Key Insights

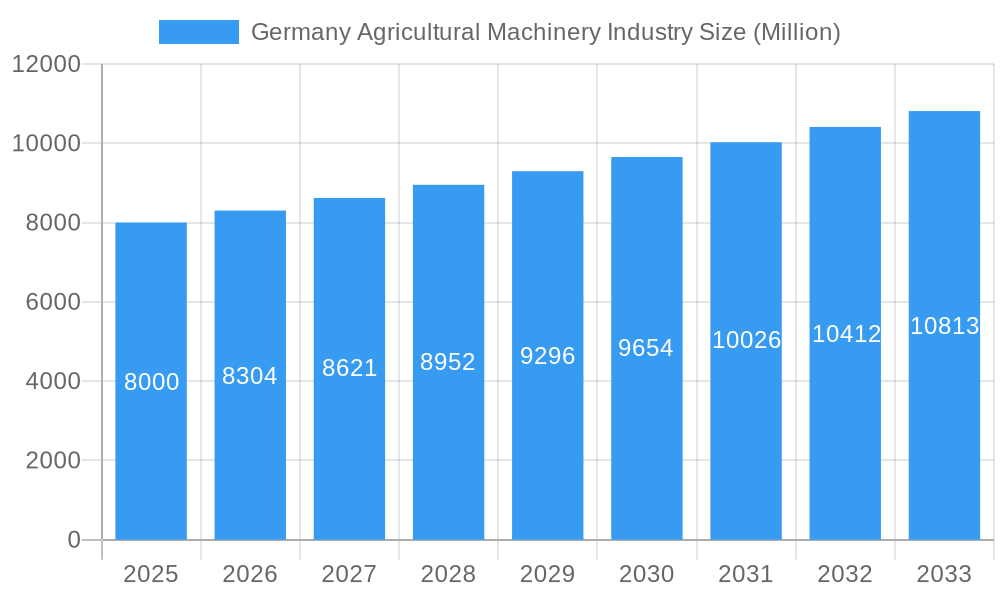

The German agricultural machinery market, valued at approximately €8 billion in 2025, is projected to experience steady growth, driven by factors such as increasing mechanization needs, government support for sustainable farming practices, and a rising demand for high-efficiency equipment. The market's Compound Annual Growth Rate (CAGR) of 3.8% from 2025 to 2033 indicates a gradual but consistent expansion. Key segments contributing to this growth include tractors (particularly those in the 40-100 HP range, reflecting the prevalence of medium-sized farms), harvesting machinery (combine harvesters are a significant driver due to increasing grain production), and precision farming equipment like sprayers and seed drills. The adoption of precision technologies aimed at optimizing resource utilization and maximizing yields is a prominent trend. Growth is further spurred by governmental initiatives promoting sustainable agriculture, including subsidies for modern machinery and environmentally friendly technologies.

Germany Agricultural Machinery Industry Market Size (In Billion)

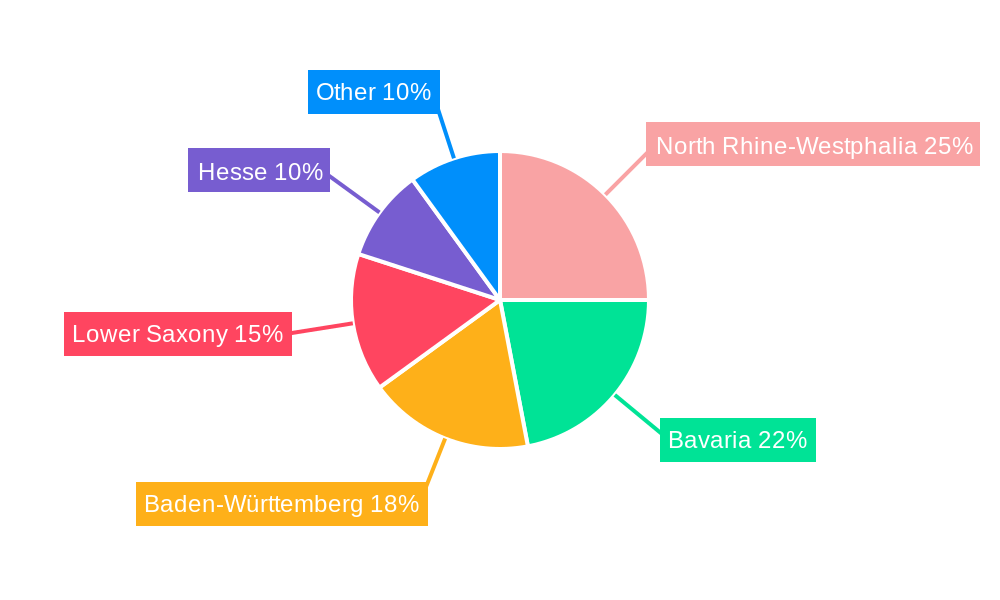

However, challenges remain. Rising input costs (fuel, components) and potential labor shortages in the agricultural sector could act as restraints. Competition among established players like Deere & Company, CNH Industrial, and CLAAS, alongside the emergence of smaller, specialized manufacturers, creates a dynamic market landscape. Regional variations exist within Germany, with regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, known for their intensive agricultural activities, expected to contribute significantly to market growth. The forecast period will see a continued focus on technological advancements, including automation, data analytics, and GPS-guided machinery, enhancing operational efficiency and productivity for German farmers. The market’s sustained growth underscores the importance of agricultural modernization and the long-term commitment to technological innovation within the German agricultural sector.

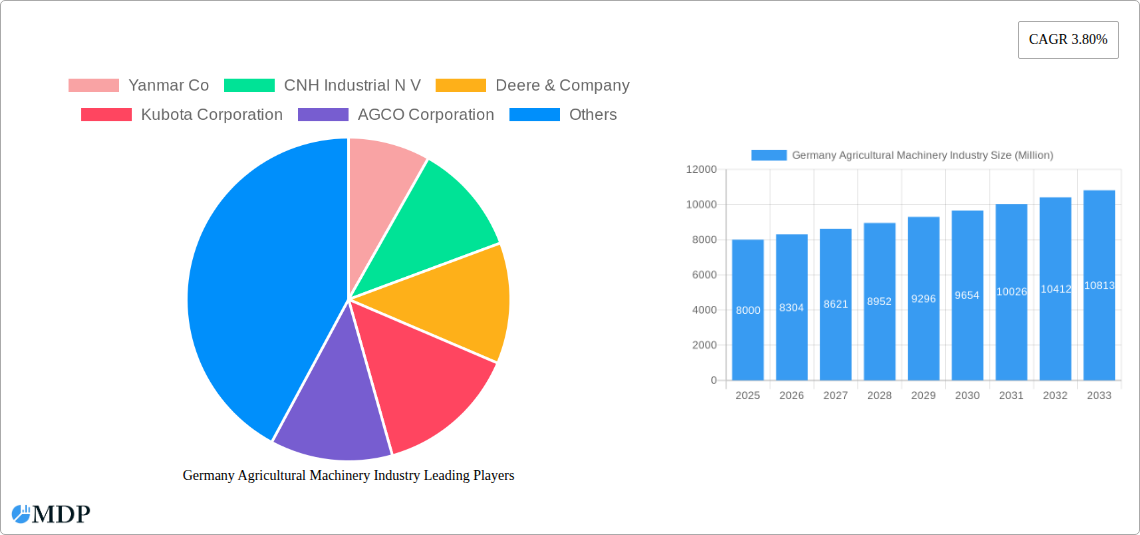

Germany Agricultural Machinery Industry Company Market Share

Germany Agricultural Machinery Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the German agricultural machinery industry, covering market dynamics, leading players, technological advancements, and future growth prospects. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts until 2033, offering invaluable insights for stakeholders, investors, and industry professionals. The German agricultural machinery market, valued at xx Million in 2024, is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Germany Agricultural Machinery Industry Market Dynamics & Concentration

The German agricultural machinery market is characterized by a moderate level of concentration, with several multinational corporations holding significant market share. Key players like Deere & Company, CNH Industrial N.V., and CLAAS KGaA mbH compete intensely, driving innovation and influencing market dynamics. The market share of these leading players is estimated to be around xx% collectively in 2024, with Deere & Company holding the largest share at an estimated xx%. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx M&A deals recorded between 2019 and 2024. This relatively low M&A activity indicates a degree of market stability. Innovation drivers include increasing demand for precision agriculture technologies, stricter environmental regulations promoting sustainable farming practices, and the need for improved efficiency to offset labor shortages. The regulatory framework, while generally supportive of technological advancements, also places emphasis on safety and environmental compliance, shaping product development strategies. Substitute products, such as manual labor or older, less efficient machinery, are gradually being replaced due to rising labor costs and the need for enhanced productivity. End-user trends show a clear preference for technologically advanced machinery offering features like GPS guidance, automated steering, and data analytics.

Germany Agricultural Machinery Industry Industry Trends & Analysis

The German agricultural machinery market is experiencing substantial growth, driven by several key factors. Technological advancements, particularly in precision agriculture, are significantly impacting market dynamics. The adoption of GPS-guided machinery, automated systems, and data analytics is improving efficiency and yield, leading to increased demand. Consumer preferences are shifting towards more efficient, sustainable, and technologically advanced equipment, influencing manufacturers' product development strategies. The market is witnessing a growing preference for larger tractors with higher horsepower, reflecting the trend towards larger-scale farming operations. Competitive dynamics are intense, with leading players engaging in strategic investments in research and development to enhance their product offerings and maintain their market positions. This competition is driving innovation and price reductions, benefitting end-users. The market penetration of precision agriculture technologies is steadily increasing, with an estimated xx% adoption rate in 2024, projected to reach xx% by 2033. This growth is further fueled by supportive government policies and initiatives promoting sustainable agriculture and technological adoption. The overall market growth reflects the interplay of technological advancements, evolving consumer preferences, and competitive pressures, creating a dynamic and rapidly evolving landscape.

Leading Markets & Segments in Germany Agricultural Machinery Industry

Within the German agricultural machinery market, the segment for tractors in the 40-100 HP range currently holds the largest market share, driven by its suitability for a wide range of farming operations. This segment is projected to maintain its dominance throughout the forecast period. The equipment segment, encompassing plows, harrows, seed drills, and other implements, also represents a significant portion of the market. Key drivers include:

- Government subsidies and support for agricultural modernization: These incentives encourage farmers to adopt new technologies.

- Increasing land values and pressure for improved yields: This compels farmers to invest in efficient machinery.

- Growing awareness of sustainable farming practices: This stimulates demand for machinery that minimizes environmental impact.

The dominance of these segments is further reinforced by the widespread adoption of mechanized farming practices across the country. Other segments, such as harvesting machinery and haying & forage machinery, also contribute significantly to the overall market size, though they exhibit a comparatively slower growth rate than the tractor and equipment segments.

Germany Agricultural Machinery Industry Product Developments

Recent product innovations focus on enhancing precision, efficiency, and sustainability. Examples include the integration of GPS technology, automated steering systems, and variable rate application technologies in tractors and sprayers. Manufacturers are emphasizing fuel efficiency, reduced environmental impact, and improved operator comfort. New models frequently incorporate advanced features that streamline operations and improve yield, resulting in significant competitive advantages. The introduction of high-density balers, as exemplified by Case IH's LB 424 XLD model, illustrates the ongoing pursuit of optimized efficiency and improved output.

Key Drivers of Germany Agricultural Machinery Industry Growth

Several factors are driving the growth of the German agricultural machinery industry. Technological advancements like precision farming technologies and automation are improving efficiency and productivity. Government initiatives promoting sustainable agriculture and supporting technological adoption are creating a favorable environment for growth. The increasing demand for food production, coupled with the need for efficient farming practices, is pushing up demand for modern agricultural machinery. Furthermore, favorable economic conditions and investments in agricultural infrastructure are contributing to the overall growth of the sector.

Challenges in the Germany Agricultural Machinery Industry Market

The German agricultural machinery market faces several challenges. Fluctuations in agricultural commodity prices can impact investment in new machinery. Supply chain disruptions and rising input costs can increase production expenses, leading to price increases for end-users. Intense competition among major players puts downward pressure on profit margins. Strict environmental regulations and stringent safety standards can add complexity and cost to product development and manufacturing. These factors can cumulatively slow down market growth. Finally, an aging farming population presents a challenge to labor availability and skill levels required to operate increasingly sophisticated machinery.

Emerging Opportunities in Germany Agricultural Machinery Industry

Several emerging opportunities exist within the German agricultural machinery market. The growing adoption of precision agriculture and data-driven farming provides significant potential for technological innovation. Strategic partnerships between manufacturers and agricultural technology companies can accelerate the development and deployment of new solutions. Expansion into related markets, such as precision livestock farming or agricultural robotics, represents significant long-term growth potential. The increasing demand for sustainable agriculture creates opportunities for manufacturers offering environmentally friendly machinery and technologies.

Leading Players in the Germany Agricultural Machinery Industry Sector

Key Milestones in Germany Agricultural Machinery Industry Industry

- September 2021: John Deere introduced new harvester heads (H423, H425, H425HD), enhancing harvesting efficiency.

- March 2022: Deere launched See & Spray Ultimate, a targeted spraying system improving herbicide application.

- October 2022: Case IH launched Farmall A model tractors (90A and 100A), enhancing versatility for various farm tasks.

- December 2022: Case IH launched the LB 424 XLD large square baler, increasing bale density by 10% and improving bale quality.

Strategic Outlook for Germany Agricultural Machinery Industry Market

The German agricultural machinery market is poised for continued growth, driven by technological advancements, increasing demand for food production, and supportive government policies. Strategic opportunities lie in investing in research and development of precision agriculture technologies, expanding into new segments like agricultural robotics, and forging strategic partnerships to leverage innovative solutions. Manufacturers focusing on sustainability and efficiency will be well-positioned to capture a greater market share in the years to come. The market's long-term potential hinges on embracing technological advancements and adapting to the evolving needs of modern agriculture.

Germany Agricultural Machinery Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Germany Agricultural Machinery Industry Segmentation By Geography

- 1. Germany

Germany Agricultural Machinery Industry Regional Market Share

Geographic Coverage of Germany Agricultural Machinery Industry

Germany Agricultural Machinery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. Decrease in Farm Labour

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Agricultural Machinery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yanmar Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CNH Industrial N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kubota Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AGCO Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agrale S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CLAAS KGaA mbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Yanmar Co

List of Figures

- Figure 1: Germany Agricultural Machinery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Germany Agricultural Machinery Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 3: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 4: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 5: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 6: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 7: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 8: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 9: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 10: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 11: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Region 2020 & 2033

- Table 13: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Production Analysis 2020 & 2033

- Table 15: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 16: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 21: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 22: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Price Trend Analysis 2020 & 2033

- Table 23: Germany Agricultural Machinery Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Germany Agricultural Machinery Industry Volume Kiloton Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Agricultural Machinery Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Germany Agricultural Machinery Industry?

Key companies in the market include Yanmar Co, CNH Industrial N V, Deere & Company, Kubota Corporation, AGCO Corporation, Agrale S A, CLAAS KGaA mbH, Mahindra & Mahindra Ltd.

3. What are the main segments of the Germany Agricultural Machinery Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

Decrease in Farm Labour.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

December 2022: Case IH launched a new LB 424 XLD large sqaure baler model that produces extra-dense 120cm*70cm bales, up with a 10% increase in density, which improves bale quality, handling, and rotor cutter.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Agricultural Machinery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Agricultural Machinery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Agricultural Machinery Industry?

To stay informed about further developments, trends, and reports in the Germany Agricultural Machinery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence