forecast period (2025-2033). Key growth drivers include the rising global demand for food, increasing crop yields in key agricultural regions like the US Corn Belt, and government initiatives promoting agricultural productivity. Technological disruptions, such as precision farming technologies and the development of advanced fertilizer formulations, are transforming the industry, enhancing efficiency and sustainability. Consumer preferences are shifting towards sustainable and environmentally friendly fertilizers, increasing the demand for biofertilizers and organic options. The competitive landscape is highly dynamic, with intense rivalry among major players based on pricing, product innovation, and market reach. Market penetration of advanced fertilizer technologies (e.g., controlled-release fertilizers) is expected to reach xx% by 2033.

Leading Markets & Segments in North America Fertilizer Industry

The United States dominates the North American fertilizer market, accounting for approximately xx% of total revenue. Within the segments:

- Type: Straight fertilizers hold the largest market share, driven by their cost-effectiveness and widespread application.

- Form: Conventional fertilizers continue to dominate, although the demand for specialty fertilizers is growing rapidly, driven by the need for targeted nutrient management.

- Application Mode: Soil application remains the prevalent method, while fertigation and foliar application are gaining traction due to their enhanced efficiency.

- Crop Type: Horticultural crops and turf & ornamental segments are high-growth markets driven by increased landscaping and gardening activities.

Key Drivers for Dominant Regions:

- United States: Strong agricultural sector, favorable government policies, and robust infrastructure.

- Canada: Significant agricultural land, investment in agricultural technology, and export-oriented agricultural economy.

- Mexico: Growing population, increasing food demand, and government support for agricultural development.

North America Fertilizer Industry Product Developments

Recent product innovations focus on enhancing nutrient use efficiency, improving environmental sustainability, and developing customized fertilizer solutions tailored to specific crop needs. Technological advancements like controlled-release fertilizers and biostimulants are improving nutrient delivery and crop uptake, reducing waste and environmental impact. The market is witnessing the emergence of products with improved nutrient content, enhanced formulation, and reduced environmental footprint, offering substantial competitive advantages.

Key Drivers of North America Fertilizer Industry Growth

Technological advancements in fertilizer production and application methods, coupled with increasing government support for agricultural development and the growing global demand for food, are primary growth catalysts. Economic factors, such as rising disposable incomes and increasing agricultural output, further fuel demand. Favorable government policies that incentivize sustainable agricultural practices also contribute significantly.

Challenges in the North America Fertilizer Industry Market

The industry faces challenges including volatile raw material prices, stringent environmental regulations, supply chain disruptions (particularly during global events), and intense competition among major players. These factors contribute to fluctuating fertilizer prices and operational complexities, impacting profitability and overall market stability. The increasing adoption of sustainable agricultural practices also presents a significant challenge, necessitating a shift towards eco-friendly fertilizer solutions.

Emerging Opportunities in North America Fertilizer Industry

The industry presents exciting opportunities through technological innovation, including the development of more efficient and environmentally friendly fertilizers and precision farming technologies that optimize nutrient application. Strategic partnerships aimed at streamlining supply chains and expanding market reach, coupled with government support for sustainable agriculture, will facilitate long-term growth. Expansion into high-growth markets, such as organic and specialty fertilizers, offers additional avenues for growth.

Leading Players in the North America Fertilizer Industry Sector

- Wilbur-Ellis Company LLC

- Haifa Group

- CF Industries Holdings Inc

- Koch Industries Inc

- The Mosaic Company

- The Andersons Inc

- Yara International AS

- Nutrien Ltd

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

Key Milestones in North America Fertilizer Industry Industry

- August 2022: Koch Industries Inc invested USD 30 Million in a Kansas nitrogen plant, boosting UAN production by 35,000 tons annually.

- October 2022: The Andersons Inc acquired Mote Farm Service, Inc., expanding its retail farm center network.

- January 2023: ICL Group Ltd formed a strategic partnership with General Mills, supplying specialty phosphate solutions and aiming for international expansion.

Strategic Outlook for North America Fertilizer Industry Market

The North American fertilizer market is poised for sustained growth, driven by technological advancements, evolving consumer preferences, and government support. Strategic partnerships, product innovation, and expansion into niche markets, such as specialty and organic fertilizers, will be crucial for achieving long-term success in this competitive industry. The focus on sustainability and efficiency will continue to shape future market dynamics, creating opportunities for innovative companies.

North America Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

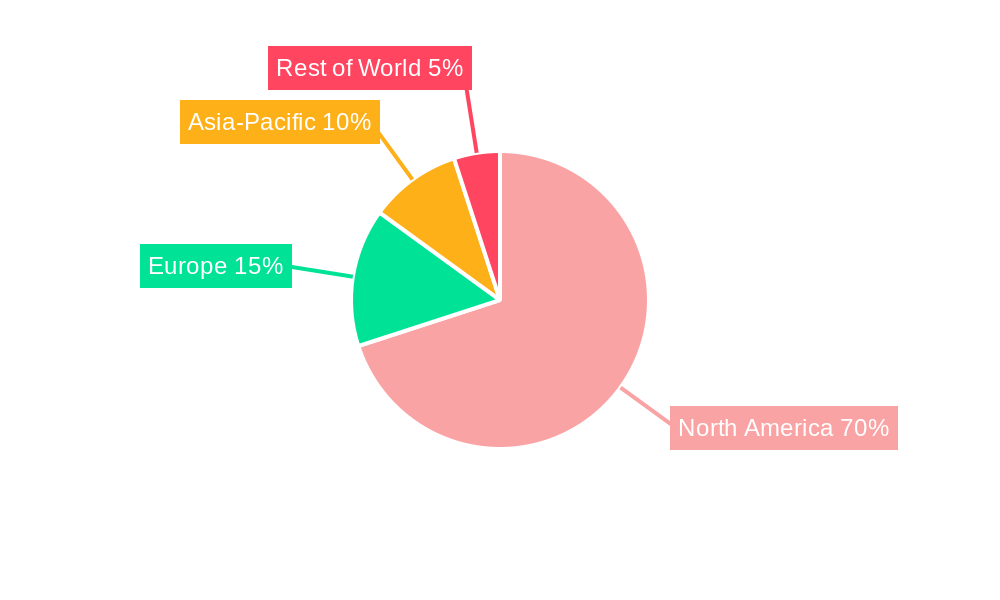

North America Fertilizer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Fertilizer Industry Regional Market Share

Geographic Coverage of North America Fertilizer Industry

North America Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness of Landscaping Maintenance; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Wilbur-Ellis Company LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Haifa Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CF Industries Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koch Industries Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Mosaic Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Andersons Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yara International AS

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nutrien Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ICL Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sociedad Quimica y Minera de Chile SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Wilbur-Ellis Company LLC

List of Figures

- Figure 1: North America Fertilizer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Fertilizer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Fertilizer Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Fertilizer Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fertilizer Industry?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the North America Fertilizer Industry?

Key companies in the market include Wilbur-Ellis Company LLC, Haifa Group, CF Industries Holdings Inc, Koch Industries Inc, The Mosaic Company, The Andersons Inc, Yara International AS, Nutrien Ltd, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the North America Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.76 billion as of 2022.

5. What are some drivers contributing to market growth?

Awareness of Landscaping Maintenance; Technological Advancements.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Skilled Labor; Wastage of High Amount of Water For Irrigating Lawns.

8. Can you provide examples of recent developments in the market?

January 2023: ICL has entered into a strategic partnership agreement with General Mills, in which it will be the supplier of strategic specialty phosphate solutions to General Mills. The long-term agreement will also focus on international expansion.October 2022: The Andersons entered into an agreement to acquire the assets of Mote Farm Service, Inc. to expand thier retail farm center network.August 2022: Koch invested around USD 30 million in the Kansas nitrogen plant to increase UAN production by 35,000 tons per year to meet growing UAN demand across western Kansas and eastern Colorado.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fertilizer Industry?

To stay informed about further developments, trends, and reports in the North America Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence