Key Insights

The Indian specialty fertilizer market is poised for significant expansion, projected to reach $39.9 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3%. This growth is fueled by the imperative to increase crop yields, meet escalating demand for premium agricultural products, and embrace sustainable farming initiatives. The market is anticipated to grow to an estimated $69.9 billion by 2033, driven by the increasing adoption of advanced techniques such as fertigation and foliar application. Farmers are increasingly recognizing the superior benefits of specialty fertilizers over conventional options, alongside a heightened focus on enhancing crop quality and nutritional content. Controlled Release Fertilizers (CRF) and water-soluble fertilizers are leading segments due to their precision nutrient delivery and superior efficacy. Horticultural and field crops represent the primary consumption categories, underscoring the growing demand for fruits, vegetables, and staple grains.

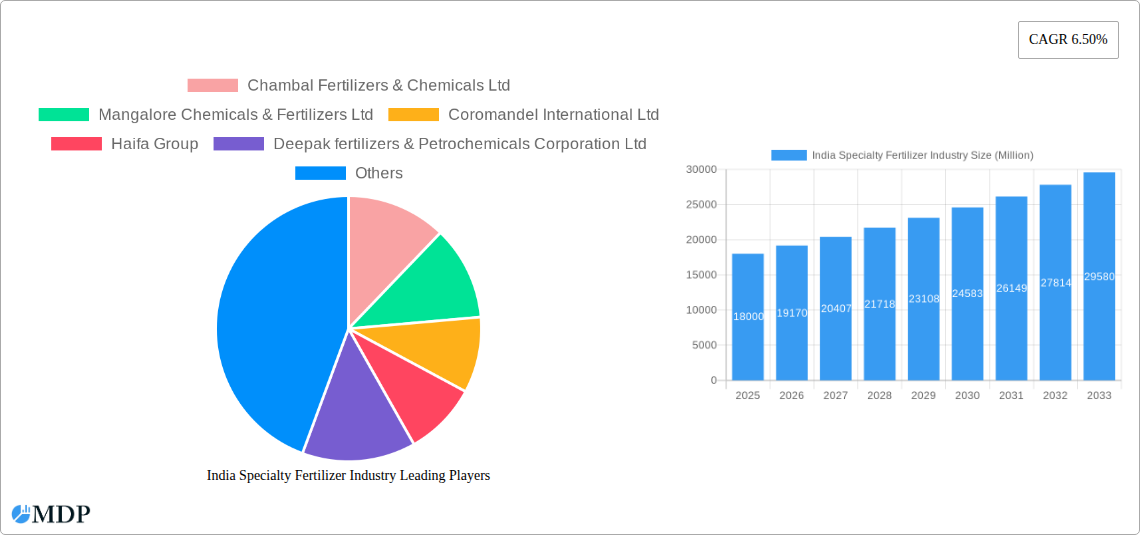

India Specialty Fertilizer Industry Market Size (In Billion)

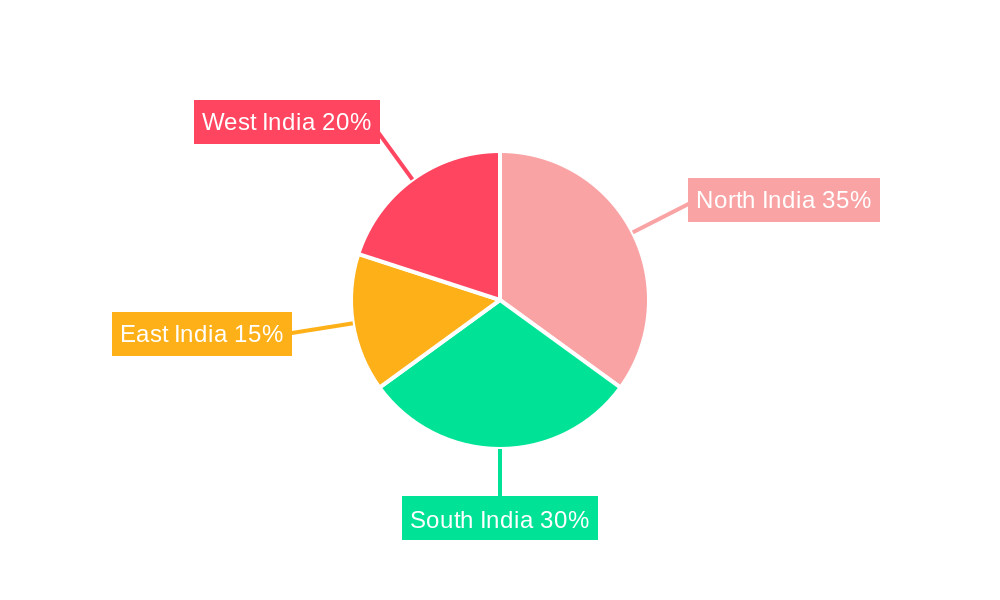

Geographically, the North and South regions currently lead the market due to intensive agricultural practices. However, investments in agricultural infrastructure and government support are expected to drive substantial growth in the East and West regions over the forecast period. Key market participants, including Chambal Fertilizers, Mangalore Chemicals, Coromandel International, Yara, and ICL, are strategically investing in R&D, product diversification, and distribution network expansion to leverage market opportunities. Potential growth inhibitors include volatile raw material costs, environmental considerations associated with specific specialty fertilizer types, and the necessity for enhanced farmer education on optimal application methods.

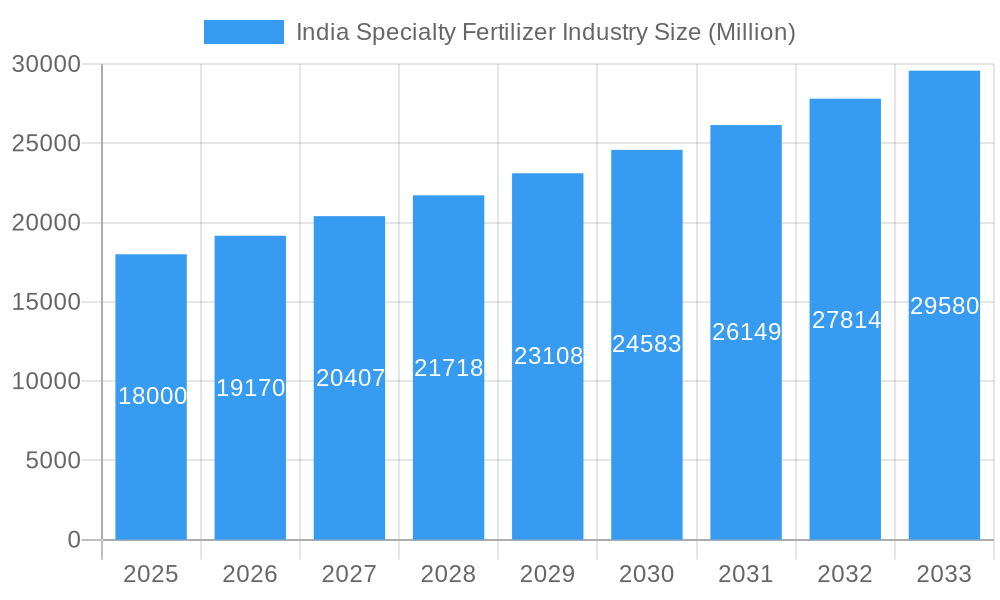

India Specialty Fertilizer Industry Company Market Share

India Specialty Fertilizer Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India specialty fertilizer industry, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We project a market size of XX Million in 2025, experiencing significant growth throughout the forecast period. This report utilizes high-impact keywords to maximize search engine optimization (SEO) and deliver actionable intelligence.

India Specialty Fertilizer Industry Market Dynamics & Concentration

The Indian specialty fertilizer market exhibits a moderately concentrated landscape, with several major players vying for market share. While a few large multinational corporations hold significant positions, a vibrant ecosystem of domestic producers and regional players also contribute to the market's dynamism. Market concentration is influenced by factors like economies of scale in production, access to raw materials, and distribution networks. The market share of the top 5 players is estimated at approximately 60% in 2025.

- Innovation Drivers: Technological advancements in fertilizer formulation, including nano-fertilizers and bio-stimulants, are key innovation drivers. Companies are focusing on developing products with improved nutrient use efficiency (NUE) and sustainable practices.

- Regulatory Frameworks: Government policies promoting sustainable agriculture and improved nutrient management influence market dynamics. Regulations related to fertilizer registration, quality control, and environmental protection create both opportunities and challenges.

- Product Substitutes: Organic fertilizers and biofertilizers present competition to specialty fertilizers. However, the demand for specialty fertilizers is likely to remain robust due to their efficacy and targeted application.

- End-User Trends: Growing awareness among farmers about the benefits of precision fertilization and improved crop yields is driving demand for specialty fertilizers. Increased adoption of advanced agricultural techniques such as fertigation further fuels growth.

- M&A Activities: The number of M&A deals in the Indian specialty fertilizer industry has been steadily increasing, indicating strategic consolidation and expansion efforts by major players. In 2024, approximately 5 major M&A deals were observed, mostly focused on enhancing product portfolios and distribution networks. This signifies a consolidation trend to enhance market share and competitiveness.

India Specialty Fertilizer Industry Industry Trends & Analysis

The Indian specialty fertilizer market is experiencing robust growth, driven by factors such as rising agricultural output, government initiatives promoting sustainable farming practices, and increasing farmer awareness about precision agriculture. The market is characterized by a shift towards high-value specialty fertilizers, showcasing enhanced nutrient use efficiency and tailored crop solutions. We project a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration is expected to increase as more farmers adopt advanced agricultural techniques and realize the benefits of targeted fertilization.

Technological advancements, particularly in nano-fertilizers and controlled-release formulations, are significantly impacting the market. The increasing availability of advanced data analytics solutions is further enhancing farm management practices, leading to higher fertilizer efficiency and optimized yields. Consumer preferences are shifting towards eco-friendly and sustainable specialty fertilizers, influencing product development strategies across the industry. Competitive dynamics are intense, with companies vying for market share through product innovation, strategic partnerships, and efficient distribution networks.

Leading Markets & Segments in India Specialty Fertilizer Industry

While the demand for specialty fertilizers is widespread across India, certain regions demonstrate stronger growth potential. The states of Punjab, Haryana, Uttar Pradesh, and Andhra Pradesh, known for their intensive agriculture, represent significant markets. Within the specialty fertilizer segments:

- Specialty Type: CRF (Controlled Release Fertilizers) and water-soluble fertilizers are experiencing rapid growth, driven by their efficient nutrient delivery and reduced environmental impact. Liquid fertilizers also contribute significantly, offering ease of application and precise nutrient control.

- Application Mode: Fertigation (fertilizer application through irrigation systems) is gaining popularity due to its precise nutrient delivery and efficient water usage. Foliar application is also widely adopted, particularly for micronutrients. Soil application remains the traditional method but its efficiency is becoming less preferred than others.

- Crop Type: Horticultural crops and high-value field crops show high demand for specialty fertilizers. Turf & ornamental applications constitute a smaller yet rapidly growing niche.

Key Drivers:

- Favorable government policies: Government subsidies and initiatives promoting sustainable agriculture play a crucial role.

- Infrastructure development: Investments in irrigation systems and farm mechanization are supporting the adoption of fertigation and other advanced application methods.

- Rising disposable incomes: Increased farmer incomes translate into higher investments in inputs that enhance crop yields.

India Specialty Fertilizer Industry Product Developments

Recent innovations focus on developing environmentally friendly and efficient specialty fertilizers. Controlled-release fertilizers (CRFs), nano-fertilizers, and bio-stimulants are gaining traction. Companies are also focusing on developing customized fertilizer blends to address specific crop needs and soil conditions. These innovations aim to improve nutrient use efficiency, reduce environmental impact, and enhance crop yields.

Key Drivers of India Specialty Fertilizer Industry Growth

The growth of the Indian specialty fertilizer industry is fuelled by a convergence of factors. Technological advancements, including the development of nano-fertilizers and bio-stimulants, are improving nutrient use efficiency and reducing environmental impact. Government policies promoting sustainable agriculture and investments in irrigation infrastructure are also providing support. Additionally, the increasing awareness among farmers regarding the benefits of precision fertilization contributes significantly to industry expansion. Economic growth and rising disposable incomes of farmers further bolster demand.

Challenges in the India Specialty Fertilizer Industry Market

The Indian specialty fertilizer market faces several challenges, including high input costs, fluctuations in raw material prices, and stringent regulatory requirements. Supply chain disruptions caused by geopolitical factors and logistical bottlenecks affect production and distribution. Intense competition among domestic and multinational players impacts pricing and profitability. Furthermore, counterfeiting of fertilizer products remains a significant concern for the industry. These factors pose constraints on the growth trajectory, affecting market access and profitability.

Emerging Opportunities in India Specialty Fertilizer Industry

The Indian specialty fertilizer industry holds vast growth opportunities. Technological breakthroughs in areas like nano-fertilizers and bio-stimulants offer significant potential for improved nutrient use efficiency and sustainable agriculture. Strategic partnerships between fertilizer companies and agricultural technology providers can enhance market reach and provide integrated solutions to farmers. Expanding into newer markets and promoting the use of specialty fertilizers in horticulture and high-value crops offers significant growth avenues.

Leading Players in the India Specialty Fertilizer Industry Sector

- Chambal Fertilizers & Chemicals Ltd

- Mangalore Chemicals & Fertilizers Ltd

- Coromandel International Ltd

- Haifa Group

- Deepak fertilizers & Petrochemicals Corporation Ltd

- Indian Farmers Fertiliser Cooperative Limited

- Grupa Azoty S A (Compo Expert)

- Yara International AS

- ICL Group Ltd

- Sociedad Quimica y Minera de Chile SA

Key Milestones in India Specialty Fertilizer Industry Industry

- November 2018: ICL Fertilizers launched a new line of premium fertilizers (Polysulphate, ICLPotashpluS, and ICLPKpluS), enhancing precision farming capabilities.

- February 2019: Coromandel International partnered with Agrinos, expanding its product offerings and boosting its complete plant nutrition solutions.

- November 2019: IFFCO launched nano-technology based products (nano nitrogen, nano zinc, and nano copper) for on-field trials, promoting sustainable farming practices.

Strategic Outlook for India Specialty Fertilizer Industry Market

The Indian specialty fertilizer market is poised for robust growth driven by technological innovation, government support, and evolving farmer preferences. Companies focusing on sustainable and efficient products will gain a competitive edge. Strategic partnerships, expansions into new geographic markets, and targeted product development for specific crop types will be crucial for long-term success. The market offers significant potential for players who leverage technological advancements and adapt to the evolving needs of the agricultural sector.

India Specialty Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Specialty Fertilizer Industry Segmentation By Geography

- 1. India

India Specialty Fertilizer Industry Regional Market Share

Geographic Coverage of India Specialty Fertilizer Industry

India Specialty Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization

- 3.3. Market Restrains

- 3.3.1. Heavy Initial Procurement Cost and High Expenditure on Maintenance

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Specialty Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chambal Fertilizers & Chemicals Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mangalore Chemicals & Fertilizers Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Coromandel International Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Haifa Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deepak fertilizers & Petrochemicals Corporation Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indian Farmers Fertiliser Cooperative Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grupa Azoty S A (Compo Expert)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yara International AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ICL Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sociedad Quimica y Minera de Chile SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chambal Fertilizers & Chemicals Ltd

List of Figures

- Figure 1: India Specialty Fertilizer Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Specialty Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: India Specialty Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: India Specialty Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Specialty Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Specialty Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Specialty Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Specialty Fertilizer Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: India Specialty Fertilizer Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: India Specialty Fertilizer Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Specialty Fertilizer Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Specialty Fertilizer Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Specialty Fertilizer Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Specialty Fertilizer Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Specialty Fertilizer Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the India Specialty Fertilizer Industry?

Key companies in the market include Chambal Fertilizers & Chemicals Ltd, Mangalore Chemicals & Fertilizers Ltd, Coromandel International Ltd, Haifa Group, Deepak fertilizers & Petrochemicals Corporation Ltd, Indian Farmers Fertiliser Cooperative Limited, Grupa Azoty S A (Compo Expert), Yara International AS, ICL Group Ltd, Sociedad Quimica y Minera de Chile SA.

3. What are the main segments of the India Specialty Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Shortage of Skilled Labor; Government Support to Enhance Farm Mechanization.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Heavy Initial Procurement Cost and High Expenditure on Maintenance.

8. Can you provide examples of recent developments in the market?

November 2019: IFFCO Launches its Nano Technology based Products nano nitrogen, nano zinc and nano copper for on- field trials as part of its efforts to cut United Statesge of chemical fertilisers and boost farmers' income.February 2019: Coromandel International announced a strategic partnership with Agrinos. The partnership allows Coromandel to widen its product offerings of complete plant nutrition solutions, organic fertilizers, and specialty nutrients. Coromandel, in partnership with Agrinos, will offer growers high-technology inputs under the brand name ARITHRI.November 2018: ICL Fertilizers developed a new line of premium fertilizers that help farmers feed their crops precisely. Polysulphate, ICLPotashpluS, and ICLPKpluS are manufactured from polyhalite, a mineral extracted at the ICL mine in Boulby, United Kingdom, to meet the agricultural need for balanced, targeted nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Specialty Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Specialty Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Specialty Fertilizer Industry?

To stay informed about further developments, trends, and reports in the India Specialty Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence