Key Insights

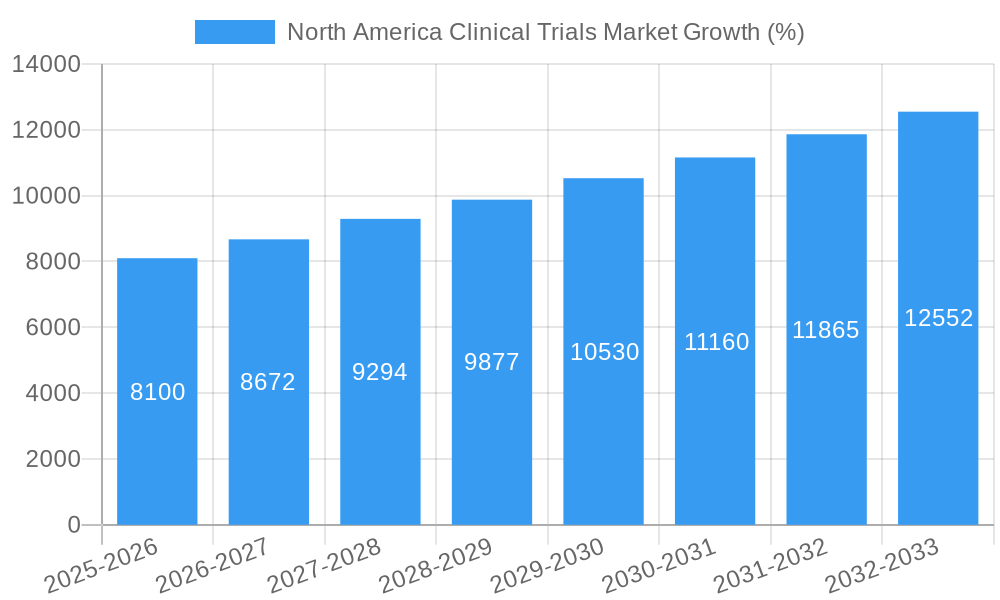

The North American clinical trials market, valued at approximately $X billion in 2025 (estimated based on the provided 8.10% CAGR and a stated market size "XX" in million units – requiring a reasonable assumption for the "XX" value, say, $100 billion, for illustrative purposes, which can be adjusted as needed with actual data), is poised for robust growth over the forecast period 2025-2033. This expansion is fueled by several key drivers. The increasing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions necessitates extensive clinical research and development. Furthermore, advancements in medical technologies, including personalized medicine and gene therapy, create new avenues for clinical trials, requiring significant investment and a growing workforce. Government initiatives promoting medical innovation and supporting research through funding programs and regulatory streamlining also contribute significantly. The market is segmented by trial phase (I-IV), study design (Treatment Studies, Randomized Control Trials – double, single, and non-blind; Non-randomized Control Trials – observational studies), and major players such as Novo Nordisk, Roche, Pfizer, and IQVIA. The North American region, particularly the United States, is expected to dominate the market owing to advanced healthcare infrastructure, substantial investment in R&D, and a robust regulatory framework. However, challenges such as increasing clinical trial costs, stringent regulatory requirements, and ethical concerns regarding patient data privacy and informed consent may restrain market growth to some degree.

The competitive landscape is characterized by the presence of large pharmaceutical companies, Contract Research Organizations (CROs), and clinical research laboratories. Companies are focusing on strategic partnerships and acquisitions to expand their service offerings and geographic reach. Technological advancements in data analytics and artificial intelligence (AI) are transforming clinical trial processes, leading to increased efficiency and reduced timelines. The growing adoption of decentralized clinical trials (DCTs) is further expected to accelerate market growth by enhancing patient accessibility and participation. While challenges remain, the overall outlook for the North American clinical trials market remains positive, driven by technological advancements, increasing prevalence of chronic diseases, and a supportive regulatory environment. Continued growth is anticipated, particularly within the phases involving advanced therapies and personalized medicine approaches.

North America Clinical Trials Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America clinical trials market, covering market dynamics, industry trends, leading segments, key players, and future growth opportunities. The study period spans from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. This report is crucial for stakeholders across the pharmaceutical, biotech, and CRO industries seeking actionable insights to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

North America Clinical Trials Market Market Dynamics & Concentration

The North America clinical trials market is characterized by a moderately concentrated landscape, with key players like Novo Nordisk AS, PAREXEL International Corporation, F Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America, and Pfizer Inc holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory changes, and strategic mergers and acquisitions (M&A).

- Market Share: The top 5 players collectively hold approximately xx% of the market share in 2025. This is projected to xx% by 2033.

- Innovation Drivers: Continuous advancements in medical technology, novel drug development, and personalized medicine drive significant market growth.

- Regulatory Frameworks: Stringent regulatory approvals and ethical considerations impact clinical trial timelines and costs. The FDA’s evolving guidelines play a crucial role.

- Product Substitutes: The emergence of alternative therapies and diagnostic tools could impact demand for certain clinical trials.

- End-User Trends: Increasing prevalence of chronic diseases, growing geriatric population, and rising demand for improved healthcare outcomes fuel market demand.

- M&A Activities: The market has witnessed xx M&A deals in the historical period (2019-2024), primarily driven by strategic expansion and portfolio diversification. This trend is expected to continue.

North America Clinical Trials Market Industry Trends & Analysis

The North America clinical trials market exhibits a robust CAGR of xx% during the forecast period (2025-2033). Several key factors drive this growth:

- Technological Disruptions: Advancements in digital technologies, including AI and machine learning, are transforming clinical trial design, data management, and patient recruitment.

- Consumer Preferences: Patients are increasingly demanding greater transparency and participation in clinical trials, influencing trial design and recruitment strategies.

- Competitive Dynamics: Intense competition among CROs and pharmaceutical companies necessitates continuous innovation and operational efficiency.

- Market Growth Drivers: The rising prevalence of chronic diseases such as cancer, cardiovascular diseases, and diabetes significantly drives market growth. Increasing government funding for research and development also plays a vital role. Furthermore, the rising adoption of advanced technologies like telemedicine and remote patient monitoring has led to improved trial efficiency. Market penetration of decentralized clinical trials is anticipated to increase significantly, leading to a higher level of efficiency.

- Market Penetration: The market penetration of innovative treatment modalities and digital technologies is expected to increase to xx% by 2033.

Leading Markets & Segments in North America Clinical Trials Market

The United States dominates the North America clinical trials market, driven by robust healthcare infrastructure, substantial research funding, and a large patient pool. Within the segments:

- Phase I Trials: Driven by the need for early-stage drug safety and efficacy assessment.

- Phase II Trials: Focuses on efficacy evaluation in a larger patient population.

- Phase III Trials: Large-scale trials to confirm drug effectiveness and safety before regulatory submission.

- Phase IV Trials: Post-market surveillance to monitor long-term safety and efficacy.

- Treatment Studies: The most prevalent trial design, focusing on evaluating therapeutic interventions.

- Randomized Control Trials (RCTs): Double-blind RCTs are widely adopted for their robustness. Single-blind and non-blind RCTs are also utilized based on specific study requirements.

- Non-randomized Control Trials: Observational studies are increasingly used to evaluate real-world evidence.

Key Drivers:

- Economic Policies: Government incentives and funding for research and development.

- Healthcare Infrastructure: Well-established healthcare facilities and research institutions.

- Technological Advancements: Adoption of advanced technologies leading to greater efficiency.

North America Clinical Trials Market Product Developments

Recent innovations include the development of advanced digital tools for patient recruitment and data management, accelerating trial timelines and reducing costs. The increased focus on decentralized trials, leveraging telemedicine and remote monitoring, is enhancing patient engagement and access. These advancements contribute to improved trial efficiency and cost-effectiveness, making clinical trials more accessible and enhancing the value proposition for pharmaceutical and biotech companies.

Key Drivers of North America Clinical Trials Market Growth

The growth of the North America clinical trials market is fueled by several factors:

- Technological Advancements: Artificial intelligence (AI) and machine learning are revolutionizing trial design and data analysis.

- Economic Factors: Increased funding for research and development from both government and private sources.

- Regulatory Landscape: The FDA's focus on expediting drug approvals facilitates faster trial timelines.

Challenges in the North America Clinical Trials Market Market

Significant challenges include:

- Regulatory Hurdles: Stringent regulatory requirements and lengthy approval processes can delay trials.

- Supply Chain Issues: The COVID-19 pandemic exposed vulnerabilities in the supply chain, impacting trial timelines and costs.

- Competitive Pressures: Intense competition among CROs and pharmaceutical companies. The estimated cost for conducting clinical trials in the US is xx Million, which increases the competitive pressure on companies.

Emerging Opportunities in North America Clinical Trials Market

Emerging opportunities include:

- Technological Breakthroughs: Advancements in gene therapy, immunotherapy, and personalized medicine are creating new therapeutic areas and trial designs.

- Strategic Partnerships: Collaborations between pharmaceutical companies and technology providers are driving innovation.

- Market Expansion: Increased focus on emerging markets and global trial expansion.

Leading Players in the North America Clinical Trials Market Sector

- Novo Nordisk AS

- PAREXEL International Corporation

- F Hoffmann-La Roche Ltd

- ICON PLC

- Eli Lilly and Company

- Clinipace

- Pharmaceutical Product Development LLC

- IQVIA

- Laboratory Corporation of America

- Pfizer Inc

Key Milestones in North America Clinical Trials Market Industry

- September 2022: IVERIC bio, Inc. initiated an Open-label Extension (OLE) Phase 3 trial for avacincaptad pegol.

- September 2022: The University of Illinois at Chicago launched a clinical trial investigating blood flow and blood pressure in Down syndrome.

Strategic Outlook for North America Clinical Trials Market Market

The North America clinical trials market presents substantial long-term growth potential, driven by technological advancements, increasing investment in R&D, and the growing prevalence of chronic diseases. Strategic partnerships and collaborations will be crucial for navigating the evolving regulatory landscape and maximizing market opportunities. The focus on decentralized trials and technological innovation will continue to shape the industry's future.

North America Clinical Trials Market Segmentation

-

1. Phase

- 1.1. Phase I

- 1.2. Phase II

- 1.3. Phase III

- 1.4. Phase IV

-

2. Design

-

2.1. Treatment Studies

-

2.1.1. Randomized Control Trial

- 2.1.1.1. Double Blind Trial Randomized Trial

- 2.1.1.2. Single Blind Trial Randomized Trial

- 2.1.1.3. Non-blind Randomized Trial

- 2.1.2. Adaptive Clinical Trial

- 2.1.3. Non-randomized Control Trial

-

2.1.1. Randomized Control Trial

-

2.2. Observational Studies

- 2.2.1. Cohort Study

- 2.2.2. Case Control Study

- 2.2.3. Cross Sectional Study

- 2.2.4. Ecological Study

-

2.1. Treatment Studies

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Clinical Trials Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Clinical Trials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Workforce for Clinical Research; Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 5.1.1. Phase I

- 5.1.2. Phase II

- 5.1.3. Phase III

- 5.1.4. Phase IV

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Treatment Studies

- 5.2.1.1. Randomized Control Trial

- 5.2.1.1.1. Double Blind Trial Randomized Trial

- 5.2.1.1.2. Single Blind Trial Randomized Trial

- 5.2.1.1.3. Non-blind Randomized Trial

- 5.2.1.2. Adaptive Clinical Trial

- 5.2.1.3. Non-randomized Control Trial

- 5.2.1.1. Randomized Control Trial

- 5.2.2. Observational Studies

- 5.2.2.1. Cohort Study

- 5.2.2.2. Case Control Study

- 5.2.2.3. Cross Sectional Study

- 5.2.2.4. Ecological Study

- 5.2.1. Treatment Studies

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Phase

- 6. United States North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 6.1.1. Phase I

- 6.1.2. Phase II

- 6.1.3. Phase III

- 6.1.4. Phase IV

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Treatment Studies

- 6.2.1.1. Randomized Control Trial

- 6.2.1.1.1. Double Blind Trial Randomized Trial

- 6.2.1.1.2. Single Blind Trial Randomized Trial

- 6.2.1.1.3. Non-blind Randomized Trial

- 6.2.1.2. Adaptive Clinical Trial

- 6.2.1.3. Non-randomized Control Trial

- 6.2.1.1. Randomized Control Trial

- 6.2.2. Observational Studies

- 6.2.2.1. Cohort Study

- 6.2.2.2. Case Control Study

- 6.2.2.3. Cross Sectional Study

- 6.2.2.4. Ecological Study

- 6.2.1. Treatment Studies

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Phase

- 7. Canada North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 7.1.1. Phase I

- 7.1.2. Phase II

- 7.1.3. Phase III

- 7.1.4. Phase IV

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Treatment Studies

- 7.2.1.1. Randomized Control Trial

- 7.2.1.1.1. Double Blind Trial Randomized Trial

- 7.2.1.1.2. Single Blind Trial Randomized Trial

- 7.2.1.1.3. Non-blind Randomized Trial

- 7.2.1.2. Adaptive Clinical Trial

- 7.2.1.3. Non-randomized Control Trial

- 7.2.1.1. Randomized Control Trial

- 7.2.2. Observational Studies

- 7.2.2.1. Cohort Study

- 7.2.2.2. Case Control Study

- 7.2.2.3. Cross Sectional Study

- 7.2.2.4. Ecological Study

- 7.2.1. Treatment Studies

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Phase

- 8. Mexico North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 8.1.1. Phase I

- 8.1.2. Phase II

- 8.1.3. Phase III

- 8.1.4. Phase IV

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Treatment Studies

- 8.2.1.1. Randomized Control Trial

- 8.2.1.1.1. Double Blind Trial Randomized Trial

- 8.2.1.1.2. Single Blind Trial Randomized Trial

- 8.2.1.1.3. Non-blind Randomized Trial

- 8.2.1.2. Adaptive Clinical Trial

- 8.2.1.3. Non-randomized Control Trial

- 8.2.1.1. Randomized Control Trial

- 8.2.2. Observational Studies

- 8.2.2.1. Cohort Study

- 8.2.2.2. Case Control Study

- 8.2.2.3. Cross Sectional Study

- 8.2.2.4. Ecological Study

- 8.2.1. Treatment Studies

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Phase

- 9. United States North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Clinical Trials Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Novo Nordisk AS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PAREXEL International Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 F Hoffmann-La Roche Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ICON PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eli Lilly and Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Clinipace

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Pharmaceutical Product Development LLC

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 IQVIA

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Laboratory Corporation of America

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pfizer Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Novo Nordisk AS

List of Figures

- Figure 1: North America Clinical Trials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Clinical Trials Market Share (%) by Company 2024

List of Tables

- Table 1: North America Clinical Trials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 3: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 4: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Clinical Trials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Clinical Trials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 12: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 13: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 16: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 17: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Clinical Trials Market Revenue Million Forecast, by Phase 2019 & 2032

- Table 20: North America Clinical Trials Market Revenue Million Forecast, by Design 2019 & 2032

- Table 21: North America Clinical Trials Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Clinical Trials Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clinical Trials Market?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the North America Clinical Trials Market?

Key companies in the market include Novo Nordisk AS, PAREXEL International Corporation, F Hoffmann-La Roche Ltd, ICON PLC, Eli Lilly and Company, Clinipace, Pharmaceutical Product Development LLC, IQVIA, Laboratory Corporation of America, Pfizer Inc.

3. What are the main segments of the North America Clinical Trials Market?

The market segments include Phase, Design, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Clinical Trials; High R&D Expenditure of the Pharmaceutical Industry; Rising Prevalence of Diseases.

6. What are the notable trends driving market growth?

Phase III is the Largest Segment Under Phases that is Expected to Grow During the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Skilled Workforce for Clinical Research; Stringent Regulations.

8. Can you provide examples of recent developments in the market?

In September 2022, IVERIC bio, Inc. started an Open-label Extension (OLE) phase 3 trial to assess the safety of intravitreal administration of avacincaptad pegol (complement C5 inhibitor) in patients with geographic atrophy who previously completed phase 3 study ISEE2008 (GATHER2).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clinical Trials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clinical Trials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clinical Trials Market?

To stay informed about further developments, trends, and reports in the North America Clinical Trials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence