Key Insights

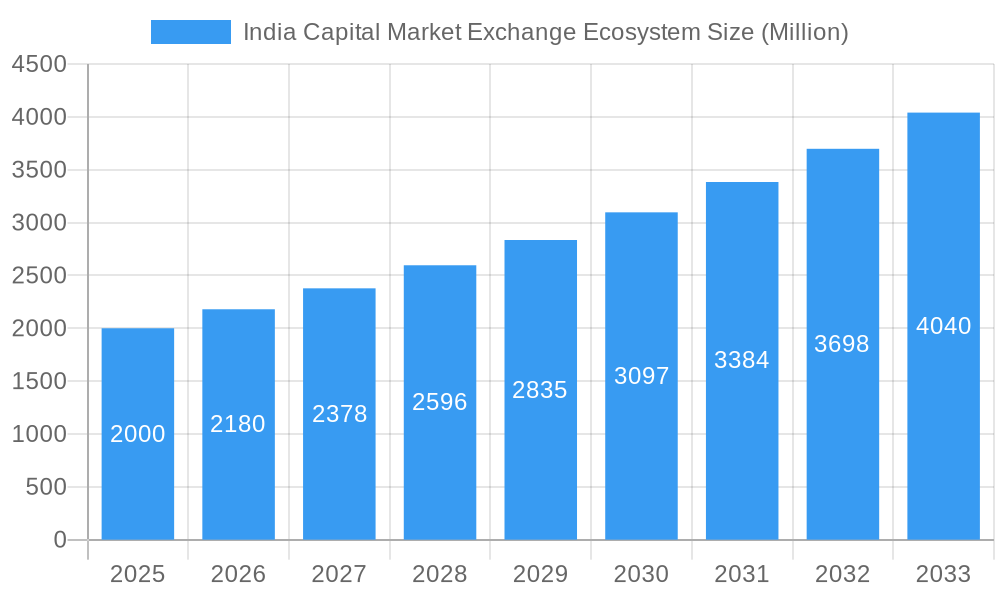

The India Capital Market Exchange Ecosystem is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 9% through 2025 to 2033. This growth trajectory is propelled by surging retail investor participation, bolstered by digitalization and enhanced financial literacy. Supportive government initiatives aimed at financial inclusion and market liberalization are also fostering a conducive environment. The proliferation of fintech solutions and innovative trading platforms is democratizing access and improving user experience, drawing in a broader participant base. While global economic uncertainties and evolving regulations present potential challenges, the long-term outlook remains robust, anticipating substantial market development. Key segments within the ecosystem, including brokerage firms, exchanges, and investment advisory services, highlight a vibrant and competitive landscape. Leading entities such as Taurus Corporate Advisory Services Limited and Valuefy Solutions Private Limited are at the forefront of this evolution, driving innovation and competition.

India Capital Market Exchange Ecosystem Market Size (In Billion)

The forecast period from 2025 to 2033 is expected to see the India Capital Market Exchange Ecosystem expand considerably. This growth will be underpinned by increasing financial awareness, advancements in technological infrastructure, and a favorable regulatory framework. With a base market size of $124 billion in 2025, and an estimated CAGR of 9%, the market is projected to reach approximately $200 billion by 2030 and potentially exceed $300 billion by 2033. Short-term fluctuations may occur due to external economic shocks, but underlying structural drivers suggest sustained long-term potential. Market segmentation is likely to encompass diverse categories such as investment types (equities, derivatives, debt), investor profiles (retail, institutional), and regional breakdowns. Companies are strategically investing in technological capabilities, customer engagement, and service diversification to maintain a competitive edge in this dynamic sector.

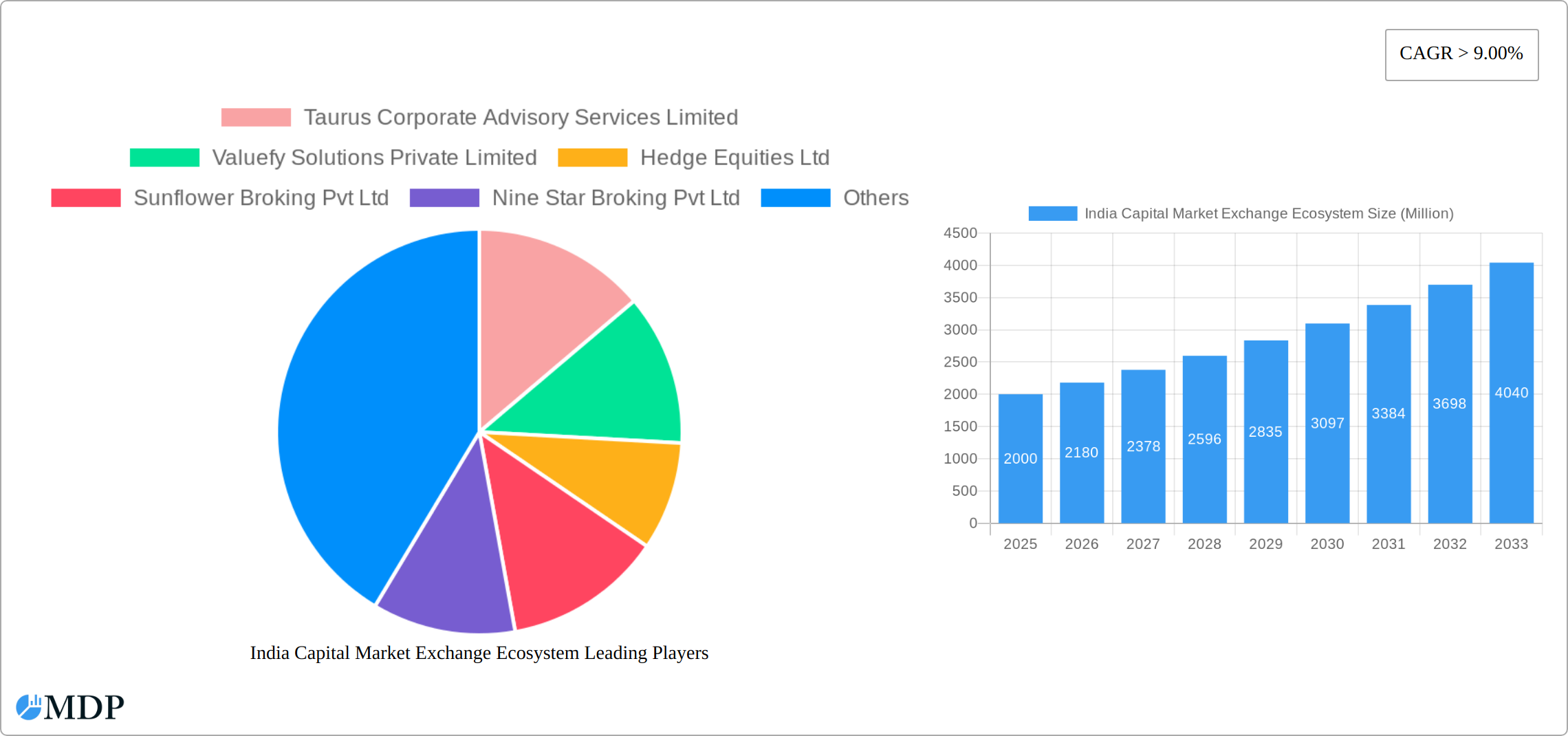

India Capital Market Exchange Ecosystem Company Market Share

India Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

Unlocking the potential of India's dynamic capital market exchange ecosystem with this in-depth market analysis. This report provides a comprehensive overview of the industry, forecasting robust growth from 2025 to 2033. This report covers key market dynamics, trends, leading players, and future opportunities, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers.

India Capital Market Exchange Ecosystem Market Dynamics & Concentration

This section provides a comprehensive analysis of the competitive landscape within the Indian capital market exchange ecosystem. It delves into key aspects including market concentration, drivers of innovation, the prevailing regulatory frameworks, the availability of substitute products, evolving end-user trends, and significant mergers & acquisitions (M&A) activities. The study period spans from 2019 to 2033, with 2025 designated as the base and estimated year, and the forecast period extending from 2025 to 2033, building upon the historical data from 2019-2024.

The Indian capital market exchange ecosystem is currently characterized by a moderately concentrated market structure, where a few prominent players command a substantial market share. However, the dynamic landscape is witnessing heightened competition fueled by the rapid emergence of innovative fintech companies and the accelerating adoption of advanced technologies. Key drivers of this market evolution include groundbreaking innovations in trading technologies, significant regulatory reforms designed to enhance investor participation and market access, and the widespread integration of digital platforms across the financial services spectrum.

- Market Share (2024 Estimate): The top 5 players collectively hold an estimated 60% of the market share. The remaining 40% is distributed amongst a diverse array of smaller market participants. Specific market share figures for individual companies are subject to detailed segmental analysis and are estimated to be in the range of xx Million units.

- M&A Activity (2019-2024): Over the historical period from 2019 to 2024, a total of xx M&A deals were recorded. These transactions were primarily propelled by strategic consolidation initiatives within the brokerage sector and the aggressive expansion strategies of emerging fintech enterprises. The aggregate value of these M&A activities is estimated to be approximately xx Million.

- Regulatory Framework: The Securities and Exchange Board of India (SEBI) continues to play a pivotal role in shaping the market dynamics through its comprehensive suite of regulations and proactive policy interventions. These regulatory guidelines are under continuous review and adaptation, significantly influencing market entry strategies, operational paradigms, and investor protection mechanisms.

- Product Substitutes: The proliferation of alternative investment avenues presents a growing competitive challenge to the traditionally exchange-traded products. While these alternatives are gaining traction, the core of the market remains firmly anchored by established instruments such as equities and derivatives.

- End-User Trends: A notable surge in retail investor participation is a significant trend, largely attributable to enhanced digital literacy and the increased accessibility of user-friendly online trading platforms. Concurrently, institutional investors continue to be vital contributors and major players in the market.

India Capital Market Exchange Ecosystem Industry Trends & Analysis

This section delves into the key trends shaping the Indian capital market exchange ecosystem, encompassing market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report uses 2025 as the base year and projects growth until 2033.

The Indian capital market exchange ecosystem is experiencing substantial growth, driven by factors such as rising disposable incomes, increased financial literacy, and the expansion of the middle class. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated to be xx%. Market penetration, particularly in Tier 2 and Tier 3 cities, remains relatively low, indicating significant growth potential. Technological disruption, including the adoption of artificial intelligence (AI), blockchain technology, and high-frequency trading, is transforming market operations. Consumers increasingly prefer digital platforms and mobile trading apps for their ease of use and convenience. The competitive landscape is marked by fierce competition, particularly among brokerage firms, who are vying for market share through innovative products and services.

Leading Markets & Segments in India Capital Market Exchange Ecosystem

This section meticulously identifies the dominant geographical regions, countries, and market segments that constitute the Indian capital market exchange ecosystem. The analysis is underpinned by critical drivers, including the influence of economic policies and the ongoing development of robust infrastructure.

- Dominant Segment: Currently, the equity segment holds the leading position in terms of market dominance, closely followed by the derivatives segment. However, forward-looking projections indicate that the debt segment is poised for substantial growth in the ensuing years.

- Key Drivers:

- Economic Growth: India's sustained and robust economic expansion is a primary catalyst, driving increased investment activities and fostering greater participation in the capital markets.

- Government Initiatives: Proactive government policies aimed at promoting financial inclusion and deepening capital market infrastructure are instrumental in supporting and accelerating market expansion.

- Technological Advancements: Continuous improvements in technology and the expansion of digital infrastructure are significantly enhancing market accessibility, operational efficiency, and overall market integrity.

- Regulatory Reforms: Streamlined regulatory processes and enhanced investor protection measures are crucial in attracting a wider spectrum of participants and fostering greater confidence in the market.

- Dominance Analysis: The prevailing dominance of the equity segment can be attributed to the strong investment preference exhibited by both retail and institutional investors. The derivatives segment thrives due to the increasing adoption of hedging strategies and speculative trading approaches. The debt market, meanwhile, is experiencing steady expansion, driven by growing institutional participation and the demand for diversified investment alternatives.

India Capital Market Exchange Ecosystem Product Developments

The Indian capital market exchange ecosystem witnesses continuous product innovation. New trading platforms, algorithmic trading tools, and risk management solutions are constantly being developed. These advancements aim to enhance trading efficiency, reduce costs, and improve risk management capabilities. The integration of artificial intelligence and machine learning is enabling personalized investment recommendations and automated trading strategies. The increasing adoption of mobile trading platforms underscores the market's focus on convenient access and user experience. The overall trend is toward more sophisticated, technology-driven products tailored to the evolving needs of investors.

Key Drivers of India Capital Market Exchange Ecosystem Growth

The robust growth trajectory of India's capital market exchange ecosystem is being propelled by a confluence of powerful factors. Foremost among these are technological advancements, including the widespread adoption of high-frequency trading (HFT) and algorithmic trading strategies, which are significantly enhancing market efficiency and liquidity. Complementing these technological leaps are supportive government policies, such as initiatives focused on broadening financial inclusion and deepening the capital markets, which collectively create an exceptionally conducive environment for sustained growth. Furthermore, the uplift in disposable incomes across the Indian populace, coupled with a rising tide of financial literacy, is directly translating into increased and more informed participation in the capital markets.

Challenges in the India Capital Market Exchange Ecosystem Market

The Indian capital market exchange ecosystem faces several challenges. Regulatory hurdles, including complex compliance requirements, can hinder market expansion. Supply chain issues, such as the lack of skilled professionals and technological infrastructure, can restrict growth. Intense competition among market participants leads to price wars and reduced profitability. These factors, combined with macroeconomic uncertainties, pose significant challenges to the growth of the market. For example, the xx Million loss incurred by xx company in 2023 highlights the challenges faced by companies operating in this space.

Emerging Opportunities in India Capital Market Exchange Ecosystem

The Indian capital market exchange ecosystem is brimming with promising emerging opportunities. Technological breakthroughs, such as the integration of blockchain technology for enhanced transparency and security, and the development of AI-driven trading platforms, hold the potential for transformative improvements in efficiency and operational robustness. Strategic alliances and collaborations between established financial institutions and agile fintech companies are paving the way for synergistic growth and accelerated innovation. There exists significant untapped potential in expanding market reach into underserved regions, particularly in rural areas, offering substantial growth prospects. Moreover, the increasing global emphasis on ESG (Environmental, Social, and Governance) investing principles is creating novel avenues for sustainable finance and responsible investment within the Indian market.

Leading Players in the India Capital Market Exchange Ecosystem Sector

- Taurus Corporate Advisory Services Limited

- Valuefy Solutions Private Limited

- Hedge Equities Ltd

- Sunflower Broking Pvt Ltd

- Nine Star Broking Pvt Ltd

- Research Icon

- Agroy Finance and Investment Ltd

- United Stock Exchange of India

- Basan Equity Broking Ltd

- Indira Securities P Ltd

- List Not Exhaustive

Key Milestones in India Capital Market Exchange Ecosystem Industry

- 2020: Launch of several new mobile trading platforms by brokerage firms.

- 2021: Increased adoption of algorithmic trading strategies by institutional investors.

- 2022: Implementation of new SEBI regulations aimed at improving investor protection.

- 2023: xx (Significant industry development needs specific details).

- 2024: xx (Significant industry development needs specific details).

Strategic Outlook for India Capital Market Exchange Ecosystem Market

The future of the Indian capital market exchange ecosystem is promising. Continued economic growth, technological advancements, and regulatory reforms will drive market expansion. Strategic partnerships and collaborations between traditional financial institutions and fintech companies will foster innovation and enhance market efficiency. The focus on financial inclusion and expanding access to capital markets will further stimulate growth. The market is poised for significant growth, presenting attractive opportunities for investors and industry participants.

India Capital Market Exchange Ecosystem Segmentation

-

1. Primary Markets

- 1.1. Equity Market

- 1.2. Debt Market

- 1.3. Corporate Governance and Compliance Monitoring

- 1.4. Corporate Restructuring

- 1.5. Intermediaries Associated

-

2. Secondary Markets

- 2.1. Cash Market

- 2.2. Equity Derivatives Markets

- 2.3. Commodity Derivatives Market

- 2.4. Currency Derivatives Market

- 2.5. Interest Rate Derivatives Market

- 2.6. Market Infrastructure Institutions

- 2.7. Intermediaries Associated

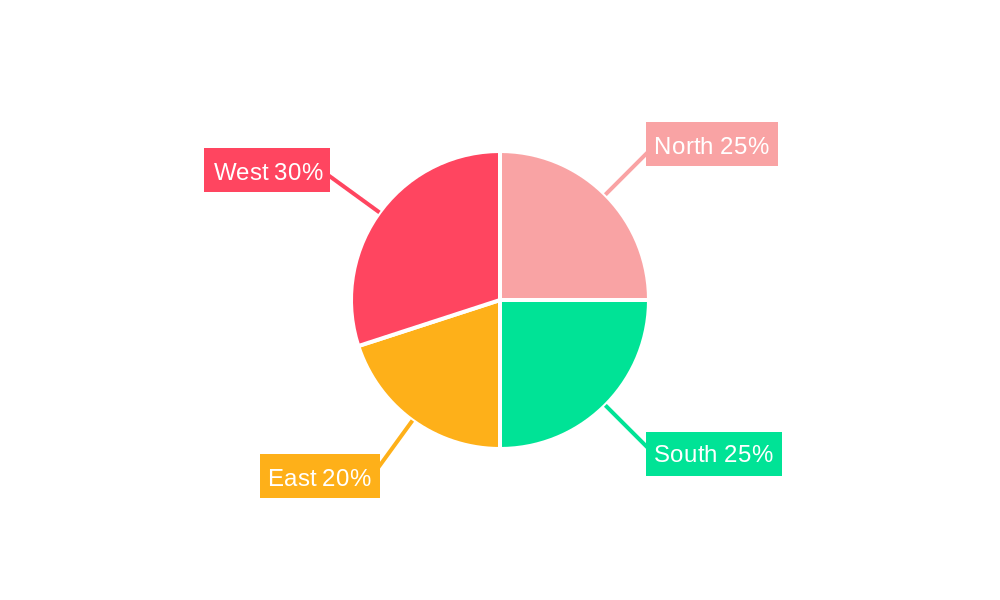

India Capital Market Exchange Ecosystem Segmentation By Geography

- 1. India

India Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of India Capital Market Exchange Ecosystem

India Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Equity Derivatives Occupied with Major Share in the Secondary Capital Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 5.1.1. Equity Market

- 5.1.2. Debt Market

- 5.1.3. Corporate Governance and Compliance Monitoring

- 5.1.4. Corporate Restructuring

- 5.1.5. Intermediaries Associated

- 5.2. Market Analysis, Insights and Forecast - by Secondary Markets

- 5.2.1. Cash Market

- 5.2.2. Equity Derivatives Markets

- 5.2.3. Commodity Derivatives Market

- 5.2.4. Currency Derivatives Market

- 5.2.5. Interest Rate Derivatives Market

- 5.2.6. Market Infrastructure Institutions

- 5.2.7. Intermediaries Associated

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Primary Markets

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taurus Corporate Advisory Services Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Valuefy Solutions Private Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hedge Equities Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunflower Broking Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nine Star Broking Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Research Icon

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Agroy Finance and Investment Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Stock Exchange of India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Basan Equity Broking Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indira Securities P Ltd **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taurus Corporate Advisory Services Limited

List of Figures

- Figure 1: India Capital Market Exchange Ecosystem Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 2: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 3: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Primary Markets 2020 & 2033

- Table 5: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Secondary Markets 2020 & 2033

- Table 6: India Capital Market Exchange Ecosystem Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Capital Market Exchange Ecosystem?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the India Capital Market Exchange Ecosystem?

Key companies in the market include Taurus Corporate Advisory Services Limited, Valuefy Solutions Private Limited, Hedge Equities Ltd, Sunflower Broking Pvt Ltd, Nine Star Broking Pvt Ltd, Research Icon, Agroy Finance and Investment Ltd, United Stock Exchange of India, Basan Equity Broking Ltd, Indira Securities P Ltd **List Not Exhaustive.

3. What are the main segments of the India Capital Market Exchange Ecosystem?

The market segments include Primary Markets, Secondary Markets.

4. Can you provide details about the market size?

The market size is estimated to be USD 124 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Equity Derivatives Occupied with Major Share in the Secondary Capital Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the India Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence